As filed with the Securities and Exchange Commission

on August 15, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ASE Technology Holding Co., Ltd.

(Exact name of registrant as specified in its charter (English translation))

|

Republic of China

(State or other jurisdiction of incorporation

or organization)

|

N/A

(I.R.S. Employer Identification No.) |

| |

26, Chin 3rd Road

Nanzih District

Kaohsiung, 811, Taiwan

Republic of China

(Address of Principal Executive Offices) |

|

| |

|

|

|

ASE Technology Holding Co., Ltd. 2024 Restricted Stock Awards Plan

(Full Title of the Plan) |

| |

|

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, DE 19711

(302) 738-6680

(Name, address and telephone number, including area

code, of agent for service)

|

|

Copies to:

|

|

Joseph Tung

ASE Technology Holding Co., Ltd.

Room 1901, No. 333, Section 1, Keelung Rd.

Taipei,

110,

Taiwan, Republic of China

(+886) 2-6636-5678

|

James C. Lin, Esq.

Davis Polk & Wardwell LLP

c/o 10th Floor, The Hong Kong Club Building

3A Chater Road

Hong Kong

(+852) 2533-3300 |

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☒ |

Accelerated filer ☐ |

| |

|

| Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

Smaller reporting company ☐ |

| |

|

| |

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information required by Item 1 and Item 2

of Part I of Form S-8 to be contained in the Section 10(a) prospectus is omitted from this registration statement on Form S-8 (this “Registration

Statement”) in accordance with Rule 428 under the Securities Act of 1933, as amended (the “Securities Act”) and the

introductory note to Part I of Form S-8. The documents containing the information specified in Part I of Form S-8 have been or will be

delivered to the participants in the incentive plan covered by this Registration Statement (the “Plan”) as required by Rule

428(b)(1) under the Securities Act. These documents, which include the statement of availability required by Item 2 of Part I of Form

S-8, and the documents incorporated by reference in this Registration Statement pursuant to Item 3 of Part II of Form S-8, taken together,

constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

| |

Item 3. |

Incorporation of Documents by Reference |

The following documents filed by the Registrant

with the Securities and Exchange Commission (the “Commission”) are incorporated herein by reference:

| (a) | the Registrant’s annual report on Form 20-F for the fiscal year ended December 31, 2023 filed with the Commission on April 3,

2024; and |

| (b) | the description of common shares and American depositary shares of the Registrant contained under the headings “Description of HoldCo Common Shares” and “Description of HoldCo American Depositary Shares” in the registration statement on Form

F-4 (File No. 333-214752) of Advanced Semiconductor Engineering, Inc.’s, the predecessor company of the Registrant, filed with the

Commission on January 16, 2018, including any amendment or report filed for the purpose of updating such description. |

In addition, all documents subsequently filed

by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), after the date of this Registration Statement and prior to the filing of a post-effective amendment which indicates that

all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed to be incorporated

by reference in this Registration Statement and to be part hereof from the date of filing of such documents.

Any statement contained herein or in a document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof to the

extent that a statement contained herein or in any other subsequently filed document which is also incorporated or deemed to be incorporated

by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as

so modified or superseded, to constitute a part of this Registration Statement.

| |

Item 4. |

Description of Securities |

Not applicable.

| |

Item 5. |

Interests of Named Experts and Counsel |

Not applicable.

| |

Item 6. |

Indemnification of Directors and Officers |

The relationship between the Registrant and its

directors and officers is governed by the Republic of China (“R.O.C.”) Civil Code, the R.O.C. Company Law and the Registrant’s

Articles of Incorporation. There is no written contract between the Registrant and its directors and officers governing the rights and

obligations of such parties. Under Section 10, Chapter 2, Book II of the R.O.C. Civil Code, each person who was or is a party or is threatened

to be made a party to, or is involved in any threatened, pending or completed action, suit or proceeding by reason of the fact that such

person is or was a director or officer of the Registrant, in the absence of willful misconduct or negligence on the part of such person

in connection with such person’s performance of duties as a director or officer, as the case may be, may be indemnified and held

harmless by the Registrant to the fullest extent permitted by applicable law. In addition, the Registrant has obtained an insurance policy

which provides liability coverage, including coverage for liabilities arising under the U.S. federal securities laws, for directors and

officers and which contains certain exceptions and exclusions.

| |

Item 7. |

Exemption from Registration Claimed |

Not applicable.

The Exhibits listed on the accompanying Exhibit

Index are filed as a part of, or incorporated by reference into, this Registration Statement.

(a) The

undersigned Registrant hereby undertakes:

(1) To

file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) to

include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) to

reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration

Statement; and

(iii) to

include any material information with respect to the Plan not previously disclosed in this Registration Statement or any material change

to such information in this Registration Statement;

provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii)

do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed

with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated

by reference in this Registration Statement.

(2) That,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to

be the initial bona fide offering thereof.

(3) To

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering.

(b) The

undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of

an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this

Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering

of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of

the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a

claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director,

officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for

filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized,

in Taipei, Taiwan, Republic of China, on August 15, 2024.

| |

ASE TECHNOLOGY HOLDING CO., LTD. |

| |

|

| |

|

| |

By: |

/s/ Joseph Tung |

| |

Name: |

Joseph Tung |

| |

Title: |

Chief Financial Officer |

POWER OF ATTORNEY

Know all persons by these presents, that each

person whose signature appears below, constitutes and appoints each of Jason C.S. Chang and Joseph Tung as his or her true and lawful

attorney-in-fact and agent, upon the action of such appointee, with full power of substitution and resubstitution, to do any and all acts

and things and execute, in the name of the undersigned, any and all instruments which each of said attorneys-in-fact and agents may deem

necessary or advisable in order to enable ASE Technology Holding Co., Ltd. to comply with the Securities Act of 1933, as amended (the

“Securities Act”), and any requirements of the Securities and Exchange Commission (the “Commission”) in respect

thereof, in connection with the filing with the Commission of this registration statement under the Securities Act, including specifically

but without limitation, power and authority to sign the name of the undersigned to such registration statement, and any amendments to

such registration statement (including post-effective amendments), and to file the same with all exhibits thereto and other documents

in connection therewith, with the Commission, to sign any and all applications, registration statements, notices or other documents necessary

or advisable to comply with applicable state securities laws, and to file the same, together with other documents in connection therewith

with the appropriate state securities authorities, granting unto each of said attorneys-in-fact and agents full power and authority to

do and to perform each and every act and thing requisite or necessary to be done in and about the premises, as fully and to all intents

and purposes as the undersigned might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and

agents may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities

Act, this registration statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Signature |

Title |

Date |

| |

|

|

| |

|

|

|

/s/ Jason C.S. Chang |

Director and Chairman |

August 15, 2024 |

| Jason C.S. Chang |

(principal executive officer) |

|

| |

|

|

| |

|

|

|

/s/ Richard H.P. Chang |

Director, Vice Chairman and President |

August 15, 2024 |

| Richard H.P. Chang |

|

|

| |

|

|

| |

|

|

|

/s/ Tien Wu |

Director and Chief Operating Officer |

August 15, 2024 |

| Tien Wu |

|

|

| |

|

|

| |

|

|

|

/s/ Joseph Tung |

Chief Financial Officer |

August 15, 2024 |

| Joseph Tung |

(principal financial officer) |

|

| |

|

|

| |

|

|

| |

|

|

|

/s/ Jeffrey Chen |

Director; Chairman, Universal Scientific Industrial (Shanghai) Co., Ltd. |

August 15, 2024 |

| Jeffrey Chen |

|

| |

|

|

| |

|

|

| |

|

|

|

/s/ Rutherford Chang |

Director; General Manager,

China Region of ASE Inc. |

August 15, 2024 |

| Rutherford Chang |

|

| |

|

|

| |

|

|

| |

|

|

|

/s/ Andrew Tang |

Director and Chief Procurement Officer |

August 15, 2024 |

| Andrew Tang |

|

|

| |

|

|

| |

|

|

|

/s/ Shen-Fu Yu |

Independent Director |

August 15, 2024 |

| Shen-Fu Yu |

|

|

| |

|

|

| |

|

|

|

/s/ Mei-Yueh Ho |

Independent Director |

August 15, 2024 |

| Mei-Yueh Ho |

|

|

| |

|

|

| |

|

|

|

/s/ Wen-Chyi Ong |

Independent Director |

August 15, 2024 |

| Wen-Chyi Ong |

|

|

| |

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE OF THE

REGISTRANT

Pursuant to the Securities Act of 1933, as amended,

the undersigned, the duly authorized representative in the United States of the registrant, has signed this registration statement or

amendment thereto in Newark, Delaware, on August 15, 2024.

| |

PUGLISI & ASSOCIATES |

| |

|

| |

|

| |

By: |

/s/ Donald J. Puglisi |

| |

Name: |

Donald J. Puglisi |

| |

Title: |

Managing Director |

EXHIBIT INDEX

|

Exhibit

No. |

Description |

| 4.1* |

Articles of Incorporation of the Registrant (English translation). |

| |

|

| 4.2 |

Deposit Agreement dated April 30, 2018 by and among the Registrant, Citibank, N.A., as Depositary, and the Holders and Beneficial Owners of American Depositary Shares issued thereunder (incorporated by reference to Exhibit 2(a) to the annual report on Form 20-F (File No. 001-16125) for the year ended December 31, 2019 filed with the Securities and Exchange Commission on March 31, 2020). |

| |

|

| 5.1* |

Opinion of Baker & McKenzie, Taipei, R.O.C. counsel to the Registrant, as to the legality of the securities being registered. |

| |

|

| 23.1* |

Consent of Deloitte & Touche, independent registered public accounting firm. |

| |

|

| 23.2* |

Consent of Baker & McKenzie, Taipei (included in Exhibit 5.1). |

| |

|

| 23.3* |

Consent of PricewaterhouseCoopers, independent registered public accounting firm. |

| |

|

| 24.1* |

Power of Attorney (included in the signature pages hereof). |

| |

|

| 99.1* |

ASE Technology Holding Co., Ltd. 2024 Restricted Stock Awards Plan (English translation). |

| |

|

| 107* |

Filing fee table |

* Filed herewith

Exhibit 4.1

ASE Technology Holding Co.,

Ltd.

Articles

of Incorporation

Chapter One: General Principals

Article 1.

The Company is called 日月光投資控股股份有限公司

and is registered as a company limited by shares according to the ROC Company Act. The English name of the Company is ASE Technology

Holding Co., Ltd.

Article 2.

The Company is engaged in the following businesses:

H201010 General Investment Business.

Article 3.

The investment made by the Company in other companies

as a limited liability shareholder thereof is not subject to the limitation that such investment shall not exceed a certain percentage

of the paid-in capital as set forth in the ROC Company Act.

Article 4.

The Company may provide external guaranty.

Article 5.

The Company’s headquarter

is located in Kaohsiung, Taiwan, ROC and may set up domestic or foreign branches, offices or business establishments as resolved by the

Board of Directors, if necessary.

Chapter Two: Shares

Article 6.

The Company’s total capital is NT$55 billion

divided into 5.5 billion shares with a par value of NT$10 per share. Stock options worth of NT$4 billion are set aside for employee subscription.

The Board of Directors is authorized to issue the unissued shares in installments if deemed necessary for business purposes.

“Employees” referred to in the preceding

paragraph include employees of the parent or subsidiaries of the Company that meet certain requirements, which are to be

Page 1

[Translation to June 26, 2024 Chinese Version]

prescribed by the Board of Directors.

Article 6-1.

Unless otherwise approved specifically by the central

authority of the respective industry or other laws and regulations, when the Company issues new shares, there shall be 10 to 15% of such

new shares reserved for subscription by employees of the Company.

The Company may issue new shares to employees with restricted

rights after the resolutions of the Shareholders’ Meeting.

The Company may buy back its shares and transfer them to

employees in accordance with relevant laws and regulations.

Employees referred to in the three preceding subparagraphs

include employees of parent or subsidiary companies that meet certain conditions, which are to be prescribed by the Board of Directors.

Article 7.

According to Article 161-2 of the ROC Company Act, the Company

may be exempted from printing any share certificate for the shares issued but shall register the issued shares with a centralized securities

depositary enterprise and follow the regulations of that enterprise.

Article 8.

No registration of share transfer shall be made within

sixty days before each ordinary general shareholders’ meeting, or within thirty days before each extraordinary general shareholders’

meeting or five days before the record date for dividends, bonuses or other distributions as determined by the Company.

Article 9.

The rules governing stock affairs of the Company shall

be made pursuant to the laws and the regulations of the relevant authorities.

Chapter Three: General Shareholders’

Meeting

Article 10.

General shareholders’ meetings include ordinary meetings

and extraordinary meetings. Ordinary meetings shall be convened according to law by the Board of Directors once

Page 2

[Translation to June 26, 2024 Chinese Version]

annually within 6 months after the end of each fiscal year.

Extraordinary meetings will be held according to the law whenever necessary.

Article 11.

General shareholders’ meetings shall be convened

by written notice stating the date, place and purpose dispatched to each shareholder at least 30 days, in the case of ordinary meetings,

and 15 days, in the case of extraordinary meetings, prior to the date set for such meeting.

Article 12.

Unless otherwise required by the ROC Company Act, shareholders’

resolutions shall be adopted by at least half of the votes of the shareholders present at a general shareholders’ meeting who hold

at least half of all issued and outstanding shares of the Company.

Article 13.

Each shareholder of the Company shall have one vote per share,

unless otherwise provided by Article 179 of the ROC Company Act.

Article 14.

Any shareholder, who for any reason is unable to attend

general shareholders’ meetings, may execute a proxy printed by the Company, in which the authorized matters shall be expressly stated,

to authorize a proxy to attend the meeting for him/her. Such proxy shall be submitted to the Company at least 5 days prior to the general

shareholders’ meeting.

Article 15.

The general shareholders’ meeting shall be convened

by the Board of Directors unless otherwise stipulated in the ROC Company Act, and the person presiding over the meeting will be the Chairman

of the Board of Directors (the “Chairman”). If the Chairman is on leave or for any reason cannot discharge his duty, Paragraph

3 of Article 208 of the ROC Company Act should apply. If the general shareholders’ meeting is convened by a person entitled to do

so other than a member of the Board of Directors, that person shall act as the person presiding over the meeting. If two or more persons

are entitled to call the general shareholders’ meeting, those persons shall elect one to act as the person presiding over the meeting.

Page 3

[Translation to June 26, 2024 Chinese Version]

Chapter Four: Director

Article 16.

The Company shall have 9 directors, of which there

shall be 3 independent directors and 6 non-independent directors to be elected by the general shareholders’ meeting from candidates

with legal capacity. Each director shall hold office for a term of three years, and may continue to serve in the office if re-elected.

The election of the directors of the Company shall

be conducted pursuant to Article 198 of the ROC Company Act and relevant regulations.

When handling the aforementioned

election of directors, the election of independent directors and non-independent directors should be held together, provided, however,

that the number of independent directors and non-independent directors elected shall be calculated separately; those that receive votes

representing more voting rights will be elected as independent directors or non-independent directors.

The Company shall then establish an audit committee

in lieu of supervisors in accordance with Article 14-4 of the ROC Securities and Exchange Act to exercise the powers and duties of supervisors

stipulated in the ROC Company Act, the ROC Securities and Exchange Act, and other applicable laws and regulations. The audit committee

shall comprise solely of the independent directors. The responsibilities, powers and other related matters of the audit committee shall

be separately stipulated in rules adopted by the Board of Directors in accordance with applicable laws and regulations.

Article 16-1.

The election of the Company’s directors uses

the candidate nomination system. Shareholders who hold 1% or more of the Company’s issued shares and the Board of Directors may

nominate a list of candidates for directors. After the Board of Directors examines and confirms the qualifications of the candidate(s)

for serving as a director, the name(s) is/are sent to the general shareholders’ meeting for election. If the general shareholders’

meeting is convened by a person entitled to do so other than a member of the Board of Directors, after such person examines and confirms

the qualifications of the candidate(s) for serving as a director, the name(s) is/are sent to the general shareholders’ meeting for

election. All matters regarding the acceptance method and

Page 4

[Translation to June 26, 2024 Chinese Version]

announcement of the nomination of candidates for directors

will be handled according to the ROC Company Act, the ROC Securities and Exchange Act, and other relevant laws and regulations.

Article 16-2.

The remuneration of the Company’s independent

directors is set at NT$3 million per person annually. For those that do not serve a full year, the remuneration will be calculated in

proportion to the number of days of the term that were actually served. The additional remuneration of the Company’s independent

directors who are also the members of the Company’s Compensation Committee is set at NT$ 360,000 per person annually. For those

that do not serve a full year, the additional remuneration will be calculated in proportion to the number of days of the term that were

actually served.

Article 17.

The Board of Directors is constituted by directors. Their

powers and duties are as follows:

| (1). | Preparing business plans; |

| (2). | Preparing surplus distribution or loss make-up proposals; |

| (3). | Preparing proposals to increase or decrease capital; |

| (4). | Reviewing material internal rules and contracts; |

| (5). | Hiring and discharging the general manager; |

| (6). | Establishing and dissolving branch offices; |

| (7). | Reviewing budgets and audited financial statements; and |

| (8). | Other duties and powers granted by or in accordance with the ROC Company Act or shareholders’

resolutions. |

Article 18.

The Board of Directors is constituted by directors,

and the Chairman and Vice Chairman are elected by more than half of the directors at a board meeting at which two-thirds or more of the

directors are present. If the Chairman is on leave or for any reason cannot discharge his duties, his/her acting proxy shall be elected

in accordance with Article 208 of the ROC Company Act.

Article 19.

Board of Directors meetings shall be convened according to

the law by the Chairman, unless otherwise stipulated by the ROC Company Act. Board of Directors meetings

Page 5

[Translation to June 26, 2024 Chinese Version]

can be held at the place that the Company is headquartered,

or at any place that is convenient for the directors to attend and appropriate for the meeting to be convened, or via video conference.

Article 19-1.

Directors shall be notified of Board of Director meetings

no later than seven days prior to the meetings. However, in case of any emergency, a Board of Directors meeting may be convened at any

time.

Notifications of Board of Directors meetings may be in writing

or via email or fax.

Article 20.

A director may execute a proxy to appoint another

director to attend the Board of Directors meeting and to exercise his/her voting right, but a director can accept only one proxy.

Chapter Five: Manager

Article 21.

The Company has one general manager. The appointment,

discharge and salary of the general manager shall be managed in accordance with Article 29 of ROC Company Act.

Chapter Six: Accounting

Article 22.

The fiscal year of the Company starts from January

1 and ends on December 31 every year. At the end of each fiscal year, the Board of Directors shall prepare financial and accounting books

in accordance with the ROC Company Act and submit them according to law to the ordinary general shareholders’ meeting for approval.

Article 23.

If the Company is profitable, 0.01% (inclusive) to

1% (inclusive) of the profits shall be allocated as compensation to employees and 0.75% (inclusive) or less of the profits should be allocated

as compensation to directors. While the Company has accumulated losses, the profit shall be set aside to compensate losses before distribution.

Page 6

[Translation to June 26, 2024 Chinese Version]

The compensation being distributed to employees in the form

of stock or cash shall be approved by more than half of the directors at a board meeting at which two-thirds or more of the directors

are present and report to the general shareholders’ meeting.

The Company distributes profit to employees in the

form of shares by a resolution of a meeting of Board of Directors, and in accordance with the provision of the preceding paragraph, may

resolve, at the same meeting of the Board of Directors, to distribute the shares by way of new shares to be issued by the Company or existing

shares to be repurchased by the Company.

“Employees” referred

to in the three preceding paragraphs include employees of controlling or subsidiary companies that meet certain conditions, which are

to be prescribed by the Board of Directors.

Article 24.

The annual net income (“Income”)

shall be distributed in the order of sequences below:

| (1) | Making up for losses, if any. |

| (2) | 10% being set aside as legal reserve. |

| (3) | Allocation or reversal of a special surplus reserve in accordance with laws or regulations set forth

by the authorities concerned. |

The remainder plus the undistributed earnings shall

be distributed in accordance with the proposal submitted by the Board of Directors and adopted by the general shareholders’ meeting.

However,

when earnings are distributed as cash dividends, this may be approved by the majority of the directors at a Board meeting in which over

two-thirds of the directors are present, and then reported to the shareholders' meeting.

However,

when earnings are distributed as cash dividends, this may be approved by the majority of the directors at a Board meeting in which over

two-thirds of the directors are present, and then reported to the shareholders' meeting.

Article 25.

The Company is at the stage of stable growth. In order

to accommodate the capital demand for the present and future business development and satisfy the shareholder’s demand for the cash

inflow, the Residual Dividend Policy is adopted for the dividend distribution of the Company. The ratio for cash dividends shall be not

less than 30% of the total dividends; and the residual dividends shall be distributed in form of stocks in accordance with the distribution

plan proposed by the Board of Directors and resolved by the general shareholders’ meeting.

Page 7

[Translation to June 26, 2024 Chinese Version]

Chapter Seven: Appendix

Article 26.

The bylaws and rules of procedure of the Company shall be

stipulated separately.

Article 27.

Any matter not covered by these Articles of Incorporation

shall be subject to the ROC Company Act.

Article 28.

These Articles of Incorporation were made on February

12, 2018 as approved by all the promoters.

The first amendment was made on June 21, 2018. The

second amendment was made on June 27, 2019. The third amendment was made on June 24, 2020.

The fourth amendment was made on August 12, 2021.

The fifth amendment was made on June 26, 2024.

Page 8

[Translation to June 26, 2024 Chinese Version]

Exhibit 5.1

|

|

August 15, 2024

ASE Technology Holding Co., Ltd.

26, Chin 3rd Road

Nanzih District

Kaohsiung, Taiwan

Republic of China

Re: Registration

Statement on Form S-8 of ASE Technology Holding Co., Ltd.

Ladies and Gentlemen:

We act as the special Republic of China (the “ROC”)

counsel to you, ASE Technology Holding Co., Ltd. (“you” or the “Company”) in connection with your

filing with the United States Securities and Exchange Commission (the “SEC”)

a Registration Statement on Form S-8 (the “Registration Statement”) under the

United States Securities Act of 1933, as amended (the “Securities Act”) on August

15, 2024 for the registration of the issuance of a certain number of shares of common stock, par value NT$10 per share, of the Company

(the “New Shares”) under the 2024 Restricted Stock Awards Plan (the

“Restricted Stock Awards Plan”).

In rendering this opinion, we have examined the

originals or copies of the following documents:

| (i) | the resolution made at the meeting of the board of directors of the Company held on March 28, 2024 and

the resolution made at the annual general meeting of shareholders of the Company held on June 26, 2024 (collectively, the “Resolutions”), |

| (ii) | the Articles of Incorporation as amended on June 26, 2024 and

the corporate registration card dated July 9, 2024 of the Company, |

| (iii) | the public records of the Company made available at the website of the ROC Ministry of Economic Affairs

(“MOEA”) on August 15, 2024, |

| (iv) | the approval letter of the Financial Supervisory Commission dated July 29, 2024(Ref. 1130350508); |

Baker & McKenzie, a Taiwanese Partnership, is a member of Baker

& McKenzie International, a Swiss Verein.

| (v) | Registration Statement, which constitutes a prospectus of the Company under the Securities Act, with the

Restricted Stock Awards Plan attached as an exhibit, and |

| (vi) | the certificate issued by the Company to us dated August 15, 2024. |

We have also examined the

relevant laws and regulations of the ROC and originals or copies of such other documents, agreements and instruments as we have deemed

necessary as a basis for the opinions hereinafter expressed. During our review of the above documents, we have (i) relied on such statements

as to factual matters made in the Resolutions, (ii) assumed that all documents we received from the Company are final documents, as may

be amended or supplemented prior to the date that New Shares are issued, and (iii) made such investigation as we have deemed necessary

as a basis for the opinions hereinafter expressed.

To the extent that the obligations

of the Company under the Resolutions may be dependent upon such matters, we have assumed for purposes of this opinion that (i) your corporate

registration is not subject to cancellation or revocation as a result of having submitted forged or altered documents in your application

for registration of its company incorporation, (ii) your public records made available at the website of the MOEA are a full, current

and correct record of the corporate status of you at the time of our search, (iii) all factual statements made in the documents submitted

to us are correct and complete and that such documents are not void and have not been amended, superseded, revoked or revised in any manner,

and (iv) the minutes of the Resolutions are the full records of resolutions passed at meetings duly convened and held by the shareholders

or the board of the directors of the Company, as the case may be.

In our examination, we have assumed the genuineness

of the signatures, the authenticity of all documents submitted to us as originals, the conformity to authentic original documents of all

documents submitted to us as copies and the legal capacity of all individuals executing those documents.

We are opining herein as to the effect on the

subject transaction only of the present laws and regulations of the ROC, and we express no opinion with respect to the applicability thereto,

or the effect thereon, of the laws of any other jurisdiction.

Based upon the foregoing, and subject to the assumptions

and qualifications herein contained, we are of the opinion that, as of the date hereof:

(1)

the Company has been duly incorporated and is validly existing under the laws of the ROC as a company limited by shares; and

(2)

the New Shares (initially in the form of the certificate of payment) have been duly authorized and, when delivered to the persons

who have been granted with such New Shares under the Restricted Stock Awards Plan, will be validly issued, fully paid and non-assessable.

For the purposes of this opinion, the term “non-assessable” in relation to shares of capital stock of the Company under ROC

law means that no calls for further payment can be made upon such capital stock or upon any holders of such capital stock solely by reason

of their ownership thereof.

Our opinion is subject to the qualification that:

| (i) | The exercise of any rights may not be repugnant to public interests or have a primary purpose to harm

another person, and that rights must be exercised in good faith. |

| (ii) | No liability arising from a willful act or gross negligence may be disclaimed in advance. |

| (iii) | Enforcement of rights for claims in relation to the subscription rights under the Restricted Stock Awards

Plan and Resolutions is subject to applicable statutes of limitations under the laws of the ROC. |

| (iv) | Under the Code of Civil Procedure, a party to the litigation has the right to dispute at the oral proceeding

the fact alleged by the opposing party, and the court has discretionary power to admit or rule out the evidence. Any determination, certificate

or other matters stated in the Resolutions to be conclusive may, nevertheless, be subject to review by the court. |

| (v) | The exercise of any rights may be limited by laws relating to reasonableness, good faith, public order

and good morals and the limitation of actions, and failure to exercise any right may constitute a waiver of that right against all obligors. |

| (vi) | Judgment on a claim in relation to the subscription rights under the Restricted Stock Awards Plan; the

New Shares or the Resolutions may be rendered in United States dollars but such judgment may be satisfied by the payment of an amount

in New Taiwan Dollars equivalent to the amount of the judgment (determined on the date of satisfaction of the judgment). |

| (vii) | The Company is required to obtain the approval of the Central Bank of the Republic of China (Taiwan) at

the time conversion is sought in order to convert New Taiwan Dollars in the equivalent of more than US$50,000,000 into foreign currency

in any year. |

Our opinion is rendered as of the date hereof

based on the ROC laws and the facts existing on the date hereof. We express no opinion on any issue relating to the ROC tax consequences

in relation to the subscription rights under the Restricted Stock Awards Plan and New Shares other than those set forth in the Registration

Statement and herein. Our opinion does not address any non-ROC tax consequences that may result from the transactions described in the

Registration Statement. An opinion of counsel is not binding on the ROC tax authorities or the courts, and there can be no assurance that

the ROC tax authorities or a court will not take a contrary position or that such contrary position will not be upheld.

Whenever a statement or opinion herein with respect

to the existence or absence of facts is indicated to be based on “our knowledge” or a similar phrase, it is intended to indicate

to signify that attorneys in our office who have devoted substantive attention to this matter have acquired actual knowledge of the existence

or absence of such facts. We have not undertaken any independent investigation to determine the accuracy of any such statement or opinion,

and no inference that we have any knowledge of any matters bearing on the accuracy of such statement or opinion should be drawn from our

representation of the Company.

This opinion is rendered only to the Company and

is solely for benefit of the Company in connection with the transaction contemplated by the Form S-8. Except for being furnished to the

respective officers and employees of the Company, this opinion may not be relied upon by the Company for any other purpose, or furnished

to, quoted to, relied upon, or otherwise referred to by any other person, firm or corporation for any purpose, without our express prior

written consent, save to the extent required to be disclosed by law or any regulatory or governmental authority or any court, provided

that such disclosure does not entitle the recipients to rely on this opinion.

Subject to the qualification hereof, we hereby

consent to the use of this opinion as an exhibit to the Registration Statement. In giving such consent, we do not thereby admit that we

fall within the category of person whose consent is required under Section 7 of the Securities Act or the regulations promulgated thereunder.

This opinion is given by the Taipei office of

Baker & McKenzie (國際通商法律事務所),

a Taiwanese partnership, and not on behalf of any other member or affiliated firm of Baker & McKenzie, a Swiss Verein.

| |

Very truly yours, |

| |

|

| |

|

| |

/s/ Baker & McKenzie, Taipei |

| |

Baker & McKenzie, Taipei |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in

this Registration Statement on Form S-8 of ASE Technology Holding Co., Ltd. of our reports dated March 28, 2024, relating to the consolidated

financial statements of ASE Technology Holding Co., Ltd. and its subsidiaries (collectively, the “Group”) and the effectiveness

of the Group’s internal control over financial reporting, appearing in the Annual Report on Form 20-F of ASE Technology Holding

Co., Ltd. for the year ended December 31, 2023.

/s/ Deloitte & Touche

Taipei, Taiwan

Republic of China

August 15, 2024

Exhibit 23.3

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by reference in this Registration

Statement on Form S-8 of ASE Technology Holding Co., Ltd. (the “Company”) of our report dated March16, 2022 relating to the

financial statements of Siliconware Precision Industries Co., Ltd., which appears in the Company’s annual report on Form 20-F for

the year ended December 31, 2021.

/s/ PricewaterhouseCoopers, Taiwan

Taipei, Taiwan

Republic of China

August 15, 2024

Exhibit 99.1

ASE Technology Holding Co.,

Ltd.

2024 Restricted Stock Awards

Plan

To attract and retain talents,

motivate and engage employees for the best interest of the Company and its shareholders, so as to ensure the alignment of the employees’

and shareholders’ interests, and to ensure the alignment of the Company’s operating goals with its Environmental, Social,

and Corporate Governance (ESG) performance, the following issuance rules of ASE’s 2024 Restricted Stock Awards Plan (“the

Rules”) are therefore stipulated in accordance with Article 267 of the Company Act and the Regulations Governing the Offering and

Issuance of Securities by Securities Issuers (“the Regulations”) released by the Financial Supervisory Commission.

| Article | 2: Duration

of issuance |

Within two years following the

day the approval notice from the competent authority is delivered, the Company may issue the restricted stock awards once or multiple

times. The actual date of issuance and related matters shall be determined by the chairman of the Company (“the Chairman”)

as authorized by the Company’s board of directors (“the Board of Directors").

| Article | 3: Qualification

requirements for employees |

| I. | To protect shareholders’ interest, the Company

shall cautiously manage the Plan. Regular (full-time) employees of the Company, or a company controlled by the Company that is not listed

domestically or abroad or an affiliate, who are already employed on the date that the restricted stock awards are awarded and meet certain

performance requirements shall be eligible to participate in the Restricted Stock Awards Plan (“the Plan”). The stock awards

will only be available to employees who are: (a) highly related to the Company’s future strategy and development, (b) critical to

the Company's business operation or (c) key technical talent. |

| II. | The number of shares granted shall be deliberated

upon the granting criteria which are formulated by the employee’s seniority, position, performance, overall contribution, special

contribution and other meaningful factors in management. The number of shares granted shall be resolved by the Chairman and submitted

to the Board of Directors for approval. However, for employees who are managerial officers or the directors, the award of such shares

is subject to approval from the Compensation Committee; for employees who are neither the directors nor the managerial officers, the award

of such shares is subject to approval from the Audit Committee. |

| III. | Employees holding over 10% of the Company’s

outstanding common shares are not eligible for the Plan. Neither board members who are not the Company’s employees are not eligible

for the Plan. |

| IV. | The sum of the cumulative awarded shares of restricted

stock awards and the cumulative granted shares of employee stock options to each employee in accordance with Article 56-1-1of the Regulations

shall not exceed 0.3% of the total outstanding shares of the Company, and shall not exceed 1% of the total outstanding shares of the Company

when added the cumulative granted shares of employee stock options in accordance with Article 56-1 of the Regulations.

However, with special approval from the central competent authority of the relevant industry, the total

number of employee stock options and restricted stock awards obtained by a single employee may be exempted from the above-mentioned restriction.

If the laws and regulations are revised in the future, the Company may apply the revised laws and regulations. |

| Article | 4: Total

amount of issuance |

The total number of shares issued

by the Company under this Plan shall not exceed 16,500,000 common shares, each share having a par value of NT$10, for a total amount of

not exceeding NT$165,000,000.

| Article | 5: The

terms and conditions for issuance |

| I. | Issue price: The current issue is gratuitous. |

| II. | Type of issued shares: The Company’s newly

issued common shares |

| 1. | Employee's continuous employment with the Company

through the vesting dates, no violation on any terms of the Company’s employment agreement, working rules, non-compete and Proprietary

Information Management agreements or the |

agreement of restricted stock awards and achievement of both “personal performance requirement”

and “the Company’s operation objectives” during the vesting period are required to receive the vested shares. In three

years after the date of issuance, the maximum number of shares that can vest each year is 1/3 of the total stock awards granted (“the

vesting limit”).

The actual

total number of vesting shares shall be determined by the vesting ratio set according to the achievement of both personal performance

and the Company’s operation objectives and will be specified in the respective agreements of employees by the Company. The share

calculation shall be rounded down to the nearest integer.

| 2. | The personal performance requirement is the employee’s

personal performance rating for the most recent year prior to the end of each vesting period at “B” (inclusive) rating or

better and meeting the personal performance requirement which the criteria were set by the Company and agreed with separate employee. |

The Company's

operation objectives are based on 4 indexes: consolidated operating revenue, consolidated gross profit and gross margin (%), and consolidated

operating profit and operating margin(%) (Collectively, “performance indexes”) of the semiconductor packaging and testing

business (including the substrate (materials) business; referred to below as the “packaging and testing business”) of the

continuing operation and the Company’s Environmental, Social, and Corporate Governance achievements(“ESG KPI”). Targets

A and B achievement levels for the performance indexes are set up in the table below. The indexes will be deemed achieved when either

target A or B is achieved. If one out of the three aforementioned performance indexes is achieved, the total number of vested shares for

the year shall be 50% of the vesting limit. If two out of the three aforementioned performance indexes are achieved, the total number

of vested shares for the year shall be 60% of the vesting limit. If all of the three aforementioned performance indexes are achieved,

the total number of vested shares for the year shall be 70% of the vesting limit. If the ESG KPI is achieved, the total number of vested

shares for the year will be 30% of the vesting limits.

The determination

of achievement of performance indexes to the target and the achievement levels shall, in principle, be based on the consolidated financial

statements of subsidiaries related to the

Company's packaging and testing business and be reviewed by a certified public accountant for

the most recent fiscal year prior to the end of each vesting period. However, during the vesting period, if the Company or its subsidiaries

acquire or dispose the shareholder equities of other business units, departments or subsidiaries (the "variable business units")

through mergers, acquisitions or trades that should be incorporated or has been incorporated into the Company’s consolidated financial

statements, the operating revenue, gross profit, operating profit, GHG (Greenhouse Gas) intensity, and Water Withdrawal Intensity of the

variable business units shall not be included in the calculation of the aforementioned operation indexes.

The determination

of achievement of ESG KPI and standards shall, in principle, be based on a report of the Company's subsidiaries related to packaging and

testing business in the most recent year prior to the end of each vesting period and the report shall be verified by a third-party impartial

agency.

| Index |

Target A |

Target B |

| consolidated operating revenue |

The consolidated operating revenue of the Company's packaging

and testing business exceeds the consolidated operating revenue of previous year or its rate of change (YoY) is superior to the average

of the peers within the same industry. The peers within the same industry aforementioned refer to the semiconductor packaging and testing

corporations listed in TWSE/TPEx and their annual consolidated operating revenue exceed NT$ 15 billion or more.

|

The consolidated operating revenue of the Company's packaging

and testing business exceeds the average consolidated operating revenue of previous 3 years.

|

| consolidated gross profit and gross margin(%) |

The total consolidated gross profit of the Company's packaging

and testing business exceeds the total consolidated gross profit of the packaging and testing business in the previous year or exceeds

the average of the total consolidated gross profit of the packaging and testing business of the previous 3 years.

|

The total consolidated gross margin of the Company's packaging

and testing business exceeds the total consolidated gross margin of the packaging and testing business in the previous year or exceeds

the average of the total consolidated gross margin of the packaging and testing business of the previous 3 years.

|

| consolidated operating profit and operating margin(%) |

The consolidated operating profit of the Company's packaging

and testing business exceeds the consolidated operating profit of the packaging and testing business in the previous year or exceeds the

average of the consolidated operating profit of the packaging and testing business of the previous 3 years.

|

The consolidated operating margin of the Company's packaging

and testing business exceeds the consolidated operating margin of the packaging and testing business in the previous year or exceeds the

average of the operating margin of the packaging and testing business of the previous 3 years.

|

| ESG KPI |

(a) GHG intensity

(GHG emissions/revenue):

Year 2024: Reduce by more than 9% (Based on Year 2015)

Year 2025: Reduce by more than 10% (Based on Year 2015)

Year 2026: Reduce by more than 11% (Based on Year 2015)

And

(b) Water Withdrawal Intensity (water withdraw/revenue):

Year 2024: Reduce by more than 9% (Based on Year 2015)

Year 2025: Reduce by more than 10% (Based on Year 2015)

Year 2026: Reduce by more than 11% (Based on Year 2015)

|

| IV. | Handling process when the employees fail to achieve

the vesting conditions |

| 1. | After the shares of restricted stock awards are granted to the employee, the Company

shall have the right to revoke and cancel any and all portions of the unvested shares of restricted stock awards in the event that the

employee is not employed by the Company on the vesting date, commits a material breach of the Company’s employment agreement, working

rules, non-compete/ Proprietary Information Management agreements and the agreement of restricted stock awards, fails to meet the employee’s

personal performance requirement and the Company’s operation objectives, or violates Item 8 of Article 5 regarding modification

withdrawal, cancellation, expiry or termination of the authorization to the Company or the appointed person as the deputy to handle all

events for management of restricted stock awards in the security trust account in |

| 2. | The Company shall revoke and cancel any and all portions of the unvested shares

of restricted stock awards granted to the employee if the employee resigns voluntarily or the employee has been discharged or laid-off

during the vesting period. |

| 3. | The dividends distributed for the unvested shares of restricted stock awards (including

cash dividends, stock dividends, and cash and stock issued from legal reserve and capital surplus) and interests derived therefrom shall

be returned to the Company by the security custodian in full when the Company reclaims and cancels the unvested shares at no extra cost

to the Company; whereas the dividends and the interests derived therefrom returned to the Company by the security custodian are limited

to the dividends (including cash dividends, stock dividends, and cash and stock issued from legal reserve and capital surplus) distributed

for the unvested shares of restricted stock awards and the interests derived therefrom in the very |

year of shares of restricted stock

awards unvested. Stock dividends and stock issued from legal reserve and capital surplus shall be deemed as unissued shares of the Company

after the security custodian has returned them, and shall be canceled and the change shall be registered.

| V. | In the event of any of the following occurrences,

the unvested portion of restricted stock awards shall be handled as follows. |

| 1. | On leave without pay (approved by the company): The rights and obligations of the

employees with respect to the unvested shares of restricted stock awards under the Rules shall remain in effect. However, the actual vested

shares of restricted stock awards shall be determined by the vesting conditions set by the Rules and calculated on a pro-rata basis based

on the number of months absent on such leave for the year of the Company’s operation objective. (if the actual working days exceed

half of the working days in a particular month, then the month should be counted as a month of employment.) |

| 2. | Retirement: The rights and obligations of the employees with respect to the unvested

shares of restricted stock awards under the Rules shall remain in effect. However, the actual vested shares of restricted stock awards

shall be determined by the vesting conditions set by the Rules and calculated on a pro-rata basis based on the number of months absent

on such leave for the year of the Company’s operation objective. (if the actual working days exceed half of the working days in

a particular month, then the month should be counted as a month of employment.) |

| 3. | Termination of employment due to disabilities as a result of occupational accidents

of employee: Any unvested restricted stock awards shall immediately vest upon such termination date. If both of the vesting conditions

including the Company’s operation objectives and personal performance target have already been determined (in accordance with Article

5.3) as of the date of termination, the actual vested shares of restricted stock awards shall be subject to adjustment in accordance with

the vesting conditions set under the Rules. If one or both of the vesting conditions have not yet been determined as of the vesting date,

all of the unvested shares of restricted stock awards shall be vested. |

| 4. | Termination of employment due to death of employee for any cause: Upon death of

the employee, for unvested restricted stock awards, the legal heirs of the employee shall complete all required legal procedures and provide

relevant supporting documentation before being granted the shares to be inherited or interest disposed of. If both of the vesting conditions

including the Company’s operation objectives and personal performance target have already been determined (in accordance with Article

5.3) as of the date of death of the employee, the actual vested shares of restricted stock awards shall be subject to adjustment in accordance

with the vesting conditions set under the Rules. If one or both of the vesting conditions have not yet been determined as of the vesting

date, all of the unvested shares of restricted stock awards shall be vested. |

| 5. | If the employee has outstanding contribution or any other special contribution

to the Company, the Company's Chairman is authorized to determine whether the unvested restricted stock awards of the employee could be

vested or not on a case by case basis when the employee’s employment is terminated with the Company. |

| 6. | When it is determined that the vesting conditions cannot be achieved, the Company

may reclaim, at any time, the determined unvested restricted stock awards and cancel the shares. |

| VI. | The Company will reclaim the issued restricted stock

awards and cancel the shares when the vesting conditions are not achieved. |

| VII. | The rights that are subject to restriction until

vesting conditions are met |

| 1. | Before the vesting conditions are met, except for inheritance, employees may not

sell, pledge, transfer, give to another person, create any encumbrance on, or otherwise dispose of, the restricted stock awards. |

| 2. | Before the vesting conditions are met, rights of the restricted stock awards to

attend the shareholder’s meeting, submit proposals, speak and vote at the meeting shall be the same as the Company’s common

shares issued and shall be performed in accordance with the custodian agreement. |

| 3. | Before the vesting conditions are met, except the aforementioned rights, the other

rights of restricted stock awards, including but not limited to stock dividend, cash dividend, rights to receive from legal reserve and

capital surplus, stock options at cash capital increase, shall be the same as the Company’s common shares issued and be performed

in accordance with the custodian agreement. |

| 4. | If the employee achieves the vesting conditions on the book closure date for the

Company’s issuance of bonus dividends, cash dividends, subscription of new shares in rights issue, during the book closure period

for shareholder’s meeting pursuant to Item 3 of Article 165 of the Company Act, or other statutory book closure period till the

record date for rights distribution, the timing and procedures for lifting the restrictions on the restricted stock awards shall be performed

in accordance with the custodian agreement or relevant laws/regulations. |

| VIII. | Other important stipulations |

| 1. | The restricted stock awards shall be deposited in a security trust account after

the issuance. Before the vesting conditions are met, the employee shall not request the trustees to return the restricted stock awards

for any reason or in any method. |

| 2. | During the period that the restricted stock awards are deposited in a security

account after the issuance, management of the restricted stock awards in the security trust account including but not limited to the negotiation,

execution, amendment, renewal, termination, and expiration of the custodian agreement and the instruction to deliver, use or disposal

of the trust property with the custodian shall be performed by the Company or the person appointed on behalf of the employees. |

| Article | 6: Execution

and confidentiality of the agreement |

| I. | The employees are deemed to have been granted the

restricted stock awards only when they have entered into the “agreement of receiving restricted stock awards” upon notification

by the responsible unit of the Company and complete all the required process for trust custody service. If the employee fails to execute

the agreement, it’s deemed that the rights to the restricted stock awards are forfeited by the employee. |

| II. | The employee receiving restricted stock awards or

the rights derived therefrom in accordance with the Rules shall comply with the Rules and the “agreement of receiving restricted

stock awards”. It’s deemed the vesting conditions are not met in case of violation. The employee shall keep confidential after

signing the agreement for the related contents of the Rules and the rights under the agreement. The Company shall have the right to revoke

and cancel any and all portions of the unvested shares of restricted stock awards in the event that the employee violates the Rules and

the agreement. |

Any tax incurred from granting the restricted stock

awards under the Plan shall be governed by the applicable R.O.C. laws and regulations.

| Article | 8: Other

important covenants |

| I. | The Rules shall be executed after effective registration

with the competent authority. If modifications of the issuance rules are required due to amendment to the laws and regulations or instructions

from the competent authority, the Chairman is authorized to make any necessary amendment to the Rules. The amendment to the Rules shall

be proposed to be reviewed and approved by the Board of Directors for ratification and issuance. |

| II. | For the matters not stipulated in the Rules, except

as otherwise provided by law, the Board of Directors or the person appointed by the Board of Directors are authorized with full power

and authority to revise and execute pursuant to the applicable laws and regulations. |

S-8

EX-FILING FEES

0001122411

0001122411

1

2024-08-14

2024-08-14

0001122411

2024-08-14

2024-08-14

iso4217:USD

xbrli:pure

xbrli:shares

Ex-Filing Fees

CALCULATION OF FILING FEE TABLES

S-8

ASE Technology Holding Co., Ltd.

Table 1: Newly Registered and Carry Forward Securities

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Line Item Type |

|

Security Type |

|

Security Class Title |

|

Notes |

|

Fee Calculation

Rule |

|

Amount Registered |

|

Proposed Maximum Offering

Price Per Unit |

|

Maximum Aggregate Offering Price |

|

Fee Rate |

|

Amount of Registration Fee |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Newly Registered Securities |

| Fees to be Paid |

|

Equity |

|

Common Shares, par value NT$10.00 per share |

|

(1) |

|

Other |

|

16,500,000 |

|

$ |

4.59 |

|

$ |

75,735,000.00 |

|

0.0001476 |

|

$ |

11,178.48 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Offering Amounts: |

|

$ |

75,735,000.00 |

|

|

|

|

11,178.48 |

| Total Fees Previously Paid: |

|

|

|

|

|

|

|

|

| Total Fee Offsets: |

|

|

|

|

|

|

|

|

| Net Fee Due: |

|

|

|

|

|

|

$ |

11,178.48 |

__________________________________________

Offering Note(s)

| (1) | |

This registration statement on Form S-8 (this “Registration Statement”) covers common shares, par value NT$10.00 per share (“Common Shares”), of ASE Technology Holding Co., Ltd. (the

“Company” or the “Registrant”), which are represented by American depositary shares (“ADSs”), with each ADS representing two Common Shares. The ADSs issuable upon deposit of the

Common Shares have been registered under a separate registration statement on Form F-6.

This Registration Statement covers Shares (i) issuable pursuant to the ASE

Technology Holding Co., Ltd. 2024 Restricted Stock Awards Plan (the “Plan”) and (ii) pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), any additional

Common Shares that become issuable under the Plan by reason of any stock dividend, stock split, or other similar transaction.

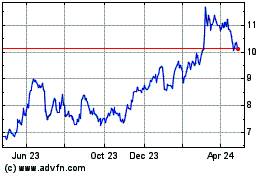

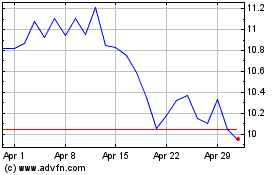

Estimated in accordance with Rule 457(c) and (h)

solely for purposes of calculating the registration fee. The per share and aggregate offering prices are estimated based on the average of the high price of NT$152.0 and the low price of

NT$145.5 of the Registrant’s Common Shares reported on the Taiwan Stock Exchange on August 12, 2024, which is within five business days prior to filing this Registration Statement, in

accordance with Rule 457(c) under the Securities Act. For the purpose of calculating the per share and aggregate offering prices, New Taiwan dollar amounts were translated into U.S. dollars at

a rate of NT$32.41 to US$1.00, the exchange rate as set forth in the H.10 weekly statistical release of the Federal Reserve System of the United States on August 9, 2024.

Rounded

up to the nearest penny. |

v3.24.2.u1

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.2.u1

Offerings - Offering: 1

|

Aug. 14, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common Shares, par value NT$10.00 per share

|

| Amount Registered | shares |

16,500,000

|

| Proposed Maximum Offering Price per Unit |

4.59

|

| Maximum Aggregate Offering Price |

$ 75,735,000.00

|

| Fee Rate |

0.01476%

|

| Amount of Registration Fee |

$ 11,178.48

|

| Offering Note |

This registration statement on Form S-8 (this “Registration Statement”) covers common shares, par value NT$10.00 per share (“Common Shares”), of ASE Technology Holding Co., Ltd. (the

“Company” or the “Registrant”), which are represented by American depositary shares (“ADSs”), with each ADS representing two Common Shares. The ADSs issuable upon deposit of the

Common Shares have been registered under a separate registration statement on Form F-6.

This Registration Statement covers Shares (i) issuable pursuant to the ASE

Technology Holding Co., Ltd. 2024 Restricted Stock Awards Plan (the “Plan”) and (ii) pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), any additional

Common Shares that become issuable under the Plan by reason of any stock dividend, stock split, or other similar transaction.

Estimated in accordance with Rule 457(c) and (h)

solely for purposes of calculating the registration fee. The per share and aggregate offering prices are estimated based on the average of the high price of NT$152.0 and the low price of

NT$145.5 of the Registrant’s Common Shares reported on the Taiwan Stock Exchange on August 12, 2024, which is within five business days prior to filing this Registration Statement, in

accordance with Rule 457(c) under the Securities Act. For the purpose of calculating the per share and aggregate offering prices, New Taiwan dollar amounts were translated into U.S. dollars at

a rate of NT$32.41 to US$1.00, the exchange rate as set forth in the H.10 weekly statistical release of the Federal Reserve System of the United States on August 9, 2024.

Rounded

up to the nearest penny.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |