Amplify Energy Provides Hedging Update

September 01 2023 - 7:00AM

Amplify Energy Corp. (“Amplify” or the “Company”) (NYSE: AMPY)

announced today that the Company has recently added to its

commodity derivative positions in order to meet initial hedge

requirements under its new senior secured reserve-based revolving

credit facility (the “New Credit Facility”) which was announced on

August 1, 2023.

Under the terms of the New Credit Facility, the

Company was required to hedge projected Proved Developed Producing

natural gas and crude oil production volumes (on an equivalent

basis) totaling at least 75% for the first 24 consecutive calendar

months, and at least 50% of the subsequent 12 months, following the

closing date of the New Credit Facility on July 31, 2023.

Amplify posted an updated investor presentation

containing additional hedging information on its website,

www.amplifyenergy.com, under the Investor Relations section.

The following table reflects the hedged volumes

under Amplify’s commodity derivative contracts and the average

fixed floor and ceiling prices at which production is hedged for

July 2023 through December 2026, as of August 31, 2023:

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

2024 |

|

|

2025 |

|

|

2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural Gas Swaps: |

|

|

|

|

|

|

|

|

|

|

Average Monthly Volume (MMBtu) |

|

|

|

|

662,500 |

|

|

675,000 |

|

|

291,667 |

|

|

Weighted Average Fixed Price ($) |

|

|

|

$ |

3.72 |

|

$ |

3.74 |

|

$ |

3.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural Gas Collars: |

|

|

|

|

|

|

|

|

|

|

Two-way collars |

|

|

|

|

|

|

|

|

|

|

Average Monthly Volume (MMBtu) |

|

|

1,248,000 |

|

|

627,083 |

|

|

500,000 |

|

|

291,667 |

|

|

Weighted Average Ceiling Price ($) |

|

$ |

5.55 |

|

$ |

4.32 |

|

$ |

4.10 |

|

$ |

4.10 |

|

|

Weighted Average Floor Price ($) |

|

$ |

3.41 |

|

$ |

3.43 |

|

$ |

3.50 |

|

$ |

3.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil Swaps: |

|

|

|

|

|

|

|

|

|

|

Average Monthly Volume (Bbls) |

|

|

113,167 |

|

|

61,333 |

|

|

53,000 |

|

|

30,917 |

|

|

Weighted Average Fixed Price ($) |

|

$ |

67.25 |

|

$ |

73.55 |

|

$ |

70.68 |

|

$ |

70.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil Collars: |

|

|

|

|

|

|

|

|

|

|

Two-way collars |

|

|

|

|

|

|

|

|

|

|

Average Monthly Volume (Bbls) |

|

|

15,000 |

|

|

102,000 |

|

|

59,500 |

|

|

|

|

Weighted Average Ceiling Price ($) |

|

$ |

76.16 |

|

$ |

80.20 |

|

$ |

80.20 |

|

|

|

|

Weighted Average Floor Price ($) |

|

$ |

65.00 |

|

$ |

70.00 |

|

$ |

70.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three-way collars |

|

|

|

|

|

|

|

|

|

|

Average Monthly Volume (Bbls) |

|

|

50,000 |

|

|

|

|

|

|

|

|

Weighted Average Ceiling Price ($) |

|

$ |

74.54 |

|

|

|

|

|

|

|

|

Weighted Average Floor Price ($) |

|

$ |

58.00 |

|

|

|

|

|

|

|

|

Weighted Average Sub-Floor Price ($) |

|

$ |

43.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

About Amplify Energy

Amplify Energy Corp. is an independent oil and

natural gas company engaged in the acquisition, development,

exploitation and production of oil and natural gas properties.

Amplify’s operations are focused in Oklahoma, the Rockies

(Bairoil), federal waters offshore Southern California (Beta), East

Texas / North Louisiana, and the Eagle Ford (Non-op). For more

information, visit www.amplifyenergy.com.

Investor Relations Contacts

Jim Frew – Senior Vice President and Chief Financial

Officer(832) 219-9044jim.frew@amplifyenergy.com

Michael Jordan – Director, Finance and Treasurer(832)

219-9051michael.jordan@amplifyenergy.com

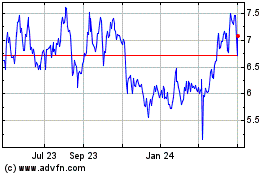

Amplify Energy (NYSE:AMPY)

Historical Stock Chart

From Jan 2025 to Feb 2025

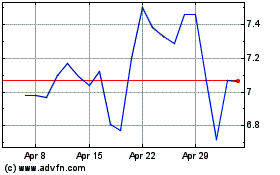

Amplify Energy (NYSE:AMPY)

Historical Stock Chart

From Feb 2024 to Feb 2025