American Tower Closes the Sale of Operations in India to Brookfield

September 12 2024 - 7:03AM

Business Wire

American Tower Corporation (NYSE: AMT) (“American Tower”) today

announced that it has closed the previously announced sale of 100%

of the equity interests in its operations in India (“ATC India”) to

Data Infrastructure Trust (“DIT”), an Infrastructure Investment

Trust sponsored by an affiliate of Brookfield Asset Management

(NYSE: BAM, TSX: BAM) (“Brookfield”).

Total cash proceeds to American Tower associated with the

transaction represents approximately INR 210 billion, or $2.5

billion at today’s exchange rates. Total cash proceeds include

approximately $320 million associated with the monetization of

optionally converted debentures issued by Vodafone Idea and

payments on ATC India receivables, net of withholding tax, and

approximately $2.2 billion of final proceeds at closing. Such

proceeds are expected to be used to repay American Tower’s existing

indebtedness, including the repayment of the existing India term

loan at closing. No further proceeds associated with this

transaction are anticipated.

American Tower’s current 2024 outlook midpoints, as reported in

the Company’s Form 8-K dated July 30, 2024, included full year

contributions from the India business. As a result of the

transaction, results associated with ATC India will now be reported

as discontinued operations. The Company estimates that the current

outlook midpoints for property revenue and Adjusted EBITDA,

including the contributions from discontinued operations and

adjusted to reflect the closing of the transaction, are $10,830

million and $7,185 million, respectively, and AFFO Attributable to

AMT Shareholders per diluted Share, which will be reported

inclusive of contributions from discontinued operations, is $10.48

per Share. The Company estimates that property revenue and Adjusted

EBITDA from continuing operations and AFFO attributable to AMT

common stockholders per Share from continuing operations proforma

for interest expense savings associated with the use of ATC India

sale proceeds, with proceeds and associated interest expense

savings impacts considered on an annualized basis, would have been

$9,920 million, $6,805 million and $9.95, respectively.

Supplementary slides with additional details have been provided

on the “Investor Relations” section of the Company’s website under

“Investor Presentations.”

Citi is serving as lead financial advisor and CDX Advisors is

serving as financial advisor to American Tower. Talwar Thakore

& Associates (TT&A) is serving as principal legal advisor

to American Tower.

About American Tower

American Tower, one of the largest global REITs, is a leading

independent owner, operator and developer of multitenant

communications real estate with a portfolio of nearly 148,000

communications sites (excludes India assets sold) and a highly

interconnected footprint of U.S. data center facilities. For more

information about American Tower, please visit the “Investor

Relations” section of the Company’s website,

www.americantower.com.

Cautionary Language Regarding Forward-Looking

Statements

This press release contains “forward-looking statements”

concerning the Company’s goals, beliefs, expectations, strategies,

objectives, plans, future operating results and underlying

assumptions and other statements that are not necessarily based on

historical facts. Examples of these statements include, but are not

limited to, statements regarding the expected use of the proceeds

to repay existing indebtedness and the expected impacts of the

transaction on the Company’s outlook. Actual results may differ

materially from those indicated in the Company’s forward-looking

statements as a result of various factors, including those factors

set forth under the caption “Risk Factors” in Item 1A of its most

recent annual report on Form 10-K, and other risks described in

documents the Company subsequently files from time to time with the

Securities and Exchange Commission. The Company undertakes no

obligation to update the information contained in this press

release to reflect subsequently occurring events or

circumstances.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911741652/en/

ATC Contact: Adam Smith Senior Vice President,

Investor Relations and FP&A Telephone: (617)

375-7500

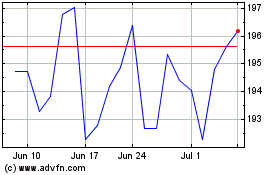

American Tower (NYSE:AMT)

Historical Stock Chart

From Oct 2024 to Nov 2024

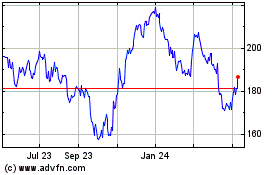

American Tower (NYSE:AMT)

Historical Stock Chart

From Nov 2023 to Nov 2024