agilon health, inc. (NYSE: AGL), the company transforming health

care for seniors by empowering primary-care physicians to focus on

the entire health of their patients, announced results for the

first quarter ended March 31, 2021.

First Quarter 2021

Results:

- Total revenue of $413 million increased 42% from 2020 and would

have increased approximately 50% including a recently completed

group Medicare Advantage (MA) contract that is retroactive to

January 2021

- Members of approximately 165,300 as of March 31 increased 35%

from 2020 and would have increased 42% to approximately 174,300

including the retroactive group contract

- Same geography membership growth of 8% from 2020 and same

geography membership growth of 15% including the retroactive group

contract

- Net loss from continuing operations of $14 million, compared to

$8 million in 2020

- Medical Margin of $52 million, compared to $42 million in

2020

- Adjusted EBITDA of $4 million, compared to $3 million in

2020

“We are pleased with our first quarter results, highlighted by

42% revenue growth and 35% membership growth. Including the

retroactive group MA contract, same geography membership growth

increased 15%, reflective of strong member retention and

broad-based additions across all markets. Our aligned partnership

model is resonating with physician groups and we began implementing

six new geographies with approximately 49,000 members that will

go-live in January 2022,” said Steve Sell, Chief Executive Officer.

“With the completion of our initial public offering, we are well

capitalized to support our growth strategy. We plan to use the

proceeds to scale our platform, support growth of our existing

physician partners, and partner with additional groups to help

transform senior care in local communities across the country.”

Outlook for Second Quarter and Fiscal

Year 2021:

Quarter Ending June 30, 2021

Year Ending December 31, 2021

Low

High

Low

High

Ending members

175,000

177,000

182,000

184,000

Total revenues ($M)

$470

$475

$1,765

$1,780

Adjusted EBITDA ($M)

($41)

($38)

Total revenue outlook for the second quarter 2021 includes an

estimated $24 million associated with the group MA contract

attributable to the first quarter. Adjusted EBITDA loss reflected

in the full year 2021 outlook is expected to be weighted to the

second half of the fiscal year.

We have not reconciled guidance for Adjusted EBITDA to net

income (loss), the most directly comparable GAAP measure, and have

not provided forward-looking guidance for net income (loss),

because of the uncertainty around certain items that may impact net

income (loss), including stock-based compensation, that are not

within our control or cannot be reasonably predicted.

Membership Details

Membership as of March 31, 2021 was approximately 165,300, an

increase of 35% from 2020. Average membership during the first

quarter 2021 was approximately 163,000. Including an estimated

49,000 members currently in implementation for 2022 go-live, total

MA membership on the agilon platform was approximately 214,300 as

of March 31, 2021.

Same geography membership increased 8% year-over-year during the

first quarter 2021 and increased 15% including a recently completed

group MA contract that is retroactive to January 2021. During the

first quarter, a group MA contract transitioned between two payers

in one of our geographies. Due to the timing required to complete

the transition, agilon health’s first quarter 2021 results do not

include the revenue, membership, or costs of these members. agilon

health recently completed a new agreement covering this membership

and this will be reflected in the company’s financial results for

the second quarter 2021, including retroactive amounts associated

with first quarter 2021. We estimate the retroactive revenue and

membership associated with this contract for the first quarter 2021

are approximately $24 million and 9,000, respectively. Importantly,

patients covered by this group plan were under the continuous care

of their primary care doctor during this transition.

Direct Contracting

In collaboration with seven of our physician group partners, we

launched five Direct Contracting Entities (DCE) with over 50,000

attributed beneficiaries on April 1, 2021. The DCE program allows

physician groups on the agilon platform to operate a single line of

business for Medicare patients. While the recent announcement from

the Center for Medicare and Medicaid Innovation will limit new DCE

entrants for 2022, we will be able to utilize existing DCEs as a

vehicle for existing or new physician groups to participate in the

Direct Contracting program.

Initial Public Offering and Debt Refinancing

On April 19, 2021, we completed the initial public offering of

53,590,000 shares of common stock at a price of $23.00 per share.

The net proceeds of the offering were approximately $1.16 billion,

after underwriting fees and other offering expenses.

On February 18, 2021, we executed a new credit facility

agreement (2021 Secured Credit Facilities). The 2021 Secured Credit

Facilities included an initial $100 million senior secured term

loan and a $100 million senior secured revolving credit facility.

Subsequent to the end of the first quarter and in connection with

our initial public offering, we repaid $50 million of the senior

secured term loan.

As of April 30, 2021, including the impact from the initial

public offering, debt refinancing, debt repayment and other items,

agilon health had approximately $1.1 billion of cash and $50

million of debt outstanding.

Webcast and Conference Call:

agilon health will host a conference call and webcast to discuss

first quarter 2021 results on Thursday, May 27, 2021 at 8:30 AM

Eastern Time. The conference call and webcast can be accessed by

dialing (855) 435-0829 for U.S. participants, or +1 (639) 491-2399

for international participants, and referencing participant code

9436419, or visiting the “Events & Presentations” section of

https://investors.agilonhealth.com. A replay of the call will be

available via webcast for on-demand listening shortly after the

completion of the call.

About agilon health

agilon health is transforming health care for seniors by

empowering primary-care physicians to focus on the entire health of

their patients. Through our partnerships and our platform, agilon

is leading the nation in creating the system we need – one built on

the value of care, not the volume of fees. We honor the

independence of local physicians and serve as their partners so

they can be the doctors they trained to be. agilon provides the

capital, data, payor relationships, executive experience and

contract support that allow physician groups to take on the risk of

total care for their most vulnerable patients. The result:

healthier communities, and doctors who can devote the right amount

of time with the patients who need it most. With rapidly growing

appeal, agilon is scaled to grow and is here to help our nation’s

best independent physician groups have a sustained, thriving

future. Together, we are reinventing primary care.

Forward Looking Statements

Statements in this release that are not historical facts are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements include, among other things, statements regarding our

and our officers’ intent, belief or expectation as identified by

the use of words such as “may,” “will,” “project,” “expect,”

“believe,” “intend,” “anticipate,” “seek,” "target," “forecast,”

“plan,” “potential,” “estimate,” “could,” “would,” “should,” and

other comparable and derivative terms or the negatives thereof.

Examples of forward-looking statements include, among other things:

(i) statements regarding timing, outcomes and other details

relating to current, pending or contemplated new markets, new

partnership structures, financing activities, dispositions, or

other transactions discussed in this release; and (ii) statements

regarding growth opportunities, ability to deliver sustainable

long-term value, business environment, long term opportunities and

strategic growth plan including without limitation with respect to

expected revenue and net income, total and average membership,

Adjusted EBITDA, and other financial projections and assumptions,

as well as comparable statements included in other sections of this

release. Forward-looking statements reflect our current

expectations and views about future events and are subject to risks

and uncertainties that could significantly affect our future

financial condition and results of operations. While

forward-looking statements reflect our good faith belief and

assumptions we believe to be reasonable based upon current

information, we can give no assurance that our expectations or

forecasts will be attained. Further, we cannot guarantee the

accuracy of any such forward-looking statement contained in this

release, and such forward-looking statements are subject to known

and unknown risks and uncertainties that are difficult to predict.

These risks and uncertainties that could cause actual results and

outcomes to differ from those reflected in forward-looking

statements include, but are not limited to: our history of net

losses, and our ability to achieve or maintain profitability in an

environment of increasing expenses; our ability to identify and

develop successful new geographies, physician partners and payors,

or to execute upon our growth initiatives; our ability to execute

our operation strategies or to achieve results consistent with our

historical performance; our expectation that our expenses will

increase in the future and the risk that medical expenses incurred

on behalf of members may exceed the amount of medical revenues we

receive; our ability to secure contracts with Medicare Advantage

payors or to secure Medicare Advantage at favorable financial

terms; our ability to recover startup costs incurred during the

initial stages of development of our physician partner

relationships and program initiatives; significant reductions in

our membership; challenges for our physician partners in the

transition to a Total Care Model; inaccuracies in the estimates and

assumptions we use to project the size, revenue or medical expense

amounts of our target market; the spread of, and response to, the

novel coronavirus, or COVID-19, and the inability to predict the

ultimate impact on us; security breaches, loss of data or other

disruptions to our data platforms; the impact of devoting

significant attention and resources to the provision of certain

transition services in connection with the disposition of our

California operations; our subsidiaries’ lack of performance or

ability to fund their operations, which could require us to fund

such losses; our dependence on a limited number of key payors; the

limited terms of our contracts with payors and that they may not be

renewed upon their expiration; our reliance on our payors for

membership attribution and assignment, data and reporting accuracy

and claims payment; our dependence on physician partners and other

providers to effectively manage the quality and cost of care and

perform obligations under payor contracts; our dependence on

physician partners to accurately, timely and sufficiently document

their services and potential False Claims Act or other liability if

any diagnosis information or encounter data are inaccurate or

incorrect; reductions in reimbursement rates or methodology applied

to derive reimbursement from, or discontinuation of, federal

government healthcare programs, from which we derive substantially

all of our total revenue; statutory or regulatory changes,

administrative rulings, interpretations of policy and

determinations by intermediaries and governmental funding

restrictions, and their impact on government funding, program

coverage and reimbursements; regulatory proposals directed at

containing or lowering the cost of healthcare and our participation

in such proposed models; the impact on our revenue of CMS modifying

the methodology used to determine the revenue associated with MA

members; our substantial indebtedness and the potential that we may

incur additional indebtedness; and risks related to other factors

discussed under “Risk Factors” in our Registration Statement on

Form S-1. Except as required by law, we do not undertake, and

hereby disclaim, any obligation to update any forward-looking

statements, which speak only as of the date on which they are

made.

agilon health, inc.

Consolidated Balance

Sheets

In thousands, except share and

per share data

March 31,

2021

December 31,

2020

(unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

105,289

$

106,795

Restricted cash and equivalents

14,202

28,383

Receivables, net

288,827

144,555

Prepaid expenses and other current assets,

net

9,314

9,639

Current assets held for sale and

discontinued operations, net

—

4,825

Total current assets

417,632

294,197

Property and equipment, net

4,799

6,456

Intangible assets, net

61,609

60,468

Goodwill

41,540

41,540

Other assets, net

47,259

43,700

Non-current assets held for sale, net

1,199

—

Total assets

$

574,038

$

446,361

LIABILITIES, CONTINGENTLY REDEEMABLE

COMMON STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT)

Current liabilities:

Medical claims and related payables

$

276,984

$

162,868

Accounts payable and accrued expenses

95,122

97,244

Current portion of long-term debt

—

3,041

Current liabilities held for sale and

discontinued operations

—

3,682

Total current liabilities

372,106

266,835

Long-term debt, net of current portion

99,412

64,665

Other liabilities

91,264

90,091

Total liabilities

562,782

421,591

Commitments and contingencies

Contingently redeemable common stock,

$0.01 par value: 76,201 shares issued and outstanding

309,500

309,500

Stockholders' equity (deficit):

Common stock, $0.01 par value: 500,000

shares authorized; 249,474 and 249,374 shares issued and

outstanding, respectively

2,494

2,494

Additional paid-in capital

265,603

263,966

Accumulated deficit

(566,268

)

(551,190

)

Total agilon health, inc. stockholders'

equity

(298,171

)

(284,730

)

Noncontrolling interests

(73

)

—

Total stockholders’ equity (deficit)

(298,244

)

(284,730

)

Total liabilities, contingently redeemable

common stock and stockholders’ equity (deficit)

$

574,038

$

446,361

agilon health, inc.

Consolidated Statements of

Operations

In thousands, except per share

data

(unaudited)

Three Months Ended March

31,

2021

2020

Revenues:

Medical services revenue

$

412,412

$

289,814

Other operating revenue

692

1,234

Total revenues

413,104

291,048

Expenses:

Medical services expense

360,354

247,653

Other medical expenses

23,661

18,426

General and administrative

37,777

27,605

Depreciation and amortization

3,427

3,198

Total expenses

425,219

296,882

Income (loss) from operations

(12,115

)

(5,834

)

Other income (expense):

Other income (expense), net

1,336

122

Interest expense

(2,941

)

(2,149

)

Income (loss) before income

taxes

(13,720

)

(7,861

)

Income tax benefit (expense)

(16

)

—

Income (loss) from continuing

operations

(13,736

)

(7,861

)

Discontinued operations:

Income (loss) before income taxes

(1,351

)

(8,089

)

Income tax benefit (expense)

(64

)

(149

)

Total discontinued operations

(1,415

)

(8,238

)

Net income (loss)

(15,151

)

(16,099

)

Noncontrolling interests’ share in

earnings (loss)

73

—

Net income (loss) attributable to

common shares

$

(15,078

)

$

(16,099

)

Net income (loss) per common share,

basic and diluted

Continuing operations

$

(0.04

)

$

(0.02

)

Discontinued operations

$

(0.01

)

$

(0.03

)

Weighted average shares outstanding,

basic and diluted

325,659

321,250

agilon health, inc.

Condensed Consolidated

Statements Of Cash Flows

In thousands, except per share

data

(unaudited)

Three Months Ended March

31,

2021

2020

Cash flows from operating

activities:

Net income (loss)

$

(15,151

)

$

(16,099

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

3,481

3,363

Stock-based compensation expense

1,472

1,071

Loss on debt extinguishment

1,186

—

Other noncash items

1,766

837

Changes in operating assets and

liabilities

(33,582

)

(15,299

)

Net cash provided by (used in) operating

activities

(40,828

)

(26,127

)

Cash flows from investing

activities:

Purchase of property and equipment,

net

(178

)

(345

)

Purchase of intangible assets

(3,986

)

(33

)

Investment in loans receivable and

other

(1,204

)

(359

)

Proceeds from repayment of loans

receivable

—

1,056

Proceeds from sale of business, net of

cash divested

(3,706

)

—

Net cash provided by (used in) investing

activities

(9,074

)

319

Cash flows from financing

activities:

Proceeds from equity issuances, net

—

28,128

Proceeds from exercise of stock

options

165

—

Proceeds from the issuance of long-term

debt

100,000

—

Debt issuance costs

(1,218

)

—

Repayments of long-term borrowings

(68,649

)

(760

)

Net cash provided by (used in) financing

activities

30,298

27,368

Net increase (decrease) in cash, cash

equivalents and restricted cash and equivalents

(19,604

)

1,560

Cash, cash equivalents and restricted cash

and equivalents from continuing operations, beginning of period

135,178

139,152

Cash, cash equivalents and restricted cash

and equivalents from discontinued operations, beginning of

period

3,917

6,460

Cash, cash equivalents and restricted

cash and equivalents, beginning of period

139,095

145,612

Cash, cash equivalents and restricted cash

and equivalents from continuing operations, end of period

119,491

142,563

Cash, cash equivalents and restricted cash

and equivalents from discontinued operations, end of period

—

4,609

Cash, cash equivalents and restricted

cash and equivalents, end of period

$

119,491

$

147,172

agilon health, inc.

Key Operating Metrics

In thousands

(unaudited)

MEDICAL MARGIN

Three Months Ended March

31,

2021

2020

Medical services revenue

$

412,412

$

289,814

Medical services expense

(360,354

)

(247,653

)

Medical margin

$

52,058

$

42,161

Medical margin represents the amount earned from medical

services revenue after medical services expenses are deducted.

Medical services expense represents costs incurred for medical

services provided to our members. As our platform matures over

time, we expect medical margin to increase in absolute dollars.

However, medical margin per member per month (PMPM) may vary as the

percentage of new members brought onto our platform fluctuates. New

membership added to the platform is typically dilutive to medical

margin PMPM.

GENERAL AND ADMINISTRATIVE COSTS,

INCLUDING PLATFORM SUPPORT COSTS

Three Months Ended March

31,

2021

2020

Platform support costs

$

28,408

$

23,520

Geography entry costs(1)

3,222

652

Severance and related costs

454

2

Management fees(2)

375

330

Stock-based compensation expense

1,472

1,021

Other(3)

3,846

2,080

General and administrative

$

37,777

$

27,605

(1)

Represents physician incentive

expense related to surplus sharing and other direct medical

expenses incurred to improve care for our members in our live

geographies. Excludes costs in geographies for which we are

contracted to go live in January of the following year.

(2)

Represents management fees and

other expenses paid to Clayton Dubilier & Rice, LLC

(“CD&R”). In connection with our initial public offering, we

terminated our consulting agreement with CD&R, effective April

16, 2021. We were not charged a fee in connection with the

termination of this agreement.

(3)

Includes changes in non-cash

accruals for unasserted claims and contingent liabilities.

Our platform support costs, which include regionally-based

support personnel and other operating costs to support our

geographies, are expected to decrease over time as a percentage of

revenue as our physician partners add members and our revenue

grows. Our operating expenses at the enterprise level include

resources and technology to support payor contracting, clinical

program development, quality, data management, finance and legal

functions.

agilon health, inc.

Non-GAAP Financial

Measures

In thousands

(unaudited)

NETWORK CONTRIBUTION

Three Months Ended March

31,

2021

2020

Income (loss) from operations

$

(12,115

)

$

(5,834

)

Other operating revenue

(692

)

(1,234

)

Other medical expenses

23,661

18,426

Other medical expenses—live

geographies(1)

(21,916

)

(17,421

)

General and administrative

37,777

27,605

Depreciation and amortization

3,427

3,198

Network contribution

$

30,142

$

24,740

(1)

Represents physician incentive

expense related to surplus sharing and other direct medical

expenses incurred to improve care for our members in our live

geographies. Excludes costs in geographies for which we are

contracted to go live in January of the following period. For the

three months ended March 31, 2021 and 2020, costs incurred in

implementing geographies were $1.8 million and $1.0 million,

respectively.

ADJUSTED EBITDA

Three Months Ended March

31,

2021

2020

Net income (loss)

$

(15,151

)

$

(16,099

)

(Income) loss from discontinued

operations, net of income taxes

1,415

8,238

Interest expense

2,941

2,149

Income tax expense (benefit)

16

0

Depreciation and amortization

3,427

3,198

Geography entry costs(1)

4,967

1,658

Severance and related costs

454

2

Management fees(2)

375

330

Stock-based compensation expense

1,472

1,021

Other(3)

3,846

2,080

Adjusted EBITDA

$

3,762

$

2,577

(1)

Represents direct geography entry

costs, including investments to develop and expand our platform,

physician incentive expense, employee-related expenses and

marketing. For the three months ended March 31, 2021 and 2020, (i)

$1.8 million and $1.0 million, respectively, are included in other

medical expenses and (ii) $3.2 million and $0.7 million,

respectively, are included in general and administrative

expenses.

(2)

Represents management fees and

other expenses paid to CD&R. In connection with our initial

public offering, we terminated our consulting agreement with

CD&R, effective April 16, 2021. We were not charged a fee in

connection with the termination of this agreement.

(3)

Includes changes in non-cash

accruals for unasserted claims and contingent liabilities.

In addition to providing results that are determined in

accordance with GAAP, we present network contribution and Adjusted

EBITDA, which are non-GAAP financial measures.

We define network contribution as medical services revenue less

the sum of: (i) medical services expense and (ii) other medical

expenses excluding costs incurred in implementing geographies.

Other medical expenses consist of physician incentive expense

related to surplus sharing and other direct medical expenses

incurred to improve care for our members. We believe this metric

provides insight into the economics of our Total Care Model as it

includes all medical services expense associated with our members’

care as well as partner incentive and additional medical costs we

incur as part of our aligned partnership model. Other medical

expenses are largely variable and proportionate to the level of

surplus in each respective geography.

We define Adjusted EBITDA as net income (loss) adjusted to

exclude: (i) income (loss) from discontinued operations, net of

income taxes, (ii) interest expense, (iii) income tax expense

(benefit), (iv) depreciation and amortization expense, (v)

geography entry costs, (vi) share-based compensation expense, (vii)

severance and related costs and (viii) certain other items that are

not considered by us in the evaluation of ongoing operating

performance.

Income (loss) from operations is the most directly comparable

GAAP measure to network contribution. Net income (loss) is the most

directly comparable GAAP measure to Adjusted EBITDA.

We believe network contribution and Adjusted EBITDA help

identify underlying trends in our business and facilitate

evaluation of period-to-period operating performance of our live

geographies by eliminating items that are variable in nature and

not considered by us in the evaluation of ongoing operating

performance, allowing comparison of our recurring core business

operating results over multiple periods. We also believe network

contribution and Adjusted EBITDA provide useful information about

our operating results, enhance the overall understanding of our

past performance and future prospects, and allow for greater

transparency with respect to key metrics we use for financial and

operational decision-making. We believe network contribution and

Adjusted EBITDA or similarly titled non-GAAP measures are widely

used by investors, securities analysts, ratings agencies, and other

parties in evaluating companies in our industry as a measure of

financial performance. Other companies may calculate network

contribution and Adjusted EBITDA or similarly-titled non-GAAP

measures differently from the way we calculate these metrics. As a

result, our presentation of network contribution and Adjusted

EBITDA may not be comparable to similarly titled measures of other

companies, limiting their usefulness as comparative measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210526005986/en/

Investor Contact Matthew Gillmor VP of Investor Relations

investor.relations@agilonhealth.com

Media Contact Shannan Siemens Managing Director, Mercury

media@agilonhealth.com

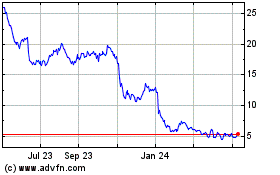

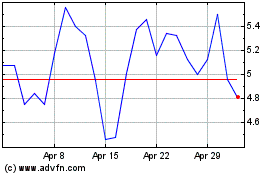

Agilon Health (NYSE:AGL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Agilon Health (NYSE:AGL)

Historical Stock Chart

From Nov 2023 to Nov 2024