false

0000803578

0000803578

2024-08-19

2024-08-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 19, 2024

FIREFLY NEUROSCIENCE, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

|

001-41092

|

|

54-1167364

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

1100 Military Road

Kenmore, NY

|

|

14217

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: 888-237-6412

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $0.0001 par value per share

|

|

AIFF

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

Appointment of Directors

On August 19, 2024, the Board of Directors (the “Board”) of Firefly Neuroscience, Inc. (the “Company”) appointed David Johnson and Stella Vnook to the Board, with Mr. Johnson to serve as Executive Chairman of the Board pursuant to the Johnson Employment Agreement (as defined herein), effective as of August 19, 2024. Upon Ms. Vnook’s appointment, Ms. Vnook will succeed (i) David DeCaprio as a member of the Audit Committee of the Board and (ii) Arun Menawat as a member of the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”), each effective as of August 19, 2024. Ms. Vnook will also replace Brian Posner as the Chairperson of the Nominating Committee, effective as of August 19, 2024.

There are no arrangements or understandings between either of Mr. Johnson or Ms. Vnook and any other person pursuant to which Mr. Johnson or Ms. Vnook was named a director of the Company. Other than the Johnson Employment Agreement, neither of Mr. Johnson nor Ms. Vnook has any direct or indirect material interest in any transaction or proposed transaction required to be reported under Item 404(a) of Regulation S-K.

Additionally, on August 19, 2024, the Board designated (i) Greg Lipschitz, David DeCaprio and Jon Olsen to serve as Class I members of the Board, with such term to expire at the first annual meeting of stockholders following the filing of the Certificate of Incorporation (such date, the “Filing Date”), (ii) Brian Posner and Stella Vnook to serve as Class II directors of the Board, with such term to expire at the second annual meeting of stockholders following the Filing Date, and (iii) David Johnson and Arun Menawat to serve as Class III members of the Board, with such term to expire at the third annual meeting of stockholders following the Filing Date.

Employment Agreement with David Johnson

On August 19, 2024 (the “Effective Date”), the Company entered into an Employment Agreement with David Johnson (the “Johnson Employment Agreement”), pursuant to which Mr. Johnson has agreed to serve as Executive Chairman of the Board. Pursuant to the Johnson Agreement, the Company shall pay Mr. Johnson a monthly salary of $12,500 ($150,00 annually) (the “Base Salary”), which such Base Salary shall be reviewed by the Board on an annual basis for increase. Additionally, as soon as administratively practicable following the Effective Date (and in all events, no later than 60 days following the Effective Date), the Company shall grant Mr. Johnson an award of restricted stock that represents, in the aggregate, five (5%) percent of the Company’s issued and outstanding common stock determined on a fully diluted basis as of the Effective Date, with (A) one-half of the initial grant to vest in two equal tranches on each of the six (6) and twelve (12) month anniversary of the Effective Date and (B) all unvested shares subject to the initial grant to vest on the first to occur of the following: (1) a “change in control” (as defined in the applicable award agreement) and (2) the termination of Mr. Johnson’s employment by the Company without Cause or by Mr. Johnson with Good Reason (each as defined in the Johnson Employment Agreement). Pursuant to the Johnson Employment Agreement, Mr. Johnson may receive a one-time performance bonus (the “Performance Bonus”) based upon the achievement of certain gross capital proceeds raised as a part of a successful financing (a “Successful Financing”). If the Successful Financing is (i) under or equal to $5,000,000, (ii) in excess of $5,000,000 and up to or equal to $10,000,000 and (iii) in excess of $10,000,000, Mr. Johnson shall be entitled to a cash bonus of $50,000, $100,000, and $150,000, respectively.

Pursuant to the Johnson Employment Agreement, the term of the Johnson Employment Agreement shall begin on the Effective Date. Either party may terminate the Johnson Employment Agreement any time upon written notice; provided that the Company and the Mr. Johnson will be required to provide the other at least thirty (30) days’ advance written notice of a termination without Cause or Mr. Johnson’s voluntary resignation without Good Reason, respectively. Upon termination of Mr. Johnson’s employment, the Company shall pay the Mr. Johnson (i) any unpaid Base Salary accrued through the date of termination, (ii) any accrued and unpaid paid time off or similar pay to which Mr. Johnson is entitled as a matter of law or Company policy, (iii) any amounts due to Mr. Johnson under the terms of the Company’s benefit plans, and (iv) any unreimbursed expenses properly incurred prior to the date of termination. The Johnson Employment Agreement also contains certain non-solicitation, non-disparagement and confidentiality provisions customary for agreements of such nature.

The foregoing summary description of the Johnson Employment Agreement is qualified in its entirety by reference to the full text of the Johnson Employment Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein in its entirety by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

Number

|

|

Description of Exhibit

|

|

| |

|

|

| 10.1 |

|

|

|

| 104 |

|

Cover Page Interactive Data File

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

FIREFLY NEUROSCIENCE, INC.

|

| |

|

|

|

Date: August 20, 2024

|

By:

|

/s/ Jon Olsen

|

| |

Name:

|

Jon Olsen

|

| |

Title:

|

Chief Executive Officer

|

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (this “Agreement”) is dated as of August 19, 2024 (the “Effective Date”) and is entered into by and between David Johnson (the “Executive”) and Firefly Neuroscience, Inc., a Delaware corporation (the “Company”). The Company and the Executive shall be referred to herein as the “Parties.”

RECITALS

WHEREAS, the Company and the Executive desire to state in writing the terms and conditions of their agreement and understandings with respect to the employment of the Executive after the closing date of the proposed reverse merger transaction between WaveDancer, Inc., a Delaware corporation (“WaveDancer”) and the Company, as contemplated by that certain Agreement and Plan of Merger, dated as of November 15, 2023 (as amended by that certain Amendment No. 1, dated as of January 12, 2024), pursuant to which, among other things, FFN Merger Sub, Inc., a Delaware corporation, and a wholly-owned subsidiary of WaveDancer, will merge with and into the Company, with the Company continuing as the surviving corporation and a wholly-owned subsidiary of WaveDancer.

NOW, THEREFORE, in consideration of the mutual promises and agreements contained herein, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the Parties hereby agree as follows:

ARTICLE I.

SERVICES TO BE PROVIDED BY EXECUTIVE

A. Position and Responsibilities. The Executive shall serve in the position of Executive Chairman and shall perform services for the Company as requested or as needed to perform the Executive’s job. The duties of the Executive shall be those duties which can reasonably be expected to be performed by a person in such position. At all times during the Term (as defined below), the Executive shall report exclusively to, and be subject to the direction and supervision of, the Board of Directors of the Company (the “Board”).

B. Performance. The Executive’s places of employment shall be in Bucks County, Pennsylvania and Naples, Florida. During the Executive’s employment with the Company, the Executive shall devote 100% of the Executive’s time, energy, skill and reasonable best efforts for an average of fifty-two (52) days per year to the performance of the Executive’s duties hereunder to the Company in a manner that will faithfully and diligently further the business and interests of the Company, and shall exercise reasonable best efforts to perform the Executive’s duties in a diligent, trustworthy, good faith and business‑like manner, all for the purpose of advancing the business of the Company. The Executive shall at all times act in a manner consistent with the Executive’s position.

ARTICLE II.

COMPENSATION FOR SERVICES

As compensation for all services the Executive will perform under this Agreement, the Company will pay the Executive, and the Executive shall accept as full compensation, the following:

A. Base Salary. The Company shall pay the Executive a monthly salary of $12,500 ($150,000, annually) (“Base Salary”). The Company shall pay the Base Salary in accordance with the normal payroll policies of the Company. The Executive’s Base Salary will be reviewed by the Board on an annual basis for increase.

B. Inducement Grant. As soon as administratively practicable following the Effective Date hereof (and in all events no later than 60 days after the Effective Date), the Company (pursuant to approval of the Board) shall grant the Executive an award of restricted stock that represents, in the aggregate, five percent of the Company’s issued and outstanding common stock (“Common Stock”) determined on a fully diluted basis as of the Effective Date (the “Initial Grant”). The Initial Grant shall be subject to the terms and conditions of an award agreement that shall provide, among other things, that (A) one-half of the Initial Grant shall vest in two equal tranches on each of the 6th and 12th month anniversary of the Effective Date, provided the Executive is employed by the Company in any capacity, on the applicable vesting date; and (B) all unvested shares subject to the Initial Grant shall immediately vest on the first to occur of the following: (1) a “change in control” (as defined in the applicable award agreement) and (2) the termination of the Executive’s employment by the Company without Cause (as defined below) or by the Executive with Good Reason (as defined below).

C. Performance Bonus. The Executive may also be eligible to receive a one-time performance bonus (the “Performance Bonus”) based upon the achievement of a successful financing by the Company calculated in accordance with the schedule below, payable on or before March 15th of the year following the year to which the Performance Bonus relates. Notwithstanding the foregoing, to be eligible to receive the Performance Bonus, the Executive must remain employed through the payment date of the Performance Bonus. The evaluation of a successful financing and the awarding of the Performance Bonus shall be determined reasonably and in good faith by the Board.

|

Gross Capital Proceeds Raised as Part of Successful Financing

|

|

Cash Bonus Amount

|

|

Under or equal to $5,000,000

|

|

$ |

50,000 |

|

|

In excess of $5,000,000 and up to or equal to $10,000,000

|

|

$ |

100,000 |

|

|

In excess of $ $10,000,000

|

|

$ |

150,000 |

|

D. Other Expenses. The Company agrees that, during the Executive’s employment, it will promptly reimburse the Executive for out-of-pocket expenses reasonably incurred in connection with the Executive’s performance of the Executive’s services hereunder, upon the presentation by the Executive of an itemized accounting of such expenditures, with supporting receipts, provided that the Executive submits such expenses for reimbursement in compliance with the Company’s expense reimbursement policies. Reimbursement shall be in compliance with the Company’s expense reimbursement policies and, if applicable, Article V, Section I(ii).

E. Other Benefits. In lieu of any Company-provided benefits, to the extent permitted by applicable law, the Company agrees to pay the Executive an additional $1,250 per month ($15,000, annually), payable on the first payroll date during each month less applicable payroll deductions and tax withholdings.

F. Indemnification and Insurance. The Company agrees to defend and indemnify the Executive to the maximum amount permitted by law. The Company shall also ensure that the Executive is covered under a Directors and Officers Liability Policy sufficient to protect the Executive from claims arising from the Executive’s role as an officer or director of the Company.

G. Legal Fees. The Company shall reimburse the Executive for all of the Executive’s reasonable, documented legal fees and expenses associated with the negotiation of this Agreement up to a maximum of $5,000 within 30 days of the Effective Date.

ARTICLE III.

TERM; TERMINATION

A. Term of Employment. This Agreement’s stated term and employment relationship created hereunder will begin on the Effective Date and will remain in effect until terminated by either party in accordance with this Article III (the “Term”). The Executive shall resign as a member of the Board upon termination if requested by the Company.

B. Termination. Either party may terminate the Executive’s employment at any time upon written notice; provided that the Company and the Executive will be required to provide the other at least 30 days’ advance written notice of a termination without Cause (as defined below) or the Executive’s voluntary resignation without Good Reason (as defined below), respectively. The date of the Executive’s termination shall be the date stated in the notice of termination. Upon termination of the Executive’s employment, the Company shall pay the Executive (i) any unpaid Base Salary accrued through the date of termination, (ii) any accrued and unpaid paid time off or similar pay to which the Executive is entitled as a matter of law or Company policy, (iii) any amounts due to the Executive under the terms of the Benefit Plans, and (iv) any unreimbursed expenses properly incurred prior to the date of termination (the “Accrued Obligations”).

(i) Expiration of the Agreement; Termination for Cause or Voluntary Resignation without Good Reason. In the event the Executive voluntarily resigns without Good Reason, the Company may, in its sole discretion, shorten the notice period and determine the date of termination without any obligation to pay the Executive any additional compensation other than the Accrued Obligations and without triggering a termination of the Executive’s employment without Cause. In addition, in the event this Agreement expires, the Company terminates the Executive’s employment for Cause, or the Executive voluntarily resigns without Good Reason, the Company shall have no further liability or obligation to the Executive under this Agreement other than the Accrued Obligations. The Accrued Obligations shall be payable in a lump sum within the time period required by applicable law, and in no event later than 30 days following the Executive’s employment termination date. For purposes of this Agreement, “Cause” means a termination of employment because of: (a) the Executive’s failure or refusal to perform the duties of the Executive’s position in a manner causing material detriment to the Company; (b) the Executive’s willful misconduct with regard to the Company or its business, assets or executives (including, without limitation, the Executive’s fraud, embezzlement, intentional misrepresentation, misappropriation, conversion or other act of dishonesty with regard to the Company); (c) the Executive’s commission of an act or acts constituting a felony or any crime involving fraud or dishonesty as determined in good faith by the Company; (d) the Executive’s breach of a fiduciary duty owed to the Company; (e) any material breach of this Agreement or any other agreement with the Company; or (f) any injury, illness or incapacity which shall wholly or continuously disable the Executive from performing the essential functions of the Executive’s position for any successive or intermittent period of at least 12 months. In each such event listed above, if the circumstances are curable, the Company shall give the Executive written notice thereof which shall specify in reasonable detail the circumstances constituting Cause, and there shall be no Cause with respect to any such circumstances if cured by the Executive within 30 days after such notice.

(ii) Termination Without Cause or for Good Reason. In the event the Executive’s employment is terminated by the Company without Cause or by the Executive for Good Reason at any time, the Executive shall receive, subject to the execution and timely return by the Executive of a release of claims in the form to be delivered by the Company, which release shall, by its terms, be irrevocable no later than the sixtieth (60th) day following the Executive’s employment termination date, severance pay in an aggregate amount equal to the Executive’s Base Salary for 12 months, less applicable payroll deductions and tax withholdings, payable in accordance with the normal payroll policies of the Company over a 12 month period, as applicable, with the first such payment being paid to the Executive on the Company’s first regular pay date on or after the 60th day following the Executive’s employment termination date. For purposes of this Agreement, “Good Reason” means a termination of employment because of: (x) a materially adverse diminution in the Executive’s role or responsibilities without the Executive’s consent; or (y) any material breach of this Agreement by the Company or any other agreement with the Executive. In each such event listed above, the Executive shall give the Company written notice thereof within 30 days following the first occurrence of such event, which notice shall specify in reasonable detail the circumstances constituting Good Reason, and there shall be no Good Reason with respect to any such circumstances if cured by the Company within 30 days after such notice or, if such event is not cured by the Company, the Executive terminates the Executive’s employment with the Company no later than 60 days following the first occurrence of such event.

ARTICLE IV.

RESTRICTIVE COVENANTS

A. Confidentiality.

(i) Confidential Information. During the Executive’s employment with the Company, the Company shall grant the Executive otherwise prohibited access to its trade secrets and confidential information which is not known to the Company’s competitors or within the Company’s industry generally, which was developed by the Company over a long period of time and/or at its substantial expense, and which is of great competitive value to the Company, and access to the Company’s customers and clients. For purposes of this Article IV, the “Company” shall also include its parents, subsidiaries and affiliates. For purposes of this Agreement, “Confidential Information” includes any trade secrets or confidential or proprietary information of the Company, including, but not limited to, the following: methods of operation, products, inventions, services, processes, equipment, know-how, technology, technical data, policies, strategies, designs, formulas, developmental or experimental work, improvements, discoveries, research, plans for research or future products and services, corporate transactions, database schemas or tables, software, development tools or techniques, training procedures, training techniques, training manuals, business information, marketing and sales methods, plans and strategies, competitors, markets, market surveys, techniques, production processes, infrastructure, business plans, distribution and installation plans, processes and strategies, methodologies, budgets, financial data and information, customer and client information, prices and costs, fees, customer and client lists and profiles, employee, customer and client nonpublic personal information, supplier lists, business records, product construction, product specifications, audit processes, pricing strategies, business strategies, marketing and promotional practices, management methods and information, plans, reports, recommendations and conclusions, information regarding the skills and compensation of employees and contractors of the Company, and other business information disclosed to the Executive by the Company, either directly or indirectly, in writing, orally, or by drawings or observation. “Confidential Information” does not include, and there shall be no obligation hereunder with respect to, information that (a) is generally available to the public on the date of this Agreement or (b) becomes generally available to the public other than as a result of a disclosure not otherwise permissible hereunder.

(ii) No Unauthorized Use or Disclosure. The Executive acknowledges and agrees that Confidential Information is proprietary to and a trade secret of the Company and, as such, is a special and unique asset of the Company, and that any disclosure or unauthorized use of any Confidential Information by the Executive will cause irreparable harm and loss to the Company. The Executive understands and acknowledges that each and every component of the Confidential Information (a) has been developed by the Company at significant effort and expense and is sufficiently secret to derive economic value from not being generally known to other parties, and (b) constitutes a protectable business interest of the Company. The Executive acknowledges and agrees that the Company owns the Confidential Information. The Executive agrees not to dispute, contest, or deny any such ownership rights either during or after the Executive’s employment with the Company. The Executive agrees to preserve and protect the confidentiality of all Confidential Information. The Executive agrees that the Executive shall not during the period of the Executive’s employment with the Company and thereafter, directly or indirectly, disclose to any unauthorized person or use for the Executive’s own account any Confidential Information without the Company’s consent. Throughout the Executive’s employment with the Company thereafter: (a) the Executive shall hold all Confidential Information in the strictest confidence, take all reasonable precautions to prevent its inadvertent disclosure to any unauthorized person, and follow all Company policies protecting the Confidential Information; and (b) the Executive shall not, directly or indirectly, utilize, disclose or make available to any other person or entity, any of the Confidential Information, other than in the proper performance of the Executive’s duties.

(iii) Return of Property and Information. Upon the termination of the Executive’s employment for any reason, the Executive shall immediately return and deliver to the Company any and all Confidential Information, software, devices, cell phones, personal data assistants, credit cards, data, reports, proposals, lists, correspondence, materials, equipment, computers, hard drives, papers, books, records, documents, memoranda, manuals, e-mail, electronic or magnetic recordings or data, including all copies thereof, which belong to the Company or relate to the Company’s business and which are in the Executive’s possession, custody or control, whether prepared by the Executive or others. If at any time after termination of the Executive’s employment the Executive determines that the Executive has any Confidential Information in the Executive’s possession or control, the Executive shall immediately return to the Company all such Confidential Information in the Executive’s possession or control, including all copies and portions thereof.

B. Restrictive Covenants. In consideration for (i) the Company’s promise to provide Confidential Information to the Executive, (ii) the substantial economic investment made by the Company in the Confidential Information and goodwill of the Company, and/or the business opportunities disclosed or entrusted to the Executive, (iii) access to the Company’s customers and clients, and (iv) the Company’s employment of the Executive pursuant to this Agreement and the compensation and other benefits provided by the Company to the Executive, to protect the Company’s Confidential Information and business goodwill of the Company, the Executive agrees to the following restrictive covenants:

(i) Non-Solicitation. The Executive agrees that during the Term and for a period of 12 months following the Executive’s termination (the “Restricted Period”), other than in connection with the Executive’s duties under this Agreement, the Executive shall not, and shall not use any Confidential Information to, directly or indirectly, either as a principal, manager, agent, employee, consultant, officer, director, stockholder, partner, investor or lender or in any other capacity, and whether personally or through other persons:

(a) Solicit business from, attempt to conduct business with, or conduct business with any client, customer, or prospective client or customer of the Company with whom the Company conducted business or solicited within the final 12 months prior to the Executive’s termination, and who or which: (A) the Executive contacted, called on, serviced, did business with, or had contact with during the Executive’s employment or that the Executive attempted to contact, call on, service, or do business with during the Executive’s employment; or (B) that the Executive became acquainted with or dealt with, for any reason, as a result of the Executive’s employment. This restriction applies only to business that is in the scope of services or products provided by the Company; or

(b) Hire, solicit for employment, induce or encourage to leave the employment of the Company, or otherwise cease their employment or other relationship with the Company, on behalf of itself or any other individual or entity, any employee, independent contractor or any former employee or independent contractor of the Company whose employment or contractor relationship ceased less than 12 months earlier.

(ii) Mutual Non-Disparagement. During the Executive’s employment with the Company and any time thereafter, the Executive shall not make, publish, or otherwise transmit any false, disparaging or defamatory statements, whether written or oral, regarding the Company and any of its employees, executives, agents, investors, procedures, investments, products, policies, or services. The Board and the Company’s named executive officers will not make or publish any statement, written or verbal, to any person or entity, including in any forum or media, or take any action, in disparagement of the Executive, including negative references to or about the Executive’s services, policies, practices, documents, methods of doing business, strategies, or objectives, or take any other action that may disparage the Executive to the general public. However, nothing in this Article IV, Section B(ii) shall prohibit: (1) the Executive, any member of the Board or any named executive officer of the Company from testifying truthfully in response to a subpoena or participating in any governmental proceeding; (2) the Executive from engaging in any criticism or other statements made internally within the Company on a need-to-know basis, and provided such criticism or other statement is not presented in a disruptive or insubordinate manner, concerning Company’s performance or nonperformance; and (3) any named executive officer or member of the Board from engaging in any criticism or other statements made internally within the Company on a need-to-know basis concerning the Executive’s performance or nonperformance of the Executive’s duties or responsibilities for the Company.

C. No Interference. Notwithstanding any other provision of this Agreement, (i) the Executive may disclose Confidential Information when required to do so by a court of competent jurisdiction, by any governmental agency having authority over the Executive or the business of the Company or by any administrative body or legislative body (including a committee thereof) with jurisdiction to order the Executive to divulge, disclose or make accessible such information; and (ii) nothing in this Agreement is intended to interfere with the Executive’s right to (a) report possible violations of state or federal law or regulation to any governmental or law enforcement agency or entity; (b) make other disclosures that are protected under the whistleblower provisions of state or federal law or regulation; (c) file a claim or charge with the Equal Employment Opportunity Commission (“EEOC”), any state human rights commission, or any other governmental agency or entity; or (d) testify, assist, or participate in an investigation, hearing, or proceeding conducted by the EEOC, any state human rights commission, any other governmental or law enforcement agency or entity, or any court. For purposes of clarity, in making or initiating any such reports or disclosures or engaging in any of the conduct outlined in subsection (ii) above, the Executive may disclose Confidential Information to the extent necessary to such governmental or law enforcement agency or entity or such court, need not seek prior authorization from the Company, and is not required to notify the Company of any such reports, disclosures or conduct.

D. Defend Trade Secrets Act. The Executive is hereby notified in accordance with the Defend Trade Secrets Act of 2016 that the Executive will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney solely for the purpose of reporting or investigating a suspected violation of law, or is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding. If the Executive files a lawsuit for retaliation against the Company for reporting a suspected violation of law, the Executive may disclose the Company’s trade secrets to the Executive’s attorney and use the trade secret information in the court proceeding if the Executive files any document containing the trade secret under seal, and does not disclose the trade secret, except pursuant to court order.

E. Tolling. If the Executive violates any of the restrictions contained in this Article IV, the Restricted Period shall be suspended and shall not run in favor of the Executive from the time of the commencement of any violation until the time when the Executive cures the violation to the satisfaction of the Company.

F. Remedies. The Executive acknowledges that the restrictions contained in Article IV of this Agreement, in view of the nature of the Company’s business and the Executive’s position with the Company, are reasonable and necessary to protect the Company’s legitimate business interests and that any violation of Article IV of this Agreement would result in irreparable injury to the Company. In the event of a breach by the Executive of Article IV of this Agreement, then the Company shall be entitled to a temporary restraining order and injunctive relief restraining the Executive from the commission of any breach. Such remedies shall not be deemed the exclusive remedies for a breach or threatened breach of this Article IV but shall be in addition to all remedies available at law or in equity, including the recovery of damages from the Executive, the Executive’s agents, any future employer of the Executive, and any person that conspires or aids and abets the Executive in a breach or threatened breach of this Agreement.

G. Reasonableness. The Executive hereby represents to the Company that the Executive has read and understands, and agrees to be bound by, the terms of this Article IV. The Executive acknowledges that the scope and duration of the covenants contained in this Article IV are fair and reasonable in light of (i) the nature and wide geographic scope of the operations of the Company’s business; (ii) the Executive’s level of control over and contact with the Company’s business; and (iii) the amount of compensation, trade secrets and Confidential Information that the Executive is receiving in connection with the Executive’s employment by the Company.

H. Reformation. If any of the aforesaid restrictions are found by a court of competent jurisdiction to be unreasonable, or overly broad as to geographic area or time, or otherwise unenforceable, the Parties intend for the restrictions herein set forth to be modified by the court making such determination so as to be reasonable and enforceable and, as so modified, to be fully enforced. By agreeing to this contractual modification prospectively at this time, the Company and the Executive intend to make this provision enforceable under the law or laws of all applicable jurisdictions so that the entire agreement not to compete and this Agreement as prospectively modified shall remain in full force and effect and shall not be rendered void or illegal.

I. No Previous Restrictive Agreements. The Executive represents that, except as disclosed to the Company, the Executive is not bound by the terms of any agreement with any previous employer or other party to refrain from using or disclosing any trade secret or confidential or proprietary information in the course of the Executive’s employment with the Company or to refrain from competing, directly or indirectly, with the business of such previous employer or any other party. The Executive further represents that the Executive’s performance of all the terms of this Agreement and the Executive’s work duties for the Company do not and will not breach any agreement to keep in confidence proprietary information, knowledge or data acquired by the Executive in confidence or in trust prior to the Executive’s employment with the Company. The Executive shall not disclose to the Company or induce the Company to use any confidential or proprietary information or material belonging to any previous employer or others.

ARTICLE V.

MISCELLANEOUS PROVISIONS

A. Governing Law. The Parties agree that this Agreement shall be governed by and construed under the laws of the State of Delaware. In the event of any dispute regarding this Agreement, the Parties hereby irrevocably agree to submit to the exclusive jurisdiction of the federal and state courts situated in New Castle County, Delaware, and the Executive agrees that the Executive shall not challenge personal or subject matter jurisdiction in such courts. The Parties also hereby waive any right to trial by jury in connection with any litigation or disputes under or in connection with this Agreement.

B. Headings. The paragraph headings contained in this Agreement are for convenience only and shall in no way or manner be construed as a part of this Agreement.

C. Severability. In the event that any court of competent jurisdiction holds any provision in this Agreement to be invalid, illegal or unenforceable in any respect, the remaining provisions shall not be affected or invalidated and shall remain in full force and effect.

D. Reformation. In the event any court of competent jurisdiction holds any restriction in this Agreement to be unreasonable and/or unenforceable as written, the court may reform this Agreement to make it enforceable, and this Agreement shall remain in full force and effect as reformed by the court.

E. Entire Agreement. This Agreement constitutes the entire agreement between the Parties, and fully supersedes any and all prior agreements, understanding or representations between the Parties pertaining to or concerning the subject matter of this Agreement, including, without limitation, the Executive’s employment with the Company. No oral statements or prior written material not specifically incorporated in this Agreement shall be of any force and effect, and no changes in or additions to this Agreement shall be recognized, unless incorporated in this Agreement by written amendment, such amendment to become effective on the date stipulated in it. Any amendment to this Agreement must be signed by all parties to this Agreement. The Executive acknowledges and represents that in executing this Agreement, the Executive did not rely, and has not relied, on any communications, promises, statements, inducements, or representation(s), oral or written, by the Company, except as expressly contained in this Agreement. The Parties represent that they relied on their own judgment in entering into this Agreement.

F. Waiver. No waiver of any breach of this Agreement shall be construed to be a waiver as to succeeding breaches. The failure of either of the Parties to insist in any one or more instances upon performance of any terms or conditions of this Agreement shall not be construed as a waiver of future performance of any such term, covenant or condition but the obligations of either of the Parties with respect thereto shall continue in full force and effect. The breach by one of the Parties to this Agreement shall not preclude equitable relief or the obligations of the other.

G. Modification. The provisions of this Agreement may be amended, modified or waived only with the prior written consent of the Company and the Executive, and no course of conduct or failure or delay in enforcing the provisions of this Agreement shall be construed as a waiver of such provisions or affect the validity, binding effect or enforceability of this Agreement or any provision hereof.

H. Assignment. This Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective heirs, successors and permitted assigns. The Executive may not assign this Agreement to a third party. The Company may assign its rights, together with its obligations hereunder, to any affiliate and/or subsidiary of the Company or any successor thereto or any purchaser of substantially all of the assets of the Company.

I. Code Section 409A.

(i) To the extent (a) any payments to which the Executive becomes entitled under this Agreement, or any agreement or plan referenced herein, in connection with the Executive’s termination of employment with the Company constitute deferred compensation subject to Section 409A of the Code; (b) the Executive is deemed at the time of the Executive’s separation from service to be a “specified employee” under Section 409A of the Code; and (c) at the time of the Executive’s separation from service the Company is publicly traded (as defined in Section 409A of Code), then such payments (other than any payments permitted by Section 409A of the Code to be paid within six months of the Executive’s separation from service) shall not be made until the earlier of (x) the first day of the seventh month following the Executive’s separation from service or (y) the date of the Executive’s death following such separation from service. Upon the expiration of the applicable deferral period described in the immediately preceding sentence, any payments which would have otherwise been made during that period (whether in a single sum or in installments) in the absence of this Article V, Section I shall be paid to the Executive or the Executive’s beneficiary in one lump sum, plus interest thereon at the Delayed Payment Interest Rate computed from the date on which each such delayed payment otherwise would have been made to the Executive until the date of payment. For purposes of the foregoing, the “Delayed Payment Interest Rate” shall mean the national average annual rate of interest payable on jumbo six (6) month bank certificates of deposit, as quoted in the business section of the most recently published Sunday edition of The New York Times preceding the Executive’s separation from service.

(ii) To the extent any benefits provided under Article II, Sections B, D, or G or Article III, Section B(ii) above are otherwise taxable to the Executive, such benefits shall, for purposes of Section 409A of the Code, be provided as separate in-kind payments of those benefits, and the provision of in-kind benefits during one calendar year shall not affect the in-kind benefits to be provided in any other calendar year.

(iii) In the case of any amounts payable to the Executive under this Agreement, or under any plan of the Company, that may be treated as payable in the form of “a series of installment payments,” as defined in Treas. Reg. §1.409A-2(b)(2)(iii), the Executive’s right to receive such payments shall be treated as a right to receive a series of separate payments for purposes of Treas. Reg. §1.409A-2(b)(2)(iii).

(iv) It is intended that this Agreement comply with or be exempt from the provisions of Section 409A of the Code and the Treasury Regulations and guidance of general applicability issued thereunder, and in furtherance of this intent, this Agreement shall be interpreted, operated, and administered in a manner consistent with such intent.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK. SIGNATURE PAGE FOLLOWS.]

IN WITNESS WHEREOF, the Company and the Executive have caused this Agreement to be executed on the date first set forth above, to be effective as of that date.

| EXECUTIVE: |

|

| |

|

| |

|

|

/s/ David Johnson

|

|

| David Johnson |

|

| |

|

| |

|

| COMPANY: |

|

| |

|

| FIREFLY NEUROSCIENCE, INC. |

|

| |

|

| |

|

| |

|

|

/s/ Jon Olsen

|

|

| By: Jon Olsen |

|

| Title: Chief Executive Officer |

|

v3.24.2.u1

Document And Entity Information

|

Aug. 19, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

FIREFLY NEUROSCIENCE, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 19, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-41092

|

| Entity, Tax Identification Number |

54-1167364

|

| Entity, Address, Address Line One |

1100 Military Road

|

| Entity, Address, City or Town |

Kenmore

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

14217

|

| City Area Code |

888

|

| Local Phone Number |

237-6412

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AIFF

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000803578

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

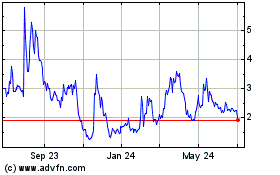

WaveDancer (NASDAQ:WAVD)

Historical Stock Chart

From Nov 2024 to Dec 2024

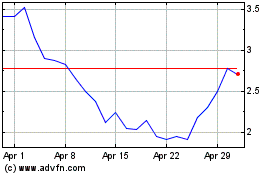

WaveDancer (NASDAQ:WAVD)

Historical Stock Chart

From Dec 2023 to Dec 2024