InsideView, the leader in CRM Intelligence™, today announced that

it has secured $19 million in financing led by Split Rock Partners,

with participation from the company's existing investors, Emergence

Capital, Foundation Capital, and Rembrandt Venture Partners. The

investment will be utilized to accelerate research and development,

market expansion, and increase adoption of the company's CRM

Intelligence Platform by B2B enterprises. Used by nearly 13,000

companies and over 350,000 marketing, sales and account management

professionals, InsideView provides the data, insights and

connections that help organizations find more leads, win more

deals, and grow accounts.

"This investment further validates the market opportunity for

CRM Intelligence and provides us with the capital required to

accelerate our market leadership in the space," said Umberto

Milletti, CEO of InsideView. "We received tremendous interest from

investors who realize CRM Intelligence is required to drive results

at every stage of the buying lifecycle -- from the first marketing

touch, through the sales process and through the account management

and growth stage. The addition of Split Rock to our team brings

additional cloud-based software expertise, and a long-term

perspective. We welcome Jim to our board, and look forward to his

contribution."

The InsideView CRM Intelligence Platform delivers fresh,

validated company and contact data, prospect and company insights

and professional connections to sales and marketing, within

existing workflows and CRM or marketing automation systems.

InsideView offers three applications built on the platform:

InsideView for Marketing™, InsideView for Sales™, and InsideView

for Account Management™. InsideView is integrated with all major

CRM platforms and leading marketing automation solutions.

InsideView joins many fast-growing companies in the Split Rock

Software and Internet Services portfolio. These companies share

characteristics including a focus on advanced technology solutions

for today's B2B enterprises and strong business models that produce

high gross margins, recurring revenue streams, and efficient

methods of customer acquisition. This practice focuses on

investments in fast growing cloud and Internet services companies

whose target markets have the potential to exceed $1 billion.

Jim Simons, Split Rock Managing Director commented: "We are

pleased to welcome InsideView to the Split Rock portfolio of

innovative B2B cloud companies. InsideView has demonstrated a

unique understanding of the marketing and sales process and how CRM

can be improved to support it. The rapid growth of its customer

base indicates a tremendous appetite for InsideView solutions, and

our due diligence conversations with InsideView customers revealed

a clear impact on revenue and productivity, to a degree we rarely,

if ever, see."

The CRM market leads all enterprise software categories, and is

projected to grow to a $36 billion market by 2017, according to

Gartner Research*. Earlier this year, CSO Insights found that 63%

of sales reps' time is spent in non-sales activities such as

research. Worse, only about 60% make quota. Most marketing and

sales departments report poor CRM adoption**. InsideView unlocks

the power of these CRM investments and provides the critical

intelligence these professionals need to effectively build pipeline

and grow revenue. "This investment allows us to rapidly deliver

critical new capabilities and CRM integrations that will help our

customers achieve greater marketing and sales performance,"

continued Milletti. "As CRM adoption grows, InsideView will

continue to provide advanced functionality that makes CRM

investments pay off for B2B enterprises."

About InsideView InsideView provides CRM

Intelligence™ to drive marketing, sales and account management

results. We help you find better leads, win more deals and maintain

and grow customers. InsideView provides the data, insights, and

connections that make every prospect and customer conversation more

relevant, valuable and productive. InsideView® is used by more than

350,000 sales and marketing professionals, and in over 13,000

market-leading companies including Adobe, Hub International,

Franklin Covey, Rosetta Stone, and SuccessFactors. InsideView is

headquartered in San Francisco, California. Follow @InsideView on

Twitter or the InsideView Blog. For more information, visit

www.insideview.com.

About Emergence Capital Partners Emergence

Capital Partners, based in San Mateo, Calif., is the leading

venture capital firm focused on early and growth-stage

Technology-Enabled Services companies. Its mission is to invest in

emerging leaders unleashing the power of Technology-Enabled

Services to empower business users and organizations around the

globe. Emergence's partners have funded and helped build more than

50 TES companies, more than any other venture firm. Emergence

Capital has $575 million under management. The firm's investments

include companies such as Salesforce.com (CRM), SuccessFactors

(SFSF), Yammer, Lithium, YouSendIt, Box, and Veeva Systems. More

information on Emergence's third fund can be found at

http://www.emcap.com/

About Foundation Capital At Foundation

Capital, we're dedicated to the proposition that one entrepreneur's

idea, with the right support, can become a business that changes

the world. We helped Atheros create the mobile Internet, EnerNOC

invent the energy demand response market, and Netflix revolutionize

media distribution and consumption, among many others. We're

currently invested in more than 80 high-growth ventures in the

areas of consumer, information technology, software,

semiconductors, and clean technology including BoardVantage, Chegg,

Coverity, Lending Club, MobileIron, Simply Hired, Sunrun, TubeMogul

and Venafi. Foundation Capital's eighteen initial public offerings

include Envestnet, Financial Engines, Netflix, NetZero, Responsys

and Silver Spring Networks. For more information, please visit

www.foundationcapital.com.

About Rembrandt Venture Partners Rembrandt

Venture Partners (RVP) was established in 2004 to provide private

equity capital to early stage technology companies. We focus our

investments on a variety of sectors including Internet

infrastructure, application software delivered as a service,

communications, mobile products and services.

www.rembrandtvc.com

About Split Rock Partners Split Rock

Partners, with offices in Minneapolis and Menlo Park, seeks

emerging opportunities in software, Internet services and

healthcare. Since 2005, Split Rock has raised $575 million over two

funds. Split Rock supports leading teams with flexible capital

spanning both primary and secondary investments. Representative

companies backed by Split Rock's team include 8thBridge, Ardian,

Atritech, BlueKai, Code42, Compete, eBureau, Entellus, Evalve,

HireRight, Histogenics, Holaira, Intacct, Janrain, LowerMyBills,

MyNewPlace, QuinStreet (NASDAQ: QNST), RF Surgical, SPS Commerce

(NASDAQ: SPSC) and Tornier (NASDAQ: TRNX). Additional information

about the firm can be found at www.splitrock.com

All brands mentioned in this press release are the sole property

of their registered owners.

- Gartner Group, as reported in Forbes Magazine, June 18,

2013

- CSO Insights, 2013

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: Kelli Tejada +1 (415) 271-9820 Email Contact

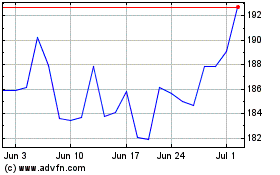

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Jan 2025 to Feb 2025

SPS Commerce (NASDAQ:SPSC)

Historical Stock Chart

From Feb 2024 to Feb 2025