Service Properties Trust Prices an Aggregate of $1.2 Billion of Senior Unsecured Notes

May 17 2024 - 4:55PM

Business Wire

Service Properties Trust (Nasdaq: SVC), or SVC, today announced

that it has priced underwritten public offerings of $700.0 million

of 8.375% Senior Guaranteed Unsecured Notes due 2029 and $500.0

million of 8.875% Senior Guaranteed Unsecured Notes due 2032. Both

series of notes will be guaranteed by certain of SVC’s

subsidiaries. The settlement of the offerings is expected to occur

on June 3, 2024, subject to the satisfaction of customary closing

conditions. SVC expects to use the net proceeds from the offerings

to redeem $800.0 million principal amount outstanding of its 7.50%

senior unsecured notes due 2025, or the 7.50% Notes, and, together

with cash on hand to the extent necessary, (1) to fund the purchase

of any and all of the $350.0 million principal amount outstanding

of its 4.50% senior unsecured notes due 2025, or the 4.50% Notes,

including any premium and accrued and unpaid interest on the

tendered notes, pursuant to its previously announced tender offer,

or the Tender Offer, and (2) to the extent any of the 4.50% Notes

have not been tendered pursuant to the Tender Offer, effect the

satisfaction and discharge of such notes, or the Satisfaction and

Discharge. SVC expects to use any remaining proceeds for general

business purposes.

The joint book-running managers for the offerings were Citigroup

Global Markets Inc., BofA Securities, Inc., J.P. Morgan Securities

LLC., BMO Capital Markets Corp., Goldman Sachs & Co. LLC,

Morgan Stanley & Co. LLC, PNC Capital Markets LLC, UBS

Securities LLC and Wells Fargo Securities LLC.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which the offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of that state or

jurisdiction. SVC and the guarantors have filed a registration

statement including a prospectus and will file a prospectus

supplement with the Securities and Exchange Commission, or SEC, for

the offerings to which this communication relates. Before you

invest, you should read the prospectus and prospectus supplement,

when available, in that registration statement and other documents

SVC has filed with the SEC for more complete information about SVC

and the guarantors and the offerings. You may obtain these

documents for free by visiting EDGAR on the SEC’s website at

www.sec.gov. Copies of the prospectus supplement relating to the

offerings and the related prospectus may be obtained by calling

Citigroup toll-free, at (800) 831-9146, BofA Securities, toll-free

at (800) 294-1322 or J.P. Morgan, toll free at

1-(212)-834-4533.

About Service Properties Trust

Service Properties Trust (Nasdaq: SVC) is a real estate

investment trust which owns a diverse portfolio of hotels and

service focused retail net lease properties across the United

States and in Puerto Rico and Canada, the majority of which are

extended stay and select service. SVC is managed by The RMR Group

(Nasdaq: RMR), a leading U.S. alternative asset management company.

SVC is headquartered in Newton, MA.

WARNING CONCERNING

FORWARD-LOOKING STATEMENTS

This press release contains statements, including statements

about the offerings, the tender offer and the satisfaction and

discharge, that constitute forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995 and

other securities laws. Also, whenever SVC uses words such as

“believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”,

“will”, “may” and negatives or derivatives of these or similar

expressions, SVC is making forward-looking statements. These

forward-looking statements are based upon SVC’s present intent,

beliefs or expectations, but forward-looking statements are not

guaranteed to occur and may not occur. SVC currently intends to use

the net proceeds from these offerings to redeem the 7.50% Notes;

however, the receipt and use of the proceeds is dependent on the

closing of these offerings which may not occur. SVC may not

purchase $350.0 million of the 4.50% Notes in the Tender Offer and

the Tender Offer may not be completed. SVC also currently intends

to effect the Satisfaction and Discharge of any notes not purchased

by it in the Tender Offer; however, SVC may determine not to effect

the Satisfaction and Discharge or it may be delayed. Actual results

may differ materially from those contained in or implied by SVC’s

forward-looking statements. Forward-looking statements involve

known and unknown risks, uncertainties and other factors, some of

which are beyond SVC’s control.

The information contained in SVC’s filings with the SEC,

including under the caption “Risk Factors” in SVC’s periodic

reports, or incorporated therein, identifies other important

factors that could cause differences from SVC’s forward-looking

statements. SVC’s filings with the SEC are available on the SEC’s

website at www.sec.gov.

You should not place undue reliance upon forward-looking

statements.

Except as required by law, SVC does not intend to update or

change any forward-looking statements as a result of new

information, future events or otherwise.

A Maryland Real Estate Investment Trust with

transferable shares of beneficial interest listed on the Nasdaq. No

shareholder, Trustee or officer is personally liable for any act or

obligation of the Trust.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240517376527/en/

Stephen Colbert, Director, Investor Relations (617) 796-8232

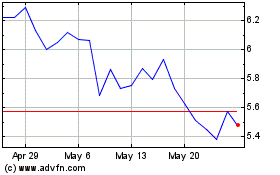

Service Properties (NASDAQ:SVC)

Historical Stock Chart

From Oct 2024 to Nov 2024

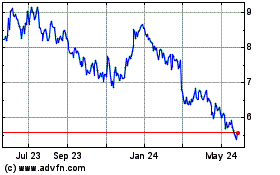

Service Properties (NASDAQ:SVC)

Historical Stock Chart

From Nov 2023 to Nov 2024