false

0001940177

0001940177

2025-02-12

2025-02-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 12, 2025

PODCASTONE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-41795 |

|

35-2503373 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

345 North Maple Drive, Suite 295

Beverly Hills, CA 90210

(Address of principal executive offices) (Zip Code)

(310) 858-0888

(Registrant’s telephone number, including

area code)

n/a

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, $0.00001 par value per share |

|

PODC |

|

The NASDAQ Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On February 12, 2025, PodcastOne,

Inc. (the “Company”) issued a press release announcing its operating and financial highlights and results for the third quarter

and nine months ended December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1.

The information included

herein and in Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except

as expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure.

On February 5, 2025, the

Company issued a press release announcing that it plans to hold a conference call and audio webcast to provide a business update and discuss

its operating and financial results for the third quarter ended December 31, 2024 on February 12, 2025. A copy of the press release is

attached hereto as Exhibit 99.2.

The information included

herein and in Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject

to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange

Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

PODCASTONE, INC. |

| |

|

| Dated: February 12, 2025 |

By: |

/s/ Aaron Sullivan |

| |

Name: |

Aaron Sullivan |

| |

Title: |

Chief Financial Officer |

Exhibit

99.1

PodcastOne

(NASDAQ: PODC) Reports Q3 Fiscal

2025 Financial Results; Revenue Increases 22% YoY to $12.7 Million, Fiscal 2025

Nine-Month Revenue Hits Record $38.0 Million

Company

Expands Content Slate and Audience Reach While Strengthening Monetization

Capabilities Through Strategic Partnership with Amazon’s

ART19

LOS

ANGELES, CA, February 12, 2025 -- PodcastOne (NASDAQ: PODC), a leading publisher and podcast

sales network, has reported its financial results for the fiscal third quarter ended December 31, 2024 (“Q3 Fiscal 2025”).

Key

Highlights:

| ● | Revenue

increased 22% to $12.7 million |

| ● | Ranked

as one of the Top 10 U.S. Podcast Publishers with a U.S. unique monthly audience of

5.2 million and 16.2 million U.S. downloads & streams as of January 2025 |

| ● | Established

strategic partnership with Amazon’s ART19 for hosting services, driving growth for

shows and delivering results for advertisers |

| ● | Expanded

programming slate to 196 shows and surpassed 3.9 billion network downloads |

| ● | Expanded

the A&E relationship with the launch of Ancient Aliens, a podcast adaptation of

The History Channel’s hit show |

| ● | Reaffirmed

guidance for Fiscal 2025 revenues to increase at least 17% to at least a record $51.0 million;

driving expected positive Adjusted EBITDA* |

Management

Commentary

“The

recent migration and partnership with Amazon’s ART19 hosting platform marks a major evolution for PodcastOne that enhances operational

efficiencies while strengthening our monetization capabilities and audience engagement”, said Kit Gray, President and Co-Founder

of PodcastOne. “This strategic move positions us to better serve advertisers and maximize the value of our content across our growing

network.”

Mr.

Gray continued, “PodcastOne remains committed to delivering premium content while expanding our host and advertiser relationships.

To date, we have grown our programming slate to 196 shows and surpassed 3.9 billion network downloads through key expansion deals, including

our collaboration with A&E’s The History Channel, and the renewal of flagship podcasts hosted by Adam Carolla, Brendan

Schaub, and Kaitlyn Bristowe. Looking ahead, we are focused on leveraging our leadership position in podcasting to drive sustainable

growth through organic expansion, acquisitions, and strategic initiatives, creating long term value for our creators, partners, and shareholders.”

Fiscal

Third Quarter 2025 Financial Results

Revenue

in Q3 Fiscal 2025 increased 22% to $12.7 million, compared to $10.4 million in the same prior year quarter.

Operating

Loss in Q3 Fiscal 2025 was $1.6 million, compared to an operating loss of $2.6 million in the prior year quarter.

Net

loss in Q3 Fiscal 2025 was $1.6 million, or $(0.06) per basic and diluted share, compared to a net loss of $2.6 million, or $(0.11) per

basic and diluted share, in the prior year quarter.

Adjusted

EBITDA* in Q3 Fiscal 2025 was $(0.7) million, compared to Adjusted EBIDTA* of $(0.4) million in the prior year quarter.

Fiscal

2025 Guidance

PodcastOne

reaffirms its guidance for Fiscal 2025 revenues of at least a record $51.0 million, representing an increase of at least 17% when compared

to revenues of $43.3 million in Fiscal 2024. PodcastOne expects positive Adjusted EBIDTA* in Fiscal 2025.

Fiscal

Third Quarter 2025 Earnings Conference Call

Management

will host an investor conference call at 11:30 a.m. Eastern time / 8:30 a.m. Pacific time, on Wednesday, February 12, 2025, to discuss

PodcastOne’s Q3 Fiscal 2025 financial results, provide a corporate update, and conclude with Q&A from telephone participants.

To participate, please use the following information:

| Date: | Wednesday,

February 12, 2025 |

| Time: | 11:30

a.m. EST |

| U.S./International Dial-in: | (800)

715-9871 / +1 (646) 307-1963 |

| Conference ID: | 7454038 |

| Webcast: | PODC

Fiscal Third Quarter 2025 Earnings Call |

Please

join at least five minutes before the start of the call to ensure timely participation.

A

playback of the call will be available through Wednesday, February 19, 2025. To listen, please call (800) 770-2030 within the United

States and Canada, using replay pin number 7454038#.

A webcast replay will also be available using the webcast link above or by visiting PodcastOne’s investor relations page at www.ir.podcastone.com.

About PodcastOne

PodcastOne

(NASDAQ: PODC) is a leading podcast platform that provides creators and advertisers with a comprehensive 360-degree solution in sales,

marketing, public relations, production, and distribution. PodcastOne has surpassed 3.9 billion total downloads with a community of 200

top podcasters, including Adam Carolla, Kaitlyn Bristowe, Jordan Harbinger, LadyGang, A&E’s Cold Case Files, and Varnamtown. PodcastOne

has built a distribution network reaching over 1 billion monthly impressions across all channels, including YouTube, Spotify, Apple Podcasts,

and iHeartRadio. PodcastOne is also the parent company of PodcastOne Pro which offers fully

customizable production packages for brands, professionals, or hobbyists. For more information, visit www.podcastone.com

and follow us on Facebook, Instagram,

YouTube, and X at @podcastone.

Forward-Looking

Statements

All

statements other than statements of historical facts contained in this press release are “forward-looking statements,” which

may often, but not always, be identified by the use of such words as “may,” “might,” “will,” “will

likely result,” “would,” “should,” “estimate,” “plan,” “project,” “forecast,”

“intend,” “expect,” “anticipate,” “believe,” “seek,” “continue,”

“target” or the negative of such terms or other similar expressions. These statements involve known and unknown risks, uncertainties

and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by

such statements, including: LiveOne’s reliance on its largest OEM customer for a substantial percentage of its revenue; LiveOne’s

and PodcastOne’s ability to consummate any proposed financing, acquisition, special dividend, merger, distribution or transaction,

including the spin-out of LiveOne’s pay-per-view business, the timing of the consummation of any such proposed event, including

the risks that a condition to the consummation of any such event would not be satisfied within the expected timeframe or at all, or that

the consummation of any proposed financing, acquisition, merger, special dividend, distribution or transaction will not occur or whether

any such event will enhance shareholder value; PodcastOne’s ability to continue as a going concern; PodcastOne’s ability

to attract, maintain and increase the number of its listeners; PodcastOne identifying, acquiring, securing and developing content; LiveOne’s

intent to repurchase shares of its and/or PodcastOne’s common stock from time to time under LiveOne’s announced stock repurchase

program and the timing, price, and quantity of repurchases, if any, under the program; LiveOne’s ability to maintain compliance

with certain financial and other covenants; PodcastOne successfully implementing its growth strategy, including relating to its technology

platforms and applications; management’s relationships with industry stakeholders; uncertain and unfavorable outcomes in legal

proceedings and/or PodcastOne’s or LiveOne’s ability to pay any amounts due in connection with any such legal proceedings;

LiveOne’s ability to extend and/or refinance its indebtedness and/or repay its indebtedness when due; changes in economic conditions;

competition; risks and uncertainties applicable to the businesses of PodcastOne, LiveOne and/or LiveOne’s other subsidiaries; and

other risks, uncertainties and factors including, but not limited to, those described in PodcastOne’s Annual Report on Form 10-K

for the fiscal year ended March 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 1, 2024,

Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2024, filed with the SEC on November 14, 2024, and in PodcastOne’s

other filings and submissions with the SEC. These forward-looking statements speak only as of the date hereof, and PodcastOne disclaims

any obligation to update these statements, except as may be required by law. PodcastOne intends that all forward-looking statements be

subject to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995.

Use of

Non-GAAP Financial Measures*

To

supplement our consolidated financial statements, which are prepared and presented in accordance with the accounting principles generally

accepted in the United States of America (“GAAP”), we present Contribution Margin (Loss) and Adjusted Earnings Before Interest

Tax Depreciation and Amortization (“Adjusted EBITDA”), which are non-GAAP financial measures, as measures of our performance.

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, or as a substitute for, or

superior to, operating loss and or net income (loss) or any other performance measures derived in accordance with GAAP or as an alternative

to net cash provided by operating activities or any other measures of our cash flows or liquidity.

We

use Contribution Margin (Loss) and Adjusted EBITDA to evaluate the performance of our operating segment. We believe that information

about these non-GAAP financial measures assists investors by allowing them to evaluate changes in the operating results of our business

separate from non-operational factors that affect operating income (loss) and net income (loss), thus providing insights into both operations

and the other factors that affect reported results. Adjusted EBITDA is not calculated or presented in accordance with GAAP. A limitation

of the use of Adjusted EBITDA as a performance measure is that it does not reflect the periodic costs of certain amortizing assets used

in generating revenue in our business. Accordingly, Adjusted EBITDA should be considered in addition to, and not as a substitute for

operating income (loss), net income (loss), and other measures of financial performance reported in accordance with GAAP. Furthermore,

this measure may vary among other companies; thus, Adjusted EBITDA as presented herein may not be comparable to similarly titled measures

of other companies.

Contribution Margin (Loss) is defined as Revenue less Cost of Sales. Adjusted EBITDA is defined as earnings before interest, other (income)

expense, income tax expense, depreciation and amortization and before (a) non-cash GAAP purchase accounting adjustments for certain deferred

revenue and costs, (b) legal, accounting and other professional fees directly attributable to acquisition activity, (c) employee severance

payments and third party professional fees directly attributable to acquisition or corporate realignment activities, (d) certain non-recurring

expenses associated with legal settlements or reserves for legal settlements in the period that pertain to historical matters that existed

at acquired companies prior to their purchase date and a one-time minimum guarantee to effectively terminate a live events distribution

agreement post COVID-19, and (e) certain stock-based compensation expense. Management does not consider these costs to be indicative

of our core operating results.

With

respect to projected full fiscal year 2025 Adjusted EBITDA, a quantitative reconciliation is not available without unreasonable efforts

due to the high variability, complexity and low visibility with respect to purchase accounting adjustments, acquisition-related charges

and legal settlement reserves excluded from Adjusted EBITDA. We expect that the variability of these items to have a potentially unpredictable,

and potentially significant, impact on our future GAAP financial results.

For

more information on these non-GAAP financial measures, please see the tables entitled “Reconciliation of Non-GAAP Measure to GAAP

Measure” included at the end of this release.

PodcastOne IR

Contact:

Chris Donovan

MZ Group

(914) 352-5853

PODC@mzgroup.us

PodcastOne

Press Contact:

(310) 246-4600

Susan@Guttmanpr.com

Financial

Information

The

tables below present financial results for the three and nine months ended December 31, 2024 and 2023.

PodcastOne,

Inc.

Consolidated Statements of Operations (Unaudited)

(In thousands, except share and per share amounts)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

$ | 12,710 | | |

$ | 10,442 | | |

$ | 38,022 | | |

$ | 31,595 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 11,983 | | |

| 9,387 | | |

| 34,834 | | |

| 26,666 | |

| Sales and marketing | |

| 894 | | |

| 732 | | |

| 2,618 | | |

| 3,433 | |

| Product development | |

| 9 | | |

| 15 | | |

| 40 | | |

| 70 | |

| General and administrative | |

| 1,281 | | |

| 2,601 | | |

| 4,130 | | |

| 4,736 | |

| Impairment of intangible assets | |

| - | | |

| - | | |

| 176 | | |

| - | |

| Amortization of intangible assets | |

| 125 | | |

| 307 | | |

| 830 | | |

| 523 | |

| Total operating expenses | |

| 14,292 | | |

| 13,042 | | |

| 42,628 | | |

| 35,428 | |

| Loss from operations | |

| (1,582 | ) | |

| (2,600 | ) | |

| (4,606 | ) | |

| (3,833 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | | |

| | | |

| | |

| Interest expense, net | |

| - | | |

| - | | |

| - | | |

| (2,247 | ) |

| Change in fair value of bifurcated embedded derivative | |

| - | | |

| - | | |

| - | | |

| (7,603 | ) |

| Total other expense, net | |

| - | | |

| - | | |

| - | | |

| (9,850 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before provision (benefit) for income taxes | |

| (1,582 | ) | |

| (2,600 | ) | |

| (4,606 | ) | |

| (13,683 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Provision (benefit) for income taxes | |

| 1 | | |

| - | | |

| 12 | | |

| - | |

| Net loss | |

$ | (1,583 | ) | |

$ | (2,600 | ) | |

$ | (4,618 | ) | |

$ | (13,683 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share – basic and diluted | |

$ | (0.06 | ) | |

$ | (0.11 | ) | |

$ | (0.19 | ) | |

$ | (0.64 | ) |

| Weighted average common shares – basic and diluted | |

| 24,535,258 | | |

| 23,072,179 | | |

| 24,133,630 | | |

| 21,252,375 | |

PodcastOne,

Inc.

Consolidated Balance Sheets (Unaudited)

(In thousands)

| |

|

December 31, |

|

|

March 31, |

|

| |

|

2024 |

|

|

2024 |

|

| |

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

| Current Assets |

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

572 |

|

|

$ |

1,445 |

|

| Accounts receivable, net |

|

|

5,826 |

|

|

|

6,023 |

|

| Prepaid expense and other current assets |

|

|

237 |

|

|

|

1,105 |

|

| Total Current Assets |

|

|

6,635 |

|

|

|

8,573 |

|

| Property and equipment, net |

|

|

269 |

|

|

|

309 |

|

| Goodwill |

|

|

12,041 |

|

|

|

12,041 |

|

| Intangible assets, net |

|

|

1,373 |

|

|

|

3,145 |

|

| Related party receivable |

|

|

315 |

|

|

|

57 |

|

| Total Assets |

|

$ |

20,633 |

|

|

$ |

24,125 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current Liabilities |

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

4,826 |

|

|

$ |

7,383 |

|

| Related party payable |

|

|

797 |

|

|

|

315 |

|

| Total Current Liabilities |

|

|

5,623 |

|

|

|

7,698 |

|

| Other long term liabilities |

|

|

- |

|

|

|

86 |

|

| Total Liabilities |

|

|

5,623 |

|

|

|

7,784 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and Contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Common stock, $0.00001 par value; 100,000,000 shares authorized; 24,846,839 and 23,608,049 shares issued and outstanding as of December 31, 2024 and March 31, 2024, respectively |

|

|

- |

|

|

|

- |

|

| Additional paid in capital |

|

|

49,239 |

|

|

|

45,952 |

|

| Accumulated deficit |

|

|

(34,229 |

) |

|

|

(29,611 |

) |

| Total stockholders’ equity |

|

|

15,010 |

|

|

|

16,341 |

|

| Total Liabilities and Stockholders’ Equity |

|

$ |

20,633 |

|

|

$ |

24,125 |

|

PodcastOne,

Inc.

Reconciliation of Non-GAAP Measure to GAAP Measure

Adjusted EBITDA* Reconciliation (Unaudited)

(In thousands)

| | |

| | |

| | |

| | |

Non- | | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

Recurring | | |

| | |

| | |

| |

| | |

Net | | |

Depreciation | | |

| | |

Acquisition and | | |

Other | | |

(Benefit) | | |

| |

| | |

Income | | |

and | | |

Stock-Based | | |

Realignment | | |

(Income) | | |

Provision | | |

Adjusted | |

| | |

(Loss) | | |

Amortization | | |

Compensation | | |

Costs (1) | | |

Expense(2) | | |

for Taxes | | |

EBITDA* | |

| Three Months Ended December 31, 2024 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | (1,583 | ) | |

$ | 188 | | |

$ | 718 | | |

$ | 6 | | |

$ | - | | |

$ | 1 | | |

$ | (670 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Three Months Ended December 31, 2023 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | (2,600 | ) | |

$ | 372 | | |

$ | 1,786 | | |

$ | 86 | | |

$ | - | | |

$ | - | | |

$ | (356 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nine Months Ended December 31, 2024 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | (4,618 | ) | |

$ | 1,201 | | |

$ | 1,972 | | |

$ | 44 | | |

$ | - | | |

$ | 12 | | |

$ | (1,389 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nine Months Ended December 31, 2023 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total | |

$ | (13,683 | ) | |

$ | 710 | | |

$ | 2,724 | | |

$ | 804 | | |

$ | 9,850 | | |

$ | - | | |

$ | 405 | |

| (1) | Non-Recurring

Acquisition and Realignment Costs include non-cash GAAP purchase accounting adjustments for certain deferred revenue and costs, legal,

accounting and other professional fees directly attributable to acquisition activity, employee severance payments and third party professional

fees directly attributable to acquisition or corporate realignment activities, and certain non-recurring expenses associated with legal

settlements or reserves for legal settlements in the period that pertain to historical matters that existed at acquired companies prior

to their purchase date. |

| (2) | Other

(Income) Expense above primarily includes interest expense, net and change in fair value of derivative liabilities. These are included

in the statement of operations in other income (expense) and are an add back to net loss above in the reconciliation of Adjusted EBITDA*

to loss. |

| * | See

the definition of Adjusted EBITDA under “Use of Non-GAAP Financial Measures” within this release. |

PodcastOne,

Inc.

Reconciliation of Non-GAAP Measure to GAAP Measure

Contribution

Margin* Reconciliation (Unaudited)

(In thousands)

| | |

Three Months Ended | | |

Nine Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Revenue: | |

$ | 12,710 | | |

$ | 10,442 | | |

$ | 38,022 | | |

$ | 31,595 | |

| Less: | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| (11,983 | ) | |

| (9,387 | ) | |

| (34,834 | ) | |

| (26,666 | ) |

| Amortization of developed technology | |

| (57 | ) | |

| (58 | ) | |

| (178 | ) | |

| (112 | ) |

| Gross Profit | |

| 670 | | |

| 997 | | |

| 3,010 | | |

| 4,817 | |

| | |

| | | |

| | | |

| | | |

| | |

| Add back amortization of developed technology: | |

| 57 | | |

| 58 | | |

| 178 | | |

| 112 | |

| Contribution Margin* | |

$ | 727 | | |

$ | 1,055 | | |

$ | 3,188 | | |

$ | 4,929 | |

| * | See

the definition of Contribution Margin under “Use of Non-GAAP Financial Measures” within this release. |

8

Exhibit 99.2

PodcastOne (PODC) to

Host Third Quarter Fiscal Year 2025 Financial Results Conference Call on

Wednesday, February 12, 2025, at 11:30 a.m. Eastern Standard

Time

LOS ANGELES, Feb. 05, 2025 -- PodcastOne (NASDAQ:

PODC), a leading publisher and podcast sales network plans to announce its operating and financial results for its third quarter fiscal

year 2025 ended December 31, 2024, on Wednesday, February 12, 2025.

PodcastOne President, Kit Gray, and Chief

Financial Officer, Aaron Sullivan will host the conference call, followed by a question-and-answer session.

To access the call, please use the following

information:

Third Quarter Fiscal Year 2025 Earnings Conference Call

| Date: |

Wednesday, February 12, 2025 |

| Time: |

11:30 a.m. Eastern Time (8:30 a.m. Pacific Time) |

| Webcast Link: |

PODC 3Q25 Earnings Conference Call |

| Dial-in: |

+1 (800) 715-9871 |

| International Dial-in: |

+1 (646) 307-1963 |

| Conference Code: |

7454038 |

A telephone replay will be available commencing

approximately three hours after the call and will remain available through Wednesday, 26th February 2025, by dialing +1(800) 770-2030

from the U.S., or +1(609) 800-9909 from international locations, and entering replay pin number: 7454038#. The replay can also be viewed

through the webcast link above and the presentation utilized during the call will be available via the investor relations section of the

Company’s website here.

About PodcastOne

PodcastOne (NASDAQ:

PODC) is a leading podcast platform that provides creators and advertisers with a full 360-degree solution in sales, marketing, public

relations, production and distribution. PodcastOne has over 3.5 billion total downloads with a community of 200 top podcasters, including

Adam Carolla, Kaitlyn Bristowe, Jordan Harbinger, LadyGang, A&E’s Cold Case Files, and Varnamtown. PodcastOne has built a distribution

network reaching over 1 billion listeners a month across all channels, including its majority shareholder, LiveOne (NASDAQ: LVO), as well

as Spotify, Apple Podcasts, iHeartRadio, Samsung and over 150 shows exclusively available in Tesla vehicles. PodcastOne is also the parent

company of LaunchpadOne,

an innovative self-serve platform developed to launch, host, distribute and monetize independent user-generated podcasts. For more information,

visit www.podcastone.com and

follow us on Facebook, Instagram, YouTube and X at

@podcastone.

Forward-Looking Statements

All statements other than statements of historical facts contained in this press release are “forward-looking statements,”

which may often, but not always, be identified by the use of such words as “may,” “might,” “will,”

“will likely result,” “would,” “should,” “estimate,” “plan,” “project,”

“forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,”

“continue,” “target” or the negative of such terms or other similar expressions. These statements involve known

and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from

those expressed or implied by such statements, including: LiveOne’s reliance on its largest OEM customer for a substantial percentage

of its revenue; LiveOne’s and PodcastOne’s ability to consummate any proposed financing, acquisition, merger, distribution

or other transaction, the timing of the consummation of any such proposed event, including the risks that a condition to the consummation

of any such event would not be satisfied within the expected timeframe or at all, or that the consummation of any proposed financing,

acquisition, merger, special dividend, distribution or transaction will not occur or whether any such event will enhance shareholder value;

PodcastOne’s ability to continue as a going concern; PodcastOne’s ability to attract, maintain and increase the number of

its listeners; PodcastOne identifying, acquiring, securing and developing content; LiveOne’s intent to repurchase shares of its

and/or PodcastOne’s common stock from time to time under LiveOne’s announced stock repurchase program and the timing, price,

and quantity of repurchases, if any, under the program; LiveOne’s ability to maintain compliance with certain financial and other

covenants; PodcastOne successfully implementing its growth strategy, including relating to its technology platforms and applications;

management’s relationships with industry stakeholders; LiveOne’s ability to extend and/or refinance its indebtedness and/or

repay its indebtedness when due; uncertain and unfavorable outcomes in legal proceedings and/or LiveOne’s ability to pay any amounts

due in connection with any such legal proceedings; changes in economic conditions; competition; risks and uncertainties applicable to

the businesses of PodcastOne, LiveOne and/or LiveOne’s other subsidiaries; and other risks, uncertainties and factors including,

but not limited to, those described in PodcastOne’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024, filed with

the U.S. Securities and Exchange Commission (the “SEC”) on July 1, 2024, PodcastOne’s Quarterly Report on Form 10-Q

for the fiscal quarter ended September 30, 2024, filed with the SEC on November 14, 2024, and in PodcastOne’s other filings and

submissions with the SEC. These forward-looking statements speak only as of the date hereof, and PodcastOne disclaims any obligation to

update these statements, except as may be required by law. PodcastOne intends that all forward-looking statements be subject to the safe-harbor

provisions of the Private Securities Litigation Reform Act of 1995.

IR Contact:

Chris Donovan

914-352-5853

PODC@mzgroup.us

Press Contact:

310.246.4600

Susan@Guttmanpr.com

v3.25.0.1

Cover

|

Feb. 12, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 12, 2025

|

| Entity File Number |

001-41795

|

| Entity Registrant Name |

PODCASTONE, INC.

|

| Entity Central Index Key |

0001940177

|

| Entity Tax Identification Number |

35-2503373

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

345 North Maple Drive

|

| Entity Address, Address Line Two |

Suite 295

|

| Entity Address, City or Town |

Beverly Hills

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90210

|

| City Area Code |

(310)

|

| Local Phone Number |

858-0888

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.00001 par value per share

|

| Trading Symbol |

PODC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

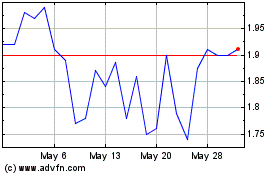

PodcastOne (NASDAQ:PODC)

Historical Stock Chart

From Feb 2025 to Mar 2025

PodcastOne (NASDAQ:PODC)

Historical Stock Chart

From Mar 2024 to Mar 2025