0001095981false00010959812024-08-142024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 14, 2024 |

PLUS THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-34375 |

33-0827593 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

4200 Marathon Blvd. Suite 200 |

|

Austin, Texas |

|

78756 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (737) 255-7194 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

PSTV |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 14, 2024, Plus Therapeutics, Inc. (the “Company”) reported financial results for the second quarter ended June 30, 2024 and other recent corporate updates. A copy of the press release is furnished as Exhibit 99.1 to this report and incorporated by reference.

The information in this Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1) is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, whether made before or after today’s date, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific references in such filing.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

PLUS THERAPEUTICS, INC. |

|

|

|

|

Date: |

August 14, 2024 |

By: |

/s/ Marc H. Hedrick, M.D. |

|

|

|

Marc H. Hedrick, M.D.

President and Chief Executive Officer |

Plus Therapeutics Reports Second Quarter 2024 Financial Results and Recent Business Highlights

Presented Positive Interim ReSPECT-LM Phase 1 Data for Rhenium (186Re) Obisbemeda for Leptomeningeal Metastases

Presented Positive Topline Clinical Trial Results for CNSide diagnostic in the FORESEE trial

Management to host conference call August 14, 2024 at 5:00 p.m. ET

AUSTIN, Texas, August 14, 2024 (GLOBE NEWSWIRE) – Plus Therapeutics, Inc. (Nasdaq: PSTV) (the “Company”), a clinical-stage pharmaceutical company developing targeted radiotherapeutics with advanced platform technologies for central nervous system (CNS) cancers, today announced financial results for the second quarter ended June 30, 2024, and provided an overview of recent and upcoming business highlights.

Q2 2024 RECENT HIGHLIGHTS AND MILESTONES

•Presented positive ReSPECT-LM Phase 1 study data at the 2024 Society for NeuroOncology /American Society for Clinical Oncology (SNO/ASCO) CNS Metastases Conference. Rhenium (186Re) Obisbemeda was safe and well-tolerated in the first 4 dosing cohorts (n=16 patients). Current median overall survival is 12 months with 8 of 16 patients treated remaining alive. Additional detail can be found here

•Reported topline FORESEE clinical trial results at SNO/ASCO. The trial demonstrated that CNSide, PLUS’ novel diagnostic platform met its primary clinical endpoint. The CNSide test was found to help clinical decision making in over 90% of provider decisions (n=50/55 clinical decisions) and helped to inform therapy selection in 24% of provider decisions (n=13/55 clinical decisions). Furthermore, the CNSide test improved tumor cell detection in LM patients compared to cytology (80% vs. 29%) in matched samples. Additional details can be found here

•Reported that isotopic rhenium-186, the active radioisotope in Rhenium (186Re) Obisbemeda, substantially spared the spinal cord vs. other beta-emitting radionuclides at the 2024 Society of Nuclear Medicine and Molecular Imaging (SNMMI) annual meeting

•Submitted a new clinical protocol to the U.S. Food and Drug Administration (FDA), under its active Investigational New Drug application (IND 153715) for a Phase 1 study to evaluate multiple administrations of Rhenium (186Re) Obisbemeda for the treatment of patients with LM

•Received $3.3 million grant payment from Cancer Prevention & Research Institute of Texas (CPRIT) in June 2024 to support the clinical development of Rhenium (186Re) Obisbemeda for LM

“Plus’ lead investigational drug Rhenium (186Re) Obisbemeda continues to show safety and promising signs of efficacy after a single administration in patients with LM,” said Marc H. Hedrick, M.D., Plus Therapeutics President and Chief Executive Officer. “We are on track to complete the single administration ReSPECT-LM Phase 1 trial soon, expand to multiple doses, and move to Phase 2 funded by our existing CPRIT award.”

UPCOMING EVENTS AND MILESTONES

•Presentations planned for the following upcoming medical conferences:

o Congress of Neurological Surgeons (CNS) Annual Conference (September 28-October 2, 2024)

▪Treatment Of Recurrent Glioblastoma (rGBM) Via Convection Enhanced Delivery (CED) With Rhenium (186Re) Obisbemeda (Rhenium-186 Nanoliposome, 186RNL): ReSPECT-GBM Phase 2 Trial Update

o Society for Neuro-Oncology (SNO) Annual Conference (November 22-26, 2024)

▪Rhenium (186Re) obisbemeda (rhenium nanoliposome,186RNL) for the treatment of leptomeningeal metastases (LM): Summary of the phase 1 dose escalation study and phase 2 administered dose selection

▪CSF Tumor Cell (CSF-TC) Detection, Quantification and Biomarker assessment helps in clinical management of breast cancer and Non-Small Cell Lung cancer patients having Leptomeningeal Disease

▪The Oncogenetic Flip in Patients with Leptomeningeal Metastatic Disease (LMD): Longitudinal Detection in Cerebrospinal Fluid Tumor Cells (CSF-TCs) Reveals Implications for Differential Treatment of the LMD Tumor

•Complete ReSPECT-LM Phase 1 single administration trial and determine the recommended Phase 2 dose

•Initiate ReSPECT-LM Phase 1 multiple administration trial

•Obtain IND approval for a Phase 1/2 trial of Rhenium (186Re) Obisbemeda via convection enhanced delivery (CED) funded by the Department of Defense (DoD) office of the Congressionally Directed Medical Research Programs (CDMRP) for pediatric ependymoma and high-grade glioma

FIRST HALF 2024 FINANCIAL RESULTS

•The Company’s cash and investments balance was $8.4 million at June 30, 2024 compared to $8.6 million at December 31, 2023

•The Company recognized $3.0 million in grant revenue in the first half of 2024 compared to $2.4 million in the same period of 2023, which represents CPRIT’s share of the costs incurred for our Rhenium (186Re) Obisbemeda development for the treatment of patients with LM

•Total operating loss for the first half of 2024 was $7.0 million compared to $6.2 million in the same period of 2023. The increase is primarily due to increased spend related to the ReSPECT-LM trial

•Net loss for first half of 2024 was $6.2 million, or $(1.15) per basic share, compared to a net loss of $6.3 million, or $(2.60) per basic share, for the same period the prior year

SECOND QUARTER 2024 RESULTS CONFERENCE CALL

The Company will hold a conference call and live audio webcast at 5:00 pm Eastern Time today to discuss its financial results and provide a general business update.

A live webcast will be available at ir.plustherapeutics.com/events.

Participants may also pre-register any time before the call here. Once registration is completed, participants will be provided a dial-in number with a personalized conference code to access the call. Please dial in 15 minutes prior to the start time.

Following the live call, a replay will be available on the Company’s website under the ‘For Investors’ section. The webcast will be available on the Company’s website for 90 days following the live call.

About Plus Therapeutics

Plus Therapeutics, Inc. is a clinical-stage pharmaceutical company developing targeted radiotherapeutics for difficult-to-treat cancers of the central nervous system with the potential to enhance clinical outcomes for patients. Combining image-guided local beta radiation and targeted drug delivery approaches, the Company is advancing a pipeline of product candidates with lead programs in recurrent glioblastoma (GBM) and leptomeningeal metastases (LM). The Company has built a supply chain through strategic partnerships that enable the development, manufacturing and future potential commercialization of its products. Plus Therapeutics is led by an experienced and dedicated leadership team and has operations in key cancer clinical development hubs including Austin and San Antonio, Texas. For more information, visit https://plustherapeutics.com/.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains statements that may be deemed “forward-looking statements” within the meaning of U.S. securities laws, including statements regarding clinical trials, expected operations and upcoming developments. All statements in this press release other than statements of historical fact are forward-looking statements. These forward-looking statements may be identified by future verbs, as well as terms such as “potential,” “anticipating,” “planning” and similar expressions or the negatives thereof. Such statements are based upon certain assumptions and assessments made by management in light of their experience and their perception of historical trends, current conditions, expected future developments and other factors they believe to be appropriate.

These statements include, without limitation, statements under the heading Upcoming Expected Events and Milestones and statements regarding the following: the potential promise of rhenium (186Re) obisbemeda; expectations as to the Company’s future performance including the next steps in developing the Company’s product candidate; the Company’s clinical trials including statements regarding the timing and characteristics of the ReSPECT-GBM, ReSPECT-LM and ReSPECT-PBC clinical trials; the continued evaluation of rhenium (186Re) obisbemeda including through evaluations in additional patient cohorts; reporting results of preclinical combination studies of rhenium (186Re) obisbemeda with PD-1 and PD-L1 checkpoint inhibitors; development and potential submission of ReSPECT-PBC investigational new drug application (IND) for pediatric ependymoma and high grade glioma; development and utility of CNSide leptomeningeal metastases diagnostic test.

The forward-looking statements included in this press release could differ materially from those expressed or implied by these forward-looking statements because of risks, uncertainties, and other factors that include, but are not limited to, the following: the early stage of the Company’s product candidates and therapies, the results of the Company’s research and development activities, including uncertainties relating to the clinical trials of its product candidates and therapies; the Company’s liquidity and capital resources and its ability to raise additional cash, the outcome of the Company’s partnering/licensing efforts, risks associated with laws or regulatory requirements applicable to it, market conditions, product performance, litigation or potential litigation, and competition within the cancer diagnostics and therapeutics field, ability to develop and protect proprietary intellectual property or obtain licenses to intellectual property developed by others on commercially reasonable and competitive terms, and material security breach or cybersecurity attack affecting the Company’s operations or property. This list of risks, uncertainties, and other factors is not complete. Plus Therapeutics discusses some of these matters more fully, as well as certain risk factors that could affect Plus Therapeutics’ business, financial condition, results of operations, and prospects, in its reports filed with the SEC, including Plus Therapeutics’ annual report on Form 10-K for the fiscal year ended December 31, 2023, quarterly reports on Form 10-Q, and current reports on Form 8-K. These filings are available for review through the SEC’s website at www.sec.gov. Any or all forward-looking statements Plus Therapeutics makes may turn out to be wrong and can be affected by inaccurate assumptions Plus Therapeutics might make or by known or unknown risks, uncertainties, and other factors, including those identified in this press release. Accordingly, you should not place undue reliance on the forward-looking statements made in this press release, which speak only as of its date. The Company assumes no responsibility to update or revise any forward-looking statements to reflect events, trends or circumstances after the date they are made unless the Company has an obligation under U.S. federal securities laws to do so.

Investor Contact

Charles Y. Huang, MBA

Director of Capital Markets and Investor Relations

Office: (202)-209-5751 | Direct (301)-728-7222

chuang@plustherapeutics.com

PLUS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except share and par value data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

4,912 |

|

|

$ |

8,554 |

|

Investments |

|

|

3,523 |

|

|

|

— |

|

Other current assets |

|

|

945 |

|

|

|

1,280 |

|

Total current assets |

|

|

9,380 |

|

|

|

9,834 |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

732 |

|

|

|

906 |

|

Operating lease right-of-use assets |

|

|

139 |

|

|

|

202 |

|

Goodwill |

|

|

372 |

|

|

|

372 |

|

Intangible assets, net |

|

|

557 |

|

|

|

42 |

|

Other assets |

|

|

32 |

|

|

|

32 |

|

Total assets |

|

$ |

11,212 |

|

|

$ |

11,388 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

6,946 |

|

|

$ |

6,631 |

|

Operating lease liability |

|

|

92 |

|

|

|

120 |

|

Warrant liability |

|

|

6,160 |

|

|

|

— |

|

Deferred grant liability |

|

|

2,297 |

|

|

|

— |

|

Line of credit |

|

|

3,292 |

|

|

|

— |

|

Term loan obligation, current |

|

|

— |

|

|

|

3,976 |

|

Total current liabilities |

|

|

18,787 |

|

|

|

10,727 |

|

|

|

|

|

|

|

|

Noncurrent operating lease liability |

|

|

50 |

|

|

|

85 |

|

Deferred grant liability |

|

|

— |

|

|

|

1,924 |

|

Total liabilities |

|

|

18,837 |

|

|

|

12,736 |

|

|

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; 1,952 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively |

|

|

— |

|

|

|

— |

|

Common stock, $0.001 par value; 100,000,000 shares authorized; 5,962,644 and 5,704,219 issued and outstanding at June 30, 2024, and 4,522,656 issued and 4,444,097 outstanding as of December 31, 2023, respectively |

|

|

6 |

|

|

|

5 |

|

Treasury stock (at cost, 258,425 and 78,559 shares as of June 30, 2024 and December 31, 2023, respectively) |

|

|

(500 |

) |

|

|

(126 |

) |

Additional paid-in capital |

|

|

479,571 |

|

|

|

479,274 |

|

Accumulated deficit |

|

|

(486,702 |

) |

|

|

(480,501 |

) |

Total stockholders’ deficit |

|

|

(7,625 |

) |

|

|

(1,348 |

) |

Total liabilities and stockholders’ deficit |

|

$ |

11,212 |

|

|

$ |

11,388 |

|

PLUS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Three Months Ended June 30, |

|

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Grant revenue |

|

$ |

1,279 |

|

|

$ |

1,854 |

|

|

$ |

2,956 |

|

|

$ |

2,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

2,773 |

|

|

|

1,420 |

|

|

|

5,536 |

|

|

|

4,403 |

|

General and administrative |

|

|

2,203 |

|

|

|

1,924 |

|

|

|

4,416 |

|

|

|

4,169 |

|

Total operating expenses |

|

|

4,976 |

|

|

|

3,344 |

|

|

|

9,952 |

|

|

|

8,572 |

|

Loss from operations |

|

|

(3,697 |

) |

|

|

(1,490 |

) |

|

|

(6,996 |

) |

|

|

(6,212 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Financing expense |

|

|

(3,545 |

) |

|

|

— |

|

|

|

(3,545 |

) |

|

|

— |

|

Change in fair value of warrants |

|

|

4,694 |

|

|

|

— |

|

|

|

4,694 |

|

|

|

— |

|

Warrant issuance costs |

|

|

(432 |

) |

|

|

— |

|

|

|

(432 |

) |

|

|

— |

|

Interest income |

|

|

67 |

|

|

|

120 |

|

|

|

139 |

|

|

|

171 |

|

Interest expense |

|

|

(27 |

) |

|

|

(112 |

) |

|

|

(61 |

) |

|

|

(246 |

) |

Total other income (expense) |

|

|

757 |

|

|

|

8 |

|

|

|

795 |

|

|

|

(75 |

) |

Net loss |

|

$ |

(2,940 |

) |

|

$ |

(1,482 |

) |

|

$ |

(6,201 |

) |

|

$ |

(6,287 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share information: |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share of common stock - basic |

|

$ |

(0.45 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.15 |

) |

|

$ |

(2.60 |

) |

Weighted average number of shares of common stock outstanding - basic |

|

|

6,500,831 |

|

|

|

2,509,378 |

|

|

|

5,411,382 |

|

|

|

2,415,221 |

|

Net loss per share of common stock - diluted |

|

$ |

(0.71 |

) |

|

$ |

(0.59 |

) |

|

$ |

(1.45 |

) |

|

$ |

(2.60 |

) |

Weighted average number of shares of common stock outstanding - diluted |

|

|

10,742,924 |

|

|

|

2,509,378 |

|

|

|

7,532,428 |

|

|

|

2,415,221 |

|

PLUS THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

For the Six Months Ended June 30, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows used in operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(6,201 |

) |

|

$ |

(6,287 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

325 |

|

|

|

318 |

|

Amortization of deferred financing costs and debt discount |

|

|

20 |

|

|

|

119 |

|

Share-based compensation expense |

|

|

297 |

|

|

|

280 |

|

Accretion of discount on short-term investments |

|

|

(23 |

) |

|

|

— |

|

Non-cash financing expense |

|

|

3,545 |

|

|

|

— |

|

Change in fair value of warrants |

|

|

(4,694 |

) |

|

|

— |

|

Loss on disposal of property and equipment |

|

|

— |

|

|

|

2 |

|

Amortization of operating lease right-of-use assets |

|

|

63 |

|

|

|

57 |

|

Increases (decreases) in cash caused by changes in operating assets and liabilities: |

|

|

|

|

|

|

Grant receivable |

|

|

— |

|

|

|

718 |

|

Other current assets |

|

|

335 |

|

|

|

1,510 |

|

Accounts payable and accrued expenses |

|

|

360 |

|

|

|

(3,589 |

) |

Change in operating lease liabilities |

|

|

(63 |

) |

|

|

(56 |

) |

Deferred grant liability |

|

|

373 |

|

|

|

(1,643 |

) |

Net cash used in operating activities |

|

|

(5,663 |

) |

|

|

(8,571 |

) |

|

|

|

|

|

|

|

Cash flows used in investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(121 |

) |

|

|

(108 |

) |

Purchase of short-term investments |

|

|

(3,500 |

) |

|

|

— |

|

Purchase of intangible assets |

|

|

(545 |

) |

|

|

— |

|

Net cash used in investing activities |

|

|

(4,166 |

) |

|

|

(108 |

) |

|

|

|

|

|

|

|

Cash flows used in/provided by financing activities: |

|

|

|

|

|

|

Principal payments of term loan obligation |

|

|

(3,996 |

) |

|

|

(804 |

) |

Proceeds from credit facility |

|

|

3,292 |

|

|

|

— |

|

Purchase of treasury stock |

|

|

(374 |

) |

|

|

— |

|

Proceeds from sale of common stock, warrants and pre-funded warrants, net |

|

|

7,265 |

|

|

|

2,258 |

|

Net cash provided by financing activities |

|

|

6,187 |

|

|

|

1,454 |

|

Net decrease in cash and cash equivalents |

|

|

(3,642 |

) |

|

|

(7,225 |

) |

Cash and cash equivalents at beginning of period |

|

|

8,554 |

|

|

|

18,120 |

|

Cash and cash equivalents at end of period |

|

$ |

4,912 |

|

|

$ |

10,895 |

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flows information: |

|

|

|

|

|

|

Cash paid during period for: |

|

|

|

|

|

|

Interest |

|

$ |

32 |

|

|

$ |

135 |

|

Supplemental schedule of non-cash investing and financing activities: |

|

|

|

|

|

|

Unpaid offering cost |

|

$ |

375 |

|

|

$ |

35 |

|

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

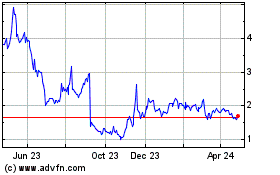

Plus Therapeutics (NASDAQ:PSTV)

Historical Stock Chart

From Oct 2024 to Nov 2024

Plus Therapeutics (NASDAQ:PSTV)

Historical Stock Chart

From Nov 2023 to Nov 2024