0001852973FALSE00018529732024-08-152024-08-150001852973us-gaap:CommonStockMember2024-08-152024-08-150001852973us-gaap:WarrantMember2024-08-152024-08-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

August 15, 2024

Date of Report (date of earliest event reported)

___________________________________

BOREALIS FOODS INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Ontario (State or other jurisdiction of incorporation or organization) | 001-40778 (Commission File Number) | 98-1638988 (I.R.S. Employer Identification Number) |

1540 Cornwall Rd., Suite 104 Oakville, ON L6J 7W5 |

(Address of principal executive offices and zip code) |

(905) 278-2200 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Shares | BRLS | Nasdaq Capital Market |

| Warrants | BRLSW | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 - Other Events

On August 15, 2024, Borealis Foods Inc. issued a letter to its shareholders providing an update on continued gross margin expansion and expectation for a stronger second half of 2024. A copy of this letter is furnished with this report as Exhibit 99.1.

The information contained in this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d): The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 19th day of August, 2024.

| | | | | | | | |

Date: August 14, 2024 | BOREALIS FOODS INC. |

| |

Date: August 20, 2024 | By | /s/ Pouneh V. Rahimi |

| | Pouneh V. Rahimi |

| | Chief Legal Officer |

| | |

Borealis Foods’ CEO Reza Soltanzadeh Issues Letter to Shareholders;

Highlights Continued Gross Margin Expansion and Expectation for Stronger Second Half of 2024

New York, NY, August 15, 2024 – Borealis Foods Inc. ("Borealis" or the "Company") (Nasdaq: BRLS), a pioneering food tech company dedicated to crafting premium-quality, nutritious food solutions accessible to all, today announced that CEO Reza Soltanzadeh has issued a letter to shareholders discussing second quarter financial results and the Company’s strategic developments.

Dear Fellow Shareholders:

We continued to make steady progress during the second quarter and while our reported results included some important accomplishments, the real excitement lies in the transformative work happening behind the scenes as we laid critical groundwork for advancing our goal of being a leading, innovative food-tech company with accelerating sales in the second half of 2024 and beyond.

Here’s a glimpse of the progress we’re making:

•Continued margin improvement – We reported second quarter gross margin of 7.9%, marking the third consecutive quarter of positive margins and reflecting an expansion of margins from the first quarter and an improvement in gross profit dollars of 24% from the year-ago quarter. To be successful, it is imperative that we continue to expand margins. During the quarter we were faced with intense price and promotion activity from our competitors in the value ramen category. We responded by accelerating our longer-term strategy of pivoting to our higher margin products, led by our flagship Chef Woo brand, which saw shipments increase over 5x from the year ago quarter. This strategic decision enabled us to continue our margin expansion and we intend to continue working hard to maximize our margins. Stay tuned as we continue to optimize our product lineup and introduce groundbreaking offerings to the market

•Stronger second half ahead – Historically, the soup market heats up with the arrival of fall, and this year is poised to be no different. We’re strategically positioned to capitalize on this seasonal surge with a revamped sales mix and expanded product lines. Our efforts to increase our distribution channels give me optimism that we are on a path to deliver a combination of growing sales and expanded margins.

•Distribution expansion & plant utilization – Our efforts to broaden our distribution network are paying off. New agreements are bringing Borealis products to a wider range of retailers

and distribution channels, including food service and humanitarian food programs. We’re also forming strategic partnerships with major multinational food companies and look forward to sharing more about these developments. Additionally, our institutional channel sales, especially with schools across the U.S., are set to ramp up this fall. We’ve already begun shipping to schools in 20 states, and this expansion is driving improved plant utilization and cost absorption, further boosting our margins.

•Gordon Ramsay, Borealis Brand Ambassador & investor – We’re thrilled to have culinary superstar Chef Ramsay as our Brand Ambassador and shareholder. His latest creations are sure to dazzle ramen aficionados and set new standards in the industry. We can’t wait to unveil these exciting new flavors and expect to see them hit store shelves this fall.

In summary, we have a lot to be excited about, especially as our much-anticipated second half is now at hand. During the last few months, we have accomplished a tremendous amount and I look forward to being able to share those initiatives with our fellow shareholders soon. Our vision is to be a leading innovative food tech company that creates a range of products that advance our mission of fighting malnutrition. We’re still very much in the early stages of our journey and hope to share more news on all we’ve been working on very soon.

In addition to executing on the many pieces of our strategic plan, we are also highly focused on resolving the going concern issue that was contained in reference to the financial statements in our recent SEC filings, and are making solid progress on this front. We are enthusiastic about Borealis’ growth strategy and outlook, and I look forward to reporting on Borealis Foods’ continued developments.

In Good Health,

Reza

Reza Soltanzadeh

CEO

Borealis Foods Inc.

About Borealis

Borealis is an innovative food technology company with a mission to address global food security challenges through its research and development of tasty, highly nutritious and functional food products that are both affordable and sustainable. The Company's focus on affordability and sustainability reflects its commitment to making a positive impact on both human life and the

planet. Borealis distributes its food products throughout the United States, Canada, Mexico and recently began distributing its products in Europe.

Forward Looking Statements

Certain statements made in this release are "forward looking statements" within the meaning of the "safe harbor" provisions of the United States Private Securities Litigation Reform Act of 1995, including statements regarding the and future financial condition and performance of Borealis, and the expected financial impacts of the Business Combination (including future revenue and pro forma enterprise value), markets, and expected future growth and market opportunities. Forward-looking statements generally relate to management's current expectations, hopes, beliefs, intentions, strategies, plans, objections or projections about future events or Borealis' future financial condition or operating performance. When used in this press release, the words "estimates," "projected," "expect," "anticipate," "forecasts," "plans," "intend," "believe," "seek," "may," "will," "should," "future," "propose" and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future performance, conditions or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside Company's control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. These risks, uncertainties, assumptions and other important factors are detailed in the Company's periodic and current reports filed with the Securities and Exchange Commission, including the disclosures under "Risk Factors" in the Company’s Form 10-Q for the quarter ended March 31, 2024 and its Form 8-K/A filed with the Securities and Exchange Commission on April 15, 2024. As such, readers are cautioned not to place undue reliance on any forward-looking statements and readers should not rely on these forward-looking statements as predictions of future events.

Forward-looking statements are based upon estimates and assumptions that, while considered reasonable by management of Borealis, are inherently uncertain. Factors that may cause actual result to differ from current expectations include, but are not limited to: financial and operating performance; changes to existing applicable laws or regulations; the possibility that Borealis or the combined company may be adversely affected by economic, business, or competitive factors; Borealis' estimates of revenue, expenses, operating costs and profitability; the evolution of the markets in which Borealis competes and Borealis' ability to enter new markets effectively; and the ability of Borealis to implement its strategic initiatives and continue to innovate its existing services.

Forward-looking statements speak only as of the date they are made. Investors are cautioned not to put undue reliance on forward-looking statements and Borealis assumes no obligation and does

not intend to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required by securities and other applicable laws.

Contacts

Investors:

Jeremy Hellman

Vice President

The Equity Group

jhellman@equityny.com

(212) 836-9626

Media:

Henry Wong

Chief Marketing Officer

Borealis Foods

hwong@borealisfoods.com

(905) 278-2200

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

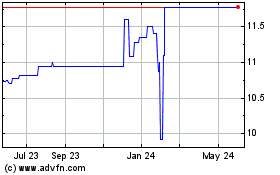

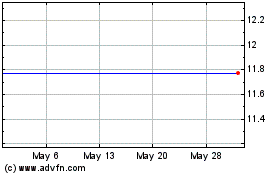

Oxus Acquisition (NASDAQ:OXUSU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Oxus Acquisition (NASDAQ:OXUSU)

Historical Stock Chart

From Nov 2023 to Nov 2024