Marqeta Announces New Enhancements to Its Program Management Capabilities, Reducing the Complexity of Building Modern Payment Experiences

October 22 2024 - 7:00AM

Business Wire

Marqeta’s new UX Toolkit and Portfolio

Migration products aim to greatly decrease the time it takes to

migrate cardholders onto the Marqeta platform and design delightful

new cardholder experiences.

Marqeta (NASDAQ: MQ), the global modern card issuing platform

that enables embedded finance solutions for the world’s innovators,

today introduced two new products – UX Toolkit and Portfolio

Migrations – to its card program management tools. Marqeta’s

program management capabilities combine the power of its technology

with its breadth of expertise around card implementation, helping

to drive the success and scalability of its customers’ card

programs. UX Toolkit will allow Marqeta’s customers to create

modern payment experiences from scratch with fewer development

resources required, while its Portfolio Migration service reduces

complexity for customers upgrading existing card programs onto the

Marqeta platform, without impacting their existing cardholder

experience. Combined, these two products are expected to further

enhance Marqeta’s leadership in program management and enable its

customers to deliver better user experiences for their

cardholders.

“Card programs that fail to meet consumer expectations risk

being left behind. The market is moving quickly and innovators need

a partner like Marqeta that can keep up,” said Simon Khalaf, CEO of

Marqeta. “As leaders in card program management, Marqeta is

constantly raising the bar, making it easier for companies to move

to our platform and create delightful experiences that meet

consumers where they are.”

UX Toolkit aims to eliminate months of front-end development,

allowing for amazing payment experiences to be built faster

The needs of cardholders are changing rapidly, and Marqeta's UX

Toolkit improves the process of developing front-end experiences

for its customers, significantly reducing development time. The

toolkit was designed to comply with current regulatory requirements

and is pre-approved by several partners, including major card

networks, removing the need for businesses to manage on their

own.

UX Toolkit allows its customers to build truly unique and

branded cardholder experiences, guided by Marqeta’s deep expertise

in designing payment flows. It gives customers access to a

comprehensive set of User Interface (UI) components and templates

optimized for Marqeta’s APIs, that allow its customers to design

engaging front end cardholder experiences for debit and credit

programs. With the UI components, businesses can more easily build

and update the front-end experience for onboarding customers,

funding accounts, PIN management and security, transaction history,

filing disputes and account statements. UX Toolkit also includes

the Marqeta Studio, a builder environment that provides extensive

customization options for the UI components, including theme,

color, logo, shape, and font, to fully match the business’s brand

and ensure consistency across the entire user interface. Several

Marqeta customers, including Bold.org and Finfare, have signed on

to use UX Toolkit to integrate the features into their existing

products and improve their customer experience.

“As soon as Marqeta showed us its new UX Toolkit, its capacity

to accelerate how we create exceptional cardholder experiences was

readily apparent,” said Dror Liebenthal, Co-Founder and CEO of

Bold.org. “With this toolkit, we can easily and quickly modernize

our payment experience to reflect our brand and meet the needs of

our customers.”

Portfolio Migration removes the complexity of transferring

card programs

Moving a payment card portfolio from any processor is a

complicated and onerous process, often requiring significant time

and resources. Marqeta's Portfolio Migration service removes the

complexity of transferring card programs, ensuring a smooth

transition and seamless cardholder experience. This service,

coupled with Marqeta’s white-glove approach, utilizes Marqeta's

advanced migration engine to move large volumes of data and align

that data with Marqeta's own standardized scale. As a result,

customers have access to Marqeta’s advanced card management

features and data analytics that can improve the cardholder

experience. Portfolio Migration is a key component of Marqeta's

program management capabilities, reducing the operational burden of

migrating card programs to its platform. With Portfolio Migration,

Marqeta proactively addresses and mitigates potential issues,

allowing its customers to focus on what they do best, delivering

exceptional user experiences that meet cardholder demands.

“Our new UX Toolkit and Portfolio Migrations engine represent

the full strength of Marqeta, innovative new products shaped by our

unmatched experience building and scaling card programs,” said Matt

Sollie, SVP & GM of Card Program Management at Marqeta. “It’s

never been easier to migrate a program to Marqeta, build out a

best-in-class front-end payments experience and tap into the full

benefits of our program management tools.”

Learn more about Marqeta’s program management capabilities

here.

About Marqeta (NASDAQ: MQ)

Marqeta makes it possible for companies to build and embed

financial services into their branded experience—and unlock new

ways to grow their business and delight users. The Marqeta platform

puts businesses in control of building financial solutions,

enabling them to turn real-time data into personalized, optimized

solutions for everything from consumer loyalty to capital

efficiency. With compliance and security built-in, Marqeta’s

platform has been proven at scale, processing more than $200

billion in annual payments volume in 2023. Marqeta is certified to

operate in more than 40 countries worldwide and counting. Visit

www.marqeta.com to learn more.

Forward-Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements expressed or implied in this press release include, but

are not limited to, quotations and statements relating to changing

consumer preferences; increasing consumer adoption of certain

digital payment methods, products, and solutions; which payment,

banking, and financial services products and solutions may succeed;

technological and market trends; Marqeta’s business; Marqeta’s

products and services; and statements made by Marqeta’s senior

leadership. Actual results may differ materially from the

expectations contained in these statements due to risks and

uncertainties, including, but not limited to, the following: any

factors creating issues with changes in domestic and international

business, market, financial, political and legal conditions; and

those risks and uncertainties included in the “Risk Factors”

disclosed in Marqeta's Annual Report on Form 10-K, as may be

updated from time to time in Marqeta’s periodic filings with the

SEC, available at www.sec.gov and Marqeta’s website at

http://investors.marqeta.com. The forward-looking statements in

this press release are based on information available to Marqeta as

of the date hereof. Marqeta disclaims any obligation to update any

forward-looking statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022386371/en/

James Robinson press@marqeta.com

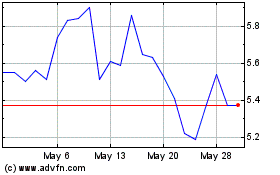

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

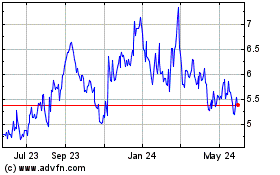

Marqeta (NASDAQ:MQ)

Historical Stock Chart

From Dec 2023 to Dec 2024