false000175950900017595092025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2025

Lyft, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38846 | | 20-8809830 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

185 Berry Street, Suite 400

San Francisco, California 94107

(Address of principal executive offices, including zip code)

(844) 250-2773

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol | | Name of each exchange

on which registered |

| Class A Common Stock, par value of $0.00001 per share | | LYFT | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 11, 2025, Lyft, Inc. (the “Company” or “Lyft”) issued a press release announcing its financial results for the quarter and fiscal year ended December 31, 2024. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure

On February 11, 2025, Lyft posted supplemental investor materials on its investor.lyft.com website. Lyft announces material information to the public about Lyft, its products and services and other matters through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, webcasts, the investor relations section of its website (investor.lyft.com), its X accounts (@lyft and @davidrisher), its Chief Executive Officer’s LinkedIn account (linkedin.com/in/jdavidrisher/), and its blogs (including: lyft.com/blog, lyft.com/hub, and eng.lyft.com) in order to achieve broad, non-exclusionary distribution of information to the public and for complying with its disclosure obligations under Regulation FD.

The information in this current report on Form 8-K and the Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 8.01 Other Events

Share Repurchase Program

On February 11, 2025, Lyft announced that its board of directors has authorized the repurchase of up to $500 million of the Company’s Class A common stock. Repurchases may be made from time to time through open market purchases or through privately negotiated transactions subject to market conditions, applicable legal requirements and other relevant factors. The repurchase program does not obligate the Company to acquire any particular amount of its Class A common stock and may be suspended at any time at the Company’s discretion. The timing and number of shares repurchased will depend on a variety of factors, including the stock price, business and market conditions, corporate and regulatory requirements, alternative investment opportunities, acquisition opportunities, and other factors.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits: | | | | | | | | |

Exhibit

No. | | Exhibit Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. | | | | | | | | |

| | LYFT, INC. |

| | |

| Date: | February 11, 2025 | /s/ Erin Brewer |

| | Erin Brewer |

| | Chief Financial Officer |

Lyft Reports Record Q4 and Full-Year 2024 Results

Announces Inaugural Share Repurchase Program of $500 million

Achieved annual all-time high Rides and riders

SAN FRANCISCO, CA, February 11, 2025 - Lyft, Inc. (Nasdaq:LYFT) today announced financial results for the fourth quarter and full year ended December 31, 2024.

“2024 was a record-smashing year for Lyft. Thanks to our industry-leading service levels, we helped 44 million people across the U.S. and Canada get off their tuchuses,” said CEO David Risher. "But we've got more to do. Our biggest competition is inertia. 2025 will be the year we show millions of riders and drivers: You've now got a better rideshare choice.”

“We achieved record Gross Bookings, significant margin expansion, our first full year of GAAP profitability, and record cash flow generation,” said CFO Erin Brewer. “We surpassed every target we provided at investor day and the best part is that 2024 was only the beginning of our multi-year plan.”

Record Fourth Quarter 2024 Financial Highlights

•Gross Bookings of $4.3 billion, up 15% year over year.

•Revenue of $1.6 billion, up 27% year over year.

•Net income of $61.7 million compared to net loss $(26.3) million in Q4’23.

•Net income as a percentage of Gross Bookings was 1.4% compared to net loss as a percentage of Gross Bookings of (0.7)% in Q4’23.

•Adjusted EBITDA of $112.8 million compared to $66.6 million in Q4’23.

◦Adjusted EBITDA margin (calculated as a percentage of Gross Bookings) was 2.6% compared to 1.8% in Q4’23.

Record Full-Year 2024 Financial Highlights

•Gross Bookings of $16.1 billion was up 17% year over year.

•Revenue of $5.8 billion was up 31% year over year.

•Net income of $22.8 million compared to a net loss of $(340.3) million in 2023.

◦Net income as a percentage of Gross Bookings was 0.1% compared to net loss as a percentage of Gross Bookings of (2.5)% in 2023.

•Adjusted EBITDA of $382.4 million compared to $222.4 million in 2023.

◦Adjusted EBITDA margin (calculated as a percentage of Gross Bookings) was 2.4%, compared to 1.6% in 2023.

•Net cash provided by (used in) operating activities of $849.7 million compared to $(98.2) million in 2023.

•Free cash flow of $766.3 million compared to $(248.1) million in 2023.

Operational Highlights

•Record Rides: In Q4, Rides grew 15% year over year to 219 million. In 2024, Rides grew 17% year over year to 828 million.

•Growth in Active Riders: In Q4, Active Riders grew 10% year over year to an all-time high of 24.7 million. In 2024, the company reached an all-time high of 44 million annual riders.

•Improving Driver Preference: In both Q4 and 2024, preference for Lyft surged, resulting in the highest number of driver hours in our company’s history. According to Q4 survey results, Lyft has a 16 percentage point advantage in preference vs. the other rideshare app.

•Best-in-Class Service Levels: During Q4, Lyft’s average ETAs became the fastest in the industry.

Inaugural Share Repurchase Program

Lyft’s Board of Directors has authorized the repurchase of up to $500 million of the Company’s Class A common stock. Repurchases may be made from time to time through open market purchases or through privately negotiated transactions subject to market conditions, applicable legal requirements and other relevant factors. The repurchase program does not obligate the Company to acquire any particular amount of its Class A common stock and may be suspended at any time at the Company’s discretion. The timing and number of shares repurchased will depend on a variety of factors, including the stock price, business and market conditions, corporate and regulatory requirements, alternative investment opportunities, acquisition opportunities, and other factors.

Q1’25 Outlook

•Rides growth in the mid-teens year over year driven by industry-leading service levels and strong rider and driver growth and engagement.

•Gross Bookings growth of approximately 10% to 14% year over year, or approximately $4.05 billion to $4.20 billion, amidst the recent pricing environment in the U.S. market.

•Adjusted EBITDA of approximately $90 million to $95 million and an Adjusted EBITDA margin (calculated as a percentage of Gross Bookings) of approximately 2.2% to 2.3%.

We have not provided the forward-looking GAAP equivalent to our non-GAAP outlook or a GAAP reconciliation as a result of the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation and income tax. Accordingly, a reconciliation of this non-GAAP guidance metric to its corresponding GAAP equivalent is not available without unreasonable effort. However, it is important to note that the reconciling items could have a significant effect on future GAAP results. We have provided historical reconciliations of GAAP to non-GAAP metrics in tables at the end of this release. For more information regarding the non-GAAP financial measures discussed in this earnings release, please see "GAAP to non-GAAP Reconciliations" below.

Financial and Operational Results through the Fourth Quarter of 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Year Ended December 31, |

| | Dec. 31, 2024 | | Sept. 30, 2024 | | Dec. 31, 2023 | | 2024 | | 2023 |

| | (in millions, except for percentages) |

| Active Riders | | 24.7 | | 24.4 | | 22.4 | | | | |

| Rides | | 218.5 | | 216.7 | | 190.8 | | 828.3 | | 709.0 |

| Gross Bookings | | $ | 4,278.9 | | $ | 4,108.4 | | $ | 3,724.3 | | $ | 16,099.4 | | $ | 13,775.2 |

| Revenue | | $ | 1,550.3 | | $ | 1,522.7 | | $ | 1,224.6 | | $ | 5,786.0 | | $ | 4,403.6 |

Net income (loss) | | $ | 61.7 | | $ | (12.4) | | $ | (26.3) | | $ | 22.8 | | $ | (340.3) |

Net income (loss) as a percentage of Gross Bookings | | 1.4 | % | | (0.3) | % | | (0.7) | % | | 0.1 | % | | (2.5) | % |

| Net cash provided by (used in) operating activities | | $ | 153.4 | | $ | 264.0 | | $ | 43.5 | | $ | 849.7 | | $ | (98.2) |

| Adjusted EBITDA | | $ | 112.8 | | $ | 107.3 | | $ | 66.6 | | $ | 382.4 | | $ | 222.4 |

| Adjusted EBITDA margin (calculated as a percentage of Gross Bookings) | | 2.6 | % | | 2.6 | % | | 1.8 | % | | 2.4 | % | | 1.6 | % |

Adjusted Net Income | | $ | 114.5 | | $ | 118.1 | | $ | 71.1 | | $ | 391.5 | | $ | 250.7 |

Free cash flow | | $ | 140.0 | | $ | 242.8 | | $ | 14.9 | | $ | 766.3 | | $ | (248.1) |

Note: Information on our key metrics and non-GAAP financial measures are also available on our Investor Relations page.

Definitions of Key Metrics

Active Riders

The number of Active Riders is a key indicator of the scale of our user community. Lyft defines Active Riders as all riders who take at least one ride during a quarter where the Lyft Platform processes the transaction. An Active Rider is identified by a unique phone number. If a rider has two mobile phone numbers or changed their phone number and that rider took rides using both phone numbers during the quarter, that person would count as two Active Riders. If a rider has a personal and business profile tied to the same mobile phone number, that person would be considered a single Active Rider. If a ride has been requested by an organization using our Concierge offering for the benefit of a rider, we exclude this rider in the calculation of Active Riders, unless the ride is accessible in that rider’s Lyft App.

Rides

Rides represent the level of usage of our multimodal platform. Lyft defines Rides as the total number of rides including rideshare and bike and scooter rides completed using our multimodal platform that contribute to our revenue. These include any Rides taken through our Lyft App. If multiple riders take a private rideshare ride, including situations where one party picks up another party on the way to a destination, or splits the bill, we count this as a single rideshare ride. Each unique segment of a Shared Ride is considered a single Ride. For example, if two riders successfully match in Shared Ride mode and both complete their Rides, we count this as two Rides. We have largely shifted away from Shared Rides, and now only offer Shared Rides in limited markets. Lyft includes all Rides taken by riders via our Concierge offering, even though such riders may be excluded from the definition of Active Riders unless the ride is accessible in that rider’s Lyft App.

Gross Bookings

Gross Bookings is a key indicator of the scale and impact of our overall platform. Lyft defines Gross Bookings as the total dollar value of transactions invoiced to rideshare riders including any applicable taxes, tolls and fees excluding tips to drivers. It also includes amounts invoiced for other offerings, including but not limited to: Express Drive vehicle rentals, bike and scooter rentals, and amounts recognized for subscriptions, bike and bike station hardware and software sales, media, sponsorships, partnerships, and licensing and data access agreements.

Adjusted EBITDA margin (calculated as a percentage of Gross Bookings)

Adjusted EBITDA margin (calculated as a percentage of Gross Bookings) is calculated by dividing Adjusted EBITDA for a period by Gross Bookings for the same period. For the definition of Adjusted EBITDA, refer to “Non-GAAP Financial Measures”.

Webcast

Lyft will host a webcast today at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time) to discuss these financial results and business highlights. To listen to a live audio webcast, please visit our Investor Relations page at https://investor.lyft.com/. The archived webcast will be available on our Investor Relations page shortly after the call.

About Lyft

Whether it’s an everyday commute or a journey that changes everything, Lyft is driven by our purpose: to serve and connect. In 2012, Lyft was founded as one of the first ridesharing communities in the United States. Now, millions of drivers have chosen to earn on billions of rides. Lyft offers rideshare, bikes, and scooters all in one app — for a more connected world, with transportation for everyone.

Available Information

Lyft announces material information to the public about Lyft, its products and services and other matters through a variety of means, including filings with the Securities and Exchange Commission, press releases, public conference calls, webcasts, the investor relations section of its website (investor.lyft.com), its X accounts (@lyft and @davidrisher), its Chief Executive Officer’s LinkedIn account (linkedin.com/in/jdavidrisher) and its blogs (including: lyft.com/blog, lyft.com/hub, and eng.lyft.com) in order to achieve broad, non-exclusionary distribution of information to the public and for complying with its disclosure obligations under Regulation FD.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally relate to future events or Lyft's future financial or operating performance. In some cases, you can identify forward looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates,” “going to,” "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern Lyft's expectations, strategy, priorities, plans or intentions. Forward-looking statements in this release include, but are not limited to, Lyft’s guidance and outlook, including for the first quarter of 2025, and the trends and assumptions underlying such guidance and outlook, and Lyft’s plans and expectations, including statements about autonomous partnerships and the timing of the availability of autonomous vehicles pursuant to such partnerships. Lyft’s expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including risks related to the macroeconomic environment and risks regarding our ability to forecast our performance due to our limited operating history and the macroeconomic environment and the risk that our partnerships may not materialize as expected. The forward-looking statements contained in this release are also subject to other risks and uncertainties, including those more fully described in Lyft's filings with the Securities and Exchange Commission (“SEC”), including in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2024, and in our Annual Report on Form 10-K for the full fiscal year 2024 that will be filed with the SEC by March 3, 2025. The forward-looking statements in this release are based on information available to Lyft as of the date hereof, and Lyft disclaims any obligation to update any forward-looking statements, except as required by law. This press release discusses “customers”. For rideshare, there are two customers in every car - the driver is Lyft’s customer, and the rider is the driver’s customer. We care about both.

Non-GAAP Financial Measures

To supplement Lyft's financial information presented in accordance with generally accepted accounting principles in the United States of America, or GAAP, Lyft considers certain financial measures that are not prepared in accordance with GAAP, including Adjusted Net Income (Loss), Adjusted EBITDA, Adjusted EBITDA margin (calculated as a percentage of Gross Bookings) and free cash flow. Lyft defines Adjusted EBITDA as net income (loss) adjusted for interest expense, other income (expense), net, provision for (benefit from) income taxes, depreciation and amortization, stock-based compensation expense, payroll tax expense related to stock-based compensation, sublease income and gain from lease termination, as well as, if applicable, restructuring charges and costs related to acquisitions and divestitures. Adjusted EBITDA margin (calculated as a percentage of Gross Bookings) is calculated by dividing Adjusted EBITDA for a period by Gross Bookings for the same period and is considered a key metric. Lyft defines Adjusted Net Income (Loss) as net income (loss) adjusted for amortization of intangible assets, stock-based compensation expense (net of any benefit), payroll tax expense related to stock-based compensation and gain from lease termination, as well as, if applicable, restructuring charges and cost related to acquisitions and divestitures. Lyft defines free cash flow as GAAP net cash provided by (used in) operating activities less purchases of property and equipment and scooter fleet.

Beginning in the first quarter of 2025, we will no longer present Adjusted Net Income (Loss) as our management no longer uses this metric for purposes of understanding and evaluating our operating performance.

Lyft subleases certain office space and earns sublease income. Sublease income is included within other income, net on the condensed consolidated statement of operations, while the related lease expense is included within operating expenses and loss from operations. Lyft believes the adjustment to include sublease income in Adjusted EBITDA is useful to investors by enabling them to better assess Lyft’s operating performance, including the benefits of recent transactions, by presenting sublease income as a contra-expense to the related lease charges that are part of operating expenses.

In the fourth quarter of 2024, we terminated a portion of the lease for the Company’s San Francisco headquarters. The right-of-use asset associated with the portion of this lease was previously impaired as part of our restructuring plans in the fourth quarter of 2022 and second quarter of 2023, and the extinguishment of the remaining lease liability resulted in the recorded gain within operating lease costs. We believe this does not reflect the current period performance of our ongoing operations and that the adjustment to exclude this gain from lease termination from Adjusted EBITDA and Adjusted Net Income (Loss) is useful to investors by enabling them to better assess Lyft’s ongoing operating performance and provide for better comparability with Lyft’s historically disclosed Adjusted EBITDA and Adjusted Net Income (Loss) amounts.

In November 2022, April 2023 and September 2024, Lyft committed to plans of termination as part of efforts to reduce operating expenses. Lyft believes the costs associated with these restructuring efforts do not reflect performance of Lyft’s ongoing operations. Lyft believes the adjustment to exclude the costs related to restructuring from Adjusted EBITDA and Adjusted Net Income (Loss) is useful to investors by enabling them to better assess Lyft’s ongoing operating performance and provide for better comparability with Lyft’s historically disclosed Adjusted EBITDA and Adjusted Net Income (Loss) amounts.

Lyft uses its non-GAAP financial measures in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies, and to communicate with our board of directors concerning our financial performance. Free cash flow is a measure used by our management to understand and evaluate our operating performance and trends. We believe free cash flow is a useful indicator of liquidity that provides our management with information about our ability to generate or use cash to enhance the strength of our balance sheet, further invest in our business and pursue potential strategic initiatives. Free cash flow has certain limitations, including that it does not reflect our future contractual commitments and it does not represent the total increase or decrease in our cash

balance for a given period. Free cash flow does not necessarily represent funds available for discretionary use and is not necessarily a measure of our ability to fund our cash needs.

Lyft’s definitions may differ from the definitions used by other companies and therefore comparability may be limited. In addition, other companies may not publish these or similar metrics. Furthermore, these measures have certain limitations in that they do not include the impact of certain expenses that are reflected in our consolidated statement of operations that are necessary to run our business. Thus, our non-GAAP financial measures should be considered in addition to, not as substitutes for, or in isolation from, measures prepared in accordance with GAAP.

| | | | | |

| Contacts | |

| Aurélien Nolf, Investor Relations | Stephanie Rice, Media |

investor@lyft.com | press@lyft.com |

Lyft, Inc.

Consolidated Balance Sheets

(in thousands, except for per share data)

(unaudited) | | | | | | | | | | | |

| December 31, |

| 2024 | | 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 759,319 | | | $ | 558,636 | |

| Short-term investments | 1,225,124 | | | 1,126,548 | |

| Prepaid expenses and other current assets | 966,090 | | | 892,235 | |

| Total current assets | 2,950,533 | | | 2,577,419 | |

| Restricted cash and cash equivalents | 186,721 | | | 211,786 | |

| Restricted investments | 1,355,451 | | | 837,291 | |

| Other investments | 42,516 | | | 39,870 | |

| Property and equipment, net | 444,864 | | | 465,844 | |

| Operating lease right of use assets | 148,397 | | | 98,202 | |

| Intangible assets, net | 42,776 | | | 59,515 | |

| Goodwill | 251,376 | | | 257,791 | |

| Other assets | 12,435 | | | 16,749 | |

| Total assets | $ | 5,435,069 | | | $ | 4,564,467 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 97,704 | | | $ | 72,282 | |

| Insurance reserves | 1,701,393 | | | 1,337,868 | |

| Accrued and other current liabilities | 1,666,278 | | | 1,508,855 | |

| Operating lease liabilities — current | 25,192 | | | 42,556 | |

| Convertible senior notes, current | 390,175 | | | — | |

| Total current liabilities | 3,880,742 | | | 2,961,561 | |

| Operating lease liabilities | 152,074 | | | 134,102 | |

| Long-term debt, net of current portion | 565,968 | | | 839,362 | |

| Other liabilities | 69,269 | | | 87,924 | |

| Total liabilities | 4,668,053 | | | 4,022,949 | |

| | | |

| Stockholders’ equity | | | |

| Preferred stock, $0.00001 par value; 1,000,000 shares authorized as of December 31, 2024 and 2023; no shares issued and outstanding as of December 31, 2024 and 2023 | — | | | — | |

| Common stock, $0.00001 par value; 18,000,000 Class A shares authorized as of December 31, 2024 and 2023; 409,474 and 391,239 Class A shares issued and outstanding as of December 31, 2024 and 2023, respectively; 100,000 Class B shares authorized as of December 31, 2024 and 2023; 8,531 and 8,567 Class B shares issued and outstanding, as of December 31, 2024 and 2023, respectively | 4 | | | 4 | |

| Additional paid-in capital | 11,035,246 | | | 10,827,378 | |

| Accumulated other comprehensive income (loss) | (10,103) | | | (4,949) | |

| Accumulated deficit | (10,258,131) | | | (10,280,915) | |

| Total stockholders’ equity | 767,016 | | | 541,518 | |

| Total liabilities and stockholders’ equity | $ | 5,435,069 | | | $ | 4,564,467 | |

Lyft, Inc.

Consolidated Statements of Operations

(in thousands, except for per share data)

(unaudited) | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 | | 2022 |

| Revenue | $ | 5,786,016 | | | $ | 4,403,589 | | | $ | 4,095,135 | |

| Costs and expenses | | | | | |

| Cost of revenue | 3,337,714 | | | 2,543,954 | | | 2,435,736 | |

| Operations and support | 443,821 | | | 427,239 | | | 443,846 | |

| Research and development | 397,073 | | | 555,916 | | | 856,777 | |

| Sales and marketing | 788,972 | | | 481,004 | | | 531,512 | |

| General and administrative | 937,348 | | | 871,080 | | | 1,286,180 | |

| Total costs and expenses | 5,904,928 | | | 4,879,193 | | | 5,554,051 | |

| Loss from operations | (118,912) | | | (475,604) | | | (1,458,916) | |

| Interest expense | (28,921) | | | (26,223) | | | (19,735) | |

| Other income (expense), net | 173,183 | | | 170,123 | | | (99,988) | |

| Income (loss) before income taxes | 25,350 | | | (331,704) | | | (1,578,639) | |

| Provision for (benefit from) income taxes | 2,566 | | | 8,616 | | | 5,872 | |

| Net income (loss) | $ | 22,784 | | | $ | (340,320) | | | $ | (1,584,511) | |

| Net income (loss) per share attributable to common stockholders | | | | | |

| Basic | $ | 0.06 | | | $ | (0.88) | | | $ | (4.47) | |

| Diluted | $ | 0.06 | | | $ | (0.88) | | | $ | (4.47) | |

| Weighted-average number of shares outstanding used to compute net income (loss) per share attributable to common stockholders | | | | | |

| Basic | 409,181 | | | 385,335 | | | 354,731 | |

| Diluted | 413,651 | | | 385,335 | | | 354,731 | |

| Stock-based compensation included in costs and expenses: | | | | | |

| Cost of revenue | $ | 24,895 | | | $ | 30,170 | | | $ | 44,132 | |

| Operations and support | 8,397 | | | 15,468 | | | 25,442 | |

| Research and development | 117,833 | | | 214,160 | | | 391,983 | |

| Sales and marketing | 17,286 | | | 29,682 | | | 49,867 | |

| General and administrative | 162,510 | | | 195,053 | | | 239,343 | |

Lyft, Inc.

Consolidated Statements of Cash Flows

(in thousands)

(unaudited) | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 | | 2022 |

| Cash flows from operating activities | | | | | |

| Net income (loss) | $ | 22,784 | | | $ | (340,320) | | | $ | (1,584,511) | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities | | | | | |

| Depreciation and amortization | 148,892 | | | 116,513 | | | 154,798 | |

| Stock-based compensation | 330,921 | | | 484,533 | | | 750,767 | |

| Amortization of premium on marketable securities | 284 | | | 117 | | | 2,955 | |

| Accretion of discount on marketable securities | (89,425) | | | (68,125) | | | (23,245) | |

| Amortization of debt discount and issuance costs | 3,737 | | | 2,877 | | | 2,823 | |

| (Gain) loss on sale and disposal of assets, net | 7,831 | | | (11,278) | | | (60,655) | |

| Gain on lease termination | (29,610) | | | — | | | — | |

| Impairment of non-marketable equity security | — | | | — | | | 135,714 | |

| Other | 2,469 | | | (4,261) | | | 23,592 | |

| Changes in operating assets and liabilities, net effects of acquisition | | | | | |

| Prepaid expenses and other assets | (76,359) | | | (86,922) | | | (275,945) | |

| Operating lease right-of-use assets | 26,276 | | | 20,046 | | | 96,317 | |

| Accounts payable | 21,712 | | | (41,079) | | | (27,215) | |

| Insurance reserves | 363,524 | | | (79,482) | | | 348,721 | |

| Accrued and other liabilities | 164,057 | | | (75,571) | | | 262,358 | |

| Lease liabilities | (47,356) | | | (15,292) | | | (43,759) | |

| Net cash provided by (used in) operating activities | 849,737 | | | (98,244) | | | (237,285) | |

| Cash flows from investing activities | | | | | |

| Purchases of marketable securities | (4,177,429) | | | (3,288,659) | | | (4,049,515) | |

| Purchases of term deposits | (4,388) | | | (3,539) | | | (13,586) | |

| Proceeds from sales of marketable securities | 232,910 | | | 452,465 | | | 676,854 | |

| Proceeds from maturities of marketable securities | 3,415,318 | | | 3,481,042 | | | 3,308,664 | |

| Proceeds from maturities of term deposits | 5,733 | | | 8,539 | | | 395,092 | |

| Purchases of property and equipment and scooter fleet | (83,470) | | | (149,819) | | | (114,970) | |

| Cash paid for acquisitions, net of cash acquired | — | | | 1,630 | | | (146,334) | |

| Sales of property and equipment | 92,045 | | | 92,594 | | | 129,840 | |

| Other | 1,303 | | | 5,500 | | | — | |

| Net cash (used in) provided by investing activities | (517,978) | | | 599,753 | | | 186,045 | |

| Cash flows from financing activities | | | | | |

| Repayment of loans | (84,070) | | | (72,484) | | | (67,639) | |

| Proceeds from issuance of convertible senior notes | 460,000 | | | — | | | — | |

| Payment of debt issuance costs | (11,888) | | | — | | | — | |

| Purchase of capped call | (47,886) | | | — | | | — | |

| Repurchase of Class A common stock | (50,000) | | | — | | | — | |

| Payment for settlement of convertible senior notes due 2025 | (350,000) | | | — | | | — | |

| Proceeds from exercise of stock options and other common stock issuances | 15,051 | | | 10,993 | | | 21,655 | |

| Taxes paid related to net share settlement of equity awards | (40,328) | | | (3,021) | | | (6,733) | |

| Principal payments on finance lease obligations | (46,748) | | | (43,466) | | | (34,783) | |

| Contingent consideration paid | — | | | (14,100) | | | — | |

| Net cash used in financing activities | (155,869) | | | (122,078) | | | (87,500) | |

| Effect of foreign exchange on cash, cash equivalents and restricted cash and cash equivalents | (1,636) | | | 533 | | | (631) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash and cash equivalents | 174,254 | | | 379,964 | | | (139,371) | |

| Cash, cash equivalents and restricted cash and cash equivalents | | | | | |

| Beginning of period | 771,786 | | | 391,822 | | | 531,193 | |

| End of period | $ | 946,040 | | | $ | 771,786 | | | $ | 391,822 | |

Lyft, Inc.

Consolidated Statements of Cash Flows

(in thousands)

(unaudited) | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 | | 2022 |

| Reconciliation of cash, cash equivalents and restricted cash and cash equivalents to the consolidated balance sheets | | | | | |

| Cash and cash equivalents | $ | 759,319 | | | $ | 558,636 | | | $ | 281,090 | |

| Restricted cash and cash equivalents | 186,721 | | | 211,786 | | | 109,368 | |

| Restricted cash, included in prepaid expenses and other current assets | — | | | 1,364 | | | 1,364 | |

| Total cash, cash equivalents and restricted cash and cash equivalents | $ | 946,040 | | | $ | 771,786 | | | $ | 391,822 | |

| | | | | |

| Supplemental disclosures of cash flow information | | | | | |

| Cash paid for income taxes | 11,207 | | | 9,425 | | | 10,723 | |

| Cash paid for interest | 28,304 | | | 20,176 | | | 16,752 | |

| | | | | |

| Non-cash investing and financing activities | | | | | |

| Financed vehicles acquired | $ | 83,600 | | | $ | 127,095 | | | $ | 48,104 | |

| Purchases of property and equipment and scooter fleet not yet settled | 10,599 | | | 4,505 | | | 31,534 | |

| Contingent consideration | — | | | — | | | 15,000 | |

| Right-of-use assets acquired under finance leases | 45,207 | | | 79,102 | | | 11,428 | |

| Right-of-use assets acquired under operating leases | 7,710 | | | 3,795 | | | 498 | |

| Remeasurement of finance and operating lease right of use assets | 54,689 | | | (10,582) | | | (321) | |

Lyft, Inc.

GAAP to Non-GAAP Reconciliations

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended December 31, |

| Dec. 31, 2024 | | Sept. 30, 2024 | | Dec. 31, 2023 | | 2024 | | 2023 |

Adjusted EBITDA | | | | | | | | | |

| | | | | | | | | |

| Net income (loss) | $ | 61.7 | | | $ | (12.4) | | | $ | (26.3) | | | $ | 22.8 | | | $ | (340.3) | |

| Adjusted to exclude the following: | | | | | | | | | |

Interest expense(1) | 8.1 | | | 8.9 | | | 9.7 | | | 34.7 | | | 29.7 | |

| Other income, net | (39.2) | | | (50.9) | | | (45.4) | | | (173.2) | | | (170.1) | |

| Provision for (benefit from) income taxes | (1.2) | | | (0.7) | | | 3.2 | | | 2.6 | | | 8.6 | |

| Depreciation and amortization | 33.7 | | | 45.1 | | | 31.2 | | | 148.9 | | | 116.5 | |

| Stock-based compensation | 76.1 | | | 89.0 | | | 91.7 | | | 330.9 | | | 484.5 | |

| Payroll tax expense related to stock-based compensation | 1.5 | | | 1.7 | | | 1.6 | | | 14.8 | | | 12.5 | |

Sublease income | 0.5 | | | 0.9 | | | 1.1 | | | 3.5 | | | 4.8 | |

Gain from lease termination(2) | (29.6) | | | — | | | — | | | (29.6) | | | — | |

Restructuring charges(3)(4)(5) | 1.2 | | | 25.8 | | | — | | | 26.9 | | | 76.2 | |

Adjusted EBITDA | $ | 112.8 | | | $ | 107.3 | | | $ | 66.6 | | | $ | 382.4 | | | $ | 222.4 | |

| Gross Bookings | $ | 4,278.9 | | | $ | 4,108.4 | | | $ | 3,724.3 | | | $ | 16,099.4 | | | $ | 13,775.2 | |

Net income (loss) as a percentage of Gross Bookings | 1.4 | % | | (0.3 | %) | | (0.7 | %) | | 0.1 | % | | (2.5 | %) |

| Adjusted EBITDA margin (calculated as a percentage of Gross Bookings) | 2.6 | % | | 2.6 | % | | 1.8 | % | | 2.4 | % | | 1.6 | % |

_______________

(1) Includes $1.4 million, $1.5 million and $1.2 million related to the interest component of vehicle related finance leases in the three months ended December 31, 2024, September 30, 2024 and December 31, 2023, respectively, and $5.8 million and $3.4 million related to the interest component of vehicle related finance leases in the years ended December 31, 2024 and 2023, respectively.

(2) In the fourth quarter of 2024, we recorded a $29.6 million gain as a result of a lease termination.

(3) In the third and fourth quarters of 2024, we incurred restructuring charges of $14.1 million of fixed asset disposals, $11.1 million of other current assets disposals and other costs and $1.8 million of severance and other employee costs. Restructuring related charges for accelerated depreciation of fixed assets of $10.6 million are included on its respective line item. These charges were related to the restructuring plan announced in September 2024.

(4) In the second quarter of 2023, we incurred restructuring charges of $46.6 million of severance and other employee costs and $5.7 million in impairment charges, fixed asset write-offs and other costs. Restructuring related charges for stock-based compensation of $9.7 million, accelerated depreciation of $0.7 million and payroll tax expense related to stock-based compensation of $0.6 million are included on their respective line items. These charges were related to the restructuring plan announced in April 2023.

(5) In the first quarter of 2023, we incurred restructuring charges of $4.3 million of severance and other employee costs and $19.6 million related to right-of-use asset impairments and other costs due to ongoing transformational initiatives. In addition, restructuring related charges for accelerated depreciation of $0.3 million and stock-based compensation of $0.2 million are included on their respective line items. These charges were related to the restructuring plan announced in November 2022.

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Year Ended December 31, |

| Dec. 31, 2024 | | Sept. 30, 2024 | | Dec. 31, 2023 | | 2024 | | 2023 |

Adjusted Net Income(1) | | | | | | | | | |

| | | | | | | | | |

| Net income (loss) | $ | 61.7 | | | $ | (12.4) | | | $ | (26.3) | | | $ | 22.8 | | | $ | (340.3) | |

| Adjusted to exclude the following: | | | | | | | | | |

| Amortization of intangible assets | 3.5 | | | 3.5 | | | 4.1 | | | 15.0 | | | 16.8 | |

| Stock-based compensation expense | 76.1 | | | 89.0 | | | 91.7 | | | 330.9 | | | 484.5 | |

| Payroll tax expense related to stock-based compensation | 1.5 | | | 1.7 | | | 1.6 | | | 14.8 | | | 12.5 | |

Gain from lease termination(2) | (29.6) | | | — | | | — | | | (29.6) | | | — |

Restructuring charges(3)(4)(5) | 1.2 | | | 36.4 | | | — | | | 37.6 | | | 77.2 | |

Adjusted Net Income(1) | $ | 114.5 | | | $ | 118.1 | | | $ | 71.1 | | | $ | 391.5 | | | $ | 250.7 | |

_______________

(1) Beginning in the first quarter of 2025, we will no longer present Adjusted Net Income (Loss) as a non-GAAP financial measure.

(2) In the fourth quarter of 2024, we recorded a $29.6 million gain as a result of a lease termination.

(3) In the third and fourth quarters of 2024, we incurred restructuring charges of $14.1 million of fixed asset disposals, $11.1 million of other current assets disposals and other costs, $10.6 million of accelerated depreciation of fixed assets and $1.8 million of severance and other employee costs. These charges were related to the restructuring plan announced in September 2024.

(4) In the second quarter of 2023, we incurred restructuring charges of $46.6 million of severance and other employee costs, $5.7 million in impairment charges, fixed asset write-offs and other costs and $0.7 million of accelerated depreciation. Restructuring related charges for stock-based compensation of $9.7 million and payroll tax expense related to stock-based compensation of $0.6 million are included on their respective line items. These charges were related to the restructuring plan announced in April 2023.

(5) In the first quarter of 2023, we incurred restructuring charges of $4.3 million of severance and other employee costs, $19.6 million related to right-of-use asset impairments and other costs and $0.3 million related to accelerated depreciation of certain fixed assets due to ongoing transformational initiatives. In addition, restructuring related charges for the stock-based compensation of $0.2 million are included on their respective line items. These charges were related to the restructuring plan announced in November 2022.

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2024 | | 2023 | | 2022 |

| Free cash flow | | | | | |

| | | | | |

| Net cash provided by (used in) operating activities | $ | 849.7 | | | $ | (98.2) | | | $ | (237.3) | |

| Less: purchases of property and equipment and scooter fleet | (83.5) | | | (149.8) | | | (115.0) | |

| Free cash flow | $ | 766.3 | | | $ | (248.1) | | | $ | (352.3) | |

Note: Due to rounding, numbers presented may not add up precisely to the totals provided.

v3.25.0.1

Cover Page

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

Lyft, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38846

|

| Entity Tax Identification Number |

20-8809830

|

| Entity Address, Address Line One |

185 Berry Street

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94107

|

| City Area Code |

(844)

|

| Local Phone Number |

250-2773

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, par value of $0.00001 per share

|

| Trading Symbol |

LYFT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001759509

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

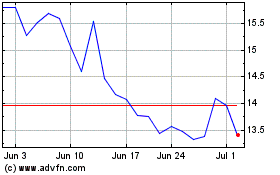

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lyft (NASDAQ:LYFT)

Historical Stock Chart

From Feb 2024 to Feb 2025