La Rosa Holdings Corp. (NASDAQ: LRHC) (“La Rosa” or the

“Company”), a holding company for six agent-centric,

technology-integrated, cloud-based, multi-service real estate

segments, today provided a business update and reported financial

results for the third quarter ended September 30, 2024.

Key Financial Highlights

- Total revenue

increased 188% year-over-year to $19.6 million for the third

quarter ended September 30, 2024 from $6.8 million for the third

quarter ended September 30, 2023

- Residential real

estate services revenue increased $12.6 million to $16.5 million,

or 328%, for the third quarter ended September 30, 2024 from $3.8

million for the third quarter ended September 30, 2023

-

Property management revenue increased by approximately $341

thousand to $2.9 million, or 14%, for the third quarter ended

September 30, 2024 from $2.5 million for the third quarter ended

September 30, 2023

- Real Estate Brokerage Services (Commercial) revenue increased

by approximately $34 thousand to $64 thousand, or 110% for the

third quarter ended September 30, 2024 from $31 thousand for the

third quarter ended September 30, 2023

-

Total revenue increased approximately 155% year-over-year to $51.7

million for the nine months ended September 30, 2024 from $20.3

million for the nine months ended September 30, 2023; surpassing

initial revenue guidance by approximately $6.7 Million

-

Residential real estate services revenue increased $30.7 million to

$42.6 million, or 259%, for the nine months ended September 30,

2024 from $11.9 million for the nine months ended September 30,

2023

-

Property management revenue increased by approximately $986

thousand to $8.2 million, or approximately 14%, in the nine months

ended September 30, 2024 from $7.2 million for the nine months

ended September 30, 2023

-

Real Estate Brokerage Services (Commercial) revenue increased by

approximately $149 thousand to $249 thousand, or 148% for the nine

months ended September 30, 2024 from $100 thousand for the nine

months ended September 30, 2023

Q3 2024 Operational Achievements

- Acquired seven real

estate brokerage franchisees in the first nine months of 2024

fiscal year

- Completed

acquisition of Nona Title Agency LLC DBA Red Door Title

- Announced intent to

acquire real estate brokerage firm with over 950 agents and more

than $19.0 million in revenue for 2023

- Completed debt restructuring, improving the financial position

and reducing debt under the notes by approximately 9.5%

Joe La Rosa, CEO of La Rosa, commented, “We’re

pleased to report that revenue grew an impressive 188% in Q3 2024

comparing to Q3 2024 and approximately 155% for the first nine

months of 2024 as compared to the same period of 2023. This

performance was fueled by acquisitions of real estate brokerage

franchisees and an increase in agent count. During the third

quarter, we acquired Nona Title Agency, enabling us to offer title

insurance services. We believe that this addition enhances our

ability to provide seamless, end-to-end experiences for homebuyers

and sellers, while positioning title services as a high-margin

revenue stream projected to grow significantly in 2025.

“We are developing a transformative proptech

company that empowers agents with state-of-the-art tools to deliver

exceptional service and revolutionize the real estate experience

through innovation and efficiency. At the heart of this initiative

is our proprietary platform, My Agent Account, which we continually

refine to give our agents a competitive edge, enhance productivity,

and set new industry benchmarks. Our competitive revenue share

model and agent-centric approach have been key drivers of our

strong organic growth. Since June 1, 2024, we have successfully

onboarded over 400 agents in just three months. We believe that it

is a testament to the strength of our model and our ongoing

commitment to empowering and supporting our expanding agent

network. This growth underscores our focus on creating an

environment where agents can thrive and achieve success.

“We are leveraging our momentum with ambitious

plans for further growth. In addition to acquiring franchisees, we

are exploring strategic acquisitions, including a recent Letter of

Intent (LOI) to acquire a real estate brokerage generating $19

million in revenue in 2023, supported by a network of 950+ agents

across multiple states. This aligns with our vision of providing

technology-driven real estate solutions, expanding market reach,

and delivering greater value to agents.

“Looking ahead, we anticipate an annualized

revenue run rate of $100 million by the end of 2024, driven by

scaling operations, expanding revenue streams, and integrating new

agents and technologies. We expect to achieve profitability in

2025, supported by disciplined cost management, enhanced technology

offerings, and continued focus on agent success and customer

satisfaction,” concluded Mr. La Rosa.

The closings of the acquisitions mentioned in

this press release are subject to, and contingent upon, the parties

entering into their respective definitive agreements. There can be

no assurances that these acquisitions will be consummated.

Financial Results

Total revenue for the third quarter ended

September 30, 2024, was $19.6 million compared to $6.8 million for

the third quarter ended September 30, 2023. Residential real estate

services revenue increased $12.6 million to $16.5 million, or 328%,

in the third quarter ended September 30, 2024, from $3.8 million

for the third quarter ended September 30, 2023. The increase was

driven by $12.2 million of revenue from the six acquisitions

completed in the fourth quarter of fiscal year 2023 and the seven

acquisitions completed in the first nine months of fiscal year

2024. We increased our transaction fee, monthly agent fee, and

annual fee effective September 1, 2023, which, if volume returns to

2023 levels, real estate brokerage services revenue, excluding

incremental acquisition revenue, will increase in 2024. Selling,

general and administrative costs, excluding stock-based

compensation, for the third quarter ended September 30, 2024, were

approximately $3.0 million, compared to $988 thousand for the third

quarter ended September 30, 2023. A portion of this increase was

driven by $1.1 million of additional costs from the thirteen

acquisitions we completed since the Company’s initial public

offering (IPO) in October 2023 in addition to increased payroll and

benefits, insurance and training, and public company costs in

connection with the IPO, compared to the same period in 2023. Net

loss was $3.4 million, or $(0.21) basic and diluted loss per share,

for the third quarter ended September 30, 2024, compared to net

loss of $344 thousand, or $(0.06) basic and diluted loss per share,

for the third quarter ended September 30, 2023.

Total revenue for the nine months ended

September 30, 2024, was $51.7 million compared to $20.3 million for

nine months ended September 30, 2023. Residential real estate

services revenue increased $30.7 million to $42.6 million, or 259%,

in the nine months ended September 30, 2024, from $11.9 million for

the nine months ended September 30, 2023. The increase was driven

by $32 million of revenue from the six acquisitions completed in

the fourth quarter of fiscal year 2023 and the seven acquisitions

completed in the first nine months of fiscal year 2024. Selling,

general and administrative costs, excluding stock-based

compensation, for the nine months ended September 30, 2024, were

$8.5 million, compared to $2.9 million for the nine months ended

September 30, 2023. A portion of this increase was driven by $1.9

million of additional costs from the thirteen acquisitions we

completed since the Company’s IPO in October 2023 in addition to

increased payroll and benefits, insurance and training, and public

company costs in connection with the IPO, compared to the same

period in 2023. Net loss was $10.5 million, or $(0.70) basic and

diluted loss per share, for the nine months ended September 30,

2024, compared to net loss of $1.7 million, or $(0.29) basic and

diluted loss per share, for the nine months ended September 30,

2023.

About La Rosa Holdings

Corp.

La Rosa Holdings Corp. (Nasdaq: LRHC) is

disrupting the real estate industry by offering agents a choice

between a revenue share model or an annual fee-based model with

100% agent commissions. Leveraging its proprietary technology

platform, La Rosa empowers agents and franchisees to deliver

top-tier service to their clients. The Company provides both

residential and commercial real estate brokerage services and

offers technology-based products and services to its sales agents

and franchise agents.

La Rosa's business model is structured around

internal services for agents and external services for the public,

including residential and commercial real estate brokerage,

franchising, real estate brokerage education and coaching, and

property management. The Company has 24 La Rosa Realty corporate

real estate brokerage offices and branches located in Florida,

California, Texas, Georgia, and Puerto Rico. The Company also has 9

La Rosa Realty franchised real estate brokerage offices and

branches and 3 affiliated real estate brokerage offices, all within

the United States and Puerto Rico.

For more information, please

visit: https://www.larosaholdings.com.

Stay connected with La Rosa, sign up for news alerts

here: larosaholdings.com/email-alerts.

Forward-Looking Statements

This press release contains forward-looking

statements regarding the Company’s current expectations that are

subject to various risks and uncertainties. Such statements include

statements regarding the Company’s ability to grow its business and

other statements that are not historical facts, including

statements which may be accompanied by the words “intends,” “may,”

“will,” “plans,” “expects,” “anticipates,” “projects,” “predicts,”

“estimates,” “aims,” “believes,” “hopes,” “potential” or similar

words. These statements are not guarantees of future

performance and are subject to certain risks, uncertainties and

assumptions that are difficult to predict. Actual results could

differ materially from those described in these forward-looking

statements due to certain factors, including without limitation,

the Company's ability to achieve profitable operations, our ability

to successfully integrate acquisitions into our business

operations, customer acceptance of new services, the demand for the

Company’s services and the Company’s customers' economic condition,

the impact of competitive services and pricing, general economic

conditions, the successful integration of the Company’s past and

future acquired brokerages, the effect of the recent National

Association of Realtors' landmark settlement on our business

operations, and other risk factors detailed in the Company's

filings with the United States Securities and Exchange Commission

(the "SEC”). You are urged to carefully review and consider any

cautionary statements and other disclosures, including the

statements made under the heading “Risk Factors” in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2023,

and other reports and documents that we file from time to time with

the SEC, including our Quarterly Report on Form 10-Q for the fiscal

quarter ended September 30, 2024. Forward-looking statements

contained in this press release are made only as of the date of

this press release, and La Rosa does not undertake any

responsibility to update any forward-looking statements in this

release, except as may be required by applicable law. References

and links to websites have been provided as a convenience, and the

information contained on such websites has not been incorporated by

reference into this press release.

For more information, contact:

info@larosaholdings.com

Investor Relations

Contact:Crescendo Communications, LLCDavid Waldman/Natalya

RudmanTel: (212) 671-1020 Email: LRHC@crescendo-ir.com

| |

|

| La Rosa

Holdings Corp. and Subsidiaries |

|

| Condensed

Consolidated Balance Sheets |

|

| |

|

|

|

|

|

| |

|

September

30, 2024 |

|

December 31,

2023 |

|

| |

|

(unaudited) |

|

(audited) |

|

|

Assets |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash |

|

$ |

1,811,608 |

|

|

$ |

959,604 |

|

|

|

Restricted cash |

|

|

2,148,148 |

|

|

|

1,484,223 |

|

|

|

Accounts receivable, net of allowance for credit losses of $165,554

and $83,456, respectively |

|

|

817,391 |

|

|

|

826,424 |

|

|

|

Other current assets |

|

|

1,188 |

|

|

|

— |

|

|

|

Total current assets |

|

|

4,778,335 |

|

|

|

3,270,251 |

|

|

| |

|

|

|

|

|

| Noncurrent

assets: |

|

|

|

|

|

|

Property and equipment, net |

|

|

17,739 |

|

|

|

14,893 |

|

|

|

Right-of-use asset, net |

|

|

1,088,759 |

|

|

|

687,570 |

|

|

|

Intangible assets, net |

|

|

5,673,222 |

|

|

|

4,632,449 |

|

|

|

Goodwill |

|

|

8,102,089 |

|

|

|

5,702,612 |

|

|

|

Other long-term assets |

|

|

26,853 |

|

|

|

21,270 |

|

|

|

Total noncurrent assets |

|

|

14,908,662 |

|

|

|

11,058,794 |

|

|

|

Total assets |

|

$ |

19,686,997 |

|

|

$ |

14,329,045 |

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

2,093,563 |

|

|

$ |

1,147,073 |

|

|

|

Accrued expenses |

|

|

729,043 |

|

|

|

227,574 |

|

|

|

Contract liabilities |

|

|

72,365 |

|

|

|

— |

|

|

|

Line of credit |

|

|

75,697 |

|

|

|

— |

|

|

|

Derivative liability |

|

|

50,040 |

|

|

|

— |

|

|

|

Advances on future receipts |

|

|

262,263 |

|

|

|

77,042 |

|

|

|

Accrued acquisition cash consideration |

|

|

341,404 |

|

|

|

300,000 |

|

|

|

Notes payable, current |

|

|

2,095,692 |

|

|

|

4,400 |

|

|

|

Lease liability, current |

|

|

526,609 |

|

|

|

340,566 |

|

|

|

Total current liabilities |

|

|

6,246,676 |

|

|

|

2,096,655 |

|

|

| |

|

|

|

|

|

| Noncurrent

liabilities: |

|

|

|

|

|

|

Note payable, net of current |

|

|

643,734 |

|

|

|

615,127 |

|

|

|

Security deposits payable |

|

|

1,821,582 |

|

|

|

1,484,223 |

|

|

|

Lease liability, noncurrent |

|

|

581,622 |

|

|

|

363,029 |

|

|

|

Other liabilities |

|

|

2,950 |

|

|

|

2,950 |

|

|

|

Total non-current liabilities |

|

|

3,049,888 |

|

|

|

2,465,329 |

|

|

|

Total liabilities |

|

|

9,296,564 |

|

|

|

4,561,984 |

|

|

| |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred stock - $0.0001 par value; 50,000,000 shares authorized;

2,000 Series X shares issued and outstanding at September 30, 2024

and December 31, 2023, respectively |

|

|

— |

|

|

|

— |

|

|

|

Common stock - $0.0001 par value; 250,000,000 shares authorized;

18,560,199 and 13,406,480 issued and outstanding at September 30,

2024 and December 31, 2023, respectively |

|

|

1,856 |

|

|

|

1,341 |

|

|

|

Additional paid-in capital |

|

|

26,433,290 |

|

|

|

18,016,400 |

|

|

|

Accumulated deficit |

|

|

(21,478,792 |

) |

|

|

(12,107,756 |

) |

|

|

Total stockholders' equity - La Rosa Holdings Corp.

shareholders |

|

|

4,956,354 |

|

|

|

5,909,985 |

|

|

|

Noncontrolling interest in subsidiaries |

|

|

5,434,079 |

|

|

|

3,857,076 |

|

|

|

Total stockholders' equity |

|

|

10,390,433 |

|

|

|

9,767,061 |

|

|

|

Total liabilities and stockholders' equity |

|

$ |

19,686,997 |

|

|

$ |

14,329,045 |

|

|

| |

|

|

|

|

|

| La Rosa

Holdings Corp. and Subsidiaries |

| Condensed

Consolidated Statements of Operations |

|

(unaudited) |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

|

$ |

19,593,036 |

|

|

$ |

6,792,250 |

|

|

$ |

51,733,355 |

|

|

$ |

20,320,606 |

|

| |

|

|

|

|

|

|

|

|

| Cost of

revenue |

|

|

17,957,130 |

|

|

|

6,216,751 |

|

|

|

47,349,141 |

|

|

|

18,450,162 |

|

| |

|

|

|

|

|

|

|

|

| Gross

profit |

|

|

1,635,906 |

|

|

|

575,499 |

|

|

|

4,384,214 |

|

|

|

1,870,444 |

|

| |

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

246,369 |

|

|

|

49,277 |

|

|

|

691,704 |

|

|

|

242,548 |

|

|

General and administrative |

|

|

2,747,616 |

|

|

|

938,634 |

|

|

|

7,809,627 |

|

|

|

2,672,372 |

|

|

Stock-based compensation - general and administrative |

|

|

389,711 |

|

|

|

5,041 |

|

|

|

4,054,821 |

|

|

|

79,341 |

|

|

Total operating expenses |

|

|

3,383,696 |

|

|

|

992,952 |

|

|

|

12,556,152 |

|

|

|

2,994,261 |

|

| |

|

|

|

|

|

|

|

|

| Loss from

operations |

|

|

(1,747,790 |

) |

|

|

(417,453 |

) |

|

|

(8,171,938 |

) |

|

|

(1,123,817 |

) |

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(98,566 |

) |

|

|

(6,966 |

) |

|

|

(197,425 |

) |

|

|

(147,505 |

) |

|

Loss on extinguishment of debt |

|

|

(722,729 |

) |

|

|

- |

|

|

|

(722,729 |

) |

|

|

- |

|

|

Amortization of debt discount |

|

|

(135,185 |

) |

|

|

(207,887 |

) |

|

|

(455,289 |

) |

|

|

(882,781 |

) |

|

Change in fair value of derivative liability |

|

|

307,098 |

|

|

|

10,201 |

|

|

|

218,998 |

|

|

|

138,985 |

|

|

Other income, net |

|

|

4,544 |

|

|

|

278,266 |

|

|

|

4,544 |

|

|

|

278,834 |

|

| Net

loss |

|

|

(2,392,628 |

) |

|

|

(343,839 |

) |

|

|

(9,323,839 |

) |

|

|

(1,736,284 |

) |

|

Less: Net income (loss) attributable to noncontrolling interests in

subsidiaries |

|

|

59,540 |

|

|

|

— |

|

|

|

47,197 |

|

|

|

— |

|

| Net loss

after noncontrolling interest in subsidiaries |

|

|

(2,452,168 |

) |

|

|

(343,839 |

) |

|

|

(9,371,036 |

) |

|

|

(1,736,284 |

) |

|

Less: Deemed dividend |

|

|

920,038 |

|

|

|

— |

|

|

|

1,150,706 |

|

|

|

— |

|

| Net loss

attributable to common stockholders |

|

$ |

(3,372,206 |

) |

|

$ |

(343,839 |

) |

|

$ |

(10,521,742 |

) |

|

$ |

(1,736,284 |

) |

| |

|

|

|

|

|

|

|

|

| Loss per

share of common stock attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.21 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.70 |

) |

|

$ |

(0.29 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted

average shares used in computing net loss per share of common stock

attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

16,358,452 |

|

|

|

6,180,633 |

|

|

|

14,970,099 |

|

|

|

6,063,056 |

|

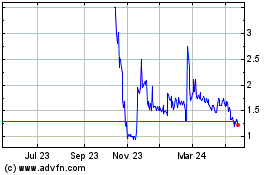

La Rosa (NASDAQ:LRHC)

Historical Stock Chart

From Nov 2024 to Dec 2024

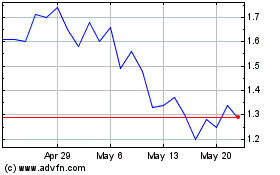

La Rosa (NASDAQ:LRHC)

Historical Stock Chart

From Dec 2023 to Dec 2024