Full-year 2024 revenue of $1.36 billion

reflects growing consumer demand for better-for-you, functional

products

Celsius’ retail sales increased 22%

year-over-year and category market share grew 160 basis points to

11.8% in 20241

Announced agreement to acquire Alani Nu,

creating a leading better-for-you, functional lifestyle platform;

combines two growing, scaled energy brands with clear category

tailwinds

Celsius Holdings to host webcast to discuss

fourth quarter and full-year 2024 results, and transaction details

at 6 p.m. ET today

Celsius Holdings, Inc. (Nasdaq: CELH) (“Celsius” or “the

company”) today reported fourth quarter and full-year 2024

financial results.

Summary of Fourth Quarter and Full-Year 2024 Financial

Results

Summary Financials

4Q 2024

4Q 2023

Change

FY 2024

FY 2023

Change

(Millions except for percentages and

EPS)

Revenue

$332.2

$347.4

(4)%

$1,355.6

$1,318.0

3%

N. America

$311.9

$332.8

(6)%

$1,280.9

$1,263.3

1%

International

$20.3

$14.6

39%

$74.7

$54.7

37%

Gross Margin

50.2%

47.8%

+240 BPS

50.2%

48.0%

+220 BPS

Net Income

$(18.9)

$50.1

(138)%

$145.1

$226.8

(36)%

Net Income att. to Common

Shareholders

$(25.8)

$39.1

(166)%

$107.5

$182.0

(41)%

Diluted EPS

$(0.11)

$0.17

(165)%

$0.45

$0.77

(42)%

Adjusted Diluted EPS*

$0.14

$0.17

(18)%

$0.70

$0.78

(10)%

Adjusted EBITDA*

$62.9

$65.2

(4)%

$255.7

$295.6

(13)%

*The company reports financial results in accordance with generally

accepted accounting principles in the United States (“GAAP”), but

management believes that disclosure of Adjusted EBITDA and Adjusted

Diluted EPS, which are non-GAAP financial measures that management

uses to assess our performance, may provide users with additional

insights into operating performance. Please see “Use of Non-GAAP

Measures” and reconciliations of these non-GAAP measures to the

most directly comparable GAAP measures, both of which can be found

below.

John Fieldly, Chairman and CEO of Celsius Holdings, said:

“Our record $1.36 billion full-year 2024 revenue reflects a solid

year of performance, underscored by consumers’ continued preference

for our great-tasting, functional products. Celsius achieved

exceptional milestones in 2024, which included contributing 30% of

all category growth and increasing our category share by 160 basis

points to 11.8%.1 We also increased our total points of

distribution by 37%1 in 2024, ensuring that Celsius is available in

more places to meet consumer demand, and our ACV reached new

heights at over 98.7%1. We believe we have the right strategy to

drive sustained, long-term growth, and we expect that the

acquisition of Alani Nu will further strengthen Celsius’ position

as an innovative leader in the large, growing global energy

category.”

Jarrod Langhans, Chief Financial Officer of Celsius Holdings,

said: “We are pleased that our strategic initiatives are

driving long-term share gains and strong retail sales growth. For

the full year, revenue increased 3%, and we expanded our gross

margin 220 basis points to 50.2%. We are investing behind our

growth through targeted strategic investments in vertical

integration and capital efficient expansion. We are also excited to

announce the acquisition of Alani Nu, which offers a compelling

strategic rationale and strong financial benefits. We believe our

capital allocation strategy is fully aligned with our vision to be

a high-growth leader and deliver the greatest value to our

consumers and shareholders.”

_____________

1 Circana Total US MULO+ w/C Calendar year

ended 12/29/24, RTD Energy

FINANCIAL AND MARKET HIGHLIGHTS FOR THE

FOURTH QUARTER OF 2024

For the three months ended Dec. 31, 2024, revenue was

approximately $332.2 million, compared to $347.4 million for the

three months ended Dec. 31, 2023, a 4.4% decline. Fourth quarter

revenue was negatively impacted by higher domestic allowances from

a number of programs including our distributor incentive program,

compared to the same period last year.

Fourth quarter international sales of $20.3 million increased

39% year over year from organic growth in our established EMEA

markets, as well as recent international expansion launches across

the UK and Ireland, France, Australia and New Zealand.

International revenue excluding 2024 expansion markets increased 8%

compared to the prior-year period.

For the three months ended Dec. 31, 2024, gross profit increased

by $0.5 million to $166.7 million from $166.2 million for the three

months ended Dec. 31, 2023. Gross profit margin was 50.2% for the

three months ended Dec. 31, 2024, a 240 basis point increase from

47.8% for the same period in 2023. The increase in gross profit is

primarily attributed to lower outbound freight and materials.

Selling, general and administrative expenses for the three

months ended Dec. 31, 2024, increased $77.9 million, or 73%, to

$185.2 million from $107.3 million in the quarter ended Dec. 31,

2023, driven primarily by accrued legal expenses in connection with

an ongoing litigation matter. Selling, general and administrative

expenses were also impacted by one-time restructuring related

professional services and contractual co-packer obligations in the

quarter ended Dec. 31, 2024.

Diluted earnings per share for the fourth quarter was $(0.11)

compared to $0.17 for the prior-year period. Non-GAAP adjusted

diluted earnings per share for the fourth quarter was $0.14

compared to $0.17 for the prior-year period.

Retail Performance

Retail sales of Celsius in total U.S. MULO Plus with Convenience

increased by 2% year over year as reported by Circana for the

last-thirteen-week period ended Dec. 29, 20242. Celsius dollar

share for the same period was 10.9%, a decrease of 0.5% from the

prior-year period3.

FINANCIAL AND MARKET HIGHLIGHTS FOR

FULL-YEAR 2024

Revenue for the 12 months ended Dec. 31, 2024, increased 3% to

$1,355.6 million compared to $1,318.0 million for the prior year.

Revenue for the 12 months ended Dec. 31, 2024, was impacted by

timing of orders from our largest distributor, increased

promotional activity and incentive programs. International sales of

$74.7 million increased 37% from $54.7 million for the prior

year.

Gross profit increased 7% to $680.2 million compared to $633.1

million for the prior year. Gross profit as a percentage of revenue

was 50.2% for the 12 months ended Dec. 31, 2024, up from 48.0% in

the prior year.

Diluted earnings per share for the year ended Dec. 31, 2024, was

$0.45 compared to $0.77 for the prior year. Non-GAAP adjusted

diluted earnings per share was $0.70 compared to $0.78 for the

prior-year period.

Retail Performance

Retail sales of Celsius in total U.S. MULO Plus with Convenience

increased by 22.1% year over year as reported by Circana for the

calendar year ended Dec. 29, 20244. Celsius dollar share for the

same period was 11.8%, an increase of 1.6% from the prior-year

period5.

_____________

2 Circana Total US MULO+ w/C L13W ended

12/29/24, RTD Energy

3 Circana Total US MULO+ w/C L13W ended

12/29/24, RTD Energy

4 Circana Total US MULO+ w/C Calendar year

ended 12/29/24, RTD Energy

5 Circana Total US MULO+ w/C Calendar year

ended 12/29/24, RTD Energy

Acquisition of Alani Nu

The Company also announced today that it has entered into a

definitive agreement to acquire Alani Nutrition LLC (“Alani Nu”)

for $1.8 billion including $150 million in tax assets for a net

purchase price of $1.65 billion, comprising a mix of cash and

stock. The agreement has been approved by the Celsius Board of

Directors. The transaction is subject to customary closing

conditions, including regulatory approvals, and is expected to

close in the second quarter of 2025. The company has provided

additional details regarding this transaction in a separate press

release, and management will discuss the transaction on today’s

webcast at 6:00 p.m. ET. A presentation highlighting this

transaction will be available on the Celsius Holdings investor

relations website at https://ir.celsiusholdingsinc.com.

Fourth Quarter and Full-Year 2024 Earnings Webcast

Management will host a webcast today, Thursday, Feb. 20, 2025,

at 6:00 p.m. ET to discuss the company’s fourth quarter and

full-year 2024 financial results and the Alani Nu transaction with

the investment community. Investors are invited to join the webcast

accessible from https://ir.celsiusholdingsinc.com. Downloadable

files, an audio replay and transcript will be made available on the

Celsius Holdings investor relations website.

About Celsius Holdings, Inc.

Celsius Holdings, Inc. (Nasdaq: CELH) is a functional beverage

company and the owner of energy drink brand CELSIUS® and hydration

brand CELSIUS HYDRATIONTM. Born in fitness and pioneering the

rapidly growing, better-for-you functional beverage category, the

company creates and markets leading functional beverage products.

For more information, please visit www.celsiusholdingsinc.com.

Forward-Looking Statements

This press release contains statements by Celsius Holdings, Inc.

(“Celsius”, “we”, “us”, “our” or the “Company”) that are not

historical facts and are considered forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements may address, among other

things, our prospects, plans, business strategy and expected

financial and operational results. You can identify these

statements by the use of words such as “anticipate,” “believe,”

“could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,”

“would”, ”could”, ”project”, ”plan”, “potential”, ”designed”,

“seek”, “target”, variations of these terms, the negatives of such

terms and similar expressions. These statements are based on

certain assumptions that we have made in light of our experience in

the industry as well as our perceptions of historical trends,

current conditions, expected future developments and other factors

we believe are appropriate in these circumstances. These

forward-looking statements are based on our current expectations

and beliefs concerning future developments and their potential

effect on us. You should not rely on forward-looking statements

because our actual results may differ materially from those

indicated by forward-looking statements as a result of a number of

important factors. These factors include, but are not limited to:

changes to our commercial agreements with PepsiCo, Inc.;

management’s plans and objectives for international expansion and

global operations; general economic and business conditions; our

business strategy for expanding our presence in our industry; our

expectations of revenue; operating costs and profitability; our

expectations regarding our strategy and investments; our ability to

successfully integrate business that we may acquire, including our

pending acquisition of Alani Nu; our ability to achieve the

benefits that we expect to realize as a result of our acquisitions,

including Alani Nu; the potential negative impact on our financial

condition and results of operations if we fail to achieve the

benefits that we expect to realize as a result of our business

acquisitions, including Alani Nu; liabilities of the businesses

that we acquire that are not known to us; our expectations

regarding our business, including market opportunity, consumer

demand and our competitive advantage; anticipated trends in our

financial condition and results of operation; the impact of

competition and technology change; existing and future regulations

affecting our business; the Company’s ability to comply with the

rules and regulations of the Securities and Exchange Commission

(the “SEC”); and those other risks and uncertainties discussed in

the reports we have filed with the SEC, such as our Annual Report

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K. Forward-looking statements speak only as of the date the

statements were made. We do not undertake any obligation to update

forward-looking information, except to the extent required by

applicable law.

CELSIUS HOLDINGS, INC. - FINANCIAL

TABLES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except par

value)

(Unaudited)

December 31, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

890,190

$

755,981

Accounts receivable-net1

270,342

183,703

Note receivable-net

—

2,318

Inventories-net

131,165

229,275

Deferred other costs-current2

14,124

14,124

Prepaid expenses and other current

assets

18,759

19,503

Total current assets

1,324,580

1,204,904

Property, plant and equipment-net

55,602

24,868

Right of use assets-operating leases

21,606

1,957

Right of use assets-finance leases-net

230

208

Intangibles-net

12,213

12,139

Goodwill

71,582

14,173

Deferred other costs-non-current2

234,215

248,338

Deferred tax assets

38,699

29,518

Other long-term assets

8,154

291

Total Assets

$

1,766,881

$

1,536,396

LIABILITIES, MEZZANINE EQUITY

AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable3

$

41,287

$

42,840

Accrued expenses4

148,780

62,120

Income taxes payable

10,834

50,424

Accrued promotional allowance5

135,948

99,787

Lease liability operating leases

3,265

980

Lease liability finance leases

100

59

Deferred revenue2

9,513

9,513

Other current liabilities

15,808

10,890

Total current liabilities

365,535

276,613

Lease liability operating leases

16,674

955

Lease liability finance leases

211

193

Deferred tax liability

2,330

2,880

Deferred revenue2

157,714

167,227

Total Liabilities

542,464

447,868

Commitment and contingencies (Note 15)

Mezzanine Equity2:

Series A convertible preferred shares,

$0.001 par value, 5% cumulative dividends; 1,466,666 shares issued

and outstanding at each of December 31, 2024 and December 31, 2023,

aggregate liquidation preference of $550,000 as of December 31,

2024 and December 31, 2023.

824,488

824,488

Stockholders’ Equity:

Common stock, $0.001 par value;

300,000,000 shares authorized, 235,013,960 and 231,787,482 shares

issued and outstanding at December 31, 2024 and December 31, 2023,

respectively.

79

77

Additional paid-in capital

297,579

276,717

Accumulated other comprehensive loss

(3,250

)

(701

)

Retained earnings (accumulated

deficit)

105,521

(12,053

)

Total Stockholders’ Equity

399,929

264,040

Total Liabilities, Mezzanine Equity and

Stockholders’ Equity

$

1,766,881

$

1,536,396

[1] Includes $168.2 million and $130.0

million from a related party as of December 31, 2024 and December

31, 2023, respectively; and

[2] Amounts in this line item are

associated with a related party for all periods presented.

[3] Includes $1.7 million and $0.1 million

due to a related party as of December 31, 2024 and December 31,

2023, respectively.

[4] Includes $0.2 million and $1.0 million

due to a related party as of December 31, 2024 and $1.0 million as

of December 31, 2023, respectively.

[5] Includes $75.1 million and $51.8

million due to a related party as of December 31, 2024 and December

31, 2023, respectively.

CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE INCOME

(In thousands, except per

share amounts)

(Unaudited)

For the Three Months Ended

December 31,

For the Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue1

$

332,197

$

347,435

$

1,355,630

$

1,318,014

Cost of revenue

165,524

181,190

675,423

684,875

Gross profit

166,673

166,245

680,207

633,139

Selling, general and administrative

expenses2

185,169

107,302

524,479

366,773

(Loss) income from operations

(18,496

)

58,943

155,728

266,366

Other income (expense):

Interest income on note receivable

(28

)

8,835

—

128

Interest income-net

7,892

27

39,263

26,501

Foreign exchange loss

(1,378

)

(20

)

(1,734

)

(1,246

)

Other income

1,793

—

1,793

—

Total other income

8,279

8,842

39,322

25,383

Net (loss) income before provision for

income taxes

(10,217

)

67,785

195,050

291,749

Provision for income taxes

(8,659

)

(17,669

)

(49,976

)

(64,948

)

Net (loss) income

$

(18,876

)

$

50,116

$

145,074

$

226,801

Dividends on Series A convertible

preferred stock3

(6,912

)

(6,950

)

(27,500

)

(27,462

)

Income allocated to participating

preferred stock3

—

(4,085

)

(10,117

)

(17,348

)

Net (loss) income attributable to

common stockholders

$

(25,788

)

$

39,081

$

107,457

$

181,991

Other comprehensive (loss) income:

Foreign currency translation (loss) gain,

net of income tax

(2,912

)

1,840

(2,549

)

1,180

Comprehensive (loss) income

$

(28,700

)

$

40,921

$

104,908

$

183,171

*(Loss) earnings per share4:

Basic

$

(0.10

)

$

0.17

$

0.46

$

0.79

Diluted

$

(0.11

)

$

0.17

$

0.45

$

0.77

*Please refer to Note 3 in the Company’s

Annual Report on Form 10-K for the period ended December 31, 2024,

for Earnings per Share reconciliations.

[1] Includes $194.2 million and $742.0

million for the three and twelve months ended December 31, 2024,

respectively, and $192.3 million and $782.3 million for the three

and twelve months ended December 31, 2023, respectively, from a

related party.

[2] Includes $0.8 million and $2.4 million

for the three and twelve months ended December 31, 2024,

respectively, and $1.3 million and $2.4 million for the three and

twelve months ended December 31, 2023, respectively, from a related

party.

[3] Amounts in this line item are

associated with a related party for all periods presented.

[4] Forward Stock Split - The accompanying

consolidated financial statements and notes thereto have been

retrospectively adjusted to reflect the three-for-one stock split

that became effective on November 13, 2023. See Note 2. Basis of

Presentation and Summary of Significant Accounting Policies for

more information.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

Reconciliation of GAAP net

income to non-GAAP adjusted EBITDA and Adjusted EBITDA

Margin

Three months ended

December 31,

Twelve months ended

December 31,

2024

2023

2024

2023

Net (loss) income (GAAP

measure)

$

(18,876

)

$

50,116

$

145,074

$

226,801

Add

back/(Deduct):

Net interest income

(7,864

)

(8,862

)

(39,263

)

(26,629

)

Provision for income taxes

8,659

17,669

49,976

64,948

Depreciation and amortization expense

2,385

1,105

7,274

3,226

Non-GAAP EBITDA

(15,696

)

60,028

163,061

268,346

Stock-based compensation1

5,905

5,005

19,591

21,226

Foreign exchange

1,378

20

1,734

1,246

Distributor Termination2

—

126

—

(3,115

)

Legal Settlement Costs3

54,005

—

54,005

7,900

Reorganization Costs4

5,965

—

5,965

—

Acquisition Costs5

2,008

—

2,008

—

Penalties6

9,350

—

9,350

—

Non-GAAP Adjusted EBITDA

$

62,915

$

65,179

$

255,714

$

295,603

Non-GAAP Adjusted EBITDA Margin

18.9

%

18.8

%

18.9

%

22.4

%

Reconciliation of GAAP diluted

Earnings per share to non-GAAP Adjusted diluted Earnings per

share

Three months ended

December 31,

Twelve months ended

December 31,

2024

2023

2024

2023

Diluted (loss) earnings per share (GAAP

measure)

$

(0.11

)

$

0.17

$

0.45

$

0.77

Add

back/(Deduct)7:

Distributor Termination2

—

—

—

$

(0.01

)

Legal Settlement Costs3

$

0.16

—

$

0.16

$

0.02

Reorganization Costs4

$

0.05

—

$

0.05

$

—

Acquisition Costs5

$

0.01

—

$

0.01

$

—

Penalties6

$

0.03

—

$

0.03

$

—

Non-GAAP diluted earnings per

share

$

0.14

$

0.17

$

0.70

$

0.78

_____________

1Selling, general and administrative

expenses related to employee non-cash stock-based compensation

expense. Stock-based compensation expense consists of non-cash

charges for the estimated fair value of unvested restricted share

unit and stock option awards granted to employees and directors.

The Company believes that the exclusion provides a more accurate

comparison of operating results and is useful to investors to

understand the impact that stock-based compensation expense has on

its operating results.

2Distributor termination represents

reversals of accrued termination payments. The unused funds

designated for termination expense payments to legacy distributors

were reimbursed to Pepsi for the quarter ended June 30, 2023.

3 2024 accrued expense for estimated

liability in connection with an ongoing litigation during the

quarter ended December 31, 2024. 2024 accrued expense for SEC

settlement during the quarter ended December 31, 2024. 2023 legal

class action settlement pertained to the McCallion vs Celsius

Holdings class action lawsuit, which the company settled during the

quarter ended June 30, 2023.

4 Reorganization costs represent

international re-alignment costs incurred during the quarter ended

December 31, 2024.

5 Acquisition costs include fees for

Professional services received during the fourth quarter ended

December 31, 2024 related to a business acquisition.

6 Accrued expense in the quarter ended

December 31, 2024 related to contractual co-packer obligations.

7 Add backs and deductions are net of

their respective impacts from tax and reallocation of earnings to

participating securities.

USE OF NON-GAAP MEASURES

Celsius defines Adjusted EBITDA as net income before net

interest income, income tax expense (benefit), and depreciation and

amortization expense, further adjusted by excluding stock-based

compensation expense, foreign exchange gains or losses, distributor

termination fees and legal settlement costs. Adjusted EBITDA Margin

is the ratio between the company’s Adjusted EBITDA and net revenue,

expressed as a percentage. Adjusted diluted earnings per share is

GAAP diluted earnings per share net of add backs and deductions for

distributor termination, legal settlement costs, reorganization

costs, acquisitions costs, and penalties. Adjusted EBITDA, Adjusted

EBITDA Margin, and Adjusted diluted earnings per share are non-GAAP

financial measures.

Celsius uses Adjusted EBITDA, Adjusted EBITDA Margin, and

Adjusted diluted earnings per share for operational and financial

decision-making and believes these measures are useful in

evaluating its performance because they eliminate certain items

that management does not consider indicators of Celsius’ operating

performance. Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted

diluted earnings per share may also be used by many of Celsius’

investors, securities analysts, and other interested parties in

evaluating its operational and financial performance across

reporting periods. Celsius believes that the presentation of

Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted diluted

earnings per share, provides useful information to investors by

allowing an understanding of measures that it uses internally for

operational decision-making, budgeting and assessing operating

performance.

Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted diluted

earnings per share are not recognized terms under GAAP and should

not be considered as a substitute for net income or any other

financial measure presented in accordance with GAAP. Non-GAAP

financial measures have limitations as analytical tools and should

not be considered in isolation or as substitutes for analysis of

Celsius’ results as reported under GAAP. Celsius strongly

encourages investors to review its financial statements and

publicly filed reports in their entirety and not to rely on any

single financial measure.

Because non-GAAP financial measures are not standardized,

Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted diluted

earnings per share as defined by Celsius, may not be comparable to

similarly titled measures reported by other companies. It therefore

may not be possible to compare Celsius’ use of these non-GAAP

financial measures with those used by other companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220191829/en/

Paul Wiseman Investors: investorrelations@celsius.com Press:

press@celsius.com

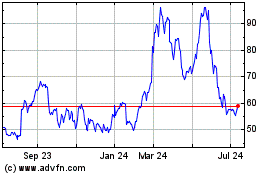

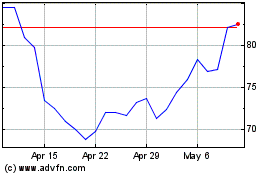

Celsius (NASDAQ:CELH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Celsius (NASDAQ:CELH)

Historical Stock Chart

From Feb 2024 to Feb 2025