Combines two growing, scaled energy brands with

clear category tailwinds

Net purchase price of $1.65 billion,

representing an attractive valuation of less than 3x 2024A net

revenue and approximately 12x fully synergized 2024A EBITDA1

Transaction expected to be accretive to cash

EPS in the first full year of ownership

Celsius today separately released fourth

quarter and full-year 2024 results; Company to host webcast at 6:00

p.m. ET today

Celsius Holdings, Inc. (Nasdaq: CELH) (“Celsius” or “the

company”) today announced that it has entered into a definitive

agreement to acquire Alani Nutrition LLC (“Alani Nu”) for $1.8

billion including $150 million in tax assets for a net purchase

price of $1.65 billion, comprising a mix of cash and stock. The

transaction will combine two growing, scaled brands in the U.S.

energy drink category, creating a leading better-for-you,

functional lifestyle platform that is well positioned to capitalize

on the growing consumer preference for zero-sugar alternatives.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250220357704/en/

Celsius and Alani Nu (Photo: Business

Wire)

Founded in 2018, Alani Nu is a growing, female-focused brand

that delivers functional beverages and wellness products that are

aspirational yet accessible for a growing community of Gen Z and

millennial consumers. Alani Nu provides complementary brand

positioning and access to attractive female consumer demographics

driving incremental energy drink category growth. The acquisition

is expected to provide the opportunity for additional, adjacent

category expansion, ultimately enabling Celsius to reach more

people, in more places, more often. The added breadth of the

combined platform is expected to further strengthen the company’s

position with ample resources for ongoing growth investment.

John Fieldly, Chairman and CEO of Celsius, said, “Celsius is at

a defining moment in the better-for-you, functional lifestyle

products movement, and we are thrilled to welcome Alani Nu to the

Celsius family. We have deep respect for the strong community of

supporters and fans Alani Nu has developed and the authentic brand

and partnerships they have formed. Together, we expect to broaden

the availability of Alani Nu’s functional products to help more

people achieve their wellness goals with great-tasting, functional

product options at more moments throughout their lives.”

Katy Schneider, Co-Founder of Alani Nu, commented, “When we

founded Alani Nu in 2018, our goal was simple: to create products

that made women feel their absolute best—inside and out. Watching

this brand grow into a movement of strong, confident women has been

the honor of a lifetime. As Alani Nu enters this next chapter with

Celsius, I have full confidence that they are the best partner to

enhance Alani Nu's growth and success while staying true to what

makes it so special. I’m incredibly proud of everything we’ve built

and beyond grateful for this amazing community who made it all

possible. I’m thrilled for Alani to reach new heights.”

Max Clemons, Co-Founder and Co-CEO of Congo Brands, which

operates Alani Nu, added, “We believe Celsius can unlock key growth

opportunities for Alani Nu and are excited to partner with John and

the Celsius team as they continue to disrupt and grow the

functional beverage space.”

Retail sales of Alani Nu in total U.S. MULO Plus with

Convenience increased by 78% year over year as reported by Circana

for the last-four-week period ended Jan. 26, 20252. Alani Nu dollar

share for the same last-four-week-period was 4.8%, an increase of

~200 basis points from the prior-year period3.

Upon closing, Alani Nu will operate within Celsius, and key

members of the Congo Brands leadership team have agreed to continue

as advisors to Celsius to help ensure continued business

momentum.

Compelling Strategic Rationale

- Creates a leading better-for-you, functional lifestyle

platform at the intersection of consumer megatrends. With the

addition of Alani Nu, the combined Celsius platform is expected to

drive ~$2 billion in sales across a differentiated energy portfolio

that is firmly aligned with the ongoing consumer shift towards

premium, functional beverage options that cater to health &

wellness and active lifestyles.

- Combines two growing, scaled energy brands with clear

category tailwinds. The transaction is expected to enhance

Celsius’ position as an innovative leader in the large, growing

global energy category, which is projected to grow at a 10% CAGR

from 2024 to 20294, with a scaled, on-trend, sugar-free

platform.

- Provides complementary brand positioning and attractive

consumer demographics and is expected to drive incremental category

growth. Alani Nu will provide Celsius expanded access to a

fast-growing, wellness-focused audience that is driving incremental

category growth.

- Leverages combined strengths and capabilities to drive the

next phase of growth. The added breadth of the combined

platform is expected to further strengthen the company’s position

with ample resources for ongoing growth investment. Both brands

will be well positioned under the Celsius platform to drive

continued distribution gains, access consumers in growing

adjacencies, drive innovation and brand awareness, achieve

incremental category growth and propel further global

expansion.

- Enhances topline growth algorithm and is expected to be cash

EPS accretive in year one with a meaningful synergy

opportunity. The acquisition of Alani Nu is expected to add

significant topline scale and growth and is expected to be

accretive to cash EPS in the first full year of ownership; $50

million of run-rate cost synergies are expected to be achieved over

two years post-close, contributing to strong pro-forma

profitability and significant cash flow generation.

Transaction Details Under the terms of the agreement,

Celsius has agreed to acquire Alani Nu from co-founders, Katy and

Haydn Schneider, and Congo Brands’ Co-Founders, Max Clemons and

Trey Steiger, for $1.8 billion comprising a mix of cash and stock

including a potential $25 million earn-out based on 2025

performance. This includes approximately $150 million net present

value of tax benefits for a net purchase price of $1.65 billion and

represents an attractive valuation of less than 3x 2024A revenue of

$595 million and approximately 12x fully synergized 2024A EBITDA of

$137 million1.

The purchase price consideration is comprised of $1,275 million

of cash and a $25 million earn-out and $500 million (or

approximately 22.5 million shares) of newly issued restricted

shares of Celsius Holdings common stock, representing approximately

8.7% pro-forma ownership. The cash consideration consists of fully

committed debt financing of $900 million and approximately $375

million of cash on hand. The company’s liquidity position is

expected to remain robust with pro-forma net leverage of

approximately 1.0x5 and ample cash on the balance sheet.

Stock consideration will be subject to a lock-up agreement,

which will be released over a two-year period, aligning long-term

interests to drive future growth and value creation. A transition

services agreement and consulting agreements retain key brand

leadership to support the integration process.

The agreement has been approved by the Celsius Board of

Directors. The transaction is subject to customary closing

conditions, including regulatory approvals, and is expected to

close in the second quarter of 2025.

_______________________________________ 1 Based on 2024A

Adjusted EBITDA including estimated run-rate cost synergies of $50

million to be achieved over 2-years post-close (excludes total cost

to achieve) and purchase price net of ~$150 million tax benefit

step-up (net present value). Please see “Use of Non-GAAP Measures”

and reconciliation to the most directly comparable GAAP measure

below. 2 Circana Total US MULO+ w/C L4W ended 1/26/25, RTD Energy 3

Circana Total US MULO+ w/C L4W ended 1/26/25, RTD Energy 4

Euromonitor as of February 2025, Global Energy Drink Category 5

Based on 2024A combined company Pro-Forma Adjusted EBITDA including

estimated run-rate cost synergies of $50 million (excluding cost to

achieve). Excludes transaction fees & expenses.

Advisors UBS Investment Bank acted as exclusive financial

advisor to Celsius and is providing a committed financing package

comprised of a $900 million Term Loan B and a $100 million

Revolving Credit Facility, and Freshfields US LLP is serving as

legal counsel to Celsius. J.P. Morgan Securities LLC is serving as

Alani Nu’s financial advisor and Greenberg Traurig, P.A. is serving

as legal counsel.

Fourth Quarter and Full-Year 2024 Earnings Webcast The

company issued a separate press release today reporting its fourth

quarter and full-year 2024 financial results. Management will host

a webcast today, Thursday, Feb. 20, 2025, at 6:00 p.m. ET, to

discuss the company’s fourth quarter and full-year 2024 financial

results as well as business updates with the investment community.

Investors are invited to join the webcast accessible from

https://ir.celsiusholdingsinc.com. Downloadable files, an audio

replay and transcript will be made available on the Celsius

investor relations website.

About Celsius Holdings, Inc. Celsius Holdings, Inc.

(Nasdaq: CELH) is a functional beverage company and the owner of

energy drink brand CELSIUS® and hydration brand CELSIUS HYDRATION™.

Born in fitness and pioneering the rapidly growing, better-for-you

functional beverage category, the company creates and markets

leading functional beverage products. For more information, please

visit www.celsiusholdingsinc.com.

About Alani Nu Founded in 2018 by entrepreneur and

influencer, Katy Hearn, Alani Nu® is a health and wellness brand

focused on providing low-calorie products with unique flavors.

Alani Nu offers a range of products including energy drinks, daily

essentials, on-the-go snacks and more, and can be found at Walmart,

Target, GNC, The Vitamin Shoppe, Kroger Family Stores nationwide,

Costco and on Amazon.

Forward-Looking Statements This press release contains

statements by Celsius Holdings, Inc. (“Celsius,” “we,” “us,” “our”

or the “Company”) that are not historical facts and are considered

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements may address, among other things, our prospects, plans,

business strategy and expected financial and operational results.

You can identify these statements by the use of words such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “should,” “will,” “would,” ”could,” ”project,” ”plan,”

“potential,” ”designed,” “seek,” “target,” variations of these

terms, the negatives of such terms and similar expressions. These

statements are based on certain assumptions that we have made in

light of our experience in the industry as well as our perceptions

of historical trends, current conditions, expected future

developments and other factors we believe are appropriate in these

circumstances. These forward-looking statements are based on our

current expectations and beliefs concerning future developments and

their potential effect on us. You should not rely on

forward-looking statements because our actual results may differ

materially from those indicated by forward-looking statements as a

result of a number of important factors. These factors include, but

are not limited to: changes to our commercial agreements with

PepsiCo, Inc.; management’s plans and objectives for international

expansion and global operations; general economic and business

conditions; our business strategy for expanding our presence in our

industry; our expectations of revenue; operating costs and

profitability; our expectations regarding our strategy and

investments; our ability to successfully integrate business that we

may acquire, including our pending acquisition of Alani Nu; our

ability to achieve the benefits that we expect to realize as a

result of our acquisitions, including Alani Nu; the potential

negative impact on our financial condition and results of

operations if we fail to achieve the benefits that we expect to

realize as a result of our business acquisitions, including Alani

Nu; liabilities of the businesses that we acquire that are not

known to us; our expectations regarding our business, including

market opportunity, consumer demand and our competitive advantage;

anticipated trends in our financial condition and results of

operation; the impact of competition and technology change;

existing and future regulations affecting our business; the

Company’s ability to comply with the rules and regulations of the

Securities and Exchange Commission (the “SEC”); and those other

risks and uncertainties discussed in the reports we have filed with

the SEC, such as our Annual Report on Form 10-K, Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K. Forward-looking

statements speak only as of the date the statements were made. We

do not undertake any obligation to update forward-looking

information, except to the extent required by applicable law.

Use of Non-GAAP Measures Celsius defines Adjusted EBITDA

as net income before net interest income, income tax expense

(benefit), and depreciation and amortization expense, further

adjusted by excluding stock-based compensation expense, foreign

exchange gains or losses, distributor termination fees and legal

settlement costs. Adjusted EBITDA Margin is the ratio between the

Company’s Adjusted EBITDA and net revenue, expressed as a

percentage. Adjusted diluted earnings per share is GAAP diluted

earnings per share net of add backs and deductions for distributor

termination, legal settlement costs, reorganization costs,

acquisitions costs, and penalties. Adjusted EBITDA, Adjusted EBITDA

Margin, and Adjusted diluted earnings per share are non-GAAP

financial measures.

Celsius uses Adjusted EBITDA, Adjusted EBITDA Margin, and

Adjusted diluted earnings per share for operational and financial

decision-making and believes these measures are useful in

evaluating its performance because they eliminate certain items

that management does not consider indicators of Celsius’ operating

performance. Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted

diluted earnings per share may also be used by many of Celsius’

investors, securities analysts, and other interested parties in

evaluating its operational and financial performance across

reporting periods. Celsius believes that the presentation of

Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted diluted

earnings per share, provides useful information to investors by

allowing an understanding of measures that it uses internally for

operational decision-making, budgeting and assessing operating

performance.

Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted diluted

earnings per share are not recognized terms under GAAP and should

not be considered as a substitute for net income or any other

financial measure presented in accordance with GAAP. Non-GAAP

financial measures have limitations as analytical tools and should

not be considered in isolation or as substitutes for analysis of

Celsius’ results as reported under GAAP. Celsius strongly

encourages investors to review its financial statements and

publicly filed reports in their entirety and not to rely on any

single financial measure.

Because non-GAAP financial measures are not standardized,

Adjusted EBITDA, Adjusted EBITDA Margin, and Adjusted diluted

earnings per share as defined by Celsius, may not be comparable to

similarly titled measures reported by other companies. It therefore

may not be possible to compare Celsius’ use of these non-GAAP

financial measures with those used by other companies.

Preliminary Estimated Unaudited Financial Information

This press release certain preliminary estimated unaudited

financial information for Alani Nu for the year ended December 31,

2024. This information is preliminary in nature based only upon

information available at this time. Final results for Alani Nu

remain subject to the completion of its closing procedures, final

adjustments and developments that may arise between now and the

time the financial results are finalized. You must exercise caution

in relying on this information and should not draw any inferences

from this information regarding financial or operating data not

provided. We cannot assure you that these preliminary estimated

results will not differ materially from the information reflected

in Alani Nu’s final financial statements for the year ended

December 31, 2024. These preliminary estimates should not be viewed

as substitutes for Alani Nu’s audited consolidated financial

statements prepared in accordance with GAAP. In addition, they are

not necessarily indicative of the results to be achieved in any

future period.

Pro-Forma Financial Information The following table

presents summary historical and unaudited pro forma condensed

consolidated financial data for Celsius and Alani Nu, which are

based on (i) Celsius’ unaudited financial statements for the year

ended December 31, 2024, and (ii) Alani Nu’s preliminary estimated

unaudited financial statements for the year ended December 31,

2024.

This pro forma financial information reflects Celsius’ pending

acquisition of Alani Nu as if the transaction (the “Transaction”)

had occurred on January 1, 2024. This pro forma financial

information does not reflect the completion of the Transaction or

Celsius’ capital structure following the completion of the

Transaction and are not indicative of results that would have been

reported had the Transaction occurred as of January 1, 2024. This

information is only a summary and should be read in conjunction

with the information included in the section entitled

“Forward-Looking Statements” and Celsius historical financial

information included in its earnings press release for the quarter

and year ended December 31, 2024, and in Celsius’ filings with the

Securities and Exchange Commission.

The summary historical and unaudited pro forma condensed

consolidated financial information that follows is presented for

informational purposes only and is not intended to represent or be

indicative of the consolidated results of operations or financial

position that would have been reported had the Transaction been

completed as of January 1, 2024, and should not be taken as

representative of Celsius’ future consolidated results of

operations or financial position had the Transaction occurred as of

such date. These estimates are based on financial information

available at the time of the preparation of this press release.

Based on the timing of the closing of the Transaction and other

factors, Celsius cannot assure you that the actual adjustments will

not differ materially from the pro forma adjustments reflected in

the summary unaudited pro forma combined financial information. It

is expected that, following the consummation of the Transaction, we

will incur non-recurring expenses associated with the Transaction

and integration of the operations of Alani Nu. These expenses and

integration costs are not reflected in this summary unaudited pro

forma condensed consolidated financial information.

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

Reconciliation of GAAP net

income to non-GAAP Adjusted EBITDA and Pro forma Adjusted

EBITDA

(In thousands)

(Unaudited)

Year Ended

Dec. 31, 2024

Year Ended

Dec. 31, 2024

Celsius

Alani

Estimated

Pro Forma

Net income (GAAP measure)

$

145,074

$

68,091

$

213,165

Add back /

(Deduct):

Net interest (income) expense

(39,263

)

4,867

(34,396

)

Provision for income taxes

49,976

1,659

51,635

Depreciation and amortization expense

7,274

5,559

12,833

Non-GAAP EBITDA

163,061

80,176

243,237

Stock-based compensation1

19,591

-

19,591

Foreign Exchange

1,734

-

1,734

Distributor termination2

-

2,911

2,911

Legal Settlements Costs3

54,005

2,960

56,966

Reorganization cost4

5,965

-

5,965

Acquisition Costs5

2,008

-

2,008

Penalties6

9,350

-

9,350

Other non-recurring costs

-

926

926

Non-GAAP Adjusted EBITDA

255,714

86,973

342,687

Pro Forma Net Synergies

50,000

50,000

Pro Forma Adjusted EBITDA

$

305,714

$

86,973

$

392,687

1 Selling, general and administrative expenses related to

employee non-cash stock-based compensation expense. Stock-based

compensation expense consists of non-cash charges for the estimated

fair value of unvested restricted share unit and stock option

awards granted to employees and directors. The Company believes

that the exclusion provides a more accurate comparison of operating

results and is useful to investors to understand the impact that

stock-based compensation expense has on its operating results. 2

Distributor termination represents reversals of accrued termination

payments. The unused funds designated for termination expense

payments to legacy distributors were reimbursed to Pepsi for the

quarter ended June 30, 2023. 3 2024 accrued expense for estimated

liability in connection with an ongoing litigation during the

quarter ended December 31, 2024. 2024 accrued expense for SEC

settlement during the quarter ended December 31, 2024. 2023 legal

class action settlement pertained to the McCallion vs Celsius

Holdings class action lawsuit, which the company settled during the

quarter ended June 30, 2023. 4 Reorganization costs represent

international re-alignment costs incurred during the quarter ended

December 31, 2024. 5 Acquisition costs include fees for

Professional services received during the fourth quarter ended

December 31, 2024, related to a business acquisition. 6 Accrued

expense in the quarter ended December 31, 2024, related to

contractual co-packer obligations.

Reconciliation of Non-GAAP

Valuation Metrics

(in thousands)

(unaudited)

12x fully

synergized 2024A adjusted EBITDA

2024 Actual

Alani

Adjusted EBITDA1

86,973

Pro Forma Net Synergies2

50,000

Total Adjusted EBITDA

136,973

Net purchase price3

1,650,000

Adjusted EBITDA Multiple

12.0x

Purchase Price

1,625,000

Earnout

25,000

Including earnout

1,650,000

NPV of Tax

150,000

Total Purchase price

1,800,000

<3x 2024A

Revenue

Alani

2024 Revenue1

594,907

Net purchase price3

1,650,000

Revenue Multiple

2.8x

Pro Forma net

leverage

Net debt4

384,810

2024 Adjusted EBITDA5

392,687

Pro-forma net leverage

1.0x

New Debt

900,000

Unrestricted Cash

890,190

Cash used for Transaction

375,000

Net Cash

515,190

Net Debt

384,810

1 Represents preliminary, unaudited 2024 Alani financials 2

Estimated run-rate cost synergies to be achieved over two-years

post close 3 Excludes ~$150 million net present value of tax

benefits 4 Total principal debt outstanding less unrestricted cash

5 Based on 2024A Adjusted EBITDA including estimated run-rate

synergies

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220357704/en/

Paul Wiseman Investors: investorrelations@celsius.com Press:

press@celsius.com

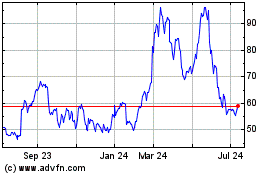

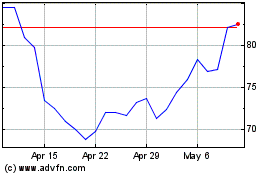

Celsius (NASDAQ:CELH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Celsius (NASDAQ:CELH)

Historical Stock Chart

From Feb 2024 to Feb 2025