Is Bitcoin Ready To Break Through $70,000? Analyzing The Next Steps For The Crypto Leader

October 28 2024 - 10:33PM

NEWSBTC

As the US presidential election draws near, Bitcoin has briefly

surged to the $70,000 mark for the first time in over five months.

This milestone coincides with former President Donald Trump leading

in polls against Vice President Kamala Harris, setting the stage

for potential shifts in the cryptocurrency landscape depending on

the election outcome. $70,000 As Key Level For Bitcoin To Surpass

March Record The recent uptick in Bitcoin’s price has been

bolstered by a rally in the stock market, with analysts noting that

investors are increasingly pricing in a potential Trump

victory. Tony Sycamore, a market analyst at IG Australia Pty,

indicated that Bitcoin needs to maintain a solid break past $70,000

to build confidence in surpassing its previous record of $73,798

set in March. Trump has positioned himself as a pro-crypto

candidate, pledging to make the US the cryptocurrency capital of

the world. In contrast, Harris has taken a more cautious stance,

advocating for a regulatory framework for the industry.

Amidst the political backdrop, options traders have ramped up their

bets, with many speculating that Bitcoin could reach $80,000 by the

end of November, irrespective of who wins the election.

Related Reading: Are ‘ETF Paper Bitcoins’ Suppressing BTC Prices?

Analyst Provides Answers Implied volatility around Election Day on

November 5 has also risen, reflecting the uncertainty in the

market. Notably, spot Bitcoin ETFs in the US have seen

approximately $3.1 billion in net inflows this month, further

contributing to the positive sentiment surrounding

cryptocurrencies. Regulatory Concerns Surround Harris’s Stance On

Crypto Crypto analyst VirtualBacon recently highlighted the

significance of the upcoming election for the cryptocurrency

market, dubbing it the “Crypto Election.” Prediction markets

currently favor Trump at 60%, although these figures may be skewed

due to the crypto community’s historical support for him. National

polls indicate a tighter race, with Harris holding a slight lead of

just over 1%. The crypto industry has contributed

approximately $119 million to campaigns this election year,

representing nearly half of all corporate donations. However,

major players like Coinbase and Ripple are strategically donating

across party lines to promote supportive legislation rather than

backing a single candidate. While both Trump and Harris have

publicly expressed favorable views on cryptocurrency, their

commitments to concrete legislative action remain uncertain.

Harris’s regulatory approach raises concerns, as her campaign has

emphasized protecting minority investors in digital assets without

providing specifics. Moreover, her tenure as Vice President

coincided with the appointments of prominent crypto critics such as

the US Securities and Exchange Commission (SEC) chair Gary Gensler,

and US Treasury Secretary Janet Yellen. On the other hand, Trump’s

evolving views towards cryptocurrency, including the launch of a

successful NFT project and a DeFi platform, suggest a warming to

the industry. As the election approaches, VirtualBacon

suggests that it’s crucial to consider that economic data released

post-election will significantly influence market sentiment.

The upcoming Federal Open Market Committee (FOMC) meeting in

November could provide critical insights into inflation and

liquidity, impacting both the broader market and the trajectory of

cryptocurrencies. BTC’s Path To $100,000 Despite the speculation

surrounding the impact of the presidential election, which is just

7 days away, another analyst, Ali Martinez, noted that over the

past eleven years, seven of them have seen massive gains for the

market’s leading crypto. As can be seen in the chart provided by

Martinez, the average November gain for BTC is a massive 46%, which

if the market follows these late patterns, could see a November

price of just over $100,000 per coin. Related Reading: Cardano

Price Prediction: Analyst Says 80-90% Correction Is Over With 100%

Jump Imminent However, for BTC to confirm a breakout to retest its

all-time high, it will be key for it to consolidate above the

$70,000 mark in the coming days ahead of the election, positioning

it well for a dramatic breakout to even higher prices.

Featured image from DALL-E, chart from TradingView.com

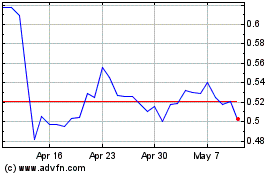

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Oct 2024 to Oct 2024

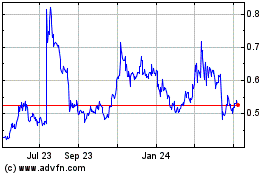

Ripple (COIN:XRPUSD)

Historical Stock Chart

From Oct 2023 to Oct 2024