Solana Eases Gains: Can SOL Bulls Safeguard the $132 Support?

July 04 2024 - 1:18AM

NEWSBTC

Solana started a fresh decline from the $155 resistance. SOL price

is down over 10%, but the bulls are now protecting the $132

support. SOL price started a strong decline from the $155

resistance against the US Dollar. The price is now trading below

$145 and the 100-hourly simple moving average. There was a break

below a connecting bullish trend line with support at $150 on the

hourly chart of the SOL/USD pair (data source from Kraken). The

pair could correct losses unless the bulls struggle to protect the

$132 support. Solana Price Dives 10% Solana price struggled to

continue higher above the $155 resistance. SOL reacted to the

downside and declined below the $150 support. There was a break

below a connecting bullish trend line with support at $150 on the

hourly chart of the SOL/USD pair. The pair gained bearish momentum

below the $145 support and declined more than outperformed Bitcoin

and Ethereum in the past two sessions. There was a drop toward the

$132 support zone. A low was formed at $132.17 and the price is now

attempting a recovery wave. There was a move above the $135 level.

The price is now approaching the 23.6% Fib retracement level of the

recent decline from the $154.74 swing high to the $132.17 low.

Solana is now trading well below the $145 level and the 100-hourly

simple moving average. If there is another increase, the price

might face resistance near the $138 level. The next major

resistance is near the $143.50 level and the 50% Fib retracement

level of the recent decline from the $154.74 swing high to the

$132.17 low. A successful close above the $143.50 resistance could

set the pace for another steady increase. The next key resistance

is near $150. Any more gains might send the price toward the $155

level. More Losses in SOL? If SOL fails to rise above the $143.50

resistance, it could start another decline. Initial support on the

downside is near the $135 level. The first major support is near

the $132 level, below which the price could test $125. If there is

a close below the $125 support, the price could decline toward the

$112 support in the near term. Technical Indicators Hourly MACD –

The MACD for SOL/USD is gaining pace in the bearish zone. Hourly

Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below

the 50 level. Major Support Levels – $135, and $132. Major

Resistance Levels – $143.50 and $150.

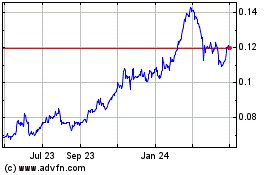

TRON (COIN:TRXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

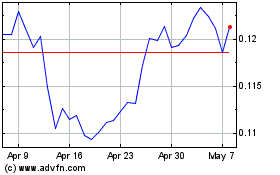

TRON (COIN:TRXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024