German Triggers Bitcoin Crash With Rapid Selling: Here’s How Much BTC They Have Left

July 09 2024 - 8:30AM

NEWSBTC

The price of Bitcoin has crashed again as the German government

continues its BTC selling spree. The government has already sold

millions of dollars worth of Bitcoin, putting immense pressure on

the pioneer cryptocurrency amidst broader market volatility.

German Government Initiates Massive BTC Sell-Off Bitcoin’s

consistent price decline has been driven by multiple factors

including outflows from Spot Bitcoin ETFs, unfavorable market

conditions and Mt Gox’s BTC redistribution plans. Lately, the

cryptocurrency’s price has been further pressured by the

substantial BTC sell-offs executed by the German government.

Related Reading: Dogecoin Vs. Shiba Inu Vs. PEPE: Comparing The

Profitability Of The Top Meme Coins For weeks, Germany has sold

thousands of Bitcoin worth hundreds of millions of dollars. On June

25, blockchain analytics platform Arkham Intelligence reported that

the government sold 900 BTC worth about $52 million. They moved 400

BTC to Coinbase and Kraken and transferred the rest to an

unidentified address. Additionally, last week the German

government executed another major Bitcoin sell-off, transferring a

whopping 3,000 BTC valued roughly at $172 million to exchanges. The

government moved 1,300 BTC to Kraken, Bitstamp, and Coinbase and

sold the rest to an unknown wallet address. The most recent

BTC transaction was on Monday, June 8, when the German police sold

an additional 2,738.7 BTC worth approximately $155.3

million. Arkham Intelligence revealed that the Bitcoin was

likely sold to crypto exchanges or market makers, including

Kraken, Cumberland, 139Po, and address bc1qu. As of writing,

the German government still holds a staggering amount of Bitcoin.

Arkham’s data has revealed that the government’s holdings amount to

26,053 BTC valued at approximately $1.49 billion. Despite the

BTC’s recent crash, the German government Bitcoin continues to sell

their BTC holdings at a rapid pace. Joanna Cotar, a member of the

German Bundestag, the National parliament of the Federal Republic

of Germany, has shown her displeasure with the government’s

decision to sell off their BTC holdings. Cotar disclosed that the

government should be strategically holding BTC and not selling them

off. She disclosed that their recent BTC sell-offs were

counterproductive and not sensible, urging the government to

utilize their BTC as a strategic reserve currency.

Bitcoin Price Update After Crash Over the past week, Bitcoin’s

price fell by a substantial 8.71% after crashing by 17.10% in the

past month. This decline has been attributed to unabating selling

pressures and recent bearish trends in the crypto market.

Related Reading: XRP Price: Crypto Analyst Identifies ‘Point Of

Control’ That Could See A Repeat Of 2017 Since the beginning of

June, Bitcoin’s price movements have been displaying weakness and

underperforming significantly. Despite inflows into Spot Bitcoin

ETFs, Bitcoin had remained volatile under the $60,000 price mark,

showing minor upward momentum. Including the German

government’s BTC sell-offs, crypto analyst, Ali Martinez has also

revealed in an X post that Bitcoin whales have sold over 30,000 BTC

worth approximately $1.8 billion in the past month. This 30,000 BTC

sell-off which surpasses the German government’s current Bitcoin

holdings has contributed significantly to Bitcoin’s decline to its

present price of $57,039, according to CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com

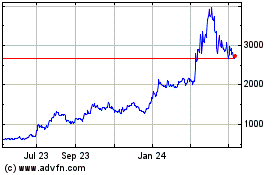

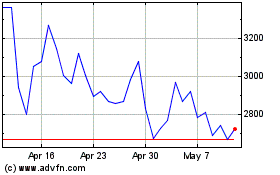

Maker (COIN:MKRUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Maker (COIN:MKRUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024