Floki Inu Warning: Analyst Says ‘Prepare For The Crash’ – Details

October 28 2024 - 2:00AM

NEWSBTC

Floki Inu (FLOKI) is having a hard time because of bearish patterns

in the market, which is making buyers nervous. Some predictions say

the price could go up by 220%, hitting $0.00044 by November 26,

2024. However, new research shows that the short-term technical

signs point in a different direction. Related Reading:

MicroStrategy Stock Hits All-Time High As Bitcoin Blazes Past

$67,000 Crypto analyst Alan Santana has pointed out that the

token’s current sideways movement may signal further declines.

Since reaching a high in March 2024, FLOKI has been trapped in a

bearish trend, unable to regain its previous momentum. After a

brief rally in June, the price has stagnated, reflecting a shift in

market sentiment. According to Santana, traders should “prepare for

the crash”, given the current negative market dynamics in play,

based on his examination of the memecoin’s price movement.

#Altcoins | #FLOKI ✴️ Floki Inu Major Drop Now Imminent: Prepare

For The Crash! I remember we traded Floki Inu successfully on the

bullish side, it was a nice ride, do you remember? Market

conditions have changed. Notice the huge green candles in February

2024, these are about… pic.twitter.com/5OrScWHNeb — Alan Santana

(@lamatrades1111) October 27, 2024 Analyzing The Current Dynamics

The current technical indicators show a disturbing trend for Floki

Inu. It seems the token is experiencing a long consolidation phase,

which can be termed as a “distribution phase,” and the sellers are

in charge. The heavy trading volumes during its earlier bullish

moves, particularly in February and March, have shifted to heavy

selling in recent weeks. As of now, FLOKI trades at $0.0001315,

down 1.20% over the past day, and many are watching key support

levels closely. Two really important support zones have developed.

Should the bearish trend persist, analysts estimate FLOKI would

retest the initial support level at $0.00009557. Should that break,

the token may drop to a possible lowest value of $0.00004200. For

those clinging to their tokens, this situation begs questions about

whether it is time to change their stance. Fibonacci Levels Suggest

Weakness Another technical indicator that is negative in its

sentiment is the Fibonacci retracing levels. Most importantly, for

FLOKI to dominate the market, it has been consistently rejected at

the 0.618 and 0.786 levels. The persistent rejection of the price

here indicates that the positive feeling is being crushed. Price

action shows that FLOKI will go below its current trading range,

which piles on more pressure on the holders as well. Caution For

Investors In view of these contradictory messages, investors should

still be extremely cautious. Since the immediate future seems hard,

many predictions indicate there’s going to be an uptrend, and

investors can hit a price that might reach $0.00044 at the end of

November. However, many traders remain skeptical given the current

sentiment. Related Reading: Whales Hit All-Time High Bitcoin

Holdings At 670,000 – What Does This Mean For BTC? The Fear &

Greed Index reads at 69, marking a greed level in the market. It is

basically what leads to downturns. For the last month, FLOKI had

its green days at 43%, volatility rate at 7.48%. Prior to making

any decisions, it could be prudent for individuals wishing to enter

the market to wait for more distinct indications of positive mood.

When it comes to cryptocurrency, timing can be crucial. Featured

image from Pexels, chart from TradingView

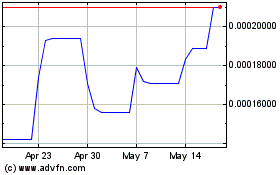

FLOKI (COIN:FLOKIUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

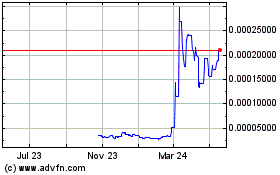

FLOKI (COIN:FLOKIUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024