TIDMPMG

RNS Number : 6638T

Parkmead Group (The) PLC

26 November 2021

26 November 2021

The Parkmead Group plc

("Parkmead", "the Company" or "the Group")

Preliminary Results for the year ended 30 June 2021

Parkmead, the UK and Netherlands focused independent energy

group, is pleased to report its preliminary results for the year

ended 30 June 2021.

HIGHLIGHTS

Revenue momentum from increased gas prices; strong financial

position

-- Revenue for the period was GBP3.6 million (2020: GBP4.1

million), with a 33% increase in the second half compared to the

first half reflecting the strong recovery in gas prices from the

COVID-19 pandemic lows

-- Gross profit increased by 39% to GBP1.8 million (2020: GBP1.3

million), showing the robustness of Parkmead's gas assets and

continued improving efficiency

-- Gross margin increased from 31% to 49%

-- Well capitalised, with cash balances of GBP23.4 million

(US$31.6 million) as at 30 June 2021

-- Parkmead has seen the benefit of the strong climb in energy

prices and are 100% unhedged. From lows of around EUR5.0/MWh in

July 2020 prices have rebounded strongly, with Dutch TTF prices

reaching around EUR75.0/MWh in November 2021

-- Excellent revenue generation since period end, EUR3.0 million

of revenue generated in the first four months of FY 2022, 355%

higher than the equivalent four months last year

-- Parkmead's Netherlands assets remain very low cost to

operate, and were uninterrupted by lockdown restrictions introduced

by the Dutch Government

-- Non-cash impairment charge recorded of GBP10.9 million

relating primarily to relinquishment of the Platypus licence at the

pre-development stage

-- Parkmead maintains strict financial discipline with very low operating costs

Acquisition of Netherlands gas royalty and potential drilling

campaign in 2022

-- Acquisition of Netherlands gas royalty completed in July 2021

for a consideration of EUR565k, satisfied through a part cash

payment and part of the remaining 2021 net revenue from the

Geesbrug gas field

-- The revenue associated with this royalty for just the year to

30 June 2020 was EUR325k, delivering a relatively short payback

-- Through this acquisition, Parkmead's effective financial

interest doubled from 7.5% to 15% in the Grolloo, Geesbrug and

Brakel gas fields

-- Gross production at the Group's Netherlands assets for the

financial year averaged 30.3 million cubic feet per day ("MMscfd"),

which equates to approximately 5,212 barrels of oil equivalent per

day ("boepd")

-- Low-cost onshore gas portfolio in the Netherlands produces

from four separate gas fields with an average field operating cost

of just US$9.9 per barrel of oil equivalent, generating strong cash

flows

-- Average netback per barrel of oil equivalent for the last two

months from the Netherlands (September and October 2021) of

EUR48.3

-- Partnership analysing a potential two-well drilling campaign

next year from the Diever site, targeting LDS-A and LDS-B

-- Drilling would target 22.7 Bcf of gross gas resources, on a

P50 basis, in the prolific Rotliegendes reservoirs found on the

licence (CoS of between 40 and 49%)

-- Papekop gas development has successfully progressed through

the concept select gate; planned gas development targeting 35.6 Bcf

of gross reserves with oil upside

Renewables Growth Strategy

-- Two successful sales of separate areas of non-core land from

UK renewable energy portfolio achieved an aggregate cash

consideration of GBP4.0 million, representing a substantial 82% of

the original Pitreadie net consideration

-- Sites with the largest renewable energy potential have been retained and high-graded

-- Technical studies are already underway on a specific location

within the Group's onshore land portfolio for the potential

development of a large wind farm

-- This area of land lies adjacent to the Mid Hill Wind Farm

which encompasses 33 Siemens wind turbines with a generating

capacity of around 75 megawatts

-- Other renewable opportunities exist across the Group's asset portfolio

-- Considering further acquisition opportunities to expand the Group's renewables portfolio

UK North Sea licence refocus

-- New project secured through successful award of Fynn licence

in the Central North Sea (Parkmead 50% and operator), containing

two undeveloped discoveries and a prospect in the Piper

Formation

-- Fynn Beauly is a very large oil discovery extending across

multiple blocks and is estimated to contain oil-in-place of between

602 and 1,343 million barrels, with our licence containing a

section of the discovery to the south holding oil-in-place of

between 77 and 202 million barrels

-- Fynn Andrew is wholly contained on the licence and holds 50

million barrels of oil-in-place on a P50 basis

-- Addition of these blocks adds 34.4 million barrels of 2C resources to Parkmead

-- Extension to the Skerryvore licence has been successfully

awarded to Parkmead (as operator) and joint venture partners

-- Completed reprocessing of Skerryvore 3D seismic, allowing

final rock physics and inversion scopes to begin

-- Multiple exploration and development activities centred

around Skerryvore prospect in 2021/22

-- Skerryvore's main prospects are three stacked targets, at Mey

and Chalk level, which together could contain 157 million barrels

of oil equivalent ("MMBoe")

-- Relinquishment of Playtpus licence by Parkmead and the

remaining joint venture partner following the very late withdrawal

of the majority partner and operator

-- Parkmead continues to assess draft commercial offers received

for the potential tie-back of the Greater Perth Area ("GPA")

project, which has the potential to deliver 75-130 MMBoe on a P50

basis

-- For the Perth field development alone, every $10/bbl increase

in the oil price adds approximately GBP130 million to the P50

post-tax NPV of the project

Substantial gas and oil reserves and resources

-- 2P reserves of 45.5 million barrels of oil equivalent

("MMBoe") as at 30 September 2021 (45.7 MMBoe as at 30 September

2020)

Evaluating further acquisitions and opportunities

-- Nine acquisitions, at both asset and corporate level, have been completed to date

-- Parkmead actively evaluating further acquisition

opportunities in renewables, gas and oil in line with its strategy

to build a balanced portfolio of assets

Parkmead's Executive Chairman, Tom Cross, commented:

"I am pleased to report an important year of progress for

Parkmead, despite the year being significantly disrupted by the

COVID-19 pandemic. The substantial rise in gas prices post year end

is also creating strong momentum for the Group. We intend to

capitalise on this by further balancing the Group's operations to

include other energies.

The innovative royalty deal we completed in July enhances our

gas interests in the Netherlands and adds significant value to

Parkmead. This growth step adds to our portfolio of high-quality

energy projects delivered through acquisitions, organic growth and

active asset management.

The successful divestment of non-core land areas is a testament

to the team's ability to ensure value is generated from its assets.

Parkmead has already identified a number of possible locations for

renewable energy opportunities within the Group's high-graded

onshore acreage.

Our team is carefully evaluating further potential gas, oil and

renewable energy acquisitions that would complement our existing

business.

Parkmead is well positioned for the future. We have excellent UK

and Netherlands regional expertise, strong financial discipline,

and a growing portfolio of high-quality assets. The Group will

continue to build upon the inherent value in its existing interests

with a balanced, acquisition-led, growth strategy to secure

opportunities that maximise future value for our shareholders."

For enquiries please contact:

The Parkmead Group plc +44 (0) 1224 622200

Tom Cross (Executive Chairman)

Ryan Stroulger (Chief Financial Officer)

finnCap Ltd (NOMAD and Broker to Parkmead) +44 (0) 20 7220 0500

Marc Milmo / Seamus Fricker - Corporate

Finance

Andrew Burdis / Barney Hayward - ECM

CHAIRMAN'S STATEMENT

2021 has been an important year for Parkmead as we recover from

the COVID-19 pandemic. Parkmead's experienced and resourceful team

ensured that the Group was able to quickly transition to remote

working to cope with the COVID-19 restrictions, where necessary,

and demonstrated commitment and innovation to developing new work

programmes to support the future growth of the business. This,

combined with a carefully managed business strategy, ensured that

the Group was resilient during the historical lows in commodity

prices and difficult market conditions during the year. The Group's

gas production also remained uninterrupted throughout national and

local COVID-19 restrictions providing a strong position that meant

we were able to capitalise on these conditions to make a producing

gas acquisition.

We also continued to make a number of important steps in

progressing our strategy to balance the Group's operations through

initiating new work programmes, refining development plans and

lowering our operational costs. Parkmead is now a more resilient

company with a very positive outlook for the years ahead.

Financial Performance

The Group's revenue for the year to 30 June 2021 was GBP3.6m

(2020: GBP4.1m), generating a 39% increase in gross profit to

GBP1.8m (2020: GBP1.3m). The gross margin improved from 31% to 49%

showing the high-quality nature of Parkmead's onshore production in

the Netherlands, especially given the economic environment during

the period.

The reduced revenue in the year reflected the substantially

lower commodity prices during 2020 resulting from the pandemic.

Since the lows experienced in the last financial year, we have seen

a very encouraging recovery in prices, particularly in Dutch gas.

Revenue in the second half of the year increased by 33% compared to

the first half as a result of this price recovery. This strength in

gas prices has continued since the financial year end, with prices

more than tripling during the period from June 2021 to October

2021.

As a result, Parkmead has recorded EUR3 million of revenue

during the first four months of the current financial year alone,

355% higher than the equivalent four months last year. Parkmead

continues to remain unhedged for 100% of our gas production, thus

giving exposure to these higher Dutch gas prices for the remainder

of the year.

Parkmead maintains a strong balance sheet with total assets of

GBP78.7m (2020: GBP89.8m) as at 30 June 2021. Cash and cash

equivalents at year-end were GBP23.4m (2020: GBP25.7m) and interest

bearing loans receivable were GBP2.9m (2020: GBP2.9m). The Group's

net asset value was GBP57.7m (2020: GBP71.3m). We reduced debt

within the Group by 86% to GBP0.5m on a pre-IFRS 16 basis at 30

June 2021 (2020: GBP3.6m). This prudent approach is an important

part of our financial discipline.

Exploration and evaluation expenses were GBP11.1m (2020:

GBP1.6m), which includes a non-cash impairment of GBP10.9 million

related to the relinquishment of Licences P.2296, P.2362 and P.1242

(Platypus) in the UK North Sea. Administrative expenses were

GBP3.0m (2020: GBP0.3m). Underlying staff costs stayed almost flat

at GBP2.0 million (2020: GBP1.9m).

In June 2021, Parkmead completed an extensive tendering process

with the view of appointing a new auditor following the ten year

tenure from Nexia Smith & Williamson. We are pleased to

announce that Jeffreys Henry assumed the role of auditor in August

2021. Parkmead would like to express our sincere thanks to Nexia

Smith & Williamson for their work.

Netherlands

Our Netherlands production remained some of the most efficient

and profitable, on a per-barrel basis, across Europe in 2021.

Production across the fields remained uninterrupted throughout

national and local COVID-19 lockdowns.

Gas production across the four fields has remained strong, with

average gross production of 30.3MMscfd, approximately 5,212boepd.

The operating cost of the combined fields is very low at just $9.9

per barrel of oil equivalent. These high-quality assets, combined

with efficient operational cost control underpins the strong gross

profit margin and allows us to invest in further opportunities.

Parkmead's onshore gas production continues to form a key part of

the Group and an important role in our transition to a lower-carbon

environment.

On our Drenthe VI licence, the Diever gas field remains in the

top three most prolific producing onshore fields in the

Netherlands. Parkmead and our JV partners are also pleased to be

making material progress on the Leemdijk and De Bree prospects

(renamed LDS-A and LDS-B respectively), also on the Drenthe VI

licence. A two-well drilling campaign from the Diever well site,

targeting both structures, is scheduled for late 2022/early 2023,

and if successful, offers a fast-track tie-in opportunity.

Our Drenthe V licence includes the Geesbrug gas field, which

continues to see steady production at material rates. During the

reporting period, seismic reprocessing has been ongoing to identify

infill opportunities on this licence.

Finally, we are pleased to report that our Papekop development

has successfully progressed through the concept select gate and we

will now carry out some further engineering studies and continue

the permitting process.

Gas Royalty Acquisition

In July 2021 Parkmead completed the acquisition of a historic

royalty associated with the Group's existing interests in the

Drenthe IV, Drenthe V and Andel Va licenses in the Netherlands from

Vermilion Energy. These licences contain the Grolloo, Geesbrug and

Brakel onshore gas fields, respectively.

This royalty was previously held by NAM, a Shell and ExxonMobil

joint venture. The consideration for this acquisition was EUR565k,

satisfied through a part cash payment of approximately EUR150k and

the remaining 2021 net revenue from Parkmead's working interest in

the Geesbrug gas field. The acquisition removed the royalty

associated with the existing producing gas wells. The revenue

associated with this royalty for the year to 30 June 2020 was

EUR325k, meaning a relatively short payback.

Through this important acquisition, Parkmead has increased its

net gas production from these wells, doubling the Group's effective

financial interest from 7.5% to 15% (in line with Parkmead's

working interest in the licences). This step added significant core

value to Parkmead and will extend the producing life of these

fields through greater partner alignment.

UK Licence Refocus

The Company has now finalised the award of Licence P.2516

(Parkmead 50% and operator) containing two undeveloped oil

discoveries, Fynn Beauly and Fynn Andrew, as well as an oil

prospect in the Piper Formation. The licence covers Blocks 14/20g

& 15/16g situated in the Central North Sea and is adjacent to

Parkmead's GPA project.

Fynn Beauly is a very large oil discovery which extends across a

number of blocks. The entire discovery is estimated to contain

oil-in-place of between 602 and 1,343 million barrels, with Licence

P.2516 containing a section of the discovery to the south holding

oil-in-place of between 77 and 202 million barrels.

Fynn Andrew is wholly contained on the licence and holds 50

million barrels of oil-in-place on a P50 basis. The addition of

these blocks to Parkmead's portfolio adds 34.4 million barrels of

2C resources to the Group. Parkmead's partner on the licence is

Orcadian Energy.

An extension to the Skerryvore licence, P.2400, has been

successfully awarded to Parkmead and its joint venture partners.

The joint venture has made significant progress over the last year

having completed reprocessing of the 3D seismic, allowing final

rock physics and inversion scopes to begin. Follow-on technical

studies are planned before the end of the year, ahead of a drilling

decision 2022.

The acreage around Skerryvore is currently seeing activity on

several fronts, with Harbour Energy drilling the adjacent Talbot

opportunity and Shell looking to drill the Edinburgh prospect.

Development activity is also taking place in close proximity to

Skerryvore at Tommeliten A (ConocoPhillips) and Affleck (NEO

Energy).

Skerryvore's main prospects are three stacked targets, at Mey

and Chalk level, which together could contain 157 million barrels

of oil equivalent ("MMBoe"). Parkmead operates the Skerryvore

licence with a 30% working interest. Joint venture partners in the

licence are Serica Energy (20%), CalEnergy Resources (20%) and

Zennor Petroleum (30%).

Following the unexpected, late withdrawal of Dana Petroleum from

the Platypus licence, Parkmead agreed in principle to become the

temporary acting operator and entered into commercial discussions

with the Platypus supply chain to formulate a revised commercial

project that could be put to the regulatory authorities to seek

extension of the licence. A considered and improved commercial plan

was put to the regulator well ahead of the formal end of the

licence, however, despite intensive and prolonged discussions it

was not possible to arrive at suitable terms for an extension and,

although a new licence could be sought in due course, it was

ultimately decided by the partners not to pursue the matter further

at this time. So Parkmead has prudently recognised a full

impairment charge. The Board of Parkmead is now able to re-focus

the Group's time and resources, that it would otherwise have spent

on Platypus on projects, where we can see a clear pathway to

delivering enhanced shareholder value.

Elsewhere in the UK, we have secured an extension to the Initial

Term A of West of Shetland licence P.2406, which contains the large

Davaar Paleocene prospect. We have begun interpretation of the

newly reprocessed seismic data ahead of further work next year.

The Greater Perth Area (GPA) development continues to form a

part of our balanced portfolio of assets. This year has seen the

completion of transportation studies for our base case development

concept. The studies have confirmed there are no technical hurdles

associated with the transportation and processing of fluids from

the Perth producing wells all the way through the infrastructure to

the onshore facilities. Parkmead continues to engage with leading,

internationally-renowned supply chain companies in order to

optimise the commercial solution.

Parkmead continues to assess draft commercial offers received

from the Scott field partnership for the potential tie-back of the

GPA project. Scott lies just 10km southeast of the GPA project and

a tie-back could yield a number of mutually beneficial advantages

for both the Scott partnership and Parkmead. A tie-back to Scott is

just one path to potentially unlock the substantial value of the

GPA project. The GPA project has the potential to deliver 75-130

MMBoe on a P50 basis. For the Perth field development alone, every

$10/bbl increase in the oil price adds approximately GBP130 million

to the P50 post-tax NPV of the project.

We believe that projects like GPA play an important role in

underpinning the supply of energy that the UK requires in its

transition to net zero. As a fuel that is primarily used for

transportation, manufacturing and petrochemicals, oil will continue

to feature as a vital commodity in the UK and it is very important

that the UK continues to develop its projects in order to reduce

reliance on less-regulated, more carbon-intensive imports.

Parkmead believes that production of hydrocarbons from GPA can

be done in a sustainable fashion in alignment with the UK

government's most recent targets on carbon emissions.

Onshore Renewables

In March 2021, Parkmead completed the successful sales of two

separate areas of non-core land from its UK renewable energy

portfolio for an aggregate consideration of GBP4.0 million. This

divestment follows detailed analysis carried out across the Group's

onshore land acreage. Sites with the largest renewable energy

potential have been retained and high-graded, with a strategy to

divest non-core land. These sales are in line with that

strategy.

A number of renewable energy opportunities exist within our

onshore portfolio and we continue to advance these through

Parkmead's in-house technical and commercial expertise, alongside

regional experts. Significant wind energy potential lies at a

location within our portfolio some 15 miles west of Aberdeen. The

acreage has excellent average wind speeds and lies adjacent to the

Mid Hill Wind Farm which contains 33 Siemens wind turbines with a

generating capacity of around 75 megawatts (MW). Technical studies

are already underway at this site.

Outlook

Our focus at Parkmead is to continue building a robust and

balanced European energy business with both organic and inorganic

growth opportunities. We have an excellent and determined team of

energy experts who view the rapidly-changing energy landscape as an

opportunity, not as a threat. Our team is looking at several new

opportunities in gas and renewable energy.

We maintain a very healthy appetite for transactions which could

provide incremental revenue, cash flow and long-term value for

shareholders.

Our proactive approach to investment in cleaner energies stands

us in excellent shape to continue building a balanced portfolio of

assets within the Company.

We continue to remain unhedged for 100% of our gas production,

thus giving exposure to the higher Dutch gas prices for the

remainder of the year.

We have started the 2022 financial year on a sound footing with

record high gas prices and work ongoing across a number of projects

which should pave the way for a successful year ahead.

Tom Cross

Executive Chairman

25 November 2021

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

Notes:

1. Tim Coxe, Parkmead Group's Managing Director, North Sea,

holds a First-Class Master's Degree in Engineering and over 30

years of experience in the oil and gas industry. Tim is accountable

for the company's HSE, Subsurface, Drilling, Production Operations

and Development Project functions and has approved the technical

information contained in this announcement. Reserves and contingent

resource estimates have been produced by Parkmead's subsurface team

and are stated as of 30 September 2021. Parkmead's evaluation of

reserves and resources was prepared in accordance with the 2007

Petroleum Resources Management System prepared by the Oil and Gas

Reserves Committee of the Society of Petroleum Engineers and

reviewed and jointly sponsored by the World Petroleum Council, the

American Association of Petroleum Geologists and the Society of

Petroleum Evaluation Engineers.

Group statement of profit or loss

for the year ended 30 June 2021

Jun-21 Jun-20

Continuing operations Notes GBP'000 GBP'000

Revenue 3,608 4,080

Cost of sales (1,835) (2,806)

Gross profit 1,773 1,274

Exploration and evaluation expenses 4 (11,116) (1,556)

Gain on bargain purchase - 362

Loss on sale of assets (388) -

Administrative expenses 2 (3,040) (257)

------------------------------------------------ ------ ------------- --------

Operating loss (12,771) (177)

Finance income 148 199

Finance costs (819) (814)

Loss before taxation (13,442) (792)

Taxation (364) 310

------------------------------------------------ ------ ------------- --------

Loss for the period attributable to the equity

holders of the Parent (13,806) (482)

------------------------------------------------ ------ ------------- --------

(Loss) / earnings per share (pence)

Basic 3 (12.64) (0.45)

Diluted 3 (12.64) (0.45)

Adjusted EBITDA (958) 1,574

Depreciation (611) (764)

Amortisation and exploration write-off (10,855) (1,298)

Loss on sale of property, plant and equipment (388) -

Gain on bargain purchase - 362

Provision for share based payments 41 (51)

Operating Loss (12,771) (177)

Group statement of profit or loss and other comprehensive

income

for the year ended 30 June 2021

2021 2020

GBP'000 GBP'000

------------------------------------- --------- --------

(Loss) / profit for the year (13,806) (482)

-------------------------------------- --------- --------

Other comprehensive income

Income tax relating to components

of other comprehensive income - -

------------------------------------- --------- --------

Other comprehensive income

for the year, net of tax - -

------------------------------------- --------- --------

Total comprehensive (loss)

/ income for the year attributable

to the equity holders of

the Parent (13,806) (482)

-------------------------------------- --------- --------

Group statement of financial position

as at 30 June 2021

2021 2020

GBP'000 GBP'000

Non-current assets

Property, plant and equipment: development

& production 14,646 11,979

Property, plant and equipment: other 4,654 9,411

Goodwill 2,174 2,174

Exploration and evaluation assets 29,497 36,089

Investment in subsidiaries and joint - -

ventures

Interest bearing loans 2,900 2,900

Deferred tax assets - 3

--------------------------------------------- ------ --------- -----------

Total non-current assets 53,871 62,556

--------------------------------------------- ------ --------- -----------

Current assets

Trade and other receivables 1,352 1,414

Inventory 66 131

Cash and cash equivalents 23,378 25,708

Total current assets 24,796 27,253

--------------------------------------------- ------ --------- -----------

Total assets 78,667 89,809

--------------------------------------------- ------ --------- -----------

Current liabilities

Trade and other payables (3,490) (4,437)

Current tax liabilities (241) -

-------------------------------------------- ------- --------- -----------

Total current liabilities (3,731) (4,437)

--------------------------------------------- ------ --------- -----------

Non-current liabilities

Trade and other payables (1,011) (1,372)

Loans (500) (3,600)

Deferred tax liabilities (1,339) (1,404)

Decommissioning provisions (14,365) (7,650)

--------------------------------------------- ------ --------- -----------

Total non-current liabilities (17,215) (14,026)

--------------------------------------------- ------ --------- -----------

Total liabilities (20,946) (18,463)

--------------------------------------------- ------ --------- -----------

Net assets 57,721 71,346

--------------------------------------------- ------ --------- ---------

Equity attributable to equity holders

Called up share capital 19,688 19,678

Share premium 88,017 87,805

Merger reserve 3,376 3,376

Retained deficit (53,360) (39,513)

--------------------------------------------- ------------- ---------

Total Equity 57,721 71,346

--------------------------------------------- ----------------- ---------

Group statement of changes in equity

for the year ended 30 June 2021

Share Share Merger Retained Total

capital premium reserve deficit

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ------------- --------- --------- ----------- -----------

At 30 June 2019 19,533 87,805 - (39,082) 68,256

------------------------------ ------------- --------- --------- ----------- -----------

Loss for the year - - - (482) (482)

Total comprehensive loss for

the year - - - (482) (482)

Share capital issued 145 - 3,376 - 3,521

Share-based payments - - - 51 51

------------------------------ ------------- --------- --------- ----------- -----------

At 30 June 2020 19,678 87,805 3,376 (39,513) 71,346

------------------------------ ------------- --------- --------- ----------- -----------

Loss for the year - - - (13,806) (13,806)

Total comprehensive loss for

the year - - - (13,806) (13,806)

Share capital issued 10 212 - - 222

Share-based payments - - - (41) (41)

------------------------------ ------------- --------- --------- -----------

At 30 June 2021 19,688 88,017 3,376 (53,360) 57,721

------------------------------ ------------- --------- --------- ----------- -----------

Group statement of cashflows

for the year ended 30 June 2021

2021 2020

Notes GBP'000 GBP'000

---------------------------------- ------ -------------- ----------

Cashflows from operating

activities

Continuing activities 4 (1,191) 882

Taxation paid (124) (1,883)

---------------------------------- ------ -------------- ----------

Net cash (used in) /

generated by operating

activities (1,315) (1,001)

---------------------------------- ------ -------------- ----------

Cash flow from investing

activities

Interest received 148 163

Acquisition of exploration

and evaluation assets (369) (3,335)

Disposal of property, 4,000 -

plant and equipment

Acquisition of property,

plant and equipment:

development and production (165) (34)

Acquisition of property,

plant and equipment:

other (114) (416)

Decommissioning expenditure (31) -

Net cash from Pitreadie - 24

Net cash generated by

/ (used in) investing

activities 3,469 (3,598)

---------------------------------- ------ -------------- ----------

Cash flow from financing

activities

Interest paid (110) (113)

Lease payments (421) (410)

Repayment from loans (3,100) -

and borrowings

Net cash (used in) /

generated by financing

activities (3,631) (523)

---------------------------------- ------ -------------- ----------

Net (decrease) / increase

in cash and cash equivalents (1,477) (5,122)

---------------------------------- ------ -------------- ----------

Cash and cash equivalents

at beginning of year 25,708 30,666

Effect of foreign exchange rate

differences (853) 164

---------------------------------- ------ -------------- ----------

Cash and cash equivalents at

end of year 23,378 25,708

---------------------------------- ------ -------------- ----------

Notes to the financial information for the year ended 30 June

2021

1. Basis of preparation of the financial information

The financial information set out in this announcement does not

comprise the Group and Company's statutory accounts for the years

ended 30 June 2021 or 30 June 2020.

The financial information has been extracted from the audited

statutory accounts for the years ended 30 June 2021 and 30 June

2020. The auditors reported on those accounts; their reports were

unqualified and did not contain a statement under either Section

498 (2) or Section 498 (3) of the Companies Act 2006 and did not

include references to any matters to which the auditor drew

attention by way of emphasis.

The statutory accounts for the year ended 30 June 2020 have been

delivered to the Registrar of Companies. The

statutory accounts for the year ended 30 June 2021 will be

delivered to the Registrar of Companies following the

Company's Annual General Meeting.

The accounting policies are consistent with those applied in the

preparation of the interim results for the period ended 31 December

2020 and the statutory accounts for the year ended 30 June 2020,

and have been prepared in accordance with International Financial

Reporting Standards ("IFRS") as adopted by the United Kingdom.

2. Administrative expenses

Administrative expenses include a charge in respect of a

non-cash revaluation of share appreciation rights (SARs) and share

based payments totalling GBP56,000 (2020: GBP1,364,000 credit). The

SARs may be settled by cash and are therefore revalued with the

movement in share price. The valuation was impacted by the increase

in share price between 30 June 2020 and 30 June 2021.

3. Profit / (loss) per share

Profit/(loss) per share attributable to equity holders of the

Company arise from continuing and discontinued operations as

follows:

2021 2020

(Loss) / profit per 1.5p ordinary share

from continuing operations (pence)

Basic (12.64)p (0.45)p

Diluted (12.64)p (0.45)p

The calculations were based on the following information:

2021 2020

GBP'000 GBP'000

Loss attributable to ordinary shareholders

Continuing operations (13,806) (482)

--------------------------------------------- ------------ ------------

Total (13,806) (482)

--------------------------------------------- ------------ ------------

Weighted average number of shares in issue

Basic weighted average number of shares 109,188,561 106,282,006

--------------------------------------------- ------------ ------------

Dilutive potential ordinary shares

Share options - -

--------------------------------------------- ------------ ------------

Profit/(loss) per share is calculated by dividing the

profit/(loss) for the year by the weighted average number of

ordinary shares outstanding during the year.

Diluted profit/(loss) per share

Profit/(loss) per share requires presentation of diluted

profit/(loss) per share when a company could be called upon to

issue shares that would decrease net profit or net loss per share.

When the group makes a loss the outstanding share options are

therefore anti-dilutive and so are not included in dilutive

potential ordinary shares.

4. Notes to the statement of cashflows

Reconciliation of operating (loss) / profit to net cash flow

from continuing operations

2021 2020

GBP'000 GBP'000

Operating profit / (loss) (12,771) (177)

Depreciation 611 764

Amortisation and exploration write-off 10,855 1,298

Loss on sale of property, plant and equipment 388 -

Gain on bargain purchase - (362)

Provision for share based payments (41) 51

Currency translation adjustments 853 (164)

Decreases / (increase) in receivables 62 (683)

Decrease in stock 65 230

Increase/(decrease) in payables (1,213) (75)

(1,191) 882

----------------------------------------------- ------------ --------

5. Approval of this preliminary announcement

This announcement was approved by the Board of Directors on 25

November 2021.

6. Publication of annual report and accounts

Copies of the Annual Report and Accounts will be made available

shortly on the Company's website www.parkmeadgroup.com, along with

a copy of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR LELLLFFLBFBV

(END) Dow Jones Newswires

November 26, 2021 02:00 ET (07:00 GMT)

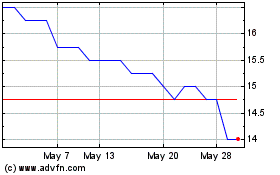

The Parkmead (AQSE:PMG.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

The Parkmead (AQSE:PMG.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024