Free

Writing Prospectus

VanEck Merk Gold ETF

2024-08-30 VanEck Merk Gold ETF (OUNZ) - Website

0001546652

Pursuant to 433/164

333-274643

lanEck Icik I.olr1 ETF STFTATEGIES - The VanEck Merk Gold ETF (the ' Trust" or 'OUNZ”) provides investors with a convenient and cost - efficient way to buy and hold gold through an exchange traded product with the option to take physical delivery of gold. Overview Delivery Fees INSIGHTS & PESEAFTCH ABOUT MEEK Taking Delivery Responsible Sourcing Documents

Overview Os'eis ieis helix ciiibility VanEck Merk Gold ETF holds gold bullion in the form of allocated Delivery Fees Taking Delivery London Bars. It differentiates itself by providing investors with the option to take physical delivery of gold bullion in exchange for their shares. f/‹iin ci‘tibility For the purpose of facilitating delivery, Merk has developed a proprietary process for the conversion of London Bars into gold coins and bars in denominations investors may desire. Taking delivery of gold is not a taxable event as investors merely take possession of what they already own: the gold. Responsible Sourcing l•’und In1oi'ination Market Price Shares Outstanding Gold in VanEck Merk Gold ETF ! 1 ’ Gold per Share ’ 1 ! Gold per 1,000 Shares ’ 1 ! Documents 524.34 43,887,292 423,809.924 oz 0.0 10 OZ 9.657 oz

Overview EXPENSE RATIO 0.25 0 /o Delivery Fees NET ASSETS 1,062.8mm Taking Delivery Responsible Sourcing GOLD PRICE 52 ,521.34 Vault audit February 02, 2024 Vault visit July 03 , 2024 Bid — Ask History NAV History Bar List NAV per Share Closing Sale Price Closing Mid Bid - Ask Price Premium/Discount to NAV Gold per Basket Indicative Gold per Basket Documents $24.216 1 $24.22 S24.215 - 0.0103 O A 482.839 oz 482.835 oz

Overview OUNZ Delivers Retirement Account Eligible Delivery Fees Taking Delivery Tax Efficiency With OUNZ, because you own a pro - rata share of the gold, taking delivery of gold is not taxable. You simply take delivery of what you already own. (“) Responsible Sourcing Gold in OUNZ shares 2000 FAQ Documents

Overview Delivery Proven record of delivering gold. Delivery Fees Delivery Application Cfirk to fifl - in the short Delivery Application. Taking Delivery Responsible Sourcing 20 Share Submission Once the investor's Delivery Application is approved, we give a window of up to 7 business days after the approval to submit the shares. fiustomer Service Our experienced team is here to help. CaM toll - free at (855) MRK — OUNZ or email. Allocated Gold Yes, OUNZ's physical gold is held in a segregated fashion in the name of the Trust. Each investor owns a pro - rata share of OUNZ. and as such holds pro - rata ownership of the Trust's gold. OUNZ's holdings are identified in a weight list of bars published at merkgotd.com showing the unique bar number, gross weight, the assay or fineness of each bar and its fine weight. Documents

Overview Internal C/ontrols OUNZ's intet na I controls are auJitccl each Delivery Fees Guiding Priiici;iles Taking Delivery Responsible Sourcing Re i›• rting Documents When we began the journey to find a better way to hold gold, we worked hard to research all of the known methods. As we were not satisfied with the existing ways to buy and hold gold, we decided to develop our own product. During the creation of our product we uncovered various challenges that arise when one bridges the retail and institutional gold market, including: • We learned that some banks that deal in gold are not even aware that they cannot offer allocated gold. • Some service providers we evaluated did not meet our standards when we performed our due diligence.

Overview Delivery Fees Taking Delivery Responsible Sourcing Documents We determined the best way to define our goals for this product was to develop “Guiding Principles”. Based upon the process created the U.S. patent office granted us U S patent #8 , 626 ,6 41. II lilies Lr In I 'z•LdiL car In Ir If LiLuLili etL /WLu i r ietr NV L, ir ikLuuir i/. • We wanted to design a product robust enough to allow Large numbers of investors to have their gold delivered should that need occur . However, we learned that many custodians, have little desire to open their vault on a frequent basis in order to allow investors to take delivery of their gold . • We held numerous discussions with firms that work only in the gold storage business, not the banking business. While it was enlightening to visit their vaults in the U.S. and abroad, we realized that we could not design an exchange traded product that sufficiently addressed our concerns.

Overview D eli very Fees Taking Delivery Responsib Ie Sourcing Documents Exchanging Physical Gold for Physical Gold of Different Specifications. To facilitate the ability to exchange shares into physical gold for delivery, we may exchange the Trust's gold for gold of different specifications. All gold obtained by the Trust must be without numismatic value and have a minimum fineness (or purity) of 995 parts per 1,000 (99.5%), except that the Trust may also obtain American Gold Eagle Coins (with a minimum fineness of 9 1.67%) solely for delivery to a Delivery Applicant. All gold held by the Trust is valued based upon its Fine Ounce content. While Delivery Applicants may always request London Bars, market conditions may cause us to limit other types of physical gold made available for delivery. To meet its primary objective to provide investors with an opportunity to invest in gold through the shares and to be able to take delivery of physical gold in exchange for their shares, we ("the Sponsor) have structured the Trust along the fotLowing principles: Holding London Bars. To allow investors to invest in gold through the shares, the Trust holds London Bars. When traded in institutional sizes, London Bars typically carry the lowest transaction cost compared to other forms of gold because there is no need to convert London Bars to gold of other specifications or involve a precious metals dealer before a Delivery Applicant takes delivery of London Bars. By contrast, taking delivery of forms of gold other than London Bars typically involves conversion costs (i.e., converting London Bars to physical gold of other specifications) and the assistance of a precious metals dealer. As such, the Trust holds primarily London Bars to facilitate a cost effective process to create and redeem Baskets. Charging an Exchange Fee. The Exchange Fee varies depending on the type of physical gold a Delivery Applicant would like to take delivery of and reflects costs arising from: reviewing Delivery Applications, coordinating with Delivery Applicants and the Trust's other service providers, the conversion of London Bars into physical gold to be delivered, and the related expenses of the Trustee and us.

Overview D eli very Fees Taking Delivery Maintaining Allocated Gold. The Trust wifi hold its London Bars in allocated form in the Trust Allocated Account with the Custodian. The Trust Allocated Account wifi be used to hold the individually identified bars of gold deposited with the Trust. The physical gold is held in a segregated fashion in the name of the Trust, not commingfed with other depositor funds or assets. The Trust has full title to the gold with the Custodian holding it on the Trust's behalf. Each investor owns a pro - rata share of the Trust, and as such holds pro - rata ownership of the Trust assets, corresponding to the number of shares held. Trust holdings are identified in a weight fist of bars published on the Trust's website showing the unique bar number, gross weight, the assay or fineness of each bar and its fine weight. Credits or debits to the holding will be effected by physical movements of bars to or from the Trust's physical holding. The Trust's gold holdings are subject to periodic audits. Taking Delivery of London Bars. Delivery Applicants requesting London Bars will need to submit shares that very closely correspond in Fine Ounces to the median Fine Ounce content of London Bars held by the Trust multiplied by the number of London Bars requested. London Bars are delivered directly from the Custodian. It may not be possible to exactly match the number of Responsib Ie Sourcing Documents Minimizing Cash Holdings. The Trust is committed to minimizing the use of cash, keeping essentially all assets of the Trust in gold. To achieve this, we have agreed to pay the Trust's ordinary expenses and to be reimbursed therefor through the issuance of shares to it rather than through receiving cash. The Trust will not normally hold cash, or any other assets besides gold, but may temporarily hold a very limited amount of cash in connection with deliveries of physical gold to Delivery Applicants. Permitting Investors to Take Delivery of Physical Gold. Delivery Applicants may submit shares to the Trust in exchange for physical gold. • Delivery Applicants may take delivery of as Little as a 1 Ounce Bar, subject to a minimum dollar value that is specified by us from time to time on the Trust's website. By requiring that the delivery of gold to Delivery Applicants meet certain minimum dollar value criteria, which may change from time to time, safes taxes are not anticipated to be applicable to the delivery of gold to Delivery Applicants. However, if such taxes do apply, they are the sole responsibility of the Delivery Applicant.

Overview D eli very Fees Taking Delivery shares submitted with the number of Fine Ounces represented by the requested physical gold, requiring the Trust to sell some gold to facilitate the delivery request . Minimizing the Use of Unaffocated Gold. The Trust will need unaLlocated gold to facilitate transactions with Authorized Participants to exchange gold into different specifications to meet delivery requests from Delivery Applicants of physical gold and to pay Trust expenses not assumed by us, if any. The Custodian only will accept a delivery of gold in exchange for a Basket if it can promptly convert the gold to allocated gold. The Custodian must allocate physical gold to the Trust such that, at the end of each business day, the Trust may hold no more than 430 Fine Ounces, corresponding to the maximum weight of a London Bar, in unaLlocated gold. To meet its secondary objective to have the shares reflect the performance of the price of gold, we have structured the Trust as follows: Responsib Ie Sourcing Documents • Taking delivery of physical gold is subject to guidelines intended to minimize the amount of cash that will be distributed with physical gold. As a result, investors need to submit shares that correspond very closely to the number of Fine Ounces represented by the gold requested. The Trust will ship physical gold to a Delivery Applicant by a conventional shipping carrier such as the U.S. Postal Service, Federal Express, United Parcel Service or armored transportation service. A conventional shipping carrier may deliver gold to residential addresses. An armored transportation service, which may be required for insurance purposes, will only deliver to trusted, non - residential addresses. Transactions with Authorized Participants. By allowing Authorized Participants to directly issue and redeem Baskets with the Trust, Authorized Participants may be able to take advantage of price discrepancies between the Trust's underlying gold holdings and the value of the shares. As a result of this incentive

Overview D eli very Fees Taking Delivery Responsib Ie Sourcing Documents provided to Authorized Participants, the value of the shares may reflect the performance of the price of gold. Minimize cash delivery. To minimize the cash portion of delivery by Delivery Applicants of physical gold for their shares, we wifi only approve Delivery Applications where the number of shares to be submitted Leads to a cash portion that is as low as practical in our assessment. Exchange of Shares for Physical Gotd other than London Bars. For physical gold other than London Bars, we wifi require the submission of shares that correspond in net assets to the number of Fine Ounces contained in the physical gold requested. The number of shares required for submission wifi typically be the smallest whole number of shares greater than the net assets of the Trust corresponding to the Fine Ounce content of physical gold requested. We may demand that an additional share or shares be submitted when, in our assessment, it facilitates the exchange process, such as when extraordinary Trust expenses may be expected, by reducing the likelihood that the net asset value of the Trust differs on the Share Submission Day from that anticipated by us at the time the Delivery Application is filed, which is in advance of the Share Submission Day . Exchange of Shares for London Bars. Because London Bars vary in Fine Ounce content between 350 Fine Ounces and 430 Fine Ounces, it may be difficult to obtain a combination of London Bars that closely matches the number of Fine Ounces represented by the shares submitted. Delivery Applicants wifi need to submit shares that very closely correspond in Fine Ounces to the median Fine Ounce content of London Bars held by the Trust multiplied by the number of London Bars requested. Any portion of the exchange not delivered in physical gold will be provided in cash.

Overview D eli very Fees '1’1ic s1iiii'cs Ol‘1éi in iin cstmcnt that is: Easily Accessible and Relatively Cost Efficient. Investors can access the gold market through a traditional brokerage account. We believe that investors will be able to more effectively implement strategic and tactical asset allocation strategies that use gold by using the shares instead of using the traditional means of purchasing, trading and holding gold. Transaction costs related to the shares may also be lower than those associated with the purchase, storage and insurance of physical gold. Taking Delivery Exchange Traded and Transparent. The shares will trade on the NYSE Arca under the symbol “OUNZ,” and will provide investors with an efficient means to implement various investment strategies. Upon effectiveness of the registration statement, of which this Prospectus is a part, the shares will be eligible for margin accounts. The Trust will nothold or employ any derivatives and the shares will be backed by the assets of the Trust. Furthermore, the value of the Trust's holdings will be reported on the Trust's website daily. Responsib Ie Sourcing Documents Minimal Credit Risk. The shares represent an interest in physical gold owned by the Trust (other than up to a maximum of 430 Fine Ounces of gold held in unallocated form) and held in physical custody at the Custodian. Physical gold of the Trust is not subject to borrowing arrangements with third parties. Other than the gold temporarily being held in unallocated form to facilitate the delivery of physical gold to Delivery Applicants, redemptions by Authorized Participants, the exchange of gold to different specifications and the payment of Trust expenses not assumed by us, if any, the Trust's gold is not subject to counterparty or credit risks. The gold is held in the form of London Bars which is allocated to the Trust Allocated Account and held in the Trust's name by the Custodian. This contrasts with other financial products that gain exposure to gold through the use of derivatives that may be subject to counterparty and credit risks. For more information, please also read the OU NZ FAO s. For the VanEck Merk Gold ETF*" delivery application, please click here

Overview Patent Delivery Fees Taking Delivery Responsible Sourcing Documents On January 7, 2014, Merk Investments LLC was issued patent #8,626,641 by the United States Patent and Trademark Office for a "Deliverable commodity investment vehicle." The VanEck Merk Gold ETF opens a new interface between the institutional and retail world of owning gold." - - Axed Merk, President and Chief Investment Officer at Merk Investments. "Never before have investors been able to buy and own gold through an exchange traded product while being able to take delivery of gold in a form suitable for the individual. The U.S. patent office confirms what we do is truly new, innovative and worthy of patent protection. No one before has been able to combine the institutional and retail benefits of holding gold. From the patent description: "The invention relates generally to systems and methods for investing in commodities, and more specifically to commodity investment vehicles offering a conversion or delivery feature." Read more Market Price: The current price at which shares arc boug ht and sold (reporting subject to a pprox. 20mii dcLay). NAV: The doLlar value of a sing ie share, based on the value of the underlying assets of the fund minus its liabilities. divided by the number of shares outstanding. A Basket is 50.000 Shares. "Indicative" Gold per Basket refers to the projection for the next tra ding day's basket size. ’ G old per Share and G old in Val Eck Merk Gold ETF nui›Jbers arc net of accrued expenses.

Trading fees and other œsts may appty. (*) If an investor redeems some or aM of ils shares in exchange for the undertying gold (incfuding American Gold Eagle Coins) represented by the redeemed shares, the exchange will generafty not be a taxable event for the investor (exœpt with respect to any Cash Proceeds). A subsequent safe ofthe gold received by the investor wifi be a taxable everrL For detaits, pÏease sœ "Taxation of U.S. Investors" in the p rosr›ect ts . A dehvery appficant must submit a defÎvery appficaôon and payment for the processing and defivery fees to cover the cost of preparing and transporting the gold. The detivery of physicaf gold to appficants may take considerabte time and the deÏay in deÏivery couÏd resuft in fosses if the price of gold dectines. A share submission is irrevocabfe. The materiaf must be preœded or accompanied bya n rosnectus . Before investing you shoufd œrefuffy œnsider the VanEck Merk Gold ETP's {"Trust”) irrvesonœit objectives, risks, d'iarges and expensw Investing involves significant rish, including passible loss of principaL The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity poot for the purpases of the Commodity Exchange Act . Shares of the Trust are not subject to d'ie same regulatory requirements as mutuat funds Because shares oi'the Trust are intended to reflect d'ie price of the gold hetd in the Trust, the marhet price of the shares is subject to fluctuations similar to thase affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value ( - NAV"). Brokerage commissions will reduce returns The request for redemption of shares fbr gold is subject to a number of risks including but not limited fa he potential for the price of gold to decline during he time between the submission of he request and delivery. Delivery may fake a considerable amount o/time depending on your location. Commodities and commodfi:y - index linked securities may 6e af?écted by changes in overall market movements and other factors sucf› as weather, disease, em6argoes, or political and regulatory developments, as wetl as trading activity o7specu/ators and arbitrageurs in the underlying commodities. Tr iJ st shares trade life stocks, are subject to investment risk and with fluctuate in mar1et value. Tlne vatue of Trust shares relates directly to he value of the gold hetd 6y the Tr iJ st (less its expenses}, and fluctuations in the price of gold could materially and adversely af?éct an investment in the shares. The price received upon the safe of the shares, wt›ich frade at market price, may be more or less than the value of the gold represented 6y them. The Trust does not generate any income, and as the Tr iJ st regularly issues shares to pay for he Sponsor's ongoing expenses, tlne amount o/ gotcf represented by eact› Share will decline over time. investing involves risk, and you would lose money on an investment in the Trust. Far a more complete discussion of the risk factors relative to the Trust carefully read the p rosper:fus.

This content is pub£ishecl in the Unitecl States for residents of specifiecl countries. Investors are subject to securities and tax regulations within their app£icab£e jurisdictions that are not addressed on this contend Nothing in this content should be considered a solicitation to buy or an offer to self shares of any investment in any jurisdiction where the offer or soUcitation would be unLawfu£ under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction. The sponsor of the Trust is Merk Investments LLC (the "Sponsor”). VanEck provides marketing services to the TrusL AU rights reserved. A£L trademarks, service marks or registered trademarks are the property of their respective owners.

Overview Delivery Fees l7elii ei'› lees Taking Delivery Responsible Sourcing The Processin g Fees for investors taking delivery of their gold ("Delivery Applicants") are comprised of an Exchan ge Fee and a Deliver y Fee . Deli ery See No Delivery Fee is charged for the delivery of physical gold to destinations in the lower 4B States. The Exchange Fee below is effective August 23, 2024 and supersedes any previously published Exchange Fees, including those in the prospectus: Documents

Overview Delivery Fees Type of Gold Bar Taking Delivery Responsible Sourcing Fee per Oun cc Fee per Application 99.99% $109.00 $500 1oz 2024 US Mint Gold Buffalo 9999% 528.00 $500 1oz Gold Bar Royal Canadian Mint 91.67% $110.00 $500 1oz 2024 US Mint Gold Eagle 9999% $ 15.00 $500 1kg Kilo Bars 95.00 0 /o - 9 9 . 9 9 % 3 o. 0 0 3 4 Ooo London bars Exchange Fee Purity Documents

Overview Delivery Fees Sar P le Excli.in be F'ees 20 Taking Delivery Responsible Sourcing During times of high demand for coins in the market, Processing Fees may be updated frequently and may be updated after the time a Delivery Applicant submits an application before it is pre - approved. in this case, the Delivery Applicant may have to pay a higher Processing Fee to have the Delivery Application pre - approved. You may also use our online calculator to determine the number of ounces your shares correspond to. Documents

Overview Delivery Fees Taking Delivery Responsible Sourcing The Exchange Fee covers the cost of exchanging OUNZ shares into gold bars in the form of London Bars which the Trust holds in the vault, as weft as the cost of converting London Bars into the gold coins or smaller gold bars that investors may prefer for delivery. The Exchange Fee for gold coins and bars, outside of London Bars, reflects the premium such coins and bars are trading at relative to the spot price of gold. In an effort to keep Exchange Fees predictable, the precious metals dealer will choose coins and bars from inventory regardless of date. Special requests may be accommodated, but are subject to inventory and may be subject to higher fees. We would publish the pricing for special requests on this page, making it available to other investors as well. Aside from being able to request delivery of London Bars, investors may request to have their shares exchanged for other gold bars and coins, without numismatic value, having a minimum fineness (or purity) of 995 parts per 1,000 (99.5%) or, for American Gold Eagle gold coins, with a minimum fineness of 91.6796. All fees are subject to change upon notice and the Sponsor may waive or reduce the Exchange Fees from time to time. Ready to take delivery? Please click here . Documents

Trading fees and other œsts may appfy. (*) If an investor redeems some or aM of ils shares in exchange for the undertying gold (incfuding American Gold Eagle Coins) represented by the redeemed shares, the exchange will generafty not be a taxable event for the investor (exœpt with respect to any Cash Proceeds). A subsequent safe ofthe gold received by the investor wifi be a taxable everrL For detaits, pÏease sœ "Taxation of U.S. Investors" in the p rosr›ect ts . A dehvery appficant must submit a defÎvery appficaôon and payment for the processing and defivery fees to cover the cost of preparing and transporting the gold. The detivery of physicaf gold to appficants may take considerabte time and the deÏay in deÏivery couÏd resuft in fosses if the price of gold dectines. A share submission is irrevocabfe. The materiaf must be preœded or accompanied bya n rosnectus . Before investing you shoufd œrefuffy œnsider the VanEck Merk Gold ETP's {"Trust”) irrvesonœit objectives, risks, d'iarges and expensw Investing involves significant rish, including passible loss of principaL The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity poot for the purpases of the Commodity Exchange Act . Shares of the Trust are not subject to d'ie same regulatory requirements as mutuat funds Because shares oi'the Trust are intended to reflect d'ie price of the gold hetd in the Trust, the marhet price of the shares is subject to fluctuations similar to thase affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value ( - NAV"). Brokerage commissions will reduce returns The request for redemption of shares fbr gold is subject to a number of risks including but not limited fa he potential for the price of gold to decline during he time between the submission of he request and delivery. Delivery may fake a considerable amount o/time depending on your location. Commodities and commodfi:y - index linked securities may 6e af?écted by changes in overall market movements and other factors sucf› as weather, disease, em6argoes, or political and regulatory developments, as wetl as trading activity o7specu/ators and arbitrageurs in the underlying commodities. Tr iJ st shares trade life stocks, are subject to investment risk and with fluctuate in mar1et value. Tlne vatue of Trust shares relates directly to he value of the gold hetd 6y the Tr iJ st (less its expenses}, and fluctuations in the price of gold could materially and adversely af?éct an investment in the shares. The price received upon the safe of the shares, wt›ich frade at market price, may be more or less than the value of the gold represented 6y them. The Trust does not generate any income, and as the Tr iJ st regularly issues shares to pay for he Sponsor's ongoing expenses, tlne amount o/ gotcf represented by eact› Share will decline over time. investing involves risk, and you would lose money on an investment in the Trust. Far a more complete discussion of the risk factors relative to the Trust carefully read the p rosper:fus.

This content is pub£ishecl in the Unitecl States for residents of specifiecl countries. Investors are subject to securities and tax regulations within their app£icab£e jurisdictions that are not addressed on this contend Nothing in this content should be considered a solicitation to buy or an offer to self shares of any investment in any jurisdiction where the offer or soUcitation would be unLawfu£ under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction. The sponsor of the Trust is Merk Investments LLC (the "Sponsor”). VanEck provides marketing services to the TrusL AU rights reserved. A£L trademarks, service marks or registered trademarks are the property of their respective owners.

Documents Overview Delivery Fees Taking Delivery Responsible Sourcing laking Deliver›' How Many OUNZ Shares Do You Own 2000 2000+ - N umbcr of Sh arcs As of the most recent close of business on Aug 28, 2024, your shares correspond to 19.3136 oz of gold kc GaI d c I r y

Overview Delivery Fees 20 Taking Delivery Responsible Sourcing Documents

Overview Delivery Fees Taking Delivery Responsible Sourcing I.old Delis ei•› : . i Eas› . S 1 — 2 — J 1. Investor files a Delivery Application. 2. Investor instructs their broker to submit their ETF shares to take delivery of their gold. 3. Gold sent to Investor. If you are an investor interested in taking delivery of physical gold in exchange for your OUNZ shares (Delivery Applicants), you must submit a signed Delivery Application to us (the "Sponsor"). A Delivery Application expresses your non - binding intention to exchange shares for physical gold on the Share Submission Day or within the applicable grace period. Documents

Overview Delivery Fees Taking Delivery Responsible Sourcing l . lnve sttir 1'iles a Delivery Applicat itin A completed and signed Delivery Application must be submitted to us by up loadin g. by fax to 650 - 745 - 7045; or by mail to Merk Investments LLC; Attn: VanEck Merk Gold ETF; 1150 Chestnut St, Menlo Park, CA 94025. We will only process a Delivery Application once the Processin g Fees have been paid. The Processing Fee is due at the time the Delivery Application is submitted to us and is fully refundable until you rrevocabLy submit your shares to the Trustee. Click here for details on fees. Once we pre - approve a Delivery Application, we wifi provide to you (typically by email) a Delivery Applicant Share Submission Form along with the pre - approved Delivery Application. You must submit a completed and signed Delivery Applicant Share Submission Form to your broker (typically done via fax), with the pre - approved Delivery Application attached. Documents

Overview Delivery Fees Taking Delivery Responsible Sourcing 2. lnvesttir instructs their broker tti submit their E 1 P shares tti take deli ery of their ‹old On the Share Submission Day (or within the applicable grace period), your broker shall, in accordance with the instructions in the Delivery Application: • Complete and sign the second page of the Delivery Applicant Share Submission Form. • Fax to the Trustee the completed and signed Delivery Applicant Share Submission Form, with the pre - approved Delivery Application attached; and • Submit OUNZ shares to the Trustee. The Delivery Application is not binding until shares are delivered to the Trust. Documents

Overview Delivery Fees Taking Delivery Responsib Ie Sourcing 3. Gtild sent tti Investtir Physical gold will be delivered to a Delivery Applicant based on instructions in the Delivery Application. Once physical gold has been tendered to the courier identified in the Delivery Application, the physical gold cannot be returned and is no longer the responsibility of the Trust, the Trustee, the Custodian, the precious metals dealer or us. The Trust will ship physical gold to a Delivery Applicant fully insured using accepted business practices for precious metals delivery that may include, amongst others, use of a conventional shipping carrier (e.g., U.S. Postal Service, Federal Express, United Parcel Service). or an armored transportation service. For additional information, please read the p ros p ectus, as well as the OUNZ FAQ section "When will I receive my _go Ld+" Let us help you take delivery of the gold you own through OUNZ. Please visit the OUNZ FAO ; contact us online ; or call us at (855) MRK - OUNZ with questions Documents

Trading fees and other œsts may appty. (*) If an investor redeems some or aM of ils shares in exchange for the undertying gold (incfuding American Gold Eagle Coins) represented by the redeemed shares, the exchange will generafty not be a taxable event for the investor (exœpt with respect to any Cash Proceeds). A subsequent safe ofthe gold received by the investor wifi be a taxable everrL For detaits, pÏease sœ "Taxation of U.S. Investors" in the p rosr›ect ts . A dehvery appficant must submit a defÎvery appficaôon and payment for the processing and defivery fees to cover the cost of preparing and transporting the gold. The detivery of physicaf gold to appficants may take considerabte time and the deÏay in deÏivery couÏd resuft in fosses if the price of gold dectines. A share submission is irrevocabfe. The materiaf must be preœded or accompanied bya n rosnectus . Before investing you shoufd œrefuffy œnsider the VanEck Merk Gold ETP's {"Trust”) irrvesonœit objectives, risks, d'iarges and expensw Investing involves significant rish, including passible loss of principaL The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity poot for the purpases of the Commodity Exchange Act . Shares of the Trust are not subject to d'ie same regulatory requirements as mutuat funds Because shares oi'the Trust are intended to reflect d'ie price of the gold hetd in the Trust, the marhet price of the shares is subject to fluctuations similar to thase affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value ( - NAV"). Brokerage commissions will reduce returns The request for redemption of shares fbr gold is subject to a number of risks including but not limited fa he potential for the price of gold to decline during he time between the submission of he request and delivery. Delivery may fake a considerable amount o/time depending on your location. Commodities and commodfi:y - index linked securities may 6e af?écted by changes in overall market movements and other factors sucf› as weather, disease, em6argoes, or political and regulatory developments, as wetl as trading activity o7specu/ators and arbitrageurs in the underlying commodities. Tr iJ st shares trade life stocks, are subject to investment risk and with fluctuate in mar1et value. Tlne vatue of Trust shares relates directly to he value of the gold hetd 6y the Tr iJ st (less its expenses}, and fluctuations in the price of gold could materially and adversely af?éct an investment in the shares. The price received upon the safe of the shares, wt›ich frade at market price, may be more or less than the value of the gold represented 6y them. The Trust does not generate any income, and as the Tr iJ st regularly issues shares to pay for he Sponsor's ongoing expenses, tlne amount o/ gotcf represented by eact› Share will decline over time. investing involves risk, and you would lose money on an investment in the Trust. Far a more complete discussion of the risk factors relative to the Trust carefully read the p rosper:fus.

This content is pub£ishecl in the Unitecl States for residents of specifiecl countries. Investors are subject to securities and tax regulations within their app£icab£e jurisdictions that are not addressed on this contend Nothing in this content should be considered a solicitation to buy or an offer to self shares of any investment in any jurisdiction where the offer or soUcitation would be unLawfu£ under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction. The sponsor of the Trust is Merk Investments LLC (the "Sponsor”). VanEck provides marketing services to the TrusL AU rights reserved. A£L trademarks, service marks or registered trademarks are the property of their respective owners.

Overview Delivery Fees Take ng Delivery Responsible Sourcing Responsible Sourcing OUNZ holds London Bars. A London Bar is a gold bar meeting London Good Deliver y Standards. Only gold bars that meet the standard may be delivered to OUNZ. The Good Delivery Standard includes a standard on responsible sourcing: The London Bullion Market Association's ("LBMA") Res p onsible Sourcin g program is a mandatory independent audit program that verifies the legitimacy of gold supply chains, ensuring sourcing meets international ethical standards: "The Responsible Sourcing Program ensures the continuous improvement of Responsible Sourcing business practices and reassures clients that afL of the metal sourced from LBMA Good Delivery Refiners is free from threat financing. The Program follows the five - step due diligence framework set out in the OECD Guidance and requires [Good Delivery] refiners to demonstrate their efforts to combat money laundering, terrorist financing and human rights abuses, and respect the environment globally." For details, including their Latest annual report, please see LBMA's Res p onsible Sourcin g resources. In the context of OUNZ, please note: • Any new gold introduced to the LBMA must abide by the LBMA's Responsible Sourcing Program. • The LBMA Responsible Sourcing Program was introduced in 2012. • 100 O A of go ld bars held b y OUNZ were refined in 2012 or Later. Documents

Overview Delivery Fees Taking Delivery Responsible Sourcing • Does that mean any gold refined before 20 12 was not responsibly sourced? No. miners and refiners had been subject to their own set of rules and regulations. The Responsible Sourcing Program was introduced, in part, to provide streamlined standards. The Responsible Sourcing Program is a continuous improvement program, as lessons from the program are incorporated as the program evolves. • Does it mean all gold refined after 2012 is sourced responsibly? It means afL gold introduced to the LBMA is subject to the LBMA Responsible Sourcing Program. Keep in mind that old London Bars are at times sent back to refineries; as such, a London Bar refined today may include gold that was first mined before 20 12. • If you have any questions or concerns about the responsible sourcing of gold held by OUNZ, please contact us . For more information, please also read OUNZ's Guidin g Principles and the OUNZ FAO s. Documents

Trading fees and other œsts may appty. (*) If an investor redeems some or aM of ils shares in exchange for the undertying gold (incfuding American Gold Eagle Coins) represented by the redeemed shares, the exchange will generafty not be a taxable event for the investor (exœpt with respect to any Cash Proceeds). A subsequent safe ofthe gold received by the investor wifi be a taxable everrL For detaits, pÏease sœ "Taxation of U.S. Investors" in the p rosr›ect ts . A dehvery appficant must submit a defÎvery appficaôon and payment for the processing and defivery fees to cover the cost of preparing and transporting the gold. The detivery of physicaf gold to appficants may take considerabte time and the deÏay in deÏivery couÏd resuft in fosses if the price of gold dectines. A share submission is irrevocabfe. The materiaf must be preœded or accompanied bya n rosnectus . Before investing you shoufd œrefuffy œnsider the VanEck Merk Gold ETP's {"Trust”) irrvesonœit objectives, risks, d'iarges and expensw Investing involves significant rish, including passible loss of principaL The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity poot for the purpases of the Commodity Exchange Act . Shares of the Trust are not subject to d'ie same regulatory requirements as mutuat funds Because shares oi'the Trust are intended to reflect d'ie price of the gold hetd in the Trust, the marhet price of the shares is subject to fluctuations similar to thase affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value ( - NAV"). Brokerage commissions will reduce returns The request for redemption of shares fbr gold is subject to a number of risks including but not limited fa he potential for the price of gold to decline during he time between the submission of he request and delivery. Delivery may fake a considerable amount o/time depending on your location. Commodities and commodfi:y - index linked securities may 6e af?écted by changes in overall market movements and other factors sucf› as weather, disease, em6argoes, or political and regulatory developments, as wetl as trading activity o7specu/ators and arbitrageurs in the underlying commodities. Tr iJ st shares trade life stocks, are subject to investment risk and with fluctuate in mar1et value. Tlne vatue of Trust shares relates directly to he value of the gold hetd 6y the Tr iJ st (less its expenses}, and fluctuations in the price of gold could materially and adversely af?éct an investment in the shares. The price received upon the safe of the shares, wt›ich frade at market price, may be more or less than the value of the gold represented 6y them. The Trust does not generate any income, and as the Tr iJ st regularly issues shares to pay for he Sponsor's ongoing expenses, tlne amount o/ gotcf represented by eact› Share will decline over time. investing involves risk, and you would lose money on an investment in the Trust. Far a more complete discussion of the risk factors relative to the Trust carefully read the p rosper:fus.

This content is pub£ishecl in the Unitecl States for residents of specifiecl countries. Investors are subject to securities and tax regulations within their app£icab£e jurisdictions that are not addressed on this contend Nothing in this content should be considered a solicitation to buy or an offer to self shares of any investment in any jurisdiction where the offer or soUcitation would be unLawfu£ under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction. The sponsor of the Trust is Merk Investments LLC (the "Sponsor”). VanEck provides marketing services to the TrusL AU rights reserved. A£L trademarks, service marks or registered trademarks are the property of their respective owners.

Overview Delivery Fees FA@ O Is there a fact sheet available? O When I own the VanEck Merk hold ETF (OUNZ), do I own gold? O What type of gold does the VanEck Merk Gold ETF (OUNZ) hold? O Can I take delivery of the gold I own through the VanEck Merk hold ETF (OUNZ)? O What type of gold can I receive? O When requesting gold coins, can I specify the mint year? O Where and how can I have my gold delivered? O When will I receive my gold? Taking Delivery Responsible Sourcing FAQ Documents

Overview Delivery Fees Taking Delivery Responsible Sourcing o Can you deliver gold if there is a panic in the markets? FAQ o How many ounces of gold do my VanEck Merk Gold ETF (OUNZ) shares correspond to? How is the ’number of shares to be submitted’ calculated? o What is the Share Submission date? o What is the Exchange Fee? o Is there a Delivery Fee? o What is the Processing Fee? o What are Estimated Cash Proceeds? o When do I have to wire payment for the fees? Documents

Overview Delivery Fees Taking Delivery Responsible Sourcing FAQ O (ian I u ire fees from an account different than my brokerage account where my VanEck Clerk tlold ETF ((OUNZ) shares are held? O (ian m Delivery Application be denied? O ›Vhat do I do if I don't receive iny shipment or if it is damaged? @ Nlay I return gold I received? Documents

Trading fees and other œsts may appty. (*) If an investor redeems some or aM of ils shares in exchange for the undertying gold (incfuding American Gold Eagle Coins) represented by the redeemed shares, the exchange will generafty not be a taxable event for the investor (exœpt with respect to any Cash Proceeds). A subsequent safe ofthe gold received by the investor wifi be a taxable everrL For detaits, pÏease sœ "Taxation of U.S. Investors" in the p rosr›ect ts . A dehvery appficant must submit a defÎvery appficaôon and payment for the processing and defivery fees to cover the cost of preparing and transporting the gold. The detivery of physicaf gold to appficants may take considerabte time and the deÏay in deÏivery couÏd resuft in fosses if the price of gold dectines. A share submission is irrevocabfe. The materiaf must be preœded or accompanied bya n rosnectus . Before investing you shoufd œrefuffy œnsider the VanEck Merk Gold ETP's {"Trust”) irrvesonœit objectives, risks, d'iarges and expensw Investing involves significant rish, including passible loss of principaL The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity poot for the purpases of the Commodity Exchange Act. Shares of the Trust are not subject to d'ie same regulatory requirements as mutuat funds Because shares oi'the Trust are intended to reflect d'ie price of the gold hetd in the Trust, the marhet price of the shares is subject to fluctuations similar to thase affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value ( - NAV"). Brokerage commissions will reduce returns The request for redemption of shares fbr gold is subject to a number of risks including but not limited fa he potential for the price of gold to decline during he time between the submission of he request and delivery. Delivery may fake a considerable amount o/time depending on your location. Commodities and commodfi:y - index linked securities may 6e af?écted by changes in overall market movements and other factors sucf› as weather, disease, em6argoes, or political and regulatory developments, as wetl as trading activity o7specu/ators and arbitrageurs in the underlying commodities. Tr iJ st shares trade life stocks, are subject to investment risk and with fluctuate in mar1et value. Tlne vatue of Trust shares relates directly to he value of the gold hetd 6y the Tr iJ st (less its expenses}, and fluctuations in the price of gold could materially and adversely af?éct an investment in the shares. The price received upon the safe of the shares, wt›ich frade at market price, may be more or less than the value of the gold represented 6y them. The Trust does not generate any income, and as the Tr iJ st regularly issues shares to pay for he Sponsor's ongoing expenses, tlne amount o/ gotcf represented by eact› Share will decline over time. investing involves risk, and you would lose money on an investment in the Trust. Far a more complete discussion of the risk factors relative to the Trust carefully read the p rosper:fus.

This content is pub£ishecl in the Unitecl States for residents of specifiecl countries. Investors are subject to securities and tax regulations within their app£icab£e jurisdictions that are not addressed on this contend Nothing in this content should be considered a solicitation to buy or an offer to self shares of any investment in any jurisdiction where the offer or soUcitation would be unLawfu£ under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction. The sponsor of the Trust is Merk Investments LLC (the "Sponsor”). VanEck provides marketing services to the TrusL AU rights reserved. A£L trademarks, service marks or registered trademarks are the property of their respective owners.

Overview Delivery Fees Fact Sheet Taking Delivery Responsible Sourcing Prclniuin I iscr)uia

Trading fees and other œsts may appfy. (*) If an investor redeems some or aM of ils shares in exchange for the undertying gold (incfuding American Gold Eagle Coins) represented by the redeemed shares, the exchange will generafty not be a taxable event for the investor (exœpt with respect to any Cash Proceeds). A subsequent safe ofthe gold received by the investor wifi be a taxable everrL For detaits, pÏease sœ "Taxation of U.S. Investors" in the p rosr›ect ts . A dehvery appficant must submit a defÎvery appficaôon and payment for the processing and defivery fees to cover the cost of preparing and transporting the gold. The detivery of physicaf gold to appficants may take considerabte time and the deÏay in deÏivery couÏd resuft in fosses if the price of gold dectines. A share submission is irrevocabfe. The materiaf must be preœded or accompanied bya n rosnectus . Before investing you shoufd œrefuffy œnsider the VanEck Merk Gold ETP's {"Trust”) irrvesonœit objectives, risks, d'iarges and expensw Investing involves significant rish, including passible loss of principaL The Trust is not an investment company registered under the Investment Company Act of 1940 or a commodity poot for the purpases of the Commodity Exchange Act. Shares of the Trust are not subject to d'ie same regulatory requirements as mutuat funds Because shares oi'the Trust are intended to reflect d'ie price of the gold hetd in the Trust, the marhet price of the shares is subject to fluctuations similar to thase affecting gold prices. Additionally, shares of the Trust are bought and sold at market price, not at net asset value ( - NAV"). Brokerage commissions will reduce returns The request for redemption of shares fbr gold is subject to a number of risks including but not limited fa he potential for the price of gold to decline during he time between the submission of he request and delivery. Delivery may fake a considerable amount o/time depending on your location. Commodities and commodfi:y - index linked securities may 6e af?écted by changes in overall market movements and other factors sucf› as weather, disease, em6argoes, or political and regulatory developments, as wetl as trading activity o7specu/ators and arbitrageurs in the underlying commodities. Tr iJ st shares trade life stocks, are subject to investment risk and with fluctuate in mar1et value. Tlne vatue of Trust shares relates directly to he value of the gold hetd 6y the Tr iJ st (less its expenses}, and fluctuations in the price of gold could materially and adversely af?éct an investment in the shares. The price received upon the safe of the shares, wt›ich frade at market price, may be more or less than the value of the gold represented 6y them. The Trust does not generate any income, and as the Tr iJ st regularly issues shares to pay for he Sponsor's ongoing expenses, tlne amount o/ gotcf represented by eact› Share will decline over time. investing involves risk, and you would lose money on an investment in the Trust. Far a more complete discussion of the risk factors relative to the Trust carefully read the p rosper:fus.

This content is pub£ishecl in the Unitecl States for residents of specifiecl countries. Investors are subject to securities and tax regulations within their app£icab£e jurisdictions that are not addressed on this contend Nothing in this content should be considered a solicitation to buy or an offer to self shares of any investment in any jurisdiction where the offer or soUcitation would be unLawfu£ under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction. The sponsor of the Trust is Merk Investments LLC (the "Sponsor”). VanEck provides marketing services to the TrusL AU rights reserved. A£L trademarks, service marks or registered trademarks are the property of their respective owners.

Lel'i stay in louch. Crxfdr'f L.s First Name * E — mail “ Phone Number Your Message * Attachment Choose Fife Last Name * X Our Team is here for you . Give us a call or send us an email . We will get back to you as quickly as possible .

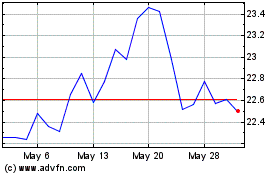

VanEck Merk Gold ETF (AMEX:OUNZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

VanEck Merk Gold ETF (AMEX:OUNZ)

Historical Stock Chart

From Feb 2024 to Feb 2025