The rapid expansion of the ETF industry over the past few years

has greatly increased the options available to investors seeking to

drill down in their sector of choice. Funds now exists that allow

investors to buy up products targeting corners of the market as

obscure as the fishing industry or solid state drives, with pretty

much everything in between covered as well. While a number of these

niche spaces have failed to gain traction among many investors,

this has certainly not been the case in one corner of the ETF

world; the precious metal mining ETF space (see Is USCI The Best

Commodity ETF?).

The sector has seen close to $3.5 billion in net inflows over

the past year alone as precious metal prices have surged, leading

many investors to believe that a similar spike was due in the

equity side as well. Unfortunately, this has not been the case as a

broad sell-off of risky assets-- including precious metal mining

firms-- hit the space hard, pushing heavy losses to companies

across the board. Given that many of the industries have favorable

Zacks Industry Ranks, and that many of the companies have

relatively favorable ratings in terms of their Zacks Rank as well,

one has to believe that this could change in the near future,

especially if precious metal prices remain elevated. In light of

this, we take a look at three of the best precious metal mining

ETFs that investors have to choose from today, highlighting funds

that focus on each of the three major precious metals; gold,

silver, and platinum:

Global X Silver Miners ETF

(SIL)

Silver is an increasingly popular metal for investors as the

product has a variety of uses beyond its traditional role as a

hedge against monetary debasement. The metal finds its way into a

number of products ranging from coins and jewelry, to electronic

wiring, medical applications, and solar energy production. For

investors seeking a targeted play on this increasingly important

sector and the companies that mine the metal, SIL is a quality

choice. The fund tracks the Solactive Global Silver Miners Index,

which is a broad based equity market performance of global

companies involved in the silver mining industry, as defined by

Structured Solutions AG (read CPER: A Better Copper ETF?).

SIL is relatively focused in its top holdings, putting close to

75% of all assets in its top ten. Additionally, three companies

make up at least 11.5% of total assets further suggesting that a

high level of concentration exists in this fund which only consists

of just over 30 securities in total. Nevertheless, the product does

do a good job of spreading assets across market cap levels,

allocating just 41% to large caps, 30% to mid caps, and the rest to

small and micro sized securities. However, unlike the other

products on the list, SIL is an extremely popular precious metal

mining ETF, trading about 660,000 shares a day. This should help to

cut down on the spread between the bid and the ask and keep total

costs low for those seeking to make a play in the space.

Unfortunately, gains haven’t exactly been easy to come by in this

fund, as SIL has slumped by about 20% on the year, a poor

performance compared to SLV’s 3.6% gain in the same time period

(read The Two Best Silver ETFs For The Next Silver Bull

Market).

First Trust ISE Global Platinum Index Fund

(PLTM)

For investors seeking a play on the priciest of all precious

metals, and a crucial component in catalytic converter production,

First Trust’s PLTM could be the way to go. The product tracks the

ISE Global Platinum Index which is designed to provide a benchmark

for investors interested in tracking public companies that are

active in platinum group metals mining based on revenue analysis of

those companies. PGMs include platinum, palladium, osmium, iridium,

ruthenium and rhodium. In other words, companies included in the

index must be actively engaged in some aspect of platinum group

metal mining such as pulling the metals out of the ground,

refining, or exploration. Interestingly, the fund also uses a

unique methodology to develop weightings based on revenue exposure

to PGM production. The component securities are grouped into

linearly weighted quartiles and then equally weighted within each

quartile. The resulting distribution allows smaller, more PGM

focused companies to be adequately represented in the index.

In total, 24 securities make up PLTM with nearly 11% going

towards Johnson Matthey (JMPLY), 8.3% to both Anglo Platinum

(AGPPY) and Impala Platinum Holdings (IMPUY). It should also be

noted that the product has a low median market cap of just $568

million, although the range is quite wide going from $80 million

all the way up to $37.3 billion. In terms of fund metrics, they are

quite favorable for this upstart product as the P/E is below 10 and

the Price/Book ratio is below 1.4, suggesting reasonable levels of

value on both measures. However, this could just be due to the

fund’s horrendous performance so far in 2011, as the product has

declined by more than 47% since the start of the year (see The Best

ETF For The Next Decade).

Global X Pure Gold Miners ETF

(GGGG)

Gold is arguably the most important metal of the group from a

market perception standpoint, as the yellow metal tends to rise

along with market fears and slump when investors are confident in

the global economy. This has been extremely important lately as the

global economic situation continues to crumble, although a stronger

dollar can dull gold’s shine in these environments. For investors

seeking to make a play on the space, most tend to gravitate towards

one of Van Eck’s ultra-popular products in the sector; GDX and

GDXJ. Although Van Eck’s Gold Miners ETF (GDX) and its pint sized

counterpart the MarketVectors Junior Gold Miners ETF (GDXJ), steal

the show in terms of assets, a new fund from Global X could

actually be a better choice for many investors. This fund tracks

the Solactive Global Pure Gold Miners Index, which is a benchmark

that only includes securities that get at least 90% of their

revenues from gold mining.

While this might seem like a minor distinction, this gives the

fund a vastly different holdings list than the other securities in

the space. In fact, three of the biggest components in GDX, Barrick

Gold Corp (ABX), Goldcorp (GG), and Newmont Mining (NEM) are

nowhere to be found in GGGG at all. Additionally, a few other names

that are in GDX but are focused on the silver industry such as Pan

American Silver Corp (PAAS) and Silver Wheaton Corp (SLW), are

decent sized components in GDX but are not in the Global X product.

Instead, GGGG focuses in on smaller companies that specialize in

gold, potentially giving the fund better correlation with the spot

price of the precious metal. While this may (or may not) be true,

investors should also note that the product isn’t exactly the most

popular, trading less than 10,000 shares a day. This suggests that

bid/ask spreads could be quite wide and that it may be difficult to

get into this precious metal mining ETF at a good price.

Furthermore, thanks to the smaller cap nature of the fund, it has

outperformed its larger cap focused counterparts, slumping by about

11.7% in year-to-date terms (see Why Aren’t Gold Stocks Rising With

The Price of Gold?).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

BARRICK GOLD CP (ABX): Free Stock Analysis Report

GOLDCORP INC (GG): Free Stock Analysis Report

NEWMONT MINING (NEM): Free Stock Analysis Report

PAN AMER SILVER (PAAS): Free Stock Analysis Report

SILVER WHEATON (SLW): Free Stock Analysis Report

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

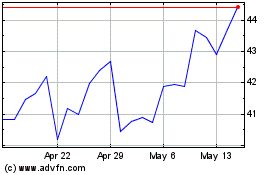

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Jan 2025 to Feb 2025

VanEck Junior Gold Miner... (AMEX:GDXJ)

Historical Stock Chart

From Feb 2024 to Feb 2025