Markets have been quite sluggish in April, as a lukewarm

earnings season has taken its toll on stocks across the board.

Broad benchmarks like the S&P 500 have retreated from their

all-time highs thanks to this lackluster earnings season, with

energy, materials, and tech leading on the downside.

This trend has pushed many investors into safer sectors like

utilities or health care for equities, and back into bonds once

more as well. In particular, we have seen a broad move back into

corporate securities, as these offer a nice mix between yield and

safety which could be ideal in this environment (read Buy These

Bond ETFs for Income and Diversification).

That is because many corporate bonds have moderate durations,

and yields that far exceed T-bill payouts. And with minimal

defaults and little prospect for an interest rate increase in the

near term, these lower volatility securities could be an

interesting way to wait out equity market volatility.

While there are a number of picks in this space, the

iShares Investment Grade Corporate Bond ETF (LQD)

could be an especially intriguing option. This fund is a low cost

(15 basis points) choice that has a great deal of volume and AUM,

which suggest that bid-ask spreads could be minimal, making it a

prime selection for shorter-term traders.

LQD in Focus

The ETF also holds a wide variety of securities in its

portfolio, with more than 1,000 names finding their way into the

fund. And with this many companies in the fund, firms don’t have

the ability to dominate the holdings profile as the top ten

accounts for less than 4.25% of the total (see Three Great Bond

ETFs Investors Have Overlooked).

In terms of maturity, the average is 12.17 years, putting it in

the middle of the curve. Still, results are skewed thanks to a

17.9% holding in ultra-long term bonds, and then 44% in 5-10

maturities, and 23.5% in 1-5 year maturities.

For credit quality, more than half the portfolio falls into the

A+ to A- range, though there is about 25% in the ‘BBB’ range, and a

bit more in the ‘AA-‘ or above segment. This results in a portfolio

that has a 30 Day SEC Yield of about 2.8%, although the 12 month

yield is a bit higher at 3.7%.

LQD Performance

This higher yield and lower volatility inherent in investment

grade bonds, has led to some outperformance as of late for the

iShares product. The fund has easily beaten out its bond

counterparts of AGG and BND, while it has also outperformed SPY in

the trailing one month time frame.

This is all despite some big outflows from this product and into

other bond funds in the space. In fact, LQD has lost about half a

billion in assets so far this quarter, and it actually leading all

bond products in outflows for the year-to-date period (See Key

Criteria to Know Before Buying an ETF).

We think this is a big mistake for many bond investors, as this

product is extremely liquid, and it has proven to be a solid mix

from a performance perspective in the recent turbulent time frame

as well.

LQD in the weeks ahead

A trend of gains could continue in the weeks ahead as well,

since the fund recently saw its short-term moving averages blow

past its longer term one. This move suggests more short term

bullishness ahead, especially considering how far the shorter term

averages have moved above the longer term ones in recent trading

periods.

Bullish trends could also be established in the bond space if

equities fail to establish their footing this earnings season. This

trend could push more back into bonds, and especially medium

duration higher quality securities.

Admittedly though, this would represent a bit of a reversal from

the current trend line, as many investors are obsessed with low

duration securities like BSV,

BKLN, or SHV for their exposure.

Yet if equities continue to slump and the Fed looks to stay on

hold, this could push investors back in LQD for their fixed income

ETF exposure (read Zacks Top Ranked Corporate Bond ETF: LQD).

Bottom Line

Even though many investors have pulled out their money from

mid-range corporate bonds, we still like the investment case for

this segment in the near term. That is why we have a Zacks ETF Rank

of 2 or ‘Buy’ on the fund, which means we believe this fund will

outperform other products over the next several months.

This could be especially true if current conditions hold in the

equity market and investors look for safer options in the fixed

income world. Shorter-duration securities may not cut it if it

looks like the Fed isn’t going to hike rates, meaning that funds

like LQD could be in focus once more when earnings season

concludes.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-BR AG BD (AGG): ETF Research Reports

PWRSH-SNR LN PR (BKLN): ETF Research Reports

VANGD-TOT BOND (BND): ETF Research Reports

VANGD-SHT TRM B (BSV): ETF Research Reports

ISHARES GS CPBD (LQD): ETF Research Reports

ISHARS-BR SH TB (SHV): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

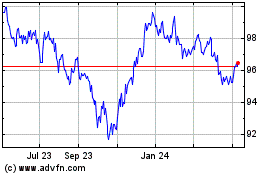

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Nov 2024 to Dec 2024

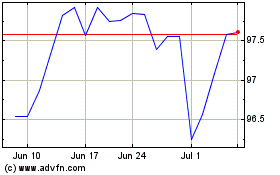

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Dec 2023 to Dec 2024