Thanks to reduced debt worries, strong growth in some of the key

members and solid data, the European economy has nicely rebounded

over the past couple of months. Though the Euro zone emerged from a

long 18-month recession, the growth seems fragile and closer to a

standstill.

This is because the Euro zone economy grew just 0.1% in the third

quarter compared to 0.3% in the second. The biggest European

economy – Germany – is showing signs of a slowdown while economic

growth in France surprisingly contracted in the third quarter.

Italy continued to shrink and entered into the third year of

recession (read: 3 European ETFs Leading the Recovery).

Further, tumbling inflation and higher unemployment is stalling the

burgeoning Euro zone economic recovery. Inflation dropped well

below the 2% annual target to 0.7% in October while unemployment

remained at a record high of 12.2%.

In order to support growth in the Euro zone, the European Central

Bank (ECB) recently cut its benchmark rate to a record low of

0.25%. If that wasn't enough, the ECB might introduce a negative

deposit rate as and when required too (read: Euro ETFs in

Focus After Surprise ECB Rate Cut).

According to Bloomberg, the rate for commercial lenders could fall

to -0.1% from the current zero level. This would be the first time

that the central bank adjusts rates by less than a quarter

percentage point. This measure will likely increase lending and

boost inflation closer to the target rate.

Based on the improving fundamentals, European stocks have moved

back on track lately and the related ETFs are seeing huge fund

inflows. For investors interested to participate in the recovery, a

focus on top ranked Europe ETFs could be a less risky way to tap

the same broad trends.

These products offer exposure to the broad European economy rather

than a particular nation and thus may be better picks at this time

for some investors (see: all the European ETFs here).

Top Ranked European ETF in Focus

We have found a number of ETFs that have the top Zacks ETF Rank of

1 or ‘Strong Buy’ rating in the broad European space and are thus

expected to outperform in the months to come (read: all the Top

Ranked ETFs).

While all these top ranked ETFs are likely to outperform, the

following three could be good choices to tap into the space. This

trio has enjoyed a strong momentum in the year-to-date period, and

al have potentially superior weighting methodologies which could

allow for these to continue leading the European space in the

months ahead.

First Trust Europe AlphaDEX Fund (FEP)

This fund provides a slightly active choice as it uses the AlphaDEX

methodology to select the stocks. The methodology seeks to narrow

the European space to only the best positioned companies. It ranks

the stocks by various growth and value factors, eliminating the

bottom ranked 25% of the stocks.

This approach produces a basket of 201 stocks, which is widely

spread across various nations and securities as each security holds

less than 1% of assets. France (18.62%), United Kingdom (17.16%)

and Germany (11.38%) occupy the top three positions in terms of

country exposure. However, the product is tilted toward financial

sector at 21.35%, closely followed by industrials (17.72%) and

consumer discretionary (17.41%).

The fund has gathered more than $237 million of assets this year,

propelling the total base to $283.5 million. The product trades in

good volume of nearly 94,000 shares per day while it charges a bit

higher 80 bps in annual fees. The ETF returned over 23.5% in the

year-to-date time frame.

SPDR STOXX Europe 50 ETF (FEU)

This fund follows the STOXX Europe 50 Index, which measures the

performance of some of the largest companies across the components

of the 20 EURO STOXX Supersector Indexes. The fund appears rich

with AUM of nearly $148 million, out of which $92 million was

pulled in this year. The ETF charges 29 bps in fees per year from

investors while volume is light.

Holding 57 securities in its basket, the product puts about 40% of

its assets in the top 10 holdings. The ETF is skewed toward

financials, as it takes roughly one-fourth of the total assets,

while healthcare, consumer staples and healthcare round out to the

next three spots.

In terms of country allocations, United Kingdom is leading with

38.92% share, followed by Switzerland (21.29%), Germany (14.98%)

and France (12.44%). The fund added nearly 17% so far this year

(read: UK ETFs in Focus on Positive Outlook).

iShares MSCI EMU Index Fund (EZU)

This is one of the most popular and liquid ETFs in the European

space as indicated by AUM of nearly $6.9 billion and average daily

volume of more than 3.3 million shares a day. The ETF tracks the

MSCI EMU index, which measures the performance of the equity

markets of the EMU member countries (those European Union members

that use the Euro as its currency).

The fund holds about 244 securities in its basket, which is pretty

spread across each security, as no single firm holds more than 3.3%

of the assets. Country weights for the top three are France

(30.68%), Germany (30.18%) and Spain (10.68%) (read: Time for This

Top Ranked German ETF?).

From a sector look, the product is a bit tilted toward financials

at 22.29% while industrials, consumer discretionary and consumer

staples make a nice mix in the portfolio. EZU charges 0.49% in

expenses and is up over 21% so far this year.

Bottom Line

Given the current trends and increasing confidence in the Euro

zone, Europe might be due for a strong bounce and a broad play on

the region may be a good idea. This is especially true if investors

take a closer look at a few of the top ranked ETFs in the space for

excellent exposure and some more outperformance in the coming

months.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-EMU IDX (EZU): ETF Research Reports

FT-EUROPE AD (FEP): ETF Research Reports

SPDR-STX EU 50 (FEU): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

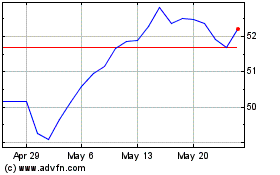

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From Oct 2024 to Nov 2024

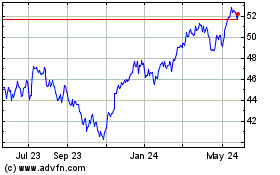

iShares MSCI Eurozone ETF (AMEX:EZU)

Historical Stock Chart

From Nov 2023 to Nov 2024