Cornerstone Strategic Value Fund, Inc. (NYSE American: CLM) (CUSIP:

21924B302) and Cornerstone Total Return Fund, Inc. (NYSE American:

CRF) (CUSIP: 21924U300), (individually the “Fund” or, collectively,

the “Funds”), each a closed-end management investment company,

announced that in keeping with each Fund’s previously adopted

monthly distribution policy, each Fund is declaring the following

distributions:

|

|

Record Date |

Payable Date |

Per Share |

| CLM |

October 15,

2024 |

October 31,

2024 |

$0.1086 |

| CLM |

November

15, 2024 |

November

29, 2024 |

$0.1086 |

| CLM |

December

16, 2024 |

December

31, 2024 |

$0.1086 |

|

|

|

|

|

| CRF |

October 15,

2024 |

October 31,

2024 |

$0.1037 |

| CRF |

November

15, 2024 |

November

29, 2024 |

$0.1037 |

| CRF |

December

16, 2024 |

December

31, 2024 |

$0.1037 |

|

|

|

|

|

Each Fund’s distribution policy provides for the

resetting of the monthly distribution amount per share

(“Distribution Amount”) annually, based on each Fund’s net asset

value on the last business day of October and the annualized

distribution percentage approved by the respective Board of

Directors (individually the “Board”, or collectively, the

“Boards”).

Distribution Percentage for

2025

Each Board today announced the distribution

percentage for the calendar year 2025 will remain at 21%, which

will be applied to the net asset value of each Fund as of the end

of October 2024 to determine the Distribution Amount for 2025. The

Distribution Percentage for 2025 is not a function of, nor is it

related to, the investment return on a Fund's portfolio.

The actual data which will determine the monthly

Distribution Amount for 2025 will not be known until the end of

October 2024. However, as an example, if the value of the net

assets and the number of shares outstanding were the same as those

on July 31, 2024, the monthly Distribution Amount for 2025 would be

reset from $0.1086 per share to $0.1240 per share for CLM and be

reset from $0.1037 per share to $0.1185 per share for CRF. The

actual Distribution Amount for each Fund for 2025 may be higher or

lower than those shown in the above examples.

Each Board believes each Fund’s distribution

policy maintains a stable, high rate of distribution. These

distributions are not tied to each Fund’s investment income or

capital gains and do not represent yield or investment return on

each Fund’s portfolio. The Distribution Amount from one calendar

year to the next will increase or decrease based on the change in

each Fund’s net asset value. The terms of each distribution policy

are reviewed and approved at least annually by each Fund’s Board

and may be modified at their discretion for the benefit of each

Fund and its stockholders.

Each Fund’s Board remains convinced its

stockholders are well served by a policy of regular distributions

which increase liquidity and provide flexibility to individual

stockholders in managing their investment in each Fund.

Stockholders have the option of reinvesting these distributions in

additional shares of their Fund or receiving them in cash.

Stockholders may consider reinvesting their regular distributions

through their Fund’s dividend reinvestment plan which may at times

provide additional benefit to stockholders who participate in their

Fund’s plan. Stockholders should carefully read the description of

the dividend reinvestment plan contained in each Fund's report to

stockholders.

Under each Fund’s distribution policy, each Fund

may distribute to stockholders each month a minimum fixed

percentage per year of the net asset value or market price per

share of its common stock or at least a minimum fixed dollar amount

per year. In determining to adopt this policy, the Board of each

Fund sought to make regular monthly distributions throughout the

year. Under each policy, each Fund’s distributions will consist

either of (1) earnings, (2) capital gains, or (3)

return-of-capital, or some combination of one or more of these

categories. A return-of-capital is the return of a portion of the

stockholder’s original investment.

Given the current economic environment and the

composition of each Fund’s portfolio, a portion of each Fund’s

distributions made during the current calendar year is expected to

consist of a return of the stockholder’s capital. Accordingly,

these distributions should not be confused with yield or investment

return on each Fund’s portfolio. The final composition of the

distributions for 2024 cannot be determined until after the end of

the year and is subject to change depending on market conditions

during the year and the magnitude of income and realized gains for

the year.

In any given year, there can be no guarantee

each Fund’s investment returns will exceed the amount of the net

distributions. To the extent the amount of distributions paid to

stockholders in cash exceeds the total net investment returns of

the Fund, the assets of a Fund will decline. If the total net

investment returns exceed the amount of cash distributions, the

assets of a Fund will increase. Distributions designated as

return-of-capital are not taxed as ordinary income dividends and

are referred to as tax-free dividends or nontaxable distributions.

A return-of-capital distribution reduces the cost basis of a

stockholder’s shares in the Fund. Stockholders can expect to

receive tax-reporting information for 2024 distributions by the

middle of February 2025 indicating the exact composition per share

of the distributions received during the calendar year.

Stockholders should consult their tax advisor for proper tax

treatment of each Fund’s distributions.

Volatility in the world economy helps to create

what Cornerstone Advisors, LLC (the “Adviser”) views as significant

opportunities through investments in closed-end funds. In addition

to holding closed-end funds which invest substantially all of their

assets in equity securities, the Adviser may also choose to take

advantage of situations in funds which invest in fixed income or

other investment categories. Closed-end funds, with their broadly

diversified holdings, enhance diversification within each Fund’s

portfolio.

Investing in other investment companies involves

substantially the same risks as investing directly in the

underlying instruments, but the total return on such investments at

the investment company level is reduced by the operating expenses

and fees of such other investment companies, including advisory

fees. To the extent each Fund invests its assets in investment

company securities, those assets will be subject to the risks of

the purchased investment company's portfolio securities, and a

stockholder in the Fund will bear not only their proportionate

share of the expenses of a Fund, but also, indirectly the expenses

of the purchased investment company. There can be no assurance the

investment objective of any investment company in which a Fund

invests will be achieved.

Under the managed distribution policy, each Fund

makes monthly distributions to stockholders at a rate which may

include periodic distributions of its net income and net capital

gains (“Net Earnings”), or from return-of-capital. If, for any

fiscal year where total cash distributions exceeded Net Earnings

(the "Excess"), the Excess would decrease each Fund's total assets

and, as a result, would have the likely effect of increasing each

Fund's expense ratio. There is a risk the total Net Earnings from

each Fund’s portfolio would not be great enough to offset the

amount of cash distributions paid to Fund stockholders. If this

were to occur, a Fund’s assets would be depleted, and there is no

guarantee a Fund would be able to replace the assets. In addition,

in order to make such distributions, a Fund may have to sell a

portion of its investment portfolio at a time when independent

investment judgment might not dictate such action. Furthermore,

such assets used to make distributions will not be available for

investment pursuant to the Fund’s investment objective.

Cornerstone Strategic Value Fund, Inc. and

Cornerstone Total Return Fund, Inc. are traded on the NYSE American

LLC under the trading symbols “CLM” and “CRF”, respectively. For

more information regarding each Fund please visit

www.cornerstonestrategicvaluefund.com and

www.cornerstonetotalreturnfund.com.

Past performance is no guarantee of future

performance. An investment in a Fund is subject to certain risks,

including market risk. In general, shares of closed-end funds often

trade at a discount from their net asset value and at the time of

sale may be trading on the exchange at a price which is more or

less than the original purchase price or the net asset value. A

stockholder should carefully consider a Fund’s investment

objective, risks, charges and expenses. Please read a Fund’s

disclosure documents before investing.

In addition to historical information, this

release contains forward-looking statements, which may concern,

among other things, domestic and foreign markets, industry and

economic trends and developments and government regulation and

their potential impact on a Fund’s investment portfolio. These

statements are subject to risks and uncertainties, including the

factors set forth in each Fund’s disclosure documents, filed with

the U.S. Securities and Exchange Commission, and actual trends,

developments and regulations in the future, and their impact on the

Fund could be materially different from those projected,

anticipated or implied. Each Fund has no obligation to update or

revise forward-looking statements.

Contact: (866) 668-6558

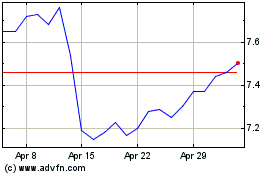

Cornerstone Strategic In... (AMEX:CLM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Cornerstone Strategic In... (AMEX:CLM)

Historical Stock Chart

From Feb 2024 to Feb 2025