Americas Gold and Silver Corporation (TSX: USA) (NYSE American:

USAS) (“Americas” or the “Company”), a growing North American

precious metals producer, reports consolidated financial and

operational results for the year ended December 31, 2022.

This earnings release should be read in conjunction with the

Company’s Management’s Discussion and Analysis, Financial

Statements and Notes to Financial Statements for the corresponding

period, which have been posted on the Americas Gold and Silver

Corporation SEDAR profile at www.sedar.com, and on its EDGAR

profile at www.sec.gov, and which are also available on the

Company’s website at www.americas-gold.com. All figures are in U.S.

dollars unless otherwise noted.

Highlights

- Revenue of $85.0 million, representing an increase of $40

million year-over-year.

- A net loss of $45.2 million for 2022, or an attributable loss

of $0.23 per share1, representing a decrease in net loss of $115.4

million compared to 2021.

- Adjusted net loss2 of $27.7 million in 2022, a decrease of $9.3

million from $37.0 million in 2021, after adjusting for one-time,

non-reoccurring items, primarily related to the Relief Canyon

mine.

- Net income from the Cosalá Operations and Galena Complex

operating segments increased by $15.3 million (+100%

year-over-year) in 2022 in aggregate compared to 2021.

- Cash costs of $0.77/oz silver produced3 and all-in sustaining

costs of $9.64/oz silver produced3 during the year. Cash costs per

ounce silver were lower than the guidance range of $4.00 to $5.00

per silver ounce.

- The Company previously reported 2022 consolidated attributable

production of approximately 5.3 million ounces of silver

equivalent4, including 1.3 million ounces of silver, 39.3 million

pounds of zinc and 24.6 million pounds of lead, exceeding the

silver equivalent guidance range of 4.8 to 5.2 million ounces.

- Production guidance for 2023 remains unchanged at 2.2-2.6

million silver ounces and 5.5-6.0 million silver equivalent ounces

at cash costs of $8.00-$9.00 per silver ounce.

“The Company is well positioned to benefit from the expected

production increase in 2023 and offers stakeholders substantial

silver optionality given the current global uncertainly,” stated

Americas President and CEO Darren Blasutti. “Though the 2022

financial results were disappointing, attributable silver

production is expected to increase by over 80% in 2023 compared

with 2022.”

Cosalá Operations

The Cosalá Operations had a successful year in fiscal 2022 as

production increased significantly following the resolution of the

illegal blockade. The operations reopened in September 2021 with

commercial production re-established in December 2021. The Cosalá

Operations produced approximately 636,000 ounces of silver, 39.3

million pounds of zinc and 15.3 million pounds of lead in 2022. The

Los Braceros processing plant treated 585,270 tonnes. Cash costs

and all-in sustaining costs were negative $19.03 per silver ounce

and negative $11.26 per silver ounce, respectively, benefitting

from strong zinc and lead production and base metal prices.

Production during 2022 initially focused on maximizing near-term

free cash flow by mining high-grade zinc areas of the Main Zone

which were fully developed prior to the illegal blockade. The

Company continued to focus on mining the higher-grade zinc areas of

the Main Zone to maximize revenue generated from the Cosalá

Operations during the year. As a result, base metal production

exceeded the upper end of the 2022 guidance range while silver

production was slightly below the bottom end of the range. The

second half of the fourth quarter saw higher silver production as

the mining rate increased in the higher-grade silver Upper

Zone.

Silver production from the Cosalá Operations in 2023 is expected

to be between 1.2 – 1.4 million ounces, benefitting from more

production from the higher-grade silver areas in the Upper Zone of

the San Rafael mine. Zinc production from the Cosalá Operations is

expected to be approximately 33 – 37 million pounds while lead

production is expected to be 11 – 13 million pounds.

Galena Complex

Galena’s Recapitalization Plan is proceeding well with the

Galena Complex 2022 production increasing to 1,120,000 ounces (100%

basis) or 11% higher year-over-year silver production compared to

2021. Lead production for the year was within expectations while

silver production was slightly below the lower end of the guidance

range due to the weaker than expected production in late Q3-2022

due to poor quality cemented backfill which required remedial work

on the effected stopes. Silver production in December 2022 was the

highest of any month during the calendar year as the operation

began accessing higher grade silver stopes including a new area on

the 3700 Level.

The Company successfully installed the major components of the

Galena hoist prior to year-end. Shaft repair will commence

following completion of electrical work and commissioning. Once it

becomes fully operational, which is expected to occur by the end of

Q2-2023, the Galena hoist will increase hoisting capacity at the

Galena Complex, support plans to increase production and improve

operational flexibility. Cash costs per silver ounce at the Galena

Complex are also anticipated to decrease with the completion of the

Galena replacement hoist as the benefits of scaling economies on

the existing cost base with higher grade silver ore are

realized.

Attributable silver production to the Company from the Galena

Complex (60% owned by Americas) in 2023 is expected to be between

1.0 – 1.2 million silver ounces benefitting from a full year of

production from higher grade ore on the 3700 Level. Attributable

lead production is expected to be between 11 – 13 million pounds.

The Galena Complex attributable production for 2022 was 672,000

ounces of silver and 9.3 million pounds of lead.

About Americas Gold and Silver Corporation

Americas Gold and Silver Corporation is a high-growth precious

metals mining company with multiple assets in North America. The

Company owns and operates the Relief Canyon mine in Nevada, USA,

the Cosalá Operations in Sinaloa, Mexico and manages the 60%-owned

Galena Complex in Idaho, USA. The Company also owns the San Felipe

development project in Sonora, Mexico. For further information,

please see SEDAR or www.americas-gold.com.

Technical Information and Qualified Persons

The scientific and technical information relating to the

operation of the Company’s material operating mining properties

contained herein has been reviewed and approved by Daren Dell,

P.Eng., Chief Operating Officer of the Company. The Company’s

current Annual Information Form and the NI 43-101 Technical Reports

for its other material mineral properties, all of which are

available on SEDAR at www.sedar.com, and EDGAR at www.sec.gov

contain further details regarding mineral reserve and mineral

resource estimates, classification and reporting parameters, key

assumptions and associated risks for each of the Company’s material

mineral properties, including a breakdown by category.

All mining terms used herein have the meanings set forth in

National Instrument 43-101 – Standards of Disclosure for Mineral

Projects (“NI 43-101”), as required by Canadian securities

regulatory authorities. These standards differ from the

requirements of the SEC that are applicable to domestic United

States reporting companies. Any mineral reserves and mineral

resources reported by the Company in accordance with NI 43-101 may

not qualify as such under SEC standards. Accordingly, information

contained in this news release may not be comparable to similar

information made public by companies subject to the SEC’s reporting

and disclosure requirements.

Cautionary Statement on Forward-Looking Information:

This news release contains “forward-looking information” within

the meaning of applicable securities laws. Forward-looking

information includes, but is not limited to: any objectives,

expectations, intentions, plans, results, levels of activity, goals

or achievements; the timing and amount of estimated future

production, production guidance, costs of production, capital

expenditures, costs and timing of development; the success of

exploration and development activities; statements regarding the

Galena Complex Recapitalization Plan, including with respect to

underground development improvements, equipment procurement and the

high-grade Phase II extension exploration drilling program and

expected results thereof and completion of the Galena hoist project

on its expected schedule and updated budget, and the realization of

the anticipated benefits therefrom; Company's Cosalá Operations,

including expected production levels; the ability of the Company to

target higher-grade silver ores at the Cosalá Operations;

statements relating to the future financial condition, assets,

liabilities (contingent or otherwise), business, operations or

prospects of the Company; and other events or conditions that may

occur in the future. Inherent in the forward-looking statements are

known and unknown risks, uncertainties and other factors beyond the

Company's ability to control or predict that may cause the actual

results, performance or achievements of the Company, or

developments in the Company's business or in its industry, to

differ materially from the anticipated results, performance,

achievements or developments expressed or implied by such

forward-looking statements.

Often, but not always, forward-looking information can be

identified by forward-looking words such as “anticipate”,

“believe”, “expect”, “goal”, “plan”, “intend”, “potential’,

“estimate”, “may”, “assume” and “will” or similar words suggesting

future outcomes, or other expectations, beliefs, plans, objectives,

assumptions, intentions, or statements about future events or

performance. Forward-looking information is based on the opinions

and estimates of Americas Gold and Silver as of the date such

information is provided and is subject to known and unknown risks,

uncertainties, and other factors that may cause the actual results,

level of activity, performance, or achievements of Americas Gold

and Silver to be materially different from those expressed or

implied by such forward-looking information. With respect to the

business of Americas Gold and Silver, these risks and uncertainties

include: risks associated with market fluctuations in commodity

prices; risks associated with generally elevated inflation; risks

related to changing global economic conditions and market

volatility, risks relating to geopolitical instability, political

unrest, war, and other global conflicts may result in adverse

effects on macroeconomic conditions, including volatility in

financial markets, adverse changes in trade policies, inflation,

supply chain disruptions, any or all of which may affect the

Company's results of operations and financial condition; the

Company’s dependence on the success of its Cosalá Operations,

including the San Rafael project, the Galena Complex and the Relief

Canyon mines, which are exposed to operational risks and other

risks, including certain development and exploration related risks,

as applicable; risks related to mineral reserves and mineral

resources, development and production and the Company's ability to

sustain or increase present production; risks related to global

financial and economic conditions; risks related to government

regulation and environmental compliance; risks related to mining

property claims and titles, and surface rights and access; risks

related to labour relations, disputes and/or disruptions, employee

recruitment and retention and pension funding and valuation; some

of the Company's material properties are located in Mexico and are

subject to changes in political and economic conditions and

regulations in that country; risks related to the Company's

relationship with the communities where it operates; risks related

to actions by certain non-governmental organizations; substantially

all of the Company's assets are located outside of Canada, which

could impact the enforcement of civil liabilities obtained in

Canadian and U.S. courts; risks related to currency fluctuations

that may adversely affect the financial condition of the Company;

the Company may need additional capital in the future and may be

unable to obtain it or to obtain it on favourable terms; risks

associated with the Company's outstanding debt and its ability to

make scheduled payments of interest and principal thereon; risks

associated with any hedging activities of the Company; risks

associated with the Company's business objectives; risks relating

to mining and exploration activities and future mining operations;

operational risks and hazards inherent in the mining industry;

risks related to competition in the mining industry; risks relating

to negative operating cash flows; risks relating to the possibility

that the Company’s working capital requirements may be higher than

anticipated and/or its revenue may be lower than anticipated over

relevant periods; and risks relating to climate change and the

legislation governing it. Although the Company has attempted to

identify important factors that could cause actual results to

differ materially from those contained in forward-looking

information, there may be other factors that cause results not to

be as anticipated, estimated, or intended. Readers are cautioned

not to place undue reliance on such information. Additional

information regarding the factors that may cause actual results to

differ materially from this forward-looking information is

available in Americas Gold and Silver’s filings with the Canadian

Securities Administrators on SEDAR and with the SEC. Americas Gold

and Silver does not undertake any obligation to update publicly or

otherwise revise any forward-looking information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law. Americas

Gold and Silver does not give any assurance that Americas Gold and

Silver will achieve its expectations, or concerning the result or

timing thereof. All subsequent written and oral forward‐looking

information concerning Americas Gold and Silver are expressly

qualified in their entirety by the cautionary statements above.

1 The Company uses the financial measure “net loss per share”

because it understands that, in addition to conventional measures

prepared in accordance with IFRS, certain investors and analysts

use this information to evaluate the Company’s liquidity,

operational efficiency, and short-term financial health.

Net loss per share is consolidated net loss divided by the

weighted average number of common shares outstanding during the

period.

Reconciliation of Net Loss per

Share

2022

2021

Consolidated net loss ('000)

$(45,187)

$(160,576)

Divided by weighted average number of

common shares outstanding

184,416,034

141,887,984

Net loss per share

$(0.25)

$(1.13)

2 This metric is a non-GAAP financial measure or ratio. The

Company uses the financial measure “adjusted net loss” because it

understands that, in addition to conventional measures prepared in

accordance with IFRS, certain investors and analysts use this

information to evaluate the Company’s profitability. The

presentation of adjusted net loss is not meant to be a substitute

for the net loss presented in accordance with IFRS, but rather

should be evaluated in conjunction with such IFRS measure. Adjusted

net loss is net loss with certain non-cash items backed-out (i.e.

impairment to property, plant and equipment, write-downs to

inventory, and loss related to the fair value of financial

instruments).

Reconciliation of Adjusted Net

Loss

2022

2021

Consolidated net loss ('000)

$45,187

$160,576

Less impairment to property, plant and

equipment from Relief Canyon ('000)

(13,440)

(55,623)

Less Relief inventory write-downs from

lowering expected gold recoveries ('000)

-

(24,780)

Less Relief inventory write-downs to net

realizable value ('000)

(7,658)

(15,127)

Less loss on metals contract liability

('000)

(657)

(20,780)

Less care and maintenance costs from

Cosalá Operations ('000)

-

(7,309)

Add gain on government loan forgiveness

('000)

4,277

-

Adjusted net loss ('000)

$27,709

$36,957

3 This metric is a non-GAAP financial measure or ratio. The

Company uses the financial measures “Cash Costs”, “Cash Costs/Ag Oz

Produced”, “All-In Sustaining Costs”, and “All-In Sustaining

Costs/Ag Oz Produced” in accordance with measures widely reported

in the silver mining industry as a benchmark for performance

measurement and because it understands that, in addition to

conventional measures prepared in accordance with IFRS, certain

investors and analysts use this information to evaluate the

Company’s underlying cash costs and total costs of operations. Cash

costs are determined on a mine-by-mine basis and include mine site

operating costs such as mining, processing, administration,

production taxes and royalties which are not based on sales or

taxable income calculations, while all-in sustaining costs is the

cash costs plus all development, capital expenditures, and

exploration spending.

Reconciliation of Consolidated Cash

Costs/Ag Oz Produced1

2022

20212,3

Cost of sales ('000)

$64,340

$3,605

Less cost of sales during illegal blockade

('000)

-

(1,071)

Adjusted cost of sales ('000)

$64,340

$2,534

Less non-controlling interests portion

('000)

(12,388)

-

Attributable cost of sales ('000)

51,952

2,534

Non-cash costs ('000)

(1,723)

160

Direct mining costs ('000)

$50,229

$2,694

Smelting, refining and royalty expenses

('000)

24,050

1,857

Less by-product credits ('000)

(73,274)

(5,406)

Cash costs ('000)

$1,005

$(855)

Divided by silver produced (oz)

1,308,201

46,128

Cash costs/Ag oz produced ($/oz)

$0.77

$(18.53)

Reconciliation of Cosalá Operations

Cash Costs/Ag Oz Produced

2022

20212,3

Cost of sales ('000)

$33,371

$3,605

Less cost of sales during illegal blockade

('000)

-

(1,071)

Adjusted cost of sales ('000)

$33,371

$2,534

Non-cash costs ('000)

(1,348)

160

Direct mining costs ('000)

$32,023

$2,694

Smelting, refining and royalty expenses

('000)

20,580

1,857

Less by-product credits ('000)

(64,710)

(5,406)

Cash costs ('000)

$(12,107)

$(855)

Divided by silver produced (oz)

636,246

46,128

Cash costs/Ag oz produced ($/oz)

$(19.03)

$(18.53)

Reconciliation of Galena Complex Cash

Costs/Ag Oz Produced

2022

20212,3

Cost of sales ('000)

$30,969

-

Non-cash costs ('000)

(625)

-

Direct mining costs ('000)

$30,344

-

Smelting, refining and royalty expenses

('000)

5,784

-

Less by-product credits ('000)

(14,274)

-

Cash costs ('000)

$21,854

-

Divided by silver produced (oz)

1,119,925

-

Cash costs/Ag oz produced ($/oz)

$19.51

-

Reconciliation of Consolidated All-In

Sustaining Costs/Ag Oz Produced 1

2022

20212,3

Cash costs ('000)

$1,005

$(855)

Capital expenditures ('000)

9,031

120

Exploration costs ('000)

2,569

58

All-in sustaining costs ('000)

$12,605

$(677)

Divided by silver produced (oz)

1,308,201

46,128

All-in sustaining costs/Ag oz produced

($/oz)

$9.64

$(14.67)

Reconciliation of Cosalá Operations

All-In Sustaining Costs/Ag Oz Produced

2022

20212,3

Cash costs ('000)

$(12,107)

$(855)

Capital expenditures ('000)

3,649

120

Exploration costs ('000)

1,296

58

All-in sustaining costs ('000)

$(7,162)

$(677)

Divided by silver produced (oz)

636,246

46,128

All-in sustaining costs/Ag oz produced

($/oz)

$(11.26)

$(14.67)

Reconciliation of Galena Complex All-In

Sustaining Costs/Ag Oz Produced

2022

20212,3

Cash costs ('000)

$21,854

-

Capital expenditures ('000)

8,970

-

Exploration costs ('000)

2,122

-

All-in sustaining costs ('000)

$32,946

-

Galena Complex Recapitalization Plan costs

('000)

6,608

-

All-in sustaining costs with Galena

Recapitalization Plan ('000)

$39,554

-

Divided by silver produced (oz)

1,119,925

-

All-in sustaining costs/Ag oz produced

($/oz)

$29.42

-

All-in sustaining costs with Galena

Recapitalization Plan/Ag oz produced ($/oz)

$35.32

-

1 Throughout this press release, consolidated production results

and consolidated operating metrics are based on the attributable

ownership percentage of each operating segment (100% Cosalá

Operations and 60% Galena Complex).

2 Production results are nil for the Cosalá Operations from

Q2-2020 through Q3-2021 due to it being placed under care and

maintenance effective February 2020 as a result of the illegal

blockade and exclude the Galena Complex due to suspension of

certain operating metrics during the Galena Recapitalization Plan

implementation.

3 Cost per ounce measurements during fiscal 2021 were based on

operating results starting from December 1, 2021 following return

to nameplate production of the Cosalá Operations. Throughout this

press release, all other production results from the Cosalá

Operations during fiscal 2021 were determined based on total

production during the year.

4 Silver equivalent ounces for 2022 and 2021 were calculated

based on all metals production at average realized silver, zinc,

and lead prices during each respective period throughout this press

release. Silver equivalent ounces for the 2023 guidance and 2024

outlook references were calculated based on $22.00/oz silver,

$1.45/lb zinc, $1.00 /lb lead, and $3.75/lb copper throughout this

press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230315005829/en/

Stefan Axell VP, Corporate Development & Communications

Americas Gold and Silver Corporation 416-874-1708

Darren Blasutti President and CEO Americas Gold and Silver

Corporation 416‐848‐9503

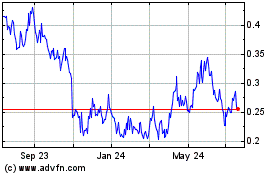

Americas Gold and Silver (AMEX:USAS)

Historical Stock Chart

From Oct 2024 to Nov 2024

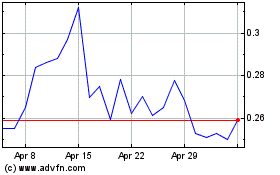

Americas Gold and Silver (AMEX:USAS)

Historical Stock Chart

From Nov 2023 to Nov 2024