Form N-CSRS - Certified Shareholder Report, Semi-Annual

July 08 2024 - 4:56PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

| Investment Company Act file number: |

811-06342 |

| |

|

| Exact name of registrant as specified in charter: |

abrdn

Global Income Fund, Inc. |

| |

|

| Address of principal executive offices: |

1900 Market Street, Suite 200 |

| |

Philadelphia, PA 19103 |

| |

|

| Name and address of agent for service: |

Sharon Ferrari |

| |

abrdn Inc. |

|

1900 Market Street, Suite 200 |

| |

Philadelphia, PA 19103 |

|

|

| Registrant’s telephone number, including area code: |

1-800-522-5465 |

| |

|

| Date of fiscal year end: |

October 31 |

| |

|

| Date of reporting period: |

April 30, 2024 |

Item 1. Reports to Stockholders.

(a) A copy of the report transmitted to shareholders

pursuant to Rule 30e-1 under the Investment Company Act of 1940 (the “1940 Act”) is filed herewith.

abrdn Global Income Fund, Inc. (FCO)

Semi-Annual Report

April 30, 2024

Letter to Shareholders (unaudited)

Dear Shareholder,

We present the Semi-Annual

Report, which covers the activities of abrdn Global Income Fund, Inc. (the “Fund”), for the six-month period ended April 30, 2024. The Fund’s principal investment objective is to provide high

current income by investing primarily in fixed income securities. As a secondary investment objective, the Fund seeks capital appreciation, but only when consistent with its principal investment objective.

Total Investment Return1

For the six-month period

ended April 30, 2024, the total return to shareholders of the Fund based on the net asset value (“NAV”) and market price of the Fund, respectively, compared to the Fund’s benchmark is

as follows:

| NAV2,3

| 8.95%

|

| Market Price2

| -2.66%

|

| Blended Benchmark4

| 7.97%

|

For more information about

Fund performance, please visit the Fund on the web at www.abrdnfco.com. Here, you can view quarterly commentary on the Fund's performance, monthly fact sheets, distribution and performance information, and other Fund

literature.

NAV, Market Price and

Premium(+)/Discount(-)

The below table represents

comparison from current six-month period end to prior fiscal year end of market price to NAV and associated Premium(+) and Discount(-).

|

|

|

|

|

|

| NAV

| Closing

Market

Price

| Premium(+)/

Discount(-)

|

| 4/30/2024

| $3.76

| $5.47

| 45.48%

|

| 10/31/2023

| $3.74

| $6.09

| 62.83%

|

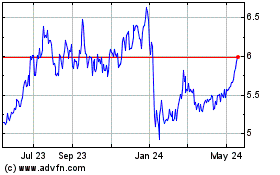

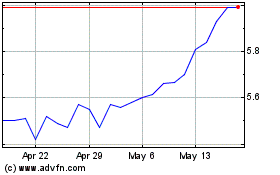

During the six-month period

ended April 30, 2024, the Fund’s NAV was within a range of $3.75 to $4.05 and the Fund’s market price

traded within a range of $4.93 to $6.63.

During the six-month period ended April 30, 2024, the Fund’s shares traded within a range of a premium(+)/discount(-) of +25.77% to +65.33%.

Managed Distribution Policy

The Fund's distributions to

common shareholders and the annualized distribution rates based on market price and NAV, respectively, for the six-month period ended April 30, 2024 and the fiscal years ended October 31, 2023 and October 31, 2022 are

shown in the table below:

|

| Distribution

per share to

common

shareholders

| Market

Price

| Annualized

distribution

rate

based on

market price

| NAV

| Annualized

distribution

rate

based on

NAV

|

| 4/30/2024

| $0.42

| $5.47

| 15.4%

| $3.76

| 22.3%

|

| 10/31/2023

| $0.84

| $6.09

| 13.8%

| $3.74

| 22.5%

|

| 10/31/2022

| $0.84

| $4.50

| 18.7%

| $3.98

| 21.1%

|

Since all distributions are

paid after deducting applicable withholding taxes, the effective distribution rate may be higher for those U.S. investors who are able to claim a tax credit.

On May 9, 2024 and June 11,

2024, the Fund announced that it will pay on May 31, 2024 and June 28, 2024, respectively, a distribution of U.S. $0.07 per share to all shareholders of record as of May 23, 2024 and June 21, 2024, respectively.

The Fund’s policy is to

provide investors with a stable monthly distribution out of current income, supplemented by realized capital gains and, to the extent necessary, paid-in capital, which is a non-taxable return of capital. This policy

is subject to an annual review as well as regular review at the quarterly meetings of the Fund’s Board of Directors (the "Board"), unless market conditions require an earlier evaluation.

Revolving Credit Facility

The Fund’s $25,000,000

revolving credit facility with The Bank of Nova Scotia was renewed for a 1-year term on February 27, 2024 (“Revolving Credit Facility”). On February 27, 2024, the Fund’s Revolving Credit Facility

with the Bank of Nova Scotia was amended to extend the scheduled commitment termination date to

{foots1}

| 1

| Past performance is no guarantee of future results. Investment returns and principal value will fluctuate and shares, when sold, may be worth more or less than original cost. Current performance may be

lower or higher than the performance quoted. Net asset value return data include investment management fees, custodial charges and administrative fees (such as Director and legal fees) and assumes the reinvestment of

all distributions.

|

{foots1}

| 2

| Assuming the reinvestment of dividends and distributions.

|

{foots1}

| 3

| The Fund’s total return is based on the reported NAV for each financial reporting period end and may differ from what is reported on the Financial Highlights due to financial statement rounding or adjustments.

|

{foots1}

| 4

| Blended Benchmark as defined in Total Investment Return section on Page 4.

|

| abrdn Global Income Fund, Inc.

| 1

|

Letter to Shareholders (unaudited) (concluded)

February 25, 2025. The Fund’s

outstanding balance as of April 30, 2024 was $22,050,000. Under the terms of the loan facility and applicable regulations, the Fund is required to maintain certain asset coverage ratios for the amount of its

outstanding borrowings. The Board regularly reviews the use of leverage by the Fund. The Fund is also authorized to use reverse repurchase agreements as another form of leverage. A more detailed description of the

Fund’s Revolving Credit Facility can be found in the Notes to Financial Statements.

Unclaimed Share Accounts

Please be advised that

abandoned or unclaimed property laws for certain states require financial organizations to transfer (escheat) unclaimed property (including Fund shares) to the state. Each state has its own definition of unclaimed

property, and Fund shares could be considered “unclaimed property” due to account inactivity (e.g., no owner-generated activity for a certain period), returned mail (e.g., when mail sent to

a shareholder is returned to the Fund's transfer agent as undeliverable), or a combination of both. If your Fund shares are categorized as unclaimed, your financial advisor or the Fund's transfer agent will

follow the applicable state’s statutory requirements to contact you, but if unsuccessful, laws may require that the shares be escheated to the appropriate state. If this happens, you will have to contact the

state to recover your property, which may involve time and expense. For more information on unclaimed property and how to maintain an active account, please contact your financial adviser or the Fund's transfer

agent.

Open Market Repurchase Program

The Board approved an open

market repurchase and discount management policy (the “Program”). The Program allows the Fund to purchase, in the open market, its outstanding common shares, with the amount and timing of any repurchase

determined at the discretion of the Fund's investment manager. Such purchases may be made opportunistically at certain discounts to NAV per share in the reasonable judgment of management based on historical discount

levels and current market conditions. If shares are repurchased, the Fund reports repurchase activity on its website on a monthly basis. For the six-month period ended April 30, 2024, the Fund did not repurchase

any shares through the Program.

On a quarterly basis, the

Board will receive information on any transactions made pursuant to this policy during the prior quarter and if shares are repurchased management will post the number of shares repurchased on its website on a

monthly basis. Under the terms of the Program, the Fund is permitted to repurchase up to 10% of its outstanding shares of common stock in the open market during any 12 month period.

Portfolio Holdings Disclosure

The Fund's complete schedule

of portfolio holdings for the second and fourth quarters of each fiscal year are included in the Fund's semi-annual and annual reports to shareholders. The Fund files its complete schedule of portfolio holdings with

the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. These reports are available on the SEC’s website

at http://www.sec.gov. The Fund makes the information available to shareholders upon request and without charge by calling Investor Relations toll-free at 1-800-522-5465.

Proxy Voting

A description of the policies

and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12 month

period ended June 30 is available by August 31 of the relevant year: (1) upon request without charge by calling Investor Relations toll-free at 1-800-522-5465; and (2) on the SEC’s website at

http://www.sec.gov.

Investor Relations Information

As part of abrdn’s

commitment to shareholders, we invite you to visit the Fund on the web at www.abrdnfco.com. Here, you can view monthly fact sheets, quarterly commentary, distribution and performance information, and other Fund

literature.

Enroll in abrdn’s email

services and be among the first to receive the latest closed-end fund news, announcements, videos, and other information. In addition, you can receive electronic versions of important Fund documents, including annual

reports, semi-annual reports, prospectuses and proxy statements. Sign up today at https://www.abrdn.com/en-us/cefinvestorcenter/contact-us/preferences

Contact Us:

| •

| Visit: https://www.abrdn.com/en-us/cefinvestorcenter

|

| •

| Email: Investor.Relations@abrdn.com; or

|

| •

| Call: 1-800-522-5465 (toll free in the U.S.).

|

Yours sincerely,

/s/ Christian Pittard

Christian Pittard

President

{foots1}

All amounts are U.S.

Dollars unless otherwise stated.

| 2

| abrdn Global Income Fund, Inc.

|

Loan Facilities and the Use of Leverage

(unaudited)

Loan Facilities and the Use of Leverage

The Fund utilizes leverage to

seek to increase the yield for its shareholders. The amounts borrowed from the Fund’s loan facility may be invested to seek to return higher rates than the rates in the Fund’s portfolio. However, the cost

of leverage could exceed the income earned by the Fund on the proceeds of such leverage. To the extent that the Fund is unable to invest the proceeds from the use of leverage in assets which pay interest at a rate

which exceeds the rate paid on the leverage, the yield on the Fund’s common stock will decrease. In addition, in the event of a general market decline in the value of assets in which the Fund invests, the effect

of that decline will be magnified in the Fund because of the additional assets purchased with the proceeds of the leverage. Non-recurring expenses in connection with the implementation of the loan facility will reduce

the Fund’s performance.

The Fund’s leveraged

capital structure creates special risks not associated with unleveraged funds having similar investment objectives and policies. The funds borrowed pursuant to the loan facility may constitute a substantial lien and

burden by reason of their prior claim against the income of the Fund and against the net assets of the Fund in liquidation. The Fund is not permitted to declare dividends or other distributions in the event of default

under the loan facility. In the event of default under the loan facility, the lender has the right to cause a liquidation of the collateral (i.e., sell portfolio securities and other assets of the Fund) and, if any

such default is not cured, the lender may be able to control the liquidation as well. A liquidation of the Fund’s collateral assets in an event of default, or a voluntary paydown of the loan facility in order to

avoid an event of default, would typically involve administrative expenses and sometimes penalties. Additionally, such liquidations often involve selling off of portions of the Fund’s assets at inopportune times

which can result in losses when markets are unfavorable. The loan facility has a term of three years and is not a perpetual form of leverage; there can be no assurance that the loan facility will be available for

renewal on acceptable terms, if at all.

The credit agreement

governing the loan facility includes usual and customary covenants for this type of transaction. These covenants impose on the Fund asset coverage requirements, Fund composition requirements and limits on certain

investments, such as illiquid investments, which are more stringent than those imposed on the Fund by the Investment Company Act of 1940, as amended (the “1940 Act”). The covenants or guidelines could

impede management of the Fund from fully managing the Fund’s portfolio in accordance with the Fund’s investment objective and policies.

Furthermore, non-compliance

with such covenants or the occurrence of other events could lead to the cancellation of the loan facility. The

covenants also include a requirement that the

Fund maintain net assets of no less than $25,000,000.

Prices and availability of

leverage are extremely volatile in the current market environment. The Board regularly reviews the use of leverage by the Fund and may explore other forms of leverage. The Fund is authorized to use reverse repurchase

agreements as another form of leverage. A reverse repurchase agreement involves the sale of a security, with an agreement to repurchase the same or substantially similar securities at an agreed upon price and date.

Whether such a transaction produces a gain for the Fund depends upon the costs of the agreements and the income and gains of the securities purchased with the proceeds received from the sale of the security. If the

income and gains on the securities purchased fail to exceed the costs, the Fund’s NAV will decline faster than otherwise would be the case. Reverse repurchase agreements, as with any leveraging techniques, may

increase the Fund’s return; however, such transactions also increase the Fund’s risks in down markets. Under the Fund's loan facilities, the Fund is charged interest on amounts borrowed at a variable rate,

which may be based on a reference rate such as the Secured Overnight Financing Rate ("SOFR”), plus a spread. Additionally, the Fund may invest in certain debt securities, derivatives or other financial

instruments that utilize SOFR as a “benchmark” or “reference rate” for various interest rate calculations.

Interest Rate Swaps

The Fund enters into interest

rate swaps to hedge interest rate risk on the credit facility. As of April 30, 2024, the Fund held interest rate swap agreements with an aggregate notional amount of$22,050,000 which represented 100% of the

Fund’s total borrowings. Under the terms of the agreements currently in effect, the Fund receives a floating rate of interest and pays fixed rates of interest for the terms and based upon the

notional amounts set forth below:

Remaining

Term as of

April 30, 2024

| Receive/(Pay)

Floating

Rate

| Amount

(in $ thousands)

| Fixed Rate

Payable (%)

|

| 70 months

| Receive

| $5,000.0

| 3.46%

|

| 94 months

| Receive

| $5,000.0

| 3.40%

|

| 106 months

| Receive

| $7,350.0

| 3.38%

|

| 110 months

| Receive

| $3,000.0

| 3.72%

|

| 118 months

| Receive

| $1,700.0

| 3.92%

|

| abrdn Global Income Fund, Inc.

| 3

|

Total Investment Return (unaudited)

The following table summarizes

the average annual Fund performance compared to the Fund’s blended benchmark and the Bloomberg Global Aggregate Index for the six-month (not annualized), 1-year, 3-year, 5-year and 10-year periods

ended April 30, 2024.

|

| 6 Months

| 1 Year

| 3 Years

| 5 Years

| 10 Years

|

| Net Asset Value (NAV)

| 8.95%

| 6.77%

| -4.77%

| -1.57%

| -0.15%

|

| Market Price

| -2.66%

| 25.92%

| -0.15%

| 5.41%

| 4.33%

|

| Blended Benchmark*

| 7.97%

| 4.28%

| -2.59%

| 0.86%

| 1.28%

|

| Bloomberg Global Aggregate Index1

| 4.43%

| -2.47%

| -5.93%

| -1.61%

| -0.44%

|

| *

| The blended benchmark is summarized in the table below:

|

| Blended Benchmark Constituents

| Weight

|

| ICE BofA Merrill Lynch Australian Government Bond Index2

| 10.0%

|

| ICE BofA Merrill Lynch New Zealand Government Bond Index3

| 5.0%

|

| iBoxx Asia Government (U.S. dollar unhedged)4

| 25.0%

|

| J.P. Morgan Emerging Markets Bond (EMBI) Global Diversified Index5

| 35.0%

|

| ICE BofA Global High Yield Constrained Index6

| 25.0%

|

Performance of a $10,000

Investment (as of April 30, 2024)

This graph shows the change in

value of a hypothetical investment of $10,000 in the Fund for the periods indicated. For comparison, the same investment is shown in the indicated index.

{foots1}

| 1

| The Bloomberg Global Aggregate Index is a measure of global investment grade debt from 24 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and

securitized fixed-rate bonds from both developed and emerging markets issuers.

|

{foots1}

| 2

| The ICE BofA Merrill Lynch Australian Government Bond Index tracks the performance of AUD denominated sovereign debt publicly issued by the Australian government in its domestic market.

|

{foots1}

| 3

| The ICE BofA Merrill Lynch New Zealand Government Bond Index tracks the performance of NZD denominated sovereign debt publicly issued by the New Zealand government in its domestic market.

|

{foots1}

| 4

| The iBoxx Asia Government (U.S. dollar unhedged) tracks the performance of local currency-denominated sovereign and quasi-sovereign debt from 11 Asian countries/territories.

|

{foots1}

| 5

| The J.P. Morgan Emerging Markets Bond (EMBI) Global Diversified Index is a comprehensive global local emerging markets index comprising liquid, fixed rate, domestic currency government bonds.

|

{foots1}

| 6

| The ICE BofA Global High Yield Constrained Index contains all securities in the ICE BofA Global High Yield Index but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on

their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a

pro-rata basis.

|

| 4

| abrdn Global Income Fund, Inc.

|

Total Investment Return (unaudited) (concluded)

abrdn Inc. has entered into

an agreement with the Fund to limit investor relations services fees, without which performance would be lower. This agreement aligns with the term of the advisory agreement and may not be terminated prior to the

end of the current term of the advisory agreement. See Note 3 in the Notes to Financial Statements.

Returns represent past

performance. Total investment return at NAV is based on changes in the NAV of Fund shares and assumes reinvestment of dividends and distributions, if any, at market prices pursuant to the dividend reinvestment program

sponsored by the Fund’s transfer agent. All return data at NAV includes fees charged to the Fund, which are listed in the Fund’s Statement of Operations under “Expenses.” Total investment

return at market value is based on changes in the market price at which the Fund’s shares traded on the NYSE American during the period and assumes reinvestment of dividends and distributions, if any, at market

prices pursuant to the dividend reinvestment program sponsored by the Fund’s transfer agent. The Fund’s total investment return is based on the reported NAV as of the financial reporting period end date of

April 30, 2024. Because the Fund’s shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on both market

price and NAV. Past performance is no guarantee of future results. The performance information provided does not reflect the deduction of taxes that a shareholder would pay on distributions received

from the Fund. The current performance of the Fund may be lower or higher than the figures shown. The Fund’s yield, return, market price and NAV will fluctuate. Performance information current to the most recent

month-end is available at www.abrdnfco.com or by calling 800-522-5465.

The annualized net operating

expense ratio, excluding fee waivers, based on the six-month period ended April 30, 2024, was 5.07%. The annualized net operating expense ratio net of fee waivers based on the six-month period ended April 30, 2024 was

5.01%. The annualized net operating expense ratio, net of fee waivers and excluding interest expense based on the six-month period ended April 30, 2024, was 2.36%.

| abrdn Global Income Fund, Inc.

| 5

|

Portfolio Composition (as a percentage of net assets) (unaudited)

As of April 30, 2024

Quality of Investments(1)(2)

As of April 30, 2024, 10.8%

of the Fund’s investments were invested in securities where either the issue or the issuer was rated “A” or better by S&P Global Ratings ("S&P"), Moody's Investors Service, Inc. ("Moody's")

or Fitch Ratings, Inc. ("Fitch") or, if unrated, was judged to be of equivalent quality by abrdn Asia Limited (the “Investment Manager”). The following table shows the ratings of securities held by the

Fund as of April 30, 2024, compared with October 31, 2023 and April 30, 2023:

| Date

| AAA/Aaa

%

| AA/Aa

%

| A

%

| BBB/Baa

%

| BB/Ba

%

| B

%

| B or below

%

| NR

%

|

| April 30, 2024

| 0.0

| 2.2

| 8.6

| 20.1

| 28.9

| 29.5

| 7.4

| 3.3

|

| October 31, 2023

| 0.5

| 3.1

| 3.6

| 27.2

| 29.8

| 25.4

| 8.1

| 2.3

|

| April 30, 2023

| 1.6

| 2.2

| 5.0

| 24.4

| 31.9

| 20.2

| 6.6

| 8.1

|

Geographic Composition(2)

The Fund’s investments

are divided into three categories: Developed Markets, Investment Grade Developing Markets and Sub-Investment Grade Developing Markets. The table below shows the geographical composition (with U.S. Dollar-denominated

bonds issued by foreign issuers allocated into country of issuance) of the Fund’s total investments as of April 30, 2024, compared with October 31, 2023 and April 30, 2023:

| Date

| Developed Markets

%

| Investment Grade

Developing Markets

%

| Sub-Investment Grade

Developing Markets

%

|

| April 30, 2024

| 47.6

| 19.8

| 32.6

|

| October 31, 2023

| 49.9

| 20.8

| 29.3

|

| April 30, 2023

| 51.2

| 21.6

| 27.2

|

Currency Composition(2)

The table below shows the

currency composition of the Fund’s total investments as of April 30, 2024, compared with October 31, 2023 and April 30, 2023:

| Date

| Developed Markets

%

| Investment Grade

Developing Markets

%

| Sub-Investment Grade

Developing Markets

%

|

| April 30, 2024

| 80.9

| 10.7

| 8.4

|

| October 31, 2023

| 86.5

| 6.7

| 6.8

|

| April 30, 2023

| 77.3

| 13.9

| 8.8

|

Maturity Composition(2)

The average maturity of the

Fund’s total investments was 6.2 years at April 30, 2024, compared with 6.6 years at October 31, 2023, and 6.4 years at April 30, 2023. The following table shows the maturity composition of the Fund’s

investments as of April 30, 2024, compared with October 31, 2023 and April 30, 2023:

| Date

| 0 to 5 Years

%

| 5 to 10 Years

%

| 10 Years & Over

%

|

| April 30, 2024

| 45.1

| 31.5

| 23.4

|

| October 31, 2023

| 25.1

| 48.4

| 26.5

|

| April 30, 2023

| 45.4

| 35.1

| 19.5

|

Modified Duration

As of April 30, 2024, the

modified duration* of the Fund was 2.1 years. This calculation excludes the interest rate swaps that are used to manage the leverage of the Fund. Excluding swaps will decrease portfolio duration.

| 6

| abrdn Global Income Fund, Inc.

|

Portfolio Composition (as a percentage of net assets) (unaudited) (concluded)

As of April 30, 2024

| *

| Modified duration is a measure of the sensitivity of the price of a bond to the fluctuations in interest rates.

|

| (1)

| For financial reporting purposes, credit quality ratings shown above reflect the lowest rating assigned by either S&P, Moody’s or Fitch if ratings differ. These rating agencies are

independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or

lower. Investments designated NR are not rated by these rating agencies. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. The Investment Manager

evaluates the credit quality of unrated investments based upon, but not limited to, credit ratings for similar investments.

|

| (2)

| % reflected in below table do not reflect exposure to derivatives.

|

| abrdn Global Income Fund, Inc.

| 7

|

Summary of Key Rates (unaudited)

The following table summarizes

the movements of key interest rates and currencies from April 30, 2024 compared to October 31, 2023 and April 30, 2023.

|

|

| Apr–24

| Oct–23

| Apr-23

|

| Australia

| 90 day Bank Bills

| 4.40%

| 4.36%

| 3.68%

|

|

| 10 yr bond

| 4.42%

| 3.90%

| 3.58%

|

|

| currency local per 1USD

| $1.54

| $1.58

| $1.51

|

| New Zealand

| 90 day Bank Bills

| 5.63%

| 5.64%

| 5.56%

|

|

| 10 yr bond

| 4.90%

| 5.55%

| 4.09%

|

|

| currency local per 1USD

| $0.00

| $1.72

| $1.62

|

| Malaysia

| 3-month T-Bills

| 3.20%

| 3.21%

| 2.85%

|

|

| 10 yr bond

| 3.99%

| 4.10%

| 3.73%

|

|

| currency local per 1USD

| RM4.77

| RM4.76

| RM4.46

|

| India

| 3-month T-Bills

| 6.98%

| 6.89%

| 6.78%

|

|

| 10 yr bond

| 7.19%

| 7.35%

| 7.11%

|

|

| currency local per 1USD

| ₹83.44

| ₹83.26

| ₹81.84

|

| Indonesia

| 3 months deposit rate

| 4.18%

| 4.10%

| 3.94%

|

|

| 10 yr bond

| 7.22%

| 7.09%

| 6.51%

|

|

| currency local per 1USD

| Rp16,260.00

| Rp15,885.00

| Rp14,670.00

|

| Russia

| Zero Cpn 3m

| 14.65%

| 13.13%

| 7.23%

|

|

| 10 yr bond

| 15.99%

| 15.99%

| 15.99%

|

|

| currency local per 1USD

| ₽93.48

| ₽93.58

| ₽80.20

|

| USD Denominated Bonds

| Mexico

| 6.25%

| 6.78%

| 5.28%

|

|

| Indonesia

| 5.53%

| 5.85%

| 4.44%

|

|

| Argentina

| 23.20%

| 23.20%

| 23.20%

|

|

| Romania

| 5.58%

| 5.37%

| 4.95%

|

| 8

| abrdn Global Income Fund, Inc.

|

Portfolio of Investments (unaudited)

As of April 30, 2024

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS—89.5%

|

|

| AUSTRALIA—15.6%

|

|

|

| Australia & New Zealand Banking Group Ltd., (fixed rate to 02/10/2033, variable rate thereafter),

6.74%, 02/10/2033(a)(b)

| AUD

| 1,300,000

| $ 870,079

|

| Commonwealth Bank of Australia, (fixed rate to 03/15/2033, variable rate thereafter), 6.70%,

03/15/2033(b)

|

| 1,800,000

| 1,185,058

|

| Macquarie Bank Ltd., 6.80%, 01/18/2033(a)

| $

| 1,000,000

| 1,032,369

|

| Mineral Resources Ltd., 8.00%, 11/01/2027(a)(b)

|

| 1,520,000

| 1,537,297

|

| National Australia Bank Ltd.

|

|

|

|

| (fixed rate to 08/03/2027, variable rate thereafter), 6.32%, 08/03/2027(a)(b)

| AUD

| 1,000,000

| 657,109

|

| (fixed rate to 03/09/2028, variable rate thereafter), 6.16%, 03/09/2028(a)(b)

|

| 800,000

| 522,966

|

| NBN Co. Ltd., 6.00%, 10/06/2033(a)(b)

| $

| 800,000

| 824,136

|

| Perenti Finance Pty. Ltd., 7.50%, 04/26/2029(a)(b)

|

| 200,000

| 201,955

|

| Westpac Banking Corp.

|

|

|

|

| (fixed rate to 06/23/2028, variable rate thereafter), 6.49%, 06/23/2028(b)

| AUD

| 600,000

| 397,358

|

| (fixed rate to 06/23/2033, variable rate thereafter), 6.93%, 06/23/2033(a)(b)

|

| 700,000

| 472,201

|

| (fixed rate to 11/15/2033, variable rate thereafter), 7.20%, 11/15/2033(b)

|

| 300,000

| 204,704

|

| Total Australia

|

| 7,905,232

|

| BARBADOS—0.4%

|

|

|

| Sagicor Financial Co. Ltd., 5.30%, 05/13/2028(a)(b)

| $

| 210,000

| 201,075

|

| BRAZIL—3.0%

|

|

|

| Banco do Brasil SA VRN, 8.75%, 10/15/2024(a)(c)

|

| 620,000

| 621,661

|

| BRF SA, 5.75%, 09/21/2050(a)(b)

|

| 200,000

| 151,308

|

| Guara Norte SARL, 5.20%, 06/15/2034(a)(d)

|

| 171,358

| 155,359

|

| Minerva Luxembourg SA, 8.88%, 09/13/2033(a)(b)

|

| 200,000

| 205,142

|

| Samarco Mineracao SA PIK, 9.50%, 06/30/2031(a)(b)(e)

|

| 405,314

| 369,935

|

| Total Brazil

|

| 1,503,405

|

| CANADA—1.5%

|

|

|

| Bombardier, Inc., 8.75%, 11/15/2030(a)(b)

|

| 117,000

| 124,475

|

| Enerflex Ltd., 9.00%, 10/15/2027(a)(b)

|

| 290,000

| 296,966

|

| Rogers Communications, Inc., (fixed rate to 03/15/2027, variable rate thereafter), 5.25%, 03/15/2027(a)(b)

|

| 275,000

| 261,399

|

| TransAlta Corp., 7.75%, 11/15/2029(b)

|

| 98,000

| 100,302

|

| Total Canada

|

| 783,142

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| CHILE—0.9%

|

|

|

| Corp. Nacional del Cobre de Chile, 3.75%, 01/15/2031(a)(b)

| $

| 330,000

| $ 287,492

|

| Empresa Nacional del Petroleo, 3.45%, 09/16/2031(a)(b)

|

| 200,000

| 167,694

|

| Total Chile

|

| 455,186

|

| CHINA—2.1%

|

|

|

| China Evergrande Group, 8.75%, 06/28/2025(a)(b)(f)(g)

|

| 200,000

| 2,180

|

| China Huadian Overseas Development 2018 Ltd., (fixed rate to 06/23/2025, variable rate thereafter), 3.38%,

06/23/2025(a)(c)

|

| 200,000

| 192,680

|

| Huarong Finance II Co. Ltd.

|

|

|

|

| EMTN, 5.50%, 01/16/2025(a)

|

| 619,000

| 611,863

|

| 5.00%, 11/19/2025(a)

|

| 200,000

| 194,050

|

| Kaisa Group Holdings Ltd., 11.95%, 11/12/2023(a)(b)(f)(g)

|

| 200,000

| 5,000

|

| Logan Group Co. Ltd.

|

|

|

|

| 7.50%, 08/25/2022(a)(b)(f)(g)

|

| 200,000

| 19,000

|

| 6.50%, 07/16/2023(a)(b)(f)(g)

|

| 200,000

| 19,102

|

| Sunac China Holdings Ltd.

|

|

|

|

| PIK, 6.00%, 09/30/2026(a)(b)(e)(g)

|

| 18,444

| 1,844

|

| PIK, 6.25%, 09/30/2027(a)(b)(e)(g)

|

| 18,467

| 1,711

|

| PIK, 6.50%, 09/30/2027(a)(b)(e)(g)

|

| 36,979

| 2,773

|

| PIK, 6.75%, 09/30/2028(a)(b)(e)(g)

|

| 55,535

| 3,864

|

| PIK, 7.00%, 09/30/2029(a)(b)(e)(g)

|

| 55,602

| 3,406

|

| PIK, 7.25%, 09/30/2030(a)(b)(e)(g)

|

| 26,152

| 1,308

|

| PIK, 1.00%, 09/30/2032(a)(b)(e)(h)

|

| 22,246

| 1,112

|

| Zhenro Properties Group Ltd., 6.63%, 01/07/2026(a)(b)(f)(g)

|

| 200,000

| 1,520

|

| Total China

|

| 1,061,413

|

| COLOMBIA—2.0%

|

|

|

| Bancolombia SA, (fixed rate to 12/18/2024, variable rate thereafter), 4.63%, 12/18/2024(b)

|

| 200,000

| 193,022

|

| Ecopetrol SA

|

|

|

|

| 5.38%, 06/26/2026(b)

|

| 351,000

| 342,223

|

| 8.88%, 01/13/2033(b)

|

| 105,000

| 107,468

|

| Empresas Publicas de Medellin ESP, 4.38%, 02/15/2031(a)(b)

|

| 437,000

| 354,256

|

| Total Colombia

|

| 996,969

|

| DOMINICAN REPUBLIC—0.4%

|

|

|

| AES Espana BV, 5.70%, 05/04/2028(a)(b)

|

| 202,000

| 189,577

|

| ECUADOR—0.4%

|

|

|

| International Airport Finance SA, 12.00%, 03/15/2033(a)(b)(d)

|

| 190,474

| 202,197

|

| FRANCE—1.4%

|

|

|

| Banijay Entertainment SASU, 8.13%, 05/01/2029(a)(b)

|

| 200,000

| 204,637

|

| BNP Paribas SA, (fixed rate to 02/25/2030, variable rate thereafter), 4.50%, 02/25/2030(a)(c)

|

| 200,000

| 158,793

|

| Cerba Healthcare SACA, 3.50%, 05/31/2028(a)(b)

| EUR

| 130,000

| 113,070

|

| abrdn Global Income Fund, Inc.

| 9

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2024

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| FRANCE (continued)

|

|

|

| Electricite de France SA, (fixed rate to 01/22/2026, variable rate thereafter), 5.00%, 01/22/2026(a)(c)

| EUR

| 100,000

| $ 105,920

|

| Nova Alexandre III SAS FRN, 9.11%, 07/15/2029(a)(b)(i)

|

| 100,000

| 105,386

|

| Total France

|

| 687,806

|

| GEORGIA—1.0%

|

|

|

| Georgian Railway JSC, 4.00%, 06/17/2028(a)(b)

| $

| 359,000

| 321,881

|

| TBC Bank JSC, (fixed rate to 07/30/2029, variable rate thereafter), 10.25%, 07/30/2029(a)(c)

|

| 200,000

| 198,836

|

| Total Georgia

|

| 520,717

|

| GERMANY—2.1%

|

|

|

| CT Investment GmbH, 6.38%, 04/15/2030(a)(b)

| EUR

| 100,000

| 106,854

|

| Gruenenthal GmbH, 3.63%, 11/15/2026(a)(b)

|

| 100,000

| 104,179

|

| HT Troplast GmbH, 9.38%, 07/15/2028(a)(b)

|

| 110,000

| 122,088

|

| IHO Verwaltungs GmbH, 8.75%, 05/15/2028(a)(b)(e)

|

| 103,347

| 118,426

|

| PrestigeBidCo GmbH FRN, 9.91%, 07/15/2027(a)(b)(i)

|

| 109,000

| 117,779

|

| Schaeffler AG, 2.88%, 03/26/2027(a)(b)

|

| 60,000

| 62,109

|

| Techem Verwaltungsgesellschaft 675 GmbH, 2.00%, 07/15/2025(a)(b)

|

| 106,000

| 110,708

|

| TK Elevator Midco GmbH, 4.38%, 07/15/2027(a)(b)

|

| 100,000

| 102,025

|

| WEPA Hygieneprodukte GmbH, 5.63%, 01/15/2031(a)(b)

|

| 100,000

| 106,453

|

| ZF Europe Finance BV, 2.50%, 10/23/2027(a)(b)

|

| 100,000

| 99,367

|

| Total Germany

|

| 1,049,988

|

| HONG KONG—1.0%

|

|

|

| AIA Group Ltd., 5.63%, 10/25/2027(a)(b)

| $

| 500,000

| 503,727

|

| INDIA—4.1%

|

|

|

| HDFC Bank Ltd., 8.10%, 03/22/2025(a)

| INR

| 110,000,000

| 1,317,818

|

| India Green Power Holdings, 4.00%, 02/22/2027(a)(b)(d)

| $

| 186,660

| 168,255

|

| Indiabulls Housing Finance Ltd., Series 6B, 9.00%, 09/26/2026

| INR

| 50,000,000

| 565,287

|

| Total India

|

| 2,051,360

|

| INDONESIA—1.5%

|

|

|

| Medco Laurel Tree Pte. Ltd., 6.95%, 11/12/2028(a)(b)

| $

| 221,000

| 211,228

|

| Medco Oak Tree Pte. Ltd., 7.38%, 05/14/2026(a)(b)

|

| 200,000

| 200,132

|

| Perusahaan Perseroan Persero PT Perusahaan Listrik Negara, 5.25%, 10/24/2042(a)

|

| 400,000

| 347,369

|

| Total Indonesia

|

| 758,729

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| IRELAND—0.3%

|

|

|

| GGAM Finance Ltd., 8.00%, 02/15/2027(a)(b)

| $

| 161,000

| $ 165,004

|

| ISRAEL—0.8%

|

|

|

| Bank Leumi Le-Israel BM, (fixed rate to 04/18/2028, variable rate thereafter), 7.13%, 04/18/2028(a)(b)

|

| 200,000

| 193,000

|

| Energean Israel Finance Ltd., 8.50%, 09/30/2033(a)(b)

|

| 230,000

| 220,846

|

| Total Israel

|

| 413,846

|

| ITALY—0.5%

|

|

|

| Lottomatica SpA FRN, 8.07%, 06/01/2028(a)(b)(i)

| EUR

| 100,000

| 107,264

|

| Telecom Italia Capital SA, 6.38%, 11/15/2033

| $

| 140,000

| 123,690

|

| Total Italy

|

| 230,954

|

| KAZAKHSTAN—1.7%

|

|

|

| KazMunayGas National Co. JSC

|

|

|

|

| 3.50%, 04/14/2033(a)(b)

|

| 200,000

| 159,659

|

| 5.75%, 04/19/2047(a)

|

| 870,000

| 718,469

|

| Total Kazakhstan

|

| 878,128

|

| KUWAIT—0.4%

|

|

|

| MEGlobal Canada ULC, 5.00%, 05/18/2025(a)

|

| 200,000

| 197,038

|

| LUXEMBOURG—1.5%

|

|

|

| Albion Financing 1 SARL/Aggreko Holdings, Inc., 5.25%, 10/15/2026(a)(b)

| EUR

| 100,000

| 106,636

|

| Cidron Aida Finco SARL, 6.25%, 04/01/2028(a)(b)

| GBP

| 100,000

| 117,927

|

| Cullinan Holdco SCSp, 4.63%, 10/15/2026(a)(b)

| EUR

| 100,000

| 86,770

|

| Ephios Subco 3 SARL, 7.88%, 01/31/2031(a)(b)

|

| 100,000

| 109,271

|

| LHMC Finco 2 SARL PIK, 7.25%, 10/02/2025(a)(b)(e)

|

| 2,943

| 3,138

|

| Matterhorn Telecom SA, 3.13%, 09/15/2026(a)(b)

|

| 200,000

| 207,571

|

| Monitchem HoldCo 3 SA, 8.75%, 05/01/2028(a)(b)

|

| 110,000

| 119,470

|

| Total Luxembourg

|

| 750,783

|

| MEXICO—2.8%

|

|

|

| BBVA Bancomer SA, (fixed rate to 01/17/2028, variable rate thereafter), 5.13%, 01/18/2033(a)(b)

| $

| 470,000

| 429,060

|

| Braskem Idesa SAPI, 6.99%, 02/20/2032(a)(b)

|

| 200,000

| 150,201

|

| Cemex SAB de CV, (fixed rate to 03/14/2028, variable rate thereafter), 9.13%, 03/14/2028(a)(c)

|

| 200,000

| 214,627

|

| Petroleos Mexicanos

|

|

|

|

| 7.19%, 09/12/2024(a)

| MXN

| 4,200,000

| 239,123

|

| 7.19%, 09/12/2024(a)

|

| 3,378,800

| 192,369

|

| Sixsigma Networks Mexico SA de CV, 7.50%, 05/02/2025(a)(b)

| $

| 210,000

| 199,657

|

| Total Mexico

|

| 1,425,037

|

| 10

| abrdn Global Income Fund, Inc.

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2024

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| MOROCCO—0.5%

|

|

|

| Vivo Energy Investments BV, 5.13%, 09/24/2027(a)(b)

| $

| 255,000

| $ 241,077

|

| NETHERLANDS—1.3%

|

|

|

| Boost Newco Borrower LLC/GTCR W Dutch Finance Sub BV, 8.50%, 01/15/2031(a)(b)

| GBP

| 100,000

| 133,077

|

| OCI NV, 3.63%, 10/15/2025(a)(b)

| EUR

| 90,000

| 94,490

|

| Stichting AK Rabobank Certificaten, 6.50%, 12/29/2049(a)(c)(j)

|

| 60,000

| 67,948

|

| Sunrise HoldCo IV BV, 5.50%, 01/15/2028(a)(b)

| $

| 200,000

| 188,371

|

| Versuni Group BV, 3.13%, 06/15/2028(a)(b)

| EUR

| 100,000

| 95,515

|

| VZ Vendor Financing II BV, 2.88%, 01/15/2029(a)(b)

|

| 100,000

| 91,917

|

| Total Netherlands

|

| 671,318

|

| NIGERIA—2.5%

|

|

|

| Access Bank PLC, 6.13%, 09/21/2026(a)

| $

| 216,000

| 199,800

|

| BOI Finance BV, 7.50%, 02/16/2027(a)(k)

| EUR

| 196,000

| 197,847

|

| IHS Netherlands Holdco BV, 8.00%, 09/18/2027(a)(b)

| $

| 230,000

| 216,372

|

| SEPLAT Energy PLC, 7.75%, 04/01/2026(a)(b)

|

| 297,000

| 286,605

|

| United Bank for Africa PLC, 6.75%, 11/19/2026(a)

|

| 380,000

| 362,159

|

| Total Nigeria

|

| 1,262,783

|

| OMAN—0.5%

|

|

|

| EDO Sukuk Ltd., 5.88%, 09/21/2033(a)

|

| 250,000

| 251,500

|

| PERU—0.5%

|

|

|

| Petroleos del Peru SA, 5.63%, 06/19/2047(a)

|

| 400,000

| 245,453

|

| PHILIPPINES—0.9%

|

|

|

| International Container Terminal Services, Inc., 4.75%, 06/17/2030(a)

|

| 260,000

| 247,498

|

| Manila Water Co., Inc., 4.38%, 07/30/2030(a)(b)

|

| 243,000

| 223,555

|

| Total Philippines

|

| 471,053

|

| RUSSIA—0.0%

|

|

|

| Sovcombank Via SovCom Capital DAC, (fixed rate to 05/06/2025, variable rate thereafter),

7.75%, 05/06/2025(a)(c)(g)(l)(m)

|

| 250,000

| –

|

| SINGAPORE—1.1%

|

|

|

| Puma International Financing SA, 7.75%, 04/25/2029(a)(b)

|

| 331,000

| 334,409

|

| Vena Energy Capital Pte. Ltd., 3.13%, 02/26/2025(a)

|

| 210,000

| 204,383

|

| Total Singapore

|

| 538,792

|

| SLOVENIA—0.2%

|

|

|

| Summer BidCo BV, 10.00%, 02/15/2029(a)(b)(e)

| EUR

| 100,000

| 107,310

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| SOUTH AFRICA—3.0%

|

|

|

| Eskom Holdings SOC Ltd.

|

|

|

|

| 7.13%, 02/11/2025(a)

| $

| 410,000

| $ 407,294

|

| 0.01%, 12/31/2032(n)

| ZAR

| 28,700,000

| 329,372

|

| Liquid Telecommunications Financing PLC, 5.50%, 09/04/2026(a)(b)

| $

| 446,000

| 260,910

|

| Sasol Financing USA LLC, 5.50%, 03/18/2031(b)

|

| 400,000

| 332,455

|

| Transnet SOC Ltd., 8.25%, 02/06/2028(a)

|

| 200,000

| 196,500

|

| Total South Africa

|

| 1,526,531

|

| SPAIN—1.2%

|

|

|

| Banco Bilbao Vizcaya Argentaria SA, (fixed rate to 03/05/2025, variable rate thereafter), Series 9, 6.50%,

03/05/2025(c)

|

| 200,000

| 197,256

|

| Banco de Sabadell SA, (fixed rate to 02/07/2028, variable rate thereafter), 5.25%, 02/07/2028(a)(b)

| EUR

| 100,000

| 110,227

|

| Cellnex Finance Co. SA

|

|

|

|

| 1.50%, 06/08/2028(a)(b)

|

| 100,000

| 96,798

|

| 2.00%, 09/15/2032(a)(b)

|

| 100,000

| 90,348

|

| Lorca Telecom Bondco SA, 4.00%, 09/18/2027(a)(b)

|

| 100,000

| 103,945

|

| Total Spain

|

| 598,574

|

| SWITZERLAND—1.0%

|

|

|

| Consolidated Energy Finance SA

|

|

|

|

| 5.63%, 10/15/2028(a)(b)

| $

| 150,000

| 126,751

|

| 12.00%, 02/15/2031(a)(b)

|

| 150,000

| 155,251

|

| UBS Group AG, (fixed rate to 11/13/2028, variable rate thereafter), 9.25%, 11/13/2028(a)(c)

|

| 200,000

| 213,446

|

| Total Switzerland

|

| 495,448

|

| TANZANIA—0.4%

|

|

|

| HTA Group Ltd., 7.00%, 12/18/2025(a)(b)

|

| 200,000

| 199,040

|

| TRINIDAD—0.6%

|

|

|

| Heritage Petroleum Co. Ltd., 9.00%, 08/12/2029(a)(b)

|

| 291,000

| 304,968

|

| TURKEY—1.0%

|

|

|

| WE Soda Investments Holding PLC, 9.50%, 10/06/2028(a)(b)

|

| 275,000

| 283,230

|

| Yapi ve Kredi Bankasi AS, (fixed rate to 01/17/2029, variable rate thereafter), 9.25%,

01/17/2029(a)(b)

|

| 200,000

| 204,464

|

| Total Turkey

|

| 487,694

|

| UKRAINE—1.0%

|

|

|

| Kernel Holding SA, 6.75%, 10/27/2027(a)(b)(g)

|

| 206,000

| 147,912

|

| MHP Lux SA, 6.95%, 04/03/2026(a)(g)

|

| 218,000

| 174,078

|

| NPC Ukrenergo, 6.88%, 11/09/2028(a)(g)(k)

|

| 200,000

| 73,900

|

| Ukraine Railways Via Rail Capital Markets PLC, 8.25%, 07/09/2026(a)(g)

|

| 200,000

| 123,418

|

| Total Ukraine

|

| 519,308

|

| abrdn Global Income Fund, Inc.

| 11

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2024

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| UNITED ARAB EMIRATES—0.4%

|

|

|

| MAF Global Securities Ltd., (fixed rate to 03/20/2026, variable rate thereafter), 6.38%,

03/20/2026(a)(c)

| $

| 200,000

| $ 196,736

|

| UNITED KINGDOM—3.1%

|

|

|

| 888 Acquisitions Ltd., 7.56%, 07/15/2027(a)(b)

| EUR

| 100,000

| 102,558

|

| BCP V Modular Services Finance II PLC, 4.75%, 11/30/2028(a)(b)

|

| 125,000

| 125,381

|

| Bellis Acquisition Co. PLC, 4.50%, 02/16/2026(a)(b)

| GBP

| 124,000

| 154,170

|

| CD&R Firefly Bidco PLC, 8.63%, 04/30/2029(a)(b)

|

| 100,000

| 124,305

|

| Iceland Bondco PLC, 10.88%, 12/15/2027(a)(b)

|

| 100,000

| 127,816

|

| Ithaca Energy North Sea PLC, 9.00%, 07/15/2026(a)(b)

| $

| 200,000

| 201,307

|

| Macquarie Airfinance Holdings Ltd.

|

|

|

|

| 6.40%, 03/26/2029(a)(b)

|

| 5,000

| 4,986

|

| 8.13%, 03/30/2029(a)(b)

|

| 125,000

| 130,713

|

| 6.50%, 03/26/2031(a)(b)

|

| 10,000

| 10,008

|

| Motion Finco SARL, 7.38%, 06/15/2030(a)(b)

| EUR

| 100,000

| 110,855

|

| Pinewood Finco PLC, 6.00%, 03/27/2030(a)(b)

| GBP

| 116,000

| 140,845

|

| Synthomer PLC, 7.38%, 05/02/2029(a)(b)

| EUR

| 100,000

| 107,669

|

| Virgin Media Vendor Financing Notes III DAC, 4.88%, 07/15/2028(a)(b)

| GBP

| 200,000

| 222,745

|

| Total United Kingdom

|

| 1,563,358

|

| UNITED STATES—24.5%

|

|

|

| Academy Ltd., 6.00%, 11/15/2027(a)(b)

| $

| 296,000

| 289,359

|

| Adams Homes, Inc.

|

|

|

|

| 7.50%, 02/15/2025(a)(b)

|

| 117,000

| 116,799

|

| 9.25%, 10/15/2028(a)(b)

|

| 204,000

| 210,654

|

| Adient Global Holdings Ltd., 3.50%, 08/15/2024(a)(b)

| EUR

| 17,635

| 18,702

|

| Affinity Interactive, 6.88%, 12/15/2027(a)(b)

| $

| 211,000

| 188,856

|

| Ardagh Packaging Finance PLC/Ardagh Holdings USA, Inc., 4.13%, 08/15/2026(a)(b)

|

| 200,000

| 166,671

|

| Ascent Resources Utica Holdings LLC/ARU Finance Corp., 5.88%, 06/30/2029(a)(b)

|

| 116,000

| 110,547

|

| Ball Corp.

|

|

|

|

| 2.88%, 08/15/2030(b)

|

| 137,000

| 114,408

|

| 3.13%, 09/15/2031(b)

|

| 34,000

| 28,236

|

| Boeing Co., 5.15%, 05/01/2030(b)

|

| 102,000

| 96,471

|

| Builders FirstSource, Inc., 4.25%, 02/01/2032(a)(b)

|

| 351,000

| 305,734

|

| Caesars Entertainment, Inc.

|

|

|

|

| 7.00%, 02/15/2030(a)(b)

|

| 4,000

| 4,028

|

| 6.50%, 02/15/2032(a)(b)

|

| 29,000

| 28,572

|

| Camelot Return Merger Sub, Inc., 8.75%, 08/01/2028(a)(b)

|

| 98,000

| 96,344

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

|

|

|

|

| Carnival Corp.

|

|

|

|

| 7.63%, 03/01/2026(a)(b)

| $

| 96,000

| $ 96,595

|

| 6.00%, 05/01/2029(a)(b)

|

| 56,000

| 54,266

|

| CCM Merger, Inc., 6.38%, 05/01/2026(a)(b)

|

| 197,000

| 196,522

|

| CCO Holdings LLC/CCO Holdings Capital Corp.

|

|

|

|

| 5.38%, 06/01/2029(a)(b)

|

| 38,000

| 33,470

|

| 4.25%, 02/01/2031(a)(b)

|

| 225,000

| 176,095

|

| 4.75%, 02/01/2032(a)(b)

|

| 63,000

| 49,545

|

| 4.25%, 01/15/2034(a)(b)

|

| 486,000

| 352,112

|

| CHS/Community Health Systems, Inc.

|

|

|

|

| 5.25%, 05/15/2030(a)(b)

|

| 120,000

| 98,110

|

| 10.88%, 01/15/2032(a)(b)

|

| 26,000

| 26,618

|

| Civitas Resources, Inc.

|

|

|

|

| 8.38%, 07/01/2028(a)(b)

|

| 73,000

| 76,152

|

| 8.63%, 11/01/2030(a)(b)

|

| 56,000

| 59,591

|

| 8.75%, 07/01/2031(a)(b)

|

| 73,000

| 77,434

|

| Clean Harbors, Inc.

|

|

|

|

| 4.88%, 07/15/2027(a)(b)

|

| 112,000

| 107,863

|

| 5.13%, 07/15/2029(a)(b)

|

| 16,000

| 15,245

|

| 6.38%, 02/01/2031(a)(b)

|

| 29,000

| 28,730

|

| Clearway Energy Operating LLC, 3.75%, 02/15/2031(a)(b)

|

| 60,000

| 50,725

|

| Cleveland-Cliffs, Inc., 6.75%, 04/15/2030(a)(b)

|

| 83,000

| 81,049

|

| Consensus Cloud Solutions, Inc.

|

|

|

|

| 6.00%, 10/15/2026(a)(b)

|

| 37,000

| 35,080

|

| 6.50%, 10/15/2028(a)(b)

|

| 102,000

| 89,311

|

| Cornerstone Building Brands, Inc., 6.13%, 01/15/2029(a)(b)

|

| 89,000

| 75,096

|

| CSC Holdings LLC, 6.50%, 02/01/2029(a)(b)

|

| 200,000

| 149,164

|

| Darling Ingredients, Inc., 6.00%, 06/15/2030(a)(b)

|

| 145,000

| 140,859

|

| Delek Logistics Partners LP/Delek Logistics Finance Corp., 8.63%, 03/15/2029(a)(b)

|

| 93,000

| 93,704

|

| Directv Financing LLC, 8.88%, 02/01/2030(a)(b)

|

| 20,000

| 19,447

|

| Encore Capital Group, Inc., 5.38%, 02/15/2026(a)(b)

| GBP

| 100,000

| 120,894

|

| Endo Finance Holdings, Inc., 8.50%, 04/15/2031(a)(b)

| $

| 9,000

| 9,145

|

| EnerSys, 6.63%, 01/15/2032(a)(b)

|

| 117,000

| 116,518

|

| Fiesta Purchaser, Inc., 7.88%, 03/01/2031(a)(b)

|

| 76,000

| 77,441

|

| Frontier Communications Holdings LLC

|

|

|

|

| 5.00%, 05/01/2028(a)(b)

|

| 48,000

| 44,159

|

| 8.75%, 05/15/2030(a)(b)

|

| 177,000

| 180,209

|

| 8.63%, 03/15/2031(a)(b)

|

| 119,000

| 120,187

|

| Goodyear Tire & Rubber Co.

|

|

|

|

| 9.50%, 05/31/2025(b)

|

| 230,000

| 230,774

|

| 5.00%, 07/15/2029(b)

|

| 215,000

| 194,999

|

| Graphic Packaging International LLC, 3.75%, 02/01/2030(a)(b)

|

| 278,000

| 241,882

|

| Hawaiian Brand Intellectual Property Ltd./HawaiianMiles Loyalty Ltd., 5.75%, 01/20/2026(a)(b)

|

| 158,999

| 149,123

|

| 12

| abrdn Global Income Fund, Inc.

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2024

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| UNITED STATES (continued)

|

|

|

| Helios Software Holdings, Inc./ION Corporate Solutions Finance SARL

|

|

|

|

| 7.88%, 05/01/2029(a)(b)

| EUR

| 100,000

| $ 106,240

|

| 8.75%, 05/01/2029(a)(b)

| $

| 200,000

| 200,396

|

| Hess Midstream Operations LP, 4.25%, 02/15/2030(a)(b)

|

| 182,000

| 164,254

|

| Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand Vacations Borrower Escrow, Inc., 6.63%,

01/15/2032(a)(b)

|

| 112,000

| 110,417

|

| Howard Midstream Energy Partners LLC, 8.88%, 07/15/2028(a)(b)

|

| 113,000

| 118,354

|

| Hyundai Capital America, 6.38%, 04/08/2030(a)(b)

|

| 200,000

| 205,385

|

| Iron Mountain, Inc.

|

|

|

|

| 5.00%, 07/15/2028(a)(b)

|

| 23,000

| 21,675

|

| 4.88%, 09/15/2029(a)(b)

|

| 60,000

| 55,366

|

| ITT Holdings LLC, 6.50%, 08/01/2029(a)(b)

|

| 104,000

| 93,935

|

| Kodiak Gas Services LLC, 7.25%, 02/15/2029(a)(b)

|

| 105,000

| 105,757

|

| Macy's Retail Holdings LLC

|

|

|

|

| 5.88%, 04/01/2029(a)(b)

|

| 35,000

| 33,746

|

| 5.88%, 03/15/2030(a)(b)

|

| 3,000

| 2,860

|

| MajorDrive Holdings IV LLC, 6.38%, 06/01/2029(a)(b)

|

| 225,000

| 211,143

|

| Meritage Homes Corp., 3.88%, 04/15/2029(a)(b)

|

| 162,000

| 146,870

|

| MGM Resorts International, 5.75%, 06/15/2025(b)

|

| 113,000

| 112,361

|

| Miter Brands Acquisition Holdco, Inc./MIWD Borrower LLC, 6.75%, 04/01/2032(a)(b)

|

| 16,000

| 15,890

|

| Moss Creek Resources Holdings, Inc., 7.50%, 01/15/2026(a)(b)

|

| 87,000

| 86,756

|

| Nabors Industries, Inc., 9.13%, 01/31/2030(a)(b)

|

| 73,000

| 75,276

|

| NCL Corp. Ltd.

|

|

|

|

| 5.88%, 02/15/2027(a)(b)

|

| 108,000

| 105,502

|

| 7.75%, 02/15/2029(a)(b)

|

| 124,000

| 126,663

|

| NCR Atleos Corp., 9.50%, 04/01/2029(a)(b)

|

| 115,000

| 122,244

|

| Neptune Bidco U.S., Inc., 9.29%, 04/15/2029(a)(b)

|

| 239,000

| 225,586

|

| New Enterprise Stone & Lime Co., Inc., 5.25%, 07/15/2028(a)(b)

|

| 87,000

| 81,722

|

| Novelis Corp., 3.25%, 11/15/2026(a)(b)

|

| 93,000

| 86,952

|

| Novelis Sheet Ingot GmbH, 3.38%, 04/15/2029(a)(b)

| EUR

| 100,000

| 100,268

|

| NRG Energy, Inc.

|

|

|

|

| 3.38%, 02/15/2029(a)(b)

| $

| 15,000

| 13,154

|

| 5.25%, 06/15/2029(a)(b)

|

| 134,000

| 126,737

|

| 7.00%, 03/15/2033(a)(b)

|

| 73,000

| 76,020

|

| OI European Group BV, 6.25%, 05/15/2028(a)(b)

| EUR

| 100,000

| 111,002

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

|

|

|

|

| Organon & Co./Organon Foreign Debt Co.-Issuer BV, 5.13%, 04/30/2031(a)(b)

| $

| 255,000

| $ 220,499

|

| Panther Escrow Issuer LLC, 7.13%, 06/01/2031(a)(b)

|

| 135,000

| 135,700

|

| Permian Resources Operating LLC, 5.88%, 07/01/2029(a)(b)

|

| 88,000

| 85,524

|

| Perrigo Finance Unlimited Co., 4.65%, 06/15/2030(b)

|

| 200,000

| 183,265

|

| Post Holdings, Inc., 5.63%, 01/15/2028(a)(b)

|

| 70,000

| 67,932

|

| Sabre GLBL, Inc., 8.63%, 06/01/2027(a)(b)

|

| 94,000

| 83,178

|

| Six Flags Entertainment Corp./Six Flags Theme Parks, Inc., 6.63%, 05/01/2032(a)(b)

|

| 60,000

| 59,761

|

| Six Flags Theme Parks, Inc., 7.00%, 07/01/2025(a)(b)

|

| 105,000

| 105,229

|

| Staples, Inc., 7.50%, 04/15/2026(a)(b)

|

| 84,000

| 80,986

|

| Star Parent, Inc., 9.00%, 10/01/2030(a)(b)

|

| 158,000

| 165,276

|

| SunCoke Energy, Inc., 4.88%, 06/30/2029(a)(b)

|

| 275,000

| 242,820

|

| Sunoco LP

|

|

|

|

| 7.00%, 05/01/2029(a)(b)

|

| 36,000

| 36,561

|

| 7.25%, 05/01/2032(a)(b)

|

| 56,000

| 56,877

|

| Talen Energy Supply LLC, 8.63%, 06/01/2030(a)(b)

|

| 124,000

| 131,196

|

| Tempur Sealy International, Inc., 3.88%, 10/15/2031(a)(b)

|

| 175,000

| 144,079

|

| Travel & Leisure Co.

|

|

|

|

| 6.00%, 04/01/2027(b)

|

| 80,000

| 79,022

|

| 4.63%, 03/01/2030(a)(b)

|

| 25,000

| 22,331

|

| TreeHouse Foods, Inc., 4.00%, 09/01/2028(b)

|

| 124,000

| 109,795

|

| Turning Point Brands, Inc., 5.63%, 02/15/2026(a)(b)

|

| 108,000

| 105,629

|

| Uniti Group LP/Uniti Group Finance, Inc./CSL Capital LLC, 10.50%, 02/15/2028(a)(b)

|

| 113,000

| 117,230

|

| Univision Communications, Inc.

|

|

|

|

| 6.63%, 06/01/2027(a)(b)

|

| 97,000

| 93,606

|

| 8.00%, 08/15/2028(a)(b)

|

| 95,000

| 94,888

|

| Venture Global Calcasieu Pass LLC

|

|

|

|

| 3.88%, 08/15/2029(a)(b)

|

| 73,000

| 64,498

|

| 6.25%, 01/15/2030(a)(b)

|

| 114,000

| 112,714

|

| 4.13%, 08/15/2031(a)(b)

|

| 145,000

| 126,552

|

| 3.88%, 11/01/2033(a)(b)

|

| 98,000

| 80,462

|

| Venture Global LNG, Inc.

|

|

|

|

| 8.13%, 06/01/2028(a)(b)

|

| 222,000

| 226,988

|

| 9.88%, 02/01/2032(a)(b)

|

| 208,000

| 221,958

|

| Vistra Operations Co. LLC

|

|

|

|

| 4.38%, 05/01/2029(a)(b)

|

| 126,000

| 114,714

|

| 7.75%, 10/15/2031(a)(b)

|

| 126,000

| 129,225

|

| Vital Energy, Inc., 9.75%, 10/15/2030(b)

|

| 169,000

| 184,142

|

| abrdn Global Income Fund, Inc.

| 13

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2024

|

| Shares or

Principal

Amount

| Value

|

| CORPORATE BONDS (continued)

|

|

| UNITED STATES (continued)

|

|

|

| Weatherford International Ltd., 6.50%, 09/15/2028(a)(b)

| $

| 15,000

| $ 15,490

|

| Wolverine World Wide, Inc., 4.00%, 08/15/2029(a)(b)

|

| 257,000

| 205,272

|

| Total United States

|

| 12,389,425

|

| ZAMBIA—0.4%

|

|

|

| First Quantum Minerals Ltd., 8.63%, 06/01/2031(a)(b)

|

| 200,000

| 193,580

|

| Total Corporate Bonds

|

| 45,195,261

|

| GOVERNMENT BONDS—46.4%

|

|

| ANGOLA—1.2%

|

|

|

| Angola Government International Bonds, 9.13%, 11/26/2049(a)

|

| 701,000

| 581,830

|

| ARGENTINA—2.8%

|

|

|

| Argentina Republic Government International Bonds

|

|

|

|

| 4.25%, 01/09/2038(b)(d)(j)

|

| 1,609,200

| 820,007

|

| 3.63%, 07/09/2046(b)(d)(j)

|

| 1,293,010

| 615,476

|

| Total Argentina

|

| 1,435,483

|

| BAHRAIN—1.5%

|

|

|

| Bahrain Government International Bonds

|

|

|

|

| 4.25%, 01/25/2028(a)

|

| 390,000

| 360,063

|

| 5.45%, 09/16/2032(a)

|

| 229,000

| 205,236

|

| 6.25%, 01/25/2051(a)

|

| 210,000

| 167,896

|

| Total Bahrain

|

| 733,195

|

| BRAZIL—3.4%

|

|

|

| Brazil Government International Bonds, 7.13%, 01/20/2037

|

| 370,000

| 381,354

|

| Brazil Notas do Tesouro Nacional,Series F, 10.00%, 01/01/2029

| BRL

| 7,434,000

| 1,360,935

|

| Total Brazil

|

| 1,742,289

|

| CHILE—0.6%

|

|

|

| Chile Government International Bonds, 4.34%, 03/07/2042(b)

| $

| 386,000

| 320,564

|

| COLOMBIA—1.5%

|

|

|

| Colombia Government International Bonds, 5.20%, 05/15/2049(b)

|

| 200,000

| 137,597

|

| Colombia TES,Series B, 9.25%, 05/28/2042

| COP

| 2,757,800,000

| 599,246

|

| Total Colombia

|

| 736,843

|

| DOMINICAN REPUBLIC—3.0%

|

|

|

| Dominican Republic International Bonds

|

|

|

|

| 5.50%, 02/22/2029(a)(b)

| $

| 200,000

| 190,032

|

| 11.25%, 09/15/2035(a)(b)

| DOP

| 19,200,000

| 343,990

|

| 5.88%, 01/30/2060(a)

| $

| 1,230,000

| 1,001,602

|

| Total Dominican Republic

|

| 1,535,624

|

| ECUADOR—2.4%

|

|

|

| Ecuador Government International Bonds, 3.50%, 07/31/2035(a)(d)(j)

|

| 2,205,200

| 1,207,801

|

|

| Shares or

Principal

Amount

| Value

|

|

|

|

| EGYPT—2.1%

|

|

|

| Egypt Government International Bonds

|

|

|

|

| 7.63%, 05/29/2032(a)

| $

| 400,000

| $ 331,144

|

| 7.90%, 02/21/2048(a)

|

| 992,000

| 718,010

|

| Total Egypt

|

| 1,049,154

|

| GEORGIA—0.6%

|

|

|

| Georgia Government International Bonds, 2.75%, 04/22/2026(a)

|

| 306,000

| 282,695

|

| GHANA—0.4%

|

|

|

| Ghana Government International Bonds, 7.63%, 05/16/2029(a)(d)

|

| 385,000

| 185,424

|

| HUNGARY—0.7%

|

|

|

| Hungary Government Bonds,Series 24/C, 2.50%, 10/24/2024

| HUF

| 128,420,000

| 342,490

|

| INDONESIA—4.3%

|

|

|

| Indonesia Government International Bonds

|

|

|

|

| 7.75%, 01/17/2038(a)

| $

| 100,000

| 119,706

|

| 3.70%, 10/30/2049

|

| 935,000

| 678,628

|

| Indonesia Treasury Bonds

|

|

|

|

| Series FR77, 8.13%, 05/15/2024

| IDR

| 14,800,000,000

| 910,300

|

| Series FR81, 6.50%, 06/15/2025

|

| 780,000,000

| 47,443

|

| Series FR82, 7.00%, 09/15/2030

|

| 341,000,000

| 20,733

|

| Series FR83, 7.50%, 04/15/2040

|

| 6,535,000,000

| 411,664

|

| Total Indonesia

|

| 2,188,474

|

| IRAQ—1.0%

|

|

|

| Iraq International Bonds, 5.80%, 01/15/2028(a)(b)(d)

| $

| 521,000

| 485,811

|

| IVORY COAST—0.7%

|

|

|

| Ivory Coast Government International Bonds, 6.63%, 03/22/2048(a)(d)

| EUR

| 444,000

| 369,593

|

| KENYA—1.6%

|

|

|

| Republic of Kenya Government International Bonds, 8.25%, 02/28/2048(a)

| $

| 932,000

| 782,880

|

| MALAYSIA—1.6%

|

|

|

| Malaysia Government Bonds

|

|

|

|

| Series 0411, 4.23%, 06/30/2031

| MYR

| 1,100,000

| 235,321

|

| Series 0419, 3.83%, 07/05/2034

|

| 800,000

| 164,648

|

| Series 0519, 3.76%, 05/22/2040

|

| 1,000,000

| 199,593

|

| Series 0120, 4.07%, 06/15/2050

|

| 1,100,000

| 222,596

|

| Total Malaysia

|

| 822,158

|

| MEXICO—2.2%

|

|

|

| Mexico Bonos

|

|

|

|

| Series M, 5.75%, 03/05/2026

| MXN

| 6,120,200

| 327,754

|

| Series M, 7.75%, 11/13/2042

|

| 16,497,100

| 777,140

|

| Total Mexico

|

| 1,104,894

|

| NIGERIA—0.6%

|

|

|

| Nigeria Government International Bonds, 7.63%, 11/28/2047(a)

| $

| 435,000

| 322,017

|

| OMAN—2.8%

|

|

|

| Oman Government International Bonds, 7.00%, 01/25/2051(a)

|

| 1,400,000

| 1,426,594

|

| PERU—2.1%

|

|

|

| Peru Government International Bonds, 6.90%, 08/12/2037(a)

| PEN

| 4,138,000

| 1,042,417

|

| 14

| abrdn Global Income Fund, Inc.

|

Portfolio of Investments (unaudited) (continued)

As of April 30, 2024

|

| Shares or

Principal

Amount

| Value

|

| GOVERNMENT BONDS (continued)

|

|

| POLAND—0.7%

|

|

|

| Republic of Poland Government Bonds,Series 0432, 1.75%, 04/25/2032

| PLN

| 1,894,000

| $ 351,121

|

| QATAR—0.9%

|

|

|

| Qatar Government International Bonds, 4.40%, 04/16/2050(a)

| $

| 576,000

| 477,149

|

| RWANDA—0.6%

|

|

|

| Rwanda International Government Bonds, 5.50%, 08/09/2031(a)

|

| 400,000

| 321,500

|

| SAUDI ARABIA—0.8%

|

|

|

| Saudi Government International Bonds, 4.38%, 04/16/2029(a)

|

| 410,000

| 393,580

|

| SENEGAL—0.7%

|

|

|

| Senegal Government International Bonds, 6.75%, 03/13/2048(a)(d)

|

| 513,000

| 376,333

|

| SOUTH KOREA—0.6%

|

|

|

| Industrial Bank of Korea, 5.13%, 10/25/2024(a)

|

| 300,000

| 299,065

|

| TURKEY—2.6%

|

|

|

| Istanbul Metropolitan Municipality, 10.50%, 12/06/2028(a)(b)

|

| 200,000

| 214,000

|

| Turkiye Government International Bonds, 9.38%, 01/19/2033

|

| 1,001,000

| 1,104,854

|

| Total Turkey

|

| 1,318,854

|

| UKRAINE—0.2%

|

|

|

| Ukraine Government International Bonds, 7.75%, 09/01/2029(a)(g)

|

| 424,000

| 118,720

|

| URUGUAY—1.4%

|

|

|

| Uruguay Government International Bonds

|

|

|

|

| 4.38%, 12/15/2028(d)(o)

| UYU

| 11,951,373

| 328,619

|

| 7.88%, 01/15/2033(e)

| $

| 165,000

| 191,590

|

| 7.63%, 03/21/2036(d)

|

| 146,000

| 169,433

|

| Total Uruguay

|

| 689,642

|

| UZBEKISTAN—0.8%

|

|

|

| National Bank of Uzbekistan, 4.85%, 10/21/2025(a)

|

| 200,000

| 191,516

|

| Republic of Uzbekistan International Bonds, 3.70%, 11/25/2030(a)

|

| 252,000

| 203,603

|

| Total Uzbekistan

|

| 395,119

|

| Total Government Bonds

|

| 23,439,313

|

| U.S. TREASURIES—0.4%

|

|

| Egypt Treasury Bills, 25.44%, 09/10/2024(p)

| EGP

| 10,625,000

| 203,281

|

| Total U.S. Treasuries

|

| 203,281

|

| WARRANTS—0.0%

|

|

| BRAZIL—0.0%

|

|

|

| OAS SA(b)(g)(m)(q)

|

| 61,465

| –

|

| UNITED STATES—0.0%

|

|

|

| Delco(b)(f)(m)(q)

|

| 73,666

| –

|

| Total Warrants

|

| –

|

|

| Shares or

Principal

Amount

| Value

|

| SHORT-TERM INVESTMENT—3.7%

|

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class, 5.25%(r)

|

| 1,872,324

| $ 1,872,324

|

| Total Short-Term Investment

|

| 1,872,324

|

Total Investments

(Cost $74,948,793)(s)—140.0%

|

| 70,710,179

|

| Liabilities in Excess of Other Assets—(40.0%)

|

| (20,204,941)

|

| Net Assets—100.0%

|

| $50,505,238

|

| (a)

| Denotes a security issued under Regulation S or Rule 144A.

|

| (b)

| The maturity date presented for these instruments represents the next call/put date.

|

| (c)

| Perpetual maturity. Maturity date presented represents the next call date.

|

| (d)

| Sinkable security.

|

| (e)

| Payment-in-kind security for which part of the income earned may be paid as additional principal.

|

| (f)

| Security is in default.

|

| (g)

| The Fund’s investment manager has deemed this security to be illiquid based upon procedures approved by the Board of Directors. Illiquid securities held by the Fund represent

1.4% of net assets as of April 30, 2024.

|

| (h)

| Convertible Bond

|

| (i)

| Variable or Floating Rate security. Rate disclosed is as of April 30, 2024.

|

| (j)

| Step bond. Rate disclosed is as of April 30, 2024.

|

| (k)

| Denotes the security is government guaranteed.

|

| (l)

| Illiquid security.

|

| (m)

| Level 3 security. See Note 2(a) of the accompanying Notes to Financial Statements.

|

| (n)

| Zero coupon bond. Rate represents yield to maturity.

|

| (o)

| Inflation linked security.

|

| (p)

| The rate shown is the discount yield at the time of purchase.

|

| (q)

| Non-income producing security.

|

| (r)

| Registered investment company advised by State Street Global Advisors. The rate shown is the 7 day yield as of April 30, 2024.

|

| (s)

| See accompanying Notes to Financial Statements for tax unrealized appreciation/(depreciation) of securities.

|

| AUD

| Australian Dollar

|

| BRL

| Brazilian Real

|

| CNH

| Chinese Yuan Renminbi Offshore

|

| COP

| Colombian Peso

|

| DOP

| Dominican Republic Peso

|

| EGP

| Egyptian Pound

|

| EMTN

| Euro Medium Term Note

|

| EUR

| Euro Currency

|

| FRN

| Floating Rate Note

|

| GBP

| British Pound Sterling

|

| HUF

| Hungarian Forint

|

| IDR

| Indonesian Rupiah

|

| INR

| Indian Rupee

|

| MXN

| Mexican Peso

|

| MYR

| Malaysian Ringgit

|

| PEN

| Peruvian Sol

|

| PIK

| Payment-In-Kind

|

| PLC

| Public Limited Company

|

| PLN

| Polish Zloty

|

| abrdn Global Income Fund, Inc.

| 15

|