600 Group PLC Covid-19 Trading Update (8801L)

May 05 2020 - 5:21AM

UK Regulatory

TIDMSIXH

RNS Number : 8801L

600 Group PLC

05 May 2020

5 May 2020

The 600 Group PLC

Covid-19 Trading Update

The 600 Group PLC ("the Group" or the "Company"), the

diversified industrial engineering company (AIM: SIXH), today

announces a trading update in response to the impact of

Covid-19.

As reported in the trading update on 21 February 2020, trading

conditions were more challenging with volatile order intake in both

Machine Tools and Industrial Laser Systems, including a number of

projects being delayed until the next financial year. The evolving

international response to COVID 19, including government

restrictions on working and movement, have impacted the Company.

The health and wellbeing of the Group's employees remains the key

priority for the Group and steps have been taken to protect all

employees at the Company's operating sites in line with relevant

regulatory guidance. At the same time, deliveries during March 2020

across all regions in which the Group operates have been negatively

affected. The ongoing restrictions also continue to create supply

challenges, particularly in the general engineering sectors.

Trading results for the year to 28 March 2020 are expected to be

broadly in line with the Board's previously revised expectations.

However, given the unprecedented uncertainty around the impact of

Covid-19 the Board are unable to provide any guidance for the

current financial year ended 31 March 2021 until such time as the

Group receives more clarity.

To help mitigate the impact of the pandemic, the Group is taking

advantage of government schemes and stimulus packages, including

loans under the USA Government Paycheck Protection Program and, has

taken action to reduce overheads wherever possible. The Group has

adopted short time working, has furloughed staff and has adopted

temporary salary reduction schemes for many employees across the

Group including, with effect from 1 March 2020, the Board and

senior executives. The Company has also deferred all non-critical

capital expenditure.

Following the de-risking of the Group with the receipt of

surplus from the successful pension scheme buy out in 2019 and the

sale of the Gamet business and property in the year ended 28 March

2020, debt levels remain in line with those at the previous year

end and the Group is covenant compliant with adequate banking

facilities.

Paul Dupee, Executive Chairman, stated "Despite the short-term

end-market weaknesses and macroeconomic uncertainty, the Board

continues to believe in the long-term fundamentals of the Group.

The Board have taken decisive action to reduce costs and to keep

the workforce and technical competencies together to ensure the

Group is well placed to reap the immediate benefits when the

markets return to normality".

ENDS

Enquiries:

The 600 Group PLC Tel: 01924 415000

Paul Dupee, Executive Chairman

Neil Carrick, Finance Director

Instinctif Partners Tel: 0207 457 2020

Mark Garraway

James Gray

Spark Advisory Partners Limited (NOMAD) Tel: 020 3368 3553

Matt Davis

WH Ireland (Broker) Tel: 020 7220 1666

Harry Ansell

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

About The 600 Group PLC

The 600 Group PLC is a distributor, designer and manufacturer of

industrial products with three principle areas of activities:

Machine Tools

The business has a strong reputation in the market for metal

turning machines. Products range from small conventional machines

for education markets, CNC workshop machines and CNC production

machines. Selected outsourcing partners support the manufacturing

of these machines and they are marketed through the Group's wholly

owned international sales organisation and a global distribution

network.

Precision Engineered Components

Machine spares are distributed to customers globally to help

maintain the installed base of group machines which number in

excess of 100,000. Additionally, work holding products are sold via

specialist distributors to OEMs, including other machine

builders.

Industrial Laser Systems

Industrial laser systems cover laser marking and processing

including cutting, drilling, ablation and a host of other niche

applications in the marking and micro machining sectors. They

require no consumables, can operate on a continuous high speed

basis and can be integrated into customers' production lines. The

businesses have their own technology and proprietary software.

Customer applications are diverse and range from aerospace to

medical and pharmaceuticals. The requirement for increased product

and component traceability is one of the market drivers.

More information on the Group can be viewed at:

www.600group.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

UPDDZGGKVDDGGZM

(END) Dow Jones Newswires

May 05, 2020 05:21 ET (09:21 GMT)

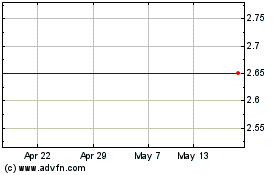

600 (LSE:SIXH)

Historical Stock Chart

From Feb 2025 to Mar 2025

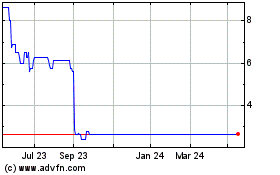

600 (LSE:SIXH)

Historical Stock Chart

From Mar 2024 to Mar 2025