TIDMORCA

RNS Number : 0515F

Orcadian Energy PLC

17 March 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the

publication of this announcement via Regulatory Information Service

(RIS), this inside information is now considered to be in the

public domain.

17 March 2022

Orcadian Energy plc

("Orcadian Energy", "Orcadian" or the "Company")

Results for the half year ended 31 December 2021

Orcadian Energy (AIM: ORCA), the North Sea focused oil and gas

development company, is delighted to announce its unaudited results

for the six months ended 31 December 2021.

Activity Focus:

-- To improve the technical and commercial definition of the Pilot development project

-- To finance the Pilot development project

-- To explore every avenue to maximise the value in our satellite discoveries and prospects

-- To propose a practical means to electrify the Central North

Sea ("CNS") and to develop a business model enabling Orcadian to

benefit from this work

Highlights:

-- Orcadian was admitted to AIM in July 2021 raising gross proceeds of GBP3 million

-- Receipt of Letter of no objection from the Oil and Gas

Authority ("OGA") and entry into the authorisation phase of

development planning for the Pilot Field

-- Received three expressions of interest for the provision of

an Floating Production Storage Offloading ("FPSO") for the Pilot

Development

-- Entered into a non-binding Heads of Terms with Carrick

Resources Limited ("Carrick") in respect of a sub-area of Licence

P2320 which covers the Carra prospect ("Carra")

-- Selected by the OGA to evaluate an approach to the

electrification of North Sea oil and gas platforms which will

dramatically cut carbon emissions.

-- Cash position as at 31 December 2021 of over GBP1.5 million

Steve Brown, Orcadian's CEO, commented:

"Our first half year results have covered a remarkable period

for Orcadian as well as the energy industry as a whole. For our own

part, we completed our listing on AIM; proposed a transformational

approach to new oil and gas developments on the United Kingdom

Continental Shelf ("UKCS") which we believe has the potential to

blaze a trail for a slew of new projects with dramatically lower

emissions than existing production; the OGA blessed those plans and

has also acknowledged the leading role we are seeking to take in

enabling electrification of the North Sea basin.

"We also believe that both the Government and society have begun

to acknowledge that continuing oil and gas production is an

essential part of an energy system in transition and thus ensuring

energy security. We believe that new North Sea developments are

essential to meet continuing demand for oil and gas, and absent

those, we believe that prices will rise, hitting the pockets of the

general public, while ensuring that old, high cost, and hence high

emissions, production has to stay online.

"Governments should be encouraging investors to back those plans

- they will help deliver an energy transition without soaring

costs. Having our own oil and gas production is the only viable

path to energy security and stability. We need to deal with the

reality of energy delivery in the cleanest and most cost effective

ways possible. We believe Orcadian can help deliver this."

For further information on the Company please visit the

Company's website: https://orcadian.energy

Contact:

Orcadian Energy plc + 44 20 7920 3150

Steve Brown, CEO

Alan Hume, CFO

-------------------------

WH Ireland (Nomad and Joint Broker) +44 20 7220 1666

-------------------------

Katy Mitchell / Andrew de Andrade (Nomad)

Harry Ansell / Fraser Marshall (Corporate

Broking)

-------------------------

Shore Capital (Joint Broker) +44 20 7408 4090

-------------------------

Toby Gibbs / James O'Neill (Advisory)

-------------------------

Tavistock (PR) + 44 20 7920 3150

-------------------------

Nick Elwes / Simon Hudson orcadian@tavistock.co.uk

-------------------------

Charlesbye (PR) + 44 7403 050525

-------------------------

Lee Cain / Lucia Hodgson

-------------------------

About Orcadian Energy

Orcadian is a North Sea oil and gas operator with a difference.

In planning its Pilot development, Orcadian has selected wind power

to transform oil production into a cleaner and greener process. The

Pilot project is moving towards approval and will be amongst the

lowest carbon emitting oil production facilities in the world,

despite being a viscous crude. Orcadian may be a small operator,

but it is also nimble, and the Directors believe it has grasped

opportunities that have eluded some of the much bigger companies.

As we strike a balance between Net Zero and a sustainable energy

supply, Orcadian intends to play its part to minimise the cost of

Net Zero and deliver reliable organic energy.

Orcadian Energy (CNS) Ltd ("CNS"), Orcadian's operating

subsidiary, was founded in 2014 and is the sole licensee of P2244,

which contains 78.8 MMbbl of 2P Reserves in the Pilot discovery,

and of P2320 and P2482, which contain a further 77.8 MMbbl of 2C

Contingent Resources in the Elke, Narwhal and Blakeney discoveries

(as audited by Sproule, see the CPR in the Company's Admission

Document for more details). Within these licences there are also

191 MMbbl of unrisked Prospective Resources. These licences are in

blocks 21/27, 21/28, 28/2 and 28/3, and lie 150 kms due East of

Aberdeen. The Company also has a 50% working interest in P2516,

which contains the Fynn discoveries. P2516 is administered by the

Parkmead Group and covers blocks 14/20g and 15/16g, which lie

midway between the Piper and Claymore fields, 180 kms due East of

Wick.

Pilot, which is the largest oilfield in Orcadian's portfolio was

discovered by Fina in 1989 and has been well appraised. In total

five wells and two sidetracks were drilled on Pilot, including a

relatively short horizontal well which produced over 1,800 bbls/day

on test. Orcadian's proposed development plan for Pilot is based

upon a Floating Production Storage and Offloading vessel, with over

thirty wells to be drilled by a Jack-up rig through a pair of well

head platforms and will include a floating wind turbine to provide

much of the energy used in the production process. Emissions per

barrel produced are expected to be about an eighth of the 2020

North Sea average and to lie in the lowest 5% of global oil

production.

Chairman's Statement

This is the first set of interim financial statements for

Orcadian Energy plc. On 15 July 2021, we were admitted to trading

on the AIM market of the LSE raising GBP3m from new investors.

These results include the impact of the IPO, which has transformed

the Company's capacity to develop the business.

In July 2021 the Company filed an addendum to the Pilot field

Concept Select Report ("CSR") with the Oil and Gas Authority

("OGA"). This followed the execution of an agreed work programme

which included polymer core flood tests and work to reduce the

projected carbon dioxide emissions from the development. The

selected concept had been revised to include a significant

improvement in process heat management and power generation

efficiency and included a floating wind turbine to provide energy

for the development scheme. This effort means that the Pilot

development will have emissions which are about an eighth of the

current North Sea average and means that Pilot will lie in the

lowest 5% of global oil production.

In August 2021, using some of the proceeds of the fundraise, we

licenced a 205 sq km 3D seismic dataset from TGS. which covers the

Pilot and Blakeney discoveries as well as the Bowhead prospect.

Axis Well Technology Ltd were also engaged to interpret the survey.

The work to date has gone very well and is currently drawing to a

conclusion. Our maps and static (geological) models of Pilot,

Bowhead, Blakeney and Feugh are now based on this recently

reprocessed seismic dataset which is the best data available over

our acreage.

In October 2021 we entered into a non-binding Heads of Terms

with Carrick Resources Ltd ("Carrick") in respect of a sub-area of

Licence P2320 which covers the Carra prospect, we continue to work

with Carrick on this opportunity.

Also, in October 2021, we were delighted to receive three

expressions of interest for the provision of an FPSO for the Pilot

project and, given quality of the responses , the directors are

confident that a suitable vessel and FPSO contractor can be chosen.

The Company is currently conducting a series of wash tank trials,

in conjunction with the wash tank technology supplier Sulzer at

TotalEnergies's facility in Pau, to derive design parameters for

the in-hull separation tanks. In parallel, the Company is running a

competitive concept definition process with the three FPSO

respondents as it moves towards making a final decision on which

vessel is best for the project.

In November 2021 the Company received a "Letter of no objection"

from the OGA in respect of the development concept for the Pilot

field. This letter signalled the finalisation of the "Assessment

phase" and the entry into the "Authorisation phase" of development

planning for the Pilot Field. In times past, this was a fairly

routine marker of progress, but since the OGA's adoption of a Net

Zero central objective, to rank equally with its MER (Maximising

Economic Recovery) objective, the directors believe this is

actually a very significant stepping-stone towards government

approval of the development of Pilot.

In December 2021 the OGA announced that Orcadian had been chosen

as one of three winners of the decarbonisation competition for the

electrification of offshore oil and gas installations, which had

been announced in September 2021. Based upon the knowledge gained

from our work on reducing emissions for the Pilot project, we

formed what we believe is a powerful consortium and prepared a

concept to electrify existing platforms in the CNS. The Company was

awarded GBP466,667 by the OGA and is working with Crondall Energy,

Enertechnos, Petrofac, North Sea Midstream Partners and Wärtsilä to

deliver a report to the OGA and Central Graben Operators by the end

of March 2022. The evaluation will include a commercial proposal

for the delivery of electrical power to Central Graben and Central

North Sea Operators interested in rapidly implementing

electrification of their platforms.

The first half year as a quoted company has been extraordinarily

busy and we are working hard focussing on four fronts:

-- firstly, to improve the technical and commercial definition of the Pilot development project;

-- secondly, to finance the Pilot development project;

-- in addition, we are exploring every avenue to maximise the

value in our satellite discoveries and prospects; and

-- finally, to propose a means to practically electrify the CNS

and to develop a business model enabling Orcadian to benefit from

this work.

Of these activities, securing finance for Pilot is paramount,

and we are exploring multiple avenues and potential opportunities

to deliver this. The work to select the FPSO contractor will help

define both the project costs and the portion of those costs which

the FPSO contractor is willing to shoulder. We are exploring the

potential for infrastructure investors to finance facilities costs

in return for a tariff (similar to the arrangements Premier entered

into for the Tolmount project); and we are testing with potential

lenders the project debt capacity, which is determined by the

robustness of the proven reserve case.

All these activities will define the equity requirement for the

project. This equity can come either from industry, through a farm

in, or the markets. The directors, whose interests are closely

aligned with shareholders, will choose the most appropriate option

which minimises dilution whilst maximising value for all the

Company's shareholders.

The directors believe that the Company is well placed with an

excellent project, the development of which is aligned with the

interests and strategy of the OGA. Given the feedback that we have

already gained from the industry, we believe that we have an

exciting year ahead in taking forward not only the Pilot

development project, but also our other discoveries and

prospects.

Joe Darby

Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE SIX MONTHSED 31 DECEMBER 2021

Unaudited Unaudited Audited

6 Month 6 Month 12 Month

Period Ended Period Ended Period Ended

31 December 31 December 30 June

2021 2020 2021

Note GBP GBP GBP

Administrative expenses (519,650) (134,396) (258,909)

Operating Loss (519,650) (134,396) (258,909)

------------- ------------- -------------

Finance costs (19,277) (19,637) (44,349)

Other income - - 3,000

Listing costs (325,449) - (76,500)

------------- ------------- -------------

Loss before tax (864,376) (154,033) (376,758)

Taxation - - 80,420

Loss for the period (864,376) (154,033) (296,338)

------------- ------------- -------------

Other comprehensive income:

Items that will or may be

reclassified to profit or

loss:

Other comprehensive income - - -

------------- ------------- -------------

Total comprehensive income (864,376) (154,033) (296,338)

------------- ------------- -------------

Basic and Diluted Earnings

per share 4 (1.38p) (0.89p) (1.34p)

All operations are continuing.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2021

Unaudited Unaudited Audited

as at as at as at

31 December 31 December 30 June

2021 2020 2021

Note GBP GBP GBP

Non-current assets

Property, plant and equipment 1,842 107 1,842

Intangible assets 5 2,694,666 1,481,834 1,814,615

2,696,508 1,481,942 1,816,457

------------ ------------ -----------

Current assets

Trade and Other Receivables 6 63,217 139,795 88,548

Cash and cash equivalents 1,517,902 17,870 179,556

1,581,119 157,665 268,104

------------ ------------ -----------

Total assets 4,277,627 1,639,607 2,084,561

------------ ------------ -----------

Non-current liabilities

Borrowings 7 (815,185) (872,430) (762,686)

(815,185) (872,430) (762,686)

------------ ------------ -----------

Current liabilities

Trade and Other Payables 8 (516,902) (401,599) (328,601)

Borrowings 7 - (330,000) (1,100,000)

(516,902) (731,599) (1,428,601)

------------ ------------ -----------

Total liabilities (1,332,087) (1,604,029) (2,191,287)

------------ ------------ -----------

Net assets / (liabilities) 2,945,540 35,578 (106,726)

------------ ------------ -----------

Equity

Ordinary share capital 9 63,755 17,401 52,202

Share premium 9 3,890,089 563,561 -

Share warrants reserve 9 15,000 - -

Reverse Acquisition Reserve 3 (38,848) - (38,848)

Retained earnings (984,456) (545,384) (120,080)

------------ ------------ -----------

Total equity 2,945,540 35,578 (106,726)

------------ ------------ -----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODED 31 DECEMBER 2021

Ordinary Share Reverse

Share Share warrants Acquisition Retained

capital premium reserve Reserve earnings Total

Note GBP GBP GBP GBP GBP GBP

Balance as at 1 July

2020 (audited) 17,401 563,561 - - (391,350) 189,612

Loss for the period and

total comprehensive income - - - - (154,034) (154,034)

-------- --------- --------- ------------ --------- ---------

Balance as at 31 December

2020 (unaudited) 17,401 563,561 - - (545,384) 35,578

Loss for the period and

total comprehensive income - - - - (296,338) (296,338)

-------- --------- --------- ------------ --------- ---------

Bonus issue of shares 9 34,801 (34,801) - - - -

Issue of shares 9 52,202 - - (52,202) - -

Transfer to Reverse Acquisition

Reserve 3 (52,202) (528,760) - 13,354 567,608 -

-------- --------- --------- ------------ --------- ---------

Balance as at 30 June

2021 (audited) 52,202 - - (38,848) (120,080) (106,726)

-------- --------- --------- ------------ --------- ---------

Loss for the period and

total comprehensive income - - - - (864,376) (864,376)

-------- --------- --------- ------------ --------- ---------

Issue of shares 9 7,625 3,042,375 - - - 3,050,000

Share issue costs 9 - (233,358) - - - (233,358)

Conversion of loans 9 3,928 1,096,072 - - - 1,100,000

Issue of warrants 9 - (15,000) 15,000 - - -

-------- --------- --------- ------------ --------- ---------

Balance as at 31 December

2021 (unaudited) 63,755 3,890,089 15,000 (38,848) (984,456) 2,945,540

-------- --------- --------- ------------ --------- ---------

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIODED 31 DECEMBER 2021

Unaudited Unaudited Audited

6 Month Period 6 Month Period 12 Month

Ended Ended Period Ended

31 December 31 December 30 June

2021 2020 2021

Note GBP GBP GBP

Cash flows from operating activities

Loss before tax for the year (864,376) (154,034) (376,758)

Adjustments for:

Depreciation - - 217

Unrealised foreign exchange loss

(gain) 33,222 - (129,511)

Decrease / (increase) in trade

and other receivables 6 25,331 (16,155) (10,409)

(Decrease) / Increase in trade

and other payables 8 (24,928) 39,128 79,504

Finance costs in the period 19,277 19,637 44,349

--------------- --------------- -------------

Cash generated from operations (811,474) (111,424) (392,608)

--------------- --------------- -------------

Income taxes paid - - 80,420

--------------- --------------- -------------

Net cash flows from operating

activities (811,474) (111,424) (312,188)

--------------- --------------- -------------

Investing activities

Purchases of property, plant and

equipment - - (1,952)

Purchases of exploration and evaluation

assets 5 (666,822) (86,165) (530,818)

--------------- --------------- -------------

Net cash used in investing activities (666,822) (86,165) (532,770)

--------------- --------------- -------------

Financing activities

Borrowings from Directors and

Officers - (45,500) -

Proceeds from issue of convertible

loan notes 7 - 230,000 1,100,000

Repayment of convertible loan

notes 7 - - (100,000)

Interest paid - (360) (6,804)

Proceeds from issue of ordinary

share capital 9 2,816,642 - -

--------------- --------------- -------------

Net cash used in financing activities 2,816,642 184,140 993,196

--------------- --------------- -------------

Net increase in cash and cash

equivalents 1,338,346 (13,449) 148,238

Cash and cash equivalents at beginning

of period 179,556 31,318 31,318

--------------- --------------- -------------

Cash and cash equivalents and

end of period 1,517,902 17,870 179,556

--------------- --------------- -------------

Significant non-cash transactions:

On 15 July all Convertible Loan Notes ("CLNs") were converted in

to ordinary shares at a price of 28 pence each. In total 3,928,572

ordinary shares were issued in full discharge of the CLNs.

NOTES TO THE FINANCIAL STATEMENTS

1. General Information

Orcadian Energy PLC (the "Company") is a public limited company

which is domiciled and incorporated in England and Wales under the

Companies Act 2006 with the registered number 13298968. The

Company's registered office is 6(th) floor, 60 Gracechurch Street,

London, EC3V 0HR, and it ordinary shares are admitted to trading on

AIM, a market of the London Stock Exchange.

The principal activity of the Group is managing oil and gas

assets and it holds a 100% interest in, and is administrator for,

UKCS Seaward Licences P2244, which contains the Pilot and Harbour

heavy oil discoveries, and P2320, which contains the Blakeney,

Feugh, Dandy & Crinan discoveries.

2. Summary of significant accounting policies

The principal accounting principles applied in the preparation

of these financial statements are set out below. These principles

have been consistently applied to all years presented, unless

otherwise stated.

2.1. Basis of preparation

The interim financial information set out above does not

constitute statutory accounts within the meaning of the Companies

Act 2006. It has been prepared on a going concern basis in

accordance with the recognition and measurement criteria of

International Financial Reporting Standards (IFRS) as adopted by

the European Union. Statutory financial statements for the year

ended 30 June 2021 were approved by the Board of Directors on 15

December 2021 and delivered to the Registrar of Companies. The

report of the auditors on those financial statements was

unqualified.

The interim financial information for the six months ended 31

December 2021 has not been reviewed or audited. The interim

financial report has been approved by the Board on 16 March

2022.

2.2. Going concern

The Directors, having made appropriate enquiries, consider that

adequate resources exist for the Company to continue in operational

existence for the foreseeable future and that, therefore, it is

appropriate to adopt the going concern basis in preparing the

interim financial statements for the period ended 31 December

2021.

2.3. Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Company's medium

term performance and the factors that mitigate those risks have not

substantially changed from those set out in the Company's 2021

Annual Report and Financial Statements, a copy of which is

available on the Company's website: https://orcadian.energy. The

key financial risks are securing finance for the Pilot project and

an emerging cost inflation risk.

2.4. Critical accounting estimates

The preparation of interim financial statements requires

management to make estimates and assumptions that affect the

reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in note xx of the Company's 2021 Annual Report and

Financial Statements. The nature and amounts of such estimates have

not changed significantly during the interim period.

The accounting policies applied are consistent with those of the

annual financial statements for the year ended 30 June 2021, as

described in those annual financial statements.

3. Group reorganisation under common control

The acquisition met the definition of a group reorganisation due

to the Company and the subsidiary being under common control at the

date of acquisition. As a result, and since Orcadian Energy Plc did

not meet the definition of a business per IFRS 3, the acquisition

fell outside of the scope of IFRS 3 and the predecessor value

method was used to account for the acquisition.

These consolidated financial statements for the period ended 31

December 2020 are of the Company's wholly owned subsidiary,

Orcadian Energy (CNS) Ltd.

On 11 May 2021, the Company issued 52,201,601 shares to acquire

the entire issued share capital of Orcadian Energy (CNS) Ltd.

The net assets of Orcadian Energy (CNS) Ltd at the date of

acquisition was as follows:

GBP

Property Plant & Equipment 1,357

Intangible Assets 1,719,292

Current Assets 447,425

Current Liabilities (284,745)

Non-Current Liabilities (1,869,975)

---------------------------- ------------

Net assets 13,354

---------------------------- ------------

The reserve that arose from the acquisition is made up as

follows:

GBP

---------------------------------------------------- ---------

As at 31 December 202 -

Cost of the investment in Orcadian Energy (CNS)

Ltd 52,202

Less: net assets of Orcadian Energy (CNS) Ltd

at acqusition (13,354)

As at 30 June 2021 (audited) and as at 31 December

2021 (unaudited) 38,848

---------------------------------------------------- ---------

4. Earnings per share

The calculation of the basic and diluted earnings per share is

calculated by dividing the loss for the year for continuing

operations for the Company by the weighted average number of

ordinary shares in issue during the year.

Dilutive loss per Ordinary Share equals basic loss per Ordinary

Share as, due to the losses incurred in all three periods

presented, there is no dilutive effect from the subsisting share

warrants.

Unaudited Unaudited Audited

6 Month Period 6 Month Period 12 Month

Ended Ended Period Ended

31 December 31 December 30 June

2021 2020 2021

GBP GBP GBP

Loss for the purposes of basic

earnings per share being net

loss attributable to the owners (864,376) (154,034) (296,338)

Weighted average number of Ordinary

Shares 62,809,231 17,400,534 22,167,804

Loss per share (1.38p) (0.89p) (1.34p)

------------------------------------- ---------------- ---------------- --------------

The weighted average number of shares is adjusted for the impact

of the acquisition as follows:

- Prior to the acquisition, the number of shares is based on

Orcadian Energy (CNS) Ltd, adjusted using the share exchange ratio

arising on the acquisition; and

- From the date of the acquisition, the number of shares is

based on the Company.

5. Intangible assets

Oil and gas

exploration

assets

GBP

Cost

------------

As at 30 June 2020 (audited) 1,283,797

------------

Additions 198,037

------------

As at 31 December 2020 (unaudited) 1,481,834

------------

Additions 332,781

------------

As at 30 June 1 (audited) 1,814,615

------------

Additions 880,051

------------

As at 31 December 2021 (Unaudited) 2,694,666

------------

6. Trade and other receivables

Unaudited Unaudited Audited

as at as at as at

31 December 31 December 30 June

Group 2021 2020 2021

GBP GBP GBP

VAT receivable 63,217 22,071 50,925

Prepayments relating to the

issue of equity - - 13,500

Prepayments other - - 24,123

Amounts due from related parties - 117,724 -

------------ ------------ --------

63,217 139,795 88,548

------------ ------------ --------

7. Borrowings

Unaudited Unaudited Audited

as at as at as at

31 December 31 December 30 June

2021 2020 2021

GBP GBP GBP

STASCO Loan 815,185 872,430 762,686

Convertible Loan Note 2020 - 330,000 380,000

Convertible Loan Note 2021 - - 720,000

------------- ------------- ----------

815,185 1,202,430 1,862,686

------------- ------------- ----------

8. Trade and other payables - due within one year

Unaudited Unaudited Audited

as at as at as at

31 December 31 December 30 June

2021 2020 2021

GBP GBP GBP

Trade payables 294,918 160,357 35,443

Accruals 191,049 241,242 276,133

Other creditor 30,935 - 17,025

------------ ------------ --------

516,902 401,599 328,601

------------ ------------ --------

9. Ordinary share capital and share premium

Group

Number of Ordinary Share

shares share capital premium

Issued GBP GBP

As at 30 June 2020 (audited) 17,400,534 17,401 563,561

As at 31 December 2020 (unaudited) 17,400,534 17,401 563,561

-------------- -------------- -----------

Transfer between reserves - 34,801 (34,801)

Issued capital of Company at acquisition 1 - -

Issue of shares upon acquisition

of subsidiary 52,201,601 52,202 -

Transfer of Ltd paid up capital

to reverse acquisition reserve (17,400,534) (52,202) (528,760)

-------------- -------------- -----------

As at 30 June 2021(audited) 52,201,602 52,202 -

-------------- -------------- -----------

Issue of shares 7,625,000 7,625 3,042,375

Share issue costs - - (233,358)

Conversion of loans 3,928,572 3,928 1,096,072

-------------- -------------- -----------

As at 31 December 2021 (unaudited) 63,755,174 63,755 3,905,089

-------------- -------------- -----------

The issued capital of the Group for the period 1 July 2020 to 11

May 2021 was that of Orcadian Energy (CNS) Ltd. Upon completion of

the acquisition the share capital of Orcadian Energy (CNS) Ltd was

transferred to the Acquisition reserve (Refer to note 4) and the

share capital of Orcadian Energy PLC was brought to account.

The ordinary shares confer the right to vote at general meetings

of the Company, to a repayment of capital in the event of

liquidation or winding up and certain other rights as set out in

the Company's articles of association.

On 15 July 2021 the Company issued 75,000 warrants over ordinary

shares of the Company at 40 pence each, exercisable at any time

over a three year period from the date of issue. The warrants were

valued using the Black-Scholes pricing model. The inputs into the

Black-Scholes model are as follows:

Grant date 15 July 2021

Exercise price 40.00 pence

Expected life 3 years

Expected volatility 77.32%

Risk free rate of

interest 0.0242%

Dividend yield Nil

Fair value of option 20.00 pence

---------------------- -------------

Volatility has been estimated based on the historic volatility

of a collection of comparable companies over a period equal to the

expected term from the grant date.

10. Events after the reporting period

Since 31 December 2021, the Company has been focussed on the

following activities:

-- Progressing, with Sulzer, wash tank trials at the

TotalEnergies test facility in Pau, these tests will help provide

useful design parameters for the wash tanks to be installed in the

FPSO hull;

-- Developing the geological and geophysical models for Pilot,

Bowhead, Blakeney and Feugh based upon the new seismic data;

-- Modelling the expected performance of a polymer flood scheme

based upon the results of the polymer core flood work and the new

maps;

-- Preparing a functional specification and basis of design to

be discussed with potential FPSO contractors;

-- Executing the agreed work programme for the OGA on the

Electrification Competition; and, of course

-- Exploring opportunities to finance the Pilot development scheme.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMZGMFRVVGZZM

(END) Dow Jones Newswires

March 17, 2022 03:00 ET (07:00 GMT)

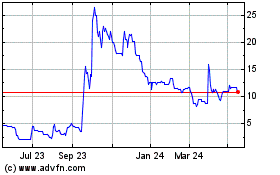

Orcadian Energy (LSE:ORCA)

Historical Stock Chart

From Jun 2024 to Jul 2024

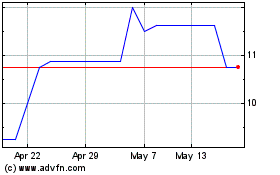

Orcadian Energy (LSE:ORCA)

Historical Stock Chart

From Jul 2023 to Jul 2024