TIDMORCA

RNS Number : 8196V

Orcadian Energy PLC

16 December 2021

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR). Upon the

publication of this announcement via Regulatory Information Service

(RIS), this inside information is now considered to be in the

public domain.

16 December 2021

Orcadian Energy plc

("Orcadian Energy", "Orcadian" or the "Company")

Results for the year ended 30 June 2021

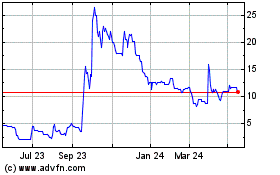

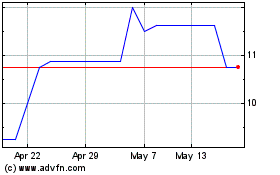

Orcadian Energy (AIM: ORCA), the North Sea focused oil and gas

development company, is delighted to announce its audited results

for the twelve months ended 30 June 2021.

Highlights:

-- Primary activity was preparing for the Company's admission to trading on AIM.

-- Following the end of the period under review:

o Orcadian admitted to AIM in July 2021 raising gross proceeds

of GBP3 million

o Receipt of Letter of no objection from the Oil and Gas

Authority ("OGA") and entry into the authorisation phase of

development planning for the Pilot Field

o Received three expressions of interest for the provision of an

FPSO for the Pilot Development

o Entered into a non-binding Heads of Terms with Carrick

Resources Limited ("Carrick") in respect of a sub-area of Licence

P2320 which covers the Carra prospect ("Carra")

o Cash position as at 15(th) December 2021 of over GBP1.5

million

o Selected by the OGA to evaluate an approach to the

electrification of North Sea oil and gas platforms which will

dramatically cut carbon emissions.

Steve Brown, Orcadian's CEO, said:

" The last financial year has been transformational for the

Company.

"Whilst these results record our position at the end of June

2021, the rest of this year has seen the Company make significant

progress in delivering its strategy.

"We were admitted to trading on AIM, a market of the London

Stock Exchange. On Admission we raised gross proceeds of GBP3m and

since then we have finalised the Concept Select process and moved

to the 'authorisation phase' for our flagship Pilot development,

whilst earlier this month we surpassed twenty-six other companies,

or consortia, to win funding of GBP466,667 in the OGA

Electrification Competition.

"The publishing of results is often a time for reflection, but

from our perspective time spent resting on laurels is time wasted.

Our focus for 2022 will be to seek to secure the financing for the

Pilot project and to secure a customer for the platform

electrification solution we will design in the coming months.

"We are determined to show the industry and the world that it is

possible to produce the oil and gas, that regular customers need,

in a cost effective way and with much, much lower emissions. We

will do this on Pilot and we believe our electrification system

will offer an opportunity for other operators on the UKCS to reduce

emissions as rapidly as possible.

"North Sea businesses can show the world how to produce oil and

gas with much lower emissions, helping to drive out high cost and

high emissions production elsewhere in the world. We are proud of

the role we are playing in this.

"We look forward to 2022 with optimism and energy and look

forward to a sea change in attitudes to responsible oil and gas

development projects and to the market continuing to recognise the

significant value in our projects."

Report and Accounts and Annual General Meeting

A copy of the annual report and accounts for the year ended 30

June 2021 is available on the Company's website (

https://orcadian.energy ) with effect from today. A further

announcement will be made when the Company posts its annual report

and accounts and notice of Annual General Meeting to its

shareholders.

For further information on the Company please visit the

Company's website: https://orcadian.energy

Contact:

Orcadian Energy plc + 44 20 7920 3150

Steve Brown, CEO

Alan Hume, CFO

-------------------------

WH Ireland (Nomad and Joint Broker) +44 20 7220 1666

-------------------------

Katy Mitchell / Andrew de Andrade (Nomad)

Harry Ansell / Fraser Marshall (Corporate

Broking)

-------------------------

Shore Capital (Joint Broker) +44 20 7408 4090

-------------------------

Toby Gibbs / James O'Neill (Advisory)

-------------------------

Tavistock (PR) + 44 20 7920 3150

-------------------------

Nick Elwes / Simon Hudson / Matthew orcadian@tavistock.co.uk

Taylor

-------------------------

Charlesbye (PR) + 44 7403 050525

-------------------------

Lee Cain / Lucia Hodgson

-------------------------

About Orcadian Energy

Orcadian is a North Sea oil and gas operator with a difference.

In planning its Pilot development, Orcadian has selected wind power

to transform oil production into a cleaner and greener process. The

Pilot project is moving towards approval and will be amongst the

lowest carbon emitting oil production facilities in the world,

despite being a viscous crude. Orcadian may be a small operator,

but it is also nimble, and the Directors believe it has grasped

opportunities that have eluded some of the much bigger companies.

As we strike a balance between Net Zero and a sustainable energy

supply, Orcadian intends to play its part to minimise the cost of

Net Zero and deliver reliable organic energy.

Orcadian Energy (CNS) Ltd ("CNS"), Orcadian's operating

subsidiary, was founded in 2014 and is the sole licensee of P2244,

which contains 78.8 MMbbl of 2P Reserves in the Pilot discovery,

and of P2320 and P2482, which contain a further 77.8 MMbbl of 2C

Contingent Resources in the Elke, Narwhal and Blakeney discoveries

(as audited by Sproule, see the CPR in the Company's Admission

Document for more details). Within these licences there are also

191 MMbbl of unrisked Prospective Resources. These licences are in

blocks 21/27, 21/28, 28/2 and 28/3, and lie 150 kms due East of

Aberdeen. The Company also has a 50% working interest in P2516,

which contains the Fynn discoveries. P2516 is administered by the

Parkmead Group and covers blocks 14/20g and 15/16g, which lie

midway between the Piper and Claymore fields, 180 kms due East of

Wick.

Pilot, which is the largest oilfield in Orcadian's portfolio was

discovered by Fina in 1989 and has been well appraised. In total

five wells and two sidetracks were drilled on Pilot, including a

relatively short horizontal well which produced over 1,800 bbls/day

on test. Orcadian's proposed development plan for Pilot is based

upon a Floating Production Storage and Offloading vessel, with over

thirty wells to be drilled by a Jack-up rig through a pair of well

head platforms and will include a floating wind turbine to provide

much of the energy used in the production process. Emissions per

barrel produced are expected to be about an eighth of the 2020

North Sea average and to lie in the lowest 5% of global oil

production.

ANNUAL RESULTS FOR THE TWELVE MONTHSED 30 JUNE 2021

Chairman's Statement

The year ended 30 June 2021 has been a watershed year for the

Orcadian Energy plc and its subsidiary (the "Group"). At the start

of the year the Group was a single private company, then called

Pharis Energy Ltd, now called Orcadian Energy (CNS) Ltd; by the end

of the year that company had been acquired by the newly formed

Orcadian Energy PLC (the "Company"), which was well on the road to

being admitted to the AIM market, an event which occurred on 15

July 2021.

Operationally, the Group has made very substantial progress with

the process of preparing the Pilot oilfield, the Group's principal

asset, for development. During the year GBP530,818 was spent on

intangible assets. This has occurred during a period when the

Government has raised the bar for emissions performance for the oil

and gas industry. The Oil and Gas Authority (the "OGA") had already

started to focus on emissions performance as we were preparing a

Concept Select Report ("CSR") for the Pilot field development which

we submitted in September 2020. A revised Strategy for the Oil

& Gas Authority which placed a range of new net zero

obligations on the UK oil and gas industry, on a par with the

existing central obligation to maximise economic recovery, was laid

before Parliament in December 2020 and came into force in February

2021.

The adoption of a polymer flooding strategy, an outcome of our

concept select work, had already substantially reduced expected

emissions from the Pilot development project, actually well below

the North Sea average, but the OGA asked us to do better, and we

responded positively to that challenge. The result is that expected

Scope 1 emissions from the Pilot development are just 2.6

kgCO2e/bbl, a performance which places the Pilot development at the

low end of the lowest 5% of global oil production (further details

of which are set out in the Company's Admission Document).

Following the end of the period under review, an addendum to the

CSR was submitted to the OGA on the 1st of July 2021 and the OGA

confirmed on the 29th November 2021 that they were content with our

proposal and that the project can move from the Assessment phase

into the Authorisation phase of the OGA's field development plan

process.

The financial results of the Group largely reflect the

investment in progressing the Pilot field and the costs of

preparing the Group for admission to AIM, a costly but necessary

process to position the Group for success. Since Orcadian Energy

(CNS) Ltd was established to apply for the Pilot licence in 2014

much has been achieved with few resources, indeed the admission to

AIM of Orcadian, when measured by the metric of proven plus

probable reserves, was the largest ever UKCS focussed admission of

an oil and gas company to the AIM market. Being quoted gives the

Group access to capital and multiplies the options the Group has to

progress the development of Pilot.

Finally, also following the end of the period under review, on

the 6th December 2021 the OGA announced that Orcadian had been

awarded GBP466,667 in the OGA Electrification Competition. In

return, we will evaluate a new concept for the electrification of

key producing oil and gas fields, initially focussing on Central

Graben area fields, which are owned and controlled by third parties

(see announcement dated 6 December 2021 for more information).

Our concept would use renewable energy, generated from local

wind farms, for the bulk of the electricity required; with back-up

power generated from gas or net zero fuels, supported by batteries

for a fast response. We will be working with Crondall Energy,

Enertechnos, Petrofac, North Sea Midstream Partners ("NSMP") and

Wärtsilä to deliver a report to the OGA and Central Graben

Operators by the end of March 2022. The OGA funding covers all our

external costs in doing this work.

We have also formed a partnership with North Sea Midstream

Partners to make a commercial proposal for the delivery of

electrical power to Central Graben and Central North Sea Operators.

It remains to be seen whether this opportunity can be developed

into a new business, but we remain committed to making the best of

every opportunity to create value for shareholders.

In any event, the Company is now well positioned to make the

best of its assets and to deliver real value for shareholders from

the very substantial reserve base the Group holds.

Financial Results

The Group incurred a loss for the year to 30 June 2021 of

GBP296,338 (30 June 2020 - loss of GBP230,519). The 2020

comparative numbers are that of wholly owned subsidiary Orcadian

Energy (CNS) Ltd. Refer to note 2.2 for further detail.

In the year to 30 June 2021 the loss mainly arose from expenses

in connection to the transaction, costs associated with the

admission process including Advisory and Consultancy Fees,

salaries, consulting and professional fees along with general

administration expenses. These expenses have been met from the

proceeds of the issue of shares.

Cash flow and cash position

Cash used in operations totalled GBP312,189 (30 June 2020 -

GBP141,254)

As at 30 June 2021, the Group had a cash balance of GBP179,556

(30 June 2020 - GBP31,318). Following the end of the financial

period under review the Company raised gross proceeds of GBP3m as

part of its Admission to AIM.

Oil Price Outlook

When the Company's shares were admitted to trading on AIM, we

stated in the Admission Document that, based on an internal

assessment of the supply and demand outlook, the Directors believed

that we were entering a period of relative scarcity of oil, which

we also believed was supportive of a higher oil price. We believe

that is now the consensus view, with demand above 100 million

barrels per day, politicians calling for OPEC to increase supply

and Brent oil prices having exceeded $80/bbl, before falling back

to the low $70s/bbl.

We also stated that the Directors expected that governments

around the world would continue their efforts to reduce carbon

dioxide emissions, obviously that could temper demand in the

future, but we also noted that under-investment in the upstream oil

industry could well counteract that pressure.

We still believe that oil prices will always be volatile, but we

also believe it is not unreasonable to plan the Group's projects on

the assumption that there is a robust outlook for oil; and the

Directors believe the Group's flagship project should be

economically robust as the NPV breakeven price for the Pilot

development scheme is approximately US$39/bbl. (see the Company's

Admission Document for details of the assumption behind that NPV)

and since January 2015 the oil price has been above US$39/bbl 94%

of the time.

UK Oil and Gas Sector

On 24 March 2021, the Government announced the North Sea

Transition Deal demonstrating the Government's commitment to the

UKCS oil and gas sector. Through this deal the UK's oil and gas

sector and the government will work together to deliver the skills,

innovation and new infrastructure required to decarbonise North Sea

oil and gas production. The Group is a part of these discussions

and with the support of the OGA will be making a proposal to supply

clean reliable energy to Platform Operators. The Directors are

confident that the Government will continue to support the oil and

gas industry, especially those companies and projects which can

demonstrate their contribution to delivering a Net Zero basin.

Business Outlook

The key challenge for the Group is the financing of the Pilot

project. The Directors are pursuing two parallel and complementary

paths to achieve this aim. The reserves have been established, and

with the receipt of a "Letter of no objection" from the OGA the

development plan is clear. We are working to attract oil companies

and contractors as partners in the development and we will continue

to do that through 2022. We are confident that, as the mist clears

after COP26, that companies will once again recognise that the UKCS

is a great place to invest and that appetite for well-designed

development opportunities which have substantial proven reserves

will re-emerge.

Joseph Darby

Chairman and Non-Executive Director

15 December 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS

FOR THE YEARED 30 JUNE 2021

Year ended Year ended

30 June 30 June

2021 2020

Note GBP GBP

Revenue - -

Administrative expenses 5 (258,909) (200,225)

Operating Loss (258,909) (200,225)

---------- ------------

Finance costs 9 (44,349) (40,294)

Other income 7 3,000 10,000

Listing costs (76,500) -

Loss before tax (376,758) (230,519)

---------- ------------

Taxation 10 80,420 -

Loss for the year (296,338) (230,519)

---------- ------------

Other comprehensive income:

Items that will or may be

reclassified to profit or

loss:

Other comprehensive income - -

---------- ----------

Total comprehensive income (296,338) (230,519)

---------- ----------

Earnings per share 11 (1.34) (1.32p)

All operations are continuing.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

30 June 30 June

2021 2020

Note GBP GBP

Non-current assets

Property, plant and equipment 12 1,842 107

Intangible assets 13 1,814,615 1,283,797

1,816,457 1,283,904

----------- -----------

Current assets

Trade and Other Receivables 14 88,548 78,138

Cash and cash equivalents 15 179,556 31,318

268,104 109,456

----------- -----------

Total assets 2,084,561 1,393,360

----------- -----------

Non-current liabilities

Borrowings 17 (762,686) (953,152)

(762,686) (953,152)

----------- -----------

Current liabilities

Trade and other payables 18 (328,601) (250,596)

Borrowings 17 (1,100,000) -

(1,428,601) (250,596)

----------- -----------

Total liabilities (2,191,287) (1,203,748)

----------- -----------

Net (liabilities) / assets (106,726) 189,612

----------- -----------

Equity

Ordinary share capital 19 52,202 17,401

Share premium 19 - 563,561

Reverse acquisition reserve 4 (38,848) -

Retained earnings (120,080) (391,350)

----------- -----------

Total equity (106,726) 189,612

----------- -----------

The consolidated Financial Statements of Orcadian Energy PLC

were approved by the Board of Directors and authorised for issue on

15 December 2021.

Signed on behalf of the Board of Directors by:

Alan Hume

Director

COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2021

30 June

2021

Note GBP

Non-current assets

Investment in subsidiary 16 52,202

52,202

-------

Current assets

Trade and Other Receivables 14 -

Cash and cash equivalents 15 -

-

-------

Total assets 52,202

-------

Non-current liabilities

Borrowings 17 -

-

-------

Current liabilities

Trade and other payables 18 -

-

-------

Total liabilities -

-------

Net assets 52,202

-------

Equity

Ordinary share capital 19 52,202

Retained earnings -

-------

Total equity 52,202

-------

Orcadian Energy PLC, company number 13298968, has used the

exemption granted under s408 of the Companies Act 2006 that allows

for the non-disclosure of the Income Statement of the parent

company. The after-tax loss attributable to Orcadian Energy PLC for

the three months to 30 June 2021 was GBPnil .

The Financial Statements were approved by the Board of Directors

and authorised for issue on 15 December 2021.

Signed on behalf of the Board of Directors by:

Alan Hume

Director

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2021

Ordinary Reverse

Share Share acquisition Retained

capital premium reserve earnings Total

Note GBP GBP GBP GBP GBP

Balance as at 1 July 2019 17,346 492,215 - (160,831) 348,730

-------- --------- ------------ --------- ---------

Loss for the year and total

comprehensive income - - - (230,519) (230,519)

Proceeds of share issues

(net of costs) 19 55 71,346 - - 71,401

-------- --------- ------------ --------- ---------

Balance as at 30 June 2020 17,401 563,561 - (391,350) 189,612

-------- --------- ------------ --------- ---------

Balance as at 1 July 2020 17,401 563,561 - (391,350) 189,612

-------- --------- ------------ --------- ---------

Loss for the year and total

comprehensive income - - - (296,338) (296,338)

Bonus issue of shares 19 34,801 (34,801) - - -

Issue of shares 19 52,202 - (52,202) - -

Transfer to reverse acquisition

reserve 4 (52,202) (528,760) 13,354 567,608 -

-------- --------- ------------ --------- ---------

Balance as at 30 June 2021 52,202 - (38,848) (120,080) (106,726)

-------- --------- ------------ --------- ---------

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

Ordinary share Represents the nominal value of shares issued

capital

Share premium account Amount subscribed for share capital in excess

of nominal value

Reverse acquisition Reserve created in accordance with the acquisition

reserve of Orcadian Energy (CNS) Ltd on 11 May, 2021

(Refer to Note 4)

Retained earnings Cumulative net gains and losses recognised

in the Consolidated Statement of Comprehensive

Income

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2021

Ordinary Retained

Share capital earnings Total

Note GBP GBP GBP

Balance as at Incorporation

29 March 2021 - - -

-------------- --------- ------

Loss for the period and total

comprehensive income - - -

Issue of shares upon acquisition

of subsidiary 19 52,202 - 52,202

-------------- --------- ------

Balance as at 30 June 2021 52,202 - 52,202

-------------- --------- ------

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

Ordinary share Represents the nominal value of shares issued

capital

Retained earnings Cumulative net gains and losses recognised

in the Consolidated Statement of Comprehensive

Income

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 JUNE 2021

Year ended Year ended

30 June 2021 30 June 2020

Note GBP GBP

Cash flows from operating activities

Loss before tax for the year (376,758) (230,519)

Adjustments for:

Depreciation 12 217 694

Unrealised foreign exchange (gain) 5 (129,511) -

(Increase) / decrease trade and other

receivables 14 (10,409) 4,435

(Decrease) / Increase in trade and

other payables 18 79,504 43,842

Finance costs in the year 9 44,349 40,294

------------- -------------

Cash generated from operations (392,608) (141,254)

------------- -------------

Income taxes paid 80,420 -

------------- -------------

Net cash flows from operating activities (312,188) (141,254)

------------- -------------

Investing activities

Purchases of property, plant and

equipment 14 (1,952) -

Purchases of exploration and evaluation

assets 13 (530,818) (750,799)

------------- -------------

Net cash used in investing activities (532,770) (750,799)

------------- -------------

Financing activities

Borrowings from Directors and Officers 21 - (882)

Proceeds from issue of convertible

loan notes 17 1,100,000 100,000

Repayment of convertible loan notes 17 (100,000) -

Proceeds from loans obtained 17 - 814,260

Interest paid (6,804) -

Proceeds from issue of ordinary share

capital 19 - -

------------- -------------

Net cash used in financing activities 993,196 913,378

------------- -------------

Net increase in cash and cash equivalents 148,238 21,325

Cash and cash equivalents at beginning

of period 15 31,318 9,993

------------- -------------

Cash and cash equivalents and end

of period 15 179,556 31,318

------------- -------------

There were no significant non-cash transactions in the year to

30 June 2021.

COMPANY STATEMENT OF CASH FLOWS

FOR THE PERIODED 30 JUNE 2021

30 June 2021

Note GBP

Cash flows from operating activities

Loss for the year -

Adjustments for:

Depreciation 12 -

Decrease in trade and other receivables 4 -

Increase in trade and other payables 18 -

Finance costs in the year -

------------

Cash generated from operations -

------------

Income taxes paid -

------------

Net cash flows from operating activities -

------------

Investing activities

Purchases of property, plant and

equipment 12 -

Purchases of exploration and evaluation

assets 13 -

------------

Net cash used in investing activities -

------------

Financing activities

Borrowings from Directors and Officers 21 -

Proceeds from issue of ordinary share

capital 19 -

------------

Net cash used in financing activities -

------------

Net increase in cash and cash equivalents -

Cash and cash equivalents at beginning

of period 15 -

------------

Cash and cash equivalents and end

of period 15 -

------------

No cash was held by the Company during the period to 30 June

2021

NOTES TO THE FINANCIAL STATEMENTS

1. General Information

Orcadian Energy PLC (the "company") is a public limited company

which is domiciled and incorporated in England and Wales under the

Companies Act 2006 with the registered number 13298968. The

Company's registered office is 6(th) floor, 60 Gracechurch Street,

London, EC3V 0HR, and i ts ordinary shares are admitted to trading

on AIM, a market of the London Stock Exchange .

The principal activity of the Group is managing oil and gas

assets and it holds a 100% interest in, and is administrator for,

UKCS Seaward Licences P2244, which contains the Pilot and Harbour

heavy oil discoveries, and P2320, which contains the Blakeney,

Feugh, Dandy & Crinan discoveries.

The financial statements presented for Group are for the year

ended 30 June 2021 and these have are shown alongside figures for

the year ended 30 June 2020 for comparative purposes.

2. Summary of significant accounting policies

The principal accounting principles applied in the preparation

of these financial statements are set out below. These principles

have been consistently applied to all years presented, unless

otherwise stated.

2.1. Basis of preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRS) and IFRS

Interpretations Committee (IFRIC) and the Companies Act 2006

applicable to companies reporting under IFRS.

The financial statements have been prepared under the historical

cost convention.

2.2. Consolidation and acquisitions

The financial statements consolidate the financial information

of the Group and companies controlled by the Group (its

subsidiaries) at each reporting date. Control is achieved where the

Company has the power to govern the financial and operating

policies of an investee entity, has the rights to variable returns

from its involvement with the investee and has the ability to use

its power to affect its returns. The results of subsidiaries

acquired or sold are included in the financial information from the

effective date of acquisition or up to the effective date of

disposal, as appropriate. Where necessary, adjustments are made to

the results of acquired subsidiaries to bring their accounting

policies into line with those used by the Group. All intra-Group

transactions, balances, income and expenses are eliminated on

consolidation. The financial statements of all Group companies are

adjusted, where necessary, to ensure the use of consistent

accounting policies.

The Company's shares were admitted to trading on AIM, a market

operated by the London Stock Exchange, on 15 July 2021. These

financial statements are the Company's first subsequent to its

admission to AIM. In connection with the admission to AIM, the

Group undertook a Group reorganisation of its corporate structure

which resulted in the Company becoming the ultimate holding company

of the Group. Prior to the reorganisation there was no ultimate

holding company as Orcadian Energy (CNS) Ltd ("CNS") was a

standalone entity. The transaction was accounted for as a capital

reorganisation rather than a reverse acquisition since it did not

meet the definition of a business combination under IFRS 3. In a

capital reorganisation, the consolidated financial statements of

the Group reflect the predecessor carrying amounts of CNS with

comparative information of CNS presented for all periods since no

substantive economic changes have occurred. The difference arising

on acquisition has been accounted for with the recognition of a

merger reserve on the balance sheet following the reorganisation of

the share capital of the Group at the point of completion of the

transaction.

2.3. Going concern

The financial statements have been prepared on a going concern

basis. The Group is not yet revenue generating and an operating

loss has been reported. The Directors have reviewed a detailed

forecast based on the funds raised, and including all required

spend to meet licence requirements. This forecast has been stress

tested by management in reaching their going concern conclusion.

Having made due and careful enquiry, the Directors are of the

opinion that the Group has adequate working capital to execute its

operations over the next 12 months. The Directors, therefore, have

made an informed judgement, at the time of approving financial

statements, that there is a reasonable expectation that the Company

has adequate resources to continue in operational existence for the

foreseeable future.

The Directors acknowledge that COVID-19 has had and may continue

to have significant adverse impacts on the global economy and

capital markets. However, the Company has been able to raise funds

during this time and are of the opinion that COVID-19 does not pose

a risk sufficient to call in to question the Group's ability to

operate as a Going Concern. The Directors are of the opinion that

the Group has adequate working capital to be able to meet its

obligations as they fall due over the next 12 months

As a result, the Directors have continued to adopt the going

concern basis of accounting in preparing the annual financial

statements for the year ended 30 June 2021.

2.4. Changes in accounting policies

2.4.1. New standards, amendments to standards and

interpretations

i) New and amended standards adopted by the Group

During the financial year, the Group has adopted the following

new IFRSs (including amendments thereto) and IFRIC interpretations

that became effective for the first time.

Standard Impact on initial application Effective date

----------------------------- ------------------------------- -----------------

IFRS 3 (amendments) Definition of a Business 01 January 2020

IFRS standards (amendments) References to the Conceptual 01 January 2020

Framework

IAS 1 (amendments) Definition of Material 01 January 2020

IAS 8 (amendments) Definition of Material 01 January 2020

IFRS 9, IAS 39 and Interest Rate Benchmark Reform 01 January 2020

IFRS 7 (amendments)

IFRS 3 (amendments) Definition of a Business 01 January 2020

IFRS standards (amendments) References to the Conceptual 01 January 2020

Framework

IFRS 3 (amendments) Definition of a Business 01 January 2020

IFRS standards (amendments) References to the Conceptual 01 January 2020

Framework

IAS 1 (amendments) Definition of Material 01 January 2020

IAS 8 (amendments) Definition of Material 01 January 2020

----------------------------- ------------------------------- -----------------

None of the standards or interpretations that came into effect

for the first time for the financial year beginning 1 July 2020 had

a material impact on the Group.

2.4.2. New standards and amended standards and interpretations

issued but not yet effective for the financial year beginning 1

July 2021

At the date of approval of these financial statements, the

following standards and interpretations which have not been applied

in these financial statements were in issue but not yet effective

(and in some cases had not been adopted by the UK):

Standard Impact on initial application Effective date

---------------------------- -------------------------------- ----------------

IFRS standards (amendments) Interest rate benchmark reform 01 January 2021

IFRS 3 (amendments) Business combinations 01 January 2022

IAS 37 (amendments) Onerous contracts 01 January 2022

IFRS standards (amendments) 2018-2020 annual improvement 01 January 2022

cycle

IAS 16 (amendments) Proceeds before intended 01 January 2022

use

IFRS 17 Insurance Contracts 01 January 2023

IFRS 17 (amendments) Insurance contracts 01 January 2023

IAS 1 (amendments) Reclassification of liabilities 01 January 2023

as current or non-current

---------------------------- -------------------------------- ----------------

The new and amended Standards and Interpretations which are in

issue but not yet mandatorily effective is not expected to be

material.

2.5. Foreign currency

2.5.1. Functional and presentation currency

Items in the company's financial statements are measured in the

currency of the primary economic environment in which the entity

operates (functional currency). he functional currency of the

Company is Pounds sterling (GBP).

Monetary amounts in these financial statements are rounded to

the nearest GBP.

2.4.2.Transactions and balances

Foreign currency transactions are translated into the functional

currency using the exchange rates prevailing at the dates of the

transactions or valuation where items are re-measured. Foreign

exchange gains and losses resulting from the settlement of such

transactions and from the translation at year-end exchange rates of

monetary assets and liabilities denominated in foreign currencies

are recognised in the income statement, except when deferred in

other comprehensive income as qualifying cash flow hedges and

qualifying net investment hedges. Foreign exchange gains and losses

that relate to borrowings and cash and cash equivalents are

presented in the income statement within 'finance income or costs.'

All other foreign exchange gains and losses are presented in the

income statement within 'Other (losses)/gains.'

Translation differences on non-monetary financial assets and

liabilities such as equities held at fair value through profit or

loss are recognised in profit or loss as part of the fair value

gain or loss. Translation differences on non-monetary financial

assets measure at fair value are included in other comprehensive

income.

2.6. Government grants

The Group recognises an unconditional government grant in profit

or loss as other income when the grant becomes receivable.

2.7. Taxation

Tax is recognised in the Statement of Comprehensive Income,

except to the extent that it relates to items recognised in other

comprehensive income or directly in equity. In this case, the tax

is also recognised in other comprehensive income or directly in

equity respectively.

R&D tax credits are recognised through the Consolidated

Statement of Comprehensive Loss upon receipt of funds.

2.8. Leases

The Group assesses whether a contract is or contains a lease at

the inception of the contract. The Group recognises a right-of-use

asset and a corresponding lease liability with respect to all lease

arrangements in which it is the lessee, except for short-term

leases (defined as leases with a lease term of 12 months or less)

and leases of low value assets (such as tablets and personal

computers, small items of office furniture and telephones). For

these leases, the Group recognises the lease payments as an

administrative expense on a straight-line basis over the term of

the lease unless another systematic basis is more representative of

the time pattern in which economic benefits from the leased assets

are consumed.

2.9. Intangible assets

Exploration and evaluation expenditures (E&E)

The Group applies the successful efforts method of accounting

for oil and gas assets, having regard to the requirements of IFRS 6

'Exploration for and Evaluation of Mineral Resources'. Costs

incurred prior to obtaining the legal rights to explore an area are

expensed immediately to the Statement of Comprehensive Income.

All licence acquisitions, exploration and evaluation costs are

capitalised, a share of administration costs is capitalised insofar

as they relate to exploration, evaluation and development

activities. These costs are written off unless commercial reserves

have been established or the determination process has not been

completed and there are no indications of impairment. If a project

is deemed commercial all of the attributable costs are transferred

into Property, Plant and Equipment. These costs are then

depreciated from the commencement of production on a unit of

production basis.

2.10. Impairment of non-financial assets

The Group assesses at each reporting date whether there is an

indication that an asset may be impaired. This includes

consideration of the IFRS 6 impairment indicators for any

intangible exploration and evaluation assets capitalised as

intangible costs. If any such indication exists, or when annual

impairment testing for an asset is required, the Group makes an

estimate of the asset's recoverable amount.

An asset's recoverable amount is the higher of its fair value

less costs to sell and its value in use. This is determined for an

individual asset, unless the asset does not generate cash inflows

that are largely independent of those from other assets or Groups

of assets, and the asset's value in use cannot be estimated to be

close to its fair value. In such cases, the asset is tested for

impairment as part of the cash-generating unit to which it belongs.

When the carrying amount of an asset or cash-generating unit

exceeds its recoverable amount, it is considered impaired and is

written down to its recoverable amount.

In assessing value in use, estimated future cash flows are

discounted to their present value using a pre-tax discount rate

that reflects current market assessments of the time value of money

and the risks specific to the asset. Impairment losses relating to

continuing operations are recognised in those expense categories

consistent with the function of the impaired asset, unless the

asset is carried at revalued amount (in which case the impairment

loss is treated as a revaluation decrease). An assessment is also

made at each reporting date as to whether there is any indication

that previously recognised impairment losses may no longer exist or

may have decreased. If such indication exists, the recoverable

amount is estimated.

A previously recognised impairment loss is reversed only if

there has been a change in the estimates used to determine the

asset's recoverable amount since the last impairment loss was

recognised. If that is the case, the carrying amount of the asset

is increased to its recoverable amount. That increased amount

cannot exceed the carrying amount that would have been determined,

net of depreciation, had no impairment loss been recognised for the

asset in prior years. Such reversal is recognised in the Statement

of Comprehensive Income unless the asset is carried at revalued

amount, in which case the reversal is treated as a revaluation

increase. After such a reversal, the depreciation charge is

adjusted in future periods to allocate the asset's revised carrying

amount, less any residual value, on a systematic basis over its

remaining useful life.

2.11. Property, plant and equipment

Property, plant and equipment is stated at cost less accumulated

depreciation and any accumulated impairment losses. Depreciation is

provided on all property, plant and equipment to write off the cost

less estimated residual value of each asset over its expected

useful economic life on a straight-line basis at the following

annual rates:

-- Property, plant and equipment - 3 years straight line.

All assets are subject to annual impairment reviews.

2.12. Financial Instruments

2.11.1 Initial recognition

A financial asset or financial liability is recognised in the

statement of financial position of the Group when it arises or when

the Group becomes part of the contractual terms of the financial

instrument.

2.11.2 Classification

Financial assets at amortised cost

The Group measures financial assets at amortised cost if both of

the following conditions are met:

(1) the asset is held within a business model whose objective is

to collect contractual cash flows; and

(2) the contractual terms of the financial asset generating cash

flows at specified dates only pertain to capital and interest

payments on the balance of the initial capital.

Financial assets which are measured at amortised cost, are

measured using the Effective Interest Rate Method (EIR) and are

subject to impairment. Gains and losses are recognised in profit or

loss when the asset is derecognised, modified or impaired.

Financial liabilities at amortised cost

Financial liabilities measured at amortised cost using the

effective interest rate method include current borrowings and trade

and other payables that are short term in nature. Financial

liabilities are derecognised if the Group 's obligations specified

in the contract expire or are discharged or cancelled.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the effective interest rate ("EIR"). The EIR amortisation

is included as finance costs in profit or loss. Trade payables

other payables are non-interest bearing and are stated at amortised

cost using the effective interest method.

Financial liabilities at fair value through profit or loss

Financial liabilities at fair value through profit or loss

include financial liabilities held for trading and financial

liabilities designated upon initial recognition as at fair value

through profit or loss. Financial liabilities are classified as

held for trading if they are incurred for the purpose of

repurchasing in the near term. Gains or losses on liabilities held

for trading are recognised in the statement of profit or loss and

other comprehensive income.

2.11.3. Derecognition

A financial asset is derecognised when:

(1) the rights to receive cash flows from the asset have

expired, or

(2) the Group has transferred its rights to receive cash flows

from the asset or has undertaken the commitment to fully pay the

cash flows received without significant delay to a third party

under an arrangement and has either (a) transferred substantially

all the risks and the assets of the asset or (b) has neither

transferred nor held substantially all the risks and estimates of

the asset but has transferred the control of the asset.

2.11.4 Impairment

The Group recognises a provision for impairment for expected

credit losses regarding all financial assets. Expected credit

losses are based on the balance between all the payable contractual

cash flows and all discounted cash flows that the Group expects to

receive. Regarding trade receivables, the Group applies the IFRS 9

simplified approach in order to calculate expected credit losses.

Therefore, at every reporting date, provision for losses regarding

a financial instrument is measured at an amount equal to the

expected credit losses over its lifetime without monitoring changes

in credit risk. To measure expected credit losses, trade

receivables and contract assets have been Grouped based on shared

risk characteristics.

2.13. Trade and other receivables

Trade and other receivables are initially recognised at fair

value when related amounts are invoiced then carried at this amount

less any allowances for doubtful debts or provision made for

impairment of these receivables.

2.14. Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand and

are subject to an insignificant risk of changes in value.

2.15. Share capital

Ordinary shares are classified as equity. Incremental costs

directly attributable to the issue of new shares or options are

shown in equity as a deduction, net of tax, from the proceeds.

2.16. Share premium

Share premium account represents the excess of the issue price

over the par value on shares issued. Incremental costs directly

attributable to the issue of new ordinary shares or options are

shown in equity as a deduction, net of tax, from the proceeds.

2.17. Trade payables

These financial liabilities are all non-interest bearing and are

initially recognised at the fair value of the consideration

payable.

2.18. Convertible loan notes and borrowings

Convertible loan notes classified as financial liabilities and

borrowings are recognised initially at fair value, net of

transaction costs incurred. After initial recognition, loans are

measured at the amortised cost using the effective interest rate

method. Any difference between the proceeds (net of transaction

costs) and the redemption value is recognised in the income

statement over the period of the borrowings using the effective

interest rate method.

2.19 Finance income and finance costs

Finance income comprises interest income on bank funds. Interest

income is recognised as it accrues in profit or loss, using the

effective interest method. Finance costs comprise interest expense

on borrowings. Borrowing costs are recognised in profit or loss in

the period in which they are incurred.

2.20 Earnings per share

Basic Earnings per share is calculated as profit attributable to

equity holders of the parent for the period, adjusted to exclude

any costs of servicing equity (other than dividends), divided by

the weighted average number of ordinary shares, adjusted for any

bonus element.

2.21 Operating segments

The Chief Operating Decision Maker (CODM) is considered to be

the Board of Directors. They consider that the Group operates in a

single segment, that of oil and gas exploration, appraisal and

development, in a single geographical location, the North Sea of

the United Kingdom. As a result, the financial information of the

single segment is the same as set out in the statement of

comprehensive income, statement of financial position, statement of

Changes in Equity and Statement of Cashflows.

2.22 Investment in Subsidiaries

The consolidated financial statements incorporate the financial

statements of the company and entities controlled by the Group (its

subsidiaries). Control is achieved where the Group has the power to

govern the financial and operating policies of an entity so as to

obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the

year are included in total comprehensive income from the effective

date of acquisition and up to the effective date of disposal, as

appropriate using accounting policies consistent with those of the

parent. All intra-group transactions, balances, income and expenses

are eliminated in full on consolidation.

Investments in subsidiaries are accounted for at cost less

impairment in the individual financial statements.

2.23 Research and development

Research and development expenditure is charged to the

Consolidate Statement of Comprehensive Income in the year in which

the claim is submitted and recovered as prior to this the recovery

of the income is not deemed to be probable.

3. Significant accounting estimates and judgements, estimates and assumptions

The preparation of financial statements using accounting

policies consistent with IFRS requires the Directors to make

estimates and assumptions that affect the reported amounts of

assets and liabilities, disclosure of contingent assets and

liabilities and the reported amounts of income and expenses. The

preparation of financial statements also requires the Directors to

exercise judgement in the process of applying the accounting

policies. Changes in estimates, assumptions and judgements can have

a significant impact on the financial statements.

Recoverable value of intangible assets

As at 30 June 2021, the Group held oil and gas exploration and

evaluation intangible assets of GBP1,814,615 (2020: GBP1,283,797).

The carrying values of intangible assets are assessed for

indications of impairment, as set out in IFRS 6, on an annual

basis. As part of this impairment assessment, the recoverable value

of the intangible assets is required to be estimated.

When estimating the recoverable value of the intangibles

Management consider the proved, probably and potential resources

per the latest CPR, likely production costs and the forecasted oil

prices.

As a result of the budget exploration costs, the licenses being

valid and the assessed recoverable value of the intangibles being

in excess of the carrying value, Management do not consider that

any intangible assets are impaired as at 30 June 2021.

These estimates and assumptions are subject to risk and

uncertainty and therefore a possibility that changes in

circumstances will impact the assessment of impairment

indicators.

There was only one critical judgement identified, apart from

those involving estimations (which are dealt with separately above)

that the Directors have made in the process of applying the Group

's accounting policies and that have the most significant effect on

the amounts recognised in the financial statements.

Approach to account for the acquisition of Orcadian Energy (CNS)

Ltd

The acquisition of Orcadian Energy (CNS) Ltd during the year via

a share for share agreement, as detailed in note 4, falls outside

of the scope of IFRS 3 as Orcadian Energy Plc at the time of the

transaction did not meet the definition of a business. The

acquisition constituted a group reorganisation since the two

entities were under common control at the date of acquisition.

As such, the Directors were required to apply judgement in

deciding the most appropriate way to account for this acquisition.

The Directors decided to adopt the predecessor value approach which

requires the assets and liabilities acquired being accounted for

using their carrying values at the date of acquisition and the

difference between the cost of the acquisition and the net assets

of the legal subsidiary at the date of acquisition being taken to

the merger reserve.

Furthermore, the Consolidated Statement of Comprehensive Loss,

Consolidated Statement of Financial Position, Consolidate Statement

of Changes in Equity and the Consolidated Statement of Cashflows

have been presented to show the group as if it were in existence

since the beginning of the comparative period.

4. Group reorganisation under common control

The acquisition met the definition of a group reorganisation due

to the Company and the subsidiary being under common control at the

date of acquisition. As a result, and since Orcadian Energy Plc did

not meet the definition of a business per IFRS 3, the acquisition

fell outside of the scope of IFRS 3 and the predecessor value

method was used to account for the acquisition.

These consolidated financial statements represent a continuation

of the consolidated financial statements of Orcadian Energy (CNS)

Ltd and include:

a. The assets and liabilities of Orcadian Energy (CNS) Ltd at

their pre-acquisition carrying amounts and the results for both

periods; and

b. The assets and liabilities of the Company as at 11 May 2021

and it's results from 11 May to 30 June 2021.

On 11 May 2021, the Company issued 52,201,601 shares entire

issued share capital of Orcadian Energy (CNS) Ltd.

The net assets of Orcadian Energy (CNS) Ltd at the date of

acquisition was as follows:

GBP

Property Plant & Equipment 1,357

Intangible Assets 1,719,292

Current Assets 447,425

Current Liabilities (284,745)

Non-Current Liabilities (1,869,975)

---------------------------- ------------

Net assets 13,354

---------------------------- ------------

The reserve that arose from the acquisition is made up as

follows:

Year ended

30 June 2021

GBP

------------------------------------------------- --------------

As at start of year -

Cost of the investment in Orcadian Energy (CNS)

Ltd 52,202

Less: net assets of Orcadian Energy (CNS) Ltd

at acquisition (13,354)

As at end of year 38,848

------------------------------------------------- --------------

5. Administrative expenses

2021 2020

GBP GBP

Office costs, rates and services 18,672 18,649

Wages and salaries 128,125 60,000

Consultants and advisers 56,113 11,335

Audit fees (note 18) 38,090 8,000

Pre-award licence costs - 17,821

Insurance 44,466 4,603

Other expenses 65,234 28,991

National Insurance 35,594 16,310

Foreign Exchange (127,603) 33,822

Depreciation 217 694

258,909 200,225

--------- -------

6. Auditor's Remuneration

During the year, the Company obtained the following services

from the Company's auditors and its associates:

2021 2020

GBP GBP

Audit of the financial statements 25,000 8,000

Transaction services 5,000 -

------ -----

30,000 8,000

------ -----

7. Other Income

2021 2020

GBP GBP

Consulting fees 3,000 -

Coronavirus support grant - 10,000

Other Income 3,000 10,000

----- ------

The Company undertook a minor consulting role during the year

for which it billed GBP3,000.

As part of the Government's support for small businesses during

the Coronavirus crisis a non-repayable Coronavirus support grant of

GBP10,000 was provided to any business whose premises were eligible

for Small Business Rate Relief as of 11 March 2020, having a

rateable value up to GBP15,000. The Company qualified for this

support and applied for and received the grant.

8. Staff numbers and costs

Group Group

2021 2020

Staff costs (including directors) GBP GBP

------- -------

Wages and salaries 128,125 138,133

Social security costs 35,594 16,309

------- -------

163,719 154,442

------- -------

No pension benefits are provided for any Directors (2020:

GBPnil).

The average number of persons (including directors) employed by

the Company during the year was:

Group and Company 2021 2020

Management and Administration 5 6

5 6

---- ----

9. Finance costs

2021 2020

GBP GBP

Interest paid 44,349 40,293

44,349 40,293

10. Taxation

Analysis of charge for the year:

2021 2020

GBP GBP

Current income tax charge - -

R&D tax credits 80,420 -

Deferred tax charge - -

------ ----

Total taxation credit/(charge) 80,420 -

------ ----

Taxation reconciliation

The below table reconciles the tax charge for the year to the

theoretical charge based on the result for the year and the

corporation tax rate.

2021 2020

GBP GBP

Loss before income tax (296,338) (230,519)

Tax at the applicable rate of 19%

(2020: 19%) (56,304) (43,799)

Effects of:

R&D tax credits 80,420 -

Expenses not deducted for tax purposes - 1,661

Unutilised tax losses 56,304 42,138

Total income tax credit / (expense) 80,420 -

---------- ----------

Due to the nature of the expenditure incurred by the Company on

the Offshore Steam Flood during the periods ending 30 June 2019 and

30 June 2020 claims were made under the SME R&D tax rebate

provisions which resulted in refunds totalling GBP80,420.

As at 30 June 2021, the Group had unused tax losses of

GBP139,767 (2020: GBP83,463) for which no deferred tax asset has

been recognised. This is due to uncertainty over the availability

of future taxable profits to offset these losses against.

11. Earnings per share

The calculation of the basic and diluted earnings per share is

calculated by dividing the loss for the year for continuing

operations for the Company by the weighted average number of

ordinary shares in issue during the year.

There is no difference between the basic and diluted earnings

per share as there were no securities on issue as at 30 June 2021

that would have a dilutive effect on earnings per share.

2021 2020

GBP GBP

-------------------------------------------- ----------- -----------

Loss for the purposes of basic earnings

per share being net loss attributable

to the owners (296,338) (230,519)

Weighted average number of Ordinary Shares 22,167,804 17,362,614

Loss per share (1.34p) (1.32p)

-------------------------------------------- ----------- -----------

The weighted average number of shares is adjusted for the impact

of the acquisition as follows:

- Prior to the acquisition, the number of shares is based on

Orcadian Energy (CNS) Ltd, adjusted using the share exchange ratio

arising on the acquisition; and

- From the date of the acquisition, the number of shares is

based on the Company.

12. Property, plant and equipment

IT hardware

& software Office equipment Total

GBP GBP GBP

Cost

As at 30 June 2019 2,842 202 3,044

----------- ---------------- -----

Additions - - -

As at 30 June 2020 2,842 202 3,044

----------- ---------------- -----

Additions 1,952 - 1,952

----------- ---------------- -----

As at 30 June 2021 4,794 202 4,996

----------- ---------------- -----

IT hardware

& software Office equipment Total

GBP GBP GBP

Depreciation

As at 30 June 2019 2,092 151 2,243

----------- ---------------- -----

Charged in the year 643 51 694

As at 30 June 2020 2,735 202 2,937

----------- ---------------- -----

Charged in the year 217 - 217

As at 30 June 2021 2,952 202 3,154

----------- ---------------- -----

Net book value as at 30 June 2021 1,842 - 1,842

----------- ---------------- -----

Net book value as at 30 June 2020 107 - 107

----------- ---------------- -----

The depreciation expense is recognised in administrative

expenses as set out in note 6.

13. Intangible assets

Oil and gas

exploration

assets

GBP

Cost

------------

As at 30 June 2019 532,998

------------

Additions 750,799

------------

As at 30 June 2020 1,283,797

------------

Additions 530,818

------------

As at 30 June 2021 1,814,615

------------

No general office expenses incurred during the year were

capitalised (2020: GBPnil).

The carrying value of the prospecting and exploration rights is

supported by the estimated resource and current market values as

contained in the Competent Person's Report date 1 April 2021 which

was prepared by Sproule B.V.

14. Trade and other receivables

Group 2021 2020

GBP GBP

VAT receivable 50,925 5,914

Prepayments relating to the issue of

equity 13,500 -

Prepayments other 24,123 -

Amounts due from related parties - 72,224

88,548 78,138

------ ------

Amounts due from related parties were unsecured, interest free

and had no fixed repayment date.

The fair value of other receivables is the same as their

carrying values as stated above.

The maximum exposure to credit risk at the reporting date is the

carrying value of each class of receivable mentioned above. The

Company does not hold any collateral as security.

15. Cash and cash equivalents

Group 2021 2020

GBP GBP

Cash at bank and in hand 179,556 31,318

179,556 31,318

------- ------

There is no material difference between the fair value of cash

and cash equivalents and their book value.

16. Investment in subsidiary

Name Address of the Nature of business Proportion

registered office of ordinary

shares held

directly by

parent (%)

----------------- -------------------- -------------------- -------------

6(th) floor,

60 Gracechurch

Orcadian Energy Street, London, Managing oil and

(CNS) Ltd EC3V 0HR gas assets 100

The acquisition of Orcadian Energy (CNS) Ltd took place on 11

May 2021. Refer to note 4 for further details.

17. Borrowings

2021

------------------------------------------------------

Convertible Convertible

loan note STASCO Loan loan note

2020 GBP 2021 Total

GBP GBP GBP

As at 30 June 2020 100,000 853,152 - 953,152

Convertible loan note

issues 380,000 - 720,000 1,100,000

Convertible loan note

repayments (100,000) - - (100,000)

Interest accrued - 39,045 - 39,045

Effect of foreign exchange - (129,511) - (129,511)

---------------------------- ------------ -------------- ------------ ----------

As at 30 June 2021 380,000 762,686 720,000 1,862,686

---------------------------- ------------ -------------- ------------ ----------

Between July and December 2020 the Company issued GBP380,000 of

convertible loan notes. In January 2021 GBP100,000 of convertible

loan notes were repaid in cash and a further CLN for GBP100,000 was

issued to a further lender. The term for these CLN's was three

years with an interest rate of 12% per annum if they were redeemed.

If conversion to Ordinary Shares no interest is applied.

In March 2021 the Company issued GBP705,000 of convertible loan

notes, and in June 2021 the Company issued GBP15,000 of convertible

loan notes. These CLN's had a term of one year and a zero interest

rate.

Subsequent to reporting date on 15 July 2021, all CLNs were

converted in to ordinary shares at a price of 28 pence each, which

was a 30% discount to the fundraise price. In total 3,928,572

ordinary shares were issued in full discharge of the CLNs. No

interest was paid on the CLNs as they were converted in to ordinary

shares.

2020

--------------------------------------------------

Convertible Convertible

loan note STASCO loan note Total

2018 Loan 2020 GBP

GBP GBP GBP

As at 30 June 2019 70,000 - - 70,000

Convertible loan note issues - - 100,000 100,000

Convertible loan notes redeemed

for shares (70,000) - - (70,000)

Loan drawdowns - 814,260 814,260

Interest accrued - 38,892 - 38,892

--------------------------------- ------------ --------- ------------ -----------

As at 30 June 2020 - 853,152 100,000 953,152

--------------------------------- ------------ --------- ------------ -----------

Convertible loan notes were exercised in the year leading to

shares being issued for a total value of GBP71,400. No cash was

received in consideration for these shares.

The STASCO loan was drawn down on 23 August 2019. The loan is

repayable by 23 August 2023 and is subject to an interest rate at

LIBOR plus 5% with interest accruing on a compounding basis.

On 20 March 2020 and 28 May 2020 the Company issued GBP50,000 of

convertible loan notes on each of those dates.

18. Trade and other payables - due within one year

2021 2020

GBP GBP

Trade payables 35,443 8,003

Accruals 276,133 242,593

Other creditor 17,025 -

------- -------

328,601 250,596

------- -------

The carrying values of trade and other payables are considered

to be a reasonable approximation of the fair value and are

considered by the Directors as payable within one year.

19. Ordinary share capital and share premium

Group

Number of Ordinary Share

shares share capital premium

Issued GBP GBP

As at 30 June 2019 17,345,610 17,346 492,215

--------------- -------------- ------------

Issue of shares 54,924 55 71,346

--------------- -------------- ------------

As at 30 June 2020 17,400,534 17,401 563,561

Transfer between reserves - 34,801 (34,801)

Issued capital of Company at acquisition 1 - -

Issue of shares upon acquisition

of subsidiary 52,201,601 52,202 -

Transfer of Ltd paid up capital

to reverse acquisition reserve (17,400,534) (52,202) (528,760)

--------------- -------------- ------------

As at 30 June 2021 52,201,601 52,202 -

The issued capital of the Group for the period 1 July 2020 to 11

May 2021 is that of Orcadian Energy (CNS) Ltd. Upon completion of

the acquisition the share capital of Orcadian Energy (CNS) Ltd was

transferred to the Acquisition reserve (Refer to note 4) and the

share capital of Orcadian Energy PLC was brought to account.

The ordinary shares confer the right to vote at general meetings

of the Company, to a repayment of capital in the event of

liquidation or winding up and certain other rights as set out in

the Company's articles of association.

Company

Number of Share

shares Share capital premium

Issued GBP GBP

Balance as at Incorporation 29 March

2021 1 - -

Issue of shares upon acquisition

of subsidiary 52,201,601 52,202 -

As at 30 June 2021 52,202,602 52,202 -

On 29 March 2021, the Company issued one new ordinary shares of

GBP0.001 upon incorporation.

On 11 May 2021, the Company issued 52,202,601 new ordinary

shares of GBP0.001 each at nominal value for the acquisition of

100% of the issued capital of Orcadian Energy (CNS) Ltd pursuant to

a share swap arrangement (Refer to Note 4).

20. Related parties

21.1 Transactions with related parties

The Company had the following related party transactions:

(1) The Company makes use of an office at 70 Claremont Road

which is currently provided to the Company by Mrs Julia

Cane-Honeysett and Mr Stephen Brown at a rental of GBP1,000 per

calendar month. The company pays for the services and business

rates associated with the property.

21.2 Loans to/from related parties

During the year, several Directors and shareholders provided

funds to the Company as a working capital injection.

The following balances are outstanding at the end of the

reporting period in relation to these transactions:

Amount due (to)/from

related parties

GBP

As at 30 June 2020 72,224

Funds advanced to the Company (135,000)

Loan amounts settlement by the Related Party 72,224

--------------------

As at 30 June 2021 (135,000)

As at 30 June 2021 the Company had issued convertible loan notes

(CLNs") from Company Directors Alan Hume totalling GBP135,000.

These CLNs were converted in to 482,142 ordinary shares post year

end on 15 July 2021 at 28 pence per share.

21.3. Key management personnel

Directors of the Company are considered to be key management

personnel. The remuneration of the Directors has been set out in

note 8.

21. Ultimate controlling party

The Directors consider Stephen Brown and Julia Cane-Honeysett to

be the ultimate controlling parties given their combined holding of

55.87% of the issued capital of the Company.

22. Financial instruments

The Company holds the following financial instruments:

Financial assets

2021 2020

Financial assets at amortised cost: GBP GBP

Trade receivables

Other financial assets at amortised

cost - 72,224

Cash and cash equivalents 179,556 31,318

------- -------

179,556 103,542

------- -------

The maximum exposure to credit risk at the end of the reporting

period is the carrying amount of each class of financial assets

mentioned above.

Financial liabilities

2021 2020

Financial liabilities at amortised GBP GBP

cost:

Trade payables 35,443 8,003

Borrowings 762,686 853,152

------- -------

798,129 861,155

------- -------

2021 2020

Financial liabilities at fair value

through profit and loss GBP GBP

Borrowings 1,100,000 100,000

--------- -------

1,100,000 100,000

--------- -------

23. Financial risk management

23.1. Financial risk factors

The Company's activities expose it to a variety of financial

risks: market risk, credit risk and liquidity risk. The Company's

overall risk management programme focuses on the unpredictability

of financial markets and seeks to minimise potential adverse

effects on the Company's financial performance.

Risk management is carried out by the executive management

team.

a) Market risk

The Company is exposed to market risk, primarily relating to

interest rate, foreign exchange and commodity prices. The Company

does not hedge against market risks as the exposure is not deemed

sufficient to enter into forward contracts. The Company has not

sensitised the figures for fluctuations in interest rates, foreign

exchange or commodity prices as the Directors are of the opinion

that these fluctuations would not have a significant impact on the

Financial Statements at the present time. The Directors will

continue to assess the effect of movements in market risks on the

Company's financial operations and initiate suitable risk

management measures where necessary.

b) Credit risk

Credit risk arises from cash and cash equivalents as well as

outstanding receivables. To manage this risk, the Company

periodically assesses the financial reliability of customers and

counterparties.

The amount of exposure to any individual counter party is

subject to a limit, which is assessed by the Board.

The Company considers the credit ratings of banks in which it

holds funds in order to reduce exposure to credit risk. The Company

will only keep its holdings of cash with institutions which have a

minimum credit rating of 'A'.

c) Liquidity risk

The Company's continued future operations depend on the ability

to raise sufficient working capital through the issue of equity

share capital or debt. The Directors are reasonably confident that

adequate funding will be forthcoming with which to finance

operations. Controls over expenditure are carefully managed.

The following table summarizes the Company's significant

remaining contractual maturities for financial liabilities at 30

June 2021, and 30 June 2020.

Contractual maturity analysis as at 30 June 2021

Less than

12 1 - 5 Total

Months Year GBP

GBP GBP

--------------------- ---------- ------------ ------------

Accounts payable 35,443 - 35,443

Accrued liabilities 276,133 - 293,158

Other creditor 17,025 - 17,025

STASCO Loan - 762,686 762,686

----------------------- ---------- ------------ ------------

328,601 762,686 1,091,287

--------------------- ---------- ------------ ------------

Contractual maturity analysis as at 30 June 2020

1 - 5 Longer than

Year 5 years Total

GBP GBP GBP

--------------------- ---------- ------------ ----------

Accounts payable 8,003 - 8,003

Accrued liabilities 242,593 - 242,593

STASCO Loan - 853,152 853,152

----------------------- ---------- ------------ ----------

250,596 853,152 1,103,748

--------------------- ---------- ------------ ----------

23.2. Capital risk management

The Company's objectives when managing capital are to safeguard

the Company's ability to continue as a going concern, in order to

enable the Company to continue its exploration and development of

oil and gas resources. In order to maintain or adjust the capital

structure, the Company may adjust the issue of shares or sell

assets to reduce debts.

The Company defines capital based on the total equity and

reserves of the Company. The Company monitors its level of cash

resources available against future planned operational activities

and may issue new shares in order to raise further funds from time

to time.

24. Commitments

The Company has entered into the following non-cancellable

commitments in respect of exploration licences:

2021 2020

GBP GBP

Due within one year 197,771 94,348

Later than one year but not later

than five years 112,729 298,951

------- -------

Total commitments 310,500 393,299

------- -------

25. Events after the reporting period

The Company listed on the Alternative Investment Market (AIM) on

the 15(th) July 2021. At the same time the Company placed 7,500,000

New Ordinary Shares to raise gross proceeds of GBP3,000,000.

On the 15(th) July 2021 the Company issued 125,000 new shares of

40p each to a supplier in part payment of an outstanding bill.

On 15(th) July all Convertible Loan Notes ("CLNs") were

converted in to ordinary shares at a price of 28 pence each. In

total 3,928,572 ordinary shares were issued in full discharge of

the CLNs.

On the 15(th) July the Company filed an addendum to the Pilot

field Concept Select Report ("CSR") with the Oil and Gas Authority

("OGA"). This followed the execution of an agreed work programme

which included polymer core flood tests and work to reduce the

carbon dioxide emissions from the project. The selected concept has

now been revised to include a significant improvement in process

heat management and power generation efficiency.

On the 29(th) November 2021 the Company received a "Letter of no

objection" from the Oil and Gas Authority ("OGA") in respect of the

development concept for the Pilot field. This letter signals the

finalisation of the "Assessment phase" and the entry into the

"Authorisation phase" of development planning for the Pilot

Field.

On 6(th) December 2021 the Company was awarded GBP466,667 by the

OGA to evaluate a new concept for the electrification of key

producing oil and gas fields initially focussing on Central Graben

area fields owned and operated by others. Orcadian is working with

Crondall Energy, Enertechnos, Petrofac, North Sea Midstream

Partners ("NSMP") and Wärtsilä; together the working group will

undertake an evaluation of this concept and deliver a report to the

OGA and Central Graben Operators by the end of March 2022. The

evaluation will include a commercial proposal for the delivery of

electrical power to Central Graben and Central North Sea Operators

interested in rapidly implementing electrification of their

platforms.