TIDMMGNS

RNS Number : 5242T

Morgan Sindall Group PLC

25 March 2021

Morgan Sindall Group plc ('the Company')

Legal Entity Identifier (LEI) number: 2138008339ULDGZRB345

Annual Financial Report

25 March 2021

Further to the release of the Company's Preliminary Results

announcement on 25 February 2021, the Company announces that it has

today published and issued to shareholders the 2020 Annual Report

and Accounts ('Annual Report'), Notice of Annual General Meeting

2021 and Form of Proxy. In addition, it has published its 2020

Responsible Business data sheet and 2020 Gender pay gap report. The

following documents can be downloaded from the Company's website at

www.morgansindall.com :

-- 2020 Annual Report -

https://www.morgansindall.com/investors/reports-results-and-presentations

-- Notice of Annual General Meeting 2021 -

https://www.morgansindall.com/investors/shareholder-centre/agm

-- 2020 Responsible Business data sheet - https://www.morgansindall.com/investors/reports-results-and-presentations

-- 2020 Gender pay gap report - https://www.morgansindall.com/who-we-are/governance

The Annual Report, Notice of Annual General Meeting and Form of

Proxy have been submitted to the Financial Conduct Authority's

national storage mechanism ('NSM') and will shortly be available

via the NSM website at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The Company will hold its Annual General Meeting at 10.00am on

Thursday, 6 May 2021 at the Company's registered office, Kent

House, 14-17 Market Place, London W1W 8AJ.

Our preference is to welcome shareholders in person to our 2021

Annual General Meeting, particularly given the constraints we faced

in 2020 due to the Covid-19 pandemic. However, at present, in light

of the current Covid-19 legislation and public health guidance

issued by the UK government, restricting, amongst other things,

indoor public gatherings until mid-May and in order to protect the

wellbeing of our people and our shareholders, the Board is

currently proposing that this year's AGM will be held as a closed

meeting. Accordingly, save for the Chair of the meeting and such

other persons as the Chair of the meeting may decide should be

admitted for the purposes of forming a quorum, shareholder

attendance in person at the AGM will not be permitted as long as

the current restrictions are still in place. Shareholders can,

however, be represented by the Chair of the meeting acting as their

proxy and we remain committed to encouraging shareholder engagement

on the business of the AGM.

In light of these restrictions, arrangements have been put in

place for shareholder engagement. We strongly encourage

shareholders to participate in the AGM by submitting any questions

on the business of the AGM in advance of the meeting by email to

cosec@morgansindall.com (marked for the attention of the Company

Secretary). We will endeavour to publish any questions received

before 10.00am on Tuesday, 4 May 2021 and our responses to those

questions on our website prior to the AGM. Following the AGM, we

will publish on our website any further questions received after

10.00am on Tuesday, 4 May 2021 and our answers to those

questions.

The Company will continue to closely monitor the developing

impact of Covid-19 and the latest legislation and guidance issued

by the UK government. If circumstances evolve such that the Board

considers that, within safety constraints and in accordance with

government guidance, arrangements regarding attendance at the AGM

can change, the Company will notify shareholders as soon as

reasonably practicable of any such changes via a Regulatory

Information Service, on the 'AGM' page of our website at

www.morgansindall.com and, if applicable, in accordance with the

Company's articles of association. The Board encourages

shareholders to monitor the Company's website and regulatory

information services for any updates in relation to the AGM. Should

we consider that it has become possible to allow shareholders to

attend the AGM, we will only be able to accommodate a limited

number of shareholders at our offices.

In accordance with the requirements of Rules 4.1 and 6.3.5 of

the Disclosure Guidance and Transparency Rules, a description of

the principal risks and uncertainties affecting the Group is set

out in Appendix 1 to this announcement. The Company's Preliminary

Results announcement released on 25 February 2021 contained all

other information required by DTR 6.3.5.

ENQUIRIES:

Morgan Sindall Group plc Tel: 020 7307 9200

Clare Sheridan, Company Secretary

Appendix 1

The Group's risk profile continues to be supported by a strong

balance sheet and secured workload, and a continued focus on

contract selectivity. Following initial Covid-19 issues, all

divisions are fully operational and observing safe operating

practices, with impacts included in current forecasting. The

government's continued support for UK construction provides

confidence that future activity can be maintained without material

disruption, but we remain vigilant.

Our approach

Risk is inherent in our business and cannot be completely

eliminated. Our risk governance model ensures that our principal

risks and the controls implemented throughout the Group are under

regular review at all levels.

Group Board

The Board is responsible for setting the Group's risk appetite

and for ongoing risk management, including assessing the principal

risks that threaten our strategy and performance.

Audit committee

The audit committee assists the Board in monitoring risk management and

internal control, and formally reviews the Group and divisional

risk registers on behalf of the Board.

Divisional boards Risk committee

-----------------------------------------------------

Each division identifies the risks The risk committee consists of heads

facing its business and takes measures of key Group functions, including

to mitigate the impacts. Senior managers legal, company secretarial, IT, finance,

take ownership of specific risks internal audit, tax, treasury and

and ensure that tolerance levels commercial. The committee identifies

are not exceeded. risks for the Group risk register

and reviews the Group and divisional

risk registers before they are presented

to the Board and audit committee.

The committee ensures that inherent

and emerging risks across the Group

are identified and managed appropriately.

Risk reviews Strategic planning Delegated authorities Divisional reporting

----------------------- ----------------------- --------------------------

Twice a year each Risk management Our finance director The divisional

division carries is part of our and Group head risk registers

out a detailed business planning of audit and assurance record the activities

risk review, recording process. Each year have produced a needed to manage

significant matters objectives and schedule of delegated each risk, with

in its risk register. strategies are authorities that mitigating activities

Each risk is evaluated, set that align assigns approval embedded in day-to-day

both before and with the risk appetite of material decisions operations for

after the effect defined by the to appropriate which every employee

of mitigation, Board. levels of management. has some responsibility.

as to its likelihood Such decisions Rigorous reporting

of occurrence and include project procedures are

severity of impact selection, tender in place to monitor

on strategy. The pricing and capital significant risks

Group head of audit requirements. Board throughout the

and assurance follows approval is required divisions and ensure

the same process before undertaking they are communicated

for identifying large, complex to the Group head

and reviewing projects. The approval of audit and assurance.

Group risks, conferring system is regularly

with reviewed.

the risk committee.

----------------------- ----------------------- --------------------------

Internal audit

The Group head of audit and assurance reviews and collates the divisional

risk registers and draws from them when compiling the

Group risk register. An annual review across the Group is undertaken,

focusing on significant projects and trends, and areas of concern.

Overview of the Group's risk profile

During 2020, the Board reviewed the Group's risk appetite and

concluded that no significant changes were required. The Group

navigated the initial Covid-19 pandemic, resuming full operations

and high levels of productivity within a relatively short space of

time while maintaining an overall positive net cash position.

During this period, we agreed revised programmes on our live

project portfolio, reflecting the high quality of operational

delivery and risk management in our operations and the strength of

our client and supply chain relationships. Our strict adherence to

safe operating procedures, together with the government's clear

directive that construction activity continue through any lockdown

restrictions, provide confidence that future activity can be

maintained without material disruption.

UK macroeconomic uncertainty continues to be driven by the

pandemic and, to a lesser extent, the EU/UK withdrawal agreement

which could impact on materials and labour supply. We are keeping a

close watch on developments and will adjust our strategy in

response to any clear indicators. However, government commitments,

confirmed in its November 2020 Spending Review and National

Infrastructure Strategy, continue to support our business model,

particularly in housebuilding and regeneration - areas expected to

be a primary UK growth driver - and construction and

infrastructure. In addition, our diversity of offering protects the

business from cyclical changes in individual markets.

The divisions remain focused on long-term partnerships, our

favoured route to market, as it allows us to operate with clients

and in environments where we have a track record in delivery,

thereby providing more predictable outcomes. In addition, a

sizeable portion of our regeneration schemes and construction order

book is supported by public sector and regulated clients, via

frameworks and joint venture arrangements secured over the medium

to longer term. Our regeneration activities consist mostly of

non-speculative, land option style arrangements with efficient

capital structures, all underpinned by a long-term visible

pipeline.

Divisional perspectives

Construction & Infrastructure's long-term focus on

selectivity is endorsed by its underlying outturn margin, cash and

future order book. This reflects the work that the division has

done over the past few years to improve all areas of its operation

and risk management.

Fit Out, while more susceptible to GDP and macroeconomic

fluctuations, has not witnessed any significant market or client

behavioural change, with its pipeline and order book maintaining

good visibility into the early part of 2021.

Property Services' contracts were remobilised during the second

half of 2020, achieving a more normal level of activity. Any future

challenges around access to properties can be partly mitigated

through the adherence to strict operating procedures and/or

completing the work when conditions allow.

Following the first lockdown, residential demand and sales

exceeded expectations across a broad UK portfolio, and activity

quickly recommenced on development schemes. The speed of

decision-making by potential partners for new development schemes

has remained cautious, although it improved in the second half of

the year.

In the medium term, we are confident that, because of the UK's

need for longer-term housing, the homes we build will continue to

be in demand and remain affordable; this is currently endorsed by

the high level of forward reservations into 2021. There are a

number of uncertainties, such as consumer confidence and the end of

the stamp duty holiday, that could adversely impact on the Group's

sales. However, options are available to help mitigate any negative

fluctuations: the majority of our schemes are subject to economic

viability conditions, future phases can be remodelled or deferred,

the pace of build can be accelerated or reduced, robust risk and

capital controls are in place to manage exposure, and there is the

possibility of further government interventions to help stimulate

the market.

Financing

In terms of resourcing our medium- and long-term plans, the

Group remains in a strong financial position with average daily net

cash for 2020 in excess of cGBP180m. In the last quarter of 2020,

the Group secured a new GBP150m committed revolving credit

facility, which extends until late 2023 and includes two further

one-year extension options; this is in addition to the Group's

existing GBP30m facility, providing a total of GBP180m of committed

facilities.

People

Voluntary employee turnover within the divisions is at healthy

levels and where we are recruiting, we are witnessing significant

interest in the new positions we have created to help us achieve

our strategic objectives.

Emerging risks

The Group's strategic planning process includes identifying any

emerging risks that may affect our ability to deliver our

objectives over the medium to longer term. This is supplemented by

additional reviews that take place via our twice-yearly internal

risk management process and monthly Board reporting, which focus on

any matters likely to impact the Group's strategy. The principal

risks identified in this section contain details of related matters

that could emerge together with the associated mitigations. In

addition, the Board monitors wider emerging issues including the

following:

-- the acceleration by the Covid-19 pandemic of remote working

and the impact on office demand;

-- long-term scarcity of skilled labour in the industry; and

-- risks associated with the shift towards new methods of

construction.

None of the above are currently considered to require adjustment

of the Group's business model or strategy, but will be monitored

for

any significant changes.

Principal risks

The principal risks to the business are set out on the following

pages. The list is not exhaustive but includes those risks

currently considered

most significant in terms of potential impact, together with

mitigating actions being taken.

The risks have been extensively reviewed including those

associated with Covid-19. The remaining risks have not changed

significantly, although

they reflect the contributions to macroeconomic uncertainty made

by the pandemic and the Brexit dynamics of the fourth quarter. Any

changes

in severity and likelihood of impacts compared to 2019 have been

indicated and signify the Board's opinion of pre-mitigation risk

movement.

Risk and Update on risk status Mitigating activities

potential

impact

Covid-19 New

The pandemic * In 2020, the Covid-19 pandemic had an impact across * The Group's focus on its balance sheet prior to the

is an example the Group in all areas of operations as a result of crisis, which allowed us to navigate through the

of the speed compliance with government guidelines. pandemic with positive net cash.

and

scale at

which * We responded well to initial challenges from the * The Group's favourable risk and cash profile, which

events can pandemic and expect to be able to navigate subsequent permitted us to be accepted for access to the

unfold. waves, avoiding material disruption. government's Covid Corporate Financing Facility

(CCFF).

In these

circumstances * The government's directive that construction activity

we must adapt should continue through lockdowns, together with our * In operations, all divisions responding well to new,

quickly and strict adherence to safe operating procedures, safe ways of working and currently remaining fully

rapidly to provides a level of confidence that future activity operational.

new can be maintained.

ways of

working * Prior investment in IT, which allowed our employees

and have * Revised Covid-19 client programmes and agreements are to work remotely with minimal inconvenience.

sufficient predominantly in place and included within

financial forecasting, signifying the strength of our

resources relationships and operational management. * Our decentralised structure, which allowed us to

to ensure the remain agile and responsive during the crisis.

business can

continue to * During the pandemic, our long-term relationships and

operate standing with primary UK suppliers have proved * Our focus on developing strong relationships with our

effectively. fundamental in managing product supply issues and clients, partners and suppliers resulted in optimal

should hold us in good stead post-Brexit. assistance being afforded to us during the pandemic.

----------------------------------------------------------- -----------------------------------------------------------

Changes in Increase

the * There continues to be uncertainty arising from the * The UK is expected to continue investing in areas

economy Covid-19 pandemic and, to a lesser extent, the EU that complement our strategy, including affordable

There could withdrawal agreement, which includes potential housing, infrastructure and regeneration. This

be fewer or impacts on the economy. We continue supports our business model, which is designed to

less provide a mix of earnings across different market

profitable cycles.

opportunities * to monitor the situation closely, however, we believe

in our chosen that in the medium to longer term, the markets in

markets. which we operate remain favourable and structurally * Strategic focus on market spread, geographical

Allocating secure. capability and diversification to protect against the

resources and cyclical effect of individual markets.

capital to

declining * We are reassured by the quality and volume of our

markets or pipeline of opportunities and secured workload in * High proportion of secured workload with public

less both regeneration and construction, and believe that sector and regulated entities via long-term

attractive this, together with our business model, should arrangements, with a healthy level of demand and

opportunities provide some insulation against any specific adverse typically preferential terms.

would reduce consequences.

our

profitability * Continuing with our strategy of being selective, with

and cash * The continued scrutiny of UK construction balance our procurement routes, margins, contract terms and

generation. sheets remains a differentiator for us and continues secured workload all remaining favourable.

to underpin our positive position in the sector,

meaning that our stakeholders can engage with

confidence while allowing us to be highly selective. * An enhanced understanding of medium-term pipeline

quality, assisted by insights generated from

analytical software, that enables us to predict

trends more accurately and adjust our strategy in

response. Regular reporting on sales, opportunities

pipeline and secured workload, using customer

relationship management software.

----------------------------------------------------------- -----------------------------------------------------------

Risk and Update on risk status Mitigating activities

potential

impact

Exposure to No change

UK housing * While a number of new and existing investor schemes * Working closely with public sector partners and

market suffered some initial delay due to the pandemic, government agencies such as Homes England to provide

The UK housing agreements did conclude, allowing schemes to viable development and affordable homes.

sector is recommence.

strongly

influenced by * Largely non-speculative, risk-share development

government * Post Covid-19 sales and volumes returned to vehicles, subject to viability conditions that reduce

stimulus pre-crisis levels and, on certain schemes, we any negative impact from market fluctuations.

and consumer accelerated build to meet increased demand.

confidence.

* Targeting of forward-sold and funded sections of

If mortgage * Despite external factors, there continues to be clea large-scale residential schemes to institutional

availability r investors.

and government support for new affordable housing, which

affordability supports our business model and market positioning.

are * A geographically spread residential portfolio that

reduced this offers protection against regional variations and is

could make * The speed of decision-making by potential partners geared to an affordable product.

existing for new development schemes remains cautious,

schemes although it did improve in the second half of the

difficult year. * A constrained land bank, preferring and targeting

to sell and option-type agreements with owners that limit and/or

future defer long-term exposure and boost return on capital

developments * Macroeconomic uncertainty, including matters such as employed.

unviable, consumer confidence and the end of the stamp duty

reducing holiday, could impact sales; however, mitigations ar

profitability e * Regular forecasting and monitoring of development

and tying up available and there may be further government pipeline of opportunities and secured workload,

capital. interventions and housing stimulus. including monitoring key UK statistics such as

unemployment, lending and affordability.

* For a large proportion of our portfolio we have the

ability to slow down (or speed up) build rates on

current schemes should the need arise.

* Rigorous three-stage approval process before

committing to development schemes and capital

commitments.

---------------------------------------------------------- -----------------------------------------------------------

Poor contract No change

selection * The quality of our long-term secured workload should * Clear selectivity, strategy and business plan to

In a volatile underpin future performance and provide sustainable target optimal markets, sectors, clients and projects

market where performance and outcomes, also allowing us to remain ,

competition highly selective when bidding future work. which have proven to have delivered favourable

is high, a outcomes. A deliberately large proportion of projects

division conducted via framework or joint venture arrangements

might accept * Our order book maintains a high proportion of public with repeat clients who share our philosophy and

a contract sector, regulated industry and framework clients wit values, making predictable outcomes more likely.

outside h

its core typically healthier risk profiles and is secured in

competencies limited competition. * A proportion of construction work secured via sister

or for which company regeneration schemes, where expertise

it has provided at an early stage can greatly influence the

insufficient * There are no changes to the sectors or markets in likelihood of project success.

resources. which we operate, meaning it is less likely that we

would engage with a client or carry out a project

Failure to that does not provide a positive outcome. * Divisions selecting projects according to pre-agreed

understand types of work, contract size and risk profile, with a

the project multi-stage process of bid approval, including tender

risks may lead * The high quality of client and supply chain review boards, risk profiling and sign-off by

to poor relationships, operational delivery and risk appropriate levels of

delivery management in Construction & Infrastructure has been

and ultimately evident throughout the Covid-19 pandemic and allowed

result in us to navigate the crisis well. * management.

reputational

damage and

loss * Employee planning and profiling to ensure appropriate

of levels of capable resource for future work.

opportunities.

* Initiatives to select supply chain partners who match

our expectations in terms of quality, sustainability

and availability.

---------------------------------------------------------- -----------------------------------------------------------

Risk and Update on risk status Mitigating activities

potential

impact

Responsible Increase

business * The focus on responsible business practice has * A responsible business forum with representatives

Being socially, increased significantly from both a governmental and from each division, chaired by our Group finance

economically investor perspective and we need to ensure that we director. As of January 2021, this role is being

and communicate a clear strategy and continue to measure undertaken by the Group management team.

environmentally and report our performance against it. Four of our

responsible divisions are using the supply chain social value

in all that bank that we developed with Simetrica, to measure the * Regeneration activities that 'enhance communities' by

we do is social, economic and environmental value our projects physically reviving town centres and stimulating

crucial. bring to local communities. local economies through: procuring locally where we

can; providing training and work opportunities to

As a local people through our projects; taking part in

responsible * We have an extensive supply chain who are local volunteering activities; and attracting

business, we strategically important to us and their performance visitors and businesses to the newly-regenerated

have five Total on our projects is key to our success and reputation. areas.

Commitments: Our approach is to develop long-term partnerships so

protecting that they help deliver high-quality projects for our

people, clients and meet our Total Commitments. * The use of Group-wide KPIs and targets by our

developing divisions to measure their performance against the

people, Total Commitments, which ensures consistency of

improving the objectives and standards throughout the Group.

environment, Divisional performance is then consolidated and

working reported as one set of Group results.

together

with our supply

chain, and

enhancing

communities.

These

Commitments

are aligned

to our purpose,

the needs of

our

stakeholders

and our

obligations

towards

society.

We must ensure

that these key

aspects are

embedded in

our culture

and underpin

what we do,

in addition

to complying

with increasing

regulation and

reporting.

If this is not

well managed,

incidents may

occur that

result

in legal

action,

fines, costs

and insurance

claims as well

as project

delays.

It could also

damage the

Group's

reputation and

affect our

ability

to secure

future

work and

achieve

targets.

----------------------------------------------------------- -----------------------------------------------------------

Health and No change

safety * Our teams adapted well to new site operating * Board level health, safety and environment committee

Our number one procedures introduced as a result of the pandemic. focused on health and safety culture to drive better

priority is These procedures remain in place across the whole behaviour and performance.

to protect the business and should enable us to navigate further

health, safety waves of the pandemic in a productive and safe

and wellbeing manner. * Individuals in each division, and on the Board and

of our key Group management team, with specific responsibility

stakeholders. for health and safety matters.

* Our health and safety performance improved in the

Health and year, with a reduction in the number of lost time

safety incidents, incidents reportable to the Health and * Quarterly meetings of the Group health and safety

will always Safety Executive (RIDDORs) and accident frequency forum where representatives from all divisions

feature rate. The results were due in part to the adoption of continue to share best practice and exchange

significantly the new site operating procedures together with fewer information on emerging risks.

in the risk people working on sites in the year.

profile of a

construction * Established safety systems, audits, site visits,

business. We incident investigation and root-cause analysis,

carry out a monitoring and reporting procedures, including

significant near-miss and reporting of incidents that could

portion of our potentially have resulted in serious injury.

work in public

areas and

complex * Regular health and safety training that includes

environments, behavioural change, housekeeping on site and

requiring leadership engagement in driving site standards.

strict

observation

of Health and * Communication of each division's health and safety

Safety policy to all their employees and senior managers

Executive appointed to ensure they are implemented.

standards.

Accidents could * Major incident management and business continuity

result in legal plans, periodically reviewed and tested.

action, fines,

costs and

insurance

claims as well

as project

delays

and damage to

reputation.

Poor health

and safety

performance

could also

affect

our ability

to secure

future

work and

achieve

targets.

----------------------------------------------------------- -----------------------------------------------------------

Risk and Update on risk status Mitigating activities

potential

impact

Climate Increase

change * The focus on the impacts of climate change has * A climate action panel with representatives from each

The Group's increased significantly. We need to communicate our division, chaired by our Group director of

key strategy for addressing climate change and the sustainability and procurement.

environmental actions we are taking in order to meet the

impact is via expectations of our stakeholders.

the carbon * Science-based carbon measurements and targets put in

emissions place in response to increased demand from our

and waste * We are addressing climate change by reducing our employees and stakeholders.

that carbon emissions and waste.

we produce.

* ISO 14001- compliant environmental systems in

Our * The next step is to reduce our indirect emissions

activities that occur in our value chain. We are doing this by

can be helping our supply chain manage their own * place within all construction divisions.

impacted climate-related regulatory and reporting obligations.

by changes in The Supply Chain Sustainability School, of which we

temperature, are a member, is providing the supply chain with * Plans focused upon reducing waste generated on site

high winds support through training. and transferred to landfill.

from

increasing

severity * We achieved an A score for leadership on climate * Where possible, use of on-site energy generation and

of storms, change from CDP (the international non-profit design for low carbon and climate change adaptation.

and organisation that drives environmental disclosure to Use of alternative fuels for our vehicle fleet and

flooding. If manage environmental impacts) and were the only major generators to reduce emissions.

this is not UK based contractor to do so.

well managed,

incidents may

occur that

result

in legal

action,

fines, costs

and insurance

claims as

well

as project

delays.

It could also

damage the

Group's

reputation

and

affect our

ability

to secure

future

work and

achieve

targets.

----------------------------------------------------------- ------------------------------------------------------------

Failure to No change

attract * Brexit complicates the skills issue as availability * Giving people empowerment and responsibility together

and retain of EU workers may reduce. However, in the short term, with clear leadership and support.

talented while there could be some limited issues, our supply

people chain believes this will be manageable.

Talented * Attractive working environments, remuneration

people packages, technology tools and wellbeing initiatives

are needed to * Our current success is helping us attract and retain to help improve our employees' working lives.

provide people, reflected in high levels of applicants and

excellence falling voluntary employee turnover rates.

in project * Annual appraisals providing two-way feedback on

delivery performance.

and customer * In divisions whose voluntary employee turnover was

service. higher, improvements continue to be made to the

working environment and investment made in technology * Succession planning that includes identifying and

Skills and leadership training. developing future skills.

shortages

in the

construction * We are responding to the challenge of an ageing * Training and development to build skills and

industry employee population and undertaking work to improve experience, such as our leadership development and

remain our diversity, such as working with schools and graduate, trainee and apprenticeship programmes.

an issue for colleges to encourage more women to enter the

the industry and providing a returnships programme for

foreseeable people returning to work following a career break. * Employee engagement surveys that ensure we target

future. areas to improve employee satisfaction.

* Divisional 'people boards' that meet twice a year to

review talent in the business.

* Monthly HR reports to the Board, including reporting

on leavers and joiners.

* Interviews with leavers and joiners to understand the

reasons for their decision.

----------------------------------------------------------- ------------------------------------------------------------

Risk and Update on risk status Mitigating activities

potential

impact

Insolvency of Increase

key client, * The Covid-19 pandemic has stretched our supply * A business strategy focused on the public sector and

subcontractor, chain's financial resources. Some businesses are commercial clients in sound market sectors.

joint venture under increasing pressure from a combination of

partner or issues, including the unwind of government reliefs,

supplier reduced bank lending appetite and the ramp up in * A high proportion of our current secured workload is

An insolvency operations. public sector-focused.

could disrupt

project works,

cause delay * As we are less able to rely on historical credit * Rigorous due diligence on commercial clients and

and incur the checks, our teams have heightened sensitivity and ar supply chain partners, obtaining where necessary

costs of e relevant securities in the form of guarantees, bonds

finding looking for signs of stress that would enable early ,

a replacement, intervention and options to resolve; this includes escrows and/or more favourable payment terms.

resulting in measures to gain greater control and transparency.

significant

financial * A formal, multi-stage approval process before

loss. * Our cash position is not supported by any form of entering into contracts, supported by tender review

supply chain debtor finance and gives a clear boards.

There is a indication of our financial health. This, together

risk with our strong balance sheet and shorter payment

that credit days, means our supply chain partners regard us as * Formal joint venture selection due diligence and

checks dependable and reliable. It also gives us the option approval at Board executive director level, which

undertaken to step in and cover short-term issues, such as cash includes seeking protection in the event of default

in the past flow, if deemed appropriate. by one of the partners.

may no longer

be valid.

* Working with preferred or approved suppliers where

possible, which aids visibility of both financial an

d

workload commitments.

* Monitoring supply chain utilisation to ensure we do

not overstress their finances or operational

resource.

* Rigorous monitoring of work in progress (uninvoiced

income), debts and retentions.

---------------------------------------------------------- ----------------------------------------------------------

Inadequate No change

funding * GBP150m of the Group's GBP180m committed bank * New banking facilities of GBP150m committed to 2023

A lack of facilities were renewed in October 2020. (with two one-year options to extend) in addition to

liquidity the existing GBP30m, which together with our strong

could impact cash position provide significant headroom.

our ability * During the reporting period and for the foreseeable

to continue future, our average net daily cash continues to be

to trade or healthy and clearly indicates the cash-backed nature * A Group-led, disciplined capital allocation process

restrict our of the business. for significant project-related capital, taking into

ability to account future requirements and return on investment

achieve .

market growth * Our balance sheet continues to provide assurance for

or invest in our employees, clients, supply chain and

regeneration counterparties in an increasingly uncertain market. * Daily monitoring of cash levels and regular

schemes. This was particularly evident during the pandemic in forecasting of future cash balances and facility

the first half of the year when engagement from the headroom.

supply chain was notably positive.

* Regular stress-testing of long-term cash forecasts.

* The Group was accepted by the Bank of England as an

eligible issuer under the CCFF.

* The strength of our balance sheet, which allows us t

o

continue making investments in regeneration schemes

whilst remaining selective in construction.

---------------------------------------------------------- ----------------------------------------------------------

Risk and Update on risk status Mitigating activities

potential

impact

Mismanagement No change

of working * Our continuing focus on working capital management * Delegated authorities that require capital and

capital has enabled us to maintain levels similar to prior investment commitments to be notified and signed off

and years while continuing to improve our supply chain at key stages with senior level approval.

investments payment practices and navigate the pandemic.

Poor

management * Reinforcing a culture in the bidding and project

of working * We continue to maintain a positive momentum in cash teams of focusing on cash returns to ensure they meet

capital management in construction due to a combination of expectations.

and improved returns, cash optimisation and conversion.

investments

leads to * Monitoring and management of working capital with

insufficient * Our average net daily cash for the period acute focus on any overdue work in progress, debtors

liquidity and demonstrates our disciplined working capital or retentions.

funding management.

problems.

* Daily monitoring of cash levels and weekly cash

* Government reliefs, including CJRS receipts of forecast reports.

cGBP9.5m and GBP20m of deferred VAT, were repaid in

the fourth quarter of 2020.

* Efficient management of capital on regeneration

schemes, such as phased delivery, institutional and

government funding solutions, and forward funding

where possible.

----------------------------------------------------------- -----------------------------------------------------------

Mispricing a No change

contract * Despite the macroeconomic effects of the pandemic, * A well-established bidding process with experienced

If a contract when bidding for future work we have remained focused estimating teams.

is on selecting projects that are right for the business

incorrectly and match our risk appetite.

costed this * A continued focus on key sectors that means we are

could lead to experienced in pricing projects and less likely to

contract * Contract procurement routes and terms remain misprice than if entering new markets.

losses favourable, influenced by our strategy to focus on

and an long-term, relationship-based arrangements and

overall frameworks, and confirmed by our order book quality * A robust review of our pipeline and bids at key

reduction in and positive margins. stages, including rigorous due diligence and risk

gross margin. assessment, and obtaining senior level approval.

It might also

damage the * A large proportion of projects have forms of

relationship protection, such as negotiated and two-stage * Continuing to secure projects with repeat clients via

with the procurement routes that allow early supply chain negotiation, open book and framework style

client price lock-in, monetary contingency and/or related arrangements, with limited, selective open market

and supply contract terms, all of which help reduce risk. bids, thus offering a higher probability of

chain. successful outcomes.

* Project provision, where appropriate, for increase in

cost and/or risk that hedges against inflationary and

other project-related issues.

* A culture and strategy within the Construction

business of prioritising selectivity over volume when

bidding.

* Using the tender review process to challenge and

mitigate rising supply chain costs.

----------------------------------------------------------- -----------------------------------------------------------

Risk and Update on risk status Mitigating activities

potential

impact

Changes to No change

contracts * Construction's order book maintains a greater * Reviewing contract terms at tender stage and ensuring

and proportion of repeat work, which means we are mor any variations are approved by the appropriate level

contract e of management.

disputes likely to achieve sustainable and predictable

Changes to outcomes via sensible negotiated settlement.

contracts * Well-established systems of measuring and reporting

and contract project progress and estimated outturns that include

disputes * The high proportion of framework-related, two-sta contract variations and impact on programme, cost and

could ge quality.

lead to costs and negotiated work in our current order book

being continues to reduce the likelihood of unforeseen

incurred changes and disputes. This also applies to any EU * Continued use and development of electronic

that are not price fluctuations, as our approach allows us to dashboards for project management and change control,

recovered, take and commercial metrics designed to highlight areas of

loss account of known increases and to procure quickly focus and provide early warnings.

of following the award.

profitability

and delayed * Where legal action is necessary, notifying the Board,

receipt of taking appropriate advice and making suitable

cash. provision for costs.

Ultimately,

we may need * Digital early-warning tools and metrics that flag

to resort to potential project issues, enabling intervention

legal action earlier in the construction cycle.

to resolve

disputes,

which can

prove

costly with

uncertain

outcomes

as well as

damaging

relationships

.

------------------------------------------------------- -----------------------------------------------------------

Risk and Update on risk status Mitigating activities

potential

impact

Poor project No change

delivery * The pandemic caused initial project delays, but * Incentivising project teams on Perfect Delivery(1)

Failure to impacts were promptly renegotiated with our clients outcomes to achieve high levels of client

meet and supply chain. This reinforced the strength of our satisfaction.

client relationships, sector strategy and approach to

expectations working with preferred partners.

could incur * Various initiatives that focus on improvements in

costs that product quality, predictability and client

erode * Our continued focus on project selectivity combined experience.

profit with the continued quality of our order book reduces

margins, the probability of poor performance.

lead to the * Strategic supply chain trading arrangements that help

withholding to ensure we achieve predictable outcomes in quality

of cash * There is recognised stretch in the labour market, and behaviours.

payments which has been manageable but could be exacerbated by

and impact Brexit.

working * Digital enhancements in construction and regeneration

capital. It operations continue to develop at pace in pursuit of

may also * In terms of product availability exacerbated by improved business intelligence (project and

result Covid-19 and Brexit, a large proportion of products pipeline-related early warning indicators) and ways

in reduction are UK-sourced which helps reduce risk and we of creating better client journeys that enhance

of repeat instigated precautions towards the year end, such as relationships and outturn product quality.

business advancing the procurement of certain items. In

and client addition, our supply chain has measures in place to

referrals. minimise impacts, such as specialist software that * Formal internal peer reviews that highlight areas of

simplifies procedures at ports; using their own improvement and share best practice and 'lessons

transport; and storing materials at UK factories (or learned' exercises.

on site) ahead of programme.

* Regular formal and informal stakeholder feedback,

allowing us to intervene when required and refine our

offering to provide exceptional outcomes.

* Following the Hackitt report and in advance of

expected regulatory changes, Construction and Urban

Regeneration have reviewed and updated their

methodology and approach to ensure that outturn

project specifications are compliant. This includes

matters such as a complete refresh/revisit of design

management standards and procedures, greater scrutiny

of fire-related components incorporated in our

buildings, the engagement of independent fire

consultants on more complex schemes and enhancements

to specifications in our developments to ensure we

meet not only current but anticipated changes in

regulations.

* Long lead items have agreed delivery dates and

typically have a period of programme float head of

planned works.

* Projects typically have some protection against

inflation via monetary and programme contingency or

related contract terms.

* 1 Perfect Delivery status is granted to projects that

meet all four customer service criteria specified by

each division.

----------------------------------------------------------- -----------------------------------------------------------

Risk and Update on risk status Mitigating activities

potential

impact

Failure to No change

innovate All divisions have continued to * One of our core values is to challenge the status quo

A failure to develop solutions to improve efficiency, and innovation is strongly encouraged. New ideas are

produce or client service and employee satisfaction. welcomed from every employee, partner and supplier.

embrace There continues to be a real drive

new products from the business to adopt new

and technology (we invested GBP2.64m * Our initiatives around quality of delivery and

techniques in new technology in 2020), enhance exceptional client experiences are not just founded

could existing processes and find greater on process but are integral to our culture.

diminish efficiencies.

our delivery The Infrastructure business in

to clients particular continues to work with * Our employees enjoy working on high-profile,

and leading UK companies, such as innovative projects that provide them with the

reduce our Network Rail, Highways England, opportunity to enhance their knowledge and

competitive Thames Tideway and Sellafield, experience.

advantage. who encourage innovation and optimised

It could construction techniques and share

also in the risk and reward. This allows * Business and IT come together via forums that sponsor

make us less us to compete in areas with high and promote new innovations across the business.

attractive barriers to entry while sharing

to new ideas across the Group. For

existing example, on a project for Network

or Rail, Infrastructure created a

prospective curved concrete tunnel structure

employees. under the East Coast Main Line

at Werrington, near Peterborough

to carry slower moving freight

trains, thus increasing capacity

for the passenger service above.

Our regeneration divisions utilise

market-leading development structures

which help unlock underperforming

assets and differentiate our offering.

This includes working with leading

investment partners to create

innovative funding solutions to

improve the viability of schemes

and facilitate early engagement.

----------------------------------------------------------- -----------------------------------------------------------

UK cyber Increase

activity * In order to protect against increasing levels of UK * A dedicated team focused on providing a stable and

and failure cyber-attack, we continue to invest in established resilient IT environment, and continued investment in

to invest in security controls and external security partners who core infrastructure and applications.

information actively advise on strategy.

technology

Investment * A centralised IT service that improves efficiency,

in * Refreshed security awareness training was rolled out oversight, reporting, security and performance, while

IT is to all our employees in the year. divisional resource provides business-specific

necessary product support.

to meet the

future needs * Our investment in technology in prior years allowed

of the our employees the agility to adapt quickly to working * Group-wide financial software that provides a fully

business in a remote and secure environment during the integrated construction platform to manage the

in terms of Covid-19 pandemic. project life cycle.

expected

growth,

security and * A Group security steering group that provides

innovation, governance and oversight and a dedicated information

and enables security team, certified and accredited by key

its industry bodies, who create awareness and address

long-term threat alerts, risk and vulnerability prioritisation

success. and response.

It is also

essential * Government-accredited security installations and

in order to certification to store protectively marked

avoid information.

reputational

and

operational * Certification to the government's Cyber Essentials

impacts and Plus Scheme and ISO 27001.

loss of data

that could

result

in

significant

fines and/or

prosecution.

----------------------------------------------------------- -----------------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSUVSURAKUOUAR

(END) Dow Jones Newswires

March 25, 2021 08:51 ET (12:51 GMT)

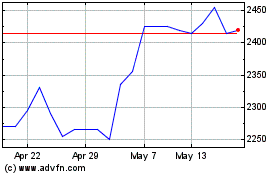

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jun 2024 to Jul 2024

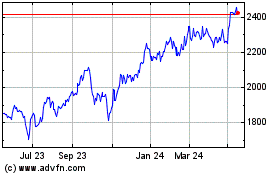

Morgan Sindall (LSE:MGNS)

Historical Stock Chart

From Jul 2023 to Jul 2024