TIDMDSG

RNS Number : 5858N

Dillistone Group PLC

26 September 2023

26 September 2023

Dillistone Group Plc

("Dillistone", the "Company" or the "Group")

Interim Results & Investor Presentations

Dillistone Group Plc, the AIM quoted supplier of software and

services to recruiters, is pleased to announce interim results for

the six months ended 30 June 2023.

Financial Highlights

-- Group eliminates losses, makes first H1 adjusted operating

profit since 2018 of GBP0.036m (H1 2022: loss (GBP0.129m)).

-- Rolling 12 month adjusted operating profit also turns

positive at GBP0.009m for the first time since H2 2018 (12 months

to June 2022: loss (GBP0.342m)).

-- First H1 recurring revenue growth since 2017 up 4% to GBP2.564m (2022: GBP2.477m).

-- Recurring revenues represented 91% (H1 2022: 88%) of Group

revenue. Total revenue flat at GBP2.826m (2022: GBP2.823m).

-- Net cash from operating activities broadly the same at GBP0.565m (2022: GBP0.560m).

-- Cash at period end of GBP0.249m (2022: GBP0.608m) reflecting

ongoing repayment of Government support loans (GBP0.300m annually).

The Board does not expect the Group to require additional

funding.

-- Board expects to deliver full year profit results in line with market expectations.

Operational Highlights

-- Strong start to year for all products, followed by

deterioration in Q2 due to widely reported drop in UK advertised

vacancies during this period leading to a downturn in demand for

many of our clients.

-- Improved operational gearing ensures that business is able to

react rapidly to changes in demand.

-- Post period end, major enhancements delivered for Talentis,

Infinity and Mid-Office, including integrations with OpenAI (the

technology behind ChatGPT) for both Talentis and Infinity.

-- Implementation of previously announced major contract win progressing well.

Commenting on the results and prospects, Giles Fearnley,

Non-Executive Chairman, said:

"In my statement in the annual report, I said that the

underlying business had improved. These results confirm that

statement with the Group returning an adjusted operating profit for

the first time since 2018, despite the challenging economic

environment.

"Even with the current economic turbulence, we fully expect to

make further progress during the remainder of the year. The Board

is confident of delivering full year profit results in line with

market expectations."

* Note: "Adjusted" refers to activities before acquisition,

reorganisation, Government support, and one-off costs

Investor Presentation: 3pm on Tuesday 26 September 2023

Jason Starr, Chief Executive, and Ian Mackin, Finance Director,

will hold an investor presentation to review the results and

prospects at 3pm on Tuesday 26 September 2023.

The presentation will be hosted through the digital platform

Investor Meet Company. Investors can sign up to Investor Meet

Company and add to meet Dillistone Group Plc via the following link

https://www.investormeetcompany.com/dillistone-group-plc/register-investor

. For those investors who have already registered and added to meet

the Company, they will automatically be invited.

Questions can be submitted pre-event to

dillistone@walbrookpr.com or in real time during the presentation

via the "Ask a Question" function.

Mello Results Special webinar: Wednesday 27 September 2023 -

event starting at 12pm

Dillistone will be presenting at the Mello Results Special

webinar, on Wednesday 27 September 2023 taking place via Zoom

Webinar. The event starts at 12.00pm.

Jason Starr, Chief Executive, and Ian Mackin, Finance Director,

will be presenting to webinar participants during the event and

taking questions. Investor wishing to attend can register here for

a free ticket for the event using code SHR100. The recording will

be sent out to all registrants within 48 hours of the event.

Contacts:

Dillistone Group Plc Via Walbrook PR

Jason Starr Chief Executive

Ian Mackin Finance Director

WH Ireland Limited (Nominated adviser)

Chris Fielding Head of Corporate Finance 020 7220 1650

Walbrook PR

Tom Cooper / Nick Rome 020 7933 8780

dillistone@walbrookpr.com

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

The person responsible for arranging the release of this

announcement on behalf of the Company is Ian Mackin, Finance

Director of the Company.

Notes to Editors:

Dillistone Group Plc is a leader in the supply and support of

software and services to the recruitment industry. Dillistone

operates through the Ikiru People ( www.IkiruPeople.com ) brand

.

The Group develops, markets and supports the Talentis,

FileFinder, Infinity, Mid-Office, ISV and GatedTalent products.

Dillistone was admitted to AIM, a market operated by the London

Stock Exchange plc, in June 2006.

Learn about our products:

Talentis Software: https://www.talentis.global/recruitment-software/

Voyager Software: https://www.voyagersoftware.com

GatedTalent Executive Jobs: https://talentis.global/all-jobs

Chairman's Statement

In my statement in the annual report, I said that the underlying

business had improved. These results confirm that view with the

Group achieving its first half year adjusted operating profit since

H2 FY2018 and its first half year profit from operating activity

since H1 FY2016.

It is perhaps though, the rolling 12-month measure of adjusted

operating profit which truly shows the progress made. The table

below shows the scale of recovery the company has achieved, with a

small profit of GBP0.009m being achieved in the 12 months to 30

June 2023, a turnaround in operating performance of more than

GBP350k, when accounting for government support.

12 months to 30 June 30 June 30 June 30 June 30 June 30 June

2018 2019 2020 2021 2022 2023

Adjusted Operating

Profit (GBP'000) 140 (6) (228) (568) (342) 9

-------- -------- -------- -------- -------- --------

In the annual report I also pointed to challenging economic

conditions. These worsened during Q2, with the widely reported

reduction in hiring leading to a number of recruitment agencies

downsizing, subsequently reducing demand for our products.

However, as a result of the restructuring undertaken over recent

years, the Group now has the ability to rapidly adjust cost in line

with market fluctuations and steps have been taken in H2 to reflect

the harsher sales environment we face. As a result, the Board

remains confident of continuing its financial recovery in 2023.

Operational Review

We split our products into two groups - products primarily

targeting contingency recruiters (largely, but not exclusively, in

the United Kingdom) and products used by executive search firms and

in-house executive search teams across the globe.

Contingency review:

In March, we announced that the Group had won a significant

contract for our Infinity product. We stated that " The contract

includes a significant amount of tailored development work which

will determine the final value of the contract. The sum total of

this development work and the ongoing licence revenue is expected

by the Board to result in the contract being the largest won since

the restructuring of the Group in January 2020."

We are pleased to report that this project is progressing well

and we anticipate that the non-recurring revenue part of the

project will largely be realised in H2 2023. While the final value

of this work remains unconfirmed, at this stage, we are now

anticipating that this will be marginally higher than originally

anticipated.

While some of our development focus has been driven by the

requirements of this contract, we continue to enhance our

contingency products to deliver more value for all our clients.

During Q2, we completed the integration of Infinity with the

"Talentis TalentGraph", allowing our contingency users to search

across the huge datapool which was previously available exclusively

to our Talentis clients. We believe this enhancement will create a

competitive advantage for Infinity, and the primary aim is to

support client retention. In addition, we are charging users a

small additional fee to take advantage of this functionality and we

have already started to generate new revenue as a result.

As noted above, the UK recruitment market saw a marked decline

in Q2, and we saw a number of our clients reduce licence numbers or

take steps to cancel contracts. We also saw a steep decline in new

business orders during this period.

The recruitment software industry tends to be relatively slow in

Q3 and this has proven to be the case this year. However, there are

no obvious signs of further deterioration, and we anticipate the

previously mentioned large contract win will ensure a positive

result for this part of the business in H2, regardless of the

economic environment.

Executive search review:

Our executive search platforms enjoy a far greater global client

base than our contingency products, with users accessing our

systems from virtually every continent. While we've seen a steep

decline in the recruitment sector in the UK, other countries have

been less consistent with some territories and sectors doing better

than others. Nevertheless, we have more clients in the UK than in

other territories and as a result our executive search products

were not immune to the fluctuations referenced above and as a

result, recurring revenue associated with our headhunting products

dropped in Q2.

In late Q2 following an extensive review by the organisation in

question, we signed a "preferred provider agreement" for Talentis

with a major global recruitment business. This has already created

opportunities that have generated new revenue for the Group.

As with our contingency products, the market for executive

search technology is typically slow over the summer months.

However, after a tough second quarter, we are pleased to report

that our Talentis product has outperformed expectations over the

summer.

We continue to develop Talentis aggressively and, post period

end, announced our first integrations with OpenAI - the technology

that underpins ChatGPT. These integrations allow users to search

for candidates more efficiently, and helps users to find "similar

candidates" based on a "template candidate". These enhancements

have been well received by our clients.

While the market remains challenging for all our executive

search products, we are pleased to see that Talentis is

increasingly being considered as a viable option for medium sized

firms and we are pleased to note increasing levels of engagement

with search firms who are considering Talentis as a CRM alternative

to an existing platform - rather than a secondary resourcing

tool.

KPIs and financial performance

The Group's operational performance has improved significantly

in recent years, with H1 FY2023 marking our return to operating

profit. The success measure for each of the KPIs used by management

is year on year improvement.

FY23 H1 FY22 H1 % Move

GBP'000 GBP'000

Total revenue 2,826 2,823 0%

--------- --------- -------

Recurring revenue 2,564 2,477 4%

--------- --------- -------

Adjusted EBITDA * 581 435 34%

--------- --------- -------

Adjusted Operating Cash ** 519 560 (8%)

--------- --------- -------

Adjusted (loss) before tax

*** (105) (274) 62%

--------- --------- -------

* EBITDA adjusted for Government support

** Operating cash adjusted for Government support received

*** (Loss) before tax adjusted for Government support associated

with Covid and exceptional costs

Revenue

Group revenue stayed broadly flat at GBP2.826m from GBP2.823m in

H1 FY2022

Recurring revenues increased by 4%, the first H1 increase since

2017, to GBP2.564m over the comparable period last year (2022: 2%

decline to GBP2.477m). Recurring revenues represented 91% of total

revenues (2022: 88%). Non-recurring revenues were down 23% at

GBP0.200m (2022: GBP0.260m).

Adjusted EBITDA*

The adjusted EBITDA* increased by 34% to GBP0.581m from

GBP0.435m in H1 FY2022. This resulted in a higher EBITDA margin of

20.6%, compared to 16.7% in H1 FY2022, reflecting the Group's focus

on efficiency, whilst maintaining our customer service.

Operating profit/(loss) and profit/(loss) before tax

The Group moved back into an operating profit in H1 FY2023. The

operating profit, before acquisition related, reorganisation and

other items, increased by 128% to stand at GBP0.036m from

(GBP0.129m) in H1 FY2022.

Inclusive of acquisition related and other items, the operating

profit was GBP0.027m compared to a loss of (GBP0.105m) in H1

FY2022.

The loss before tax decreased to (GBP0.046m) from (GBP0.274m) in

H1 FY2022. Using a like for like measure, excluding Government

support of GBP0.059m for H1 FY2023, the comparative figure for H1

FY2023 is (0.105m), a decrease in loss of 62%.

Taxation

The net tax credit for H1 is GBP0.054m (FY 2022: GBP0.091m).

Balance sheet

The Group's net assets increased slightly to GBP3.236m (H1

FY2022: GBP3.213m)

Trade and other receivables decreased to GBP0.635m (H1 FY2022:

GBP0.739m).

Trade and other payables also decreased to GBP2.523m (H1 FY2022:

GBP2.847m).

R&D development

The Group capitalised GBP0.460m in development costs in the

period (H1 FY2022: GBP0.476m) as the business continued its

commitment to developing its products. Amortisation of development

costs was GBP0.496m (H1 FY2022: GBP0.490m)

Financing

The CBIL loan balance stands at GBP0.900m (31 December 2022:

GBP1.050m) and, on the current payment profile, will be repaid by

June 2026. The Group also has a convertible loan of GBP0.400m (31

December 2022: GBP0.400m), which is not expected to be repaid until

the CBIL loan has been repaid.

Cashflow

Net cash from normalised operating activities (before government

support) decreased 7% to GBP0.519m (H1 FY2022: GBP0.560m). Adjusted

net change in cash before government support deteriorated by 17% to

(GBP0.217m) (H1 FY2022: (GBP0.186m)).

At 30 June 2023, we had net cash reserves of GBP0.249m (2022:

GBP0.608m).

Summarised cashflow H1 FY2023 H1 FY2022

GBP'000 GBP'000

Adjusted net cash from normalised operating

activities 519 560

Investing Activities - net (469) (482)

Financial Activities - net (267) (264)

---------- ----------

Adjusted Net change in cash and cash equivalents (217) (186)

Adjustment for Government Support 46 -

---------- ----------

Net change in cash and cash equivalents (171) (186)

Cash and cash equivalents at beginning of

year 433 764

Effect of foreign exchange rate changes (13) 30

---------- ----------

Cash and cash equivalents at 30 June 249 608

========== ==========

Strategy

Our long-term strategy is unchanged, concentrating on reducing

the size of our product range to concentrate on the best

opportunities while broadly maintaining consistent levels of

product development expenditure. While the economic climate is

challenging, we intend to maintain our current focus and deliver

significant improvements to users of both our product groups.

Outlook

After a challenging few years for the Group, the Board is

delighted to report a return to profitability in the first half of

2023.

The recruitment sector has had a turbulent time in recent

months, and this has unquestionably impacted upon demand for our

services. To be able to report improved performance despite these

market conditions is particularly pleasing and we are confident

that the Group has exciting times ahead of it, especially when we

see improvement in our recruitment and search customer bases.

Despite this current economic turbulence, we fully expect to

make further progress during the remainder of the year. The Board

is confident of delivering full year profit results in line with

market expectations.

Giles Fearnley

Non-Executive Chairman

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Note 6 Months ended 30 Year ended

June 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 4 2,826 2,823 5,699

Cost of sales (312) (351) (816)

---------- ---------- -----------

Gross profit 2,514 2,472 4,883

Administrative expenses (2,487) (2,683) (5,202)

---------- ---------- -----------

Result from operating

activities 4 27 (211) (319)

Analysed as:

Result from operating

activities before acquisition

related, reorganisation

and other items 36 (129) (156)

Acquisition related,

reorganisation and other

items 5 (9) (82) (163)

---------- ---------- -----------

Result after acquisition

related items 27 (211) (319)

----------------------------------------- ---------- ---------- -----------

Financial cost (73) (63) (134)

---------- ---------- -----------

(Loss) before tax (46) (274) (453)

Tax income 6 54 91 270

---------- ---------- -----------

Profit / (Loss) for the

period 8 (183) (183)

Other comprehensive income

net of tax:

Currency translation differences (6) 6 7

---------- ---------- -----------

Total comprehensive income

/ (loss) for period net

of tax 2 (177) (176)

---------- ---------- -----------

Earnings per share (pence)

Basic 8 0.04 (0.93) (0.93)

Diluted 0.04 (0.93) (0.93)

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June As at 30 June 2022 As at 31 Dec

2023 2022

Unaudited Unaudited Audited

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 3,415 3,415 3,415

Intangible assets 2,886 3,030 2,990

Right of use assets 455 541 498

Property plant & equipment 27 22 25

-------------- ------------------- -------------

6,783 7,008 6,928

Current assets

Trade and other receivables 635 739 608

Current tax receivable 134 119 72

Cash and cash equivalents 249 608 433

-------------- ------------------- -------------

1,018 1,466 1,113

-------------- ------------------- -------------

Total assets 7,801 8,474 8,041

-------------- ------------------- -------------

EQUITY AND LIABILITIES

Equity

Share capital 983 983 983

Share premium 1,631 1,631 1,631

Merger reserve 365 365 365

Convertible loan reserve 14 14 14

Retained earnings 103 79 93

Share option reserve 76 72 67

Translation reserve 64 69 70

-------------- ------------------- -------------

Total equity 3,236 3,213 3,223

Liabilities

Non current liabilities

Trade and other payables 206 252 241

Lease liabilities 448 516 483

Borrowings 1000 1300 1,150

Deferred tax 226 210 226

-------------- ------------------- -------------

Total non-current liabilities 1,880 2,278 2,100

-------------- ------------------- -------------

Current liabilities

Trade and other payables 2,317 2,595 2,341

Lease liabilities 68 88 77

Borrowings 300 300 300

Current tax payable - - -

-------------- ------------------- -------------

Total non-current liabilities 2,685 2,983 2,718

-------------- ------------------- -------------

Total liabilities 4,565 5,261 4,818

-------------- ------------------- -------------

Total liabilities and

equity 7,801 8,474 8,041

-------------- ------------------- -------------

The interim report was approved by the Board of directors and

authorised for issue on 25 September 2023. They were signed on its

behalf by:

JS Starr IJ Mackin

CONSOLIDATED STATEMENT OF CASH FLOWS

As at 30 June As at

31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Operating Activities

(Loss) before tax (46) (274) (453)

Adjustment for

Financial cost 73 63 134

Depreciation and amortisation 614 648 1,268

Share option expense 11 8 17

Other including foreign exchange adjustments

arising from operations 7 (24) (24)

Operating cash flows before movements

in working capital 659 421 942

(Increase) / Decrease in receivables (27) (124) 20

Increase / (Decrease) in payables (59) 263 (16)

Net taxation (Paid) / repaid (8) - 243

Net cash generated from operating

activities 565 560 1,189

---------- ----------- -------------

Investing Activities

Purchases of property plant and equipment (9) (5) (15)

Investment in development costs (460) (477) (1,007)

Net cash used in investing activities (469) (482) (1,022)

---------- ----------- -------------

Financing Activities

Finance cost (73) (63) (134)

Lease payments made (44) (51) (95)

Bank loan repayments (150) (150) (300)

Net cash generated from financing

activities (267) (264) (529)

---------- ----------- -------------

Net change in cash and cash equivalents (171) (186) (362)

Cash and cash equivalents at beginning

of the period 433 764 764

Effect of foreign exchange rate changes (13) 30 31

Cash and cash equivalents at end of

period 249 608 433

---------- ----------- -------------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share Merger Retained Convertible Share Foreign Total

capital premium Reserve earnings loan option exchange

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 31

December 2022 983 1,631 365 93 14 67 70 3,223

Comprehensive

income

Loss for the 6

months ended 30

June 2023 - - - 8 - - - 8

Other comprehensive -

income

Exchange differences

on translation

of overseas operations - - - - - - (6) (6)

Total comprehensive

profit - - - 8 - - (6) 2

--------- --------- --------- --------- ------------ --------- --------- --------

Transactions with

owners

Share option charge - - - 2 - 9 - 11

Balance at 30

June 2023 983 1,631 365 103 14 76 64 3,236

--------- --------- --------- --------- ------------ --------- --------- --------

Balance at 31

December 2021 983 1,631 365 262 14 64 63 3,382

Comprehensive

income

Loss for the 6

months ended 30

June 2022 - - - (183) - - - (183)

Other comprehensive -

income

Exchange differences

on translation

of overseas operations - - - - - - 6 6

Total comprehensive

(loss) - - - (183) - - 6 (177)

--------- --------- --------- --------- ------------ --------- --------- --------

Transactions with

owners

Share option charge - - - - - 8 - 8

Balance at 30

June 2022 983 1,631 365 79 14 72 69 3,213

--------- --------- --------- --------- ------------ --------- --------- --------

NOTES TO THE INTERIM

NOTES TO THE UNAUDITED INTERIM REPORT

CONSOLIDATED STATEMENT OF

1. Basis of Preparation

The financial information for the six months ended 30 June 2023

included in this condensed interim report comprises the

consolidated statement of comprehensive income, the consolidated

statement of financial position, the consolidated statement of cash

flows, the consolidated statement of changes in equity and the

related notes.

The financial information in these interim results is that of

the holding company and all of its subsidiaries (the Group). It has

been prepared in accordance with UK adopted international

accounting standards but does not include all of the disclosures

that would be required under International Financial Reporting

Standards (IFRSs). The accounting policies applied by the Group in

this financial information are the same as those applied by the

Group in its financial statements for the year ended 31 December

2022 and are those which will form the basis of the 2023 financial

statements.

The comparative financial information presented herein for the

year ended 31 December 2022 does not constitute full statutory

accounts for that period. The Group's annual report and accounts

for the year ended 31 December 2022 have been delivered to the

Registrar of Companies. The Group's independent auditor's report on

those statutory accounts was unqualified, did not draw attention to

any matters by way of emphasis, and did not contain a statement

under 498(2) or 498(3) of the Companies Act 2006.

Going concern

The directors have continued to perform detailed forecasting on

a regular basis taking into account current trading and

expectations and cash balances and, having reflected upon these

forecasts, the directors of the Company continue to adopt the going

concern basis of accounting in preparing the financial

statements.

Dillistone Group Plc is the Group's ultimate parent company. It

is a public listed company and is domiciled in the United Kingdom.

The address of its registered office and principal place of

business is 12 Cedarwood, Crockford Lane, Chineham Business Park,

Basingstoke, RG24 8WD. Dillistone Group Plc's shares are listed on

the Alternative Investment Market (AIM).

2. Share Based Payments

The Company operates two share option schemes. The fair value of

the options granted under these schemes is recognised as an

employee expense with a corresponding increase in equity. The fair

value is measured at grant date and spread over the period at the

end of which the option holder may exercise the option. The fair

value of the options granted is measured using the Black-Scholes

model.

3. Reconciliation of adjusted operating profits to consolidated

statement of comprehensive income

6 months ended 30 June 2023 and 30 June 2022

Adjusted Acquisition Adjusted Acquisition

operating related operating and reorganisation

profits items profits related

items

30-Jun-2023 2023* 30-Jun-2023 30-Jun-2022 2022* 30-Jun-2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 2,826 - 2,826 2,823 - 2,823

Cost of sales (312) - (312) (351) - (351)

Gross profit 2,514 - 2,514 2,472 - 2,472

Administrative

expenses (2,478) (9) (2,487) (2,601) (82) (2,683)

Results from

operating

activities 36 (9) 27 (129) (82) (211)

Financial cost (73) - (73) (63) - (63)

(Loss) before tax (37) (9) (46) (192) (82) (274)

Tax income 41 13 54 76 15 91

Profit / (loss)

for the period 4 4 8 (116) (67) (183)

Other comprehensive

income net of tax:

Currency translation

differences (6) - (6) 6 - 6

Total comprehensive

(loss) / profit for

the year net of tax (2) 4 2 (110) (67) (177)

------------ ------------ ------------ ------------ -------------------- ------------

* see accounts note 5

Earnings per share - from continuing activities

Basic 0.02p 0.04p (0.59)p (0.93)p

Diluted 0.02p 0.04p (0.59)p (0.93)p

Year Ended 31 December 2022

Adjusted Acquisition

operating and reorganisation

profits related

items

31 December 2022* 31 December

2022 2022

GBP'000 GBP'000 GBP'000

Revenue 5,699 - 5,699

Cost of sales (816) - (816)

------------ -------------------- ------------

Gross profit 4,883 - 4,883

Administrative expenses (5,039) (163) (5,202)

Results from operating activities

(inc furlough) (156) (163) (319)

Financial cost (134) - (134)

(Loss) before tax (290) (163) (453)

Tax income 239 31 270

(Loss) for the year (51) (132) (183)

Other comprehensive income

net of tax:

Currency translation differences 7 - 7

Total comprehensive (Loss)

for the year net of tax (44) (132) (176)

============ ==================== ============

* see accounts note 5

Earnings per share - from continuing activities

Basic (0.26p) (0.93p)

Diluted (0.26p) (0.93p)

4. Segment reporting

Results

Year ended

6 months ended 30 June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

Results from operating activities

Ikiru People 15 (128) (200)

Central 21 (1) 44

Reorganisation and other

costs - - -

Amortisation of acquisition

intangibles and other

one off costs or income (9) (82) (163)

Result from operating

activities 27 (211) (319)

========== ============ =================

Geographical segments

The following table provides an analysis of the Group's revenues

by geographical market.

Year ended

6 months ended 30

June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

UK 2,068 1,942 4,148

Europe 293 350 663

Americas 242 309 518

Australia 127 117 147

ROW 96 105 223

2,826 2,823 5,699

================ =========== =================

4. Segment reporting (continued)

Business Segment

The following table provides an analysis of the Group's revenues

by products and services.

Year ended

6 months ended 30

June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

Recurring 2,564 2,477 5,051

Non recurring 200 261 488

Third party revenues 62 85 160

2,826 2,823 5,699

============ ============ =============

'Recurring income' represents all income recognised over time,

whereas 'Non-recurring income' represents all income recognised

at a point in time. Recurring income includes all support services,

software as a service income (SaaS) and hosting income. Non-recurring

income includes sales of new licenses, and income derived from

installing those licenses including training, installation, and

data translation. Third party revenues arise from the sale of

third party software.

Business Sector

The following table provides an analysis of the Group's revenues

by market sector.

Year ended

6 months ended 30

June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

Contingent 1,703 1,712 3,441

Executive Search 1,123 1,111 2,258

2,826 2,823 5,699

============ ============ =============

5. Acquisition related items and other one off costs

Year ended

6 months ended 30

June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

Grants received from overseas

jurisdictions (59) - -

Amortisation of acquisition

intangibles 68 82 163

Total 9 82 163

========= ========= ===========

6. Tax

Year ended

6 months ended 30

June 31 Dec

2023 2022 2022

GBP'000 GBP'000 GBP'000

Current tax (13) (56) (139)

Prior year adjustment - current

tax - - (146)

Deferred tax release (28) (20) (23)

Prior year adjustment - deferred

tax - - 69

Deferred tax re acquisition

intangibles (13) (15) (31)

Tax credit for the period (54) (91) (270)

========= ========= ===========

The tax charge is calculated for each jurisdiction based on the

estimated position for the year. Deferred tax has been provided at

a rate of 25% (2022: 25%).

7. Dividends

The Board has decided not to pay an interim dividend (2022: nil

per share).

8. Earnings per Share

Year ended

6 months ended 30

June 31 Dec

2023 2022 2022

Basic earnings per share

Profit / (Loss) attributable

to ordinary shareholders GBP4,000 GBP(183,000) GBP(183,000)

Weighted average number of

shares 19,668,021 19,668,021 19,668,021

Basic earnings / (loss) per

share (pence) 0.02 (0.93) (0.93)

=========== ============= =============

9. Related party transactions

The Company has related party relationships with its

subsidiaries, its directors, and other employees of the Company

with management responsibility. There were no transactions with

these parties during the period outside the usual course of

business.

The Directors participated in the issue of convertible loan

notes in 2017 which carry interest at 8.15% per annum payable

quarterly in arrears.

There were no transactions with any other related parties.

10. Cautionary statement

This Interim Report has been prepared solely to provide

additional information to shareholders to assess the Company's

strategies and the potential for these strategies to succeed. The

Interim Report should not be relied on by any other party or for

any other purpose. The Interim Report contains certain

forward-looking statements with respect to the financial condition,

results of operations and businesses of the Company. These

statements are made in good faith based on the information

available to them up to the time of their approval of this report.

However, such statements should be treated with caution as they

involve risk and uncertainty because they relate to events and

depend upon circumstances that will occur in the future. There are

a number of factors that could cause actual results or developments

to differ materially from those expressed or implied by these

forward-looking statements. The continuing uncertainty in global

economic outlook inevitably increases the economic and business

risks to which the Company is exposed. Nothing in this announcement

should be construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LAMFTMTITBMJ

(END) Dow Jones Newswires

September 26, 2023 02:00 ET (06:00 GMT)

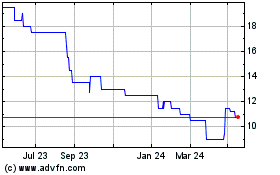

Dillistone (LSE:DSG)

Historical Stock Chart

From Nov 2024 to Dec 2024

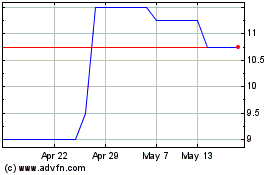

Dillistone (LSE:DSG)

Historical Stock Chart

From Dec 2023 to Dec 2024