TIDMCCP

RNS Number : 4992B

Celtic PLC

11 February 2022

Celtic plc (the "Company")

INTERIM REPORT FOR THE SIX MONTHS TO 31 DECEMBER 2021

Key Operational Items

-- Currently first in the SPFL Premiership.

-- Winners of the Premier Sports League Cup 21/22.

-- 19 home fixtures (2020: 17).

-- Participation in the UEFA Europa League group stages and

qualification to the knock-out playoff round of the UEFA Europa

Conference League.

Key Financial Items

-- Revenue increased by 29.9% to GBP52.9m (2020: GBP40.7m).

-- Profit from trading was GBP7.0m (2020: loss of GBP0.3m).

-- Profit from transfer of player registrations (shown as profit

on disposal of intangible assets) GBP25.8m (2020: GBP1.0m).

-- Profit before taxation of GBP27.6m (2020: loss of GBP5.9m).

-- Acquisition of player registrations of GBP16.8m (2020: GBP12.7m).

-- Period end net cash at bank of GBP25.6m (2020: GBP19.7m).

For further information contact:

Celtic plc Tel: 0141 551 4235

Ian Bankier

Peter Lawwell

Canaccord Genuity Limited, Nominated Adviser Tel: 020 7523 8350

and Broker

Simon Bridges

Thomas Diehl

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

CHAIRMAN'S STATEMENT

The results for the six months ended 31 December 2021 show

revenues of GBP52.9m (2020: GBP40.7m) and a profit before taxation

of GBP27.6m (2020: loss before tax of GBP5.9m). The profit from

trading, representing the profit excluding player related gains and

charges, amounted to GBP7.0m (2020: loss of GBP0.3m). Period end

net cash at bank was GBP25.6m (2020: GBP19.7m). The introductory

page to these interim results summarises the key events in the

period.

The major factors driving the much improved financial

performance for the period under review were: - first, the return

of fans to the stadium driving crucial match day income; second,

our qualification for another season in the Europa League with the

accompanying ticket sales that were absent last year; and third,

the revenues received from successful player trading, notably the

sales of Odsonne Edouard and Kristoffer Ajer. In the same period we

made substantial investments back into the player squad in order to

target the football success that drives our financial success.

Whereas the Covid-19 environment has improved markedly, the

sudden emergence of the Omicron variant and resultant

reintroduction of temporary societal restrictions in Scotland

adversely affected the football sector. This demonstrates our

continued sensitivity to the threat of the pandemic. Mindful of the

risks posed to the Club's finances from further restrictions, we

continue to manage the business on a prudent basis, balanced

against the benefits of investing in the football department. The

forecast outturn for the second half of this financial year is

expected to be more modest owing to the trading seasonality

inherent in the business. As we know, most of our earnings are

typically derived in the first six months of the financial year. In

line with prior years, we expect to incur losses in the second six

months of the financial year owing to the expectation of having

less player trading gains, lower UEFA media right distributions and

associated UEFA match ticket income, higher amortisation emanating

from player acquisitions in January and seasonally lower retail

income. In addition, our outturn earnings may be materially

impacted by success in footballing competition. On the basis that

the impact of Covid-19 appears to be receding at present, we

anticipate to finish the financial year with revenues ahead of our

previous expectations.

It has been a period of transition for both the executive and

the football department. Michael Nicholson's appointment as Chief

Executive was confirmed on 23(rd) December along with Chris McKay's

promotion to Chief Financial Officer. And our Football Manager,

Ange Postecoglou, joined us at the start of the season. Ange has

been able to assemble a first team player squad to fit his proven

methodology of attacking football. We have achieved the permanent

transfers of Osaze Urhoghide, Liam Shaw, Liel Abada, Kyogo

Furuhashi, Carl Starfelt, Joe Hart, Liam Scales, Josip Juranovic,

James McCarthy and Georgios Giakoumakis. In addition, we welcomed

to the Club two quality loan signings in Cameron Carter-Vickers and

Joao Pedro Neves Filipe (Jota). Further to this we added Daizen

Maeda, Yosuke Ideguchi, Johnny Kenny, Reo Hatate and Matt O'Riley

over December 2021 and January 2022.

As we progress through the season we are delighted to return to

winning ways, securing the first silverware of the season, the

Premier Sports Cup in December. This is the 20(th) time Celtic has

won this trophy. December also saw us finish 3(rd) in the Europa

League Group with a creditable 9 points in what was a difficult

group. We now enter the newly constituted Europa Conference League

where we will play FK Bodo / Glimt. A t the time of writing we sit

at the top of the Premiership with 12 games remaining and we have

reached the fifth round of the Scottish Cup. We also note the

progress which continues to be made by our women's first team and

in particular the magnificent achievement of winning the SWPL Cup

in December 2021, the women's team's first trophy in over 10 years.

We congratulate the players, Fran Alonso and his management team on

this success and hopefully can look forward to further success in

the near future.

On behalf of the Board I express my assured confidence in the

football management team and the executive management team who

collectively share many years' experience in Celtic Football Club

and who have worked tirelessly to restore our current position at

the top of Scottish Football. We are optimistic about the

future.

Finally, I wish to express my sincere gratitude to our

supporters, our shareholders and our commercial partners. The

support they offered over the last six months and beyond as we

emerge from Covid-19 has been immeasurable as we have navigated the

Club through this transitional period.

Ian P Bankier

11 February 2022

Chairman

INDEPENT REVIEW REPORT TO CELTIC PLC

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 31 December 2021 which comprises the Consolidated

Statement of Comprehensive Income, Consolidated Balance Sheet,

Consolidated Statement of Changes in Equity, Consolidated Cash Flow

Statement and related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 31

December 2021 is not prepared, in all material respects, in

accordance with UK adopted International Accounting Standard 34 and

the London Stock Exchange AIM Rules for Companies.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the London Stock Exchange AIM

Rules for Companies .

In preparing the half-yearly financial report, the Directors are

responsible for assessing the Company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

Directors either intend to liquidate the Company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

Transparency (Directive 2004/109/EC) Regulations 2007 and for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

BDO LLP

Chartered Accountants

Glasgow, UK

Date

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE 6 MONTHS TO 31 DECEMBER 2021

2021 2020

Unaudited Unaudited

Note GBP000 GBP000

Revenue 2 52,858 40,688

Operating expenses (before intangible asset

transactions) (45,810) (40,966)

------------ -------------

Profit/(loss) from trading before intangible

asset transactions 7,048 (278)

Exceptional operating credit 3 1,063 -

Amortisation of intangible assets (6,251) (6,583)

Profit on disposal of intangible assets 25,752 993

Operating profit/(loss) 27,612 (5,868)

-

Finance income 4 456 515

Finance expense 4 (512) (516)

Profit/(loss) before tax 27,556 (5,869)

Income tax (expense)/credit 5 (3,210) 730

------------- -------------

-

Profit/(loss) and total comprehensive income/(expense)

for the period 24,346 (5,139)

------------- -------------

Basic earnings/(loss) per Ordinary Share 6 25.78p (5.45p)

============= =============

Diluted earnings/(loss) per Share 6 18.01p (5.45p)

============= =============

The notes on pages 10 to 13 form part of these financial

statements.

CONSOLIDATED BALANCE SHEET AS AT 31 DECEMBER 2021

2021 2020

Unaudited Unaudited

Notes GBP000 GBP000

NON-CURRENT ASSETS

Property plant and equipment 57,087 57,781

Intangible assets 7 27,522 25,912

Trade and other receivables 8 14,664 9,082

99,273 92,775

CURRENT ASSETS

Inventories 2,940 3,000

Trade and other receivables 8 32,180 21,064

Cash and cash equivalents 10 27,798 23,183

------------------- -------------

62,918 47,247

------------------- -------------

TOTAL ASSETS 162,191 140,022

=================== =============

EQUITY

Issued share capital 9 27,168 27,168

Share premium 14,951 14,912

Other reserve 21,222 21,222

Accumulated profits 29,975 13,091

------------------- -------------

TOTAL EQUITY 93,316 76,393

=================== =============

NON-CURRENT LIABILITIES

Interest bearing liabilities/

bank loans 932 2,212

Debt element of Convertible

Cumulative Preference Shares 4,174 4,174

Trade and other payables 7,883 4,068

Lease Liabilities 352 431

Deferred tax 5 2,904 906

Provisions 99 128

Deferred income - 14

------------------- -------------

16,344 11,933

------------------- -------------

CURRENT LIABILITIES

Trade and other payables 26,124 24,997

Current borrowings 1,336 1,364

Lease Liabilities 562 568

Provisions 6,686 6,402

Deferred income 17,823 18,365

------------------- -------------

52,531 51,696

------------------- -------------

TOTAL LIABILITIES 68,875 63,629

=================== =============

TOTAL EQUITY AND LIABILITIES 162,191 140,022

=================== =============

Approved by the Board on 11 February 2022.

The notes on pages 10 to 13 form part of these financial

statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE 6 MONTHSED 31 DECEMBER 2021

Share Share Other Accumulated Total

capital premium reserve Profits

GBP000 GBP000 GBP000 GBP000 GBP000

EQUITY SHAREHOLDERS' FUNDS

AS AT 1 JULY 2020 (Audited) 27,167 14,849 21,222 18,230 81,468

Share capital issued 1 63 - - 64

- - - - -

Reduction in debt element

of

convertible cumulative

preference shares

Loss and total comprehensive

expense for the period - - - (5,139) (5,139)

EQUITY SHAREHOLDERS' FUNDS

AS AT 31 DECEMBER 2020 (Unaudited) 27,168 14,912 21,222 13,091 76,393

========== =========== =========== ================= ==========

EQUITY SHAREHOLDERS' FUNDS

AS AT 1 JULY 2021 (Audited) 27,168 14,912 21,222 5,629 68,931

Share capital issued - 39 - - 39

Reduction in debt element - - - - -

of convertible cumulative

preference shares

Profit and total comprehensive

income for the period - - - 24,346 24,346

EQUITY SHAREHOLDERS' FUNDS

AS AT 31 DECEMBER 2021 (Unaudited) 27,168 14,951 21,222 29,975 93,316

========== =========== =========== ================= ==========

The notes on pages 10 to 13 form part of these financial

statements.

CONSOLIDATED CASH FLOW STATEMENT

FOR THE 6 MONTHSED 31 DECEMBER 2021

Note 2021 2020

Unaudited Unaudited

GBP000 GBP000

Cash flows from operating activities

Profit/(loss) for the period after

tax 24,346 (5,139)

Income tax expense/ (credit) 3,210 (730)

Depreciation 1,320 1,241

Amortisation 6,251 6,583

Reversal of prior period impairment (1,095) -

charge

Profit on disposal of intangible assets (25,752) (993)

Finance costs 512 516

Finance income (456) (515)

--------------- ------------

8,336 963

Decrease/ (increase) in inventories 921 (1,730)

Decrease/(Increase) in receivables 1,190 (737)

Decrease in payables and deferred

income (6,644) (4,029)

--------------- ------------

Cash generated from/(used in) operations 3,803 (5,533)

Tax paid - -

Interest paid (42) (67)

Interest received 19 29

--------------- ------------

Net cash flow from/(used in) operating

activities 3,780 (5,571)

--------------- ------------

Cash flows from investing activities

Purchase of property, plant and equipment (801) (214)

Purchase of intangible assets (13,801) (6,306)

Proceeds from sale of intangible assets 20,660 14,346

--------------- ------------

Net cash generated from investing

activities 6,058 7,826

--------------- ------------

Cash flows from financing activities

Repayment of debt (640) (640)

Payments on leasing activities (378) (379)

Dividend on Convertible Cumulative

Preference Shares (481) (459)

--------------- ------------

Net cash used in financing activities (1,499) (1,478)

--------------- ------------

Net increase in cash equivalents 8,339 777

Cash and cash equivalents at 1 July 19,459 22,406

--------------- ------------

Cash and cash equivalents at 31 December 10 27,798 23,183

=============== ============

The notes on pages 10 to 13 form part of these financial

statements.

NOTES TO THE FINANCIAL INFORMATION

1. BASIS OF PREPARATION

The financial information in this interim report comprises the

Consolidated Statement of Comprehensive Income, Consolidated

Balance Sheet, Consolidated Statement of Changes in Equity,

Consolidated Cash Flow Statement and accompanying notes. The

financial information in this interim report has been prepared

under the recognition and measurement requirements in accordance

with UK adopted international accounting standards, but does not

include all of the disclosures that would be required under those

accounting standards. The accounting policies adopted in the

financial statements for the year ended 30 June 2022 will be in

accordance with UK adopted international accounting standards.

The financial information in this interim report for the six

months to 31 December 2021 and to 31 December 2020 has not been

audited, but it has been reviewed by the Company's auditor, whose

report is set out on pages 4 and 5.

Adoption of standards effective for periods beginning 1 July

2021

There have been no new standards effective from 1 July 2021,

however there have been some amendments to existing standards as

follows:

-- Amendment to IFRS 4 Insurance contracts - deferral of IFRS 9.

-- Amendment to IFRS 9, IAS 39, IFRS 7, IFRS 4 and IFRS 16

Interest rate benchmark reform - Phase 2.

-- Amendment to IFRS 16 for Covid-19 rent concessions beyond 30

June 2021, effective from 1 April 2021.

Going concern

As part of the Directors' consideration of the going concern

assumption used in preparing the Interim Report, different

scenarios have been analysed for a minimum period of 12 months from

the date of approval of the report with outlook assumptions used

beyond this time frame. The main factors considered were:

-- current financial stability of the Group and on-going access to funds;

-- current trading environment and potential future restrictions

on trading as a result of Covid-19, primarily any impact on the

attendance of fans in football stadia;

-- security of revenue streams;

-- first team football performance and success; and

-- player transfer market conditions.

The Directors have adopted a prudent approach in the assumptions

used in relation to the above, in order to provide additional

comfort around the viability of the Group going forward.

At 31 December 2021, the cash at bank was GBP27.8m. In addition,

the Group had a net receivables position with respect to player

trading payables/receivables. The 6 months of trading to 31

December 2021 have been more favourable than in the comparative

period for 2020 and as a result there remains strong liquidity in

the business. At the time writing, there are no indications that

trading conditions, and in particular the attendance of fans at

football matches, are likely to be negatively impacted in the near

future. This situation will however remain under review.

The Group has retained established contracts with a number of

our commercial partners and suppliers providing assurance over

future revenues and costs and we have clear visibility over

committed labour costs and transfer payables. In addition, the

Group has in recent years, achieved significant gains in relation

to player trading and manages the movement of players in and out of

the team strategically to ensure maximisation of value where

required while maintaining a squad of appropriate quality to

ensure, as far as possible, continued on field success. This has

been illustrated by the sales of Kris Ajer and Odsonne Edouard

during the summer 2021 transfer window.

The Group continues to have access to a GBP13m RCF with the

Co-operative Bank which was amended and restated in Sept 2020. This

provides additional access to funds should these be required. The

facility has never been drawn down and the current cash flow

forecasts over the period of the going concern review do not show a

requirement to utilise it.

The Group continues to perform a detailed budgeting process each

year which looks ahead four years from the current financial year,

and is reviewed and approved by the Board. The Group also

re-forecasts each month and this is distributed to the Board. As a

consequence, and in conjunction with the additional forecasting and

sensitivity analysis which has taken place and taking into account

reasonably forecasted worst case scenarios, the Directors believe

that the Company is well placed to manage its business risks

successfully despite the continuing uncertain economic outlook.

In consideration of all of the above, the Directors have a

reasonable expectation that the Group and Company has adequate

resources to continue in operational existence for the foreseeable

future. Thus they continue to adopt the going concern basis of

accounting in preparing the Interim Report.

2. REVENUE

6 months 6 months

to 31 to 31

Dec 2021 Dec 2020

Unaudited Unaudited

GBP000 GBP000

Football and stadium operations 23,558 12,570

Multimedia and other commercial

activities 13,973 13,049

Merchandising 15,327 15,069

52,858 40,688

=========== ===========

Number of home games 19 17

=========== ===========

3. EXCEPTIONAL OPERATING CREDIT

The exceptional operating credit of GBP1.06m (2020: nil)

represent settlement payments of GBP0.03m and an impairment

reversal of GBP1.09m which was a previously provided for in

relation to intangible assets deemed to be irrecoverable. These

events are deemed to be unusual in relation to what management

consider to be normal operating conditions.

4. FINANCE INCOME AND EXPENSE

6 months 6 months

to to

31 December 31 December

2021 2020

Unaudited Unaudited

GBP000 GBP000

Finance income:

Interest receivable on bank deposits 19 29

Notional interest income 437 486

-------------- --------------

456 515

============== ==============

6 months 6 months

to to

31 December 31 December

2021 2020

Unaudited Unaudited

GBP000 GBP000

Finance expense:

Interest payable on bank and other

loans (40) (60)

Notional interest expense (188) (172)

Dividend on Convertible Cumulative

Preference Shares (284) (284)

-------------- --------------

(512) (516)

============== ==============

5. TAXATION

Tax has been charged at 19% for the six months ended 31 December

2021 (2020: 19%) representing the best estimate of the average

annual effective tax rate expected to apply for the full year,

applied to the pre-tax income of the six month period. After

accounting for deferred tax, this has resulted in tax expense in

the statement of comprehensive income of GBP3.2m (2020: credit of

GBP0.7m).

6. EARNINGS PER SHARE

Basic earnings per share has been calculated by dividing the

profit for the period of GBP24.3m (2020: loss of GBP5.1m) by the

weighted average number of Ordinary Shares in issue of 94,446,660

(2020: 94,315,059). Diluted earnings per share has been calculated

by dividing the profit for the period by the weighted average

number of Ordinary Share, Convertible Cumulative Preference Shares

and Convertible Preferred Ordinary Shares in issue, assuming

conversion at the balance sheet if dilutive.

7. INTANGIBLE ASSETS

31 December 31 December

2021 2020

Unaudited Unaudited

Cost GBP000 GBP000

At 1 July 49,559 49,846

Additions 16,760 12,667

Disposals (19,186) (1,581)

--------------- ---------------

At period end 47,133 60,932

=============== ===============

Amortisation

At 1 July 31,256 30,018

Charge for the period 6,251 6,583

Reversal of prior period impairment 1,094 -

Disposals (18,990) (1,581)

--------------- ---------------

At period end 19,611 35,020

=============== ===============

Net Book Value at period end 27,522 25,912

=============== ===============

8. TRADE AND OTHER RECEIVABLES

31 December 31 December

2021 2020

Unaudited Unaudited

GBP000 GBP000

Trade receivables 34,381 19,024

Prepayments and accrued income 7,436 5,767

Other receivables 5,027 5,355

------------- -------------

46,844 30,146

============= =============

Amounts falling due after more than one year

included above are:

2021 2020

GBP000 GBP000

Trade receivables 14,664 9,082

============= =============

9. SHARE CAPITAL

Authorised Allotted, called up and

fully paid

31 December 31 December

2021 2020 2021 2021 2020 2020

Unaudited Unaudited Unaudited

No 000 No 000 No 000 GBP000 No 000 GBP000

Equity

Ordinary Shares of 1p each 223,681 223,608 94,457 945 94,349 944

Deferred Shares of 1p each 676,275 672,852 676,275 6,763 672,852 6,729

Convertible Preferred Ordinary

Shares of GBP1 each 14,722 14,756 12,734 12,734 12,769 12,769

Non-equity

Convertible Cumulative Preference

Shares of 60p each 18,297 18,298 15,797 9,479 15,798 9,479

Less reallocated to debt:

Initial debt - - - (2,753) - (2,753)

---------- ----------

932,975 929,514 799,263 27,168 795,768 27,168

========== ========== ========== =========== ========== ===========

10. ANALYSIS OF NET CASH AT BANK

The reconciliation of the movement in cash and cash equivalents

per the cash flow statement to net cash is as follows:

31 December 31 December

2021 2020

Unaudited Unaudited

GBP000 GBP000

Bank Loans due after more than

one year (932) (2,212)

Bank Loans due within one year (1,236) (1,264)

Cash and cash equivalents:

Cash at bank and on hand 27,798 23,183

------------- -------------

Net cash at bank at period end 25,630 19,707

============= =============

11. POST BALANCE SHEET EVENTS

Since the balance sheet date, we have secured the permanent

registrations of Daizen Maeda, Yosuke Ideguchi, Reo Hatate, Johnny

Kenny, and Matthew O'Riley.

We have also temporarily transferred the registrations of Ewan

Henderson to Hibernian, Conor Hazard to HJK Helsinki, Liam Shaw to

Motherwell, Osaze Urhoghide to KV Oostende and Lee O'Connor has

permanently transferred to Tranmere Rovers.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FZGMZNMMGZZM

(END) Dow Jones Newswires

February 11, 2022 12:45 ET (17:45 GMT)

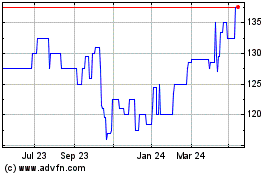

Celtic (LSE:CCP)

Historical Stock Chart

From Nov 2024 to Dec 2024

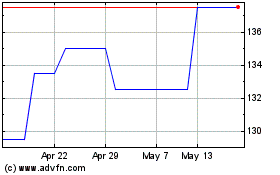

Celtic (LSE:CCP)

Historical Stock Chart

From Dec 2023 to Dec 2024