TIDMBMTO

RNS Number : 8478K

Braime (T.F.& J.H.) (Hldgs) PLC

27 September 2016

T.F. & J.H. BRAIME (HOLDINGS) P.L.C.

("Braime" or the "Company")

Interim Results For the six months ended 30th June 2016

Performance

Group sales revenue for the first six months of 2016 increased

by 1% to GBP13,619,000 (2015 - GBP13,487,000) but profit before tax

increased by 14% to GBP464,000 and profit after tax by 15% to

GBP324,000 compared to GBP282,000 in the comparable period of

2015.

Given the very weak demand level and outlook at the turn of the

year, the directors regard the interim result as satisfactory.

Dividends

The directors have decided to maintain the interim dividend

unchanged at 2.90p per share. This dividend will be paid on the

21st October 2016 to the Ordinary and "A" Ordinary shareholders on

the register on 14th October 2016. The associated ex-dividend date

will be 13th October 2016

Braime Pressings Limited

The year started out with low demand from Europe for new or

replacement parts for commercial vehicles as the EU economies

remained flat, but there has been an increase in activity in recent

months. The manufacturing business has also finally begun to

benefit from some improvements in productivity and losses have been

reduced.

4B Division

In the early months of 2016, monthly sales by 4B Braime,

particularly within the UK, continued at the worryingly low levels

experienced at the end of 2015, in part because of the uncertainty

prior to the Referendum. During the first six months of 2016, the

monthly results remained stubbornly below budget and well below the

equivalent months in 2015.

Then immediately after the unexpected result of the Referendum,

4B Braime had three strong sales months as pent up demand was

released in the UK agricultural sector. Meanwhile margins on export

sales, made since the start of the second half of the year, have

improved substantially due to the sudden 10% fall in the value of

the Pound following the Brexit decision and the company is now

trading at comparable levels to prior year.

At 4B France, 2016 started brightly but severe weather in the

spring and early summer has led to a poor harvest and many

customers have now reduced their planned expenditure for the

remainder of the year.

The other overseas subsidiaries have had a much better start to

the year than they had feared and generally remain positive about

the final result for the year, although there are signs of the

usual slowdown in the USA as the Presidential Election

approaches.

Cash Flow.

Cash throughout the first six months of the year remained tight.

This is the period when outgoings are normally high as both the tax

and dividends for the previous year become due. This situation was

exacerbated by the unusually low sales revenue in the UK companies

in the first months of 2016 and capital investment and improvements

at the Hunslet Road site.

However the "Headroom" - the difference between the maximum

amount of borrowing facility available to the group and the amount

of borrowing actually needed at any one time to pay the ongoing

costs of the business and for investments - has gradually improved

and is predicted to continue to do so throughout the second half of

2016.

The business continues to focus on reducing group stocks and the

cash it ties up in working capital. Meanwhile the group has been

able to continue its policy of investing in new equipment to

improve productivity.

Forecast for the second half of 2016.

Given the global spread of sales, the group is always going to

be exposed to the sudden effects of unexpected economic events

elsewhere. However, overall, we are reasonably optimistic of

achieving a solid result in 2016.

For further information please contact:

T.F. & J.H. Braime (Holdings) P.L.C.

O. N. A. Braime - Chairman

0113 245 7491

W. H. Ireland Limited

Katy Mitchell

0113 394 6628

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated income statement

For the six months ended 30th June 2016

-----------------

Unaudited Unaudited

6 months 6 months Audited

to to year to

Note 30th June 30th June 31st December

2016 2015 2015

GBP GBP GBP

------------------------------- ------- ------------ ------------ ---------------

Revenue 13,619,008 13,487,175 26,470,084

Changes in inventories

of finished goods and

work in progress 224,198 424,534 886,480

Raw materials and consumables

used (7,625,329) (7,975,378) (15,529,776)

Employee benefits costs (3,151,829) (2,848,956) (6,022,492)

Depreciation expense (390,290) (342,441) (758,589)

Other expenses (2,148,239) (2,305,874) (4,148,272)

------------------------------- ------- ------------ ------------ ---------------

Profit from operations 527,519 439,060 897,435

Profit on disposal of

tangible fixed assets - 14,750 1,158,140

Finance costs (64,523) (53,505) (116,830)

Finance income 580 5,870 11,726

------------------------------- ------- ------------ ------------ ---------------

Profit before tax 463,576 406,175 1,950,471

Tax expense (139,289) (123,833) (408,937)

------------------------------- ------- ------------ ------------ ---------------

Profit for the period 324,287 282,342 1,541,534

------------------------------- ------- ------------ ------------ ---------------

Profit attributable to

:

Owners of the parent 384,521 305,646 1,584,748

Non-controlling interests (60,234) (23,304) (43,214)

------------------------------- ------- ------------ ------------ ---------------

324,287 282,342 1,541,534

------------------------------- ------- ------------ ------------ ---------------

Basic and diluted earnings

per share 2 22.52p 19.61p 107.05p

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated statement of comprehensive income

For the six months ended 30th June 2016

Unaudited Unaudited

6 months 6 months

to to Audited

30th 30th year to

June June 31st December

2016 2015 2015

GBP GBP GBP

------------------------------------- ---------- ---------- ---------------

Profit for the period 324,287 282,342 1,541,534

------------------------------------- ---------- ---------- ---------------

Items that will not be reclassified

subsequently to profit or

loss

Net pension remeasurement

gain on post employment benefits - - 10,000

Items that may be reclassified

subsequently to profit or

loss

Foreign exchange losses on

re-translation of overseas

operations (151,517) (167,627) (146,822)

Other comprehensive income

for the period (151,517) (167,627) (136,822)

------------------------------------- ---------- ---------- ---------------

Total comprehensive income

for the period 172,770 114,715 1,404,712

------------------------------------- ---------- ---------- ---------------

Total comprehensive income

attributable to:

Owners of the parent 233,004 138,019 1,447,926

Non-controlling interests (60,234) (23,304) (43,214)

------------------------------------- ---------- ---------- ---------------

172,770 114,715 1,404,712

------------------------------------- ---------- ---------- ---------------

The foreign currency movements arise on the re-translation of

overseas subsidiaries' opening balance sheets at closing rates.

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated balance sheet

At 30th June 2016

Unaudited Unaudited Audited

6 months 6 months year to

to to 31(st)

30th June 30th June December

2016 2015 2015

GBP GBP GBP

Non-current assets

Property, plant and equipment 5,285,297 4,414,976 4,677,456

Goodwill 12,270 12,270 12,270

Financial assets 26,180 77,096 51,877

Total non-current assets 5,323,747 4,504,342 4,741,603

------------------------------- ------------ ------------ ------------

Current assets

Inventories 5,887,955 5,218,773 5,719,654

Trade and other receivables 5,712,176 5,028,829 5,005,099

Financial assets 50,918 49,056 57,777

Cash and cash equivalents 1,243,172 801,577 931,018

------------------------------- ------------ ------------ ------------

Total current assets 12,894,221 11,098,235 11,713,548

------------------------------- ------------ ------------ ------------

Total assets 18,217,968 15,602,577 16,455,151

------------------------------- ------------ ------------ ------------

Current liabilities

Bank overdraft (1,517,675) (1,094,170) (615,038)

Trade and other payables (4,173,632) (4,178,533) (4,053,220)

Other financial liabilities (1,981,539) (1,278,021) (1,498,171)

Corporation tax liability (177,586) (37,867) (66,854)

------------------------------- ------------ ------------ ------------

Total current liabilities (7,850,432) (6,588,591) (6,233,283)

------------------------------- ------------ ------------ ------------

Non-current liabilities

Financial liabilities (1,425,702) (1,442,491) (1,363,524)

Deferred income tax liability (230,235) (191,623) (230,235)

------------------------------- ------------ ------------ ------------

Total non-current liabilities (1,655,937) (1,634,114) (1,593,759)

------------------------------- ------------ ------------ ------------

Total liabilities (9,506,369) (8,222,705) (7,827,042)

------------------------------- ------------ ------------ ------------

Total net assets 8,711,599 7,379,872 8,628,109

------------------------------- ------------ ------------ ------------

Capital and reserves

Share capital 360,000 360,000 360,000

Capital reserve 257,319 257,319 257,319

Foreign exchange reserve (210,098) (79,386) (58,581)

Retained earnings 8,489,708 6,947,125 8,194,467

------------------------------- ------------ ------------ ------------

Total equity attributable

to the shareholders

of the parent 8,896,929 7,485,058 8,753,205

Non-controlling interests (185,330) (105,186) (125,096)

------------------------------- ------------ ------------ ------------

Total equity 8,711,599 7,379,872 8,628,109

------------------------------- ------------ ------------ ------------

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated cash flow statement

For the six months ended 30th June 2016

Unaudited Unaudited Audited

6 months 6 months year to

to to 31st December

Note 30th June 30th June 2015

2016 2015

GBP GBP GBP

-------------------------------- ------- ------------ ------------ ---------------

Operating activities

Net profit 324,287 282,342 1,541,534

-------------------------------- ------- ------------ ------------ ---------------

Adjustments for:

Depreciation 390,290 342,441 758,589

Grants amortised (6,568) (828) (1,656)

Foreign exchange losses (151,517) (163,125) (146,677)

Finance income (580) (5,870) (11,726)

Finance expense 64,523 53,505 116,830

Gain on sale of plant,

machinery and motor vehicles - (14,750) (1,158,140)

Adjustment in respect of

defined benefit scheme - - 13,000

Income tax expense 139,289 123,833 408,937

Income taxes paid (28,557) (273,020) (490,525)

-------------------------------- ------- ------------ ------------ ---------------

Operating activities

before changes in working

capital and provisions 731,167 344,528 1,030,166

-------------------------------- ------- ------------ ------------ ---------------

Increase in trade and other

receivables (707,077) (117,721) (93,991)

Increase in inventories (168,301) (330,590) (831,471)

Increase in trade and

other payables 444,450 276,825 329,488

(430,928) (171,486) (595,974)

-------------------------------- ------- ------------ ------------ ---------------

Cash generated from operations 300,239 173,042 434,192

-------------------------------- ------- ------------ ------------ ---------------

Investing activities

Purchases of property, plant,

machinery and motor vehicles (657,387) (536,905) (1,010,401)

Sale of plant, machinery

and motor vehicles - 14,750 1,190,561

Interest received 580 5,870 8,726

-------------------------------- ------- ------------ ------------ ---------------

(656,807) (516,285) 188,886

-------------------------------- ------- ------------ ------------ ---------------

Financing activities

Proceeds from long term

borrowings - 425,000 300,000

Loan financing repaid 32,556 73,848 90,346

Repayment of borrowings (35,464) (99,351) (171,020)

Repayment of hire purchase

creditors (77,204) (57,843) (130,335)

Interest paid (64,523) (53,505) (116,830)

Dividend paid (89,280) (89,280) (131,040)

-------------------------------- ------- ------------ ------------ ---------------

(233,915) 198,869 (158,879)

-------------------------------- ------- ------------ ------------ ---------------

Decrease in cash and

cash equivalents (590,483) (144,374) 464,199

Cash and cash equivalents,

beginning of period 315,980 (148,219) (148,219)

-------------------------------- ------- ------------ ------------ ---------------

Cash and cash equivalents

(including overdrafts),

end of period 3 (274,503) (292,593) 315,980

-------------------------------- ------- ------------ ------------ ---------------

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated statement of changes in equity

For the six months ended 30th June 2016

Foreign

Share Capital Exchange Retained Minority Total

Capital Reserve Reserve Earnings Total Interests Equity

GBP GBP GBP GBP GBP GBP GBP

Balance

at 1st January

2016 360,000 257,319 (58,581) 8,194,467 8,753,205 (125,096) 8,628,109

Comprehensive

income

Profit - - - 384,521 384,521 (60,234) 324,287

Other comprehensive

income

Foreign

exchange

losses on

re-translation

of overseas

operations - - (151,517) - (151,517) - (151,517)

--------------------- ---------- ---------- ------------ ------------ ------------ ------------ ------------

Total other

comprehensive

income - - (151,517) - (151,517) - (151,517)

Total comprehensive

income - - (151,517) 384,521 233,004 (60,234) 172,770

--------------------- ---------- ---------- ------------ ------------ ------------ ------------ ------------

Transactions

with owners

Dividends - - - (89,280) (89,280) - (89,280)

--------------------- ---------- ---------- ------------ ------------ ------------ ------------ ------------

Total transactions

with owners - - - (89,280) (89,280) - (89,280)

--------------------- ---------- ---------- ------------ ------------ ------------ ------------ ------------

Balance

at 30th

June 2016 360,000 257,319 (210,098) 8,489,708 8,896,929 (185,330) 8,711,599

--------------------- ---------- ---------- ------------ ------------ ------------ ------------ ------------

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated statement of changes in equity

For the six months ended 30th June 2016

Foreign Non- Controlling

Share Capital Exchange Retained Interests Total

Capital Reserve Reserve Earnings Total Equity

GBP GBP GBP GBP GBP GBP GBP

Balance

at 1st

January

2015 360,000 257,319 88,241 6,730,759 7,436,319 (81,882) 7,354,437

Comprehensive

income

Profit - - - 305,646 305,646 (23,304) 282,342

Other

comprehensive

income

Foreign

exchange

losses

on re-translation

of overseas

operations - - (167,627) - (167,627) - (167,627)

------------------- ---------- ---------- ------------ ------------ ------------ ----------------- ------------

Total other

comprehensive

income - - (167,627) - (167,627) - (167,627)

Total

comprehensive

income - - (167,627) 305,646 138,019 (23,304) 114,715

------------------- ---------- ---------- ------------ ------------ ------------ ----------------- ------------

Transactions

with owners

Dividends - - - (89,280) (89,280) - (89,280)

------------------- ---------- ---------- ------------ ------------ ------------ ----------------- ------------

Total transactions

with owners - - - (89,280) (89,280) - (89,280)

------------------- ---------- ---------- ------------ ------------ ------------ ----------------- ------------

Balance

at 30th

June 2015 360,000 257,319 (79,386) 6,947,125 7,485,058 (105,186) 7,379,872

------------------- ---------- ---------- ------------ ------------ ------------ ----------------- ------------

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated statement of changes in equity - continued

For the six months ended 30th June 2016

Foreign Non-Controlling

Share Capital Exchange Retained Interests Total

Capital Reserve Reserve Earnings Total Equity

GBP GBP GBP GBP GBP GBP GBP

Balance

at 1st January

2015 360,000 257,319 88,241 6,730,759 7,436,319 (81,882) 7,354,437

Comprehensive

income

Profit - - - 1,584,748 1,584,748 (43,214) 1,541,534

Other comprehensive

income

Net pension

remeasurement

gain recognised

directly

in equity - - - 10,000 10,000 - 10,000

Foreign

exchange

losses on

re-translation

of overseas

operations - - (146,822) - (146,822) - (146,822)

-------------------- ---------- ---------- ------------ ------------ ------------ ---------------- ------------

Total other

comprehensive

income - - (146,822) 10,000 (136,822) - (136,822)

Total comprehensive

income - - (146,822) 1,594,748 1,447,916 (43,214) 1,404,712

-------------------- ---------- ---------- ------------ ------------ ------------ ---------------- ------------

Transactions

with owners

Dividends - - - (131,040) (131,040) - (131,040)

Total transactions

with owners - - - (131,040) (131,040) - (131,040)

-------------------- ---------- ---------- ------------ ------------ ------------ ---------------- ------------

Balance

at 31st

December

2015 360,000 257,319 (58,581) 8,194,467 8,753,205 (125,096) 8,628,109

-------------------- ---------- ---------- ------------ ------------ ------------ ---------------- ------------

T.F. & J.H. Braime (Holdings) P.L.C.

Notes to the interim financial report

1. Accounting policies

Basis of preparation

The interim financial report has been prepared using accounting

policies that are consistent with those used in the preparation of

the full financial statements to 31st December 2015 and those which

management expects to apply in the group's full financial

statements to 31st December 2016.

This interim financial report is unaudited. The comparative

financial information set out in this interim financial report does

not constitute the group's statutory accounts for the period ended

31st December 2015 but is derived from the accounts. Statutory

accounts for the period ended 31st December 2015 have been

delivered to the Registrar of Companies. The auditors have reported

on those accounts. Their audit report was unqualified and did not

contain any statements under Section 498 of the Companies Act

2006.

The group's condensed interim financial information has been

prepared in accordance with International Financial Reporting

Standards ('IFRS') as adopted for the use in the European Union and

in accordance with IAS 34 'Interim Financial Reporting' and the

accounting policies included in the Annual Report for the year

ended 31st December 2015, which have been applied consistently

throughout the current and preceding periods.

2. Earnings per share and dividends

Both the basic and diluted earnings per share have been

calculated using the net results attributable to shareholders of

T.F. & J.H. Braime (Holdings) P.L.C. as the numerator.

The weighted average number of outstanding shares used for basic

earnings per share amounted to 1,440,000 (2015 - 1,440,000). There

are no potentially dilutive shares in issue.

6 months

to 30th

June 2016

GBP

Dividends paid

Equity shares

Ordinary shares

Interim of 6.20p per share paid on 12th

May 2016 29,760

'A' Ordinary shares

Interim of 6.20p per share paid on 12th

May 2016 59,520

----------------------------------------- -----------

Total dividends paid 89,280

----------------------------------------- -----------

Year to

31st

December

2015

GBP

Dividends paid

Equity shares

Ordinary shares

Interim of 6.20p per share paid on 2nd

April 2015 29,760

Interim of 2.90p per share paid on 18th

October 2015 13,920

----------------------------------------- -----------

43,680

----------------------------------------- -----------

'A' Ordinary shares

Interim of 6.20p per share paid on 2nd

April 2015 59,520

Interim of 2.90p per share paid on 18th

October 2015 27,840

----------------------------------------- -----------

87,360

----------------------------------------- -----------

Total dividends paid 131,040

----------------------------------------- -----------

T.F. & J.H. Braime (Holdings) P.L.C.

Notes to the interim financial report - continued

3. Cash and cash equivalents

Unaudited Unaudited Audited

6 months 6 months year

to to to 31st

30th June 30th June December

2016 2015 2015

GBP GBP GBP

Cash at bank and in hand 1,243,172 801,577 931,018

Bank overdrafts (1,517,675) (1,094,170) (615,038)

-------------------------- ------------ ------------ ----------

(274,503) (292,593) 315,980

-------------------------- ------------ ------------ ----------

4. Segmental information

Unaudited 6 months to 30th June

2016

Central Manufacturing Distribution Total

GBP GBP GBP GBP

------------------- ---------- -------------- ------------- -----------

Revenue

External - 1,793,834 11,825,174 13,619,008

Inter company 111,138 1,036,547 1,785,464 2,933,149

------------------- ---------- -------------- ------------- -----------

Total 111,138 2,830,381 13,610,638 16,552,157

------------------- ---------- -------------- ------------- -----------

Profit

EBITDA 42,855 (219,819) 1,094,773 917,809

Finance costs (27,760) (17,133) (19,630) (64,523)

Finance income - 267 313 580

Depreciation (35,765) (176,568) (177,957) (390,290)

Tax expense (13,072) - (126,217) (139,289)

------------------- ---------- -------------- ------------- -----------

(Loss)/profit for

the period (33,742) (413,253) 771,282 324,287

------------------- ---------- -------------- ------------- -----------

Assets

Total assets 4,489,887 2,163,769 11,564,312 18,217,968

Additions to non

current assets - 754,777 243,354 998,131

Liabilities

Total liabilities 1,352,359 2,906,318 5,247,692 9,506,369

T.F. & J.H. Braime (Holdings) P.L.C.

Notes to the interim financial report - continued

4. Segmental information - continued

Unaudited 6 months to 30th June

2015

Central Manufacturing Distribution Total

GBP GBP GBP GBP

------------------- ---------- -------------- ------------- -----------

Revenue

External - 2,023,371 11,463,804 13,487,175

Inter company 60,816 1,361,871 1,636,148 3,058,835

------------------- ---------- -------------- ------------- -----------

Total 60,816 3,385,242 13,099,952 16,546,010

------------------- ---------- -------------- ------------- -----------

Profit

EBITDA (947) (203,828) 1,001,026 796,251

Finance costs (19,246) (15,102) (19,157) (53,505)

Finance income - 355 5,515 5,870

Depreciation (3,150) (186,192) (153,099) (342,441)

Tax expense (21,290) - (102,543) (123,833)

------------------- ---------- -------------- ------------- -----------

(Loss)/profit for

the period (44,633) (404,767) 731,742 282,342

------------------- ---------- -------------- ------------- -----------

Assets

Total assets 1,328,215 4,210,758 10,063,604 15,602,577

Additions to non

current assets - 643,810 68,095 711,905

Liabilities

Total liabilities 902,879 3,015,903 4,303,922 8,222,704

Audited year to 31st December

2015

Central Manufacturing Distribution Total

GBP GBP GBP GBP

-------------------------- ---------- -------------- ------------- -----------

Revenue

External - 3,955,447 22,514,637 26,470,084

Inter company 122,593 3,267,777 4,411,488 7,801,858

-------------------------- ---------- -------------- ------------- -----------

Total 122,593 7,223,224 26,926,125 34,271,942

-------------------------- ---------- -------------- ------------- -----------

Profit

EBITDA (102,140) 35,632 1,722,532 1,656,024

Gain on sale of tangible

fixed assets - 1,149,629 8,511 1,158,140

Finance costs (48,347) (30,566) (37,917) (116,830)

Finance income - 3,666 8,060 11,726

Depreciation - (432,370) (326,219) (758,589)

Tax expense (44,540) - (364,397) (408,937)

--------------------------

(Loss)/profit for

the period (195,027) 725,991 1,010,570 1,541,534

-------------------------- ---------- -------------- ------------- -----------

Assets

Total assets 1,314,918 4,588,122 10,552,111 16,455,151

Additions to non

current assets - 1,146,385 265,722 1,412,107

Liabilities

Total liabilities 701,606 2,839,750 4,285,686 7,827,042

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR ZQLFLQKFBBBD

(END) Dow Jones Newswires

September 27, 2016 02:00 ET (06:00 GMT)

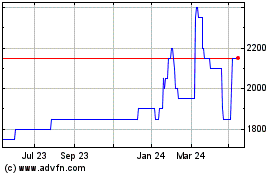

Braime (LSE:BMTO)

Historical Stock Chart

From Jan 2025 to Feb 2025

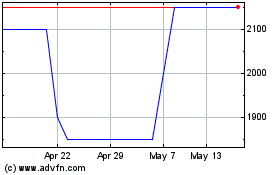

Braime (LSE:BMTO)

Historical Stock Chart

From Feb 2024 to Feb 2025