TIDMBMTO

RNS Number : 8439Z

Braime (T.F.& J.H.) (Hldgs) PLC

22 September 2015

INTERIM REPORT

FOR THE SIX MONTHS ENDED

30TH JUNE 2015

T.F. & J.H. Braime (Holdings) P.L.C.

Management commentary

For the six months ended 30th June 2015

Performance

Group sales revenue for the first six months of 2015 increased

by 11.6% to GBP13,487,000 (2014 - GBP12,088,000) but profit before

tax reduced from GBP513,000 to GBP406,000. Profit after tax fell to

GBP282,000 compared to GBP363,000 for the comparable period of

2014.

This decrease in the group result was largely caused by the

exceptional issues outlined in the divisional trading updates

below.

Dividends

The directors have decided to maintain the first interim

dividend at 2.90p per share (2014 - 2.90p). This dividend will be

paid on the 18th October 2015 to the Ordinary and `A` Ordinary

shareholders on the register on 9th October 2015. The associated

ex-dividend date will be 8th October 2015.

Braime Pressings Limited

Due to unanticipated technical problems with two of the recently

installed production lines, the company was initially unable to

achieve the production rates and the output expected from the two

standard shifts. This led to significant additional labour and

energy costs to satisfy increased demand. This fall in productivity

has slowly begun to be reversed but a substantial and continuing

improvement in productivity is essential for the company to return

to profitability.

Since April 2015, as part of the move to free the area of

buildings being sold to the Leeds Advanced Manufacturing UTC

Limited, who are building the University Technical College (UTC),

Braime Pressings faced exceptional costs of circa GBP110,000 in

condensing and improving its facilities. While major external costs

have been capitalised, these costs have been charged to the Income

Statement.

4B Division

All of the distribution companies in the 4B division, with the

exception of the UK, have enjoyed very positive starts to the year.

Our US division has benefited from the, albeit small, increase in

the value of the US Dollar and the corresponding fall in the costs

of its imported products.

Elsewhere, the fall of local currencies, relative to Sterling,

have reduced the positive effect of otherwise growing local sales

revenue in the consolidated result of the group.

During the period the UK part of our 4B division, operating in

the material handling market, has changed its name from Braime

Elevator Components Limited to 4B Braime Components Limited. This

change was made in order to better reflect the broader range of

products that it now manufactures and distributes

internationally.

4B Braime Components Limited

4B Braime Components makes a significant portion of its overall

sales directly to its exclusive distributors in Europe. These

prices are set in Euros at the start of each year. The Euro fell

against Sterling by about 15% in a very short time frame and this

had a large negative impact on the gross margin.

Overall the result for the first six months of 2015 was well

above the same period for last year but well below budget due to

the negative effect of the changes in exchange rates.

Cash and Investments

On the basis of the sale of 25% of the manufacturing site,

agreed early in 2015, for the planned UTC, the company is

re-investing circa GBP1,100,000, which is the majority of the

expected proceeds, in the modernisation of its UK facility.

T.F. & J.H. Braime (Holdings) P.L.C.

Management commentary - continued

For the six months ended 30th June 2015

Cash and Investments - continued

These improvements will have a positive effect on the operating

performance, particularly of our 4B division. The company has

already vacated the area needed for the UTC and the majority of the

modernisation work will be completed in October this year. The

funds raised by the sale are conditional on the UTC gaining

planning consent from Leeds City Council, this is expected by the

end of September. As a result of the need to finance our investment

in advance of completion of the sale, now expected in October 2015,

our cash flow has had to be very carefully managed and other

investment projects have had to be postponed.

Outlook

Revenues remain strong, although there has been a slowdown in

the UK operating subsidiaries in July and August. The principal

concerns remain the urgent need for productivity improvements in

our UK manufacturing business and the current level of exchange

rates and the corresponding negative effect this may have on the

final result for the year.

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated income statement

Interim results

For the six months ended 30th June 2015

-----------------

Unaudited Unaudited

6 months 6 months Audited

to to year to

Note 30th June 30th June 31st December

2015 2014 2014

GBP GBP GBP

------------------------------------ ------- ------------ ------------ ---------------

Revenue 13,487,175 12,088,143 24,291,700

Changes in inventories of finished

goods and work in progress 424,534 329,014 161,071

Raw materials and consumables

used (7,975,378) (7,087,247) (13,535,766)

Employee benefits costs (2,848,956) (2,481,461) (5,309,357)

Depreciation expense (342,441) (238,243) (564,244)

Other expenses (2,305,874) (2,041,763) (3,807,604)

------------------------------------ ------- ------------ ------------ ---------------

Profit from operations 439,060 568,443 1,235,800

Profit on disposal of tangible

fixed assets 14,750 - 2,796

Finance costs (53,505) (55,632) (115,291)

Finance income 5,870 43 2,164

------------------------------------ ------- ------------ ------------ ---------------

Profit before tax 406,175 512,854 1,125,469

Tax expense (123,833) (149,241) (343,340)

------------------------------------ ------- ------------ ------------ ---------------

Profit for the period 282,342 363,613 782,129

------------------------------------ ------- ------------ ------------ ---------------

Profit attributable to :

Owners of the parent 305,646 363,613 864,011

Non-controlling interests (23,304) - (81,882)

------------------------------------ ------- ------------ ------------ ---------------

282,342 363.613 782,129

------------------------------------ ------- ------------ ------------ ---------------

Basic and diluted earnings per

share 2 19.61p 25.25p 54.31p

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated statement of comprehensive income

For the six months ended 30th June 2015

Unaudited Unaudited

6 months 6 months Audited

to to year to

30th June 30th June 31st December

2015 2014 2014

GBP GBP GBP

--------------------------------------------- ----------- ----------- ---------------

Profit for the period 282,342 363,613 782,129

--------------------------------------------- ----------- ----------- ---------------

Items that will not be reclassified

subsequently to profit or loss

Net remeasurement gain on post employment

benefits - - 44,000

Items that may be reclassified subsequently

to profit or loss

Foreign exchange (losses)/gains on

re-translation of overseas operations (167,627) (26,226) 10,819

Other comprehensive income for the

period (167,627) (26,226) 54,819

--------------------------------------------- ----------- ----------- ---------------

Total comprehensive income for the

period 114,715 337,387 836,948

--------------------------------------------- ----------- ----------- ---------------

Total comprehensive income attributable

to:

Owners of the parent 138,019 337,387 918,830

Non-controlling interests (23,304) - (81,882)

--------------------------------------------- ----------- ----------- ---------------

114,715 337,387 836,948

--------------------------------------------- ----------- ----------- ---------------

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 09:59 ET (13:59 GMT)

The foreign currency movements arise on the re-translation of

overseas subsidiaries' opening balance sheets at closing rates.

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated balance sheet

At 30th June 2015

Unaudited Unaudited Audited

6 months 6 months year to

to to 31st

30th June 30th June December

2015 2014 2014

GBP GBP GBP

Non-current assets

Property, plant and equipment 4,414,976 3,142,566 4,056,506

Goodwill 12,270 12,270 12,270

Financial assets 77,096 - 101,853

Total non-current assets 4,504,342 3,154,836 4,170,629

----------------------------------------------- ------------ ------------ ------------

Current assets

Inventories 5,218,773 5,112,346 4,888,183

Trade and other receivables 5,028,829 5,017,522 4,911,108

Financial assets 49,056 - 98,147

Cash and cash equivalents 801,577 720,100 1,357,769

----------------------------------------------- ------------ ------------ ------------

Total current assets 11,098,235 10,849,968 11,255,207

----------------------------------------------- ------------ ------------ ------------

Total assets 15,602,577 14,004,804 15,425,836

----------------------------------------------- ------------ ------------ ------------

Current liabilities

Bank overdraft 1,094,170 837,994 1,505,988

Trade and other payables 4,178,533 3,662,158 3,752,594

Other financial liabilities 1,278,021 1,241,095 1,323,095

Corporation tax liability 37,867 190,588 187,054

----------------------------------------------- ------------ ------------ ------------

Total current liabilities 6,588,591 5,931,835 6,768,731

----------------------------------------------- ------------ ------------ ------------

Non-current liabilities

Financial liabilities 1,442,491 1,037,833 1,111,045

Deferred income tax liability 191,623 116,000 191,623

----------------------------------------------- ------------ ------------ ------------

Total non-current liabilities 1,634,114 1,153,833 1,302,668

----------------------------------------------- ------------ ------------ ------------

Total liabilities 8,222,705 7,085,668 8,071,399

----------------------------------------------- ------------ ------------ ------------

Total net assets 7,379,872 6,919,136 7,354,437

----------------------------------------------- ------------ ------------ ------------

Capital and reserves

Share capital 360,000 360,000 360,000

Capital reserve 257,319 77,319 257,319

Foreign exchange reserve (79,386) 51,196 88,241

Retained earnings 6,947,125 6,430,621 6,730,759

----------------------------------------------- ------------ ------------ ------------

Total equity attributable to the shareholders

of the parent 7,485,058 6,919,136 7,436,319

Non-controlling interests (105,186) - (81,882)

----------------------------------------------- ------------ ------------ ------------

Total equity 7,379,872 6,919,136 7,354,437

----------------------------------------------- ------------ ------------ ------------

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated cash flow statement

For the six months ended 30th June 2015

Unaudited Unaudited Audited

6 months 6 months year to

to to 31st December

Note 30th June 30th June 2014

2015 2014

GBP GBP GBP

--------------------------------------- ------- ------------ ------------ ---------------

Operating activities

Net profit 282,342 363,613 782,129

--------------------------------------- ------- ------------ ------------ ---------------

Adjustments for:

Depreciation 342,441 238,243 564,244

Grants amortised (828) (828) (1,656)

Non-cash operating charges - - -

Foreign exchange (losses)/gains (163,125) (24,057) 15,279

Finance income (5,870) (43) (2,164)

Finance expense 53,505 55,632 115,291

Gain on sale of plant, machinery

and motor vehicles (14,750) - (2,796)

Adjustment in respect of defined benefit

scheme - - 46,000

Income tax expense 123,833 149,241 343,340

--------------------------------------- ------- ------------ ------------ ---------------

Operating activities before

changes in working capital and

provisions 617,548 781,801 1,859,667

--------------------------------------- ------- ------------ ------------ ---------------

Increase in trade and other receivables (117,721) (1,066,255) (1,044,846)

Increase in inventories (330,590) (293,146) (68,983)

Increase in trade and other

payables 276,825 991,247 1,114,877

(171,486) (368,154) 1,048

--------------------------------------- ------- ------------ ------------ ---------------

Cash generated from operations 446,062 413,647 1,860,715

--------------------------------------- ------- ------------ ------------ ---------------

Income taxes paid (273,020) (4,680) (41,685)

--------------------------------------- ------- ------------ ------------ ---------------

Investing activities

Purchases of property, plant, machinery

and motor vehicles (536,905) (263,599) (1,368,985)

Sale of plant, machinery and

motor vehicles 14,750 - 14,540

Interest received 5,870 43 164

--------------------------------------- ------- ------------ ------------ ---------------

(516,285) (263,556) (1,354,281)

--------------------------------------- ------- ------------ ------------ ---------------

Financing activities

Proceeds from long term borrowings 425,000 - 200,000

Loan financing repaid/(provided) 73,848 - (200,000)

Repayment of borrowings (99,351) (91,348) (272,688)

Repayment of hire purchase creditors (57,843) (103,327) (170,231)

Interest paid (53,505) (55,632) (115,291)

Dividend paid (89,280) (89,280) (131,040)

--------------------------------------- ------- ------------ ------------ ---------------

198,869 (339,587) (689,250)

--------------------------------------- ------- ------------ ------------ ---------------

Decrease in cash and cash equivalents (144,374) (194,176) (224,501)

Cash and cash equivalents, beginning

of period (148,219) 76,282 76,282

--------------------------------------- ------- ------------ ------------ ---------------

Cash and cash equivalents (including

overdrafts), end of period 3 (292,593) (117,894) (148,219)

--------------------------------------- ------- ------------ ------------ ---------------

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated statement of changes in equity

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 09:59 ET (13:59 GMT)

For the six months ended 30th June 2015

Foreign Non-Controlling

Share Capital Exchange Retained Interests Total

Capital Reserve Reserve Earnings Total Equity

GBP GBP GBP GBP GBP GBP GBP

Balance at 1(st) January

2015 360,000 257,319 88,241 6,730,759 7,436,319 (81,882) 7,354,437

Comprehensive income

Profit - - - 305,646 305,646 (23,304) 282,342

Other comprehensive income

Net remeasurement gain - - - - - - -

recognised

directly in equity

Foreign exchange losses on

re-translation

of overseas operations - - (167,627) - (167,627) - (167,627)

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Total other comprehensive

income - - (167,627) - (167,627) - (167,627)

Total comprehensive income - - (167,627) 305,646 138,019 (23,304) 114,715

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Transactions with owners

Dividends - - - (89,280) (89,280) - (89,280)

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Total Transactions with

owners - - - (89,280) (89,280) - (89,280)

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Balance at 30th June 2015 360,000 257,319 (79,386) 6,947,125 7,485,058 (105,186) 7,379,872

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated statement of changes in equity

For the six months ended 30th June 2015

Foreign Non-Controlling

Share Capital Exchange Retained Interests Total

Capital Reserve Reserve Earnings Total Equity

GBP GBP GBP GBP GBP GBP GBP

Balance at 1(st) January

2014 360,000 77,319 77,422 6,156,288 6,671,029 - 6,671,029

Comprehensive income

Profit - - - 363,613 363,613 - 363,613

Other comprehensive income

Net remeasurement gain - - - - - - -

recognised

directly in equity

Foreign exchange losses on

re-translation

of overseas operations - - (26,226) - (26,226) - (26,226)

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Total other comprehensive

income - - (26,226) - (26,226) - (26,226)

Total comprehensive income - - (26,226) 363,613 337,387 - 337,387

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Transactions with owners

Dividends - - - (89,280) (89,280) -

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Total Transactions with

owners - - - (89,280) (89,280) - (89,280)

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Balance at 30th June 2014 360,000 77,319 51,196 6,430,621 6,919,136 - 6,919,136

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

T.F. & J.H. Braime (Holdings) P.L.C.

Consolidated statement of changes in equity - continued

For the six months ended 30th June 2015

Foreign Non-Controlling

Share Capital Exchange Retained Interests Total

Capital Reserve Reserve Earnings Total Equity

GBP GBP GBP GBP GBP GBP GBP

Balance at 1(st) January

2014 360,000 77,319 77,422 6,156,288 6,671,029 - 6,671,029

Comprehensive income

Profit - - - 864,011 864,011 (81,882) 782,129

Other comprehensive income

Net remeasurement gain

recognised

directly in equity - - - 44,000 44,000 - 44,000

Foreign exchange losses on

re-translation

of overseas operations - - 10,819 - 10,819 - 10,819

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Total other comprehensive

income - - 10,819 44,000 54,819 - 54,819

Total comprehensive income - - 10,819 908,011 918,830 (81,882) 836,948

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Transactions with owners

Dividends - - - (131,040) (131,040) - (131,040)

Cancellation of Preference

shares - 180,000 - (202,500) (22,500) - (22,500)

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Total Transactions with

owners - 180,000 - (333,540) (153,540) - (153,540)

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

Balance at 31(st) December

2014 360,000 257,319 88,241 6,730,759 7,436,319 (81,882) 7,354,437

--------------------------- ---------- ---------- ---------- ----------- ---------- ---------------- ----------

T.F. & J.H. Braime (Holdings) P.L.C.

Notes to the interim financial report

1. Accounting policies

Basis of preparation

The interim financial report has been prepared using accounting

policies that are consistent with those used in the preparation of

the full financial statements to 31st December 2014 and those which

management expects to apply in the group's full financial

statements to 31st December 2015.

This interim financial report is unaudited. The comparative

financial information set out in this interim financial report does

not constitute the group's statutory accounts for the period ended

31st December 2014 but is derived from the accounts. Statutory

accounts for the period ended 31st December 2014 have been

delivered to the Registrar of Companies. The auditors have reported

on those accounts. Their audit report was unqualified and did not

contain any statements under Section 498 of the Companies Act

2006.

The group's condensed interim financial information has been

prepared in accordance with International Financial Reporting

Standards ('IFRS') as adopted for the use in the European Union and

in accordance with IAS 34 'Interim Financial Reporting' and the

accounting policies included in the Annual Report for the year

ended 31st December 2014, which have been applied consistently

throughout the current and preceding periods.

2. Earnings per share and dividends

Both the basic and diluted earnings per share have been

calculated using the net results attributable to shareholders of

T.F. & J.H. Braime (Holdings) P.L.C. as the numerator.

(MORE TO FOLLOW) Dow Jones Newswires

September 22, 2015 09:59 ET (13:59 GMT)

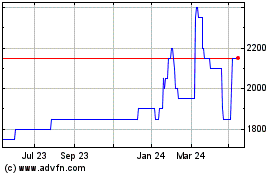

Braime (LSE:BMTO)

Historical Stock Chart

From Jan 2025 to Feb 2025

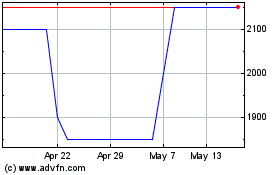

Braime (LSE:BMTO)

Historical Stock Chart

From Feb 2024 to Feb 2025