UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

January 29, 2025

Commission file number:

001-14251

SAP EUROPEAN COMPANY

(Translation of registrant's name into English)

Dietmar-Hopp-Allee 16

69190 Walldorf

Federal

Republic of Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

| Form 20-F | [X] |

Form

40-F |

[ ] |

SAP SE

FORM 6-K

On January

28, 2025, SAP SE, (“SAP"), filed a quarterly statement with Deutsche Boerse AG for the fourth quarter ended December

31, 2024 (the “Quarterly Statement”). The Quarterly Statement is attached as Exhibit 99.1 hereto and incorporated by reference

herein.

This Quarterly Statement discloses certain non-IFRS measures. These

measures are not prepared in accordance with IFRS and are therefore considered non-IFRS financial measures. The non-IFRS financial measures

that we report should be considered in addition to, and not as substitutes for or superior to, revenue, operating income, cash flows,

or other measures of financial performance prepared in accordance with IFRS.

Please refer to Explanations of Non-IFRS

Measures online (www.sap.com/about/investor/index.epx) for further information regarding

the non-IFRS measures.

Any statements contained in this document that are not historical facts

are forward-looking statements as defined in the U.S. Private Securities Litigation Reform Act of 1995. Words such as "anticipate,"

"believe," "estimate," "expect," "forecast," "intend," "may," "plan,"

"project," "predict," "should" and "will" and similar expressions as they relate to SAP are intended

to identify such forward-looking statements. SAP undertakes no obligation to publicly update or revise any forward-looking statements.

All forward-looking statements are subject to various risks and uncertainties that could cause actual results to differ materially from

expectations. The factors that could affect SAP's future financial results are discussed more fully in SAP's filings with the U.S. Securities

and Exchange Commission (the "SEC"), including SAP's most recent Annual Report on Form 20-F filed with the SEC. Readers are

cautioned not to place undue reliance on these forward-looking statements, which speak only as of their dates.

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| By: | /s/ Christopher Sessar |

| | | Name: |

Dr. Christopher Sessar |

| | | Title: |

Chief Accounting Officer |

| By: | /s/ Julia Zicke |

| | | Name: |

Dr. Julia Zicke |

| | | Title: |

Head of External Reporting and Accounting Technology |

Date: January 29, 2025

EXHIBIT INDEX

Exhibit 99.1

| Quarterly

Statement Q4 2024 |

SAP Announces Q4 and FY 2024 Results

| · | SAP meets or exceeds all financial outlook parameters for FY2024 |

| · | Current cloud backlog of €18.1 billion, up 32% and up 29% at constant currencies |

| · | Total cloud backlog of €63.3 billion, up 43% and up 40% at constant currencies |

| · | Cloud revenue up 25% and up 26% at constant currencies in FY2024 |

| · | Cloud ERP Suite revenue up 33% and up 34% at constant currencies in FY2024 |

| · | Total revenue up 10% and up 10% at constant currencies in FY2024 |

| · | IFRS operating profit down 20%, non-IFRS operating profit up 25% and up 26% at constant currencies in FY2024 |

| · | 2025 outlook anticipates accelerating cloud revenue growth |

FY 2024 | in € millions,

unless otherwise stated

| Quarterly

Statement Q4 2024 |

Walldorf, Germany –

January 28, 2025

SAP SE (NYSE: SAP) announced today its financial results for the fourth quarter and fiscal year ended December 31, 2024.

Christian

Klein, CEO:

Q4 was a strong finish to the year, with half

of our cloud order entry including AI. Looking at the full year, we exceeded our cloud goals, accelerating cloud revenue and current cloud

backlog growth against a much larger base. Total cloud backlog now stands at €63 billion, up 40%. Revenue growth has returned to

double-digits. Looking ahead, our strong position in data and Business AI gives us additional confidence that we will accelerate revenue

growth through 2027.

Dominik

Asam, CFO:

We are pleased with the strong close to 2024,

where we exceeded our cloud and software revenue, non-IFRS operating profit, and free cash flow outlook. With current cloud backlog growth

of 29%, we've demonstrated the strength of our strategy and our ability to deliver on our commitments. This progress solidly aligns with

the Ambition 2025 we set four years ago and positions us well for continued growth this year and beyond.

Financial Performance

Group results at a glance – Fourth quarter 2024

| |

IFRS |

|

Non-IFRS1 |

| € million, unless otherwise stated |

Q4

2024 |

Q4 2023 |

∆ in % |

|

Q4

2024 |

Q4 2023 |

∆ in % |

∆ in %

const. curr. |

| SaaS/PaaS |

4,585 |

3,515 |

30 |

|

4,585 |

3,515 |

30 |

30 |

| Thereof Cloud ERP Suite2 |

3,949 |

2,931 |

35 |

|

3,949 |

2,931 |

35 |

35 |

| Thereof Extension Suite3 |

636 |

584 |

9 |

|

636 |

584 |

9 |

6 |

| IaaS4 |

123 |

184 |

–33 |

|

123 |

184 |

–33 |

–33 |

| Cloud revenue |

4,708 |

3,699 |

27 |

|

4,708 |

3,699 |

27 |

27 |

| Cloud and software revenue |

8,267 |

7,382 |

12 |

|

8,267 |

7,382 |

12 |

11 |

| Total revenue |

9,377 |

8,468 |

11 |

|

9,377 |

8,468 |

11 |

10 |

| Share of more predictable revenue (in %) |

81 |

77 |

4pp |

|

81 |

77 |

4pp |

|

| Cloud gross profit |

3,429 |

2,658 |

29 |

|

3,458 |

2,669 |

30 |

29 |

| Gross profit |

6,943 |

6,204 |

12 |

|

6,972 |

6,216 |

12 |

12 |

| Operating profit (loss) |

2,016 |

1,902 |

6 |

|

2,436 |

1,969 |

24 |

24 |

| Profit (loss) after tax from continuing operations |

1,616 |

1,201 |

35 |

|

1,619 |

1,302 |

24 |

|

| Profit (loss) after tax5 |

1,616 |

1,201 |

35 |

|

1,619 |

1,302 |

24 |

|

| Earnings per share - Basic (in €) from continuing operations |

1.37 |

1.05 |

31 |

|

1.40 |

1.12 |

24 |

|

| Earnings per share - Basic (in €)5 |

1.37 |

1.05 |

31 |

|

1.40 |

1.12 |

24 |

|

| Net cash flows from operating activities from continuing operations |

–551 |

1,926 |

NA |

|

|

|

|

|

| Free cash flow |

|

|

|

|

–918 |

1,670 |

NA |

|

1

For a breakdown of the individual adjustments see table “Non-IFRS Operating Expense Adjustments by Functional Areas” in this

Quarterly Statement.

2

Cloud ERP Suite references the portfolio of strategic Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) solutions that are

tightly integrated with our core ERP solutions and are included in key commercial packages, such as RISE with SAP. The following offerings

contribute to Cloud ERP Suite revenue: SAP S/4HANA Cloud, SAP Business Technology Platform, and core solutions for HR and payroll, spend

management, commerce, customer data solutions, business process transformation, and working capital management. For additional information

and historical data on Cloud ERP Suite, see SAP’s Reporting

Framework.

3

Extension Suite references SAP’s remaining SaaS and PaaS solutions that supplement and extend the functional coverage of the Cloud

ERP Suite.

4

Infrastructure as a service (IaaS): The major portion of IaaS comes from SAP HANA Enterprise Cloud.

5

From continuing and discontinued operations.

| Quarterly

Statement Q4 2024 |

Group results at a glance – Full year 2024

| |

IFRS |

|

Non-IFRS1 |

| € million, unless otherwise stated |

Q1–Q4

2024 |

Q1–Q4

2023 |

∆ in % |

|

Q1–Q4

2024 |

Q1–Q4

2023 |

∆ in % |

∆ in % const. curr. |

| SaaS/PaaS |

16,601 |

12,916 |

29 |

|

16,601 |

12,916 |

29 |

29 |

| Thereof Cloud ERP Suite revenue2 |

14,166 |

10,626 |

33 |

|

14,166 |

10,626 |

33 |

34 |

| Thereof Extension Suite revenue3 |

2,435 |

2,290 |

6 |

|

2,435 |

2,290 |

6 |

6 |

| IaaS4 |

540 |

748 |

–28 |

|

540 |

748 |

–28 |

–27 |

| Cloud revenue |

17,141 |

13,664 |

25 |

|

17,141 |

13,664 |

25 |

26 |

| Cloud and software revenue |

29,830 |

26,924 |

11 |

|

29,830 |

26,924 |

11 |

11 |

| Total revenue |

34,176 |

31,207 |

10 |

|

34,176 |

31,207 |

10 |

10 |

| Share of more predictable revenue (in %) |

83 |

81 |

3pp |

|

83 |

81 |

3pp |

|

| Cloud gross profit |

12,481 |

9,780 |

28 |

|

12,559 |

9,821 |

28 |

28 |

| Gross profit |

24,932 |

22,534 |

11 |

|

25,011 |

22,603 |

11 |

11 |

| Operating profit (loss) |

4,665 |

5,799 |

–20 |

|

8,153 |

6,514 |

25 |

26 |

| Profit (loss) after tax from continuing operations |

3,150 |

3,600 |

–13 |

|

5,279 |

4,321 |

22 |

|

| Profit (loss) after tax5 |

3,150 |

5,964 |

–47 |

|

5,279 |

6,103 |

–13 |

|

| Earnings per share - Basic (in €) from continuing operations |

2.68 |

3.11 |

–14 |

|

4.53 |

3.72 |

22 |

|

| Earnings per share - Basic (in €)5 |

2.68 |

5.26 |

–49 |

|

4.53 |

5.51 |

–18 |

|

| Net cash flows from operating activities from continuing operations |

5,220 |

6,210 |

–16 |

|

|

|

|

|

| Free cash flow |

|

|

|

|

4,113 |

5,093 |

–19 |

|

1

For a breakdown of the individual adjustments see table “Non-IFRS Operating Expense Adjustments by Functional Areas” in this

Quarterly Statement.

2

Cloud ERP Suite references the portfolio of strategic Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) solutions that are

tightly integrated with our core ERP solutions and are included in key commercial packages, such as RISE with SAP. The following offerings

contribute to Cloud ERP Suite revenue: SAP S/4HANA Cloud, SAP Business Technology Platform, and core solutions for HR and payroll, spend

management, commerce, customer data solutions, business process transformation, and working capital management. For additional information

and historical data on Cloud ERP Suite, see SAP’s Reporting

Framework.

3

Extension Suite references SAP’s remaining SaaS and PaaS solutions that supplement and extend the functional coverage of the Cloud

ERP Suite.

4

Infrastructure as a service (IaaS): The major portion of IaaS comes from SAP HANA Enterprise Cloud.

5

From continuing and discontinued operations.

Financial Highlights1

Fourth Quarter 2024

In the fourth quarter, current cloud backlog grew by 32% to €18.08

billion and was up 29% at constant currencies. Cloud revenue was up 27% to €4.71 billion and up 27% at constant currencies, fueled

by Cloud ERP Suite revenue, which was up 35% to €3.95 billion and up 35% at constant currencies.

Software licenses revenue decreased by 18% to €0.68 billion and

was down 19% at constant currencies. Cloud and software revenue was up 12% to €8.27 billion and up 11% at constant currencies. Services

revenue was up 2% to €1.11 billion and up 2% at constant currencies. Total revenue was up 11% to €9.38 billion and up 10% at

constant currencies.

The share of more predictable revenue increased by 4 percentage points

to 81% in the fourth quarter.

IFRS cloud gross profit was up 29% to €3.43 billion. Non-IFRS cloud

gross profit was up 30% to €3.46 billion and was up 29% at constant currencies. IFRS Cloud gross margin was up 1.0 percentage points

to 72.8%, non-IFRS cloud gross margin up 1.3 percentage points to 73.5% and up 1.4 percentage points at constant currencies.

IFRS operating profit was up 6% to €2.02 billion and IFRS operating

margin decreased by 1.0 percentage points to 21.5%. Non-IFRS operating profit was up 24% to €2.44 billion and was up 24% at constant

currencies, non-IFRS operating margin increased by 2.7 percentage points to 26.0% and was up 2.9 percentage points to 26.1% at constant

currencies. IFRS and non-IFRS operating profit was mainly driven by a strong performance in SAP’s software licenses and support

business as well as disciplined execution of the 2024 transformation program. In addition, IFRS operating profit was negatively impacted

by restructuring expenses associated with the 2024 transformation program.

1 The Q4 2024 results were

also impacted by other effects. For details, please refer to the disclosures on page 23 of this document.

| Quarterly

Statement Q4 2024 |

IFRS earnings per share (basic) increased 31% to €1.37. Non-IFRS

earnings per share (basic) increased 24% to €1.40. IFRS effective tax rate was 26.8% (Q4/2023: 33.6%) and non-IFRS effective tax

rate was 30.0% (Q4/2023: 32.5%). For IFRS, the year-over-year decrease mainly resulted from changes in tax-exempt income and prior-year

taxes. For non-IFRS, the year-over-year decrease mainly resulted from prior-year taxes.

Free

cash flow in the fourth quarter came in at –€0.92 billion (Q4 2023: €1.67 billion).

The year over year decline was mainly attributable to a €1.7 billion payout under the 2024 transformation program.

Full Year 2024

SAP performed against its financial outlook as follows:

| |

Actual 2023 |

2024 Outlook

(as of January 23) |

Revised 2024 Outlook

(as of October 21) |

Actual 2024 |

| Cloud revenue (at constant currencies) |

€13.66 billion |

€17.0 – 17.3 billion |

€17.0 – 17.3 billion |

€17.21 billion |

| Cloud and software revenue (at constant currencies) |

€26.92 billion |

€29.0 – 29.5 billion |

€29.5 – 29.8 billion |

€29.96 billion |

| Operating profit (non-IFRS, at constant currencies) |

€6.51 billion |

€7.6 – 7.9 billion |

€7.8 – 8.0 billion |

€8.23 billion |

| Free cash flow |

€5.09 billion |

approx. €3.5 billion |

€3.5 – 4.0 billion |

€4.11 billion |

| Effective tax rate (non-IFRS) |

30.3% |

approx. 32% |

approx. 32% |

32.3% |

As of December 31, total cloud backlog was up 43%

to €63.29 billion and up 40% at constant currencies.

For the full year, cloud revenue was up 25% to €17.14

billion and up 26% at constant currencies. Software licenses revenue was down 21% to €1.40 billion and down 21% at constant currencies.

Cloud and software revenue was up 11% to €29.83 billion and up 11% at constant currencies. Services revenue was up 1% to €4.35

billion and up 2% at constant currencies. Total revenue was up 10% to €34.18 billion and up 10% at constant currencies.

The share of more predictable revenue increased

by 3 percentage points year over year to 83% for the full year 2024.

IFRS cloud gross profit was up 28% to €12.48 billion. Non-IFRS cloud

gross profit was up 28% to €12.56 billion and was up 28% at constant currencies. IFRS cloud gross margin was up 1.2 percentage points

to 72.8%, non-IFRS cloud gross margin up 1.4 percentage points to 73.3% and up 1.4 percentage points at constant currencies.

IFRS operating profit was down 20% to €4.66

billion and IFRS operating margin decreased by 4.9 percentage points to 13.6%. The decline in IFRS operating profit was due to restructuring

expenses of approximately €3.1 billion associated with the 2024 transformation program. Non-IFRS operating profit increased 25% to

€8.15 billion and increased 26% at constant currencies, non-IFRS operating margin increased by 3.0 percentage points to 23.9% and

was up 3.1 percentage points to 24.0% at constant currencies.

IFRS earnings per share (basic) decreased 14% to €2.68 and non-IFRS

earnings per share (basic) increased 22% to €4.53. IFRS effective tax rate was 33.9% (FY/2023: 32.6%) and non-IFRS effective tax

rate was 32.3% (FY/2023: 30.3%). For IFRS, the year-over-year increase mainly resulted from a temporary inability to offset withholding

taxes in Germany due to tax losses in 2024 resulting from restructuring, which was partly compensated by changes in tax-exempt income.

For non-IFRS, the year-over-year increase mainly resulted from a temporary inability to offset withholding taxes in Germany due to tax

losses in 2024 resulting from restructuring.

Free cash flow for the full year was down 19% to €4.11 billion.

While higher payouts for restructuring of €2.5 billion and share-based compensation of €1.3 billion weighed on free cash flow,

the performance was supported by SAP’s increased profitability and improvements in working capital. At year end, net liquidity

was €1.70 billion.

Non-Financial Performance 2024

Customer Net Promoter Score (NPS) increased 3 points year over year to

12 in 2024, at the upper end of the outlook range.

After dropping to 72% in the first half of 2024, the employee engagement

index recovered to 76% in the second half of the year. As a result, the employee engagement index for the full year 2024 decreased 6 percentage

points year over year to 74%, at the upper end of the revised outlook range.

The proportion of women in executive roles increased 0.3 percentage points

to 22.5%, in line with the outlook.

Total carbon emissions were flat at 6.9 Mt in 2024, while we initially

guided for a steady decrease.

| Quarterly

Statement Q4 2024 |

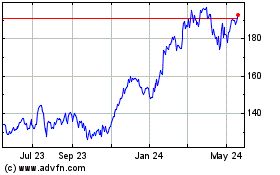

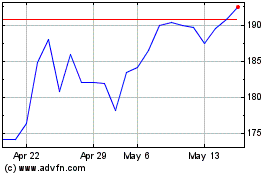

Share Repurchase Program

In May 2023, SAP announced a share repurchase program with an aggregate

volume of up to €5 billion and a term until December 31, 2025. As of December 31, 2024, SAP had repurchased 18,429,480 shares at

an average price of €162.46 resulting in a purchased volume of approximately €3.0 billion under the program.

2024 Transformation Program: Focus on scalability of operations

and key strategic growth areas

In January 2024, SAP announced a company-wide restructuring program which

is anticipated to conclude in early 2025. Overall expenses associated with the program are estimated to be approximately €3.2 billion.

Restructuring payouts amounted to €1.7 billion in the fourth quarter and €2.5 billion for the full-year 2024. In 2025, approximately

€0.7bn are expected to be paid out.

Business Highlights

In the fourth quarter, customers around the

globe continued to choose “RISE with SAP” to drive their end-to-end business transformations. These customers included: BASF,

BERNMOBIL, BP International, Brose, Chevron Corporation, Colgate-Palmolive, Conagra Brands, dm-drogerie markt, EY, Ford Motor Company,

Fressnapf, Freudenberg, FrieslandCampina, Hannover Medical School, K+S, Lanxess, Menasha Corporation, Mitie, NTPC, NTT DATA, Red Bull,

Robert Bosch, Schaeffler Technologies, Schindler Group, The South Carolina Department of Administration, STADA Arzneimittel, and voestalpine.

Coles Group, Commerz Real, General Motors,

H.B. Fuller, Hyundai Glovis, MAHLE International, SKF Group, and Trent Limited went live on SAP S/4HANA Cloud in the fourth quarter.

ACTUM Digital, CiboVita, Databricks, Inetum,

Medical University of Vienna, msg systems, North Yorkshire Council, Outreach, and Warrington Borough Council chose “GROW with SAP”,

an offering helping customers adopt cloud ERP with speed, predictability, and continuous innovation.

Key customer wins across SAP’s solution

portfolio included: ABB, AOK Federal Association, B. Braun Group, Bayer, Digital China, KNAPP, Mengniu, Migros, Mondi, PwC Germany, SA

Power Networks, Salling Group, SICK, and Unity Programme.

Ayala Land, Carlisle Companies, CP Foods,

IBM, and Tchibo went live on SAP solutions.

In the fourth quarter, SAP’s cloud revenue

performance was particularly strong in APJ and EMEA and robust in the Americas region. China, France, India, Italy, South Korea and the

Netherlands had outstanding performances, while Canada, Germany, Japan and the U.S. were particularly strong.

For the full year, China, Germany, India, Japan, and Spain all had outstanding performances in cloud revenue while Brazil, Canada and

Saudia Arabia were particularly strong.

On October 8, SAP announced powerful new capabilities

that complement and extend Joule, including collaborative AI agents imbued with custom skills to complete complex cross-disciplinary tasks.

On December 3, SAP and AWS announced GROW

with SAP on AWS, which will allow customers of all sizes to rapidly deploy SAP’s enterprise resource planning (ERP) solution while

leveraging the reliability, security and scalability of the world’s most broadly adopted cloud.

On December 16, SAP announced the general

availability of the SAP Green Ledger solution, the most comprehensive carbon accounting system globally that integrates directly with

customers’ financial data.

| Quarterly

Statement Q4 2024 |

Outlook

2025

The outlook 2025 replaces SAP’s former Ambition 2025.

Financial Outlook 2025

For 2025, SAP now expects:

| · | €21.6 – 21.9 billion cloud revenue at constant currencies (2024: €17.14 billion), up 26% to 28% at constant currencies. |

| · | €33.1 – 33.6 billion cloud and software revenue at constant currencies (2024: €29.83 billion), up 11% to 13% at constant

currencies. |

| · | €10.3 – 10.6 billion non-IFRS operating profit at constant currencies (2024: €8.15 billion), up 26% to 30% at constant

currencies. |

| · | Approximately €8.0 billion free cash flow at actual currencies (2024: €4.22 billion), based on

updated free cash flow definition (see section (N) 2025 Reporting Changes). |

| · | An

effective tax rate (non-IFRS) of approximately 32% (2024: 32.3%)2. |

The company also expects current cloud backlog growth to slightly decelerate

in 2025.

While SAP’s 2025 financial outlook for the income statement parameters

is at constant currencies (including an average exchange rate of 1.08 USD per EUR), actual currency reported figures are expected to be

impacted by currency exchange rate fluctuations as the company progresses through the year, as reflected in the table below.

Currency Impact Assuming December 31, 2024 Rates Apply for 2025

| In percentage points |

Q1 2025 |

FY

2025 |

| Cloud revenue growth |

+2.5pp |

+2.5pp |

| Cloud and software revenue growth |

+2.0pp |

+2.0pp |

| Operating profit growth (non-IFRS) |

+5.0pp |

+4.0pp |

This includes an exchange rate of 1.04 USD per EUR.

Non-Financial

Outlook 2025

For 2025, SAP now expects:

| · | A Customer Net Promoter Score of 12 to 16. |

| · | The Employee Engagement Index to be in a range of 74% to 78%. |

| · | To steadily increase the share of women in executive roles. |

| · | To steadily decrease carbon emissions across the relevant value chain. |

2

The effective tax rate (non-IFRS) is a non-IFRS financial measure and is presented for supplemental informational purposes only.

We do not provide an outlook for the effective tax rate (IFRS) due to the uncertainty and potential variability of gains and losses associated

with equity securities, which are reconciling items between the two effective tax rates (non-IFRS and IFRS). These items cannot be provided

without unreasonable efforts but could have a significant impact on our future effective tax rate (IFRS).

| Quarterly

Statement Q4 2024 |

Additional Information

This press release and all information therein

is preliminary and unaudited. Due to rounding, numbers may not add up precisely. The full Q4 and FY 2024 Quarterly Statement can be downloaded

from: https://www.sap.com/investors/sap-2024-q4-statement.

SAP Annual General Meeting of Shareholders

The

Annual General Meeting of Shareholders will take place on May 13, 2025, as a virtual event. The whole event will be webcast on the Company’s

website and online voting options will be available for shareholders. Further details will be published at https://www.sap.com/agm

in early April.

SAP Performance Measures

For more information about our key growth metrics and performance measures,

their calculation, their usefulness, and their limitations, please refer to the following document on our Investor Relations website:

https://www.sap.com/investors/performance-measures

Webcast

SAP senior management will host a financial

analyst conference call on Tuesday, January 28th at 07:00 AM (CET) / 06:00 AM (GMT) / 1:00 AM (EST) / Monday, January 27th 10:00 PM (PST),

followed by a press conference at 10:00 AM (CET) / 9:00 AM (GMT) / 4:00 AM (EST) / 1:00 AM (PST). Both conferences will be webcast on

the Company’s website at https://www.sap.com/investor and

will be available for replay. Supplementary financial information pertaining to the fourth quarter results can be found at https://www.sap.com/investor.

About SAP

As a

global leader in enterprise applications and business AI, SAP (NYSE:SAP) stands at the nexus of business and

technology. For over 50 years, organizations have trusted SAP to bring out their best by uniting

business-critical operations spanning finance, procurement, HR, supply chain, and customer experience. For more information,

visit www.sap.com.

For more information, financial community only:

| Alexandra Steiger |

+49 (6227) 7-767336 |

investor@sap.com, CET |

Follow SAP Investor Relations on LinkedIn

at SAP Investor Relations.

For more information, press only:

| Joellen Perry |

+1 (650) 445-6780 |

joellen.perry@sap.com, PT |

| Daniel Reinhardt |

+49 (6227) 7-40201 |

daniel.reinhardt@sap.com, CET |

For customers interested in learning more about SAP products:

| Global Customer Center: |

+49 180 534-34-24 |

| United States Only: |

+1 (800) 872-1SAP (+1-800-872-1727) |

Note to editors:

To preview and download broadcast-standard stock

footage and press photos digitally, please visit www.sap.com/photos.

On this platform, you can find high resolution material for your media channels.

This

document contains forward-looking statements, which are predictions, projections, or other statements about future events. These statements

are based on current expectations, forecasts, and assumptions that are subject to risks and uncertainties that could cause actual results

and outcomes to materially differ. Additional information regarding these risks and uncertainties may be found in our filings with the

Securities and Exchange Commission, including but not limited to the risk factors section of SAP’s 2023 Annual Report on Form 20-F.

©

2025 SAP SE. All rights reserved.

SAP

and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP

SE in Germany and other countries. Please see https://www.sap.com/copyright for additional trademark information and notices.

| Quarterly

Statement Q4 2024 |

Contents

| Financial and Non-Financial Key Facts

(IFRS and Non-IFRS) |

9 |

| |

|

|

| Primary Financial Statements of SAP Group

(IFRS) |

11 |

| |

|

| |

(A) |

Consolidated Income Statements |

11 |

| |

|

|

|

| |

(B) |

Consolidated Statements of Financial Position |

13 |

| |

|

|

|

| |

(C) |

Consolidated Statements of Cash Flows |

14 |

| |

|

|

|

| Non-IFRS Numbers |

15 |

| |

|

| |

(D) |

Basis of Non-IFRS Presentation |

15 |

| |

|

|

|

| |

(E) |

Reconciliation from Non-IFRS Numbers to IFRS Numbers |

15 |

| |

|

|

|

| |

(F) |

Non-IFRS Adjustments – Actuals and Estimates |

19 |

| |

|

|

|

| |

(G) |

Non-IFRS Operating Expense Adjustments by Functional

Areas |

20 |

| |

|

|

|

| Disaggregations |

21 |

| |

|

| |

(H) |

Segment Reporting |

21 |

| |

|

|

|

| |

(I) |

Revenue by Region (IFRS and Non-IFRS) |

21 |

| |

|

|

|

| |

(J) |

Employees by Region and Functional Areas |

22 |

| |

|

|

|

| Other Disclosures |

23 |

| |

|

| |

(K) |

Share-Based Payment |

23 |

| |

|

|

|

| |

(L) |

Restructuring |

23 |

| |

|

|

|

| |

(M) |

Business combinations |

24 |

| |

|

|

|

| |

(N) |

2025 Reporting changes |

24 |

| Quarterly

Statement Q4 2024 |

Financial and Non-Financial Key Facts

(IFRS and Non-IFRS)

| €

millions, unless otherwise stated |

Q1

2023 |

Q2

2023 |

Q3

2023 |

Q4

2023 |

TY

2023 |

Q1

2024 |

Q2

2024 |

Q3

2024 |

Q4

2024 |

TY

2024 |

| Revenues |

|

|

|

|

|

|

|

|

|

|

| Cloud |

3,178 |

3,316 |

3,472 |

3,699 |

13,664 |

3,928 |

4,153 |

4,351 |

4,708 |

17,141 |

| % change – yoy |

24 |

19 |

16 |

20 |

20 |

24 |

25 |

25 |

27 |

25 |

| % change constant currency – yoy |

22 |

22 |

23 |

25 |

23 |

25 |

25 |

27 |

27 |

26 |

| Cloud ERP Suite |

2,422 |

2,562 |

2,711 |

2,931 |

10,626 |

3,167 |

3,414 |

3,636 |

3,949 |

14,166 |

| % change – yoy |

35 |

30 |

26 |

28 |

29 |

31 |

33 |

34 |

35 |

33 |

| % change constant currency – yoy |

33 |

33 |

34 |

33 |

33 |

32 |

33 |

36 |

35 |

34 |

| Software licenses |

276 |

316 |

335 |

838 |

1,764 |

203 |

229 |

285 |

683 |

1,399 |

| % change – yoy |

–13 |

–26 |

–17 |

–8 |

–14 |

–26 |

–28 |

–15 |

–18 |

–21 |

| % change constant currency – yoy |

–13 |

–24 |

–14 |

–6 |

–12 |

–25 |

–27 |

–14 |

–19 |

–21 |

| Software support |

2,905 |

2,873 |

2,872 |

2,846 |

11,496 |

2,829 |

2,792 |

2,793 |

2,876 |

11,290 |

| % change – yoy |

–1 |

–3 |

–5 |

–5 |

–3 |

–3 |

–3 |

–3 |

1 |

–2 |

| % change constant currency – yoy |

–1 |

–1 |

–1 |

–1 |

–1 |

–1 |

–3 |

–2 |

1 |

–1 |

| Software licenses and support |

3,180 |

3,189 |

3,208 |

3,683 |

13,261 |

3,031 |

3,021 |

3,078 |

3,559 |

12,689 |

| % change – yoy |

–2 |

–6 |

–6 |

–6 |

–5 |

–5 |

–5 |

–4 |

–3 |

–4 |

| % change constant currency – yoy |

–2 |

–4 |

–2 |

–2 |

–3 |

–4 |

–5 |

–3 |

–4 |

–4 |

| Cloud and software |

6,358 |

6,505 |

6,679 |

7,382 |

26,924 |

6,960 |

7,175 |

7,429 |

8,267 |

29,830 |

| % change – yoy |

10 |

5 |

4 |

6 |

6 |

9 |

10 |

11 |

12 |

11 |

| % change constant currency – yoy |

8 |

8 |

9 |

10 |

9 |

11 |

10 |

12 |

11 |

11 |

| Total revenue |

7,441 |

7,554 |

7,744 |

8,468 |

31,207 |

8,041 |

8,288 |

8,470 |

9,377 |

34,176 |

| % change – yoy |

10 |

5 |

4 |

5 |

6 |

8 |

10 |

9 |

11 |

10 |

| % change constant currency – yoy |

9 |

8 |

9 |

9 |

9 |

9 |

10 |

10 |

10 |

10 |

| Share of more predictable revenue (in %) |

82 |

82 |

82 |

77 |

81 |

84 |

84 |

84 |

81 |

83 |

| Profits |

|

|

|

|

|

|

|

|

|

|

| Operating profit (loss) (IFRS) |

803 |

1,371 |

1,723 |

1,902 |

5,799 |

–787 |

1,222 |

2,214 |

2,016 |

4,665 |

| Operating profit (loss) (non-IFRS) |

1,321 |

1,457 |

1,767 |

1,969 |

6,514 |

1,533 |

1,940 |

2,244 |

2,436 |

8,153 |

| % change - yoy |

–15 |

14 |

7 |

1 |

1 |

16 |

33 |

27 |

24 |

25 |

| % change constant currency - yoy |

–15 |

19 |

13 |

5 |

5 |

19 |

35 |

28 |

24 |

26 |

| Profit (loss) after tax (IFRS) |

403 |

724 |

1,272 |

1,201 |

3,600 |

–824 |

918 |

1,441 |

1,616 |

3,150 |

| Profit (loss) after tax (non-IFRS) |

868 |

799 |

1,352 |

1,302 |

4,321 |

944 |

1,278 |

1,437 |

1,619 |

5,279 |

| % change - yoy |

–20 |

–9 |

13 |

–10 |

–6 |

9 |

60 |

6 |

24 |

22 |

| Margins |

|

|

|

|

|

|

|

|

|

|

| Cloud gross margin (IFRS, in %) |

70.5 |

71.1 |

72.7 |

71.9 |

71.6 |

72.2 |

73.0 |

73.2 |

72.8 |

72.8 |

| Cloud gross margin (non-IFRS, in %) |

70.8 |

71.4 |

73.0 |

72.2 |

71.9 |

72.5 |

73.3 |

73.7 |

73.5 |

73.3 |

| Software license and support gross margin (IFRS, in %) |

88.6 |

89.8 |

90.0 |

89.8 |

89.6 |

89.2 |

89.7 |

90.1 |

91.0 |

90.1 |

| Software license and support gross margin (non-IFRS, in %) |

88.9 |

90.2 |

90.1 |

89.8 |

89.8 |

89.2 |

89.7 |

90.1 |

91.0 |

90.1 |

| Cloud and software gross margin (IFRS, in %) |

79.5 |

80.3 |

81.0 |

80.8 |

80.4 |

79.6 |

80.0 |

80.2 |

80.7 |

80.1 |

| Cloud and software gross margin (non-IFRS, in %) |

79.9 |

80.6 |

81.2 |

81.0 |

80.7 |

79.8 |

80.2 |

80.5 |

81.0 |

80.4 |

| Gross margin (IFRS, in %) |

71.0 |

71.6 |

72.8 |

73.3 |

72.2 |

71.7 |

72.6 |

73.3 |

74.0 |

73.0 |

| Gross margin (non-IFRS, in %) |

71.3 |

71.9 |

73.0 |

73.4 |

72.4 |

71.8 |

72.7 |

73.6 |

74.3 |

73.2 |

| Operating margin (IFRS, in %) |

10.8 |

18.2 |

22.2 |

22.5 |

18.6 |

–9.8 |

14.7 |

26.1 |

21.5 |

13.6 |

| Quarterly

Statement Q4 2024 |

| €

millions, unless otherwise stated |

Q1

2023 |

Q2

2023 |

Q3

2023 |

Q4

2023 |

TY

2023 |

Q1

2024 |

Q2

2024 |

Q3

2024 |

Q4

2024 |

TY

2024 |

| Operating margin (non-IFRS, in %) |

17.8 |

19.3 |

22.8 |

23.3 |

20.9 |

19.1 |

23.4 |

26.5 |

26.0 |

23.9 |

| Key

Profit Ratios |

|

|

|

|

|

|

|

|

|

|

| Effective tax rate (IFRS, in %) |

40.5 |

33.8 |

27.8 |

33.6 |

32.6 |

16.0 |

33.8 |

33.0 |

26.8 |

33.9 |

| Effective tax rate (non-IFRS, in %) |

29.1 |

33.0 |

27.1 |

32.5 |

30.3 |

32.4 |

33.6 |

33.4 |

30.0 |

32.3 |

| |

|

|

|

|

|

|

|

|

|

|

| Earnings per share, basic (IFRS, in €) from continuing operations |

0.35 |

0.62 |

1.09 |

1.05 |

3.11 |

–0.71 |

0.76 |

1.25 |

1.37 |

2.68 |

| Earnings per share, basic (non-IFRS, in €) from continuing operations |

0.75 |

0.69 |

1.16 |

1.12 |

3.72 |

0.81 |

1.10 |

1.23 |

1.40 |

4.53 |

| Earnings per share, basic (IFRS, in €)1 |

0.41 |

2.70 |

1.09 |

1.05 |

5.26 |

–0.71 |

0.76 |

1.25 |

1.37 |

2.68 |

| Earnings per share, basic (non-IFRS, in €)1 |

0.83 |

2.40 |

1.16 |

1.12 |

5.51 |

0.81 |

1.10 |

1.23 |

1.40 |

4.53 |

| Order

Entry and current cloud backlog |

|

|

|

|

|

|

|

|

|

|

| Current cloud backlog |

11,148 |

11,537 |

12,269 |

13,745 |

13,745 |

14,179 |

14,808 |

15,377 |

18,078 |

18,078 |

| % change – yoy |

25 |

21 |

19 |

25 |

25 |

27 |

28 |

25 |

32 |

32 |

| % change constant currency – yoy |

25 |

25 |

25 |

27 |

27 |

28 |

28 |

29 |

29 |

29 |

| Share of cloud orders greater than €5 million based on total cloud order entry volume (in %) |

45 |

46 |

49 |

62 |

55 |

52 |

52 |

64 |

68 |

63 |

| Share of cloud orders smaller than €1 million based on total cloud order entry volume (in %) |

26 |

25 |

21 |

14 |

19 |

21 |

20 |

16 |

11 |

15 |

| Liquidity

and Cash Flow |

|

|

|

|

|

|

|

|

|

|

| Net cash flows from operating activities |

2,311 |

848 |

1,124 |

1,926 |

6,210 |

2,757 |

1,540 |

1,475 |

–551 |

5,220 |

| Purchase of intangible assets and property, plant, and equipment |

–257 |

–156 |

–182 |

–190 |

–785 |

–187 |

–178 |

–163 |

–270 |

–797 |

| Payments of lease liabilities |

–99 |

–89 |

–78 |

–66 |

–332 |

–78 |

–70 |

–65 |

–97 |

–310 |

| Free cash flow |

1,955 |

604 |

865 |

1,670 |

5,093 |

2,492 |

1,291 |

1,248 |

–918 |

4,113 |

| % of total revenue |

26 |

8 |

11 |

20 |

16 |

31 |

16 |

15 |

NA |

12 |

| % of profit after tax (IFRS) |

485 |

83 |

68 |

139 |

141 |

NA |

141 |

87 |

NA |

131 |

| Cash and cash equivalents |

8,766 |

14,142 |

9,378 |

8,124 |

8,124 |

9,295 |

7,870 |

10,005 |

9,609 |

9,609 |

| Group liquidity |

9,700 |

14,326 |

12,122 |

11,275 |

11,275 |

13,411 |

11,449 |

11,856 |

11,080 |

11,080 |

| Financial debt (–) |

–10,751 |

–10,146 |

–8,445 |

–7,755 |

–7,755 |

–7,770 |

–7,776 |

–8,996 |

–9,385 |

–9,385 |

| Net liquidity (+) / Net debt(–) |

–1,050 |

4,180 |

3,677 |

3,521 |

3,521 |

5,641 |

3,674 |

2,860 |

1,695 |

1,695 |

| Non-Financials

|

|

|

|

|

|

|

|

|

|

|

| Number of employees (quarter end)2 |

105,132 |

105,328 |

106,495 |

107,602 |

107,602 |

108,133 |

105,315 |

107,583 |

109,121 |

109,121 |

| Employee retention (in %, rolling 12 months) |

93.8 |

95.1 |

96.0 |

96.4 |

96.4 |

96.6 |

96.6 |

96.7 |

96.7 |

96.7 |

| Women in management (in %, quarter end) |

29.4 |

29.5 |

29.5 |

29.7 |

29.7 |

29.8 |

29.9 |

30.0 |

30.2 |

30.2 |

| Women in executive roles (in %, quarter end) |

21.8 |

21.9 |

22.1 |

22.2 |

22.2 |

21.7 |

21.9 |

22.0 |

22.5 |

22.5 |

|

Gross greenhouse gas emissions (scope 1, 2, 3 / market-based)3

(in million tons CO2 equivalents) |

|

|

|

|

6.9 |

1.8 |

1.8 |

1.8 |

1.8 |

6.9 |

1 From

continuing and discontinued operations.

2 In

full-time equivalents.

3 Our

gross greenhouse gas emissions (GHG) include the total lifecycle emissions resulting from the use of our on-premise software. The calculation

of use of sold products emissions is based on the number of active maintenance contracts at quarter end. Therefore, the emissions for

individual quarters will not add up to the total sum of GHG emissions at year end.

| Quarterly

Statement Q4 2024 |

Primary Financial Statements of SAP Group (IFRS)

| (A) | Consolidated

Income Statements |

| (A.1) | Consolidated

Income Statements – Quarter |

| € millions, unless otherwise stated |

|

Q4

2024 |

Q4 2023 |

∆ in % |

| Cloud |

|

4,708 |

3,699 |

27 |

| Software licenses |

|

683 |

838 |

–18 |

| Software support |

|

2,876 |

2,846 |

1 |

| Software licenses and support |

|

3,559 |

3,683 |

–3 |

| Cloud

and software |

|

8,267 |

7,382 |

12 |

| Services |

|

1,110 |

1,086 |

2 |

| Total

revenue |

|

9,377 |

8,468 |

11 |

| |

|

|

|

|

| Cost of cloud |

|

–1,279 |

–1,041 |

23 |

| Cost of software licenses and support |

|

–319 |

–374 |

–15 |

| Cost of cloud and software |

|

–1,598 |

–1,415 |

13 |

| Cost of services |

|

–837 |

–850 |

–2 |

| Total

cost of revenue |

|

–2,435 |

–2,265 |

8 |

| Gross

profit |

|

6,943 |

6,204 |

12 |

| Research and development |

|

–1,675 |

–1,671 |

0 |

| Sales and marketing |

|

–2,496 |

–2,266 |

10 |

| General and administration |

|

–378 |

–367 |

3 |

| Restructuring |

|

–323 |

7 |

NA |

| Other operating income/expense, net |

|

–54 |

–4 |

>100 |

| Total

operating expenses |

|

–7,361 |

–6,566 |

12 |

| Operating

profit (loss) |

|

2,016 |

1,902 |

6 |

| |

|

|

|

|

| Other

non-operating income/expense, net |

|

–83 |

0 |

NA |

| Finance income |

|

578 |

284 |

>100 |

| Finance costs |

|

–305 |

–377 |

–19 |

| Financial

income, net |

|

273 |

–93 |

NA |

| Profit

(loss) before tax from continuing operations |

|

2,207 |

1,810 |

22 |

| |

|

|

|

|

| Income tax expense |

|

–591 |

–608 |

–3 |

| Profit

(loss) after tax from continuing operations |

|

1,616 |

1,201 |

35 |

| Attributable to owners of parent |

|

1,601 |

1,221 |

31 |

| Attributable to non-controlling interests |

|

15 |

–20 |

NA |

| Profit

(loss) after tax from discontinued operations |

|

0 |

0 |

NA |

| Profit

(loss) after tax1 |

|

1,616 |

1,201 |

35 |

| Attributable to owners of parent1 |

|

1,601 |

1,221 |

31 |

| Attributable to non-controlling interests1 |

|

15 |

–20 |

NA |

| |

|

|

|

|

| Earnings

per share, basic (in €)2 from continuing operations |

|

1.37 |

1.05 |

31 |

| Earnings

per share, basic (in €)1, 2 |

|

1.37 |

1.05 |

31 |

| Earnings

per share, diluted (in €)2 from continuing operations |

|

1.36 |

1.04 |

31 |

| Earnings

per share, diluted (in €)1, 2 |

|

1.36 |

1.04 |

31 |

1 From

continuing and discontinued operations

2 For

the three months ended December 31, 2024 and 2023, the weighted average number of shares was 1,165 million (diluted 1,176 million) and

1,166 million (diluted: 1,178 million), respectively (treasury stock excluded).

| Quarterly

Statement Q4 2024 |

| (A.2) | Consolidated Income Statements – Year-to-Date |

| € millions, unless otherwise stated |

|

Q1–Q4

2024 |

Q1–Q4 2023 |

∆ in % |

| Cloud |

|

17,141 |

13,664 |

25 |

| Software licenses |

|

1,399 |

1,764 |

–21 |

| Software support |

|

11,290 |

11,496 |

–2 |

| Software licenses and support |

|

12,689 |

13,261 |

–4 |

| Cloud

and software |

|

29,830 |

26,924 |

11 |

| Services |

|

4,346 |

4,283 |

1 |

| Total

revenue |

|

34,176 |

31,207 |

10 |

| |

|

|

|

|

| Cost of cloud |

|

–4,660 |

–3,884 |

20 |

| Cost of software licenses and support |

|

–1,262 |

–1,383 |

–9 |

| Cost of cloud and software |

|

–5,922 |

–5,267 |

12 |

| Cost of services |

|

–3,321 |

–3,407 |

–3 |

| Total

cost of revenue |

|

–9,243 |

–8,674 |

7 |

| Gross

profit |

|

24,932 |

22,534 |

11 |

| Research and development |

|

–6,514 |

–6,324 |

3 |

| Sales and marketing |

|

–9,090 |

–8,828 |

3 |

| General and administration |

|

–1,435 |

–1,364 |

5 |

| Restructuring |

|

–3,144 |

–215 |

>100 |

| Other operating income/expense, net |

|

–85 |

–4 |

>100 |

| Total

operating expenses |

|

–29,511 |

–25,408 |

16 |

| Operating

profit (loss) |

|

4,665 |

5,799 |

–20 |

| |

|

|

|

|

| Other

non-operating income/expense, net |

|

–298 |

–3 |

>100 |

| Finance income |

|

1,429 |

857 |

67 |

| Finance costs |

|

–1,031 |

–1,313 |

–21 |

| Financial

income, net |

|

398 |

–456 |

NA |

| Profit

(loss) before tax from continuing operations |

|

4,764 |

5,341 |

–11 |

| |

|

|

|

|

| Income tax expense |

|

–1,614 |

–1,741 |

–7 |

| Profit

(loss) after tax from continuing operations |

|

3,150 |

3,600 |

–13 |

| Attributable to owners of parent |

|

3,124 |

3,634 |

–14 |

| Attributable to non-controlling interests |

|

26 |

–33 |

NA |

| Profit

(loss) after tax from discontinued operations |

|

0 |

2,363 |

NA |

| Profit

(loss) after tax1 |

|

3,150 |

5,964 |

–47 |

| Attributable to owners of parent1 |

|

3,124 |

6,139 |

–49 |

| Attributable to non-controlling interests1 |

|

26 |

–175 |

NA |

| |

|

|

|

|

| Earnings

per share, basic (in €)2 from continuing operations |

|

2.68 |

3.11 |

–14 |

| Earnings

per share, basic (in €)1, 2 |

|

2.68 |

5.26 |

–49 |

| Earnings

per share, diluted (in €)2 from continuing operations |

|

2.65 |

3.08 |

–14 |

| Earnings

per share, diluted (in €)1, 2 |

|

2.65 |

5.20 |

–49 |

1 From

continuing and discontinued operations

2 For the full year 2024 and 2023, the weighted average number of shares was 1,166 million (diluted: 1,180 million)

and 1,167 million (diluted: 1,180 million), respectively (treasury stock excluded).

| Quarterly

Statement Q4 2024 |

| (B) | Consolidated

Statements of Financial Position |

| as at 12/31/2024 and 12/31/2023 |

| € millions |

2024 |

2023 |

| Cash and cash equivalents |

9,609 |

8,124 |

| Other financial assets |

1,629 |

3,344 |

| Trade and other receivables |

6,774 |

6,322 |

| Other non-financial assets |

2,682 |

2,374 |

| Tax assets |

707 |

407 |

| Total

current assets |

21,401 |

20,571 |

| Goodwill |

31,147 |

29,081 |

| Intangible assets |

2,706 |

2,505 |

| Property, plant, and equipment |

4,493 |

4,276 |

| Other financial assets |

7,141 |

5,543 |

| Trade and other receivables |

209 |

203 |

| Other non-financial assets |

3,990 |

3,573 |

| Tax assets |

359 |

382 |

| Deferred tax assets |

2,676 |

2,197 |

| Total

non-current assets |

52,721 |

47,760 |

| Total

assets |

74,122 |

68,331 |

| |

| € millions |

2024 |

2023 |

| Trade and other payables |

1,990 |

1,783 |

| Tax liabilities |

585 |

266 |

| Financial liabilities |

4,277 |

1,735 |

| Other non-financial liabilities |

5,533 |

5,647 |

| Provisions |

716 |

235 |

| Contract liabilities |

5,978 |

4,975 |

| Total

current liabilities |

19,079 |

14,641 |

| Trade and other payables |

10 |

39 |

| Tax liabilities |

509 |

874 |

| Financial liabilities |

7,169 |

7,941 |

| Other non-financial liabilities |

749 |

698 |

| Provisions |

494 |

432 |

| Deferred tax liabilities |

215 |

267 |

| Contract liabilities |

88 |

33 |

| Total

non-current liabilities |

9,235 |

10,284 |

| Total

liabilities |

28,314 |

24,925 |

| Issued capital |

1,229 |

1,229 |

| Share premium |

2,564 |

1,845 |

| Retained earnings |

42,907 |

42,457 |

| Other components of equity |

4,694 |

2,367 |

| Treasury shares |

–5,954 |

–4,741 |

| Equity

attributable to owners of parent |

45,440 |

43,157 |

| |

|

|

| Non-controlling

interests |

368 |

249 |

| Total

equity |

45,808 |

43,406 |

| Total

equity and liabilities |

74,122 |

68,331 |

| Quarterly

Statement Q4 2024 |

| (C) | Consolidated

Statements of Cash Flows |

| € millions |

Q1–Q4

2024 |

Q1–Q4 2023 |

| Profit

(loss) after tax |

3,150 |

5,964 |

| Adjustments to reconcile profit (loss) after tax to net cash flows from operating activities: |

|

|

| (Profit) loss after tax from discontinued operations |

0 |

–2,363 |

| Depreciation and amortization |

1,280 |

1,373 |

| Share-based payment expense |

2,385 |

2,220 |

| Income tax expense |

1,614 |

1,741 |

| Financial income, net |

–398 |

456 |

| Increase/decrease in allowances on trade receivables |

30 |

–10 |

| Other adjustments for non-cash items |

110 |

23 |

| Increase/decrease in trade and other receivables |

–247 |

–393 |

| Increase/decrease in other assets |

–632 |

–700 |

| Increase/decrease in trade payables, provisions, and other liabilities |

603 |

633 |

| Increase/decrease in contract liabilities |

869 |

443 |

| Share-based payments |

–1,282 |

–1,091 |

| Interest paid |

–550 |

–393 |

| Interest received |

563 |

469 |

| Income taxes paid, net of refunds |

–2,277 |

–2,161 |

| Net

cash flows from operating activities – continuing operations |

5,220 |

6,210 |

| Net cash flows from operating activities – discontinued operations |

0 |

122 |

| Net

cash flows from operating activities |

5,220 |

6,332 |

| Business combinations, net of cash and cash equivalents acquired |

–1,114 |

–1,168 |

| Cash flows from derivative financial instruments related to the sale of subsidiaries or businesses |

0 |

–91 |

| Purchase of intangible assets and property, plant, and equipment |

–797 |

–785 |

| Proceeds from sales of intangible assets and property, plant, and equipment |

122 |

99 |

| Purchase of equity or debt instruments of other entities |

–6,401 |

–3,566 |

| Proceeds from sales of equity or debt instruments of other entities |

7,533 |

907 |

| Net

cash flows from investing activities – continuing operations |

–656 |

–4,603 |

| Net cash flows from investing activities – discontinued operations |

0 |

5,510 |

| Net

cash flows from investing activities |

–656 |

906 |

| Dividends paid |

–2,565 |

–2,395 |

| Dividends paid on non-controlling interests |

–1 |

–13 |

| Purchase of treasury shares |

–2,106 |

–949 |

| Proceeds from borrowings |

2,767 |

13 |

| Repayments of borrowings |

–1,185 |

–4,081 |

| Payments of lease liabilities |

–310 |

–332 |

| Transactions with non-controlling interests |

–11 |

0 |

| Net cash flows from financing activities – continuing operations |

–3,412 |

–7,758 |

| Net cash flows from financing activities – discontinued operations |

0 |

24 |

| Net

cash flows from financing activities |

–3,412 |

–7,734 |

| Effect

of foreign currency rates on cash and cash equivalents |

333 |

–388 |

| Net increase/decrease in cash and cash equivalents |

1,485 |

–883 |

| Cash

and cash equivalents at the beginning of the period |

8,124 |

9,008 |

| Cash

and cash equivalents at the end of the period |

9,609 |

8,124 |

| Quarterly

Statement Q4 2024 |

Non-IFRS Numbers

| (D) | Basis of Non-IFRS Presentation |

SAP disclose certain financial measures such as expense (non-IFRS) and

profit measures (non-IFRS) that are not prepared in accordance with IFRS and are therefore considered non-IFRS financial measures.

For

a more detailed description of all of SAP’s non-IFRS measures and their limitations as well as SAP’s constant currency and

free cash flow figures, see Explanation

of Non-IFRS Measures.

| (E) | Reconciliation from Non-IFRS Numbers to IFRS Numbers |

| (E.1) | Reconciliation of Non-IFRS Revenue – Quarter |

| € millions, unless otherwise stated |

Q4 2024 |

Q4 2023 |

∆ in % |

| IFRS |

Currency

Impact |

Non-IFRS

Constant Currency |

IFRS |

IFRS |

Non-IFRS Constant Currency |

| Revenue Numbers |

|

|

|

|

|

|

| Cloud |

4,708 |

–20 |

4,688 |

3,699 |

27 |

27 |

| Software licenses |

683 |

–6 |

677 |

838 |

–18 |

–19 |

| Software support |

2,876 |

–11 |

2,866 |

2,846 |

1 |

1 |

| Software licenses and support |

3,559 |

–17 |

3,542 |

3,683 |

–3 |

–4 |

| Cloud and software |

8,267 |

–37 |

8,230 |

7,382 |

12 |

11 |

| Services |

1,110 |

–6 |

1,104 |

1,086 |

2 |

2 |

| Total revenue |

9,377 |

–43 |

9,334 |

8,468 |

11 |

10 |

| Quarterly

Statement Q4 2024 |

| (E.2) | Reconciliation

of Non-IFRS Operating Expenses – Quarter |

| € millions, unless otherwise stated |

Q4

2024 |

Q4 2023 |

∆ in % |

| IFRS |

Adj. |

Non-

IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

Adj. |

Non-

IFRS |

IFRS |

Non-IFRS |

Non-IFRS

Constant

Currency |

| Operating

Expense Numbers |

|

|

|

|

|

|

|

|

|

|

|

| Cost of cloud |

–1,279 |

29 |

–1,250 |

|

|

–1,041 |

10 |

–1,030 |

23 |

21 |

|

| Cost of software licenses and support |

–319 |

0 |

–319 |

|

|

–374 |

0 |

–374 |

–15 |

–15 |

|

| Cost of cloud and software |

–1,598 |

29 |

–1,569 |

|

|

–1,415 |

11 |

–1,404 |

13 |

12 |

|

| Cost of services |

–837 |

0 |

–837 |

|

|

–850 |

1 |

–848 |

–2 |

–1 |

|

| Total

cost of revenue |

–2,435 |

29 |

–2,406 |

|

|

–2,265 |

12 |

–2,252 |

8 |

7 |

|

| Gross

profit |

6,943 |

29 |

6,972 |

–35 |

6,937 |

6,204 |

12 |

6,216 |

12 |

12 |

12 |

| Research and development |

–1,675 |

2 |

–1,673 |

|

|

–1,671 |

2 |

–1,669 |

0 |

0 |

|

| Sales and marketing |

–2,496 |

53 |

–2,443 |

|

|

–2,266 |

49 |

–2,216 |

10 |

10 |

|

| General and administration |

–378 |

12 |

–366 |

|

|

–367 |

9 |

–357 |

3 |

2 |

|

| Restructuring |

–323 |

323 |

0 |

|

|

7 |

–7 |

0 |

NA |

NA |

|

| Other operating income/expense, net |

–54 |

0 |

–54 |

|

|

–4 |

0 |

–4 |

>100 |

>100 |

|

| Total

operating expenses |

–7,361 |

420 |

–6,941 |

45 |

–6,896 |

–6,566 |

66 |

–6,499 |

12 |

7 |

6 |

| (E.3) | Reconciliation

of Non-IFRS Profit Figures, Income Tax, and Key Ratios – Quarter |

| € millions, unless otherwise stated |

Q4

2024 |

Q4 2023 |

∆ in % |

| IFRS |

Adj. |

Non-

IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

Adj. |

Non-

IFRS |

IFRS |

Non-IFRS |

Non-IFRS

Constant

Currency |

| Profit

Numbers |

|

|

|

|

|

|

|

|

|

|

|

| Operating

profit (loss) |

2,016 |

420 |

2,436 |

2 |

2,439 |

1,902 |

66 |

1,969 |

6 |

24 |

24 |

| Other

non-operating income/expense, net |

–83 |

0 |

–83 |

|

|

0 |

0 |

0 |

NA |

NA |

|

| Finance income |

578 |

–408 |

170 |

|

|

284 |

–142 |

142 |

>100 |

20 |

|

| Finance costs |

–305 |

94 |

–210 |

|

|

–377 |

196 |

–181 |

–19 |

16 |

|

| Financial

income, net |

273 |

–314 |

–40 |

|

|

–93 |

54 |

–39 |

NA |

4 |

|

| Profit

(loss) before tax from continuing operations |

2,207 |

106 |

2,313 |

|

|

1,810 |

121 |

1,930 |

22 |

20 |

|

| Income tax expense |

–591 |

–103 |

–694 |

|

|

–608 |

–20 |

–628 |

–3 |

10 |

|

| Profit

(loss) after tax from continuing operations |

1,616 |

3 |

1,619 |

|

|

1,201 |

101 |

1,302 |

35 |

24 |

|

| Attributable to owners of parent |

1,601 |

28 |

1,629 |

|

|

1,221 |

89 |

1,310 |

31 |

24 |

|

| Attributable to non-controlling interests |

15 |

–24 |

–10 |

|

|

–20 |

12 |

–8 |

NA |

15 |

|

| Profit

(loss) after tax1 |

1,616 |

3 |

1,619 |

|

|

1,201 |

101 |

1,302 |

35 |

24 |

|

| Attributable to owners of parent1 |

1,601 |

28 |

1,629 |

|

|

1,221 |

89 |

1,310 |

31 |

24 |

|

| Attributable to non-controlling interests1 |

15 |

–24 |

–10 |

|

|

–20 |

12 |

–8 |

NA |

15 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Key

Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Operating

margin (in %) |

21.5 |

|

26.0 |

|

26.1 |

22.5 |

|

23.3 |

–1.0pp |

2.7pp |

2.9pp |

| Effective

tax rate (in %)2 |

26.8 |

|

30.0 |

|

|

33.6 |

|

32.5 |

–6.8pp |

–2.5pp |

|

| Earnings

per share, basic (in €) from continuing operations |

1.37 |

|

1.40 |

|

|

1.05 |

|

1.12 |

31 |

24 |

|

| Earnings

per share, basic (in €)1 |

1.37 |

|

1.40 |

|

|

1.05 |

|

1.12 |

31 |

24 |

|

1

From continuing and discontinued operations

2 The difference between our effective tax rate (IFRS) and effective tax rate (non-IFRS) in Q4 2024 mainly resulted from tax effects

of restructuring expenses and equity securities. The difference between our effective tax rate (IFRS) and effective tax rate (non-IFRS)

in Q4 2023 mainly resulted from tax effects of acquisition-related charges.

| Quarterly

Statement Q4 2024 |

| (E.4) | Reconciliation

of Non-IFRS Revenue – Year-to-Date |

| € millions, unless otherwise stated |

Q1–Q4

2024 |

Q1–Q4 2023 |

∆ in % |

| IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

IFRS |

Non-IFRS

Constant

Currency |

| Revenue

Numbers |

|

|

|

|

|

|

| Cloud |

17,141 |

72 |

17,212 |

13,664 |

25 |

26 |

| Software licenses |

1,399 |

1 |

1,400 |

1,764 |

–21 |

–21 |

| Software support |

11,290 |

53 |

11,343 |

11,496 |

–2 |

–1 |

| Software licenses and support |

12,689 |

54 |

12,743 |

13,261 |

–4 |

–4 |

| Cloud

and software |

29,830 |

126 |

29,955 |

26,924 |

11 |

11 |

| Services |

4,346 |

9 |

4,355 |

4,283 |

1 |

2 |

| Total

revenue |

34,176 |

135 |

34,310 |

31,207 |

10 |

10 |

| (E.5) | Reconciliation

of Non-IFRS Operating Expenses – Year-to-Date |

| € millions, unless otherwise stated |

Q1–Q4

2024 |

Q1–Q4 2023 |

∆ in % |

| IFRS |

Adj. |

Non-

IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

Adj. |

Non-

IFRS |

IFRS |

Non-IFRS |

Non-IFRS

Constant

Currency |

| Operating

Expense Numbers |

|

|

|

|

|

|

|

|

|

|

|

| Cost of cloud |

–4,660 |

78 |

–4,582 |

|

|

–3,884 |

42 |

–3,842 |

20 |

19 |

|

| Cost of software licenses and support |

–1,262 |

0 |

–1,262 |

|

|

–1,383 |

26 |

–1,356 |

–9 |

–7 |

|

| Cost of cloud and software |

–5,922 |

78 |

–5,844 |

|

|

–5,267 |

68 |

–5,199 |

12 |

12 |

|

| Cost of services |

–3,321 |

1 |

–3,321 |

|

|

–3,407 |

2 |

–3,405 |

–3 |

–2 |

|

| Total

cost of revenue |

–9,243 |

79 |

–9,165 |

|

|

–8,674 |

70 |

–8,604 |

7 |

7 |

|

| Gross

profit |

24,932 |

79 |

25,011 |

112 |

25,124 |

22,534 |

70 |

22,603 |

11 |

11 |

11 |

| Research and development |

–6,514 |

5 |

–6,508 |

|

|

–6,324 |

7 |

–6,316 |

3 |

3 |

|

| Sales and marketing |

–9,090 |

234 |

–8,856 |

|

|

–8,828 |

412 |

–8,415 |

3 |

5 |

|

| General and administration |

–1,435 |

27 |

–1,409 |

|

|

–1,364 |

11 |

–1,354 |

5 |

4 |

|

| Restructuring |

–3,144 |

3,144 |

0 |

|

|

–215 |

215 |

0 |

>100 |

NA |

|

| Other operating income/expense, net |

–85 |

0 |

–85 |

|

|

–4 |

0 |

–4 |

>100 |

>100 |

|

| Total

operating expenses |

–29,511 |

3,489 |

–26,022 |

–56 |

–26,079 |

–25,408 |

715 |

–24,693 |

16 |

5 |

6 |

| Quarterly

Statement Q4 2024 |

| (E.6) | Reconciliation

of Non-IFRS Profit Figures, Income Tax, and Key Ratios – Year-to-Date |

| € millions, unless otherwise stated |

Q1–Q4

2024 |

Q1–Q4 2023 |

∆ in % |

| IFRS |

Adj. |

Non-

IFRS |

Currency

Impact |

Non-IFRS

Constant

Currency |

IFRS |

Adj. |

Non-

IFRS |

IFRS |

Non-IFRS |

Non-IFRS

Constant

Currency |

| Profit

Numbers |

|

|

|

|

|

|

|

|

|

|

|

| Operating

profit (loss) |

4,665 |

3,489 |

8,153 |

78 |

8,232 |

5,799 |

715 |

6,514 |

–20 |

25 |

26 |

| Other

non-operating income/expense, net |

–298 |

0 |

–298 |

|

|

–3 |

0 |

–3 |

>100 |

>100 |

|

| Finance income |

1,429 |

–777 |

652 |

|

|

857 |

–380 |

477 |

67 |

37 |

|

| Finance costs |

–1,031 |

316 |

–715 |

|

|

–1,313 |

525 |

–788 |

–21 |

–9 |

|

| Financial

income, net |

398 |

–461 |

–63 |

|

|

–456 |

145 |

–311 |

NA |

–80 |

|

| Profit

(loss) before tax from continuing operations |

4,764 |

3,028 |

7,792 |

|

|

5,341 |

860 |

6,201 |

–11 |

26 |

|

| Income tax expense |

–1,614 |

–899 |

–2,513 |

|

|

–1,741 |

–139 |

–1,880 |

–7 |

34 |

|

| Profit

(loss) after tax from continuing operations |

3,150 |

2,129 |

5,279 |

|

|

3,600 |

721 |

4,321 |

–13 |

22 |

|

| Attributable to owners of parent |

3,124 |

2,162 |

5,286 |

|

|

3,634 |

704 |

4,338 |

–14 |

22 |

|

| Attributable to non-controlling interests |

26 |

–33 |

–7 |

|

|

–33 |

16 |

–17 |

NA |

–61 |

|

| Profit

(loss) after tax1 |

3,150 |

2,129 |

5,279 |

|

|

5,964 |

139 |

6,103 |

–47 |

–13 |

|

| Attributable to owners of parent1 |

3,124 |

2,162 |

5,286 |

|

|

6,139 |

297 |

6,436 |

–49 |

–18 |

|

| Attributable to non-controlling interests1 |

26 |

–33 |

–7 |

|

|

–175 |

–158 |

–333 |

NA |

–98 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Key

Ratios |

|

|

|

|

|

|

|

|

|

|

|

| Operating

margin (in %) |

13.6 |

|

23.9 |

|

24.0 |

18.6 |

|

20.9 |

–4.9pp |

3.0pp |

3.1pp |

| Effective

tax rate (in %)2 |

33.9 |

|

32.3 |

|

|

32.6 |

|

30.3 |

1.3pp |

1.9pp |

|

| Earnings

per share, basic (in €) from continuing operations |

2.68 |

|

4.53 |

|

|

3.11 |

|

3.72 |

–14 |

22 |

|

| Earnings

per share, basic (in €)1 |

2.68 |

|

4.53 |

|

|

5.26 |

|

5.51 |

–49 |

–18 |

|

1 From

continuing and discontinued operations

2 The difference between our effective tax rate (IFRS) and effective tax rate (non-IFRS) in 2024 mainly resulted from tax effects

of restructuring expenses and equity securities. The difference between our effective tax rate (IFRS) and effective tax rate (non-IFRS)

in 2023 mainly resulted from tax effects of acquisition-related charges and restructuring expenses.

| Quarterly

Statement Q4 2024 |

| (E.7) | Reconciliation of Free Cash Flow |

| € millions, unless otherwise stated |

Q1–Q4

2024 |

Q1–Q4 2023 |

| Net

cash flows from operating activities – continuing operations |

5,220 |

6,210 |

| Purchase of intangible assets and property, plant, and equipment |

–797 |

–785 |

| Payments of lease liabilities |

–310 |

–332 |

| Free

cash flow |

4,113 |

5,093 |

| |

|

|

| Net

cash flows from investing activities – continuing operations |

–656 |

–4,603 |

| Net

cash flows from financing activities – continuing operations |

–3,412 |

–7,758 |

| (F) | Non-IFRS Adjustments – Actuals and Estimates |

| € millions, unless otherwise stated |

Estimated Amounts for

Full Year 2025 |

Q4

2024 |

Q1–Q4

2024 |

Q4 2023 |

Q1–Q4 2023 |

| Profit

(loss) before tax from continuing operations (IFRS) |

|

2,207 |

4,764 |

1,810 |

5,341 |

| Adjustment for acquisition-related charges |

380-460 |

100 |

356 |

88 |

345 |

| Adjustment for restructuring |

approximately 100 |

323 |

3,144 |

–7 |

215 |

| Adjustment for regulatory compliance matter expenses |

0 |

–3 |

–11 |

–15 |

155 |

| Adjustment for gains and losses from equity securities, net |

N/A1 |

–314 |

–461 |

54 |

145 |

| Profit

(loss) before tax from continuing operations (non-IFRS) |

|

2,313 |

7,792 |