FRANKFURT—Shares in BMW AG fell nearly 2% on Wednesday despite

record profits after the German premium car maker announced a

lower-than-expected dividend and investors become concerned over

the company's growth.

Net profit in 2015 rose 10% to €6.4 billion ($7.05 billion),

compared with €5.8 billion a year earlier. Revenue increased 15% to

€92.2 billion from €80.4 billion, helped by favorable currency

rates.

The Munich-based car maker, which produces the namesake BMW

brand sedans and sport-utility vehicles, Rolls-Royce, the MINI

luxury compact car, and BMW's iconic motorcycles, forecast another

record year in sales in 2016 after selling 2.25 million vehicles

last year. But investors noted that BMW is losing ground against

rivals Daimler AG, which makes the Mercedes-Benz brand, and Audi

AG.

"The numbers presented today reflect the past," Frank Schwope,

analyst at Nord/LB, said in a note to clients. "In the present and

future (BMW) is likely to face increased pressure from the

competition."

BMW said it would propose to shareholders to raise the dividend

on common shares to €3.20 from €2.90, and on preferred shares to

€3.22 from €2.92. Nominally, the dividend is higher, but investors

noted that the payout is flat as a percentage of earnings.

"We understand that the lack of any special dividend and flat

payout disappoint," Arndt Ellinghorst, head of automotive research

at Evercore ISI, said in a note. "Management has indicated to do

more for shareholders for quite some time."

That's why investors will listen closely when BMW Chief

Executive Harald Krü ger presents the company's new strategy next

week. In addition to hearing how the freshman CEO plans to steer

the company through the challenges facing the global auto industry,

investors are hoping he will announce a more generous dividend

policy for the future.

"We clearly expect this to be the case," Mr. Ellinghorst

said.

Mr. Krü ger was handpicked by BMW's family owners Stephan Quandt

and his sister Susanne Klatten, to take the wheel last year and

steer the company's development of new technology such as electric

vehicles, in-car digital services and new business models such as

car-sharing.

He has been hailed as a bright, young executive more at home in

the digital economy than his predecessor, Norbert Reithofer, who

BMW insiders say refused to deal with email.

But Mr. Krü ger isn't seen as much of a driving force as his

predecessor, who had a powerful, commanding presence.

Mr. Krü ger is quieter and his public appearances have raised

questions about his ability to lead BMW's masculine culture. In

September, as he took the stage at the Frankfurt Motor Show, Mr.

Krü ger fainted and was taken to a hospital for examination. Since

then, he has made few public appearances.

Under Mr. Reithofer, BMW took the lead in the premium segment

from Mercedes and took a big risk on electric vehicles, developing

the i3 battery-electric compact urban vehicle and the i8 hybrid

sports car. Mr. Krü ger takes charge at a time when BMW's rivals

are gaining ground and he will have to work hard to keep the

company out front.

Over the past few months, Mr. Krü ger has hinted that BMW as a

brand must become more like Apple, developing an iconic hardware

platform around which the company can build a vast array of digital

services. He also wants to adapt BMW's processes and structures to

the digital economy and step up development of electric

vehicles.

BMW is expected to present a new model in its i-Series, possibly

as early as next week, that will be more of a family car than

either the i3 or i8. BMW has confirmed that it would announce a new

i-model this year, but has declined to provide any details.

Shortly after taking charge at BMW, Mr. Krü ger signed on to the

joint acquisition of Nokia Corp.'s digital mapmaker, Here, with

rivals Daimler and Audi, a sign of how the entire industry is

moving into digital technology. Here's maps are a key component

needed for self-driving cars and other digital services.

BMW has also stepped up its hiring of software programmers and

plans to hire an additional 500 software engineers this year, the

company said.

Mr. Krü ger has also hired Jens Monsees, who worked at Alphabet

Inc.'s Google on automotive issues for seven years, to take charge

of BMW's digital strategy, according to a person familiar with the

situation. He is currently chief digital officer on the management

board of Arvato. BMW is expected to announce the appointment next

week.

The move comes after Volkswagen AG, Europe's biggest car maker

by sales, recently hired an Apple executive to take charge of its

digital strategy and development.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

March 09, 2016 13:05 ET (18:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

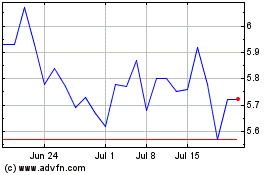

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024