Rolls-Royce Names Activist Shareholder ValueAct to Board -- 3rd Update

March 02 2016 - 8:56AM

Dow Jones News

By Robert Wall

LONDON--Rolls-Royce Holdings PLC named the representative of

U.S. activist shareholder ValueAct Capital Management LP to its

board on Wednesday, though the British engine-maker vowed to stick

to its current strategy.

The group, one of the main suppliers of aircraft engines for

plane makers Airbus Group SE and Boeing Co., said Bradley Singer,

ValueAct's chief operating officer, will join as a director with

immediate effect.

ValueAct last year became Rolls-Royce's largest shareholder and

now holds a 10.8% stake in the company. An activist investor

gaining a board seat remains a rarity in the U.K., even as it has

become a more regular occurrence in the U.S. and Europe. ValueAct

already sits on the boards of Microsoft Corp.

Rolls-Royce Chairman Ian Davis said the presence of an activist

investment-fund in the boardroom won't trigger another review of

group strategy. Rolls-Royce is committed to being a "diversified

engine and power-systems business," Mr. Davis said. "There will be

no fundamental change in direction. There is no question of a

large-scale breakup," he said.

The ValueAct representative would serve on the board as long as

ValueAct remained a major shareholder in the company, he said.

The appointment comes as Rolls-Royce Chief Executive Warren East

is set to complete a strategic review midsummer, Mr. Davis said. It

could lead to some disposals, though Mr. East has signaled there

was no plan for a thorough reshaping of Rolls-Royce's portfolio. As

well as jet engines, the group makes engines and power turbines for

the marine, defense, and energy sectors.

Mr. East recently completed an operational review that has led

to a streamlining of the organization and job cuts to restore

competitiveness.

Rolls-Royce has struggled under a series of profit warnings and

last month announced the first dividend cut in more than 20 years.

The company has seen demand weaken for some of its most profitable

products. The sharp drop in oil prices also has hit earnings at its

marine and power-systems operations.

"This is not going to be a quick fix," Mr. Davis said, echoing

Rolls-Royce's CEO.

Rolls-Royce said that ValueAct has committed not to raise its

stake beyond 12.5% and has signed up to a standstill agreement that

will run until the 2018 annual shareholder meeting. Under the pact,

ValueAct has agreed not to call for shareholder meetings, propose

mergers or changes to company strategy, nor to publicly criticize

the company.

The agreement is similar to one ValueAct has with 21st Century

Fox which nominated Jeffrey Ubben, the firm's chief executive, to

the media and entertainment group's board last year.

ValueAct has also agreed to vote its shares in support of the

board at Rolls-Royce's shareholder meetings this year and next, as

well as maintaining at least a 7.5% stake to retain its board

representation.

The appointment comes after months of talks between Rolls-Royce

and ValueAct which Mr. Davis characterized as "constructive" though

ValueAct hasn't made specific recommendations on the overhaul under

way at Rolls-Royce.

Mr. Singer would strengthen the company's ability to deal with

U.S. investors and bolsters its financial know-how, Mr. Davis said.

Mr. Singer previously was chief financial officer of Discovery

Communications and American Tower Corp. while ValueAct has

experience of the aerospace sector through having had a stake in

aircraft electronics company Rockwell Collins Inc.

Mr. Davis said he consulted with other investors before Mr.

Singer was named to the board. Most backed the move. A small number

of British investors indicated some reluctance, he said.

Rolls-Royce has fallen out of favor with some British

institutional investors in recent months as its earnings have

fallen short of expectations. Neil Woodford, a highly regarded

British investment fund manager who held Rolls-Royce stock for

almost a decade, said last year that he lacked confidence in the

engine maker's near-term prospects, saying his CF Woodford Equity

Income Fund and the Woodford Patient Capital Trust fund had sold

their shares.

Mr. Singer, who also joins the Rolls-Royce board's science and

technology committee, is blocked from serving on the group's

nominations and governance committee, audit committee or

remuneration committee under U.K. rules on nonindependent

directors, the engine maker said.

Write to Robert Wall at robert.wall@wsj.com

(END) Dow Jones Newswires

March 02, 2016 08:41 ET (13:41 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

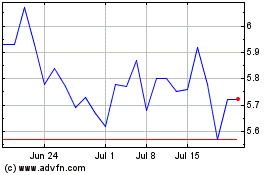

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024