Fiat Chrysler Automobiles NV Chief Executive Sergio Marchionne

is reaching for a familiar tool as he attempts to revive its

Maserati luxury brand: the SUV.

On Tuesday, Maserati pulls back the veil at the International

Geneva Motor Show on its first sport-utility vehicle, the Levante.

The vehicle debuts a year behind schedule and a decade after first

presented as a concept car, facing a crowded field of high-end SUVs

from Porsche, Bentley and Jaguar. Lamborghini and Rolls-Royce also

will soon begin selling their own SUVs.

The Levante goes on sale in May in Europe, where it is expected

to start at about €75,000 ($81,500), with export to the rest of the

world slated for later in the year. Production began Monday at Fiat

Chrysler's long-idle Mirafiori factory in Turin.

The SUV is an attempt by Mr. Marchionne to greatly expand

Maserati—a push that gains urgency now that Fiat Chrysler has spun

off Ferrari. Without Ferrari, Maserati has become the

highest-priced brand in the Italian-American company's portfolio

with some models selling for around $100,000.

Maserati sold 32,500 vehicles last year, a small slice of the

4.8 million cars Fiat Chrysler delivered. Mr. Marchionne has

promised to more than double sales of Maseratis to 75,000 by 2018

and raise the brand's operating profit margin to 10%, a level

reached in 2014 before plunging to 4.4% last year.

Mr. Marchionne has struggled to get Maserati out of first gear.

The 2013 introduction of the Ghibli, an entry-level sedan model,

initially sold well, helping double the volume of Maseratis sold in

2014.

However, auto critics complained the Ghibli's impressive road

performance was more than offset by a disappointing

interior—described by some as feeling like plastic—the result of

Mr. Marchionne's bid to cut costs by having Fiat Chrysler brands

share parts.

Maserati sales declined 13% last year and operating profit fell

by almost two-thirds, something Mr. Marchionne has pinned on the

slowdown in China and startup costs relating to the Levante launch.

The fading welcome for the Ghibli also hurt sales of the larger and

more expensive Quattroporte sedan, the new version of which was

launched in 2013.

Mr. Marchionne admitted late last year that Maserati's recent

performance has been disappointing. His growth plan outpaced

Maserati's "natural absorption rate," forcing the brand to "dial it

back," he said. Earlier this year, Fiat Chrysler idled the Turin

factory that builds the Ghibli and Quattroporte for three weeks due

to weak demand, and the plant will take another three-week break in

mid-March.

Mr. Marchionne's multiyear business plan to expand volumes and

raise profitability for Fiat Chrysler is running up against a

lackluster performance from its Chrysler, Fiat and Alfa Romeo

brands. Meanwhile, some say the auto maker is overly reliant on

selling Jeep SUVs and Ram trucks. Sales of both have soared amid

low gasoline prices.

Mr. Marchionne in January argued that low gas prices are here to

stay, leading to "a permanent shift toward SUVs and pickup trucks."

He is banking on the Levante as another arrow in his SUV

quiver.

To put Mr. Marchionne's plan back on track, the Levante will

have to regain the air of exclusivity Maserati lost with the

Ghibli. He will be looking to emulate Porsche, which has built a

commanding presence in the luxury SUV market with the Cayenne

without diluting its brand.

Porsche, with its iconic 911 sports car, will be a hard act to

follow, says Erich Joachimsthaler, founder and CEO of marketing

consultants Vivaldi Partners Group. "Maserati does not have that

strong anchor," said Mr. Joachimsthaler, who says there is

nevertheless space for the Italian brand in the luxury SUV

market.

However, the Levante is arriving late to the bonanza. The market

in the U.S. for luxury crossovers doubled in the past five years to

about 730,000 last year, but is expected to grow only 15% in the

next five years, according to AutoPacific.

In 2015, auto makers launched about a dozen luxury SUVs with an

average price of €68,000, while five years ago there were just half

that number of models available, said Paolo Martino, an analyst

with consultancy Frost & Sullivan.

"Fiat Chrysler is perhaps arriving late in this segment compared

with other manufacturers, but the company has always had a

wait-and-see strategy—wait for the others to make the first move

and then get as much feedback as possible from the market before

making a decision," said Mr. Martino. But, he added, "the Levante

can without a doubt help Maserati get back its allure."

To be successful, the Levante must win over buyers in the U.S.,

a market that accounts for 40% of Maserati's world-wide sales and

has become more important with the slowdown in China. In the U.S.

the Levante likely will be hamstrung by a lack of dealerships, said

Dave Sullivan, the head of product analysis for research firm

AutoPacific Inc.

"In the U.S. there is an insatiable appetite for crossovers, but

it takes a strong dealer and service network to provide that luxury

experience that a Maserati customer is expecting," said Mr.

Sullivan.

Write to Eric Sylvers at eric.sylvers@wsj.com

(END) Dow Jones Newswires

February 29, 2016 15:55 ET (20:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

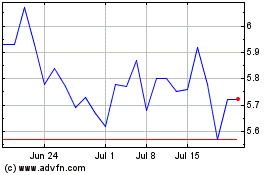

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024