Quarterly Report (10-q)

May 13 2022 - 9:02AM

Edgar (US Regulatory)

falseQ100010424183679630FL 0001042418 2022-01-01 2022-03-31 0001042418 2021-01-01 2021-03-31 0001042418 2022-03-31 0001042418 2021-12-31 0001042418 2022-05-13 0001042418 2022-01-13 2022-01-13 0001042418 2022-03-09 2022-03-09 0001042418 2020-12-31 0001042418 2021-03-31 0001042418 inti:TwoThousandFourteenEquityIncentivePlanMember 2022-03-31 0001042418 us-gaap:SeriesAPreferredStockMember 2022-03-31 0001042418 inti:SeriesBConvertiblePreferredStockMember 2022-03-31 0001042418 inti:UndesignatedPreferredStockMember 2022-03-31 0001042418 us-gaap:RoyaltyMember 2022-03-31 0001042418 us-gaap:SeriesAPreferredStockMember 2021-12-31 0001042418 inti:SeriesBConvertiblePreferredStockMember 2021-12-31 0001042418 inti:UndesignatedPreferredStockMember 2021-12-31 0001042418 us-gaap:RoyaltyMember 2021-12-31 0001042418 inti:MaynePharmaMember 2021-12-31 0001042418 inti:TwoThousandFourteenEquityIncentivePlanMember 2022-01-01 2022-03-31 0001042418 us-gaap:RetainedEarningsMember 2022-01-01 2022-03-31 0001042418 inti:MaynePharmaMember 2022-01-01 2022-03-31 0001042418 inti:LetterAgreementMember inti:LoanAmendmentMember inti:MaynePharmaMember 2022-01-01 2022-03-31 0001042418 us-gaap:CommonStockMember 2021-01-01 2021-03-31 0001042418 us-gaap:AdditionalPaidInCapitalMember 2021-01-01 2021-03-31 0001042418 us-gaap:RetainedEarningsMember 2021-01-01 2021-03-31 0001042418 inti:CitibankMember inti:PaycheckProtectionProgramLoanMember 2020-05-03 2020-05-03 0001042418 inti:PaycheckProtectionProgramLoanMember inti:CitibankMember 2020-05-02 0001042418 inti:MaynePharmaMember 2020-12-12 2020-12-12 0001042418 inti:MaynePharmaMember 2020-12-12 0001042418 inti:MaynePharmaMember 2020-12-14 0001042418 inti:MaynePharmaMember 2020-12-31 0001042418 inti:MaynePharmaMember 2021-01-01 2021-12-31 0001042418 inti:MaynePharmaMember inti:LoanAmendmentMember inti:LetterAgreementMember 2022-01-13 2022-01-13 0001042418 inti:MaynePharmaMember inti:LoanAmendmentMember inti:LetterAgreementMember 2022-01-13 0001042418 inti:MaynePharmaMember inti:LoanAmendmentMember inti:LetterAgreementMember 2022-03-09 2022-03-09 0001042418 inti:MaynePharmaMember inti:LoanAmendmentMember inti:LetterAgreementMember 2022-03-09 0001042418 inti:PaycheckProtectionProgramLoanMember inti:CitibankMember 2020-05-02 2020-05-02 0001042418 inti:MaynePharmaMember inti:LoanAmendmentMember us-gaap:SubsequentEventMember inti:LetterAgreementMember 2022-04-01 2022-04-30 0001042418 inti:SeriesBConvertibleRedeemablePreferredStockMember 2021-12-31 0001042418 us-gaap:CommonStockMember 2021-12-31 0001042418 us-gaap:AdditionalPaidInCapitalMember 2021-12-31 0001042418 us-gaap:RetainedEarningsMember 2021-12-31 0001042418 inti:SeriesBConvertibleRedeemablePreferredStockMember 2022-03-31 0001042418 us-gaap:CommonStockMember 2022-03-31 0001042418 us-gaap:AdditionalPaidInCapitalMember 2022-03-31 0001042418 us-gaap:RetainedEarningsMember 2022-03-31 0001042418 inti:SeriesBConvertibleRedeemablePreferredStockMember 2020-12-31 0001042418 us-gaap:CommonStockMember 2020-12-31 0001042418 us-gaap:AdditionalPaidInCapitalMember 2020-12-31 0001042418 us-gaap:RetainedEarningsMember 2020-12-31 0001042418 inti:SeriesBConvertibleRedeemablePreferredStockMember 2021-03-31 0001042418 us-gaap:CommonStockMember 2021-03-31 0001042418 us-gaap:AdditionalPaidInCapitalMember 2021-03-31 0001042418 us-gaap:RetainedEarningsMember 2021-03-31 iso4217:USD xbrli:shares xbrli:pure utr:Month iso4217:USD xbrli:shares

SECURITIES AND EXCHANGE COMMISSION

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2022

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from

to

Commission file number

001-13467

Inhibitor Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

|

|

|

|

|

449 South 12 th Street, Unit 1705 |

|

|

(Address of principal executive offices) |

|

|

Registrant’s telephone number (including area code):

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation

S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a

non-accelerated

filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in

Rule 12b-2

of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| |

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Indicate by check mark whether the registrant is a shell company (as defined in Rule

12b-2

of the Exchange Act). Yes ☐ No ☒

As of May 13, 2022 there were 376,858,323 shares of company common stock issued and outstanding.

Inhibitor Therapeutics, Inc.

Quarterly Report on Form

10-Q

|

|

|

|

|

|

|

|

|

|

|

|

|

Part I. Financial Information |

|

|

|

|

|

|

Condensed Financial Statements (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

INHIBITOR THERAPEUTICS, INC.

AS OF MARCH 31, 2022 AND DECEMBER

31,

2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

36,438 |

|

|

$ |

30,626 |

|

| |

|

|

24,705 |

|

|

|

28,158 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

61,143 |

|

|

|

58,784 |

|

| |

|

|

|

|

|

|

|

|

| |

|

$ |

61,143 |

|

|

$ |

58,784 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

$ |

321,701 |

|

|

$ |

279,842 |

|

Dividends payable, related party |

|

|

150,138 |

|

|

|

100,823 |

|

Notes payable, related party |

|

|

281,000 |

|

|

|

231,000 |

|

Interest payable, related party |

|

|

20,375 |

|

|

|

14,965 |

|

| |

|

|

57,000 |

|

|

|

53,000 |

|

| |

|

|

|

|

|

|

|

|

Total current liabilities |

|

|

830,214 |

|

|

|

679,630 |

|

Deferred revenue, related party |

|

|

3,000,000 |

|

|

|

3,000,000 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

3,830,214 |

|

|

|

3.679,630 |

|

| |

|

|

|

|

|

|

|

|

Commitments and contingencies (note 7) |

|

|

— |

|

|

|

— |

|

| |

|

|

|

|

|

|

|

|

Series A Preferred Stock, $0.0001 par value; 500,000 shares authorized; no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

Series B Convertible, Redeemable, Preferred Stock, $0.0001 par value; 7,246,377 shares authorized; 5,797,102 shares issued and outstanding at March 31, 2022 and December 31, 2021 |

|

|

3,960,866 |

|

|

|

3,960,866 |

|

Undesignated Preferred Stock, $0.0001 par value; 2,253,623 shares authorized; no shares issued or outstanding |

|

|

— |

|

|

|

— |

|

Common stock, $0.0001 par value; 500,000,000 shares authorized; 376,858,323 shares issued and outstanding at March 31, 2022 and December 31, 2021, respectively |

|

|

37,686 |

|

|

|

37,686 |

|

Additional paid-in capital |

|

|

50,051,711 |

|

|

|

50,051,711 |

|

| |

|

|

(57,819,334 |

) |

|

|

(57,671,109 |

) |

| |

|

|

|

|

|

|

|

|

Total stockholders’ deficit |

|

|

(3,769,071 |

) |

|

|

(3,620,846 |

) |

| |

|

|

|

|

|

|

|

|

Total liabilities and stockholders’ deficit |

|

$ |

61,143 |

|

|

$ |

58,784 |

|

| |

|

|

|

|

|

|

|

|

See notes to condensed financial statements

INHIBITOR THERAPEUTICS, INC.

CONDENSED STATEMENTS OF OPERATIONS

FOR THE THREE-MONTH PERIODS ENDED MARCH 31, 2022 AND 2021

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended March 31, |

|

| |

|

|

|

|

|

|

| |

|

$ |

— |

|

|

$ |

— |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Research and development expenses |

|

|

— |

|

|

|

3,880 |

|

General and administrative |

|

|

93,500 |

|

|

|

163,873 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

93,500 |

|

|

|

167,753 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

(93,500 |

) |

|

|

(167,753 |

) |

Interest expense, related party |

|

|

5,410 |

|

|

|

1,685 |

|

| |

|

|

— |

|

|

|

41,600 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

(98,910 |

) |

|

|

(127,838 |

) |

| |

|

|

(49,315 |

) |

|

|

(49,315 |

) |

| |

|

|

|

|

|

|

|

|

Net loss applicable to common stockholders |

|

$ |

(148,225 |

) |

|

$ |

(177,153 |

) |

| |

|

|

|

|

|

|

|

|

Basic and diluted net loss applicable to common stockholders per share |

|

$ |

(0.00 |

) |

|

$ |

(0.00 |

) |

| |

|

|

|

|

|

|

|

|

Weighted average common stock shares outstanding – basic and diluted |

|

|

376,858,323 |

|

|

|

375,527,841 |

|

| |

|

|

|

|

|

|

|

|

See notes to condensed financial statements

INHIBITOR THERAPEUTICS, INC.

CONDENSED STATEMENT OF STOCKHOLDERS’ EQUITY (DEFICIT)

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock – Series B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, January 1, 2022 |

|

|

5,797,102 |

|

|

$ |

3,960,866 |

|

|

|

376,858,323 |

|

|

$ |

37,868 |

|

|

$ |

50,051,711 |

|

|

$ |

(57,671,109 |

) |

|

$ |

(3,620,846 |

) |

Preferred stock dividends, related party |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(49,315 |

) |

|

|

(49,315 |

) |

| |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(98,910 |

) |

|

|

(98,910 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

5,797,102 |

|

|

$ |

3,960,866 |

|

|

|

376,858,323 |

|

|

$ |

37,868 |

|

|

$ |

50,051,711 |

|

|

$ |

(57,819,334 |

) |

|

$ |

(3,769,071 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock – Series B |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, January 1, 2021 |

|

|

5,797,102 |

|

|

$ |

3,960,866 |

|

|

|

376,635,873 |

|

|

$ |

37,364 |

|

|

$ |

49,814,043 |

|

|

$ |

(57,172,476 |

) |

|

$ |

(3,360,203 |

) |

Common shares issued in payment of Preferred Stock dividend, related party |

|

|

— |

|

|

|

— |

|

|

|

2,240,488 |

|

|

|

224 |

|

|

|

100,598 |

|

|

|

— |

|

|

|

100,822 |

|

| |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

37,990 |

|

|

|

— |

|

|

|

37,990 |

|

Preferred stock dividends, related party |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(49,315 |

) |

|

|

(49,315 |

) |

| |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(127,838 |

) |

|

|

(127,838 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

5,797,102 |

|

|

$ |

3,960,866 |

|

|

|

375,876,361 |

|

|

$ |

37,588 |

|

|

$ |

49,952,631 |

|

|

$ |

(57,349,629 |

) |

|

$ |

(3,398,544 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See notes to condensed financial statements

INHIBITOR THERAPEUTICS, INC.

CONDENSED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2022 AND 2021

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

$ |

(98,910 |

) |

|

$ |

(127,838 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| |

|

|

— |

|

|

|

37,990 |

|

| |

|

|

— |

|

|

|

(41,600 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Prepaid expense and other assets |

|

|

3,453 |

|

|

|

2,823 |

|

Accounts payable and other current liabilities |

|

|

51,269 |

|

|

|

36,755 |

|

| |

|

|

|

|

|

|

|

|

Net cash used in operating activities |

|

|

(44,188 |

) |

|

|

(91,870 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Proceeds from note payable, related party |

|

|

50,000 |

|

|

|

101,000 |

|

| |

|

|

|

|

|

|

|

|

Net cash provided by financing activities |

|

|

50,000 |

|

|

|

101,000 |

|

| |

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

|

5,812 |

|

|

|

9,130 |

|

Cash and cash equivalents at beginning of period |

|

|

30,626 |

|

|

|

75,059 |

|

| |

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

$ |

36,438 |

|

|

$ |

84,189 |

|

| |

|

|

|

|

|

|

|

|

Non-cash financing activities: |

|

|

|

|

|

|

|

|

Issuance of common stock for payment of Preferred Stock dividend |

|

$ |

— |

|

|

$ |

100,822 |

|

Accrued, but unpaid dividends |

|

$ |

49,315 |

|

|

$ |

49,315 |

|

| |

|

|

|

|

|

|

|

|

See notes to condensed financial statements

INHIBITOR THERAPEUTICS, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020

The accompanying unaudited condensed financial statements of Inhibitor Therapeutics, Inc., a Delaware corporation (the “Company”, “INTI”, “we”, “us” or similar terminology), have been prepared by the Company without audit. In the opinion of management, all adjustments (which include normal recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows as of March 31, 2022, and for all periods presented, have been made.

Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) have been condensed or omitted pursuant to the Securities and Exchange Commission (“SEC”) rules and regulations. These unaudited condensed financial statements should be read in conjunction with the audited financial statements and notes thereto for the year ended December 31, 2021, which are included in the Company’s Annual Report on Form

10-K

for the fiscal year ended December 31, 2021, which was filed with the SEC on March 30, 2022 (the “2020 Annual Report”). The accompanying condensed balance sheet as of December 31, 2021 has been derived from the audited financial statements at that date, but does not include all information and footnotes required by GAAP for complete financial statements.

As used herein, the term “Common Stock” means the Company’s common stock, $0.0001 par value per share.

The results of operations for the three-month period ended March 31, 2022 are not necessarily indicative of results that may be expected for any other interim period or for the full fiscal year. Readers of this Quarterly Report are strongly encouraged to review the risk factors relating to the Company which are set forth in the 202

1

Annual Report and the Company’s other filings with the SEC.

Nature of the Business and Background

The Company is a pharmaceutical development company that is focused on developing and ultimately commercializing innovative therapeutics for patients with certain cancers and certain

non-cancerous

proliferation disorders. While the Company is not presently conducting research and development activities with respect to its currently in-licensed technologies and its own intellectual property as a result of pending litigations involving the Company (see Note 7), the Company has explored and expects to continue to explore acquiring or licensing other innovative preclinical and clinical stage therapeutics addressing unmet needs and orphan indications beyond cancer.

The Company’s current primary focus (assuming normal operations are able to recommence) is expected to be on the development of therapies initially for prostate and lung cancer in the U.S. market utilizing SUBA-Itraconazole, a patented, oral formulation of the drug itraconazole currently approved by the U.S. Food and Drug Administration (“FDA”) and marketed as an anti-fungal, which the Company holds an exclusive U.S. license in the licensed field from the Company’s majority stockholder, Mayne Pharma Ventures Pty Ltd. (“Mayne Pharma”). SUBA-Itraconazole is currently licensed to the Company by Mayne Pharma on an exclusive basis in the United States in the field of certain cancers (prostate and lung cancer) and certain

non-cancerous

proliferation disorders pursuant to the Third Amended and Restated Supply and License Agreement (“Third Amended SLA”) between the Company and Mayne Pharma, dated December 17, 2018. Previously, the Company conducted a Phase 2b trial studying the use of SUBA-Itraconazole targeting basal cell carcinoma in patients with Basal Cell Carcinoma Nevus Syndrome (“SUBA-Itraconazole BCCNS”). Mayne Pharma assumed control of the clinical and regulatory program for SUBA-Itraconazole BCCNS in December 2018 pursuant to the Third Amended SLA in exchange for (among other consideration)

a 9

% quarterly cash royalty on future net sales, if any, of SUBA-Itraconazole BCCNS in the United States.

The Company demonstrated in its previous Phase 2b trial for SUBA-Itraconazole BCCNS that the dosing of oral capsules of SUBA-Itraconazole affects the Hedgehog signaling pathway, a major regulator of many fundamental cellular processes, which, in turn, can impact the development and growth of cancers such as basal cell carcinoma. Itraconazole has been approved by the FDA for, and has been extensively used to, treat fungal infections and has an extensive history of safe and effective use in humans. The Company has developed, optioned and licensed intellectual property and

know-how

related to the treatment of cancer patients using itraconazole and certain itraconazole analogues.

Manufacturing and Product Supply and Relationship with Mayne Pharma

The Company does not have any production facilities or manufacturing personnel. The Third Amended SLA provides for the supply to the Company of specially formulated capsules of SUBA-Itraconazole, manufactured by Mayne Pharma under cGMP (current good manufacturing practice) standards, for use by the Company in its clinical trials and for the future commercial supply following FDA approvals, if obtained. Pursuant to the Third Amended SLA, Mayne Pharma is obligated to supply the Company with its patented formulation of SUBA-Itraconazole in a particular oral dose formulation for the treatment of human patients with certain cancers and

non-cancerous

proliferation disorders for as long as the Third Amended SLA is in effect. The Company is required to perform specified development activities and to commercialize SUBA-Itraconazole for the treatment of cancer in the United States.

INHIBITOR THERAPEUTICS, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020

|

Liquidity and management’s plans: |

The Company had cash and cash equivalents of

$36,438

as of March 31, 2022. Based on the Company’s current operational plan and budget, the Company expects that it has sufficient cash to manage its business into June of 2022, although this estimation assumes the Company does not begin any clinical trials, acquire other drug development opportunities or otherwise face unexpected events, costs or contingencies, any of which could affect the Company’s cash requirements. Available resources may be consumed more rapidly than anticipated, resulting in the need for additional funding. As such time as the Company is able to recommence its research and development activities, significant additional funding will be required to advance the Company’s business. The Company will consider financing these and other corporate efforts and its working capital needs primarily through:

|

• |

|

proceeds from public and private financings (including most recently, financing from the Company’s majority shareholder, Mayne Pharma) and, potentially, from other strategic transactions; |

|

• |

|

royalty revenue from Mayne Pharma from sales of SUBA-Itraconazole BCCNS upon and assuming approval by FDA (after earned royalties have been applied to any royalties advanced under Third Amended SLA, although it is uncertain if and when such FDA approval will be obtained); |

|

• |

|

proceeds from the exercise of outstanding warrants previously issued in private financings (including, potentially, warrants held by the Company’s majority shareholder, Mayne Pharma); |

|

• |

|

potential partnerships with other pharmaceutical companies to assist in the supply, manufacturing and distribution of products for which the Company would expect to receive upfront milestone and royalty payments; |

|

• |

|

potential licensing and joint venture arrangements with third parties, including other pharmaceutical companies where we would receive funding based on out-licensing our product; and |

|

• |

|

government or private foundation grants or loans which would be awarded to the Company to further develop the Company’s current and future therapies, or government payroll protection or similar programs available as a result of the novel coronavirus outbreak. |

However, there is a significant risk that none of these plans will be implemented in a manner necessary to sustain the Company beyond June of 2022, and that the Company will be unable to obtain additional financing when needed on commercially reasonable terms, if at all. In particular, the Company is presently subject to shareholder litigation (see Note 7 – Legal Proceedings). The existence of the Action and the Putative Class Action (as defined in note 7) and the uncertainty surrounding their outcome has impeded the Company’s ability to secure additional funding and conduct normal operations, and may continue to do so for so long as the outcome of the Action and the Putative Class Action is uncertain.

In addition, on January 30, 2020, the International Health Regulations Emergency Committee of the World Health Organization (“WHO”) declared the novel coronavirus outbreak a public health emergency of international concern and on March 12, 2020 the WHO announced the outbreak was a pandemic. On January 31, 2020 the U.S. Health and Human Services Secretary declared a public health emergency, and subsequently state and local governments have imposed various restrictions on public activity. The Company has maintained operations virtually during the period of COVID-19 (including the various outbreaks of variants of COVID-19 which have occurred into 2022). Should the Company be able to recommence normal operations, the impact of COVID-19 on the Company’s research, development, and other activities is uncertain and unpredictable. The progression and related outbreaks of COVID-19 variants has adversely affected the U.S. and global economy, resulting in volatility in the financial markets (particularly for biotechnology companies) and has and may continue to impair the Company’s ability to raise capital.

As a result of the foregoing circumstances, there is substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements included herein do not include any adjustments relating to the recoverability or classification of asset carrying amounts or the amounts and classification of liabilities that may result should the Company be unable to continue as a going concern.

|

Summary of Significant Accounting Policies: |

The preparation of condensed financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

INHIBITOR THERAPEUTICS, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020

|

Summary of Significant Accounting Policies (continued): |

The Company currently has no ongoing source of revenues. Miscellaneous income, including interest, is recognized when earned by the Company. Deferred revenue represents cash received for royalties in advance of being earned. Such payments are reflected as deferred revenue until recognized under the Company’s revenue recognition policy. Deferred revenue would be

classified as current if management believes the Company will be able to recognize the deferred amount as revenue within twelve months of the balance sheet date. Deferred revenue will be recognized when the product is sold and the royalty is earned. Since all deferred revenue is related to the SUBA-Itraconazole BCCNS product which is yet to be approved by FDA, the Company has determined that 100% of the advances of the royalty received by Mayne Pharma should be classified as

non-current.

At March 31, 2022 and December 31, 2021, deferred revenue consisted of $3.0 million of royalties advanced by Mayne Pharma under the Third Amended SLA.

Cash and Cash Equivalents

The Company considers all highly liquid debt instruments purchased with an original maturity of three months or less to be cash equivalents. At times, the Company may maintain cash balances in excess of Federal Deposit Insurance Corporation insured amounts which is $250,000 for substantially all depository accounts. As of March 31, 2022, the Company had no excess of the amount covered by Federal Deposit Insurance Corporation.

Research and Development Expenses

Research and development costs are expensed in the period in which they are incurred and include the expenses paid to third parties who conduct research and development activities on behalf of the Company and purchased

in-process

research and development.

The Company accounts for stock-based awards to employees and

non-employees

using Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 – Accounting for Share-Based Payments, which provides for the use of the fair value based method to determine compensation for all arrangements where shares of stock or equity instruments are issued for compensation. Fair values of restricted stock units issued are determined by the Company based predominantly on the trading price of the common stock on the date of grant. Fair value of each common stock option is estimated on the date of grant using the Black-Scholes valuation model that uses assumptions for expected volatility, expected dividends, expected term, and the risk-free interest rate. Expected volatility is based on historical volatility of a peer group’s common stock and other factors estimated over the expected term of the options. The expected term of the options granted is derived using the “simplified method” which computes expected term as the average of the sum of the vesting term plus the contract term. The risk-free rate is based on the U.S. Treasury yield. No stock-based awards were issued during the quarter ended March 31, 2022.

Deferred tax assets and liabilities are recognized for future tax consequences attributed to differences between the consolidated financial statement carrying amounts of existing assets and liabilities and their respective tax bases and are measured using enacted tax rates that are expected to apply to the differences in the periods that they are expected to reverse. These differences occur primarily in share-based compensation.

Recent accounting pronouncements:

Management has considered all recent accounting pronouncements issued, but not effective, and does not believe that they will have a material impact on the Company’s financial statements.

INHIBITOR THERAPEUTICS, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020

On May 3, 2020, the Company received loan proceeds of $41,600 (the “PPP Loan”) from Citibank, N.A. pursuant to the Small Business Administration (“SBA”) Paycheck Protection Program under the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”).

The PPP Loan, which was in the form of a promissory note dated May 2, 2020, was to mature on May 2, 2022 with an interest rate of 1% per annum. No payments were made under the loan. The Company was entitled to prepay the PPP Loan at any time prior to maturity with no prepayment penalties. The promissory note contained events of default and other provisions customary for a loan of this type.

The loan was forgiven by the SBA under the terms of the CARES Act on March 31, 2021. Under the terms of the CARES Act, PPP loans and accrued interest are forgivable after eight weeks as long as the borrower uses the loan proceeds for eligible purposes, including payroll, benefits, rent and utilities, and maintains its payroll levels. The Company used the loan proceeds for purposes consistent with the CARES Act.

On December 12, 2020, the Company and Mayne Pharma entered into a letter agreement for a term debt facility (the “Loan Agreement”) pursuant to which Mayne Pharma provided an aggregate $231,000 credit facility to the Company (the “Facility”). The Facility bears interest at the rate equal to the interest rate tied to the US Bank Prime Rate plus 5.00% (the “Interest Rate”) with a maturity date of twenty four (24) months from the date of the first drawdown (the “Maturity Date”). The Interest Rate shall be adjusted for each drawdown on the Facility in accordance with changes in the monthly average of the US Bank Prime Rate, as reported in the Federal Reserve Statistical Release H .15 for the month preceding the week in which the Company shall make a drawdown against the Facility. Proceeds drawn from the Facility will be used by the Company for general working capital and corporate purposes.

The Facility was available to the Company as follows: (i) $81,000 may be drawn upon request at any time in the first annual quarter of the Facility starting December 14, 2020 ($55,000 was requested and

was

outstanding at December 31, 2020) and (ii) so long as there is no event of default and Mayne Pharma does not give notice in its discretion 30 days before the start of a quarter that it is discontinuing the funding, $75,000 may be drawn in the second and third annual quarters of the Facility, respectively. Any drawdown by the Company must equal or exceed $25,000. The Company shall have one twelve month repayment free advance period from its first drawdown on the Facility. Each other advance on the Facility will be amortized over twelve equal monthly payments of principal plus interest. No premium is payable in the event that the Company pays all principal, interest and other outstanding amounts due to Mayne Pharma prior to the Maturity Date.

The Facility is unsecured, contains no financial covenants, requires no guarantees and is not accompanied by any equity component. The Loan Agreement includes certain limited representations and warranties and negative covenants of the Company.

An event of default under the Loan Agreement includes, among other things, (i) the Company breaches its obligations under the Loan Agreement, and where that breach is capable of remedy it does not remedy the breach within 20 business days after receipt of a notice from the Mayne Pharma of the breach, (ii) Mayne Pharma validly terminates the Third Amended and Restated Supply and License Agreement dated December 17, 2018 between the Company and Mayne Pharma, or (iii) the Company becomes insolvent, including by becoming the subject of the filing or institution of bankruptcy, liquidation or dissolution proceedings.

The Loan Agreement was negotiated and approved on behalf of the Company by a special committee of disinterested, independent members of the Company’s Board of Directors (the “Board”) which was formed on November 17, 2020 for such purpose. The special Board committee consisted of W. Mark Watson, R. Dana Ono and Debra Peattie, who are each disinterested with respect to Mayne Pharma.

INHIBITOR THERAPEUTICS, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020

|

Mayne Term Debt Facility (continued): |

On January 13, 2022, the Company executed a letter agreement with Mayne Pharma to amend the Loan Agreement and the Facility (the “Loan Amendment”). Under the terms of the Loan Amendment: (i) amount of the facility was increased by $50,000 to $281,000, (ii) the maturity date of the Facility was extended to December 31, 2022, (iii) such $50,000 increase will be available for draw down from February 1, 2022 until March 31, 2022 in no less than $25,000 increments, (iv) following March 31, 2022, the outstanding amount under the Facility plus interest thereon will be amortized over equal monthly payments through the maturity date and (v) the parties acknowledged that the full $231,000 under the original Facility had been drawn down by the Company. Except as modified by the Loan Amendment, the terms and conditions of the Loan Agreement and the Facility remain in full force and effect. The proceeds of the expanded Facility will be used by the Company for general working capital purposes, including the payment of a portion of previously deferred employee compensation. Proceeds of $50,000 related to this letter agreement were received during the quarter ended March 31, 2022.

On March 9, 2022, the Company executed an additional letter agreement with Mayne Pharma to amend the Loan Agreement and the Facility (the “Second Loan Amendment”). Under the terms of the Second Loan Amendment: (i) amount of the Facility was increased by $50,000 to $331,000, (ii) such $50,000 increase will be available for draw down from April 1, 2022 until May 31, 2022 in no less than $25,000 increments, (iv) following May 31, 2022, the outstanding amount under the Facility plus interest thereon will be amortized over equal monthly payments through the maturity date and (v) the parties acknowledged that the full $281,000 under the original Facility had been drawn down by the Company. Except as modified by the Second Loan Amendment, the terms and conditions of the Loan Agreement and the Facility remain in full force and effect. The proceeds of the expanded Facility will be used by us for general working capital purposes, including the payment of a portion of previously deferred employee compensation. Proceeds of $50,000

related to this letter agreement were received in April 2022 and are anticipated to allow the Company to continue its current state of operations into June of 2022 (see Note 2).

There was no stock-based compensation for the three months ended March 31, 2022. As of March 31, 2022, there were 13,349,461 outstanding common stock options under the EIP of which 100% were vested. There was no unamortized stock-based compensation at March 31, 2022.

The Company may from time to time become a party to various legal proceedings arising in the ordinary course of business. Except as discussed below, the Company is not the subject of any pending legal proceedings.

On July 9, 2019, Hedgepath, LLC (“HPLLC”), a significant minority stockholder of the Company and an investment vehicle associated with the Company’s former Executive Chairman, filed a civil action captioned

Hedgepath, LLC v. Magrab, et al.

, Civil Action

Number 2019-0529-JTL,

in the Delaware Court of Chancery (the “Action”) against the Company’s directors (except for Debra Peattie, who was not a director at the time) and President and Chief Executive Officer, and a former director (collectively the “Individual Defendants”). On September 27, 2019, the Individual Defendants and Mayne Pharma each filed a motion to dismiss the Action.

On December 3, 2019, HPLLC filed the Verified Amended and Supplemental Complaint. In the Complaint in the Action, purportedly brought directly and derivatively on behalf of the Company, HPLLC alleges claims for breach of fiduciary duty, declaratory judgement, and dilution of stockholder equity, against the Individual Defendants and Mayne Pharma in connection with (i) the previously announced issuance of certain Company equity securities to Mayne Pharma on or about January 8, 2018, (ii) Mayne Pharma’s alleged influence over the timing and conduct of the previous clinical trial of SUBA-Itraconazole for the treatment of BCCNS, and (iii) previously announced amendments to the Supply and License Agreement, as amended (presently memorialized at the Third Amended SLA), between the Company and Mayne Pharma and certain transactions contemplated thereby. The Complaint also alleges claims for breach of fiduciary duty and fraudulent misrepresentation in connection with allegedly false and misleading statements included in Company press releases and filings with the SEC. The Complaint seeks unspecified damages, equitable and other relief from the defendants. Legal costs associated directly with the Company as a nominal defendant were initially payable by the Company until certain retention amounts were reached. Such costs are currently covered by the Company’s insurance policy.

On January 10, 2020, the Individual Defendants and Mayne Pharma each filed a motion to dismiss the Complaint. A hearing on those motions was scheduled on March 26, 2020, but was postponed to June 2020 due to the coronavirus outbreak. On June 4, 2020, the Delaware Court of Chancery held a hearing at which the separate motions of the Individual Defendants and Mayne Pharma to dismiss the Complaint were presented. At the conclusion of the hearing, the Court issued an oral ruling in which it denied the motions and declined to dismiss all counts alleged in the Complaint. Accordingly, the Action has been proceeding in the course typical for such litigation, which could include alternative dispute resolution methods.

INHIBITOR THERAPEUTICS, INC.

NOTES TO CONDENSED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED MARCH 31, 2021 AND 2020

|

Legal Proceedings (continued): |

The Company believes the Action is legally and factually baseless, and the Individual Defendants intend to defend themselves vigorously.

Additionally, on March 23, 2020, a Stockholder Class Action Complaint was filed in the Delaware Court of Chancery by a Company stockholder and purported class representative Samuel P. Sears, commencing litigation captioned Sears v. Magrab et al., C.A. No.

2020-0215-JTL

(the “Putative Class Action”). The defendants named in the Putative Class Action are identical to those named in the Action, with the exception that the Company is not a party to the litigation. The Putative Class Action asserts two direct breach of fiduciary duty

claims-one

against Mayne, the other against the Individual

Defendants-and

the facts underlying those claims almost entirely mirror those alleged in the Action. On December 10, 2020, the Court of Chancery entered an order coordinating the Action and the Putative Class Action for purposes of the litigations.

The Company believes the Putative Class Action is legally and factually baseless, and the Individual Defendants intend to defend themselves vigorously.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion and analysis should be read in conjunction with the Condensed Financial Statements and Notes thereto included elsewhere in this Quarterly Report. This discussion contains certain forward-looking statements that involve risks and uncertainties. The Company’s actual results and the timing of certain events could differ materially from those discussed in these forward-looking statements as a result of certain factors, including, but not limited to, those set forth herein and elsewhere in this Quarterly Report and in the Company’s other filings with the SEC. See “Cautionary Note Regarding Forward Looking Statements” below.

As used in this Management’s Discussion and Analysis of Financial Condition and Results of Operations, unless otherwise indicated, the terms “the Company”, “we”, “us”, “our” and similar terminology refer to Inhibitor Therapeutics, Inc.

Background and Known Trends and Uncertainties

We are a pharmaceutical development company that is focused on developing and ultimately commercializing innovative therapeutics for patients with certain cancers and certain non-cancerous proliferation disorders. While we are not presently conducting research and development activities with respect to our currently in-licensed technologies and our own intellectual property as a result of pending litigations involving our company (see note 7 to the accompanying financial statements), we have explored and expect to continue to explore acquiring or licensing other innovative preclinical and clinical stage therapeutics addressing unmet needs and orphan indications beyond cancer.

Our results of operations must be viewed in light of the pending litigations involving our company and our resulting inability to conduct meaningful research, development and other activities as a result. Until such pending litigations are resolved, we will continue to be unable to progress our business. Moreover, the resolution of such litigations is highly uncertain, and therefore even if such litigations are resolved, we cannot currently predict if and how we will be able to recommence full operations.

Critical Accounting Policies

See Note 3 of the Notes to Condensed Financial Statements included in Item 1 of this Quarterly Report for a summary of significant accounting policies and information on recently issued accounting pronouncements.

For the three months ended March 31, 2022 compared to the three months ended March 31, 2021

Research and Development Expenses.

We recognized no research and development expenses during the three months ended March 31, 2022 compared to approximately $4,000 for the three months ended March 31, 2021. Research and development expenses for the three months ended March 31, 2021 primarily included patent expenses and minimal expenses related to filing the FDA annual report related to the prostate cancer program.

General and Administrative Expenses.

We recognized approximately $0.1 million in general and administrative expenses during the three months ended March 31, 2022 compared to $0.2 million for the three months ended March 31, 2021. General and administrative expenses consisted primarily of professional fees, compensation and related costs. The decrease is primarily due to the reduction in stock compensation expense in the three months ended March 31, 2022 compared to the three months ending March 31, 2021 of approximately $0.04 million due to the timing of the vesting of management and Board stock options.

Gain on loan forgiveness.

We recognized $41,600 in gain on loan forgiveness during the three months ended March 31, 2021 when our PPP Loan was forgiven on March 31, 2021. There was no such gain in the three months ended March 31, 2022.

Liquidity and Capital Resources

We had approximately $36,000 in cash on hand at March 31, 2022. Based on our current operational plan and budget, we expect that we will have sufficient cash to manage our business into June of 2022, although this estimation assumes we do not begin any clinical trials, acquire other drug development opportunities or otherwise face unexpected events, costs or contingencies, any of which could affect our cash requirements. Available resources may be consumed more rapidly than anticipated, potentially resulting in the need for additional funding.

We will consider financing for our research and development, and other corporate efforts and our working capital needs primarily through:

| |

• |

|

proceeds from public and private financings (including most recently, financing from our majority shareholder, Mayne Pharma) and, potentially, from other strategic transactions; |

| |

• |

|

royalty revenue from Mayne Pharma from sales of SUBA-Itraconazole BCCNS upon and assuming approval by FDA (after earned royalties have been applied to any royalties advanced under Third Amended SLA, although it is uncertain if and when such FDA approval will be obtained); |

| |

• |

|

proceeds from the exercise of outstanding warrants previously issued in private financings (including, potentially, warrants held by our majority shareholder, Mayne Pharma); |

| |

• |

|

potential partnerships with other pharmaceutical companies to assist in the supply, manufacturing and distribution of our products for which we would expect to receive upfront milestone and royalty payments; |

| |

• |

|

potential licensing and joint venture arrangements with third parties, including other pharmaceutical companies where we would receive funding based on out-licensing our product; and |

| |

• |

|

government or private foundation grants or loans which would be awarded to us to further develop our current and future therapies, or government payroll protection or similar programs available as a result of the novel coronavirus outbreak. |

However, there is a significant risk that none of these plans will be implemented in a manner necessary to sustain our operations for beyond June of 2022, and that we will be unable to obtain additional financing when needed on commercially reasonable terms, if at all. In particular, we are presently subject to shareholder litigations (see Note 7 – Legal Proceedings in the accompanying unaudited financial statements). The existence of the Action and the Putative Class Action (as defined in such note) and the uncertainty surrounding their outcome has impeded our ability to secure additional funding and conduct normal operations, and may continue to do so for so long as the outcome of the Action and the Putative Class Action is uncertain.

In addition, on January 30, 2020, the International Health Regulations Emergency Committee of the World Health Organization (“WHO”) declared the novel coronavirus outbreak a public health emergency of international concern and on March 12, 2020 the WHO announced the outbreak was a pandemic. On January 31, 2020 the U.S. Health and Human Services Secretary declared a public health emergency, and subsequently state and local governments have imposed various restrictions on public activity. We have maintained operations virtually during the period of COVID-19 including the various outbreaks of variants of COVID-19 which have occurred into 2022. Should we be able to commence normal operations, the impact of COVID-19 on our research, development and other activities is uncertain and unpredictable. The progression and continued outbreaks of COVID-19 variants has adversely affected the U.S. and global economy, resulting in volatility in the financial markets (particularly for biotechnology companies) and has and may continue to impair our ability to raise capital.

If adequate funds are not available when needed, we may be required to significantly reduce or refocus operations or to obtain funds through arrangements that may require us to relinquish rights to technologies or potential markets, any of which could have a material adverse effect on us. In addition, our inability to secure additional funding in the near future could cause us to wind down or discontinue operations.

|

Quantitative and Qualitative Disclosures About Market Risk |

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this Quarterly Report, the Company’s management, with the participation of the Company’s Chief Executive Officer and Chief Financial Officer (the “Certifying Officers”), conducted evaluations of our disclosure controls and procedures. As defined under Sections 13a–15(e) and 15d–15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the term “disclosure controls and procedures” means controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the rules and forms of the SEC. Disclosure controls and procedures include without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including the Certifying Officers, to allow timely decisions regarding required disclosures.

Based on this evaluation, the Certifying Officers have concluded that our disclosure controls and procedures were effective.

Changes in Internal Control over Financial Reporting

There were no changes in our internal control over financial reporting during our first fiscal quarter of 2022 that materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

Limitations on the Effectiveness of Internal Controls

Readers are cautioned that our management does not expect that our disclosure controls and procedures or our internal control over financial reporting will necessarily prevent all fraud and material error. An internal control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within our control have been detected. The design of any system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any control design will succeed in achieving its stated goals under all potential future conditions. Over time, controls may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate.

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

Certain information set forth in this Quarterly Report on Form

10-Q,

including in Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (and the “Liquidity and Capital Resources” section thereof) and elsewhere may address or relate to future events and expectations and as such constitutes “forward-looking statements” within the meaning of the Private Securities Litigation Act of 1995. Such forward-looking statements involve significant risks and uncertainties. Such statements may include, without limitation, statements with respect to our plans, objectives, projections, expectations and intentions and other statements identified by words such as “projects”, “may”, “could”, “would”, “should”, “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans” or similar expressions. These statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties, including those detailed in our filings with the SEC. Actual results, including, without limitation: (i) our ability to develop and ultimately commercialize therapeutics, (ii) the application and availability of corporate funds and our need for future funds, or (iii) the timing for beginning, completion, and results of, clinical trials and the FDA’s review and/or approval and potential commercial launch of our products and product candidates and regulatory filings related to the same, or (iv) the results of pending litigation involving our company, may differ significantly from those set forth in the forward-looking statements. Such forward-looking statements also involve other factors which may cause our actual results, performance or achievements to materially differ from any future results, performance, or achievements expressed or implied by such forward-looking statements and to vary significantly from reporting period to reporting period. Such factors include, among others,

| |

• |

|

the timing for resolution of the pending litigations involving our company, and the nature of any such resolution, if achieved; |

| |

• |

|

acceptance of our business model (namely the repurposing of a specialty formulation of the drug itraconazole for the treatment of cancer or other diseases, and the potential acquisition or license of other pharmaceutical technologies) by investors and potential commercial collaborators; |

| |

• |

|

the uncertainties regarding the impact of the novel coronavirus outbreak and related governmental actions on our business model and our ability to implement our business; |

| |

• |

|

our future capital requirements and our ability to satisfy our capital needs; |

| |

• |

|

our ability to commence and complete required clinical trials of our product candidate and obtain approval from the FDA or other regulatory agencies in different jurisdictions; |

| |

• |

|

matters associated with the fact that Mayne Pharma is our majority stockholder and key licensor; |

| |

• |

|

our ability to secure and maintain key development and commercialization partners for our product candidate; |

| |

• |

|

our ability to obtain, maintain or protect the validity of our owned or licensed patents and other intellectual property; |

| |

• |

|

our ability to internally develop, acquire or license new inventions and intellectual property; |

| |

• |

|

our ability to retain key executive members; |

| |

• |

|

interpretations of current laws and the passages of future laws, rules and regulations applicable to our business; and |

| |

• |

|

those risk factors listed under Item 1A of our 2019 Annual Report and other factors detailed from time to time in our other filings with the SEC. |

Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual future results will not be different from the expectations expressed in this Report. We undertake no obligation to publically update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

PART II. OTHER INFORMATION

On July 9, 2019, Hedgepath, LLC (“HPLLC”), a significant minority stockholder of ours and an investment vehicle associated with our former Executive Chairman, filed a civil action captioned

Hedgepath, LLC v. Magrab, et al.

, C.A.

No. 2019-0529-JTL,

in the Delaware Court of Chancery (the “Action”) against our directors (except for Debra Peattie, who was not a director at the time) and President and Chief Executive Officer, and a former director (collectively the “Individual Defendants”). On September 27, 2019, the Individual Defendants and Mayne Pharma each filed a motion to dismiss the Action.

On December 3, 2019, HPLLC filed the Verified Amended and Supplemental Complaint. In the Complaint in the Action, purportedly brought directly and derivatively on behalf of us, HPLLC alleges claims for breach of fiduciary duty, waste, declaratory judgment, statutory violations, and dilution of stockholder equity, against the Individual Defendants and Mayne Pharma in connection with (i) the previously announced issuance of certain of our equity securities to Mayne Pharma on or about January 8, 2018, (ii) Mayne Pharma’s alleged influence over the timing and conduct of the previous clinical trial of SUBA-Itraconazole for the treatment of BCCNS, and (iii) previously announced amendments to the Supply and License Agreement, as amended (presently memorialized at the Third Amended SLA), between us and Mayne Pharma and certain transactions contemplated thereby. The Complaint also alleges claims for breach of fiduciary duty and fraudulent misrepresentation in connection with allegedly false and misleading statements included in our press releases and filings with the SEC. The Complaint seeks unspecified damages from the defendants, and equitable and other relief. Legal costs associated directly with the Company as a nominal defendant were initially payable by us until certain retention amounts were reached. Such costs are currently covered by our insurance policy.

On January 10, 2020, the Individual Defendants and Mayne Pharma each filed a motion to dismiss the Complaint. A hearing on those motions was scheduled on March 26, 2020, but was postponed to June 2020 due to the ongoing coronavirus outbreak. On June 4, 2020, the Delaware Court of Chancery held a hearing at which the separate motions of the Individual Defendants and Mayne Pharma to dismiss the Complaint were presented. At the conclusion of the hearing, the Court issued an oral ruling in which it denied the motions to dismiss the Complaint. Accordingly, the Action has been proceeding in the course typical for such litigation, which could include alternative dispute resolution methods.

Additionally, on March 23, 2020, a Stockholder Class Action Complaint was filed in the Delaware Court of Chancery by a stockholder and purported class representative, Samuel P. Sears, commencing litigation captioned

., C.A. No.

2020-0215-JTL

(the “Putative Class Action”). The plaintiff amended his complaint in May 2020. The defendants named in the Putative Class Action are identical to those named in the Action, with the exception that Inhibitor Therapeutics, Inc. is not a party to the litigation. The Putative Class Action asserts three direct breach of fiduciary duty

claims-one

against Mayne only, another against the Individual Defendants, and a third against all

defendants-and

the facts underlying those claims almost entirely mirror those alleged in the Action. On December 10, 2020, the Court of Chancery entered an order coordinating the Action and the Putative Class Action for purposes of the litigations.

We believe the Action and Putative Class Action are legally and factually baseless, and the Individual Defendants will continue to defend themselves vigorously.

Not required for smaller reporting companies.

|

Unregistered Sales of Equity Securities and Use of Proceeds. |

|

Defaults upon Senior Securities. |

| * |

A signed original of this written statement required by Section 906 has been provided to the Company and will be retained by the Company and furnished to the Securities and Exchange Commission or its staff upon request. |

15

Pursuant to the requirements of the Exchange Act, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

INHIBITOR THERAPEUTICS, INC. |

|

|

|

|

| Date: May 13, 2022 |

|

|

|

By: |

|

|

|

|

|

|

President and Chief Executive Officer (Principal Executive Officer) |

|

|

|

|

| Date: May 13, 2022 |

|

|

|

By: |

|

|

|

|

|

|

Chief Financial Officer and Treasurer (Principal Financial Officer) |

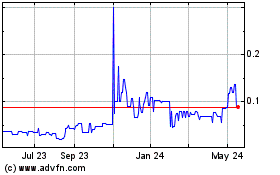

Inhibitor Therapeutics (QB) (USOTC:INTI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Inhibitor Therapeutics (QB) (USOTC:INTI)

Historical Stock Chart

From Nov 2023 to Nov 2024