Icon Media Holdings, Inc. Reports Third Quarter 2011 Results

December 01 2011 - 9:00AM

Marketwired

Icon Media Holdings, Inc. (PINKSHEETS: ICNM) reported results for

the Third Quarter ended September 30, 2011.

Third Quarter 2011

- Revenue from continuing operations of $564,536

- Net earnings of $40,046

- SG&A expense decreased by $57,379

For the quarter ended September 30, 2011, gross revenue totaled

$564,536 compared to $425,514 in the prior year comparative period,

representing over a 30% increase in revenue. Gross profit was

$430,849 for the quarter, versus $301,973 for the same period last

year. The increase in sales for the quarter is due in part to our

international expansion and increased traffic to our websites.

Selling, general and administrative expenses, or SG&A,

totaled $390,803, compared to $448,182 in the third quarter of

2010. The improvement in SG&A for the period was due in part to

lower employee compensation and benefits, office rent, utilities

and company expenses as a result of the Company's restructuring and

relocation of the corporate headquarters to North Carolina.

In the third quarter, the Company reported net earnings of

$40,046 compared to a net loss of $146,210 for the same period of

the prior year.

CEO Rob Deakin said, "We are excited with the results of this

last financial statement, and the move into profitability. With our

new and expanded avenues of revenue, we should expect to continue

with even more exciting results and increased shareholder

value."

The Company also is pleased to announce that it has entered into

an Investment Banking Agreement with Wall Street investment banking

firm JH Darbie & Company. As part of the engagement, Darbie

will assist the Company with identifying possible joint ventures,

strategic relationships and acquisition targets. Developments will

be released as conditions warrant.

About Icon Media Holdings, Inc.

(ICNM):

Icon Media Holdings, Inc. is a diversified global e-commerce

company. The Company currently owns and/or operates e-commerce

websites, including www.moviegoods.com, www.puntdogposters.com, and

sells on storefronts such as Amazon, Amazon UK and eBay, among

others. The Company also supports e-commerce companies through its

financial services division IFX Financial Group. Corporate website:

www.iconmediaholdings.com.

Forward-Looking Statements & Disclaimers: The information in

this Press Release includes certain "forward-looking" statements

within the meaning of the Safe Harbor provisions of Federal

Securities Laws, as that term is defined in section 27a of the

United States Securities Act of 1933, as amended, and section 21e

of the United States Securities Exchange Act of 1934, as amended.

Statements in this document, which are not purely historical, are

forward-looking statements and include any statements regarding

beliefs, plans, expectations or intentions regarding the future.

Investors are cautioned that such statements are based upon

assumptions that in the future may prove not to have been accurate

and are subject to significant risks and uncertainties, including

the future financial performance of the Company. Although the

Company believes that the expectations reflected in its

forward-looking statements are reasonable, it can give no assurance

that such expectations or any of its forward-looking statements

will prove to be correct. Readers are cautioned not to place undue

reliance on these forward-looking statements that speak only as of

the date of this release, and the Company undertakes no obligation

to update publicly any forward-looking statements to reflect new

information, events, or circumstances after the date of this

release except as required by law.

Contact: Terry Kraemer Phone: 919.237.5700 ext. 203

info@iconmediaholdings.com

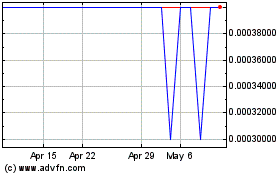

Icon Media (PK) (USOTC:ICNM)

Historical Stock Chart

From Jun 2024 to Jul 2024

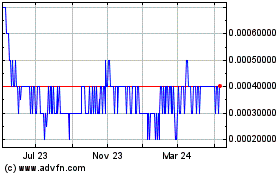

Icon Media (PK) (USOTC:ICNM)

Historical Stock Chart

From Jul 2023 to Jul 2024