Global Brokerage, Inc. Receives Approximately 78.5% Yes Votes to Move Forward with the Prepackaged Plan of Reorganization

December 11 2017 - 7:58PM

Global Brokerage, Inc. (NASDAQ:GLBR) (“Global Brokerage”),

announced today that, after receiving votes from approximately

78.5% of the holders of its 2.25% Convertible Notes due 2018 (the

“Current Notes”) unanimously approving its proposed, prepackaged

plan of reorganization (the “Plan”), Global Brokerage has filed a

voluntary petition for reorganization under Chapter 11 of the

Bankruptcy Code in the United States Bankruptcy Court for the

Southern District of New York. The bankruptcy case is expected to

take no longer than sixty days. All voting creditors voted in favor

of the Plan.

As announced on November 10, 2017, Global Brokerage and its

affiliate, Global Brokerage Holdings, LLC (“Global Brokerage

Holdings”), an ad hoc group of holders of more than 68.5% of the

Current Notes, FXCM Group, LLC (“FXCM Group” or “FXCM”) and

Leucadia National Corporation and LUK-FX Holdings, LLC entered into

a restructuring support agreement (the “RSA”) to restructure the

obligations of Global Brokerage and Global Brokerage Holdings

pursuant to the Plan . The overall purpose of the Plan is to enable

Global Brokerage to exchange the Current Notes for new notes that

have a five-year extended maturity and to restructure its current

operations to reduce current expenses.

FXCM Group is not involved with the Chapter 11 filing.

FXCM’s customers and customer funds will not be impacted by the RSA

and the Plan. Similarly, FXCM’s banking and trading

counterparties, service providers, and other business relationships

will not be impacted. FXCM Group, a leading retail FX and CFD

broker will continue to operate normally.

Global Brokerage’s legal advisors are King & Spalding LLP,

and its financial advisors are Perella Weinberg Partners LP.

Additional information regarding Global Brokerage’s Chapter 11 case

and the Plan can be found in the Current Report on Form 8-K filed

with the SEC on November 13, 2017 and on the Prime Clerk website

at: https://cases.primeclerk.com/globalbrokerage.

Disclosure Regarding Forward-Looking

Statements

In addition to historical information, this earnings release may

contain “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933, Section 21E of the Exchange Act

and/or the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include statements preceded by, followed

by, or including the words “believes,” “expects,” “anticipates,”

“plans,” “estimates,” “projects,” “forecasts,” or similar

expressions. Examples of forward-looking statements in this news

release are statements about the expected terms and timing of the

Plan, the expected SEC deregistration and the financial impact on

Global Brokerage, including reduced expenses, resulting from the

restructuring transactions. These forward-looking statements are

not historical facts and are based on current expectations,

estimates and projections about Global Brokerage’s industry,

business plans, management’s beliefs and certain assumptions made

by management, many of which, by their nature, are inherently

uncertain and beyond our control. Accordingly, readers are

cautioned that any such forward-looking statements are not

guarantees of future performance and are subject to certain risks,

uncertainties and assumptions that are difficult to predict

including, without limitation, risks associated with Global

Brokerage’s strategy to focus on its operations outside the United

States, risks associated with the events that took place in the

currency markets on January 15, 2015 and their impact on Global

Brokerage’s capital structure, risks associated with Global

Brokerage’s ability to recover all or a portion of any capital

losses, risks relating to the ability of Global Brokerage to

satisfy the terms and conditions of or make payments pursuant to

the terms of the finance agreements with Leucadia, as well as risks

associated with Global Brokerage’s obligations under its other

financing agreements, risks related to Global Brokerage’s

dependence on FX market makers, market conditions, risks associated

with the outcome of any potential litigation or regulatory

inquiries to which Global Brokerage may become subject, risks

associated with potential reputational damage to Global Brokerage

resulting from its sale of US customer accounts, and those other

risks described under “Risk Factors” in Global Brokerage’s Annual

Report on Form 10-K, Global Brokerage’s latest Quarterly Report on

Form 10-Q, and other reports or documents Global Brokerage files

with, or furnishes to, the SEC from time to time, which are

accessible on the SEC website at sec.gov. This information should

also be read in conjunction with Global Brokerage’s Consolidated

Financial Statements and the Notes thereto contained in Global

Brokerage’s Annual Report on Form 10-K, Global Brokerage’s latest

Quarterly Report on Form 10-Q, and in other reports or documents

that Global Brokerage files with, or furnishes to, the SEC from

time to time, which are accessible on the SEC website at

sec.gov.

About Global Brokerage, Inc.

Global Brokerage, Inc. (NASDAQ:GLBR) is a holding company with

an indirect effective ownership of FXCM Group, through its equity

interest in Global Brokerage Holdings, of between 7.5 – 37.3%

depending on the amount of distributions made by FXCM Group.

Investor Relations investorrelations@globalbrokerage.info

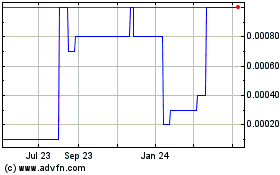

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Nov 2024 to Dec 2024

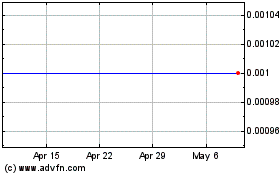

Global Brokerage (CE) (USOTC:GLBR)

Historical Stock Chart

From Dec 2023 to Dec 2024