UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 13)1

DIRTT Environmental Solutions Ltd.

(Name

of Issuer)

Common Shares, without par value

(Title of Class of Securities)

25490H106

(CUSIP Number)

ARON R. ENGLISH

22NW, LP

590 1st Ave. S

Unit C1

Seattle, Washington 98104

(206) 227-3078

RYAN NEBEL

OLSHAN FROME WOLOSKY LLP

1325 Avenue of the Americas

New York, New York 10019

(212) 451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

August 2, 2024

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☒.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW Fund, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

49,955,045 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

49,955,045 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

49,955,045 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

26.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

49,955,045 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

49,955,045 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

49,955,045 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

26.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW Fund GP, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

49,955,045 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

49,955,045 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

49,955,045 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

26.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

22NW GP, Inc. |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

49,955,045 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

49,955,045 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

49,955,045 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

26.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Aron R. English |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

OO, PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

57,447,988 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

57,447,988 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

57,447,988 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

29.9% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Bryson O. Hirai-Hadley |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

2,272 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,272 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,272 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

Alexander B. Jones |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

2,181 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

2,181 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

2,181 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The following constitutes

Amendment No. 13 to the Schedule 13D filed by the undersigned (“Amendment No. 13”). This Amendment No. 13 amends the Schedule

13D as specifically set forth herein.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby amended

and restated to read as follows:

Of the 49,955,045 Shares

beneficially owned by 22NW Fund, (i) 21,981,043 of such Shares were purchased with working capital (which may, at any given time, include

margin loans made by brokerage firms in the ordinary course of business) and have an aggregate purchase price of approximately $44,335,026,

excluding brokerage commissions, (ii) 3,899,745 of such Shares were granted by the Issuer, following shareholder approval, at a deemed

price of $0.40 per Share as reimbursement for legal fees and other expenses incurred by 22NW Fund in connection with the contested director

election at the Issuer’s 2022 annual and special meeting; and (iii) 24,074,2571

of such Shares were purchased pursuant to the exercise of 22NW Fund’s subscription rights under the Issuer’s C$30.0 million

rights offering (the “Rights Offering”) at a subscription price of C$0.35 per Share.

Of the 7,492,943 Shares directly

owned by Mr. English, (i) 1,777,369 were purchased with personal funds (which may, at any given time, include margin loans made by brokerage

firms in the ordinary course of business) and have an aggregate purchase price of approximately $994,199, excluding brokerage commissions,

and (ii) 5,715,5741 of such Shares were purchased pursuant to the exercise of Mr. English’s subscription rights

under the Rights Offering at a subscription price of C$0.35 per Share.

Of the 2,272 Shares directly

owned by Mr. Hirai-Hadley, (i) 1,250 were purchased with personal funds (which may, at any given time, include margin loans made by brokerage

firms in the ordinary course of business) and have an aggregate purchase price of approximately $1,763, excluding brokerage commissions,

and (ii) 1,022 of such Shares were purchased pursuant to the exercise of Mr. Hirai-Hadley’s subscription rights under the Rights

Offering at a subscription price of C$0.35 per Share.

Of the 2,181 Shares directly

owned by Mr. Jones, (i) 1,200 were purchased with personal funds (which may, at any given time, include margin loans made by brokerage

firms in the ordinary course of business) and have an aggregate purchase price of approximately $2,780, excluding brokerage commissions,

and (ii) 981 of such Shares were purchased pursuant to the exercise of Mr. Jones’ subscription rights under the Rights Offering

at a subscription price of C$0.35 per Share.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On August 2, 2024, 22NW Fund

entered into a support and standstill agreement (the “Support Agreement”) with the Issuer and WWT Opportunity #1 LLC

(“WWT”). The Support Agreement replaces the previously disclosed support and standstill agreement between the Issuer

and 22NW Fund entered into on March 22, 2024.

Pursuant to the Support

Agreement, the Issuer agreed to nominate Aron R. English (or a replacement director identified by 22NW Fund, the “Shareholder

Director”) for election as a member of the Issuer’s Board of Directors (the “Board”) and to recommend,

support and solicit proxies for the election of the Shareholder Director in the same manner as the other DIRTT Nominees (as defined in

the Support Agreement) at each of the Issuer’s 2025 annual general meeting of shareholders (the “2025 Meeting”)

and 2026 annual general meeting of shareholders (the “2026 Meeting”), subject to 22NW Fund continuing to beneficially

own, or exercising control or direction over, at least the lesser of 20% of the then issued and outstanding Shares and 38,592,529 Shares

(subject in each case to adjustment for stock splits, reclassifications, combinations and similar adjustments).

1 Inclusive of the internal transfer of 4,117,741 Shares from 22NW Fund to Mr. English, as further described in Item 5 of Amendment No. 11 to the Schedule 13D.

Pursuant to the Support Agreement,

22NW Fund has agreed to vote all of its Shares in favor of recommendations of the Board on director election proposals and certain other

proposals, subject to certain exceptions, at the 2025 Meeting and the 2026 Meeting (and any other meeting of the Issuer’s shareholders

held prior to the Termination Date (as defined below)). Further under the terms of the Support Agreement, 22NW Fund has also agreed (i)

not to initiate an unsolicited take-over bid for the Shares prior to the Termination Date, subject to certain exceptions, and (ii) to

certain customary standstill provisions until the Termination Date. The Support Agreement also contains certain mutual non-disparagement

provisions.

The Support Agreement contains

similar provisions relating to WWT, except that WWT is permitted to make market purchases of Shares up to the number of Shares owned by

22NW Fund and its affiliates, as of the date of the Support Agreement.

The Support Agreement will

terminate upon the earlier of (i) January 31, 2025, if the meeting to approve the Issuer’s shareholder rights plan is not held before

that date, subject to certain exceptions; (ii) any material breach of the Support Agreement, upon five (5) business days’ written

notice by the non-breaching parties to the breaching party if such breach has not been cured within such notice period, in which event

the Support Agreement can be terminated by one or both of the non-breaching parties; or (iii) the date which is 90 days following the

2026 Meeting (the “Termination Date”).

Also on August 2, 2024, 22NW

Fund and the Issuer entered into a convertible debenture repurchase agreement (the “Repurchase Agreement”). Pursuant

to the Repurchase Agreement, the Issuer has purchased from 22NW Fund for cancellation an aggregate of (i) C$18,915,000 principal amount

of the Issuer’s outstanding 6.00% convertible debentures due January 31, 2026 (the “January Debentures”) at a

purchase price of C$684.58 per C$1,000 principal amount of January Debentures and (ii) C$13,638,000 principal amount of the Issuer’s

outstanding 6.25% convertible debentures due December 31, 2026 (the “December Debentures” and together with the January

Debentures, the “Debentures”) at a purchase price of C$665.64 per C$1,000 principal amount of December Debentures,

for an aggregate purchase price of C$22,104,591.45, inclusive of a cash payment for all accrued and unpaid interest up to, but excluding,

the date of purchase of the Debentures. Following the closing of the Repurchase Agreement, 22NW Fund no longer owns any Debentures.

The foregoing descriptions

of the Support Agreement and the Repurchase Agreement do not purport to be complete and are subject to and qualified in their entirety

by reference to the full text of the Support Agreement and the Repurchase Agreement, copies of which are attached hereto as Exhibit 99.1

and Exhibit 99.2, respectively, and are incorporated by reference herein.

| Item 5. | Interest in Securities of the Issuer. |

Items 5(a) and (c) are hereby

amended and restated as follows:

(a) The

aggregate percentage of Shares reported owned by each person named herein is based upon 191,880,226 Shares outstanding as of April 30,

2024, which is the total number of Shares outstanding as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on May 8, 2024.

As of the date hereof, 22NW

Fund directly beneficially owned 49,955,045 Shares, constituting approximately 26.0% of the Shares outstanding.

As of the date hereof, Mr.

English directly beneficially owned 7,492,943 Shares, constituting approximately 3.9% of the Shares outstanding.

As of the date hereof, Mr.

Hirai-Hadley directly beneficially owned 2,272 Shares, constituting less than 1% of the Shares outstanding.

As of the date hereof, Mr.

Jones directly beneficially owned 2,181 Shares, constituting less than 1% of the Shares outstanding.

22NW, as the investment manager

of 22NW Fund, may be deemed to beneficially own the 49,955,045 Shares beneficially owned by 22NW Fund, constituting approximately 26.0%

of the Shares outstanding. 22NW GP, as the general partner of 22NW Fund, may be deemed to beneficially own the 49,955,045 Shares beneficially

owned by 22NW Fund, constituting approximately 26.0% of the Shares outstanding. 22NW Inc., as the general partner of 22NW, may be deemed

to beneficially own the 49,955,045 Shares beneficially owned by 22NW Fund, constituting approximately 26.0% of the Shares outstanding.

Mr. English, as the Portfolio Manager of 22NW, Manager of 22NW GP and President and sole shareholder of 22NW Inc., may be deemed to beneficially

own the 49,955,045 Shares beneficially owned by 22NW Fund, which, together with the Shares he directly beneficially owns, constitutes

an aggregate of 57,447,988 Shares, constituting approximately 29.9% of the Shares outstanding.

The filing of this Schedule

13D shall not be deemed an admission that the Reporting Persons are, for purposes of Section 13(d) of the Securities Exchange Act of 1934,

as amended, the beneficial owners of any securities of the Issuer he or it does not directly own. Each of the Reporting Persons specifically

disclaims beneficial ownership of the securities reported herein that he or it does not directly own.

(c) Except

as otherwise disclosed herein with respect to the Repurchase Agreement, the Reporting Persons have not engaged in any transactions in

the securities of the Issuer during the past 60 days.

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

On August 2, 2024, 22NW Fund,

WWT and the Issuer entered into the Support Agreement as defined and described in Item 4 above and attached as Exhibit 99.1 hereto.

On August 2, 2024, 22NW Fund

and the Issuer entered into the Repurchase Agreement as defined and described in Item 4 above and attached as Exhibit 99.2 hereto.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended

to add the following exhibits:

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete

and correct.

Dated: August 5, 2024

| |

22NW FUND, LP |

| |

|

| |

By: |

22NW Fund GP, LLC

General Partner |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

Manager |

| |

22NW, LP |

| |

|

| |

By: |

22NW GP, Inc.

General Partner |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

President and Sole Shareholder |

| |

22NW FUND GP, LLC |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

Manager |

| |

22NW GP, INC. |

| |

|

| |

By: |

/s/ Aron R. English |

| |

|

Name: |

Aron R. English |

| |

|

Title: |

President and Sole Shareholder |

| |

/s/ Aron R. English |

| |

ARON R. ENGLISH

Individually and as attorney-in-fact for Bryson O.

Hirai-Hadley and Alexander B. Jones |

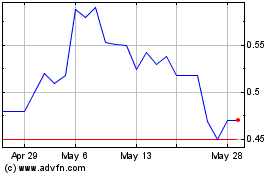

Dirtt Environmental Solu... (PK) (USOTC:DRTTF)

Historical Stock Chart

From Oct 2024 to Nov 2024

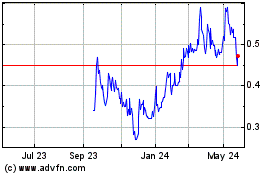

Dirtt Environmental Solu... (PK) (USOTC:DRTTF)

Historical Stock Chart

From Nov 2023 to Nov 2024