As filed

with the Securities and Exchange Commission on January 23, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CLEAN VISION CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

| Nevada |

|

7389 |

|

85–1449444 |

|

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

2711 N. Sepulveda Blvd. #1051

Manhattan Beach, CA 90266

(424) 835-1845

(Address, Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Mr. Daniel Bates

Chief Executive Officer

2711 N. Sepulveda Blvd. #1051

Manhattan Beach, CA 90266

(424) 835-1845

(Name, Address, Including Zip Code, and Telephone

Number, Including Area Code,

of Agent For Service)

Copies to:

|

Joseph M. Lucosky, Esq.

Lucosky Brookman LLP

101 Wood Avenue South, 5th Floor

Woodbridge, NJ 08830

Tel: (732) 395-4400 |

Approximate date of commencement

of proposed sale to the public:

As soon as practicable after

the effective date of this Registration Statement.

If any of the securities being

registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check

the following box. [X]

If this form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

If this form is a post-effective

amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See

the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

| |

Emerging growth company |

☒ |

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

The registrant hereby amends this Registration Statement on such date

or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states

that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the

Registration Statement shall become effective on such date as the SEC, acting pursuant to said Section 8(a), may determine.

The information in this preliminary

prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities

and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting an

offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY

23, 2023

PRELIMINARY PROSPECTUS

CLEAN VISION CORPORATION

Up to 23,000,000 Shares of Common Stock

Pursuant to this prospectus, Coventry Enterprises,

LLC (“Coventry” or the “Selling Shareholder”) may offer up to 318,000,000 shares of common stock, par

value $0.001 (the “Common Stock”), of Clean Vision Corporation, a Nevada corporation (the “Company”, “we”,

“us” or “our”) issued to Coventry in connection with the Securities Purchase Agreement by and between Coventry

and the Company dated December 9, 2023 (the “Purchase Agreement”) as follows (a) up to 3,000,000 shares of Common Stock

issued pursuant to the Purchase Agreement (the “Commitment Stock”) and (b) up to 20,000,000 shares of Common Stock issuable

to Coventry solely upon an event of a default (the “Conversion Stock”) under that certain Promissory Note issued to Coventry

on December 9, 2023 (the “Note”) in the principal amount of $300,000.

Per the terms of the Purchase Agreement, the Company

issued 15,500,000 shares of its Common Stock to Coventry. If the Company files an initial Registration Statement within forty-five calendar

days from the date of the Note, then Coventy, pursuant to its mandatory obligations thereunder, shall, within ten (10) calendar days

thereafter, return to the Company’s treasury for cancellation twelve million five hundred thousand (12,500,000) shares of Common

Stock. The 3,000,000 shares of Common Stock owned by Coventry represents approximately 0.73% of our issued and outstanding

shares of Common Stock of as of January 18, 2023.

Upon an event of default under the Note, the outstanding

principal and interest thereon may be converted, at the option of Coventry, into shares of Common Stock at a conversion price equal to

90% per share of the lowest per-share trading price during the 20 trading day period before the conversion.

Coventry is the Selling Shareholder and is deemed

to be an “underwriter” within the meaning of the Securities Act of 1933, as amended (the “Act”) and any broker-dealers

or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Act in connection

with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased

by them may be deemed to be underwriting commissions or equivalent expenses and expenses of legal counsel applicable to the sale of the

shares.

Coventry may sell the shares of Common Stock described

in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution” for more information about

how Coventry may sell the shares of Common Stock being registered pursuant to this prospectus.

The prices at which the Selling Shareholder may sell

the shares of Common Shares in this offering will be determined by the prevailing market prices for the shares of Common Shares or in

negotiated transactions

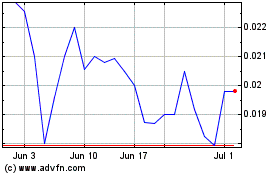

The

Common Stock is quoted on the OTCQB Market maintained by OTC Markets Group, Inc. (“OTC

Markets”), under the symbol “CLNV”. On January 18, 2023, the last reported

sale price of the Common Stock on the OTCQB was $0.074 per share.

There has been a very limited market for our securities.

While our Common Stock is quoted on the OTC Markets, there has been negligible trading volume. There is no guarantee that an active trading

market will develop in our securities.

Following the effectiveness of the

registration statement of which this prospectus forms a part, the sale and distribution of securities offered hereby may be effected

from time to time in one or more transactions that may take place on the OTC Markets (or such other market or quotation system on which

our common stock is then listed or quoted), including ordinary brokers’ transactions, privately negotiated transactions or through

sales to one or more dealers for resale of such securities as principals, at market prices prevailing at the time of sale, at prices

related to such prevailing market prices or at negotiated prices. Usual and customary or specifically negotiated brokerage fees or commissions

may be paid by the selling stockholders. The selling stockholders and intermediaries through whom such securities are sold may be deemed

“underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), with respect

to the securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation.

This prospectus describes the general manner in

which shares of common stock may be offered and sold by any selling stockholders. When the selling stockholders sell shares of common

stock under this prospectus, we may, if necessary and required by law, provide a prospectus supplement that will contain specific information

about the terms of that offering. Any prospectus supplement may also add to, update, modify or replace information contained in this

prospectus. We urge you to read carefully this prospectus, any accompanying prospectus supplement and any documents we incorporate by

reference into this prospectus and any accompanying prospectus supplement before you make your investment decision.

Investing in our securities involves risks. See

“Risk Factors” beginning on page 13 of this prospectus. We and our board of directors are not making any recommendation regarding

the exercise of your rights.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

We are an “emerging growth company” under

applicable U.S. Securities and Exchange Commission (“SEC”) rules and will be subject to reduced public company reporting requirements.

The date of this prospectus is , 2023

TABLE OF CONTENTS

Unless the context requires otherwise, references

in this prospectus to “Clean Vision,” “CLNV,” the “Company,” “we,” “our” “us”

and similar terms refer to Clean Vision Corporation, a Nevada corporation, together with its consolidated subsidiaries, unless the context

otherwise requires.

Prospectus Summary

This summary highlights selected information contained

elsewhere in this prospectus. This summary does not contain all the information that you should consider before investing in our securities.

You should carefully read the entire prospectus including “Risk Factors,” “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” and our Financial Statements and the related notes included elsewhere in this

prospectus, before making an investment decision.

Overview

We are a new entrant in the clean energy and waste-to-energy

industries focused on clean technology and sustainability opportunities. Currently, we are focused on providing a solution to the plastic

waste problem by recycling the waste and converting it into saleable byproducts, such as hydrogen and other clean-burning fuels that can

be used to generate clean energy. Using a technology known as pyrolysis, which heats the feedstock (i.e., plastic) at high temperatures

in the absence of oxygen so that the material does not burn, we are able to turn the feedstock into i) low sulfur fuel, ii) clean hydrogen

and iii) carbon black or char (char is created in the pyrolysis of plastic). We have not generated revenue to date and intend to generate

revenue from three sources: service revenue from the recycling services we provide, revenue generated from the sale of the byproducts,

and revenue generated from the sale of fuel cell equipment. Our mission is to aid in solving the problem of cost-effectively upcycling

the vast amount of waste plastic generated on land before it flows into the world’s oceans.

We currently operate through our wholly-owned subsidiary,

Clean-Seas, Inc. (“Clean-Seas”), which we acquired on May 19, 2020. Clean-Seas acquired its first pyrolysis unit in November

2021 for use in a pilot project in India, which began operations in early May 2022. We believe that this pilot project will showcase our

ability to pyrolyze waste plastic (using pyrolysis), which will generate three byproducts: i) low sulfur fuel, ii) clean hydrogen, AquaHtm,

and iii) char. We intend to sell the majority of the byproducts, while retaining a small amount of the low sulfur fuels and/or hydrogen

to power our facilities and equipment. To date, we have not generated any revenue from the provision of pyrolysis services nor have we

generated any revenue from the sale of byproducts from our operations in India or fuel cell equipment and we do not currently have any

contracts in place to sell these byproducts or fuel cell equipment. However, we believe that there is a strong market for low sulfur fuel

and clean hydrogen, upon which we intend to focus our byproduct sales.

According to analysis and projections reported by

the U.S. Energy Information Administration (“EIA”) on April 7, 2022, it is estimated that 98.3 million barrels per day of

petroleum and liquid fuels were consumed globally in March 2022, an increase of 2.4 million barrels per day from March 2021. The EIA estimates

that global consumption of petroleum and liquid fuels will rise by 1.9 million barrels per day in 2023 to average 101.7 million barrels

per day.

In a report published by Markets and Markets Research

in February 2021 entitled “Hydrogen Generation Market by Application (Petroleum Refinery, Ammonia & Methanol production, Transportation,

Power Generation), Generation & Delivery Mode (Captive, Merchant), Source (Blue, Green & Grey Hydrogen), Technology, and Region-Forecast

to 2025,” the global hydrogen generation market is projected to reach $201 billion by 2025 from an estimated $130 billion in 2020,

at a compound annual growth rate (CAGR) of 9.2% during the forecast period. While the global green hydrogen market was valued at approximately

$0.8 billion in 2021, it is predicted to grow to about $10.2 billion by 2028, with a CAGR of approximately 55.2% over the projection period,

according to research and analysis published by Facts and Factors in March 2022 entitled “Green Hydrogen Market By Type (Solid Oxide

Electrolyzer, Alkaline Electrolyzer, and Proton Exchange Membrane Electrolyzer), By Use (Transport, Power Generation, and Others) By Customer

(Petrochemicals, Glass, Food & Beverages, Chemical, Medical, and Others), and By Region – Global and Regional Industry Overview,

Market Intelligence, Comprehensive Analysis, Historical Data, and Forecast 2022–2028.”

We believe that in the near future, a significant

growth sector of the economy will be in clean energy and sustainable products and services. This belief was a key factor in our shift

in our business focus in May 2020 and our acquisition of Clean-Seas, which became our wholly-owned subsidiary on May 19, 2020. Clean-Seas

believes that it has made significant progress in identifying and developing a new business model around the clean energy and waste-to-energy

sectors.

Clean Vision’s Purpose

Global plastic waste recycling is facing unprecedented

challenges. Inadequate processing infrastructure, fewer processing locales, changing laws and conventions, and political circumstances

imperil what is already a deficient response to a global problem. Developed nations, including the United States, the world’s largest

generator of plastic waste, are finding disposal of this waste increasingly difficult, due to expensive and inefficient processing capabilities;

global conventions responding to environmental implications of international plastic export; and political constraints. In January 2018,

the People’s Republic of China, which had been accepting plastic waste from countries including the U.S., implemented its National

Sword policy limiting recyclable waste imports. As a result, the worldwide recyclables market experienced drastic limits, fewer options

for disposal, resulting in a global backlog of plastic waste. Some of the recyclable material has been rerouted to Southeast Asian countries

but the market remains in upheaval, with, at best, plastic waste floating in waiting ships and at worst, illegal dumping into international

waters or incinerated.

According to an article published by the United Nations

Environment Programme (“UNEP”) on March 2, 2022, entitled “What you need to know about the plastic pollution resolution,”

the world currently produces approximately 400 million tons of plastic waste per year, with the rate of plastic production forecasted

to double by 2040. It also estimated that by 2050, there will be more plastic in the ocean by weight than fish. According to an article

published by National Geographic entitled “A Whopping 91 Percent of Plastic Isn’t Recycled,” plastic takes more than

400 years to degrade, so most of it still exists in some form. It is estimated that only 9% of plastic waste has been recycled to date,

while the vast majority (approximately 79%) is accumulating in landfills or ending up as litter in the natural environment, including

the oceans.

The waste plastics recycling industry was valued at

$55.1 billion in 2020 and is poised to become an $88 billion industry by 2030, as reported in a March 2022 report entitled “Market

value of waste recycling services worldwide 2020-2030” published by Statista. Pyrolysis is an invaluable technology that can be

used to transform certain materials, which traditional mechanical recycling technologies currently cannot handle, into clean energy and

other valuable byproducts. Pyrolysis is also an important alternative solution to handling materials that have exhausted their potential

for further traditional mechanical recycling.

The emerging markets of the world are especially critical

to the plastic pollution problem, where waste handling and collection are not supported with the same infrastructure as in developed nations.

We believe this market condition presents a unique opportunity for us. Clean-Seas intends to leverage its management’s experience

of working in the developing nations of the world for the past decade, providing renewable energy products and services to this sector

and now will provide recycling solutions and energy generation. As stated by the Organization for Economic Co-operation and Development

(OECD) in 2021, “The path to net zero requires that emerging markets transform their energy systems, yet reliance on hydrocarbons

alongside existing policy barriers pose challenges to the green transition.”

Clean Vision plans to help provide a solution to the

plastic waste problem that the world is facing, while simultaneously creating hydrogen and other clean-burning fuels that can be used

to generate clean energy.

Our Strengths

We believe that the following are the critical investment

attributes of our company:

| ● | Pilot Project Commenced. We have acquired our first pyrolysis unit for use in our pilot project

in Hyderabad, India, which began operations in May 2022. |

| ● | Large market opportunity for effective solution. Renewable energy is a large market with an unmet

need. Plastic waste disposal affects all countries, including developing nations. With a more recent focus of governments on environmentally

friendly waste removal solutions, we believe there is a large opportunity for us. |

| ● | Unique technology. Pyrolysis technology reduces organic waste while creating valuable byproducts. |

| ● | Public support for clean technologies to protect the environment. In recent years shareholders

have been focusing on environmental sustainability and more investors have been directing their investments towards companies based on

ESG factors. |

| ● | Experienced management team. Members of our management team have years of experience in the renewable

energy sector and have begun to develop relationships with several providers of pyrolysis technologies, with whom we expect to seek a

strategic partnership or business relationship as we move forward. |

| |

● |

New Approach to Vertical Supply Chain. The Plastic Conversion Network (“PCN”) is a patent-pending software network connecting sources of waste plastic (feedstock) with conversion facilities, which will produce environmentally friendly commodities. We intend to strategically locate the conversion facilities around the world in locations that are easily accessible and in close proximity to countries that produce a large amount of plastic waste. Currently, we have entered into letters of intent and/or joint venture agreements for the development of facilities in: Morocco, France, Turkey, Sri Lanka, Puerto Rico, Arizona, Massachusetts and Michigan. |

Our Growth Strategy

We plan to provide tailored solutions to our customers

to produce clean energy primarily out of the treatment of waste. We are currently focused on waste-to-energy projects in Morocco, India,

France, Turkey, Sri Lanka, Puerto Rico, Arizona, Massachusetts and Michigan due to their proximity to plastic waste, as well as business

relationships that have been developed by the management team of Clean Vision with entities and/or municipalities in such countries. We

believe there is a virtually endless supply of waste for such projects and the demand for energy (particularly from such projects) is

growing consistently.

Another component of the clean energy and waste-to-energy

industry in the United States is environmental credits. Recycling of waste plastic mitigates the need for fossil fuels for energy generation

and the production of clean-burning diesel. We plan to aggregate these off-sets and sell them to users of fossil fuels in the form of

carbon credits or renewable energy credits depending on the location of the facilities and local market conditions. These can be used

as off-set as more governments impose a “Carbon-tax” on the end users of fossil fuels. In addition, we expect that in the

coming years, there will be new exchanges coming online specifically focused on plastic waste, and credits will be sought after, allowing

producers of plastic waste to off-set their plastic footprint, much like what has happened in the carbon markets.

We currently expect our projects to generate revenue

in several ways:

| ● | Gate Fees or Tipping Fees. It is anticipated that these fees will be paid to us to accept

waste from a government, municipality, or corporate entity that must dispose of its waste. Fees are paid to accept this feedstock (which

will be waste plastic for our Company) on a per ton basis. Gate fees are expected to vary in range from approximately $35 to $105 per

ton, depending on the jurisdiction, land availability, and daily volumes of waste. |

| ● | Sale of Hydrogen and Other Fuels. Once functional, our anticipated pyrolysis recycling facility

will convert waste into hydrogen and other clean-burning fuels. This hydrogen and other fuels can be sold to off-takers as an alternative

cleaner fuel for marine use, electrical generators, or refined into a clean-burning road grade fuel. Depending on the installation, this

fuel output product can be sold to a local fuel distributor or used in the generator sets for the generation of electricity as above. |

| ● | Commodity Sales. An additional output product of the technologies is char or carbon black,

which is used for the manufacturing of tires, bonding agents, roadway surfaces, and more. We intend to enter into agreements with consumers

of carbon black to which we will sell this output product . |

| ● | Environmental Credits. Recycling of waste plastic mitigates the need for fossil fuels for

energy generation and the production of clean-burning diesel. These off-sets can be aggregated and sold to users of fossil fuels in the

form of carbon credits or renewable energy credits depending on the location of the facilities and local market conditions. These can

be used as off-set as more governments impose a “Carbon-tax” on the end users of fossil fuels. |

| |

● |

Equipment

Sales. We have entered into a licensing agreement with Kingsberry Fuel Cell, Inc. (“Kingsbury”) whereby

we have obtained the exclusive, worldwide rights (exclusive of the United States and Canada) to Kingsberry’s fuel cell intellectual

property for a term of five years, which we intend to sell to third-parties throughout the world. These sales will provide a revenue

stream to us, as well as recurring revenue through a royalty model and ongoing service. |

Summary of Risks

Before you invest in our securities, you should carefully

consider all the information in this prospectus, including matters set forth in the section of this prospectus entitled “Risk Factors”.

We believe that the following are some of the major risks and uncertainties that may affect us:

| ● | We have a history of operating losses and will likely continue to generate operating losses. |

| ● | We may not be able to achieve or sustain profitability, and we have not generated revenue from operations

to date. |

| ● | We recently shifted to a new business line, are at an early stage of development of our current business

line and we have a limited operating history, which makes it difficult to evaluate our business and prospects. |

| ● | The equipment that is required for our operations is expensive and to date we have only acquired three

pyrolysis units. |

| ● | We require additional financing, and we may not be able to raise funds on favorable terms or at all. |

| ● | Our independent registered public accounting firm has expressed substantial doubt about our ability to

continue as a going concern. |

| ● | We are a holding company without any operations of our own and depend on our subsidiaries for cash to

meet our obligations. |

| |

● |

We

have not generated sufficient revenue or cash flow to pay our convertible debt, in the amount of $660,000 as of January 18, 2023. |

| ● | Servicing our debt requires a significant amount of cash. |

| ● | Covenant restrictions under our indebtedness may limit our ability to operate our business. |

| ● | Our success depends on the acceptance of our products and services and that our products and services

will develop and grow. |

| ● | As public awareness of the benefits of fuel converted from waste plastic grows, we expect competition

to increase. |

| ● | We face risks with obtaining raw materials. |

| ● | We do not believe that we will be able to negotiate worldwide exclusive rights to the technology we will

need to acquire. |

| ● | Project construction and development requires significant outlays of capital and is subject to numerous

risks. |

| ● | Our business model will depend on performance by third parties under contractual arrangements. |

| ● | The COVID-19 global health crisis may impact our planned operations and adversely impact our business. |

| ● | Our operations in foreign markets could cause us to incur additional costs and risks associated with doing

business internationally. |

| ● | Volatility in foreign exchange currency rates could adversely affect our financial condition and results

of operations. |

| ● | Operations in the developing world could cause us to incur additional costs and risks associated with

doing business in developing markets. |

| ● | Our business and reputation could be adversely affected if we or third parties with whom we have a relationship

fail to comply with United States or foreign anti-corruption laws or regulations. |

| ● | If we are unable to maintain our corporate reputation, our business may suffer. |

| ● | Our operations could be impacted by natural disaster. |

| ● | Delays in collection, or non-collection, of our accounts receivable could adversely affect our business,

financial position, results of operations and liquidity. |

| ● | Our patent application may not issue as a patent, which may have a material adverse effect on our ability

to prevent others from commercially exploiting products similar to ours. |

| ● | We may not be able to prevent others from unauthorized use of our intellectual property, which could harm

our business and competitive position. |

| |

● |

We

currently have no issued patents and one patent pending. If

any issued patent expires or is not maintained, our patent applications are not granted or our patent rights are contested, circumvented,

invalidated or limited in scope, we may not be able to prevent others from selling, developing or exploiting competing technologies

or products, which could have a material adverse effect on our business, prospects, financial condition, results of operations, and

cash flows. |

| ● | We may become subject to claims that we or our employees have wrongfully used or disclosed alleged trade

secrets. |

| ● | A significant portion of our intellectual property is not protected through patents or formal copyright

registration. |

| ● | Confidentiality agreements may not adequately prevent disclosure of trade secrets and other proprietary

information. |

| ● | We may need to defend ourselves against patent, copyright or trademark infringement claims. |

| ● | We are subject to extensive government regulation and changes thereto could have a material adverse effect

on our business and financial condition, results of operations and cash flows. |

| ● | We may be unable to obtain, modify, or maintain the required regulatory permits, approvals and consents

for our projects. |

| ● | We are subject to environmental laws and potential exposure to environmental liabilities. |

| ● | Changes in applicable laws and regulations can adversely affect our business, financial condition and

results of operations. |

| ● | We do not yet have adequate internal controls and our failure to achieve and maintain effective internal

control over financial reporting could have a material adverse effect on our business and share price. |

| ● | We will incur significant increased costs as a result of operating as a public company and our management

will be required to devote substantial time to new compliance initiatives. |

| ● | Our ability to utilize our net operating loss carryforwards and certain other tax attributes may be limited. |

| ● | Our stock price has been volatile and may continue to be volatile. |

| ● | The price of our Common Stock may have little or no relationship to the historical bid prices of our Common

Stock on the OTCQB. |

| ● | We have a substantial number of authorized common shares available for future issuance that could cause

dilution of our stockholders’ interest and adversely impact the rights of holders of our Common Stock. |

| ● | The holders of our Series B Convertible Non-Voting Preferred Stock and our Series C Convertible Preferred

Stock are protected from dilution upon future issuances of our Common Stock. |

| ● | Dan Bates, our CEO and Chairman, owns 2,000,000 shares of Series C Convertible Preferred Stock of

the Company, which shares of Series C Convertible Preferred Stock, vote together with our Common Stock on all stockholder matters,

and vote one hundred Common Stock votes per share. If securities or industry analysts do not publish research or reports about our

business, or if they downgrade their recommendations regarding our Common Stock, its trading price and volume could decline. |

| ● | Stockholders may face significant restrictions on the resale of our Common Stock due to federal regulations

of penny stocks. |

| ● | Stockholders who hold unregistered shares of our Common Stock will be subject to resale restrictions pursuant

to Rule 144. |

| ● | You will suffer immediate and substantial dilution in the net tangible book value of the Common Stock

you purchase. |

| ● | Daniel Bates, our Chief Executive Officer, exercises majority voting control of the Company, which will

limit your ability to influence corporate matters and could delay or prevent a change in corporate control. |

| ● | We rely on our management and if they were to leave our Company or not devote sufficient time to our company,

our business plan could be adversely affected. |

| ● | Our Bylaws provide for indemnification of officers and directors at our expense. |

| ● | Anti-takeover provisions in our Bylaws, as well as provisions of Nevada law, might discourage, delay or

prevent a change in control of our company or changes in our management. |

| ● | The JOBS Act allows us to postpone the date by which we must comply with certain laws and regulations

and to reduce the amount of information provided in reports filed with the SEC. |

| ● | Our election not to opt out of the JOBS Act’s extended accounting transition period may not make

our financial statements easily comparable to other companies. |

| ● | Global, regional and U.S. economic and geopolitical conditions may have adverse effects on our business

and financial condition. |

| ● | Many of our competitors and potential competitors may have substantially greater financial resources,

customer support, technical and marketing resources, larger customer bases, longer operating histories, greater name recognition and more

established relationships than we do. |

| ● | We may not maintain sufficient insurance coverage for the risks associated with our business operations. |

| ● | We do not anticipate paying any cash dividends. |

| ● | Any failure to protect our intellectual property rights could impair our ability to protect our technology

and our brand. |

| ● | Failure to adequately manage our planned aggressive growth strategy may harm our business. |

| ● | If we make any acquisitions, they may disrupt or have a negative impact on our business. |

| ● | We rely on network and information systems and other technologies for our business activities and certain

events, such as computer hackings, viruses or other destructive or disruptive software or activities may disrupt our operations. |

| ● | We may apply working capital and future funding to uses that ultimately do not improve our operating results

or increase the value of our securities. |

| ● | Claims, litigation, government investigations, and other proceedings may adversely affect our business

and results of operations. |

| ● | We may incur indebtedness in the future which could reduce our financial flexibility, increase interest

expense and adversely impact our operations and our costs. |

Implications of Being an Emerging Growth Company

and a Smaller Reporting Company

As a company with less than $1.237 billion in revenue

during our last fiscal year, we qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act

of 2012, or the JOBS Act. As an emerging growth company, we have elected to take advantage of reduced reporting requirements and are relieved

of certain other significant requirements that are otherwise generally applicable to public companies. As an emerging growth company:

| |

● |

we may present only two

years of audited financial statements and only t0wo years of related Management’s Discussion and Analysis of Financial Condition

and Results of Operations; |

| |

● |

we are exempt from the

requirement to obtain an attestation and report from our auditors on whether we maintained effective internal control over financial reporting

under the Sarbanes-Oxley Act; |

| |

● |

we are permitted to provide

less extensive disclosure about our executive compensation arrangements; and |

| |

● |

we are not required to

give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

If

we successfully consummate an offering of our common stock on the Nasdaq Stock Market LLC

(“Nasdaq”), we may take advantage of these provisions until the last day of the

fiscal year following the fifth anniversary of such initial public offering) if we continue

to be an emerging growth company thereafter. We will continue to remain an “emerging

growth company” until the earliest of the following: (i) the last day of the fiscal

year following the fifth anniversary of the date of the completion of our listing on Nasdaq;

(ii) the last day of the fiscal year in which our total annual gross revenue is equal to

or more than $1.07 billion; (iii) the date on which we have issued more than $1 billion in

nonconvertible debt during the previous three years; or (iv) the date on which we are deemed

to be a large accelerated filer under the rules of the United States Securities and

Exchange Commission (the “SEC”).

We are also a “smaller reporting company”

as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and have elected to take advantage of certain of the

scaled disclosures available to smaller reporting companies. To the extent that we continue to qualify as a “smaller reporting company”

as such term is defined in Rule 12b-2 under the Exchange Act, after we cease to qualify as an emerging growth company, certain of the

exemptions available to us as an “emerging growth company” may continue to be available to us as a “smaller reporting

company,” including exemption from compliance with the auditor attestation requirements pursuant to Sarbanes-Oxley Act and reduced

disclosure about our executive compensation arrangements. We will continue to be a “smaller reporting company” until we have

$250 million or more in public float (based on our Common Stock) measured as of the last business day of our most recently completed second

fiscal quarter or, in the event we have no public float (based on our Common Stock) or a public float (based on our Common Stock) that

is less than $700 million, annual revenues of $100 million or more during the most recently completed fiscal year.

We may choose to take advantage of some but not all

of these reduced burdens. We have taken advantage of reduced reporting requirements in this prospectus. Accordingly, the information contained

herein may be different from the information you receive from other public companies in which you hold stock. In addition, the JOBS Act

provides that an emerging growth company may take advantage of an extended transition period for complying with new or revised accounting

standards, delaying the adoption of these accounting standards until they would apply to private companies. We have elected to avail ourselves

of the extended transition period for complying with new or revised financial accounting standards. As a result of the accounting standards

election, we will not be subject to the same implementation timing for new or revised accounting standards as other public companies that

are not emerging growth companies which may make comparison of our financials to those of other public companies more difficult.

Recent Developments

Securities Purchase Agreement and Promissory Note

On December 9, 2022, the Company entered into the

Purchase Agreement with Coventry, pursuant to which the Company issued to Coventry on that date a Promissory Note (the “Note”)

in the principal amount of $300,000 (the “Principal Amount”) in exchange for a purchase price of $255,000. The proceeds of

the Note will be used by the Company for general working capital purposes. In addition, the Company issued to Coventry 15,500,000 shares

of Common Stock (the “Commitment Stock”), of which 12,500,000 shares of Commitment Stock are to be returned to the Company

upon the Company’s filing of the registration statement of which this prospectus forms a part on or before 45 calendar days after

the date of the Purchase Agreement.

Per the terms of the Purchase Agreement the Company

issued 15,500,000 shares of its Common Stock to Coventry. If the Company files an initial Registration Statement within forty-five calendar

days from the date of the Note, then Coventy, pursuant to its mandatory obligations thereunder, shall, within ten (10) calendar days thereafter,

return to the Company’s treasury for cancellation twelve million five hundred thousand (12,500,000) shares of Common Stock.

The Note bears “Guaranteed Interest” at

the rate of 5% per annum for the 12 months from and after the date of issuance (notwithstanding the 11-month term of the Note for an aggregate

Guaranteed Interest of fifteen thousand Dollars ($15,000.00), all of which Guaranteed Interest shall be deemed earned as of the date of

the Note. The Principal Amount and the Guaranteed Interest are due and payable in seven equal monthly payments (each, a “Monthly

Payment”) of forty-five thousand and 00/100ths Dollars ($45,000.00), commencing on May 6, 2023 and continuing on the 6th

day of each month thereafter (each, a “Monthly Payment Date”) until paid in full not later than November 6, 2023 (the “Maturity

Date”), or such earlier date as the Note is required or permitted to be repaid as provided therein, and to pay such other interest

to Coventry on the aggregate unconverted and then outstanding Principal Amount of the Note in accordance with the provisions thereof.

Project Finance Arrangement

On November 4, 2022, we entered into a consulting

agreement (the “Agreement”) with Edge Management, LLC (“Edge”), a services firm based in New York City. Under

the Agreement, Edge will assist us to develop, structure and implement project finance strategies (“Project Finance”) for

our clean energy installations around the world. Financing strategies will be in amounts and upon terms acceptable to us, and may include,

without limitation, common and preferred equity financing, mezzanine and other junior debt financing, and/or senior debt financing, including

but not limited to one or more bond offerings (“Project Financing(s)”). Under the Agreement, Edge is engaged as our exclusive

representative for Project Financing matters. Edge is entitled to receive a cash payment for any Project Financing involving as follows:

5% of the gross amount of the funding facilities (up to $500 million) of all forms approved by the lender (“Lender”) introduced

by Edge and or its affiliates and accepted by the Company on closing (“Closing”), 4% of the gross amount of the funding facilities

(for the tranche of funding ranging from $500,000,001 to $1,000,000,000) approved by the Lender introduced by Edge and or its affiliates

and accepted by the Company on Closing, and 3% of the subsequent gross amount ($1,000,000,001 and greater) of the funding facilities of

all forms approved by the Lender introduced by Edge and/or its affiliates and accepted by the Company on Closing. In addition to the cash

consulting fee, Edge shall be issued cashless, five-year warrants equal to: 2% (at a strike price to be mutually determined by the Parties

for the first tranche of funding, up to $500 million), 1% (at a strike price to be mutually determined by the Parties for the tranche

of funding ranging from $500,000,001 to $1,000,000,000), and 1% (at a strike price to be mutually determined by the Parties for any and

all subsequent Debt Funding ($1,000,000,001 and greater)) of the outstanding common and preferred shares, warrants, options, and other

forms of participation in the our Company on Closing.. The Agreement has an initial term of one (1) year and is cancellable by either

party on ninety (90) days written notice. There is no guarantee that Edge will be successful in helping us obtain Project Financing.

Corporate Information

Our principal executive offices are located at 2711

N. Sepulveda Blvd., Suite #1051, Manhattan Beach, CA 90266. Our telephone number is (424) 835-1845. Our website address is https://www.cleanvisioncorp.com.

The reference to our website is an inactive textual reference only. The information on, or that can be accessed through, our website is

not part of this prospectus. Investors should not rely on any such information in deciding whether to purchase our Common Stock.

Clean Vision was initially incorporated in Nevada

as China Vitup Health Care Holdings, Inc. on September 15, 2006. Pursuant to an Agreement and Plan of Merger and Reorganization dated

September 29, 2006, Tubac Holdings, Inc., a Wyoming corporation and a parent of the Company, was merged with and into the Company on October

2, 2006, with the Company as the surviving entity. On May 5, 2015, the Company changed its name to Emergency Pest Services, Inc. Pursuant

to a Plan of Exchange dated August 3, 2015, the Company acquired Emergency Pest Services, Inc., a Florida corporation. Pursuant to a Plan

of Exchange dated September 21, 2017, Byzen Digital Inc., a Seychelles corporation, was merged with and into the Company on November 4,

2017, with the Company as the surviving entity. On May 30, 2018, the Company changed its name to Byzen Digital Inc. On May 19, 2020, we

changed our focus to clean energy and sustainability when we acquired Clean-Seas. On March 12, 2021, the Company’s corporate name

was changed to Clean Vision Corporation to be aligned with our focus on clean energy and sustainability.

SUMMARY OF The Offering

| Issuer |

|

Clean Vision Corporation |

| |

|

|

| Shares of Common Stock offered by us |

|

None |

| |

|

|

| Shares of Common Stock offered by the Selling Shareholder |

|

23,000,000 aggregate shares of Common Stock, comprised

of (a) 3,000,000 shares of Common Stock issued to Coventry in connection with the Purchase Agreement and (b) up to

20,000,000 shares of Common Stock issuable to Coventry upon a default under the Note. |

| |

|

|

| Shares of Common Stock outstanding before the Offering |

|

414,696,273 shares (1) |

| |

|

|

| Shares of Common Stock outstanding after completion of this offering, assuming the sale of all shares offered hereby |

|

414,696,273 shares (1) |

| |

|

|

| Offering Price |

|

The Selling Shareholder may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices, or at negotiated prices. |

| |

|

|

| Use of proceeds |

|

We will not receive any proceeds from the resale of the common stock by the Selling Shareholder. |

| |

|

|

| Market for Common Stock |

|

Our common stock is quoted on OTCQB under the symbol “CLNV” |

| |

|

|

| Risk Factors |

|

The purchase of our securities involves a high degree of risk. The securities offered in this prospectus are for investment purposes only. Please refer to the section entitled “Risk Factors“ before making an investment in our Common Stock. |

You should carefully read the “Risk Factors”

section of this prospectus for a discussion of factors that you should consider before deciding to invest in our Common Stock.

(1) The number of shares of our Common Stock to

be outstanding after this offering is based on the 414,696,273 shares of our Common Stock outstanding as of January 18, 2023,

and excludes the following:

| |

● |

18,000,000 shares of Common Stock issuable upon the automatic conversion of notes in the principal amount of $360,000. |

| |

● |

20,000,000 shares of Common

Stock upon conversion of the 2,000,000 issued and outstanding Series B Convertible Non-Voting Preferred Stock, which shares automatically

converted into 20,000,000 shares of Common Stock on January 1, 2023; however, the Company and holders of the Series B Convertible

Non-Voting Preferred Stock are currently in a dispute and the Company’s Transfer Agent has been instructed to not issue

the shares of Common Stock until such dispute has been resolved. Accordingly, although the shares of Common Stock thereunder

have not been formally issued as of January 23, 2023, the shares of Series B Non-Voting Convertible Preferred Stock are no longer

outstanding. |

| |

● |

20,000,000 shares of Common Stock upon conversion of the 2,000,000 issued and outstanding Series C Convertible Preferred Stock, which shares automatically converted on January 1, 2023, but such conversion has not been effectuated as of January 23, 2023. |

| |

|

|

| |

● |

Up to 20,000,000 shares

of Common Stock issuable to Coventry upon a default under the Note. |

SUMMARY FINANCIAL DATA

The following table presents our summary historical

financial data for the periods indicated. The summary historical financial data for the years ended December 31, 2021 and 2020 and the

balance sheet data as of December 31, 2021 are derived from the audited financial statements included herein.

Historical

results are included for illustrative and informational purposes only and are not necessarily

indicative of results we expect in future periods, and results of interim periods are not

necessarily indicative of results for the entire year. You should read the following summary

financial data in conjunction with “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” and our financial statements and related

notes appearing elsewhere in this prospectus.

| Summary Statements of Operations Data | |

Year ended

December 31, 2021 | |

Year ended

December 31, 2020 | |

Nine Months Ended September 30, 2022 | |

Nine Months Ended September 30, 2021 |

| | |

| |

| |

| |

|

| Revenue, net | |

$ | — | | |

$ | — | | |

$ | — | | |

$ | — | |

| Cost of revenue | |

| — | | |

| — | | |

| — | | |

| — | |

| Gross profit | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 373,095 | | |

| 132,368 | | |

| 824,344 | | |

| 139,783 | |

| Payroll expense | |

| 1,360,518 | | |

| 400,000 | | |

| 623,549 | | |

| 1,071,527 | |

| Director fees | |

| 18,500 | | |

| — | | |

| 13,500 | | |

| — | |

| Professional fees | |

| 413,479 | | |

| 79,827 | | |

| 258,165 | | |

| 344,697 | |

| Consulting | |

| 1,955,213 | | |

| 191,500 | | |

| 1,094,768 | | |

| 1,285,319 | |

| Interest expense | |

| 1,187,033 | | |

| 522,981 | | |

| 46,256 | | |

| 1,187,033 | |

| Loss on issuance of convertible debt | |

| — | | |

| 2,006,944 | | |

| — | | |

| — | |

| Debt issuance expense - warrants | |

| — | | |

| — | | |

| 195,483 | | |

| — | |

| Loss on investment | |

| 150,000 | | |

| — | | |

| — | | |

| — | |

| Change in derivative liabilities | |

| 576,573 | | |

| (1,292,687 | ) | |

| — | | |

| 46,350 | |

| Net loss from continuing operations | |

$ | (6,034,411 | ) | |

$ | (2,040,933 | ) | |

$ | (3,056,065 | ) | |

$ | (4,074,709 | ) |

(1)

See Note 2 to our audited financial statements appearing at the end of this prospectus

for details on the calculation of basic and diluted net loss per share attributable to common

stockholders for the years ended December 31, 2021 and 2020 and Note 2 to our unaudited

condensed financial statements for details on the calculation of basic and diluted net loss

per share attributable to common stockholders for the nine months ended September 30, 2022

and 2021.

| | |

As of September

30, 2022 |

| | |

| |

| |

Pro Forma |

| | |

| |

Pro | |

As |

| Balance Sheet Data | |

Actual | |

Forma(1) | |

Adjusted(2) |

| | |

| |

| |

|

| Cash | |

$ | 2,829 | | |

| 255,000 | | |

$ | 257,829 | |

| Total assets | |

| 1,136,292 | | |

| 255,000 | | |

| 1,391,292 | |

| Total liabilities | |

| 1,315,757 | | |

| (60,000 | ) | |

| 1,255,757 | |

| Working capital

(deficit) | |

| (384,684 | ) | |

| 315,000 | | |

| (69,684 | ) |

| Accumulated deficit | |

| (16,221,150 | ) | |

| (45,000 | ) | |

| (16,266,150 | ) |

| Total stockholders’

equity (deficit) | |

| (1,979,465 | ) | |

| 360,000 | | |

| (1,619,465 | ) |

(1) The pro forma balance sheet data reflects

our receipt of $255,000 of net proceeds from the issuance of convertible notes in the principal amount of $300,000.

(2)The pro forma as adjusted balance sheet data in

the table above reflects the adjustment described in footnote (1) above plus the conversion of the notes into 18,000,000 shares

of Common Stock.

RISK FACTORS

Any investment in our securities involves a high

degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus

before deciding whether to purchase our securities. Our business, financial condition or results of operations could be materially adversely

affected by these risks if any of them actually occur. Our Common Stock is quoted on the OTCQB under the symbol CLNV. This market is extremely

limited, and the prices quoted are not a reliable indication of the value of our Common Stock. As of the date of this prospectus, there

has been very limited trading of shares of our Common Stock. If and when our Common Stock is traded, the trading price could decline due

to any of these risks, and an investor may lose all or part of his or her investment. Some of these factors have affected our financial

condition and operating results in the past or are currently affecting us. This prospectus also contains forward-looking statements that

involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements

as a result of certain factors, including the risks described below and elsewhere in this prospectus.

Risks Relating to Our

Business and Industry

Our independent registered

public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

We have insufficient cash

on hand, a working capital deficit of $384,684 and incurred net losses from operations resulting in an accumulated deficit of $16,221,150,

as of September 30, 2022. For the nine months ended September 30, 2022, we had a net loss of $3,056,065, while we had a net loss of $6,034,411

for the year ended December 31, 2021. As of the date of this prospectus, we anticipate that we will only be able to fund our current operations

through March 31, 2023, based upon our current financial standing. As a result, our independent registered public accounting firm has

issued a report on our financial statements for the period ended December 31, 2021, that includes an explanatory paragraph referring to

our recurring operating losses and expressing substantial doubt in our ability to continue as a going concern. Our ability to continue

as a going concern is dependent upon our ability to obtain additional equity financing or other capital, attain further operating efficiencies,

reduce expenditures, and, ultimately, generate revenue. Our financial statements do not include any adjustments that might result from

the outcome of this uncertainty. However, if adequate funds are not available to us when we need it, we will be required to curtail our

operations which would, in turn, further raise substantial doubt about our ability to continue as a going concern. The doubt regarding

our potential ability to continue as a going concern may adversely affect our ability to obtain new financing on reasonable terms or at

all. Additionally, if we are unable to continue as a going concern, our stockholders may lose some or all of their investment in the Company.

We have a history of

operating losses; will likely continue to generate operating losses and we may not be able to achieve or sustain profitability.

We are not profitable and

have incurred an accumulated deficit of $16,221,150 as of September 30, 2022. For the nine months ended September 30, 2022, we had a net

loss of $3,060,160, while we had a net loss of $6,034,411 for the year ended December 31, 2021. We expect to continue to incur losses

for the foreseeable future, and these losses could increase as we continue to work to develop our business. We were previously engaged

in the digital currency industries. In May 2020 we identified a new direction for the Company when we acquired Clean-Seas and we adopted

a new business strategy focused on clean energy and converting waste to energy. We have yet to commence profitable operations in either

of those businesses, therefore, the Company is continuing to incur operating losses. There can be no assurance that we will ever generate

significant sales or achieve profitability. Accordingly, the extent of future losses and the time required to achieve profitability, if

ever, cannot be predicted.

Even if we achieve profitability

in the future by adopting these new business strategies, we may not be able to sustain profitability in subsequent periods.

We also expect to experience

negative cash flows for the foreseeable future as we fund our operating losses. We may not be able to generate these revenues or achieve

profitability in the future. Our failure to achieve or maintain profitability would likely negatively impact the value of our securities

and financing activities.

To date, we have not

generated revenue from operations and we may not generate revenue from operations or that sources of revenue from financing will be available

in the future.

To date, we have not generated

any revenue from operations and have financed our operations through the sale of Common Stock in our Regulation A offering and the proceeds

from the sale of convertible notes. There can be no assurance that we will generate revenue from operations or that sources of revenue

from financing will be available or if available will be available upon favorable terms. If we raise

additional funds by issuing equity securities, our stockholders may experience dilution. Debt financing, if available, may involve agreements

that include covenants limiting or restricting our ability to take specific actions, such as incurring additional debt, making capital

expenditures or declaring dividends. Any debt financing or additional equity that we may raise may contain terms, such as liquidation

and other preferences, that are not favorable to us or our stockholders.

We recently shifted

to a new business line, are at an early stage of development of our current business line and we have a limited operating history, which

makes it difficult to evaluate our business and prospects.

In May 2020, we shifted our

business focus from the digital currency industry to the clean energy and waste to energy industries. We have a limited operating history

in our current business line, which can make it difficult for investors to evaluate our operations and prospects and may increase the

risks associated with investment into our company. We have insufficient results for investors to

use to identify historical trends. Investors should consider our prospects considering the risk, expenses and difficulties we will encounter

as an early-stage company. We have yet to demonstrate our ability to overcome the risks frequently

encountered in the clean energy and waste to energy industries and are still subject to many

of the risks common to early stage companies, including the uncertainty as to our ability to implement our business plan, market acceptance

of our proposed business and services, under-capitalization, cash shortages, limitations with respect to personnel, financing and other

resources and uncertainty of our ability to generate revenues. There is no assurance that our activities will be successful or will result

in any revenues or profit, and the likelihood of our success must be considered in light of the stage of our development. There can be

no assurance that we will be able to consummate our business strategy and plans, or that financial, technological, market, or other limitations

may force us to modify, alter, significantly delay, or significantly impede the implementation of such plans. Our business plan

is subject to all business risks associated with new business enterprises, including the absence of any significant operating history

upon which to evaluate an investment. The likelihood of our success must be considered in light of the problems, expenses, difficulties,

complications and delays frequently encountered in connection with the formation of a new business, the development of new strategy and

the competitive environment in which we will operate. It is possible that we will incur losses in the future. Our

revenue and income potential is unproven and our business model is continually evolving. We are subject to the risks inherent to the operation

of a new business enterprise and cannot assure you that we will be able to successfully address these risks. There is no guarantee

that we will be profitable, that our business will generate sufficient revenue or that we will have adequate working capital to meet its

obligations as they become due.

Additionally, our industry

segments are relatively new, and are constantly evolving. As a result, there is a lack of available information with which to forecast

industry trends or patterns. There is no assurance that sustainable industry trends or preferences will develop that will lead to predictable

growth or earnings forecasts for individual companies or the industry segment as a whole. We are also unable to determine what impact

future governmental regulation may have on trends and preferences or patterns within our industry segment.

The equipment that

is required for our operations is expensive and to date we have only acquired three pyrolysis units

To date, we have acquired

three pyrolysis units. In order to implement our business plan, we estimate that we will need to acquire several additional units. We

estimate that each unit we will acquire will cost approximately $16 million and will take approximately 12-24 months to receive from time

of order, therefore, we will be required to outlay significant funds prior to receipt of units. Pyrolysis equipment could cost as much

as $100 million, but we intend to use our efforts to purchase such equipment at the best available prices..

We require additional

financing, and we may not be able to raise funds on favorable terms or at all.

We anticipate requiring further

funds in the future to grow our operations and complete our business plan. The sources of additional capital are expected to be from the

sale of securities. Any future sale of share capital will result in dilution to existing stockholders. Furthermore, we may incur debt

in the future, and may not have sufficient funds to repay our future indebtedness or may default on our future debts, jeopardizing our

business viability.

We may not be able to borrow

or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to expand our operations and

business, which might result in the value of our securities decreasing in value or becoming worthless. Additional financing may not be

available to us on terms that are acceptable, or at all. Consequently, we may not be able to proceed with our intended business plans.

Obtaining additional financing contains risks, including:

| ● | additional equity financing may not be available to us on satisfactory terms, or at all, and any equity

we are able to issue could lead to dilution for current stockholders; |

| ● | loans or other debt instruments may have terms and/or conditions, such as interest rate, restrictive covenants

and control or revocation provisions, which are not acceptable to management or our directors; |

| ● | the current environment in capital markets combined with our capital constraints may prevent us from being

able to obtain adequate debt financing; and |

| ● | if we fail to obtain required additional financing to grow our business, we would need to delay or scale

back our business plan, reduce our operating costs, or reduce our hea0dcount, each of which would have a material adverse effect on our

business, future prospects, and financial condition. |

Additionally, we may have

difficulty obtaining additional funding, and we may have to accept terms that would adversely affect our stockholders. For example, the

terms of any future financings may impose restrictions on our right to declare dividends or on the manner in which we conduct our business.

Additionally, lending institutions or private investors may impose restrictions on a future decision by us to make capital expenditures,

acquisitions or significant asset sales. If we are unable to raise additional funds, we may be forced to curtail or even abandon our business

plan.

Failure to adequately manage our planned aggressive

growth strategy may harm our business or increase our risk of failure.

For the foreseeable future, we intend to pursue an

aggressive growth strategy for the expansion of our operations. Our ability to rapidly expand our operations will depend upon many factors,

including our ability to work in a regulated environment, establish and maintain strategic relationships, and obtain adequate capital

resources on acceptable terms. Any restrictions on our ability to expand may have a materially adverse effect on our business, results

of operations, and financial condition. Accordingly, we may be unable to achieve our targets for growth, and our operations may not be

successful or achieve anticipated operating results.

Additionally, our growth may place a significant strain

on our managerial, administrative, operational, and financial resources and our infrastructure. Our future success will depend, in part,

upon the ability of our senior management to manage growth effectively. This will require us to, among other things:

| |

● |

implement additional management information systems; |

| |

|

|

| |

● |

further develop our operating, administrative, legal, financial, and accounting systems and controls; |

| |

|

|

| |

● |

hire additional personnel; |

| |

|

|

| |

● |

develop additional levels of management within our company; and |

| |

|

|

| |

● |

maintain close coordination among our operations, legal, finance, sales and marketing, and client service and support personnel. |

Failure to accomplish any of these requirements could

impair our ability to grow and expand our operations.

We are a holding company without any operations

of our own and depend on our subsidiaries for cash to meet our obligations.

We are a holding company

and conduct all of our operations through our subsidiaries. Accordingly, repayment of our indebtedness, including the senior notes, in

part, is dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by debt repayment

or otherwise. Unless they are guarantors of the senior notes or other indebtedness, our subsidiaries do not have any obligation to pay

amounts due on our indebtedness or to make funds available for that purpose. Our subsidiaries may not be able to, or may not be permitted

to, make distributions to enable us to make payments in respect of our indebtedness. Each of our subsidiaries is a distinct legal entity,

and, under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries. In the

event that we do not receive distributions from our subsidiaries, we may be unable to make required principal and interest payments on

our indebtedness, including the senior notes.

We have not generated

sufficient revenue or cash flow to pay our convertible debt, and conversion of such debt into shares of Common Stock, which could cause

significant dilution.

As of January 18,

2023, we had outstanding convertible debt in the principal amount of $660,000. To date, we have not generated sufficient revenue or cash

flows to pay the balances owed under these notes and provide sufficient working capital to run our business. The outstanding principal

amount of the notes is convertible at any time and from time to time at the election of the holder after certain periods of time into

shares of our Common Stock at discounts to the market price of our Common Stock. In addition, upon the occurrence and during the continuation

of an Event of Default (as defined in the notes), the notes each will become immediately due and payable and we have agreed to pay additional

default interest rates. We may not have sufficient cash resources or access to funding to repay such notes. Moreover, upon conversion

of these notes, our current shareholders will suffer dilution, which could be significant.

Servicing our debt

requires a significant amount of cash. Our ability to generate sufficient cash to service our debt depends on many factors beyond our

control.

Our ability to make payments

on and to refinance our debt, to fund planned capital expenditures and to maintain sufficient working capital depends on our ability to

generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, legislative, regulatory

and other factors that are beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations

or from other sources in an amount sufficient to enable us to service our debt or to fund our other liquidity needs. If our cash flow

and capital resources are insufficient to allow us to make scheduled payments on our debt, we may need to seek additional capital or restructure

or refinance all or a portion of our debt on or before the maturity thereof, any of which could have a material adverse effect on our

business, financial condition or results of operations. We cannot assure you that we will be able to refinance any of our debt on commercially

reasonable terms or at all, or that the terms of that debt will allow any of the above alternative measures or that these measures would

satisfy our scheduled debt service obligations. If we are unable to generate sufficient cash flow to repay or refinance our debt on favorable

terms, it could significantly adversely affect our financial condition and the value of our outstanding debt. Our ability to restructure

or refinance our debt will depend on the condition of the capital markets and our financial condition. Any refinancing of our debt could

be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations.

There can be no assurance that we will be able to obtain any financing when needed.

Covenant restrictions

under our indebtedness may limit our ability to operate our business.

Our outstanding convertible

notes contain, and our future indebtedness agreements may, contain covenants that restrict our ability to finance future operations or

capital needs or to engage in other business activities. The notes restrict our ability to:

| |

● |

incur, assume or guarantee or suffer to exist any indebtedness for borrowed money of any kind, including, but not limited to, a guarantee, on or with respect to any of its property or assets now owned or hereafter acquired or any interest therein or any income or profits therefrom other than Permitted Indebtedness (as defined in the notes); |

| |

|

|

| |

● |

repurchase capital stock; |

| |

|

|

| |

● |

repay any Indebtedness (as defined in the notes) other than certain secured notes which are no longer outstanding or Permitted Indebtedness or make other restricted payments including, without limitation, paying dividends and making investments; |

| |

|

|

| |

● |

create liens; |

| |

|

|

| |

● |

sell or otherwise dispose of assets; and |

| |

|

|

| |

● |

enter into transactions with affiliates. |

In addition, the notes contain

price protection anti-dilution provisions that will discourage financing at prices below the conversion price of the notes and will result

in a decrease in the conversion price of the notes if we should issue securities below such price.

Our future success

depends on the acceptance of our products and services, which may not happen, and that our products and services will develop and grow.

Our entire business is based

on the assumption that the demand for our products and services will develop and grow. We cannot assure you that this assumption is or

will be correct. Although the market for clean energy and waste-to-energy is large, the market for fuel converted from waste through pyrolysis

is new and currently quite small. As is typical of a new and rapidly evolving industry, the demand for, and market acceptance of, “green-based”

products and services is highly uncertain. In order to be successful, we must be able to keep our understandings in place with the suppliers

of our products and educate consumers that our products perform as well as the products they currently use. We can provide no assurances

that these efforts will be successful. Similarly, we cannot assure you that the demand for our products and services will develop as anticipated.

If the market for our products fails to develop or develops more slowly than we anticipate, our business could be adversely affected.

As public awareness

of the benefits of fuel converted from waste grows, we expect competition to increase, which could make it more difficult for us to grow

and achieve profitability.

We expect competition to

increase as awareness of the environmental advantages of converting waste into fuel increases. A rapid increase in competition could negatively

affect our ability to develop a profitable client base. Many of our competitors and potential competitors may have substantially greater

financial resources, customer support, technical and marketing resources, larger customer bases, longer operating histories, greater name

recognition and more established relationships than we do. We cannot be sure that we will have the resources or expertise to compete successfully.

Compared to us, our competitors may be able to:

| |

● |

develop and expand their products and services more quickly; |

| |

|

|

| |

● |

adapt faster to new or emerging technologies and changing customer needs and preferences; |

| |

|

|

| |

● |

take advantage of acquisitions and other opportunities more readily; |

| |

|

|

| |

● |

negotiate more favorable agreements with vendors and customers; and |

| |

|

|

| |

● |

devote greater resources to marketing and selling their products or services. |

Some of our competitors may

also be able to increase their market share by providing customers with additional benefits or by reducing their prices. We cannot be

sure that we will be able to match price reductions by our competitors. In addition, our competitors may form strategic relationships

to better compete with us. These relationships may take the form of strategic investments, joint-marketing agreements, licenses or other