NetworkNewsWire

Editorial Coverage: With global electric vehicle (EV) demand

growth creating the potential for tight supplies in battery metals

such as cobalt, multinational companies and industrialized nations

are working to secure these critical metals as prices are projected

to rise.

- The growing market for electric vehicles has led to much higher

demand for battery metals such as cobalt, lithium and nickel.

- As the largest producer of EVs and largest consumer of battery

metals in the world, China is aggressively looking to secure

additional supplies of these critical minerals.

- Savvy companies are looking to lock in long-term supplies of

battery metals.

Driven by the technological advances and environmentally

friendly advantages offered by electric vehicles, the long-awaited

EV revolution seems to be taking hold. Numerous global corporations

are competing for access to limited supplies of battery metals.

Prospective cobalt producer Pacific Rim Cobalt Corp.

(OTCQB: PCRCF) (CSE: BOLT) (PCRCF

Profile), which just released a detailed corporate update, looks to be in an ideal

position to supply those corporations with cobalt. Major miners

such as BHP Group Limited (NYSE: BHP),

Freeport-McMoRan Inc. (NYSE: FCX) and VALE

S.A. (NYSE: VALE) could play a role in growing the global

supply of nickel, cobalt and lithium. Apple Inc. (NASDAQ:

AAPL) took the extraordinary step of looking for direct

supplies of cobalt last year, which shows how heated the battery

metals market has become.

To view an infographic of this editorial, click here.

EVs Challenge the Global Supply Chain, Drive Innovation

The rise in EV popularity has created a rush to buy and create

new supplies of battery metals because, unlike a normal auto, EVs

require large amounts of nickel, cobalt and lithium. Investment

bank Goldman Sachs

predicts that sales of batteries to power EVs will rise from

under $10 billion to $60 billion by 2030, which will require that

the global availability of battery metals expands to meet swelling

demand.

In addition to creating new demand for battery metals, EVs are

also challenging nations to compete in order to expand

battery-producing capacity. Chinese, Japanese and South Korean

companies are all working to

build-out their battery production infrastructure at a rapid pace.

China’s BYD Auto. Company is currently one of the largest producers

of both EVs and batteries for EVs. The company plans to expand its

battery manufacturing capacity to 60 gigawatt hours by 2020, nearly

half of China's total battery manufacturing capacity in 2017.

BYD is part of the Chinese government's plan to become a world

leader in EV production. Beijing has spent billions of dollars to

support the EV industry over the last decade. According to Chinese

research company Gaogong Industry Research Institute, Chinese

battery makers held seven of the top 10

slots on the list of the world's largest suppliers of

lithium-ion batteries for EVs last year. BYD ranked third globally,

and China's Contemporary Amperex Technology Ltd. (CATL) ranked as

the world's top EV battery manufacturer. Bloomberg New Energy

Finance estimates that China will produce 70 percent of the world's

electric-vehicle batteries by 2021.

China Isn't Alone in the Battery Build-Out

China wasn't the first country to build large-scale battery

manufacturing facilities for EVs. Both Japan and South Korea have

extensive battery fabrication operations, and major companies in

both nations plan to expand their capacity over the next decade.

According to JATO Dynamics, only 668,000

battery-powered cars were sold worldwide in 2017, but

year-over-year growth was strong at 78 percent. Roughly 82 million

passenger cars were sold in the same year, which offers some idea

of the potential market size for EVs.

There is neither a lack of government support nor a lack of

demand for EVs. One of the only areas where EV growth could face

problems may be the supply of battery metals such as nickel,

lithium and especially cobalt. Until recently, cobalt was a

by-product metal and hadn’t been mined as a primary mine product

since the World War II. In addition, currently, more than 60

percent of the world's cobalt is mined in the Democratic Republic

of Congo. Not only is the DRC difficult from a labor-rights

perspective, the country also has a long history of violence and an

inconsistent record of shipping mineral

resources.

Battery producers located in Asia are eager to secure access to

cobalt supplies outside of Southern Africa. Pacific Rim

Cobalt Corp. (OTCQB: PCRCF) (CSE: BOLT) is in a unique

position to support these battery producers grow their operations.

The company controls the Cyclops Nickel-Cobalt Project in

Indonesia, which is in proximity to all three major

battery-producing nations.

As an initial step in that direction, Pacific Rim recently

signed a preliminary offtake agreement with

Beijing Easpring Material Technology, recognized as an industry

leader in China, to purchase nickel sulphate and cobalt sulphate

from the company’s Cyclops project for an initial term of five

years. Indonesia's record on allowing the development of

large-scale mines is strong, and the Cyclops Nickel-Cobalt Project

is closer to Asian ports than either Africa or Australia, boding

well for the success of this venture.

Occupying a Unique Position

Asian battery producers have limited options when it comes to

sourcing essential metals regionally. Pacific Rim Cobalt's Cyclops

Nickel-Cobalt Project occupies a unique location, which is within 4,500 km of accessible ports in Shenzhen, Seoul

and Tokyo. The 5,000-hectare property also benefits from excellent

local infrastructure allowing for year-round access, with an

airport and city nearby. The project is a relatively new

development, unlike many cobalt projects in the West, which have

been mined-out sporadically over the last century.

In addition, further exploration work at Cyclops is planned.

After the company’s exploration results from a mini-bulk sample

were announce last year, Pacific Rim Cobalt CEO Ranjeet Sundher

commented that “we expect the near-surface

nature of cobalt/nickel mineralization at the Cyclops project will

lend itself well to low-cost, logistically straightforward

drilling. We thus anticipate the opportunity to undertake a

resource calculation study, as well as ongoing metallurgy and

process option testing, will present itself in the near future.

It’s going to be a busy year ahead, and we look forward to getting

the drills turning and building value.”

Pacific Rim Cobalt's Cyclops Nickel-Cobalt Project has returned

positive initial sampling results. Further exploration work may

help the company delineate a resource and build its way towards a

definitive resource estimate. There appears to be no shortage of

demand for battery metals, and the Cyclops Project is well placed

to potentially service nearby battery-producing companies.

A Global Drive for Vital Resources

Pacific Rim Cobalt is exploring for cobalt in a jurisdiction

that has produced some of the biggest mines in human history.

Freeport-McMoRan Inc. (NYSE: FCX) developed the

Grasberg mine in Indonesia. It is the world's largest gold mine and

second-largest producer of copper. The mine operates in the remote

highlands of the Sudirman Mountain Range in the Papua province,

located on the western half of New Guinea. Freeport-McMoRan and its

predecessors have been the only operator of exploration and mining

activities in the area since 1967.

Major miners such as BHP Group Limited (NYSE:

BHP) and VALE S.A. (NYSE: VALE) are also

looking for ways to leverage the growth in demand for battery

metals. BHP is a world-leading resources company that extracts and

processes minerals, oil and gas. The company is headquartered in

Australia but sells its products worldwide. BHP announced last year that it would be trying to sell as

much as 90 percent of the output from its Australian Nickel West

operations to the battery sector.

With its primary focus on mining, Vale is expanding production

at its Voisey’s Bay nickel mine in Canada, and the cobalt produced

there is already under contract to waiting buyers, including Wheaton Precious Metals Corporation. The

company is the world’s largest iron ore and nickel producer, with

operations in other mineral sectors as well. VALE invests in

research studies around the world to identify new mineral reserves,

and its teams of geologists and engineers use techniques ranging

from rock-sample collection and subsoil drilling to satellite image

analysis to identify the presence of minerals.

Despite production expansions by major miners, companies such as

Apple (NASDAQ: AAPL) that rely heavily on

batteries will be competing

against the EV industry to buy these essential materials. Cobalt is

a critical ingredient in the tech giant’s core product line,

including iPhones, iPads, Apple Watch and MacBooks. Recognizing the

growing demand for the mineral used in its lithium-ion batteries,

Apple may be negotiating directly

with miners to secure acquisition of the precious metal

annually for at least the next five years.

For more information on Youngevity International, visit Pacific Rim

Cobalt Corp. (OTCQB: PCRCF) (CSE: BOLT)

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content

distribution company that provides (1) access to a network of wire

services via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible, (2) article and editorial syndication to

5,000+ news outlets (3), enhanced press release services to ensure

maximum impact, (4) social media distribution via the Investor

Brand Network (IBN) to nearly 2 million followers, (5) a full array

of corporate communications solutions, and (6) a total news

coverage solution with NNW Prime. As a

multifaceted organization with an extensive team of contributing

journalists and writers, NNW is uniquely positioned to best serve

private and public companies that desire to reach a wide audience

of investors, consumers, journalists and the general public. By

cutting through the overload of information in today’s market, NNW

brings its clients unparalleled visibility, recognition and brand

awareness. NNW is where news, content and information converge.

For more information, please visit https://www.NetworkNewsWire.com

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

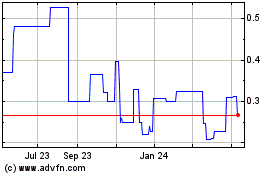

Bolt Metals (QB) (USOTC:PCRCF)

Historical Stock Chart

From Nov 2024 to Dec 2024

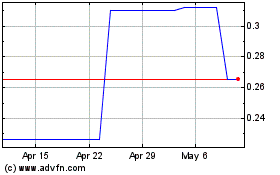

Bolt Metals (QB) (USOTC:PCRCF)

Historical Stock Chart

From Dec 2023 to Dec 2024