false000175639000017563902024-08-262024-08-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(D) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 26, 2024

__________________________

ASCEND WELLNESS HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 333-254800 | | 83-0602006 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

44 Whippany Road

Suite 101

Morristown, NJ 07960

| | | | | | | | | | | | | | |

| | (Address of principal executive offices) | | |

(646) 661-7600

| | | | | | | | | | | | | | |

| | (Registrant’s telephone number, including area code) | | |

n/a

| | | | | | | | | | | | | | |

| | (Former name or former address, if changed since last report) | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below).

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As discussed in further detail below, Ascend Wellness Holdings, Inc. (the “Company”) has entered into updated compensation arrangements with certain of its employees following changes to its leadership (as further described in this Item 5.02, the “Leadership Transition”). The Leadership Transition was approved by the Company’s board of directors (the “Board”), based on the recommendations of the compensation and corporate governance committee of the Board.

John Hartmann Transition

Effective August 26, 2024, as part of the Leadership Transition, John Hartmann no longer serves as Chief Executive Officer of the Company. Mr. Hartmann remains a member of the Board. Mr. Hartmann’s transition from the Company is not a result of any disagreement with the Company’s independent auditors or any member of management on any matter of accounting principles or practices, financial statement disclosure, or internal controls.

Samuel Brill Transition

On August 26, 2024, the Board appointed Samuel Brill as Chief Executive Officer of the Company and removed him as Lead Independent Director of the Board, while maintaining his appointment as director of the Company, effective immediately.

In connection with his appointment, the Company and Mr. Brill entered into an employment agreement, dated August 26, 2024 (the “CEO Employment Agreement”), pursuant to which Mr. Brill will receive an annual base salary of $550,000, an annual bonus based on achievement of certain target performance goal, and a one-time grant (the “CEO RSU Grant”) of 5,000,000 restricted stock units (the “RSUs”) under the Company’s 2021 Stock Incentive Plan (the “Plan”). 1,000,000 of the RSUs vest on December 31, 2024, and 1,000,000 RSUs vest on December 31, 2025 (together, the “CEO Time-Vesting RSUs”). The remaining 3,000,000 RSUs (the “CEO Performance-Based RSUs”) will vest upon the achievement of the Stock Price Condition (as defined in the CEO Employment Agreement). Mr. Brill will be eligible to participate in the Company’s Long Term Incentive Program (the “LTIP”) starting in the 2025 fiscal year.

During the first 18 months of the CEO Employment Agreement (the “Initial Term”), in the event Mr. Brill is terminated by the Company other than for Cause (as defined in the CEO Employment Agreement), the Company shall pay to Mr. Brill (i) the base salary for the remainder of the Initial Term earned but not paid through the date of termination, (ii) the CEO Time-Vesting RSUs that would have vested during the Initial Term shall vest immediately, (iii) the value of any vacation time earned but not used through the date of termination, (iv) any annual bonus earned with respect to the fiscal year immediately preceding the fiscal year in which such termination occurs, but only to the extent unpaid as of the date of termination; (v) a pro-rated annual bonus for service completed during the then current fiscal year through and including the date of termination; (vi) any other benefits payable under the terms of any employee benefit plan, program or arrangement sponsored or maintained by the Company; and (vii) any business expenses incurred but unreimbursed as of the date of termination (all of the foregoing, the “Initial Term CEO Termination Compensation”). In addition to the Initial Term CEO Termination Compensation, the Company shall continue to pay the cost of Mr. Brill’s participation in the Company’s medical and dental insurance plans for a period of the remainder of the Initial Term (the “CEO Benefit Continuation”).

After the Initial Term (the “At Will Period”), in the event Mr. Brill is terminated by the Company other than for Cause (as defined in the CEO Employment Agreement), the Company shall pay Mr. Brill (i) an amount equal to fifty-percent (50%) of the base salary earned for the full fiscal year immediately preceding the fiscal year in which such termination occurs, payable in substantially equal installments over the six (6) month period immediately following the termination date, (ii) an unvested CEO Time-Vesting RSUs shall vest, (iii) the value of any vacation time earned but not used through the date of termination, (iv) any annual bonus earned with respect to the fiscal year immediately preceding the fiscal year in which such termination occurs, but only to the extent unpaid as of the date of termination; (v) a pro-rated annual bonus for service completed during the then current fiscal year through and including the date of termination; (vi) any other benefits payable under the terms of any employee benefit plan, program or arrangement sponsored or maintained by the Company; and (vii) any business expenses

incurred but unreimbursed as of the date of termination (all of the foregoing, the “At Will CEO Termination Compensation”). In addition to the At Will CEO Termination Compensation, Mr. Brill shall be entitled to the CEO Benefit Continuation the Company shall continue to pay the cost of Mr. Brill’s participation in the Company’s medical and dental insurance plans for a period of the remainder of the Initial Term (the “CEO Benefit Continuation”) for a period of 6 months following the termination date.

If termination of Mr. Brill occurs during the At Will Period is within 18 months after a Change of Control Event (as defined in the CEO Employment Agreement), Mr. Brill shall be entitled to 100% of his base salary in a lump sum payment, and any unvested CEO Time-Vesting CEO RSUs shall vest. Mr. Brill will not receive any additional compensation for his services as a member of the Board. The At Will Period of the CEO Employment Agreement is at-will and has no specific term.

The foregoing description of the CEO Employment Agreement is subject to and qualified in its entirety by reference to the full text of the CEO Employment Agreement, a copy of which will be filed with the Company’s Quarterly Report on Form 10-Q for the period ending September 30, 2024. In addition, Mr. Brill has executed the Company’s standard indemnification agreement, substantially in the form as applicable to other executive officers and directors of the Company.

Mr. Brill, age 50, has served on the Board since May 2023, when he was also appointed as Lead Independent Director. Mr. Brill is Chairman of the Board of Invacare Holdings Corporation (OTC: IVCRQ), a global leader in the manufacturing and distribution of medical products. Mr. Brill served as the President and Chief Investment Officer of Seventh Avenue Investments, LLC (“SAI”) for the last seven years until his resignation in August 2024. At SAI, Mr. Brill managed all aspects of the private equity business of a multibillion-dollar single-family office in New York City. He played a critical role in helping the management teams of portfolio companies with strategic decisions, including mergers, acquisitions, corporate reorganization, and financial planning. Before joining SAI, Mr. Brill was the Chief Investment Officer and Portfolio Manager of Weismann Capital, a single-family office in Stamford, CT. Prior to joining Weismann Capital in November 2003, Mr. Brill was the Chief Operating Officer and Director of Amedia Networks (formerly TTR Technologies), a publicly traded technology IP company. Prior to joining Amedia in November 2001, Mr. Brill was a senior financial analyst at JDS Capital Management, a hedge fund that was also the largest shareholder of TTR, which he joined as the first employee in February 1998. He has previously served on numerous public and private boards and committees, including the Investment Committee of NewLake Capital Partners, Inc. (OTCQX: NLCP), a cannabis REIT.

Mr. Brill does not have a family relationship with any of the officers or directors of the Company. There are no related party transactions with regard to Mr. Brill reportable under Item 404(a) of Regulation S‑K.

Frank Perullo Transition

On August 26, 2024, the Company and Francis Perullo entered into a new employment agreement pursuant to which Mr. Perullo will transition to a new role as President of the Company (the “President Employment Agreement”), effective August 26, 2024. In connection with the President Employment Agreement, the parties terminated the employment agreement between the Company and Mr. Perullo, dated March 26, 2024 (the “Prior Perullo Employment Agreement”). Mr. Perullo will continue to serve as a member of the Board.

Pursuant to the President Employment Agreement, Mr. Perullo will receive an annual base salary of $550,000 and an annual bonus based on the achievement of certain target performance goals. Mr. Perullo will be eligible to participate in the Company’s LTIP starting in the 2025 fiscal year. Upon Mr. Perullo’s death or disability or termination by the Company for Cause (as defined in the President Employment Agreement), Mr. Perullo shall be entitled to any base salary, vacation time, and any unreimbursed business expenses from the prior year earned but not paid (together, the “Final President Compensation”). Upon termination other than for Cause or Mr. Perullo’s resignation for Good Reason (each as defined in the President Employment Agreement) that occurs within two years, the Company shall pay Mr. Perullo the Final President Compensation and he shall be entitled to one year of continued participation in the Company’s medical and dental insurance plans (the “President Benefit Continuation”). Upon termination other than for Cause or Mr. Perullo’s resignation for Good Reason (each as defined in the President Employment Agreement) that occurs after two years, the Company shall pay Mr. Perullo the Final

President Compensation and an amount equal to the sum of his base salary and he shall be entitled to the President Benefit Continuation. Upon termination of Mr. Perullo within 18 months after a Change of Control Event (as defined in the President Employment Agreement), Mr. Perullo shall be entitled to 100% of his annual base salary in a lump sum payment and he shall be entitled to the President Benefit Continuation for a period of six months. Mr. Perullo will not receive any additional compensation for his services as a member of the Board. The President Employment Agreement is at-will and has no specific term.

The foregoing descriptions of the President Employment Agreement is subject to and qualified in its entirety by reference to the full text of the President Employment Agreement, a copy of which will be filed with the Company’s Quarterly Report on Form 10-Q for the period ending September 30, 2024. In addition, Mr. Perullo has executed the Company’s standard indemnification agreement, substantially in the form as applicable to other executive officers and directors of the Company.

Mr. Perullo, age 48, is the co-founder of the Company and has served on the Board since May 2018. He has served as the Company’s EVP of Corporate Affairs since March 2024, and previously served as Strategic Advisor from May 2023 to March 2024, President from February 2022 to May 2023, and Interim Co-Chief Executive Officer from September 2022 to May 2023. In 2015, prior to co-founding the Company, Mr. Perullo founded the Novus Group, a consulting firm that advises government and commercial clients, and he currently serves as Principal. Prior to founding the Novus Group, Mr. Perullo founded and served as President of Sage Systems, one of the leading providers of web-based campaign management software, from 2002 to 2015.

Mr. Perullo does not have a family relationship with any of the officers or directors of the Company. There are no related party transactions with regard to Mr. Perullo reportable under Item 404(a) of Regulation S‑K.

Mark Cassebaum Transition

On August 26, 2024, the Company terminated Mark Cassebaum as Chief Financial Officer of the Company, effective immediately. Mr. Cassebaum’s departure from the Company is not a result of any disagreement with the Company’s independent auditors or any member of management on any matter of accounting principles or practices, financial statement disclosure, or internal controls.

Roman Nemchenko Transition

On August 26, 2024, the Company appointed Roman Nemchenko as Chief Financial Officer of the Company, effective immediately.

In connection with his appointment, the Company and Mr. Nemchenko entered into an employment agreement, dated August 26, 2024 (the “CFO Employment Agreement”), pursuant to which Mr. Nemchenko will receive an annual base salary of $450,000, a guaranteed cash bonus in the amount of $175,000 for the 2024 fiscal year, an annual bonus based on achievement of certain target performance goals for the subsequent fiscal years and a one-time grant (the “CFO RSU Grant”) of 350,000 RSUs under the Plan (the “CFO RSUs”), vesting 25% annually over a four year period. Upon Mr. Nemchenko’s death or disability or termination by the Company for Cause (as defined in the CFO Employment Agreement), Mr. Nemchenko shall be entitled to any base salary and vacation time from the prior year earned but not paid, a pro-rated annual bonus for the current year to be granted at the discretion of the Board and any unreimbursed business expenses (together, the “Final CFO Compensation”), and he shall be entitled to six months of continued participation in the Company’s medical and dental insurance plans (the “CFO Benefit Continuation”). Upon termination other than for Cause or Mr. Nemchenko’s resignation for Good Reason (each as defined in the CFO Employment Agreement), the Company shall pay Mr. Nemchenko the Final CFO Compensation and an amount equal to the sum of 50% of the base salary, and he shall be entitled to the CFO Benefit Continuation. Upon termination of Mr. Nemchenko within 18 months after a Change of Control Event (as defined in the CFO Employment Agreement), Mr. Nemchenko shall be entitled to 100% of his annual base salary in a lump sum payment, and any unvested CFO RSUs shall vest. The CFO Employment Agreement is at-will and has no specific term.

The foregoing descriptions of the CFO Employment Agreement is subject to and qualified in its entirety by reference to the full text of the CFO Employment Agreement, a copy of which will be filed with the Company’s Quarterly Report on Form 10-Q for the period ending September 30, 2024. In addition, Mr. Nemchenko has executed the Company’s standard indemnification agreement, substantially in the form as applicable to other executive officers and directors of the Company.

Mr. Nemchenko, age 36, served as the Company’s Executive Vice President and Chief Accounting Officer since April 2020. He played a key role in the Company’s 2021 initial public offering and has driven significant financial and operational improvements. Prior to joining the Company, Mr. Nemchenko served as Controller for Acreage Holdings from November 2017 to April 2020. With approximately 15 years of experience in finance and accounting, Mr. Nemchenko has a strong background in public offerings, financial analysis, M&A, restructurings, SEC reporting, technology implementations, tax strategy, and regulatory compliance. In addition to his prior position at Acreage Holdings, his career includes leadership roles at Oscar Health Insurance from April 2016 to November 2017, and Fortress Investment Group from May 2015 to April 2016, as well as auditing and consulting experience at Pricewaterhouse Coopers from September 2011 to May 2015. Mr. Nemchenko holds a CPA, a BS in Finance and Accounting from the State University of New York at New Paltz, and an MS in Forensic Accounting from the University at Albany.

Mr. Nemchenko does not have a family relationship with any of the officers or directors of the Company. There are no related party transactions with regard to Mr. Nemchenko reportable under Item 404(a) of Regulation S‑K.

Item 7.01. Regulation FD Disclosure.

On August 27, 2024, the Company issued a press release announcing the Leadership Transition. A copy of the press release is being furnished as Exhibit 99.1 to this Form 8-K.

The information furnished under this Item 7.01 and in the accompanying Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Exhibit Description |

99.1‡ | | |

‡ Document has been furnished, is not deemed filed and is not to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, irrespective of any general incorporation language contained in any such filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Ascend Wellness Holdings, Inc. | |

| | | |

| August 28, 2024 | | /s/ Samuel Brill | |

| | Samuel Brill

Chief Executive Officer

(Principal Executive Officer) | |

Ascend Wellness Holdings Announces Leadership Updates

NEW YORK, Aug. 27, 2024 — Ascend Wellness Holdings, Inc. ("AWH," "Ascend" or the "Company") (CSE: AAWH-U.CN) (OTCQX: AAWH), a multi-state, vertically integrated cannabis operator, today announced significant leadership changes as the Company continues to align its operations with its long-term strategic goals and financial priorities. As part of this transition, John Hartmann will no longer serve as Chief Executive Officer, and Mark Cassebaum has been terminated as Chief Financial Officer, effective immediately.

The Board of Directors has appointed Samuel Brill current Director, as Chief Executive Officer. Mr. Brill brings extensive experience in the cannabis space and a deep understanding of the Company's financial and strategic priorities as well as robust capital markets knowledge. During his tenure on the Board of Directors, Mr. Brill helped guide the Company through its recently announced refinancing transaction.

Francis Perullo, Co-Founder and current director, has been appointed as President. Mr. Perullo has deep cannabis and operational expertise and will focus on driving operational excellence across all business segments. As Co-Founder, Mr. Perullo has led the Company from inception to over a half a billion dollars in revenue over the past 5 years.

Roman Nemchenko, previously Chief Accounting Officer ("CAO"), has been appointed as Chief Financial Officer ("CFO"). In his expanded role, Mr. Nemchenko will lead the Company's financial operations, with a keen focus on improving margins, cash flow, and driving financial excellence. During his tenure as CAO, Mr. Nemchenko built out the Company's accounting and financial operations, led the Company through its initial public offering, numerous M&A transactions and the Company's tax and U.S. Securities and Exchange Commission (the "SEC") compliance requirements.

These leadership changes are part of Ascend's commitment to enhancing its operational efficiency and financial performance. The new leadership team is dedicated to driving sustainable growth and delivering long-term value for shareholders, employees, and customers.

"We are confident that this hands-on leadership team, with their diverse expertise and deep industry knowledge, will guide Ascend through this next phase of growth. The leadership changes come as part of a broader effort to realign our strategy and address recent performance challenges. We are confident that the changes will bring our focus back to the basics with an emphasis on the fundamentals and will position AWH for future success," said Abner Kurtin, Executive Chair of the Board of Directors. "Our focus will be on improving our operational performance and continuing to deliver high-quality products and services to our customers. The Board of Directors is committed to supporting the leadership team as they lead the Company through this important transition."

Samuel Brill Biography:

Samuel Brill was appointed Chief Executive Officer of Ascend in August 2024. Mr. Brill has served on the Company's Board of Directors since May 2023, when he was also appointed as Lead Independent Director. Mr. Brill is Chairman of the Board of Invacare Holdings Corporation (OTC: IVCRQ), a global leader in the manufacturing and distribution of medical products. Mr. Brill served as the President and

Chief Investment Officer of Seventh Avenue Investments, LLC ("SAI") for the last seven years. At SAI, Mr. Brill managed all aspects of the private equity business of a multibillion-dollar single-family office in New York City. He played a critical role in helping the management teams of portfolio companies with strategic decisions, including mergers, acquisitions, corporate reorganization, and financial planning. Before joining SAI, Mr. Brill was the Chief Investment Officer and Portfolio Manager of Weismann Capital, a single-family office in Stamford, CT. Prior to joining Weismann in November 2003, Mr. Brill was the Chief Operating Officer and Director of Amedia Networks (formerly TTR Technologies), a publicly traded technology IP company. Prior to joining Amedia in November 2001, Mr. Brill was a senior financial analyst at JDS Capital Management, a hedge fund that was also the largest shareholder of TTR, which he joined as the first employee in February 1998. He has served on numerous public and private boards and committees, including the Investment Committee of NewLake Capital Partners, Inc. (OTCQX: NLCP), a cannabis REIT.

Francis Perullo Biography:

Francis Perullo was appointed President of Ascend in August 2024. Prior to that, Mr. Perullo served as the EVP of Corporate Affairs. He also serves on the Board of Directors. Mr. Perullo previously served as interim Co-CEO of Ascend. Mr. Perullo's leadership has been key to Ascend's impressive growth trajectory and brand success as one of the Company's Co-Founders. Mr. Perullo spent his first three years as Chief Strategy Officer, during which time he spearheaded the Company's retail expansion strategy and built out AWH's initial footprint. Previously, Mr. Perullo served as a strategic consultant for multi-national corporations. He was Founder of Novus Group and Sage Systems, one of the leading providers of web-based data management software, which he founded in 2002.

Roman Nemchenko Biography:

Roman Nemchenko was appointed Chief Financial Officer of Ascend in August 2024, following his role as Executive Vice President and Chief Accounting Officer since April 2020. He played a key role in the Company's 2021 initial public offering and has driven significant financial and operational improvements.

With approximately 15 years of experience in finance and accounting, Mr. Nemchenko has a strong background in initial public offerings, financial analysis, M&A, restructurings, SEC reporting, technology implementations, tax strategy, and regulatory compliance. His career includes leadership roles at Acreage Holdings, Oscar Insurance, and Fortress Investment Group, as well as auditing and consulting experience at PwC. Mr. Nemchenko holds a CPA, a BS in Finance and Accounting, and an MS in Forensic Accounting.

About Ascend Wellness Holdings, Inc.

AWH is a vertically integrated operator with assets in Illinois, Maryland, Massachusetts, Michigan, Ohio, New Jersey, and Pennsylvania. AWH owns and operates state-of-the-art cultivation facilities, growing award-winning strains and producing a curated selection of products for retail and wholesale customers. AWH produces and distributes its in-house Common Goods, Simply Herb, Ozone, Ozone Reserve, and Royale branded products. For more information, visit www.awholdings.com.

Cautionary Note Regarding Forward-Looking Information

This news release includes forward-looking information and statements, which may include, but are not limited to, the plans, intentions, expectations, estimates, and beliefs of the Company. Words such as "expects", "continue", "will", "anticipates" and "intends" or similar expressions are intended to identify forward-looking information and statements. Without limiting the generality of the preceding statement, this news release contains forward-looking information and statements concerning the Company's current projections and expectations about future events and financial trends, as well as the plans and objectives of management for future operations. We caution investors that any such forward-looking information and statements are based on certain assumptions and analysis made by the Company in light of the experience of the Company and its perception of historical trends, current conditions and expected future developments, and other factors management believes are appropriate.

Forward-looking information and statements involve and are subject to assumptions and known and unknown risks, uncertainties, and other factors which may cause actual events, results, performance, or achievements of the Company to be materially different from future events, results, performance, and achievements expressed or implied by forward-looking information and statements herein. Such factors include, among others, the risks and uncertainties identified in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, and in the Company's other reports and filings with the applicable Canadian securities regulators on its profile on SEDAR+ at www.sedarplus.ca and with the SEC on its profile on EDGAR at www.sec.gov. Although the Company believes that any forward-looking information and statements herein are reasonable, in light of the use of assumptions and the significant risks and uncertainties inherent in such information and statements, there can be no assurance that any such forward-looking information and statements will prove to be accurate, and accordingly readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance upon such forward-looking information and statements. Any forward-looking information and statements herein are made as of the date hereof, and except as required by applicable laws, the Company assumes no obligation and disclaims any intention to update or revise any forward-looking information or statements herein or to update the reasons that actual events or results could or do differ from those projected in any forward-looking information and statements herein, whether as a result of new information, future events or results, or otherwise, except as required by applicable laws.

The Canadian Securities Exchange has not reviewed, approved or disapproved the content of this news release.

Contact

EVP, Investor Relations & Strategy

Rebecca Koar

IR@awholdings.com

(617) 453-4042 ext. 90102

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

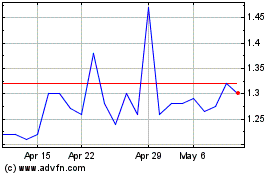

Ascend Wellness (QX) (USOTC:AAWH)

Historical Stock Chart

From Jan 2025 to Feb 2025

Ascend Wellness (QX) (USOTC:AAWH)

Historical Stock Chart

From Feb 2024 to Feb 2025