Erdene Reports 2009 First Quarter Financial Results and Provides Project Updates

May 19 2009 - 9:19AM

Marketwired Canada

Erdene Resource Development Corp. ("Erdene") (TSX:ERD), today provided an update

on its principal projects in conjunction with the release of its 2009 first

quarter financial results.

2009 First Quarter Highlights

- Completed the Beta Minerals Reverse Takeover transaction, giving Erdene a

controlling interest in Beta Minerals (now Advanced Primary Minerals Corp. (TSX

VENTURE:APD))

- Continued Exploration and Development Phase implementation plans for the

Donkin coal project

- Began work on the new Zuun Mod molybdenum project resource estimate that

incorporates data from drilling completed in 2008

- Working capital of $18.8 million as at March 31, 2009, including Erdene's

controlled subsidiary Advanced Primary Minerals Corp.

"During the first quarter we continued to make progress on our Exploration and

Development phase implementation plans for the Donkin coal project and the

completion of an updated resource estimate at the Zuun Mod molybdenum project,"

said Peter Akerley, President and CEO. "We are also pleased to see our kaolin

division operate as a new public company with established production, which we

expect will ultimately reward our shareholders."

Project Summaries and Updates

Donkin Coal Project

The Donkin coal project is located on the Donkin peninsula in Cape Breton

Island, Nova Scotia, Canada. The project is a joint venture between Xstrata Coal

Donkin (75%) and Erdene (25%) managed by Xstrata Coal Donkin Management Limited.

Current plans are to complete a feasibility study in conjunction with sales

agreements for an interim Exploration and Development Phase program utilizing a

continuous miner, which would see up to 350,000 tonnes of coal produced from the

Harbour Seam, which contains the largest volume and highest quality resource

within a total 227Mt (Indicated) resource of high volatile A bituminous coal. It

is anticipated the initial phase would require a capital investment of

approximately $65M of which Erdene is responsible for 25%, less $10M which will

be funded by Xstrata under the terms of the joint venture agreement between the

parties.

During the latter part of 2008 and the first quarter of 2009, work continued on

the Exploration and Development Phase implementation with requests for pricing

issued for the long lead-time items and major contracts associated with the

project. The final feasibility of the Exploration and Development Phase will be

released following conclusion of sales agreements. The project currently employs

10 full time or part time site personnel.

The final stage of the feasibility study for the Exploration and Development

Phase involves the negotiations for domestic and international sales contracts.

With respect to domestic sales, discussions revolve around coal quality details

and acceptable volumes to be able to meet government regulated emissions

standards for 2010 since the coal produced during the Exploration and

Development Phase will be unwashed. The supply of an unwashed product is an

interim step during the evaluation phase with the long term goal being longwall

production of a higher quality washed product. The Exploration and Development

Phase is a critical part of the overall project approval process. It will

provide additional, essential information on geology, geotechnical data, coal

quality and mineability aspects of the Donkin coal deposit. Once the feasibility

study and sales agreements are finalized, it will be presented to the Donkin

Coal Management Committee and then to the respective boards of the joint venture

partners for approval.

Zuun Mod Molybdenum Project

Located within 200 kilometres of China's border in Mongolia's Bayankhongor

Province, the Zuun Mod project measures 12 kilometres in circumference and hosts

broad zones of molybdenum/copper mineralization. The project is wholly owned by

Erdene.

During the first quarter of 2009, Minarco-MineConsult began work on a new Zuun

Mod molybdenum/copper project resource estimate incorporating the drilling

completed in 2008. Several of these holes, located in the central part of the

deposit, returned intersections of up to 400 metres in width averaging 0.06%

molybdenum with multiple higher grade zones, including one 70-metre intersection

averaging 0.11% molybdenum in the northeastern portion of the deposit. These

data add to an initial resource estimate, reported in May 2008, which totalled

110 million tonnes averaging 0.061% molybdenum in the Measured and Indicated

category. Additional drilling will eventually be required to better define the

higher grade zones and have them reflected in the overall resource. The current

focus is on completing the resource estimate, evaluating a revised mine plan and

preliminary economics and applying for a mining license.

In regards to the mining license application, the Zuun Mod exploration license

is due to expire in May 2010 and work has been proceeding to complete the

requirements for an application for a mining license. Under the Minerals Law of

Mongolia, a mining license has an initial term of 30 years, renewable twice for

20 years each. Field work commenced in October 2008 by Ecotrade XXK, a Mongolian

company, to collect data for an Environmental and Social Economic baseline study

required as part of the application for a mining license. A final report for

submission to the Ministry of Environment and Tourism was received in early May

2009. In addition, a contract was signed with AMC XXK to carry out a 1:2000

topographic survey, a hydro geological study of the Zuun Mod site and a

geological report and resource estimate for submission to the Mongolian Mineral

Resource Council as a prerequisite for granting of a mining license. The

topographic survey and hydro geology study including the completion of a

25-cemtimetre diameter drill hole for pump tests and water sampling were

completed in January 2009. Work on the AMC geological report and resource

estimate began in the first quarter of 2009 and is expected to be completed by

the end of July 2009.

Advanced Primary Minerals Corp.

On February 27, 2009, Erdene and Beta Minerals Inc. ("Beta") announced the

closing of the transaction outlined in an Amended and Restated Letter Agreement

dated January 23, 2009 (the "Agreement"), among the Company, Beta and Deepstep

Kaolin Company LLC ("Deepstep"). Pursuant to the Agreement, the Company and

Deepstep exchanged all of the outstanding common shares of Erdene Materials

Corporation ("EMC") for common shares of Beta, giving the Company a controlling

interest in Beta (the "Transaction"). Following the closing, Beta changed its

name to Advanced Primary Minerals Corporation ("APM") and on March 6, 2009 began

trading on the TSX Venture exchange under the ticker symbol APD. The Transaction

constituted an arms length "Reverse Takeover" under the applicable policies of

the TSX Venture Exchange.

APM's goal is to become North America's leading specialized primary kaolin

producer. To this end, a new state-of-the-art processing facility has been

constructed in Dearing, Georgia and the first shipment of product from the new

plant took place on May 11, 2009. The new Dearing plant is ideally located along

the Augusta Highway, adjacent to rail with existing access to all required

utilities. Extensive product development and testing has been carried out over

the past five years and APM has advanced commercial trials underway to

complement production commitments already in place.

APM is targeting value added products that benefit from the unique attributes of

the Company's high quality primary kaolin resource under a two phase development

program. Target markets under the phase one program, currently underway, are

focused primarily on primary kaolin products for the North American ceramics and

whitewares industries as well as conducting toll processing of a non-kaolin

product for a third party under a contract that guarantees minimum monthly

production volumes. The toll processing circuit within the Dearing plant is

scheduled to commence June 1, 2009.

During the phase one program, a phase two feasibility program will be completed

along with further product development and trials for an expanded product line

targeting the paint, coatings and catalysts industries as well as other

specialty industrial applications. Product trials have shown that APM's primary

kaolin products meet or exceed the quality of comparable foreign imports.

Proximity to the U.S. domestic market and elimination of foreign exchange risk

add a strong competitive advantage.

Granite Hill

The Company's Granite Hill project is a former producing granite aggregate

quarry in central Georgia. The Company owns the 342-acre property, through a

wholly owned subsidiary, which holds in excess of a 120-million ton resource and

is situated on an existing rail line. Ready Mix USA ("RMU") holds, through a

lease with the Company, an exclusive right to mine, process, and sell aggregate

from the Granite Hill property and is responsible for all associated capital and

operating costs. The Company has a carried, percent-of-sales royalty interest in

the sale of all aggregate from the property.

RMU's quarry development plan provides for an estimated start-up production rate

of one million tons of granite aggregate per year, with a design capacity of up

to 2.5 million tons. Based on current production projections, the Granite Hill

quarry will have an estimated lifespan in excess of 30 years. RMU has designed a

quarry mining plan, processing plant and facilities, and produced an

environmental impact plan. RMU has also acquired additional land adjacent to the

Granite Hill property to secure rail access to the site. During the quarter a

new county access road was approved allowing for direct access for development

of the site from existing roads while the initial development area is being

prepared for clearing. The construction phase is expected to be completed nine

to twelve months after a production decision by RMU. RMU is responsible for

fully funding the development and operating program.

Production from the Granite Hill project will target markets in the southeastern

U.S. where urban sprawl, depleted resources and the shutdown of mining in

Florida's Lake Belt aggregate district have combined to create a pending

shortage of crushed stone. At the same time the U.S. government stimulus package

is expected to initiate over $90 billion in infrastructure spending over the

next 12 to 18 months expected to spark demand for aggregate material. The Lake

Belt district is in northwestern Miami-Dade County and on average produces

approximately 45M tons of limestone or about half the state of Florida's annual

production. There is currently no mining taking place in this area as a U.S.

District Judge has stayed (pulled) all mining permits over concerns regarding

impact on the Everglades' watershed and the environment.

2009 First Quarter Financial Results Summary

Erdene's 2009 first quarter financial statements and Management's Discussion and

Analysis were filed with regulatory authorities on May 15, 2009 and are

available on the Company's website at www.erdene.com and on SEDAR at

www.sedar.com. These statements are provided on a consolidated basis

incorporating that of its controlled subsidiary, Advanced Primary Minerals Corp.

For the three months ended March 31, 2009, exploration and operating expenses

amounted to $437,595 compared to $664,395 in the first quarter 2008. Including

capitalized costs, exploration expenses were $840,435, net write-offs, for the

first quarter of 2009 and $2,206,519 for the first quarter of 2008 respectively.

Erdene's first quarter expenditures were primarily directed toward the continued

advancement of the Company's primary projects, namely the Donkin coal project

and Zuun Mod molybdenum project as well as approximately $564,000 in purchases

of plant and equipment for a new processing plant being constructed by Erdene's

controlled subsidiary APM.

Administrative expenses totalled $459,395 for the first quarter of 2009,

compared to $969,099 in first quarter 2008 (including $464,475 in stock based

compensation).

The Company recorded income of $681,223, or $0.01 per share, in the first

quarter of 2009 compared with a loss of $1,553,612, or $0.02 per share, in the

first quarter of 2008. Erdene recognized an $879,869 dilution gain on the

disposition of an interest in its subsidiary Erdene Materials Corporation. At

March 31, 2009, Erdene had approximately $17,689,316 million of cash and cash

equivalents on hand, including cash acquired on closing of the Beta Transaction,

compared with $16,195,175 million at December 31, 2008.

About Erdene

Erdene Resource Development Corp. is a diversified resource company with

multiple projects at various stages of development from exploration to

production, all focused on high-growth commodities. Erdene has a current working

capital position of approximately $17.8 million, including that of its

controlled subsidiary APM, with 89,230,877 common shares issued and outstanding

and a fully diluted position of 97,825,852 common shares.

Forward-Looking Statements

Certain information regarding Erdene contained herein may constitute

forward-looking statements within the meaning of applicable securities laws.

Forward-looking statements may include estimates, plans, expectations, opinions,

forecasts, projections, guidance or other statements that are not statements of

fact. Although Erdene believes that the expectations reflected in such

forward-looking statements are reasonable, it can give no assurance that such

expectations will prove to have been correct. Erdene cautions that actual

performance will be affected by a number of factors, most of which are beyond

its control, and that future events and results may vary substantially from what

Erdene currently foresees. Factors that could cause actual results to differ

materially from those in forward-looking statements include market prices,

exploitation and exploration results, continued availability of capital and

financing and general economic, market or business conditions. The

forward-looking statements are expressly qualified in their entirety by this

cautionary statement. The information contained herein is stated as of the

current date and subject to change after that date.

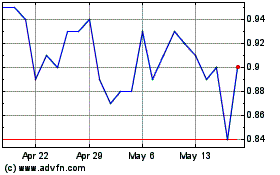

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Sep 2024 to Oct 2024

Andean Precious Metals (TSXV:APM)

Historical Stock Chart

From Oct 2023 to Oct 2024