TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company)

released its second quarter results today. François Poirier, TC

Energy’s President and Chief Executive Officer commented, “During

the first six months of 2024, we delivered 10 per cent

year-over-year growth in comparable EBITDA1 and approximately 35

per cent growth in segmented earnings.” Poirier continued, “We

continued to advance multiple strategic initiatives aimed at

maximizing the long-term value of our assets and furthering our

deleveraging efforts. We announced a historic equity ownership

agreement that will enable Indigenous Communities to become owners

in the NGTL and Foothills Systems, achieved a successful

shareholder vote to spin off the Liquids Pipelines business and

reached a five-year revenue requirement settlement on our NGTL

System in Canada. Finally, our Southeast Gateway pipeline project

in Mexico is making exceptional progress and we anticipate

completing the offshore pipeline installation in the third quarter.

This critical milestone means we are on-track to achieve commercial

in-service by mid-2025. We remain steadfast in our execution

against our clear set of 2024 strategic priorities."

Highlights

(All financial figures are unaudited and in Canadian dollars

unless otherwise noted)

- Second quarter 2024 financial results:

- Comparable earnings1 of $1.0 billion or $0.94 per common share

compared to $1.0 billion or $0.96 per common share in 2023 and net

income attributable to common shares of $1.0 billion or $0.93 per

common share compared to $0.3 billion or $0.24 per common share in

second quarter 2023

- Comparable EBITDA of $2.7 billion compared to $2.5 billion in

2023 and segmented earnings of $2.0 billion compared to $1.0

billion in second quarter 2023

- Reaffirming 2024 outlook:

- Comparable EBITDA is expected to be $11.2 to

$11.5 billion2

- Comparable earnings per common share is

expected to be lower than 20232 due to the net impact of higher net

income attributable to non-controlling interests, partially offset

by increased comparable EBITDA and higher AFUDC related to

increased capital expenditures on the Southeast Gateway pipeline

project

- Capital expenditures are anticipated to be at

the low end of $8.0 to $8.5 billion on a net basis after

considering non-controlling interests

- TC Energy shareholders voted to approve the spinoff of the

Liquids Pipelines business at our 2024 Annual and Special Meeting

of shareholders

- Reached unanimous support from customers for a five-year

negotiated revenue requirement settlement for the NGTL System that

aligns with maximizing the value of our assets

- Announced approximately $2.6 billion of asset divestitures

relative to our $3 billion asset divestiture program

- Announced Canada’s largest Indigenous equity ownership

agreement that will enable Indigenous Communities to acquire a 5.34

per cent minority interest in NGTL and Foothills Systems for gross

proceeds of $1.0 billion

- Completed the strategic alliance agreement with the CFE who

became a partner in TGNH with a 13.01 per cent equity interest in

our TGNH assets for cash proceeds of US$340 million and non-cash

consideration

- Completed a $7.15 billion refinancing by Coastal GasLink LP in

June 2024 of its existing construction credit facility through a

private bond offering of senior secured notes to Canadian and U.S.

investors

- Declared a quarterly dividend of $0.96 per common share for the

quarter ending September 30, 2024.

|

|

|

three months ended June 30 |

|

six months ended June 30 |

|

(millions of $, except per share amounts) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Income |

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to common shares |

|

|

963 |

|

|

|

250 |

|

|

|

2,166 |

|

|

|

1,563 |

|

|

per common share – basic |

|

$ |

0.93 |

|

|

$ |

0.24 |

|

|

$ |

2.09 |

|

|

$ |

1.53 |

|

| |

|

|

|

|

|

|

|

|

| Segmented earnings

(losses) |

|

|

|

|

|

|

|

|

|

Canadian Natural Gas Pipelines |

|

|

514 |

|

|

|

(394 |

) |

|

|

1,015 |

|

|

|

17 |

|

|

U.S. Natural Gas Pipelines |

|

|

762 |

|

|

|

715 |

|

|

|

1,805 |

|

|

|

1,794 |

|

|

Mexico Natural Gas Pipelines |

|

|

266 |

|

|

|

182 |

|

|

|

478 |

|

|

|

436 |

|

|

Liquids Pipelines |

|

|

270 |

|

|

|

273 |

|

|

|

586 |

|

|

|

449 |

|

|

Power and Energy Solutions |

|

|

220 |

|

|

|

255 |

|

|

|

472 |

|

|

|

507 |

|

|

Corporate |

|

|

(26 |

) |

|

|

(36 |

) |

|

|

(84 |

) |

|

|

(38 |

) |

|

Total segmented earnings (losses) |

|

|

2,006 |

|

|

|

995 |

|

|

|

4,272 |

|

|

|

3,165 |

|

|

|

|

|

|

|

|

|

|

|

| Comparable

EBITDA |

|

|

|

|

|

|

|

|

|

Canadian Natural Gas Pipelines |

|

|

846 |

|

|

|

780 |

|

|

|

1,692 |

|

|

|

1,520 |

|

|

U.S. Natural Gas Pipelines |

|

|

1,003 |

|

|

|

925 |

|

|

|

2,309 |

|

|

|

2,192 |

|

|

Mexico Natural Gas Pipelines |

|

|

286 |

|

|

|

193 |

|

|

|

500 |

|

|

|

365 |

|

|

Liquids Pipelines |

|

|

328 |

|

|

|

363 |

|

|

|

735 |

|

|

|

680 |

|

|

Power and Energy Solutions |

|

|

227 |

|

|

|

217 |

|

|

|

547 |

|

|

|

498 |

|

|

Corporate |

|

|

4 |

|

|

|

(4 |

) |

|

|

1 |

|

|

|

(6 |

) |

|

Comparable EBITDA |

|

|

2,694 |

|

|

|

2,474 |

|

|

|

5,784 |

|

|

|

5,249 |

|

|

Depreciation and amortization |

|

|

(717 |

) |

|

|

(694 |

) |

|

|

(1,436 |

) |

|

|

(1,371 |

) |

|

Interest expense included in comparable earnings |

|

|

(843 |

) |

|

|

(791 |

) |

|

|

(1,680 |

) |

|

|

(1,548 |

) |

|

Allowance for funds used during construction |

|

|

184 |

|

|

|

148 |

|

|

|

341 |

|

|

|

279 |

|

|

Foreign exchange gains (losses), net included in comparable

earnings |

|

|

(51 |

) |

|

|

70 |

|

|

|

(8 |

) |

|

|

103 |

|

|

Interest income and other included in comparable earnings |

|

|

69 |

|

|

|

52 |

|

|

|

146 |

|

|

|

94 |

|

|

Income tax (expense) recovery included in comparable earnings |

|

|

(190 |

) |

|

|

(249 |

) |

|

|

(523 |

) |

|

|

(529 |

) |

|

Net (income) loss attributable to non-controlling interests

included in comparable earnings |

|

|

(141 |

) |

|

|

(6 |

) |

|

|

(312 |

) |

|

|

(17 |

) |

|

Preferred share dividends |

|

|

(27 |

) |

|

|

(23 |

) |

|

|

(50 |

) |

|

|

(46 |

) |

|

Comparable earnings |

|

|

978 |

|

|

|

981 |

|

|

|

2,262 |

|

|

|

2,214 |

|

|

Comparable earnings per common share |

|

$ |

0.94 |

|

|

$ |

0.96 |

|

|

$ |

2.18 |

|

|

$ |

2.16 |

|

|

|

|

|

|

|

|

|

|

|

| Cash

flows |

|

|

|

|

|

|

|

|

| Net cash provided by

operations |

|

|

1,655 |

|

|

|

1,510 |

|

|

|

3,697 |

|

|

|

3,584 |

|

| Comparable funds generated

from operationsi |

|

|

1,826 |

|

|

|

1,754 |

|

|

|

4,262 |

|

|

|

3,820 |

|

| Capital spendingii |

|

|

1,591 |

|

|

|

2,991 |

|

|

|

3,488 |

|

|

|

6,024 |

|

| Acquisitions, net of cash

acquired |

|

|

— |

|

|

|

(164 |

) |

|

|

— |

|

|

|

(302 |

) |

| |

|

|

|

|

|

|

|

|

| Dividends

declared |

|

|

|

|

|

|

|

|

|

per common share |

|

$ |

0.96 |

|

|

$ |

0.93 |

|

|

$ |

1.92 |

|

|

$ |

1.86 |

|

| |

|

|

|

|

|

|

|

|

| Basic common shares

outstanding (millions) |

|

|

|

|

|

|

|

|

|

– weighted average for the period |

|

|

1,037 |

|

|

|

1,027 |

|

|

|

1,037 |

|

|

|

1,024 |

|

|

– issued and outstanding at end of period |

|

|

1,037 |

|

|

|

1,029 |

|

|

|

1,037 |

|

|

|

1,029 |

|

i Comparable funds generated from operations is

a non-GAAP measure used throughout this release. This measure does

not have any standardized meaning under GAAP and therefore is

unlikely to be comparable in similar measures presented by other

companies. The most directly comparable GAAP measure is Net cash

provided by operations. For more information on non-GAAP measures,

refer to the Non-GAAP Measures section of this

release. ii Capital spending reflects

cash flows associated with our Capital expenditures, Capital

projects in development and Contributions to equity investments.

Refer to Note 4, Segmented information, of our Condensed

consolidated financial statements for additional information.

CEO MessageDuring the first six months of 2024,

our assets continued to safely and reliably meet the growing energy

demands of North America. As a result, for the first six months of

2024, we have delivered approximately 10 per cent growth in

comparable EBITDA and approximately 35 per cent growth in segmented

earnings compared to the first six months of 2023. The outlook for

our business has never been stronger, providing accretive

investment opportunities across our natural gas and power and

energy solutions assets. Natural gas demand continues to reach

record highs and our business is strategically positioned to

continue to grow through five meaningful drivers:

- Next wave LNG growth that will feed exports from Canada, the

U.S. and Mexico by 2025

- Continued demand growth and reliability requirements for

utilities across the continent

- The increasing demands on power generation to support wide

scale electrification, coal-fired retirements, and emerging energy

needs

- Ensuring supply access; connecting North America’s lowest cost

basins to the largest demand markets

- Decarbonization, maintenance and

modernization projects that support the safe and reliable delivery

of record volumes.

By having a disciplined view on capital allocation and adhering

to our net capital expenditure limit of $6 billion to $7 billion

per year, we will purposefully select projects that are expected to

maximize the spread between our risk-adjusted return and cost of

capital, creating incremental value for our shareholders.

For the remainder of the year, we will seek to maximize the

value of our assets through safety and operational excellence,

maintain our focus on project execution, and continue our

deleveraging efforts by progressing our asset divestiture program

and streamlining our business through efficiency initiatives.

Operational highlights include:

- Total NGTL System receipts averaged 14.2 Bcf/d, up five per

cent compared to second quarter 2023

- NGTL System set an all-time record for total receipts on April

12, 2024 at 14.8 Bcf

- NGTL System set an all-time single day record for deliveries to

power generators of more than 1.1 Bcf on July 18, 2024

- U.S. Natural Gas Pipelines (USNG) daily average flows were 26.2

Bcf/d, up three per cent compared to second quarter 2023

- USNG systems set second quarter average delivery records to

power generators and LNG facilities of 2.8 Bcf/d and 3.3 Bcf/d,

respectively

- New all-time daily send out record to power plants of 5.2 Bcf

on July 15, 2024

- Mexico Natural Gas Pipelines set an all-time delivery record of

more than 4.0 Bcf on May 24, 2024

- The Keystone Pipeline System achieved 94 per cent operational

reliability in the second quarter 2024

- Bruce Power achieved 78 per cent availability in second quarter

2024, taking into account planned outages on Units 5 to 8; average

availability outlook for 2024 remains in the low-90 per cent range

now that all planned maintenance is complete for 2024

- Cogeneration power plant fleet

achieved 95.7 per cent availability in second quarter 2024.

We continue to execute projects on-time and

on-budget. During the second quarter, we made significant

progress on our Southeast Gateway pipeline project

having achieved critical milestones and remain on track to reach

commercial in-service by mid-2025. Offshore pipeline installation

has now reached over 98 per cent, with completion of the deepwater

section and approximately three kilometres of shallow water

installation remaining. We anticipate the shallow water pipeline

installation to be complete in third quarter 2024. We have also

finished all three landfall sites, with construction of onshore

facilities and final pipeline and tie-in activities progressing

well. The Bruce Power Unit 3

Major Component Replacement (MCR) program continues to advance on

plan for both cost and schedule and the Unit 4 MCR is expected to

begin in early-2025. We expect to place approximately $7

billion of projects into service in 2024 and $9

billion in 2025. Year-to-date, $1.2 billion of natural gas

capacity projects have been placed in service, including our Gillis

Access project and projects on the NGTL System. The remaining

projects expected to be placed into service this year is largely

comprised of Coastal GasLink.

Coastal GasLink (CGL) achieved mechanical

completion in November 2023 and continues to progress

post-construction reclamation activities. Commercial in-service is

expected to follow the completion of plant commissioning activities

at the LNG Canada facility and upon receiving notice from LNG

Canada. In June 2024, Coastal GasLink LP completed the largest

private bond offering in Canadian history, a $7.15 billion

refinancing of its existing construction credit facility through a

private offering of senior secured notes, representing significant

demand for Canadian energy infrastructure. Additionally, following

a positive FID announcement by Cedar LNG joint venture partners,

Haisla Nation and Pembina Pipeline Corporation, Coastal GasLink LP

sanctioned the Cedar Link project, a $1.2 billion

expansion of the CGL pipeline which is expected to enable the

delivery of up to 0.4 Bcf/d of natural gas to Cedar LNG. Funding

for the Cedar Link project will be provided through project-level

credit facilities of up to $1.5 billion, and equity to be provided

by Coastal GasLink LP partners, including us. We estimate our share

of equity contributions to fund the project will be approximately

$50 million.

We reached unanimous support from customers for a

five-year negotiated revenue requirement

settlement on the NGTL System commencing

on January 1, 2025. The settlement maintains a return on equity of

10.1 per cent on 40 per cent deemed common equity and is expected

to result in approximately $150 million to $200 million per year

increase in comparable EBITDA through increased depreciation rates

and incentive mechanisms. The settlement also enables an investment

framework that supports allocating $3.27 billion of capital towards

progression of a new multi-year growth plan. It is comprised of

multiple projects that are subject to final company and regulatory

approvals, with targeted in-service dates between 2027 and 2030.

The completion of the multi-year growth plan will enable

approximately 1.0 Bcf/d of incremental system throughput. We thank

our customers for this collaborative process finding alignment to

address evolving needs of both the industry and our business.

During the second quarter 2024, we progressed toward our

$3 billion asset divestiture target and completed

our strategic alliance agreement with the CFE, who became a partner

in TGNH with a 13.01 per cent interest for cash proceeds of US$340

million and non-cash consideration. On July 30 2024, we announced

Canada’s largest Indigenous equity ownership agreement that will

enable Indigenous Communities to collectively acquire a 5.34 per

cent minority equity interest in the NGTL System and the Foothills

Pipeline assets (together, Partnership Assets) for gross proceeds

of $1.0 billion. This historic agreement is made possible by an

equity loan guarantee provided by the Alberta Indigenous

Opportunities Corporation in support of a newly formed

Indigenous-owned investment partnership. Once finalized, the

Communities will enter into definitive agreements as co-investors

in the Partnership Assets. Investment in energy assets delivers

access to long-term revenue sources, creating meaningful change for

Indigenous Communities across Canada.

With these announcements, we are tracking to approximately

$2.6 billion of asset sales that represents the

majority of our $3 billion target prior to the end of the year. In

combination with our asset divestiture plan, strong results in the

first half of 2024, capital expenditures trending to the low end of

our 2024 outlook and continued progress on our business efficiency

initiatives, we are making significant progress towards our year

end debt-to-EBITDA3 target of 4.75 times, which represents the

upper limit we will manage to going forward. Further, we remain

committed to staying within our $6 billion to $7 billion annual net

capital expenditure limit, with a bias to the lower end, in 2025

and beyond.

In June 2024, we received approval from our shareholders to

spin off the Liquids Pipelines business (the

spinoff Transaction), South Bow Corporation (South Bow). We believe

spinning off South Bow will allow both companies to maximize the

long-term value of their respective assets. We anticipate that the

effective separation date will occur in early fourth quarter 2024.

As two separate entities, each company will have the ability to

focus on their distinct strategies and opportunity sets –

delivering essential energy that the world relies on.

We released our 2024 Report on Sustainability

that details the company's overall sustainability performance and

progress on our commitments. We reaffirm our role as part of a

collective effort to advance a lower-emissions energy system that

is affordable, reliable and secure, while working closely with our

neighbours, customers, Indigenous peoples, and governments to build

relationships and create mutually beneficial opportunities. Key

highlights include:

- Reduced absolute methane emissions by 15 per cent between 2019

and 2023

- Invested $1.8 billion in 2023 with Indigenous and Native

American suppliers in Canada and U.S., and launched a Canadian

Indigenous Equity Framework

- Introduced a new target to increase

the representation of women at the company by two per cent annually

over the next three years.

Following the spinoff Transaction, TC Energy

will continue to play a pivotal role in North America's energy

future – and increasingly provide global energy solutions through

our highly integrated natural gas delivery network. The demand for

energy in North America and globally has never been greater, and we

believe we are positioned to meet this demand while balancing

energy security, affordability and sustainability through our

critical infrastructure. We remain selective and strategic in

allocating capital in order to maximize risk-adjusted shareholder

returns and deliver long-term shareholder value.

Teleconference and WebcastWe will hold a

teleconference and webcast on Thursday, August 1, 2024 at 6:30

a.m. (MDT) / 8:30 a.m. (EDT) to discuss our second quarter 2024

financial results and Company developments. Presenters will include

François Poirier, President and Chief Executive Officer; Sean

O'Donnell, Executive Vice-President and Chief Financial Officer;

and other members of the executive leadership team.

Members of the investment community and other interested parties

are invited to participate by calling 1-844-763-8274

(Canada/U.S.) or 1-647-484-8814 (International). No

passcode is required. Please dial in 15 minutes prior to the start

of the call. Alternatively, participants may pre-register for the

call here. Upon registering, you will receive a calendar booking by

email with dial in details and a unique PIN. This process will

bypass the operator and avoid the queue. Registration will remain

open until the end of the conference call.

A live webcast of the teleconference will be available on TC

Energy's website at www.TCEnergy.com/events or via the following

URL: https://www.gowebcasting.com/13394. The webcast will be

available for replay following the meeting.

A replay of the teleconference will be available two hours after

the conclusion of the call until midnight EDT on August 8, 2024.

Please call 1-855-669-9658 (Canada/U.S.) or 1-412-317-0088

(International) and enter passcode 6645236#.

The unaudited interim Condensed consolidated financial

statements and Management’s Discussion and Analysis (MD&A) are

available on our website at

www.TCEnergy.com and will be filed today

under TC Energy's profile on SEDAR+ at

www.sedarplus.ca and with the U.S.

Securities and Exchange Commission on EDGAR at

www.sec.gov.

About TC EnergyWe’re a team of 7,000+ energy

problem solvers working to move, generate and store the energy

North America relies on. Today, we’re delivering solutions to the

world’s toughest energy challenges – from innovating to deliver the

natural gas that feeds LNG to global markets, to working to reduce

emissions from our assets, to partnering with our neighbours,

customers and governments to build the energy system of the future.

It’s all part of how we continue to deliver sustainable returns for

our investors and create value for communities.

TC Energy's common shares trade on the Toronto (TSX) and New

York (NYSE) stock exchanges under the symbol TRP. To learn more,

visit us at www.TCEnergy.com.

Forward-Looking InformationThis release

contains certain information that is forward-looking and is subject

to important risks and uncertainties and is based on certain key

assumptions. Forward-looking statements are usually accompanied by

words such as "anticipate", "expect", "believe", "may", "will",

"should", "estimate" or other similar words. Forward-looking

statements in this document may include, but are not limited to,

statements on the progress of Coastal GasLink and Southeast

Gateway, including mechanical completion, offshore installations

and in-service dates, expected comparable EBITDA and comparable

earnings per common share and targeted debt-to-EBITDA leverage

metrics for 2024, and the sources thereof, expectations with

respect to the Cedar Link project, including the financing thereof,

expectations with respect to Bruce Power, expectations with respect

to our strategic priorities, including our multi-year growth plan

for the NGTL System, and the execution thereof, our sustainability

commitments, expectations with respect to our asset divestiture

program, our expected net capital expenditures and dividend outlook

and the spinoff Transaction, including timing and expectations with

respect to TC Energy and South Bow following the completion of the

spinoff Transaction. Our forward-looking information is subject to

important risks and uncertainties and is based on certain key

assumptions. Forward-looking statements and future-oriented

financial information in this document are intended to provide TC

Energy security holders and potential investors with information

regarding TC Energy and its subsidiaries, including management's

assessment of TC Energy's and its subsidiaries' future plans and

financial outlook. All forward-looking statements reflect TC

Energy's beliefs and assumptions based on information available at

the time the statements were made and as such are not guarantees of

future performance. As actual results could vary significantly from

the forward-looking information, you should not put undue reliance

on forward-looking information and should not use future-oriented

information or financial outlooks for anything other than their

intended purpose. We do not update our forward-looking information

due to new information or future events, unless we are required to

by law. For additional information on the assumptions made, and the

risks and uncertainties which could cause actual results to differ

from the anticipated results, refer to the most recent Quarterly

Report to Shareholders and the 2023 Annual Report filed under TC

Energy's profile on SEDAR+ at www.sedarplus.ca and with the U.S.

Securities and Exchange Commission at www.sec.gov and the

"Forward-looking information" section of our Report on

Sustainability and our GHG Emissions Reduction Plan which are

available on our website at www.TCEnergy.com.

Non-GAAP MeasuresThis release contains

references to the following non-GAAP measures: comparable EBITDA,

comparable earnings, comparable earnings per common share,

comparable funds generated from operations and net capital

expenditures. It also contains references to debt-to-EBITDA, a

non-GAAP ratio, which is calculated using adjusted debt and

adjusted comparable EBITDA, each of which are non-GAAP measures.

These non-GAAP measures do not have any standardized meaning as

prescribed by GAAP and therefore may not be comparable to similar

measures presented by other entities. These non-GAAP measures are

calculated by adjusting certain GAAP measures for specific items we

believe are significant but not reflective of our underlying

operations in the period. These comparable measures are calculated

on a consistent basis from period to period and are adjusted for

specific items in each period, as applicable except as otherwise

described in the Condensed consolidated financial statements and

MD&A. Refer to: (i) each business segment for a reconciliation

of comparable EBITDA to segmented earnings (losses); (ii)

Consolidated results section for reconciliations of comparable

earnings and comparable earnings per common share to Net income

attributable to common shares and Net income per common share,

respectively; and (iii) Financial condition section for a

reconciliation of comparable funds generated from operations to Net

cash provided by operations. Refer to the Non-GAAP Measures section

of the MD&A in our most recent quarterly report for more

information about the non-GAAP measures we use. The MD&A is

included with, and forms part of, this release. The MD&A can be

found on SEDAR+ at www.sedarplus.ca under TC Energy's profile.

With respect to non-GAAP measures used in the calculation of

debt-to-EBITDA, adjusted debt is defined as the sum of Reported

total debt, including Notes payable, Long-term debt, Current

portion of long-term debt and Junior subordinated notes, as

reported on our Consolidated balance sheet as well as Operating

lease liabilities recognized on our Consolidated balance sheet and

50 per cent of Preferred shares as reported on our Consolidated

balance sheet due to the debt-like nature of their contractual and

financial obligations, less Cash and cash equivalents as reported

on our Consolidated balance sheet and 50 per cent of Junior

subordinated notes as reported on our Consolidated balance sheet

due to the equity-like nature of their contractual and financial

obligations. Adjusted comparable EBITDA is calculated as comparable

EBITDA excluding operating lease costs recorded in Plant operating

costs and other in our Consolidated statement of income and

adjusted for Distributions received in excess of (income) loss from

equity investments as reported in our Consolidated statement of

cash flows which we believe is more reflective of the cash flows

available to TC Energy to service our debt and other long-term

commitments. We believe that debt-to-EBITDA provides investors with

useful information as it reflects our ability to service our debt

and other long-term commitments. See the Reconciliation section for

reconciliations of adjusted debt and adjusted comparable EBITDA for

the years ended December 31, 2022 and 2023.

ReconciliationThe following is a reconciliation

of adjusted debt and adjusted comparable EBITDAi.

|

|

|

year ended December 31 |

|

(millions of Canadian $) |

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

| Reported total

debt |

|

63,201 |

|

|

58,300 |

|

| Management adjustments: |

|

|

|

|

|

Debt treatment of preferred sharesii |

|

1,250 |

|

|

1,250 |

|

|

Equity treatment of junior subordinated notesiii |

|

(5,144 |

) |

|

(5,248 |

) |

|

Cash and cash equivalents |

|

(3,678 |

) |

|

(620 |

) |

|

Operating lease liabilities |

|

459 |

|

|

433 |

|

|

Adjusted debt |

|

56,088 |

|

|

54,115 |

|

|

|

|

|

|

|

| Comparable EBITDAiv |

|

10,988 |

|

|

9,901 |

|

| Operating lease cost |

|

118 |

|

|

106 |

|

|

Distributions received in excess of (income) loss from equity

investments |

|

(123 |

) |

|

(29 |

) |

|

Adjusted Comparable EBITDA |

|

10,983 |

|

|

9,978 |

|

|

|

|

|

|

|

|

Adjusted Debt/Adjusted Comparable EBITDAi |

|

5.1 |

|

|

5.4 |

|

i Adjusted debt and adjusted comparable EBITDA

are non-GAAP measures. The calculations are based on management

methodology. Individual rating agency calculations will

differ.ii 50 per cent debt treatment on $2.5 billion of

preferred shares as of December 31, 2023.iii 50 per cent equity

treatment on $10.3 billion of junior subordinated notes as of

December 31, 2023. U.S. dollar-denominated notes translated at

December 31, 2023, U.S./Canada foreign exchange rate of 1.32.iv

Comparable EBITDA is a non-GAAP financial measure. See the

Forward-looking information and Non-GAAP measures sections for more

information.

Media Inquiries:Media

Relationsmedia@tcenergy.com403.920.7859 or 800.608.7859

Investor & Analyst

Inquiries: Gavin

Wylie / Hunter Mau investor_relations@tcenergy.com403.920.7911 or

800.361.6522

Download full report here:

https://www.tcenergy.com/siteassets/pdfs/investors/reports-and-filings/annual-and-quarterly-reports/2024/tce-2024-q2-quarterly-report.pdf

1 Comparable EBITDA, comparable earnings and comparable earnings

per common share are non-GAAP measures used throughout this news

release. These measures do not have any standardized meaning under

GAAP and therefore are unlikely to be comparable to similar

measures presented by other companies. The most directly comparable

GAAP measures are Segmented earnings, Net income attributable to

common shares and Net income per common share, respectively. For

more information on non-GAAP measures, refer to the Non-GAAP

Measures section of this news release. 2 Prior to the potential

impact of asset sales and the Liquids Pipelines business spinoff.3

Debt-to-EBITDA is a non-GAAP ratio. Adjusted debt and adjusted

comparable EBITDA are non-GAAP measures used to calculate

debt-to-EBITDA. See the Forward-looking information, Non-GAAP

measures and Reconciliation sections for more information.

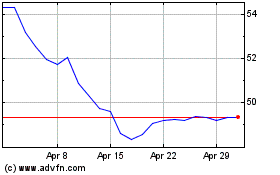

TC Energy (TSX:TRP)

Historical Stock Chart

From Nov 2024 to Dec 2024

TC Energy (TSX:TRP)

Historical Stock Chart

From Dec 2023 to Dec 2024