Calibre Mining Corp. (TSX: CXB; OTCQX: CXBMF)

(“Calibre” or the “Company”) announces financial and operating

results for the three months (“Q4”) and full year ended December

31, 2024 (“FY 2024”). Consolidated Q4 and FY 2024 filings can be

found at

www.sedarplus.ca and on the Company’s

website at

www.calibremining.com. All figures are

expressed in U.S. dollars unless otherwise stated.

Darren Hall, President and Chief

Executive Officer of Calibre, stated: “Calibre delivered a

record Q4 consolidated gold production of 76,269 ounces, and full

year 2024 production of 242,487 ounces, surpassing the revised 2024

annual production guidance. As of February 15, 2025, the year is

off to a strong start with consolidated production trending 15%

higher than budget and cash increased to $161 million, a 23%

increase over December 31, 2024.

2025 is set to be a transformative year for

Calibre, with the Valentine Gold Mine on track for first gold

during the second quarter. We hired a high quality, experienced

operating team through 2024 and are working with Reliable Controls

Corporation to conduct pre-commissioning and commissioning to

ensure operational readiness. In addition, all necessary equipment

and resources for timely production are on site. Based on the 2022

Feasibility Study*, Valentine’s life-of-mine average production is

expected to be approximately 195,000 ounces per year, with the

process plant expected to reach 2.5 Mpta by the end of 2025.

The exploration potential at Valentine is

incredibly exciting. We have seen continued success since the

discovery made southwest of the Leprechaun deposit in late 2024

with initial drill results returning grades more than 40% above

Mineral Reserve grade. As we progress during 2025, we are preparing

for the largest pure exploration program in Valentine’s history.

With tens of kilometres of the Valentine Lake Shear Zone and the

Parallel Northwest Contact still untested, we remain optimistic

about the significant upside potential as we advance efforts to

establish this district as a new gold camp.

With strong gold prices, consistent operating

performance, successful exploration results and Valentine on track

to enhance diversification and growth, I am confident that we will

continue delivering superior value for our shareholders.”

FY & Q4 2024 Highlights

- Construction of the multi-million-ounce Valentine Gold

Mine is on track for first gold during Q2 2025:

- Tailings Management Facility is complete and receiving

water;

- SAG and Ball Mill continue to advance towards

pre-commissioning;

- Structural, mechanical and piping activities advancing in the

Grinding, ADR, Reagents and Gold Room areas;

- CIL leaching tanks construction is complete and

mechanical/electrical work has commenced;

- Overland and coarse ore stockpile conveyor is progressing and

reclaim tunnel is preparing for apron feeders;

- Primary crusher installation is complete and commissioning is

well advanced;

- Pre-commissioning across the site is well underway; and

- Initial project capital costs, exclusive of sunk costs, remain

at approximately C$744 million.

- Record consolidated Q4 gold production of 76,269 ounces, 2025

off to a strong start;

- Consolidated FY 2024 gold production of 242,487 ounces,

exceeding updated 2024 guidance;

- Drill results from the expanded 100,000 metre drill program at

Valentine yield significant gold mineralization outside of the

known Mineral Resource estimate and up to 1,000 metres southwest of

the known Leprechaun open pit with grades more than 40% above

Mineral Reserve grade:

- 2.43 g/t Au over 172.8 metres including 3.84 g/t Au over 90.9

metres; and

- 2.12 g/t Au over 95.4 metres; 2.26 g/t Au over 78.3

metres;

- Ore control drilling results at the Marathon Pit at Valentine

yielded 44% additional gold on 47% higher grades than modelled in

the 2022 Mineral Reserve estimate, increasing confidence of the

deposit;

- Received the Federal Environmental Assessment approval for the

third open pit, the Berry Pit at Valentine, and commenced

construction activities at Berry in Q4 2024;

- Achieved one million ounces of gold production in Nicaragua

since becoming a producer in Q4 2019;

- Initial Inferred Mineral Resource estimate declared at the

Talavera Gold Deposit located 3 km from the Limon mill comprised of

3,847,000 tonnes averaging 5.09 g/t gold, yielding 630,000 ounces

of gold;

- High grade gold mineralization and new discoveries continue

across the Limon Mine Complex with quarterly drill results among

the best to-date at both Talavera and the VTEM Gold Corridor,

signaling the exceptional potential at Limon:

- 12.57 g/t Au over 7.1 metres including 26.65 g/t Au over 3.3

metres;

- 12.96 g/t Au over 19.9 metres; 10.59 g/t Au over 13.5 metres;

and

- 9.97 g/t Au over 6.9 metres; 14.64 g/t Au over 7.5 metres;

- Continued to intercept high grade gold mineralization from the

resource conversion and expansion program within the Guapinol open

pit area at the Eastern Borosi mine in Nicaragua, reinforcing the

potential for mine life extension:

- 13.24 g/t gold over 5.8 metres ETW including 18.52 g/t gold

over 4.0 metres ETW; and

- 9.24 g/t gold over 6.2 metres ETW including 17.45 g/t gold over

3.1 metres ETW

FY 2024 Gold Sales and Cost Metrics

- Consolidated gold sales of 242,452 ounces, generating $574.4

million in gold revenue, at an average realized gold price1 of

$2,369/oz; Nicaragua 207,224 ounces and Nevada 35,228 ounces;

- Consolidated Total Cash Cost1 (“TCC”) of $1,336/oz; Nicaragua

$1,313/oz and Nevada $1,473/oz;

- Consolidated All-In Sustaining Cost1 (“AISC”) of $1,583/oz;

Nicaragua $1,480/oz and Nevada $1,683/oz; and

- Cash and restricted cash of $131.1 million and $54.6 million,

respectively, as at December 31, 2024.

Valentine Grinding Building - February 2025

Overview of Process Plant - February 2025

CONSOLIDATED RESULTS: Q4 and FY 2024

Consolidated Results(1)

|

$'000 (except per share and per ounce

amounts) |

Three Months Ended |

Full Year Ended |

|

Q4 2024 |

Q3 2024 |

Q4 2023 |

|

2024 |

|

|

2023 |

|

|

Financial Results |

|

Revenue |

$ |

202,966 |

|

$ |

113,684 |

|

$ |

151,595 |

|

$ |

585,863 |

|

$ |

561,702 |

|

|

Cost of sales, including depreciation and amortization |

$ |

(138,607 |

) |

$ |

(97,437 |

) |

$ |

(109,742 |

) |

$ |

(433,360 |

) |

$ |

(391,299 |

) |

|

Earnings from mine operations |

$ |

64,359 |

|

$ |

16,247 |

|

$ |

41,853 |

|

$ |

152,503 |

|

$ |

170,403 |

|

|

EBITDA (2) |

$ |

73,456 |

|

$ |

29,988 |

|

$ |

43,659 |

|

$ |

182,808 |

|

$ |

214,075 |

|

|

Adjusted EBITDA (2) |

$ |

95,573 |

|

$ |

28,943 |

|

$ |

59,195 |

|

$ |

215,827 |

|

$ |

232,046 |

|

|

Net earnings |

$ |

16,661 |

|

$ |

954 |

|

$ |

12,001 |

|

$ |

34,740 |

|

$ |

85,025 |

|

|

Adjusted net earnings (2) |

$ |

38,550 |

|

$ |

2,199 |

|

$ |

22,305 |

|

$ |

66,264 |

|

$ |

96,667 |

|

|

Operating cash flows before working capital (2) |

$ |

127,587 |

|

$ |

4,170 |

|

$ |

40,441 |

|

$ |

251,510 |

|

$ |

178,158 |

|

|

Operating cash flow |

$ |

91,404 |

|

$ |

(17,833 |

) |

$ |

60,330 |

|

$ |

181,053 |

|

$ |

201,106 |

|

|

Capital expenditures (sustaining) |

$ |

6,940 |

|

$ |

10,849 |

|

$ |

9,225 |

|

$ |

35,856 |

|

$ |

28,770 |

|

|

Capital expenditures (growth) |

$ |

125,485 |

|

$ |

136,103 |

|

$ |

32,077 |

|

$ |

427,318 |

|

$ |

102,281 |

|

|

Capital expenditures (exploration) |

$ |

13,985 |

|

$ |

12,387 |

|

$ |

7,845 |

|

$ |

42,976 |

|

$ |

29,293 |

|

|

Operating Results |

|

|

|

|

|

|

Gold ounces produced |

|

76,269 |

|

|

45,697 |

|

|

75,482 |

|

|

242,487 |

|

|

283,494 |

|

|

Gold ounces sold |

|

76,252 |

|

|

46,076 |

|

|

75,505 |

|

|

242,452 |

|

|

283,525 |

|

|

Per Ounce Data |

|

|

|

|

|

|

Average realized gold price(2) ($/oz) |

$ |

2,616 |

|

$ |

2,418 |

|

$ |

1,969 |

|

$ |

2,369 |

|

$ |

1,942 |

|

|

TCC ($/oz)(2) |

$ |

1,243 |

|

$ |

1,580 |

|

$ |

1,136 |

|

$ |

1,336 |

|

$ |

1,071 |

|

|

AISC ($/oz)(2) |

$ |

1,423 |

|

$ |

1,946 |

|

$ |

1,317 |

|

$ |

1,583 |

|

$ |

1,228 |

|

|

$'000 (except per share and per ounce

amounts) |

Three Months Ended |

Full Year Ended |

|

Q4 2024 |

Q3 2024 |

Q4 2023 |

|

2024 |

|

2023 |

|

|

Financial Results |

|

Weighted Avg. Numbers of Shares Outstanding |

|

|

|

|

|

|

Basic (in thousands) |

|

838,038 |

|

796,103 |

|

|

458,094 |

|

|

766,477 |

|

456,347 |

|

|

Diluted (in thousands) |

|

869,947 |

|

828,006 |

|

|

475,292 |

|

|

794,844 |

|

473,925 |

|

|

Per Share Data |

|

|

|

|

|

|

Earnings per share – basic |

$ |

0.02 |

$ |

0.00 |

|

$ |

0.03 |

|

$ |

0.05 |

$ |

0.19 |

|

|

Earnings per share – fully diluted |

$ |

0.02 |

$ |

0.00 |

|

$ |

0.03 |

|

$ |

0.04 |

$ |

0.18 |

|

|

Adjusted net earnings per share – basic (2) |

$ |

0.05 |

$ |

0.00 |

|

$ |

0.05 |

|

$ |

0.09 |

$ |

0.21 |

|

|

Operating cash flows before working capital/share(2) |

$ |

0.15 |

$ |

0.01 |

|

$ |

0.09 |

|

$ |

0.33 |

$ |

0.39 |

|

|

Operating cash flow per share |

$ |

0.11 |

$ |

(0.02 |

) |

$ |

0.13 |

|

$ |

0.23 |

$ |

0.44 |

|

|

Balance Sheet Data (in thousands, except for

ratio) |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

131,093 |

$ |

115,800 |

|

$ |

86,160 |

|

$ |

131,093 |

$ |

86,160 |

|

|

Adjusted net debt (2) |

$ |

165,201 |

$ |

178,345 |

|

$ |

(66,054 |

) |

$ |

165,201 |

$ |

(66,054 |

) |

|

Adj. Net debt/Adj. EBITDA (LTM) ratio (2. 3) |

$ |

0.77 |

$ |

0.91 |

|

$ |

(0.28 |

) |

$ |

0.77 |

$ |

(0.28 |

) |

- Consolidated financial and operational results for 2024 include

the results from Marathon since its acquisition from the period of

January 25, 2024, to December 31, 2024.

- This is a non-IFRS measure, for further information refer to

the Non-IFRS Measures section in the Notes below.

- LTM is defined as the last twelve months.

Operating Results

|

|

Three Months Ended |

Full Year Ended |

|

NICARAGUA |

Q4 2024 |

Q3 2024 |

Q4 2023 |

2024 |

2023 |

|

Ore mined (t) |

796,789 |

574,878 |

521,325 |

2,265,749 |

2,109,956 |

|

Ore milled (t) |

617,415 |

557,635 |

527,753 |

2,161,677 |

2,072,875 |

|

Grade (g/t Au) |

3.97 |

2.30 |

3.64 |

3.28 |

3.93 |

|

Recovery (%) |

89.1 |

88.9 |

93.2 |

90.5 |

92.4 |

|

Gold produced (ounces) |

66,578 |

36,427 |

64,963 |

207,220 |

242,109 |

|

Gold sold (ounces) |

66,578 |

36,427 |

65,026 |

207,224 |

242,126 |

|

|

|

|

NEVADA |

Three Months Ended |

Full Year Ended |

|

Q4 2024 |

Q3 2024 |

Q4 2023 |

2024 |

2023 |

|

Ore mined (t) |

1,116,192 |

1,187,591 |

1,138,653 |

4,372,719 |

4,652,600 |

|

Ore placed on leach pad (t) |

1,136,772 |

1,158,381 |

1,139,889 |

4,332,507 |

4,592,642 |

|

Grade (g/t Au) |

0.36 |

0.44 |

0.33 |

0.40 |

0.36 |

|

Gold produced (ounces) |

9,691 |

9,270 |

10,519 |

35,267 |

41,385 |

|

Gold sold (ounces) |

9,674 |

9,649 |

10,479 |

35,228 |

41,399 |

2025 GUIDANCE

|

|

CONSOLIDATED |

NICARAGUA |

NEWFOUNDLAND |

NEVADA |

|

Gold Production/Sales (ounces) |

230,000 - 280,000 |

200,000 - 250,000 |

N/A |

30,000 - 40,000 |

|

TCC ($/ounce)1 |

$1,300 - $1,400 |

$1,200 - $1,300 |

N/A |

$1,600 - $1,700 |

|

AISC ($/ounce)1 |

$1,500 - $1,600 |

$1,400 - $1,500 |

N/A |

$1,600 - $1,700 |

|

Growth Capital ($ million) |

$70 - $80 |

$60 - $70 |

N/A |

$5 - $10 |

|

Exploration ($ million) |

$50 - $60 |

$25 - $30 |

$15 - $20 |

$5 - $10 |

The 2025 guidance currently covers gold

production, TCC, AISC, and growth capital for operations in

Nicaragua and Nevada. The consolidated exploration guidance

includes drilling activities at the Valentine gold mine. Guidance

for Valentine, including production, TCC, AISC, growth and

full-year consolidated details, will be provided after first gold

is produced from Valentine, expected during Q2 this year.

Calibre is nearing completion of construction at

its Valentine Gold Mine in Newfoundland & Labrador, which is

set to become Atlantic Canada’s largest gold mine. This milestone

marks a significant transformation for the Company from a junior

gold miner to a diversified, mid-tier gold producer.

Calibre will continue to reinvest in exploration

and growth, with approximately 200,000 metres of drilling planned

and the development of new satellite deposits across its asset

portfolio.

Exploration activities in 2025 include multi-rig

diamond, RC and RAB drilling in Newfoundland, Nevada and Nicaragua

alongside several geoscience initiatives. Growth capital

investments include underground and open pit mine development,

waste stripping and strategic land acquisitions.

Q4 and Full Year 2024 Conference

Call

| Date: |

Thursday,

February 20, 2025 |

| Time: |

10:00 am ET |

| Webcast link: |

https://edge.media-server.com/mmc/p/4zd24xmm |

Instructions for obtaining conference call dial-in number:

- All parties must register at the link below to participate in

Calibre’s Q4 and Full Year 2024 Conference Call.

- To register click

https://dpregister.com/sreg/10191038/fd1cb8c35e and complete the

online registration form.

- Once registered you will receive the dial-in numbers and PIN

number for input at the time of the call.

The live webcast and registration link can be

accessed here and at www.calibremining.com under the Events section

under the Investors tab. The live audio webcast will be archived

and available for replay for 12 months after the event at

www.calibremining.com. Presentation slides that will accompany the

conference call will be made available in the Investors section of

the Calibre website under Presentations prior to the conference

call.

Qualified Person

The scientific and technical information contained in this news

release was approved by David Schonfeldt P.GEO,Calibre Mining’s

Corporate Chief Geologist and a "Qualified Person" under National

Instrument 43-101.

About Calibre

Calibre is a Canadian-listed, Americas focused,

growing mid-tier gold producer with a strong pipeline of

development and exploration opportunities across Newfoundland &

Labrador in Canada, Nevada and Washington in the USA, and

Nicaragua. Calibre is focused on delivering sustainable value for

shareholders, local communities and all stakeholders through

responsible operations and a disciplined approach to growth. With a

strong balance sheet, a proven management team, strong operating

cash flow, accretive development projects and district-scale

exploration opportunities Calibre will unlock significant

value.

ON BEHALF OF THE BOARD

“Darren Hall”

Darren Hall, President & Chief Executive Officer

For further information, please contact:

Ryan KingSenior Vice President, Corporate

Development & IR T: 604.628.1010E: calibre@calibremining.com W:

www.calibremining.com

Calibre’s head office is located at Suite 1560, 200 Burrard St.,

Vancouver, British Columbia, V6C 3L6.

X / Facebook / LinkedIn / YouTube

The Toronto Stock Exchange has neither reviewed

nor accepts responsibility for the adequacy or accuracy of this

news release.

Notes

* Refer to the “Valentine Gold Project NI 43-101

Technical Report and Feasibility Study, Newfoundland &

Labrador, Canada” dated November 30, 2022 and found on the Calibre

website at www.calibremining.com and on SEDAR+

at www.sedarplus.ca.

(1) NON-IFRS FINANCIAL MEASURES

Calibre has included certain non-IFRS measures

as discussed below. The Company believes that these measures, in

addition to conventional measures prepared in accordance with IFRS,

provide investors with an improved ability to evaluate the

underlying performance of the Company. These non-IFRS measures are

intended to provide additional information and should not be

considered in isolation or as a substitute for measures of

performance prepared in accordance with IFRS. These measures do not

have any standardized meaning prescribed under IFRS, and therefore

may not be comparable to other issuers.

TCC per Ounce

of Gold: TCC include production costs, royalties,

production taxes, refinery charges, and transportation charges.

Production costs consist of mine site operating costs such as

mining, processing, local administrative costs (including

stock-based compensation related to mine operations) and current

inventory write-downs, if any. Production costs are exclusive of

depreciation and depletion, reclamation, capital and exploration

costs. TCC are net of by-product silver sales and are divided by

gold ounces sold to arrive at a per ounce figure.

AISC per

Ounce of Gold: AISC is a performance measure that reflects

the total expenditures that are required to produce an ounce of

gold from current operations. While there is no standardized

meaning of the measure across the industry, the Company’s

definition is derived from the definition as set out by the World

Gold Council in its guidance dated June 27, 2013, and November 16,

2018, respectively. The World Gold Council is a non-regulatory,

non-profit organization established in 1987 whose members include

global senior mining companies. The Company believes that this

measure is useful to external users in assessing operating

performance and the ability to generate free cash flow from

operations.

Calibre defines AISC

as the sum of TCC, corporate general and administrative expenses

(excluding one-time charges), reclamation accretion related to

current operations and amortization of asset retirement obligations

(“ARO”), sustaining capital (capital required to maintain current

operations at existing production levels), lease repayments, and

exploration expenditures designed to increase resource confidence

at producing mines. AISC excludes capital expenditures for

significant improvements at existing operations deemed to be

expansionary in nature, exploration and evaluation related to

resource growth, rehabilitation accretion not related to current

operations, financing costs, debt repayments, and taxes. Total AISC

is divided by gold ounces sold to arrive at a per ounce figure

Average

Realized Price per Ounce Sold: Average Realized Gold Price

Per Ounce Sold is intended to enable management to understand the

average realized price of gold sold in each reporting period after

removing the impact of non-gold revenues and by-produce credits,

which in the Company’s case are not significant, and to enable

investors to understand the Company’s financial performance based

on the average realized proceeds of selling gold production in the

reporting period. Average Realized Gold Price Per Ounce Sold is a

common performance measure that does not have any standardized

meaning. The most directly comparable measure prepared in

accordance with IFRS is revenue from gold sales.

Adjusted Net

Earnings: Adjusted Net Earnings and Adjusted Net Earnings

Per Share - Basic exclude a number of temporary or one-time items

considered exceptional in nature and not related to the Company’s

core operation of mining assets or reflective of recurring

operating performance. Management believes Adjusted Net Earnings

may assist investors and analysts to better understand the current

and future operating performance of the Company’s core mining

business. Adjusted Net Earnings and Adjusted Net Earnings Per Share

do not have a standard meaning under IFRS. They should not be

considered in isolation, or as a substitute for measures of

performance prepared in accordance with IFRS and are not

necessarily indicative of earnings from mine operations, earnings,

or cash flow from operations as determined under IFRS.

Cash From

Operating Activities Before Changes in Working Capital:

Cash from Operating Activities before Changes in Working Capital is

a non-IFRS measure with no standard meaning under IFRS, which is

calculated by the Company as net cash from operating activities

less working capital items. The Company believes that Net Cash from

Operating Activities before Changes in Working Capital, which

excludes these non-cash items, provides investors with the ability

to better evaluate the operating cash flow performance of the

Company.

Net Debt and

Adjusted Net Debt: The Company believes that in addition

to conventional measures prepared in accordance with IFRS, the

Company and certain investors and analysts use net debt to evaluate

the Company’s performance. Net debt does not have any standardized

meaning prescribed under IFRS, and therefore it may not be

comparable to similar measures employed by other companies. This

measure is intended to provide additional information and should

not be considered in isolation or as a substitute for measures of

performances prepared in accordance with IFRS. Net debt is

calculated as the sum of the current and non-current portions of

loans and borrowings, net of the cash and cash equivalent balance

as at the balance sheet date. Adjusted Net Debt is calculated as

Net Debt less fair value and other non-cash adjustments that will

not result in a cash outflow to the Company. The Company believes

that Adjusted Net Debt provides a better understanding of the

Company’s liquidity.

EBITDA and

Adjusted EBITDA: The Company believes that certain

investors use the EBITDA and the adjusted EBITDA (“Adjusted

EBITDA”) measures to evaluate the Company’s performance and ability

to generate operating cash flows to service debt and fund capital

expenditures. EBITDA and Adjusted EBITDA do not have a standardized

meaning as prescribed under IFRS and should not be considered in

isolation or as a substitute for measures of performance prepared

in accordance with IFRS. The Company calculates EBITDA as earnings

or loss before taxes for the period excluding depreciation and

depletion and finance costs. EBITDA excludes the impact of cash

costs of financing activities and taxes and the effects of changes

in working capital balances and therefore is not necessarily

indicative of operating profit or cash flow from operations as

determined under IFRS. Adjusted EBITDA is calculated by excluding

one-off costs or credits relating to non-routine transactions from

EBITDA that are not indicative of recurring operating performance.

Management believes this additional information is useful to

investors in understanding the Company’s ability to generate

operating cash flow by excluding from the calculation these

non-cash and cash amounts that are not indicative of the recurring

performance of the underlying operations for the reporting

periods.

Adjusted Net

Debt to Adjusted EBITDA: The Adjusted Net Debt to Adjusted

EBITDA measures provide investors and analysts with additional

transparency about the Company’s liquidity position, specifically,

the Company’s ability to generate sufficient operating cash flows

to meet its mandatory interest obligations and pay down its

outstanding debt balance in full at maturity. This measure is a

Non-IFRS measure and it is intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with

IFRS. The calculation of Adjusted Net Debt is shown above.

TCC and AISC per Ounce of Gold Sold

Reconciliations

The tables below reconcile TCC and AISC for the three months

ended December 31, 2024, September 30, 2024, and December 31,

2023:

|

|

Q4 2024 |

|

(in thousands - except per ounce amounts) |

Nicaragua |

Nevada |

Corporate |

Consolidated |

|

Production costs |

$ |

77,823 |

|

$ |

13,325 |

|

$ |

- |

$ |

91,148 |

|

|

Less: silver by-product revenue |

|

(3,465 |

) |

|

(28 |

) |

|

- |

|

(3,493 |

) |

|

Royalties and production taxes |

|

5,924 |

|

|

1,211 |

|

|

- |

|

7,135 |

|

|

Total cash costs |

$ |

80,282 |

|

$ |

14,508 |

|

$ |

- |

$ |

94,790 |

|

|

Corporate and general administration |

|

- |

|

|

- |

|

|

5,394 |

|

5,394 |

|

|

Reclamation accretion and amortization of ARO |

|

1,093 |

|

|

148 |

|

|

- |

|

1,241 |

|

|

Sustaining capital(1) |

|

6,634 |

|

|

306 |

|

|

- |

|

6,940 |

|

|

Sustaining exploration |

|

167 |

|

|

- |

|

|

- |

|

167 |

|

|

Total AISC |

$ |

88,176 |

|

$ |

14,962 |

|

$ |

5,394 |

$ |

108,532 |

|

|

|

|

|

|

|

|

Gold ounces sold |

|

66,578 |

|

|

9,674 |

|

|

- |

|

76,252 |

|

|

Total Cash Costs |

$ |

1,206 |

|

$ |

1,500 |

|

$ |

- |

$ |

1,243 |

|

|

AISC |

$ |

1,324 |

|

$ |

1,547 |

|

$ |

- |

$ |

1,423 |

|

1. Sustaining capital expenditures are shown in the Growth and

Sustaining Capital table in the Q4 and Full Year 2024 MD&A

dated December 31, 2024.

|

|

Q3 2024 |

|

(in thousands - except per ounce amounts) |

Nicaragua |

Nevada |

Corporate |

Consolidated |

|

Production costs |

$ |

57,466 |

|

$ |

12,866 |

|

$ |

- |

$ |

70,332 |

|

|

Less: silver by-product revenue |

|

(2,272 |

) |

|

(1 |

) |

|

- |

|

(2,273 |

) |

|

Royalties and production taxes |

|

3,286 |

|

|

1,084 |

|

|

- |

|

4,370 |

|

|

Refinery, transportation and other |

|

332 |

|

|

51 |

|

|

- |

|

383 |

|

|

Total cash costs |

$ |

58,811 |

|

$ |

14,001 |

|

$ |

- |

$ |

72,812 |

|

|

Corporate and general administration |

|

- |

|

|

- |

|

|

3,702 |

|

3,702 |

|

|

Reclamation accretion and amortization of ARO |

|

1,093 |

|

|

137 |

|

|

- |

|

1,230 |

|

|

Sustaining capital(1) |

|

7,499 |

|

|

3,351 |

|

|

- |

|

10,849 |

|

|

Sustaining exploration |

|

1,064 |

|

|

- |

|

|

- |

|

1,064 |

|

|

Total AISC |

$ |

68,467 |

|

$ |

17,488 |

|

$ |

3,702 |

$ |

89,658 |

|

|

Gold ounces sold |

|

36,427 |

|

9,649 |

|

- |

|

46,076 |

|

Total Cash Costs |

$ |

1,615 |

$ |

1,451 |

$ |

- |

$ |

1,580 |

|

AISC |

$ |

1,880 |

$ |

1,813 |

$ |

- |

$ |

1,946 |

1. Sustaining capital expenditures are shown in the Growth

and Sustaining Capital table in the Q4 and Full Year 2024 MD&A

dated December 31, 2024.

|

|

Q4 2023 |

|

(in thousands - except per ounce amounts) |

Nicaragua |

Nevada |

Corporate |

Consolidated |

|

Production costs |

$ |

68,902 |

|

$ |

14,541 |

|

$ |

- |

$ |

83,443 |

|

|

Less: silver by-product revenue |

|

(2,866 |

) |

|

(26 |

) |

|

- |

|

(2,892 |

) |

|

Royalties and production taxes |

|

4,267 |

|

|

986 |

|

|

- |

|

5,253 |

|

|

Total cash costs |

$ |

70,303 |

|

$ |

15,501 |

|

$ |

- |

$ |

85,804 |

|

|

Corporate and general administration |

|

- |

|

|

- |

|

|

3,642 |

|

3,642 |

|

|

Reclamation accretion and amortization of ARO |

|

602 |

|

|

182 |

|

|

- |

|

784 |

|

|

Sustaining capital(1) |

|

8,701 |

|

|

524 |

|

|

- |

|

9,225 |

|

|

Sustaining exploration |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

Total AISC |

$ |

79,606 |

|

$ |

16,207 |

|

$ |

3,642 |

$ |

99,455 |

|

|

|

|

|

|

|

|

Gold ounces sold |

|

65,026 |

|

|

10,479 |

|

|

- |

|

75,505 |

|

|

Total Cash Costs |

$ |

1,081 |

|

$ |

1,479 |

|

$ |

- |

$ |

1,136 |

|

|

AISC |

$ |

1,224 |

|

$ |

1,547 |

|

$ |

- |

$ |

1,317 |

|

1. Sustaining capital expenditures are shown in the Growth

and Sustaining Capital table in the Q4 and Full Year 2024 MD&A

dated December 31, 2024.

The tables below reconcile TCC and AISC for the years ended

December 31, 2024 and 2023:

|

|

|

2024 |

|

|

(in thousands - except per ounce amounts) |

Nicaragua |

Nevada |

Corporate |

Consolidated |

|

Production costs |

$ |

265,475 |

|

$ |

48,064 |

|

$ |

- |

$ |

313,539 |

|

|

Less: silver by-product revenue |

|

(11,432 |

) |

|

(36 |

) |

|

- |

|

(11,468 |

) |

|

Royalties and production taxes |

|

18,030 |

|

|

3,861 |

|

|

- |

|

21,891 |

|

|

Total cash costs |

$ |

272,073 |

|

$ |

51,889 |

|

$ |

- |

$ |

323,962 |

|

|

Corporate and general administration |

|

- |

|

|

- |

|

|

17,702 |

|

17,702 |

|

|

Reclamation accretion and amortization of ARO |

|

4,374 |

|

|

559 |

|

|

- |

|

4,933 |

|

|

Sustaining capital(1) |

|

29,019 |

|

|

6,837 |

|

|

- |

|

35,856 |

|

|

Sustaining exploration |

|

1,276 |

|

|

- |

|

|

- |

|

1,276 |

|

|

Total AISC |

$ |

306,742 |

|

$ |

59,285 |

|

$ |

17,702 |

$ |

383,729 |

|

|

|

|

|

|

|

|

Gold ounces sold |

|

207,224 |

|

|

35,228 |

|

|

- |

|

242,452 |

|

|

Total Cash Costs |

$ |

1,313 |

|

$ |

1,473 |

|

$ |

- |

$ |

1,336 |

|

|

AISC |

$ |

1,480 |

|

$ |

1,683 |

|

$ |

- |

$ |

1,583 |

|

1. Sustaining capital expenditures are shown in the Growth

and Sustaining Capital table in the Q4 and Full Year 2024 MD&A

dated December 31, 2024.

|

|

|

2023 |

|

|

(in thousands - except per ounce amounts) |

Nicaragua |

Nevada |

Corporate |

Consolidated |

|

Production costs(1) |

$ |

238,620 |

|

$ |

55,542 |

|

$ |

- |

$ |

294,162 |

|

|

Less: silver by-product revenue |

|

(11,136 |

) |

|

(40 |

) |

|

- |

|

(11,176 |

) |

|

Royalties and production taxes |

|

16,876 |

|

|

3,667 |

|

|

- |

|

20,543 |

|

|

Total cash costs |

$ |

244,360 |

|

$ |

59,169 |

|

$ |

- |

$ |

303,529 |

|

|

Corporate and general administration |

|

- |

|

|

- |

|

|

12,284 |

|

12,284 |

|

|

Reclamation accretion and amortization of ARO |

|

2,509 |

|

|

727 |

|

|

- |

|

3,236 |

|

|

Sustaining capital(2) |

|

27,438 |

|

|

1,332 |

|

|

- |

|

28,770 |

|

|

Sustaining exploration |

|

233 |

|

|

- |

|

|

- |

|

233 |

|

|

Total AISC |

$ |

274,540 |

|

$ |

61,228 |

|

$ |

12,284 |

$ |

348,052 |

|

|

|

|

|

|

|

|

Gold ounces sold |

|

242,126 |

|

|

41,399 |

|

|

- |

|

283,525 |

|

|

Total Cash Costs |

$ |

1,009 |

|

$ |

1,429 |

|

$ |

- |

$ |

1,071 |

|

|

AISC |

$ |

1,134 |

|

$ |

1,479 |

|

$ |

- |

$ |

1,228 |

|

- Production costs include a $0.7 million net realizable value

reversal for the Pan mine.

- Sustaining capital expenditures are shown in the Growth and

Sustaining Capital table in the Q4 and Full Year 2024 MD&A

dated December 31, 2024.

(2) AVERAGE REALIZED GOLD PRICE PER OUNCE

SOLD

The following table provides a reconciliation of Average

Realized Gold Price Per Ounce Sold to gold revenue per the

consolidated statement of operations and comprehensive income for

the reporting periods:

|

|

Three Months Ended |

Year Ended |

|

|

December 31,2024 |

September 30,2024 |

December 31,2023 |

December 31,2024 |

December 31,2023 |

|

Gold revenue (in thousands) |

$ |

199,473 |

$ |

111,411 |

$ |

148,703 |

$ |

574,395 |

$ |

550,526 |

|

Ounces of gold sold |

|

76,252 |

|

46,076 |

|

75,505 |

|

242,452 |

|

283,525 |

|

Average realized price per ounce sold(1) |

$ |

2,616 |

$ |

2,418 |

$ |

1,969 |

$ |

2,369 |

$ |

1,942 |

1. Average realized gold price per ounce

sold includes 6,900 ounces in Q4 2024 (6,900 ounces in Q3, 2024 and

18,400 ounces in 2024) at $2,239 per ounce as delivered in

accordance with the Prepayment Agreement.

(3) ADJUSTED NET EARNINGS

The following table provides a reconciliation of Adjusted Net

Earnings and Adjusted Net Earnings Per Share to the consolidated

statement of operations and comprehensive income for the reporting

periods:

|

|

Three Months Ended |

Year Ended |

|

(in thousands – except per share) |

December 31,2024 |

September 30,2024 |

December 31,2023 |

December 31,2024 |

December 31,2023 |

|

Net earnings |

$ |

16,661 |

$ |

954 |

$ |

12,001 |

$ |

34,740 |

$ |

82,025 |

|

Adjusting items (net of tax): |

|

|

|

|

|

|

Foreign exchange |

|

16,516 |

|

- |

|

- |

|

16,947 |

|

- |

|

Loss on financial instruments |

|

115 |

|

- |

|

- |

|

853 |

|

- |

|

Project assessment costs |

|

885 |

|

86 |

|

1,868 |

|

8,177 |

|

3,499 |

|

Nicaragua one-time expenses |

|

1,209 |

|

1,160 |

|

- |

|

2,369 |

|

- |

|

Pan Mine impairment & inventory write down |

|

- |

|

- |

|

6,158 |

|

- |

|

5,542 |

|

Mineral property write-off |

|

3,164 |

|

- |

|

2,278 |

|

3,178 |

|

2,601 |

|

Adjusted net earnings |

$ |

38,550 |

$ |

2,199 |

$ |

22,305 |

$ |

66,264 |

$ |

96,667 |

|

Weighted average number of shares outstanding |

|

838,038 |

|

796,103 |

|

458,094 |

|

766,477 |

|

456,347 |

|

Adjusted net earnings per share - basic |

$ |

0.05 |

$ |

0.00 |

$ |

0.05 |

$ |

0.09 |

$ |

0.21 |

1. Adjusted from net earnings to derive Adjusted net

earnings are one-time transaction costs primarily from the

acquisition of Marathon, a write- off of a receivable from a

contractor in Nicaragua, a write-off of certain exploration

expenditures and the foreign exchange loss resulting from the

translation of the Sprott Loan from US dollars to Canadian dollars

which is the functional currency of Marathon.

(4) CASH FROM OPERATING ACTIVITIES BEFORE CHANGES

IN WORKING CAPITAL

The following table provides a reconciliation of Cash from

Operating Activities before Changes in Working Capital to the

consolidated statement of cash flows for the reporting periods:

|

|

Three Months Ended |

Year Ended |

|

|

December 31,2024 |

September

30,2024 |

December 31,2023 |

December 31,2024 |

December 31,2023 |

|

Net cash (used in) provided by operating activities |

$ |

91,404 |

|

$ |

(17,833 |

) |

$ |

60,330 |

$ |

181,053 |

|

$ |

201,106 |

|

Working capital adjustments |

|

(36,183 |

) |

|

(22,003 |

) |

|

19,889 |

|

(70,457 |

) |

|

22,948 |

|

Cash from operating activities before working

capital |

$ |

127,587 |

|

$ |

4,170 |

|

$ |

40,441 |

$ |

251,510 |

|

$ |

178,158 |

(5) NET DEBT and ADJUSTED NET DEBT

The following table provides a reconciliation of Net Debt and

Adjusted Net Debt to the consolidated statement of financial

position for the reporting periods:

|

(in thousands, except ratio) |

December 31,2024 |

September 30,2024 |

June 30,2024 |

December 31,2023 |

|

Current portion of debt |

$ |

42,860 |

|

$ |

11,966 |

|

$ |

10,571 |

|

$ |

9,597 |

|

|

Non-current portion of debt |

|

293,556 |

|

|

317,287 |

|

|

316,744 |

|

|

10,509 |

|

|

Total Debt |

$ |

336,416 |

|

$ |

329,253 |

|

$ |

327,315 |

|

$ |

20,106 |

|

|

Less: Cash and cash equivalents (unrestricted) |

|

(131,093 |

) |

|

(115,800 |

) |

|

(127,582 |

) |

|

(86,160 |

) |

|

Net Debt |

$ |

205,323 |

|

$ |

213,453 |

|

$ |

199,733 |

|

$ |

(66,054 |

) |

|

Less: Fair value adjustment of Sprott Loan |

|

(40,122 |

) |

|

(35,108 |

) |

|

(34,924 |

) |

|

- |

|

|

Adjusted Net Debt |

$ |

165,201 |

|

$ |

178,345 |

|

$ |

164,809 |

|

$ |

(66,054 |

) |

(6) EBITDA and ADJUSTED EBITDA

The following table provides a reconciliation of EBITDA and

Adjusted EBITDA to the consolidated statement of operations and

comprehensive income for the reporting periods:

|

|

Three Months Ended |

Year Ended |

|

(in thousands) |

December 31,2024 |

September 30,2024 |

December 31,2023 |

December 31,2024 |

December 31,2023 |

|

Earnings before taxes |

$ |

34,015 |

|

$ |

5,716 |

|

$ |

21,515 |

|

$ |

77,863 |

$ |

133,091 |

|

|

Add back: Depreciation |

|

40,324 |

|

|

22,352 |

|

|

21,046 |

|

|

97,930 |

|

76,594 |

|

|

Add back: Finance costs, net |

|

(883 |

) |

|

1,920 |

|

|

1,098 |

|

|

7,015 |

|

4,390 |

|

|

EBITDA |

$ |

73,456 |

|

$ |

29,988 |

|

|

43,659 |

|

$ |

182,808 |

$ |

214,075 |

|

|

Add back: Net loss/(gain) on financial instruments |

|

115 |

|

|

738 |

|

|

- |

|

|

853 |

|

- |

|

|

Add back: Project assessment costs |

|

885 |

|

|

86 |

|

|

1,868 |

|

|

8,177 |

|

3,498 |

|

|

Add back: Other expenses |

|

4,694 |

|

|

1,994 |

|

|

5,499 |

|

|

7,252 |

|

6,410 |

|

|

Add back: Pan impairment & inventory write down |

|

- |

|

|

- |

|

|

8,211 |

|

|

- |

|

8,211 |

|

|

Add back: Non-cash and other adjustments |

|

16,423 |

|

|

(3,862 |

) |

|

(42 |

) |

|

16,737 |

|

(148 |

) |

|

Adjusted EBITDA |

$ |

95,573 |

|

$ |

28,943 |

|

$ |

59,195 |

|

$ |

215,827 |

$ |

232,046 |

|

1. Adjusted from EBITDA to derive Adjusted EBITDA are

one-time transaction costs primarily from the acquisition of

Marathon, a write-off of a receivable from a contractor in

Nicaragua, a write-off of certain exploration expenditures and the

foreign exchange loss resulting from the translation of the Sprott

Loan from US dollars to Canadian dollars which is the functional

currency of Marathon.

(7) ADJUSTED NET DEBT TO ADJUSTED

EBITDA

The following table provides the reconciliation of Adjusted Net

Debt to Adjusted EBITDA using the last twelve months of Adjusted

EBITDA for the reporting periods:

|

(in thousands, except ratio) |

December 31, |

September 30, |

June 30, |

December 31, |

|

2024 |

2024 |

2024 |

2023 |

|

Adjusted Net Debt |

$ |

165,201 |

$ |

178,345 |

$ |

164,809 |

$ |

(66,054 |

) |

|

Adjusted EBITDA (LTM) |

|

215,827 |

|

196,182 |

|

230,237 |

|

232,046 |

|

|

Adjusted Net Debt to Adjusted EBITDA (LTM)

ratio |

|

0.77 |

|

0.91 |

|

0.72 |

|

(0.28 |

) |

Cautionary Note Regarding Forward

Looking Information

This new release contains “forward-looking

information” and “forward-looking statements” (collectively

“forward-looking statements”) within the meaning of applicable

Canadian securities legislation. Except for statements of

historical fact relating to Calibre, forward-looking information

includes, but is not limited to, information with respect to the

Company’s expected production from, and the further potential of,

the Company’s properties; expected timing for the Company to

complete its gold delivery obligations; expected timing for the

first gold production from the Valentine mine; planned exploration

and development programs at Valentine, El Limon, La Libertad and

Pan Mine and the costs to conduct those programs; the results of

any preliminary feasibility study, including, without limitation,

life of mine, expected costs, production and net present value

estimates; the results of any preliminary economic assessment; the

Company’s ability to raise additional funds, as required; the

future price of minerals, particularly gold; the estimation of

mineral resources and mineral reserves; conclusions of economic

evaluations; the realization of mineral reserve estimates; the

timing and amount of estimated future production; costs of

production, general and administrative and other costs; capital

expenditures; success of exploration activities; mining or

processing issues; currency rates; government regulation of mining

operations; environmental risks; and outlook, guidance, and other

forecasts.

Forward-looking statements are statements that

are not historical facts and are generally, although not always,

identified by words such as “expect”, “plan”, “anticipate”,

“project”, “target”, “potential”, “schedule”, “forecast”, “budget”,

“estimate”, “assume”, “intend”, “strategy”, “goal”, “objective”,

“possible” or “believe” and similar expressions or their negative

connotations, or that events or conditions “will”, “would”, “may”,

“could”, “should” or “might” occur. All such forward-looking

statements are based on the opinions and estimates of management as

of the date such statements are made.

Forward-looking statements necessarily involve

assumptions, risks and uncertainties, certain of which are beyond

Calibre’s control, including risks associated with or related

to: the volatility of metal prices; changes in tax laws; the

dangers inherent in exploration, development and mining activities;

the uncertainty of reserve and resource estimates; cost or other

estimates; actual production, development plans and costs differing

materially from the Company’s expectations; the ability to obtain

and maintain any necessary permits, consents or authorizations

required for mining activities; the current ongoing instability in

Nicaragua and the ramifications thereof; environmental regulations

or hazards and compliance with complex regulations associated with

mining activities; the availability of financing and debt

activities, including potential restrictions imposed on Calibre’s

operations as a result thereof and the ability to generate

sufficient cash flows; remote operations and the availability of

adequate infrastructure; fluctuations in price and availability of

energy and other inputs necessary for mining operations; shortages

or cost increases in necessary equipment, supplies and labour; the

reliance upon contractors, third parties and joint venture

partners; the dependence on key personnel and the ability to

attract and retain skilled personnel; the risk of an uninsurable or

uninsured loss; adverse climate and weather conditions; litigation

risk; competition with other mining companies; community support

for Calibre’s operations, including risks related to strikes and

the halting of such operations from time to time; conflicts with

small scale miners; failures of information systems or information

security threats; compliance with anti-corruption laws, sanctions

or other similar measures; and those risk factors identified in the

Risk Factors section found at the end of the Q4 and Full Year 2024

Management’s Discussion and Analysis.

Calibre’s forward-looking statements are based

on the applicable assumptions and factors management considers

reasonable as of the date hereof, based on the information

available to management at such time. These assumptions and factors

include, but are not limited to, assumptions and factors related to

Calibre’s ability to carry on current and future operations,

including: development and exploration activities; the timing,

extent, duration and economic viability of such operations,

including any mineral resources or reserves identified thereby; the

accuracy and reliability of estimates, projections, forecasts,

studies and assessments; the availability and cost of inputs; the

price and market for outputs, including gold; the timely receipt of

necessary approvals or permits; the ability to meet current and

future obligations; the ability to obtain timely financing on

reasonable terms when required; the current and future social,

economic and political conditions; and other assumptions and

factors generally associated with the mining industry.

Calibre’s forward-looking statements are based

on the opinions and estimates of management and reflect their

current expectations regarding future events and operating

performance and speak only as of the date hereof. Calibre does not

assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions

should change other than as required by applicable securities laws.

There can be no assurance that forward-looking statements will

prove to be accurate, and actual results, performance or

achievements could differ materially from those expressed in, or

implied by, these forward-looking statements. Accordingly, no

assurance can be given that any events anticipated by the

forward-looking statements will transpire or occur, or if any of

them do, what benefits or liabilities Calibre will derive

therefrom. For the reasons set forth above, undue reliance should

not be placed on forward-looking statements.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c18bf787-819a-443f-b625-edde9d1c79bd

https://www.globenewswire.com/NewsRoom/AttachmentNg/1e8c4788-18d0-4298-9fdb-7b96949d5196

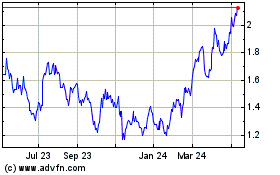

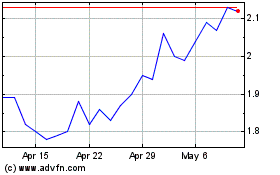

Calibre Mining (TSX:CXB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Calibre Mining (TSX:CXB)

Historical Stock Chart

From Feb 2024 to Feb 2025