Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (NYSE: VLRS

and BMV: VOLAR) (“Volaris” or “the Company”), the ultra-low-cost

carrier (ULCC) serving Mexico, the United States, Central, and

South America, today reports its unaudited financial results for

the second quarter of 20241.

Second Quarter 2024

Highlights(All figures are reported in U.S. dollars and

compared to 2Q 2023 unless otherwise noted)

- Net income of $10

million. Earnings per American Depositary Shares (ADS) of $9

cents.

- Total

operating revenue of $726 million, a 7.2% decrease.

- Total

revenue per available seat mile (TRASM) increased 12% to

$8.89 cents.

- Available

seat miles (ASMs) decreased by 17% to 8.2 billion.

- Total

operating expenses of $660 million, representing 91% of

total operating revenue.

- Total

operating expenses per available seat mile (CASM)

increased 9.1% to $8.08 cents.

- Average

economic fuel cost increased 6.1% to $2.86 per

gallon.

- CASM ex

fuel increased 11% to $5.33 cents.

-

EBITDAR of $261 million, a 23% increase.

- EBITDAR

margin was 35.9%, an increase of 8.8 percentage

points.

- Total cash,

cash equivalents, restricted cash, and short-term

investments totaled $774 million, representing 24% of the

last twelve months’ total operating revenue.

- Net

debt-to-LTM EBITDAR2 ratio decreased to

2.9x, compared to 3.1x in the previous quarter.

Enrique Beltranena, President &

Chief Executive Officer, said: “Volaris continues to

perform positively, achieving our highest absolute EBITDAR for a

second quarter despite the fleet groundings due to accelerated

engine inspections. Volaris’ unwavering focus on execution and

efficient cost control has enabled us to deliver strong results.

Our mitigation plan is on track with favorable outcomes, and we

have largely achieved our goals since the inspections began. In

fact, we are improving our full-year ASM guidance to -14%3. We

currently have a well-balanced market mix, with an increased

presence in the cross-border market that has strengthened our

TRASM, and our booking curves indicate ongoing robust performance

for the summer high season.

With recent updates from Pratt & Whitney, we

are cautiously optimistic about this evolving situation, but we

recognize that the engine's time on wing remains a challenge.

Looking ahead, as grounded aircraft gradually return to our

productive fleet, we expect recent unit revenue levels to remain

resilient and remain committed to prudent and rational growth,

prioritizing profitability.”

1 The financial information, unless otherwise

indicated, is presented in accordance with the International

Financial Reporting Standards (IFRS).2 Includes short-term

investments.3 See detailed guidance on page 5.

Second Quarter 2024 Consolidated

Financial and Operating Highlights(All figures are

reported in U.S. dollars and compared to 2Q 2023 unless otherwise

noted)

|

|

Second Quarter |

|

Consolidated Financial Highlights |

2024 |

2023 |

Var. |

|

Total operating revenue (millions) |

726 |

782 |

(7.2%) |

|

TRASM (cents) |

8.89 |

7.92 |

12.2% |

|

ASMs (million, scheduled & charter) |

8,173 |

9,873 |

(17.2%) |

|

Load Factor (RPMs/ASMs) |

85.5% |

84.6% |

0.9 pp |

|

Passengers (thousand, scheduled & charter) |

7,087 |

8,373 |

(15.4%) |

|

Fleet (at the end of the period) |

136 |

123 |

13 |

|

Total operating expenses (millions) |

660 |

731 |

(9.7%) |

|

CASM (cents) |

8.08 |

7.40 |

9.1% |

|

CASM ex fuel (cents) |

5.33 |

4.82 |

10.7% |

|

Adjusted CASM ex fuel (cents)4 |

4.86 |

4.43 |

9.6% |

|

Operating income (EBIT) (millions) |

66 |

51 |

29.4 % |

|

% EBIT Margin |

9.1% |

6.5% |

2.6 pp |

|

Net income (millions) |

10 |

6 |

66.7 % |

|

% Net income Margin |

1.4% |

0.7% |

0.7 pp |

|

EBITDAR (millions) |

261 |

212 |

23.1 % |

|

% EBITDAR Margin |

35.9% |

27.1% |

8.8 pp |

|

Net debt-to-EBITDAR5 |

2.9x |

3.5x |

(0.6x) |

Reconciliation of CASM to Adjusted CASM ex

fuel:

|

|

Second Quarter |

|

Reconciliation of CASM |

2024 |

2023 |

Var. |

| CASM

(cents) |

8.08 |

7.40 |

9.1% |

| Fuel

expense |

(2.75) |

(2.58) |

6.9% |

| CASM ex

fuel |

5.33 |

4.82 |

10.7% |

| Aircraft and engine variable

lease expenses6 |

(0.56) |

(0.41) |

36.2% |

| Sale

and lease back gains |

0.09 |

0.02 |

>100% |

| Adjusted CASM ex

fuel |

4.86 |

4.43 |

9.6% |

| Note: Figures are rounded for

convenience purposes. Further detail found in financial and

operating indicators. |

| 4 Excludes fuel expense,

aircraft and engine variable lease expenses and sale and lease-back

gains. |

| 5 Includes short-term

investments. |

| 6 Aircraft redeliveries. |

Second Quarter 2024(All figures

are reported in U.S. dollars and compared to 2Q 2023 unless

otherwise noted)

Total operating revenue

amounted to $726 million in the quarter, driven by strong domestic

demand and an improvement in total operating revenue per passenger.

This represents a 7.2% decrease, notwithstanding the 17% reduction

in total capacity resulting from aircraft-on-ground (AOG) due to

Pratt & Whitney’s accelerated engine inspections.

Total capacity, in terms of available

seat miles (ASMs), was 8.2 billion.

Booked passengers totaled 7.1

million, a 15% decrease. Mexican domestic and international booked

passengers decreased 18% and 4.9%, respectively.

The load factor for the quarter

reached 85.5%, representing an increase of 0.9 percentage

points.

TRASM rose 12% to $8.89 cents,

and total operating revenue per passenger stood at $102,

representing a 9.8% increase.

The average base fare was $49, a 4.3% increase.

The total ancillary revenue per passenger was $53, reflecting a 15%

improvement. Ancillary revenue represented 52% of total operating

revenue, up by 2.6 percentage points.

Total operating expenses were

$660 million, representing 91% of total operating revenue.

CASM totaled $8.08 cents, a

9.1% increase when compared to the same period of 2023.

The average economic fuel cost

rose 6.1% to $2.86 per gallon.

CASM ex fuel increased 11% to

$5.33 cents, mainly due to the AOG due to Pratt and Whitney's

engine preventive accelerated inspections.

Comprehensive financing result

represented an expense of $52 million, compared to a $43 million

expense in the same period of the previous year.

Income tax expense was $4

million, compared to a $2 million expense registered in the second

quarter of 2023.

Net income in the quarter was

$10 million, with an earnings per ADS of $9 cents.

EBITDAR for the quarter was

$261 million, a 23% improvement, primarily attributable to strong

unit revenues and efficient cost control, partially offset by an

increase in fuel prices. EBITDAR margin stood at

35.9%, up by 8.8 percentage points.

Balance Sheet, Liquidity, and Capital

Allocation

For the quarter, net cash flow provided by

operating activities was $304 million. Net cash flow used in

investing and financing activities was $141 million and $149

million, respectively.

As of June 30, 2024, cash, cash equivalents,

restricted cash, and short-term investments were $774 million,

representing 24% of the last twelve months' total operating

revenue.

The financial debt amounted to $638 million,

while total lease liabilities stood at $3,003 million, resulting in

a net debt of $2,8677 million.

Net debt-to-LTM

EBITDAR7 ratio stood at 2.9x, compared to

3.1x in the previous quarter and 3.5x in the same period of

2023.

The average exchange rate for the period was

Ps.17.21 per U.S. dollar, a 2.9% appreciation. At the end of the

second quarter, the exchange rate stood at Ps.18.38 per U.S.

dollar.

7 Includes short-term investments.

2024 Guidance

For the third quarter of 2024, the Company

expects:

|

|

3Q’24 |

3Q’23 (1) |

|

3Q’24 Guidance |

|

|

|

ASM growth (YoY) |

~ -14% |

+8.2% |

|

TRASM |

~$9.3 cents |

$8.37 cents |

|

CASM ex fuel |

~$5.6 cents |

$4.91 cents |

|

EBITDAR margin |

~33% |

24.4% |

|

Average USD/MXN rate |

Ps.18.40 to 18.60 |

Ps.17.06 |

|

Average U.S. Gulf Coast jet fuel price |

$2.60 to $2.70 |

$2.77 |

(1) For convenience purposes, actual reported

figures for 3Q'23 are included.

For the full year 2024, the Company expects:

|

|

Updated Guidance |

Prior Guidance |

|

Full Year 2024 Guidance |

|

|

|

ASM growth (YoY) |

~ -14% |

-16% to -18% |

|

EBITDAR margin |

32% to 34% |

32% to 34% |

|

CAPEX (2) |

$400 million |

$400 million |

|

Average USD/MXN rate |

Ps.17.80 to 18.00 |

Ps.17.30 to 17.50 |

|

Average U.S. Gulf Coast jet fuel price |

$2.60 to $2.70 |

$2.60 to $2.70 |

(2) CAPEX net of financed fleet predelivery payments.

The third quarter and full year 2024 outlook

presented above includes the compensation that Volaris expects to

receive for the projected grounded aircraft resulting from the GTF

engine removals, in accordance with the Company’s agreement with

Pratt & Whitney.

The Company's outlook is subject to unforeseen

disruptions, macroeconomic factors, or other negative impacts that

may affect its business and is based on several assumptions,

including the foregoing, which are subject to change and may be

outside the control of the Company and its management. The

Company's expectations may change if actual results vary from these

assumptions. There can be no assurances that Volaris will achieve

these results.

Fleet

During the second quarter, Volaris added two

A321neo aircraft to its fleet, bringing the total number of

aircraft to 136. At the end of the quarter, Volaris’ fleet had an

average age of 6.1 years and an average seating capacity of 197

passengers per aircraft. Of the total fleet, 60% of the aircraft

are New Engine Option (NEO) models.

|

|

Second Quarter |

First Quarter |

|

Total Fleet |

2024 |

2023 |

Var. |

2024 |

Var. |

|

CEO |

|

|

|

|

|

|

A319 |

3 |

3 |

- |

3 |

- |

|

A320 |

42 |

40 |

2 |

42 |

- |

|

A321 |

10 |

10 |

- |

10 |

- |

|

NEO |

|

|

|

|

|

|

A320 |

51 |

51 |

- |

51 |

- |

|

A321 |

30 |

19 |

11 |

28 |

2 |

|

Total aircraft at the end of the period |

136 |

123 |

13 |

134 |

2 |

Investors are urged to carefully read the Company’s periodic

reports filed with or provided to the Securities and Exchange

Commission, for additional information regarding the Company.

Investor Relations ContactRicardo Martínez /

ir@volaris.com

Media ContactIsrael Álvarez /

ialvarez@gcya.net

Conference Call Details

|

Date: |

Tuesday, July 23, 2024 |

| Time: |

9:00 am Mexico City /

11:00 am New York (USA) (ET) |

| Webcast

link: |

Volaris Webcast

(View the live webcast) |

| Dial-in & Live

Q&A link: |

Volaris Dial-in and Live

Q&A

- Click on the call link and complete

the online registration form.

- Upon registering you will receive

the dial-in info and a unique PIN to join the call, as well as an

email confirmation with the details.

- Select a method for joining the

call:

- Dial-In: A dial-in number and

unique PIN are displayed to connect directly from your phone.

- Call Me: Enter your phone number

and click “Call Me” for an immediate callback from the system.

|

About Volaris

*Controladora Vuela Compañía de Aviación, S.A.B.

de C.V. (“Volaris” or “the Company”) (NYSE: VLRS and BMV: VOLAR) is

an ultra-low-cost carrier, with point-to-point operations, serving

Mexico, the United States, Central, and South America. Volaris

offers low base fares to build its market, providing quality

service and extensive customer choice. Since the beginning of

operations in March 2006, Volaris has increased its routes from 5

to more than 201 and its fleet from 4 to 137 aircraft. Volaris

offers more than 500 daily flight segments on routes that connect

44 cities in Mexico and 29 cities in the United States, Central,

and South America, with one of the youngest fleets in Mexico.

Volaris targets passengers who are visiting friends and relatives,

cost-conscious business and leisure travelers in Mexico, the United

States, Central, and South America. Volaris has received the ESR

Award for Social Corporate Responsibility for fifteen consecutive

years. For more information, please visit ir.volaris.com. Volaris

routinely posts information that may be important to investors on

its investor relations website. The Company encourages investors

and potential investors to consult the Volaris website regularly

for important information about Volaris.

Forward-Looking Statements

Statements in this release contain various

forward-looking statements within the meaning of Section 27A of the

US Securities Act of 1933, as amended, and Section 21E of the US

Securities Exchange Act of 1934, as amended, which represent the

Company's expectations, beliefs, or projections concerning future

events and financial trends affecting the financial condition of

our business. When used in this release, the words "expects,"

“intends,” "estimates," “predicts,” "plans," "anticipates,"

"indicates," "believes," "forecast," "guidance," “potential,”

"outlook," "may," “continue,” "will," "should," "seeks," "targets"

and similar expressions are intended to identify forward-looking

statements. Similarly, statements describing the Company's

objectives, plans or goals, or actions the Company may take in the

future are forward-looking. Forward-looking statements include,

without limitation, statements regarding the Company's outlook, the

expectation of receiving certain compensation in connection with

the GTF engine removals, and the anticipated execution of its

business plan and focus on its priorities. Forward-looking

statements should not be read as a guarantee or assurance of future

performance or results. They will not necessarily be accurate

indications of the times at or by which such performance or results

will be achieved. Forward-looking statements are based on

information available at the time those statements are made and/or

management’s good faith belief as of that time concerning future

events and are subject to risks and uncertainties that could cause

actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements.

Forward-looking statements are subject to several factors that

could cause the Company's actual results to differ materially from

the Company's expectations, including the competitive environment

in the airline industry, the Company's ability to keep costs low;

changes in fuel costs, the impact of worldwide economic conditions

on customer travel behavior; the Company's ability to generate

non-ticket revenue; and government regulation. The Company's US

Securities and Exchange Commission filings contain additional

information concerning these and other factors. All forward-looking

statements attributable to us or persons acting on our behalf are

expressly qualified in their entirety by the cautionary statements

set forth above. Forward-looking statements speak only as of the

date of this release. You should not put undue reliance on any

forward-looking statements. We assume no obligation to update

forward-looking statements to reflect actual results, changes in

assumptions, or changes in other factors affecting forward-looking

information except to the extent required by applicable law. If we

update one or more forward-looking statements, no inference should

be drawn that we will make additional updates with respect to those

or other forward-looking statements.

Supplemental Information on Non-IFRS

Measures

We evaluate our financial performance by using

various financial measures that are not performance measures under

International Financial Reporting Standards (“non-IFRS measures”).

These non-IFRS measures include CASM, CASM ex fuel, Adjusted CASM

ex fuel, EBITDAR, Net debt-to-LTM EBITDAR, Total cash, cash

equivalents, restricted cash, and short-term investments. We define

CASM as total operating expenses by available seat mile. We define

CASM ex fuel as total operating expenses by available seat mile,

excluding fuel expense. We define Adjusted CASM ex fuel as total

operating expenses by available seat mile, excluding fuel expense,

aircraft and engine variable lease expenses and sale and lease back

gains. We define EBITDAR as earnings before interest, income tax,

depreciation and amortization, depreciation of right of use assets

and aircraft and engine variable lease expenses. We define Net

debt-to-LTM EBITDAR as Net debt divided by LTM EBITDAR. We define

Total cash, cash equivalents, restricted cash, and short-term

investments as the sum of cash, cash equivalents, restricted cash,

and short-term investments.

These non-IFRS measures are provided as

supplemental information to the financial information presented in

this release that is calculated and presented in accordance with

International Financial Reporting Standards (“IFRS”) because we

believe that they, in conjunction with the IFRS financial

information, provide useful information to management’s, analysts

and investors overall understanding of our operating

performance.

Because non-IFRS measures are not calculated in

accordance with IFRS, they should not be considered superior to and

are not intended to be considered in isolation or as a substitute

for the related IFRS measures presented in this release and may not

be the same as or comparable to similarly titled measures presented

by other companies due to possible differences in the method of

calculation and the items being adjusted.

We encourage investors to review our financial

statements and other filings with the Securities and Exchange

Commission in their entirety for additional information regarding

the Company and not to rely on any single financial measure.

Shareholders have the ability to receive a hard copy of the 2023

audited consolidated financial statements free of charge upon

request.

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesFinancial and Operating Indicators |

|

|

|

Unaudited(U.S. dollars, except otherwise

indicated) |

Three months ended June 30, 2024 |

Three months ended June 30, 2023 |

Variance |

|

Total operating revenues (millions) |

726 |

782 |

(7.2%) |

|

Total operating expenses (millions) |

660 |

731 |

(9.7%) |

|

EBIT (millions) |

66 |

51 |

29.4% |

|

EBIT margin |

9.1% |

6.5% |

2.6 pp |

|

Depreciation and amortization (millions) |

150 |

121 |

24.0% |

|

Aircraft and engine variable lease expenses (millions) |

45 |

40 |

12.5% |

|

Net income (millions) |

10 |

6 |

66.7% |

|

Net income margin |

1.4% |

0.7% |

0.7 pp |

|

Earnings per share

(1): |

|

|

|

|

Basic |

0.01 |

0.00 |

89.6% |

|

Diluted |

0.01 |

0.00 |

89.1% |

|

Earnings per ADS*: |

|

|

|

|

Basic |

0.09 |

0.05 |

89.6% |

|

Diluted |

0.09 |

0.05 |

89.1% |

|

Weighted average shares outstanding: |

|

|

|

|

Basic |

1,150,766,440 |

1,152,974,446 |

(0.2%) |

|

Diluted |

1,165,976,677 |

1,165,244,334 |

0.1% |

|

Financial Indicators |

|

|

|

|

Total operating revenue per ASM (TRASM) (cents) (2) |

8.89 |

7.92 |

12.2% |

|

Average base fare per passenger |

49 |

47 |

4.3% |

|

Total ancillary revenue per passenger (3) |

53 |

46 |

15.3% |

|

Total operating revenue per passenger |

102 |

93 |

9.8% |

|

Operating expenses per ASM (CASM) (cents) (2) |

8.08 |

7.40 |

9.1% |

|

CASM ex fuel (cents) (2) |

5.33 |

4.82 |

10.7% |

|

Adjusted CASM ex fuel (cents) (2) (4) |

4.86 |

4.43 |

9.6% |

|

Operating Indicators |

|

|

|

|

Available seat miles (ASMs) (millions) (2) |

8,173 |

9,873 |

(17.2%) |

|

Domestic |

4,868 |

6,614 |

(26.4%) |

|

International |

3,305 |

3,260 |

1.4% |

|

Revenue passenger miles (RPMs) (millions) (2) |

6,988 |

8,348 |

(16.3%) |

|

Domestic |

4,388 |

5,643 |

(22.2%) |

|

International |

2,600 |

2,705 |

(3.9%) |

|

Load factor (5) |

85.5% |

84.6% |

0.9 pp |

|

Domestic |

90.1% |

85.3% |

4.9 pp |

|

International |

78.7% |

83.0% |

(4.3 pp) |

|

Booked passengers (thousands) (2) |

7,087 |

8,373 |

(15.4%) |

|

Domestic |

5,324 |

6,518 |

(18.3%) |

|

International |

1,763 |

1,855 |

(4.9%) |

|

Departures (2) |

42,495 |

51,127 |

(16.9%) |

|

Block hours (2) |

109,638 |

132,965 |

(17.5%) |

|

Aircraft at end of period |

136 |

123 |

13 |

|

Average aircraft utilization (block hours) |

13.05 |

13.27 |

(1.7%) |

|

Fuel gallons accrued (millions) |

77.93 |

94.04 |

(17.1%) |

|

Average economic fuel cost per gallon (6) |

2.86 |

2.70 |

6.1% |

|

Average exchange rate |

17.21 |

17.72 |

(2.9%) |

|

Exchange rate at the end of the period |

18.38 |

17.07 |

7.6% |

|

*Each ADS represents ten CPOs and each CPO represents a financial

interest in one Series A share. |

| (1)

The basic and diluted loss or earnings per share are calculated

inaccordance with IAS 33. Basic loss or earnings per share is

calculated bydividing net loss or earnings by the average number of

shares outstanding(excluding treasury shares). Diluted loss or

earnings per share is calculated bydividing net loss or earnings by

the average number of shares outstandingadjusted for dilutive

effects. |

(2)

Includes schedule and charter. (3) Includes “Other passenger

revenues” and “Non-passenger revenues”.(4) Excludes fuel expense,

aircraft and engine variable lease expenses and saleand lease-back

gains.(5) Includes schedule.(6) Excludes Non-creditable VAT. |

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesFinancial and Operating Indicators |

|

|

|

Unaudited(U.S. dollars, except otherwise

indicated) |

Six months ended June 30, 2024 |

Six months ended June 30, 2023 |

Variance |

|

Total operating revenues (millions) |

1,494 |

1,513 |

(1.3%) |

|

Total operating expenses (millions) |

1,324 |

1,493 |

(11.3%) |

|

EBIT (millions) |

170 |

20 |

>100% |

|

EBIT margin |

11.4% |

1.3% |

10.1 pp |

|

Depreciation and amortization (millions) |

283 |

240 |

17.9% |

|

Aircraft and engine variable lease expenses (millions) |

42 |

76 |

(44.7%) |

|

Net income (loss) (millions) |

44 |

(65) |

N/A |

|

Net income (loss) margin |

2.9% |

(4.3%) |

7.2 pp |

|

Earnings (loss) per share

(1): |

|

|

|

|

Basic |

0.04 |

(0.06) |

N/A |

|

Diluted |

0.04 |

(0.06) |

N/A |

|

Earnings (loss) per ADS*: |

|

|

|

|

Basic |

0.38 |

(0.57) |

N/A |

|

Diluted |

0.37 |

(0.56) |

N/A |

|

Weighted average shares outstanding: |

|

|

|

|

Basic |

1,151,108,712 |

1,152,750,608 |

(0.1%) |

|

Diluted |

1,165,976,677 |

1,165,147,164 |

0.1% |

|

Financial Indicators |

|

|

|

|

Total operating revenue per ASM (TRASM) (cents) (2) |

9.12 |

7.81 |

16.7% |

|

Average base fare per passenger |

52 |

47 |

9.4% |

|

Total ancillary revenue per passenger (3) |

55 |

44 |

24.5% |

|

Total operating revenue per passenger |

107 |

91 |

16.7% |

|

Operating expenses per ASM (CASM) (cents) (2) |

8.08 |

7.71 |

4.8% |

|

CASM ex fuel (cents) (2) |

5.25 |

4.74 |

10.8% |

|

Adjusted CASM ex fuel (cents) (2) (4) |

5.09 |

4.36 |

16.8% |

|

Operating Indicators |

|

|

|

|

Available seat miles (ASMs) (millions) (2) |

16,390 |

19,362 |

(15.3%) |

|

Domestic |

9,636 |

13,151 |

(26.7%) |

|

International |

6,754 |

6,211 |

8.7% |

|

Revenue passenger miles (RPMs) (millions) (2) |

14,134 |

16,415 |

(13.9%) |

|

Domestic |

8,717 |

11,189 |

(22.1%) |

|

International |

5,417 |

5,226 |

3.7% |

|

Load factor (5) |

86.2% |

84.8% |

1.4 pp |

|

Domestic |

90.5% |

85.1% |

5.4 pp |

|

International |

80.2% |

84.2% |

(4.0 pp) |

|

Booked passengers (thousands) (2) |

14,010 |

16,559 |

(15.4%) |

|

Domestic |

10,309 |

12,958 |

(20.4%) |

|

International |

3,702 |

3,601 |

2.8% |

|

Departures (2) |

82,923 |

101,318 |

(18.2%) |

|

Block hours (2) |

219,001 |

263,514 |

(16.9%) |

|

Aircraft at end of period |

136 |

123 |

13 |

|

Average aircraft utilization (block hours) |

12.89 |

13.39 |

(3.8%) |

|

Fuel gallons accrued (millions) |

157.15 |

186.27 |

(15.6%) |

|

Average economic fuel cost per gallon (6) |

2.93 |

3.07 |

(4.5%) |

|

Average exchange rate |

17.10 |

18.21 |

(6.1%) |

|

Exchange rate at the end of the period |

18.38 |

17.07 |

7.6% |

|

*Each ADS represents ten CPOs and each CPO represents a financial

interest in one Series A share |

| (1)

The basic and diluted loss or earnings per share are calculated

inaccordance with IAS 33. Basic loss or earnings per share is

calculated bydividing net loss or earnings by the average number of

shares outstanding(excluding treasury shares). Diluted loss or

earnings per share is calculated bydividing net loss or earnings by

the average number of shares outstandingadjusted for dilutive

effects. |

(2)

Includes schedule and charter.(3) Includes “Other passenger

revenues” and “Non-passenger revenues”.(4) Excludes fuel expense,

aircraft and engine variable lease expenses and saleand lease-back

gains. (5) Includes schedule. (6) Excludes Non-creditable VAT. |

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesConsolidated Statement of Operations |

| |

|

Unaudited(In millions of U.S.

dollars) |

Three months ended June 30, 2024 |

Three months ended June 30, 2023 |

Variance |

|

Operating revenues: |

|

|

|

|

Passenger revenues |

693 |

746 |

(7.1%) |

|

Fare revenues |

349 |

396 |

(11.9%) |

|

Other passenger revenues |

344 |

350 |

(1.7%) |

|

|

|

|

|

|

Non-passenger revenues |

33 |

36 |

(8.3%) |

|

Cargo |

5 |

5 |

0.0% |

|

Other non-passenger revenues |

28 |

31 |

(9.7%) |

|

|

|

|

|

|

Total operating revenues |

726 |

782 |

(7.2%) |

|

|

|

|

|

| Other

operating income |

(48) |

(3) |

>100% |

| Fuel

expense |

224 |

255 |

(12.2%) |

| Aircraft

and engine variable lease expenses |

45 |

40 |

12.5% |

| Salaries

and benefits |

99 |

96 |

3.1% |

| Landing,

take-off and navigation expenses |

117 |

127 |

(7.9%) |

| Sales,

marketing and distribution expenses |

32 |

38 |

(15.8%) |

|

Maintenance expenses |

11 |

25 |

(56.0%) |

|

Depreciation and amortization |

50 |

31 |

61.3% |

|

Depreciation of right of use assets |

100 |

90 |

11.1% |

| Other

operating expenses |

30 |

32 |

(6.3%) |

|

Operating expenses |

660 |

731 |

(9.7%) |

|

|

|

|

|

|

Operating income |

66 |

51 |

29.4% |

|

|

|

|

|

| Finance

income |

12 |

9 |

33.3% |

| Finance

cost |

(72) |

(57) |

26.3% |

| Exchange

gain, net |

8 |

5 |

60.0% |

|

Comprehensive financing result |

(52) |

(43) |

20.9% |

|

|

|

|

|

|

Income before income tax |

14 |

8 |

75.0% |

| Income

tax expense |

(4) |

(2) |

100.0% |

|

Net income |

10 |

6 |

66.7% |

|

|

|

|

|

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesConsolidated Statement of Operations |

|

|

|

Unaudited(In millions of U.S.

dollars) |

Six months ended June 30, 2024 |

Six months ended June 30,

2023 |

Variance |

|

Operating revenues: |

|

|

|

|

Passenger revenues |

1,425 |

1,447 |

(1.5%) |

|

Fare revenues |

724 |

782 |

(7.4%) |

|

Other passenger revenues |

701 |

665 |

5.4% |

|

|

|

|

|

|

Non-passenger revenues |

69 |

66 |

4.5% |

|

Cargo |

11 |

10 |

10.0% |

|

Other non-passenger revenues |

58 |

56 |

3.6% |

|

|

|

|

|

|

Total operating revenues |

1,494 |

1,513 |

(1.3%) |

|

|

|

|

|

|

Other operating income |

(93) |

(4) |

>100% |

|

Fuel expense |

464 |

576 |

(19.4%) |

|

Aircraft and engine variable lease expenses |

42 |

76 |

(44.7%) |

|

Salaries and benefits |

201 |

187 |

7.5% |

|

Landing, take-off and navigation expenses |

244 |

237 |

3.0% |

|

Sales, marketing and distribution expenses |

78 |

74 |

5.4% |

|

Maintenance expenses |

48 |

51 |

(5.9%) |

|

Depreciation and amortization |

85 |

63 |

34.9% |

|

Depreciation of right of use assets |

198 |

177 |

11.9% |

|

Other operating expenses |

57 |

56 |

1.8% |

|

Operating expenses |

1,324 |

1,493 |

(11.3%) |

|

|

|

|

|

|

Operating income |

170 |

20 |

>100% |

|

|

|

|

|

|

Finance income |

24 |

16 |

50.0% |

|

Finance cost |

(134) |

(115) |

16.5% |

|

Exchange gain (loss), net |

2 |

(8) |

N/A |

|

Comprehensive financing result |

(108) |

(107) |

0.9% |

|

|

|

|

|

|

Income (loss) before income tax |

62 |

(87) |

N/A |

|

Income tax (expense) benefit |

(18) |

22 |

N/A |

|

Net income (loss) |

44 |

(65) |

N/A |

|

|

|

|

|

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

Subsidiaries |

|

Reconciliation of Total Ancillary Revenue per Passenger |

| The

following table provides additional details about the components of

total ancillary revenue for the quarter: |

|

Unaudited(In millions of U.S.

dollars) |

Three months ended June 30, 2024 |

Three months ended June 30, 2023 |

Variance |

|

|

|

|

|

|

Other passenger revenues |

344 |

350 |

(1.7%) |

|

Non-passenger revenues |

33 |

36 |

(8.3%) |

|

Total ancillary revenues |

377 |

386 |

(2.3%) |

|

|

|

|

|

|

Booked passengers (thousands) (1) |

7,087 |

8,373 |

(15.4%) |

|

|

|

|

|

|

Total ancillary revenue per passenger |

53 |

46 |

15.3% |

|

|

|

|

|

|

(1) Includes schedule and charter. |

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

Subsidiaries |

|

Reconciliation of Total Ancillary Revenue per Passenger |

| The following

table provides additional details about the components of total

ancillary revenue for the first half of the year: |

|

Unaudited(In millions of U.S.

dollars) |

Six months ended June 30, 2024 |

Six months ended June 30, 2023 |

Variance |

|

|

|

|

|

|

Other passenger revenues |

701 |

665 |

5.4% |

|

Non-passenger revenues |

69 |

66 |

4.5% |

|

Total ancillary revenues |

770 |

731 |

5.3% |

|

|

|

|

|

| Booked

passengers (thousands) (1) |

14,010 |

16,559 |

(15.4%) |

|

|

|

|

|

|

Total ancillary revenue per passenger |

55 |

44 |

24.5% |

|

|

|

|

|

| (1) Includes

schedule and charter. |

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesConsolidated Statement of Financial

Position |

|

|

|

(In millions of U.S. dollars) |

As of June 30, 2024Unaudited |

As of December 31,

2023Audited |

|

Assets |

|

|

|

Cash, cash equivalents and restricted cash |

758 |

774 |

|

Short-term investments |

16 |

15 |

|

Total cash, cash equivalents, restricted cash, and

short-term investments (1) |

774 |

- |

|

Accounts receivable, net |

226 |

251 |

|

Inventories |

16 |

16 |

|

Guarantee deposits |

200 |

148 |

|

Prepaid expenses and other current assets |

57 |

44 |

|

Total current assets |

1,273 |

1,248 |

|

Right of use assets |

2,436 |

2,338 |

|

Rotable spare parts, furniture and equipment, net |

954 |

805 |

|

Intangible assets, net |

21 |

16 |

|

Derivatives financial instruments |

1 |

2 |

|

Deferred income taxes |

249 |

236 |

|

Guarantee deposits |

441 |

462 |

|

Other long-term assets |

43 |

39 |

|

Total non-current assets |

4,145 |

3,898 |

|

Total assets |

5,418 |

5,146 |

|

Liabilities and equity |

|

|

|

Unearned transportation revenue |

459 |

343 |

|

Accounts payable |

209 |

250 |

|

Accrued liabilities |

184 |

163 |

|

Other taxes and fees payable |

271 |

262 |

|

Income taxes payable |

14 |

8 |

|

Financial debt |

325 |

220 |

|

Lease liabilities |

357 |

373 |

|

Other liabilities |

6 |

2 |

|

Total short-term liabilities |

1,825 |

1,621 |

|

Financial debt |

313 |

433 |

|

Accrued liabilities |

10 |

14 |

|

Employee benefits |

15 |

15 |

|

Deferred income taxes |

16 |

16 |

|

Lease liabilities |

2,646 |

2,518 |

|

Other liabilities |

307 |

286 |

|

Total long-term liabilities |

3,307 |

3,282 |

|

Total liabilities |

5,132 |

4,903 |

|

Equity |

|

|

|

Capital stock |

248 |

248 |

|

Treasury shares |

(12) |

(12) |

|

Contributions for future capital increases |

- |

- |

|

Legal reserve |

17 |

17 |

|

Additional paid-in capital |

284 |

282 |

|

Accumulated deficit |

(104) |

(148) |

|

Accumulated other comprehensive loss |

(147) |

(144) |

|

Total equity |

286 |

243 |

|

Total liabilities and equity |

5,418 |

5,146 |

|

(1) Non-GAAP measure. |

|

|

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesConsolidated Statement of Cash Flows – Cash

Flow Data Summary |

|

|

|

Unaudited(In millions of U.S.

dollars) |

Three months ended June 30, 2024 |

Three months ended June 30, 2023 |

|

|

|

|

|

Net cash flow provided by operating activities |

304 |

159 |

|

Net cash flow used in investing activities |

(141) |

(102) |

|

Net cash flow used in financing activities* |

(149) |

(109) |

|

Increase (decrease) in cash, cash equivalents and

restricted cash |

14 |

(52) |

|

Net foreign exchange differences |

(8) |

3 |

|

Cash, cash equivalents and restricted cash at beginning of

period |

752 |

704 |

|

Cash, cash equivalents and restricted cash at end of

period |

758 |

655 |

|

*Includes aircraft rental payments of $143 million and $131 million

for the three months ended June 30, 2024, and 2023,

respectively. |

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesConsolidated Statement of Cash Flows – Cash

Flow Data Summary |

|

|

|

Unaudited(In millions of U.S.

dollars) |

Six months ended June 30, 2024 |

Six months ended June 30, 2023 |

|

|

|

|

|

Net cash flow provided by operating activities |

549 |

367 |

|

Net cash flow used in investing activities |

(238) |

(211) |

|

Net cash flow used in financing activities* |

(320) |

(219) |

|

Decrease in cash, cash equivalents and restricted

cash |

(9) |

(63) |

|

Net foreign exchange differences |

(7) |

6 |

|

Cash, cash equivalents and restricted cash at beginning of

period |

774 |

712 |

|

Cash, cash equivalents and restricted cash at end of

period |

758 |

655 |

|

*Includes aircraft rental payments of $284 million and $258 million

for the six months ended June 30, 2024, and 2023,

respectively. |

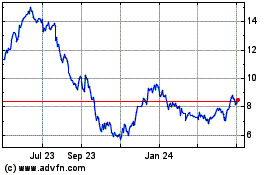

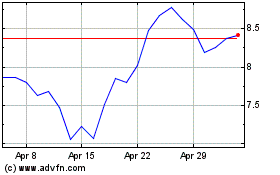

Volaris Aviation (NYSE:VLRS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Volaris Aviation (NYSE:VLRS)

Historical Stock Chart

From Feb 2024 to Feb 2025